Global Data Center Access Control Market

Market Size in USD Billion

CAGR :

%

USD

1.71 Billion

USD

3.76 Billion

2025

2033

USD

1.71 Billion

USD

3.76 Billion

2025

2033

| 2026 –2033 | |

| USD 1.71 Billion | |

| USD 3.76 Billion | |

|

|

|

|

Data Center Access Control Market Size

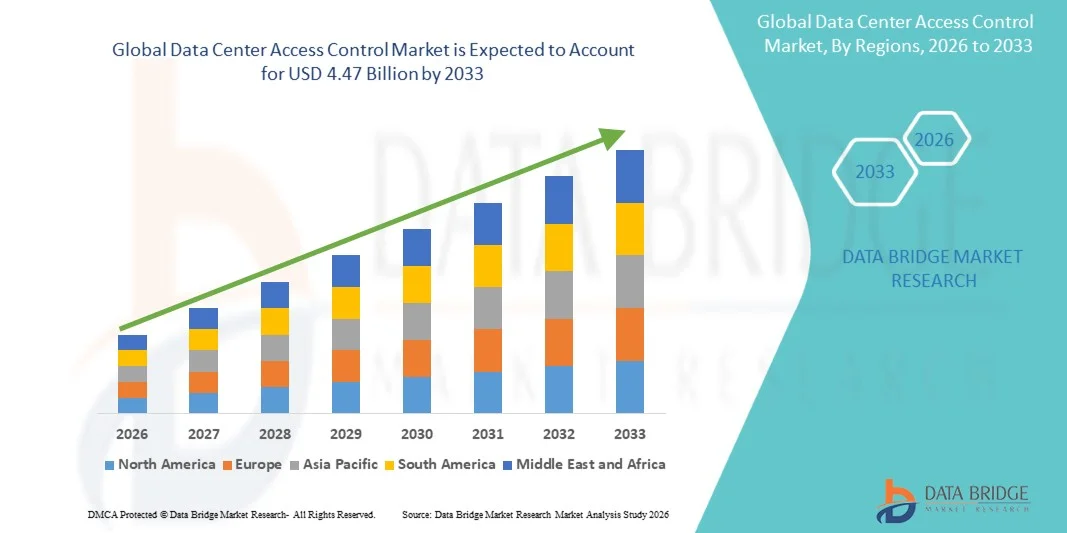

- The global data center access control market size was valued at USD 1.71 billion in 2025 and is expected to reach USD 3.76 billion by 2033, at a CAGR of 10.35% during the forecast period

- The market growth is primarily driven by the rapid expansion of hyperscale, colocation, and enterprise data centers, alongside rising concerns over physical security of critical digital infrastructure

- In parallel, increasing regulatory compliance requirements, growing incidents of unauthorized access, and the need for centralized, real-time monitoring are pushing data center operators to adopt advanced access control systems, collectively accelerating market expansion

Data Center Access Control Market Analysis

- Data center access control solutions, which manage and restrict physical entry to sensitive facilities and zones, have become essential components of modern data center security strategies due to their role in protecting critical assets, ensuring compliance, and supporting uninterrupted operations

- The growing demand for these solutions is mainly driven by increasing cloud adoption, higher data traffic volumes, and the convergence of physical security with digital security frameworks, as operators prioritize scalable, intelligent, and integrated access control mechanisms

- North America dominated the data center access control market with a share of 37.28% in 2025, due to the high concentration of hyperscale and colocation data centers, strong cybersecurity awareness, and early adoption of advanced physical security technologies

- Asia-Pacific is expected to be the fastest growing region in the data center access control market during the forecast period due to rapid digitalization, rising cloud adoption, and large-scale data center construction across emerging economies

- Hardware segment dominated the market with a market share of around 50% in 2025, due to sustained investments in physical security infrastructure such as biometric readers, smart card systems, electronic locks, and surveillance-integrated access points. Data center operators prioritize robust hardware to prevent unauthorized physical access and comply with strict regulatory and security standards

Report Scope and Data Center Access Control Market Segmentation

|

Attributes |

Data Center Access Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Data Center Access Control Market Trends

“Rising Adoption of Biometric and Multi-Factor Physical Access Control”

- A key trend in the data center access control market is the rising adoption of biometric and multi-factor physical security systems to strengthen protection of critical IT infrastructure. Data center operators are prioritizing advanced access solutions that combine biometrics, smart cards, and PIN-based authentication to minimize unauthorized entry and insider threats

- For instance, Equinix has deployed biometric access control systems across several of its global colocation facilities to ensure only verified personnel can access sensitive server areas. This approach enhances accountability and supports compliance with strict security and data protection standards required by enterprise and cloud customers

- The growing complexity of data center environments is increasing the need for layered access control mechanisms that can manage multiple security zones within a single facility. Biometric readers and multi-factor authentication systems help operators maintain granular control over who can access specific rooms, racks, or cages

- Regulatory compliance and audit requirements are also accelerating the adoption of advanced access control technologies in data centers handling financial, healthcare, and government data. Biometric systems provide detailed access logs and traceability, supporting operational transparency and risk management

- Large-scale facilities are integrating access control systems with video surveillance and security management platforms to create centralized monitoring environments. This integration improves real-time threat detection and response across expansive data center campuses

- The continued focus on safeguarding mission-critical infrastructure is reinforcing the role of biometric and multi-factor access control as standard security components. This trend is strengthening overall physical security frameworks and shaping more resilient data center operations worldwide

Data Center Access Control Market Dynamics

Driver

“Rapid Expansion of Hyperscale and Colocation Data Centers”

- The rapid expansion of hyperscale and colocation data centers is a major driver for the data center access control market, as larger facilities require more sophisticated physical security systems. The growing scale and density of these data centers increase the need for controlled access across multiple entry points and operational zones

- For instance, Digital Realty has expanded its global data center footprint and implemented advanced access control solutions to secure its hyperscale facilities. These systems help manage high volumes of staff, contractors, and customers while maintaining strict physical security protocols

- The rising demand for cloud services and digital storage is pushing operators to build new facilities and expand existing ones, driving consistent investment in access control infrastructure. Each new deployment requires scalable and reliable security systems that can adapt to evolving operational needs

- Colocation data centers hosting multiple tenants require robust access control to segregate customer environments and protect proprietary assets. This requirement is increasing adoption of customizable and policy-driven access control platforms

- The sustained growth of large-scale data centers is reinforcing demand for advanced physical security solutions. This expansion continues to position access control systems as essential components of modern data center infrastructure

Restraint/Challenge

“High Implementation and Integration Costs”

- High implementation and integration costs remain a key challenge for the data center access control market, particularly for advanced biometric and multi-factor systems. These solutions require significant upfront investment in hardware, software, and secure network integration

- For instance, Iron Mountain Data Centers has highlighted the complexity of integrating advanced access control systems with existing security and facility management platforms across its global sites. Such integrations demand customized configurations and skilled technical resources, increasing overall deployment costs

- Legacy data centers face additional challenges when upgrading older infrastructure to support modern access control technologies. Retrofitting facilities often involves structural modifications and system compatibility adjustments, which further elevate expenses

- Ongoing maintenance, system updates, and cybersecurity measures add to the total cost of ownership for access control solutions. Operators must continuously invest to ensure systems remain reliable and resistant to emerging security threats

- The challenge of balancing robust security requirements with cost efficiency continues to influence purchasing decisions. This restraint is prompting market participants to explore scalable and modular access control solutions that reduce financial barriers while maintaining security performance

Data Center Access Control Market Scope

The market is segmented on the basis of offering, data center type, data center size, and access control as a service.

• By Offering

On the basis of offering, the Data Center Access Control market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of around 50% in 2025, driven by sustained investments in physical security infrastructure such as biometric readers, smart card systems, electronic locks, and surveillance-integrated access points. Data center operators prioritize robust hardware to prevent unauthorized physical access and comply with strict regulatory and security standards. The long operational life, mandatory deployment across entry points, and continuous upgrades of access hardware further support its dominant position.

The software segment is anticipated to witness the fastest growth from 2026 to 2033, supported by the rising need for centralized access management, real-time monitoring, and analytics-driven security insights. Software platforms enable role-based access, audit trails, and seamless integration with building management and cybersecurity systems. Increasing adoption of AI-enabled security software and cloud-based control dashboards is accelerating demand across modern data center environments.

• By Data Center Type

On the basis of data center type, the market is segmented into hyperscale data centers, colocation data centers, and enterprise data centers. Hyperscale data centers accounted for the largest market share in 2025, owing to massive scale operations, high asset density, and stringent multi-layer security requirements. Operators of hyperscale facilities deploy advanced access control systems to manage large workforces, third-party vendors, and restricted zones efficiently. The critical nature of hyperscale infrastructure and high capital investments drive consistent spending on advanced access control solutions.

The colocation data center segment is expected to register the fastest growth rate during the forecast period, driven by increasing demand from multiple tenants requiring customized and isolated access privileges. Colocation providers rely heavily on flexible and scalable access control systems to ensure tenant-level security and compliance. Growing adoption of hybrid cloud strategies and outsourcing of IT infrastructure continues to boost security investments in this segment.

• By Data Center Size

On the basis of data center size, the market is segmented into small & medium data centers and large data centers. Large data centers dominated the market in 2025 due to their complex infrastructure, higher number of access points, and greater exposure to security risks. These facilities require multi-factor authentication, biometric systems, and continuous monitoring to safeguard critical assets. The need for compliance with international security and data protection standards further strengthens adoption among large-scale operators.

Small & medium data centers are projected to experience the fastest growth from 2026 to 2033, supported by digital transformation initiatives and increasing deployment of edge and regional data centers. These facilities are increasingly adopting cost-effective and scalable access control solutions to enhance physical security without heavy capital expenditure. Growing awareness of security threats and regulatory requirements is accelerating adoption across this segment.

• By Access Control as a Service

On the basis of access control as a service, the market is segmented into hosted ACaaS, managed ACaaS, and hybrid ACaaS. The managed ACaaS segment held the largest revenue share in 2025, driven by data center operators’ preference for outsourced security management and reduced operational complexity. Managed services provide continuous monitoring, regular updates, and expert oversight, ensuring high reliability and compliance. This model is particularly attractive for facilities seeking predictable costs and minimized in-house security management burdens.

The hybrid ACaaS segment is expected to witness the fastest growth during the forecast period, fueled by the need to balance on-premise control with cloud-based flexibility. Hybrid models allow data centers to retain control over critical access functions while leveraging cloud platforms for scalability and analytics. Increasing concerns around data sovereignty and security customization are accelerating adoption of hybrid ACaaS solutions.

Data Center Access Control Market Regional Analysis

- North America dominated the data center access control market with the largest revenue share of 37.28% in 2025, driven by the high concentration of hyperscale and colocation data centers, strong cybersecurity awareness, and early adoption of advanced physical security technologies

- Data center operators across the region place strong emphasis on multi-factor authentication, biometric access, and real-time monitoring to safeguard critical infrastructure and sensitive data

- The presence of leading cloud service providers, stringent regulatory compliance requirements, and continuous investments in digital infrastructure further strengthen the adoption of advanced access control solutions across enterprise, colocation, and hyperscale facilities

U.S. Data Center Access Control Market Insight

The U.S. data center access control market accounted for the largest revenue share in 2025 within North America, supported by rapid expansion of hyperscale data centers and growing demand for secure cloud and edge computing infrastructure. Operators are increasingly deploying biometric systems, smart credentials, and centralized access management platforms to address rising security threats. Strong investments from major cloud providers, combined with regulatory focus on data protection and critical infrastructure security, continue to propel market growth across the country.

Europe Data Center Access Control Market Insight

The Europe data center access control market is expected to grow at a steady CAGR during the forecast period, driven by strict data protection regulations and increasing emphasis on physical security compliance. Growing adoption of colocation and enterprise data centers across Western and Northern Europe is supporting demand for advanced access control systems. The region’s focus on secure digital transformation and cross-border data governance is further accelerating investments in access management solutions.

U.K. Data Center Access Control Market Insight

The U.K. data center access control market is projected to register notable growth during the forecast period, fueled by rising cloud adoption, expansion of colocation facilities, and increasing concerns around data sovereignty. Operators are prioritizing secure access frameworks to protect mission-critical infrastructure supporting BFSI, government, and IT services. The country’s strong regulatory environment and ongoing investments in digital infrastructure continue to support market expansion.

Germany Data Center Access Control Market Insight

The Germany data center access control market is anticipated to expand at a considerable CAGR, driven by the country’s strong industrial base and growing demand for secure enterprise and colocation data centers. German operators emphasize privacy-focused, high-reliability access control solutions aligned with strict compliance standards. Increasing investments in energy-efficient and highly secure data center facilities further contribute to sustained market growth.

Asia-Pacific Data Center Access Control Market Insight

The Asia-Pacific data center access control market is expected to grow at the fastest CAGR during 2026 to 2033, driven by rapid digitalization, rising cloud adoption, and large-scale data center construction across emerging economies. Expanding IT infrastructure, government-led digital initiatives, and increasing demand for secure data storage are accelerating adoption of advanced access control systems. The region’s growing role as a global data center hub is significantly boosting market momentum.

Japan Data Center Access Control Market Insight

The Japan data center access control market is witnessing steady growth, supported by the country’s advanced technological ecosystem and strong focus on infrastructure security. High demand for reliable, automated access systems in enterprise and colocation data centers is driving adoption. Japan’s emphasis on operational continuity and disaster resilience further supports investments in advanced access control technologies.

China Data Center Access Control Market Insight

China accounted for the largest revenue share in the Asia-Pacific data center access control market in 2025, driven by rapid expansion of hyperscale data centers and strong government support for digital infrastructure development. Growing adoption of cloud computing, artificial intelligence, and smart city initiatives is fueling demand for secure physical access systems. The presence of large domestic data center operators and continuous investments in security modernization are key factors supporting market growth in China.

Data Center Access Control Market Share

The data center access control industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- Suprema Inc. (South Korea)

- ASSA ABLOY (Sweden)

- IDEMIA (France)

- Brivo Systems, LLC. (U.S.)

- NEC Corporation (Japan)

- Salto Systems, S.L. (Spain)

- Allegion plc (Ireland)

- Axis Communications AB (Sweden)

- Nedap N.V. (Netherlands)

- dormakaba Group (Switzerland)

- Johnson Controls (Ireland)

Latest Developments in Global Data Center Access Control Market

- In August 2025, ASSA ABLOY strengthened its position in the data center access control market through the acquisition of SiteOwl, a U.S.-based cloud platform focused on physical security lifecycle management. This development enhances ASSA ABLOY’s ability to deliver end-to-end, cloud-enabled access control solutions, enabling data center operators to achieve better asset visibility, streamlined deployment, and centralized management. The integration supports the growing market shift toward digitalized, software-driven physical security frameworks across large-scale and distributed data center environments

- In August 2025, Allegion expanded its European access control footprint by acquiring Brisant Secure Limited, a U.K.-based security hardware provider known for high-security locks and key systems. This acquisition strengthens Allegion’s hardware portfolio relevant to data center facilities, particularly in regions prioritizing high-assurance physical security and regulatory compliance. The move enhances Allegion’s ability to serve enterprise and colocation data centers seeking advanced, durable access control hardware integrated with broader security ecosystems

- In June 2025, Suprema broadened its access control portfolio with the launch of the CoreStation 20 (CS-20) and Door Interface (DI-24) modules, reinforcing its competitiveness in large-scale data center deployments. These solutions support high user volumes, encrypted communication, and PoE+ connectivity, addressing scalability and reliability requirements critical to hyperscale and enterprise data centers. The expansion reflects increasing market demand for modular, high-performance controllers capable of supporting complex access architectures

- In April 2025, Honeywell introduced an upgraded cloud-based physical access management platform tailored for critical infrastructure, including data centers. The enhancement focuses on real-time monitoring, centralized credential management, and seamless integration with cybersecurity and building management systems. This development supports the market trend toward unified security platforms that reduce operational complexity while improving compliance and risk mitigation for multi-site data center operators

- In February 2025, HID Global launched an advanced biometric access control solution designed specifically for high-security environments such as hyperscale and colocation data centers. The solution emphasizes multi-factor authentication and mobile credential integration, addressing rising concerns over unauthorized access and insider threats. This launch underscores the growing market shift toward biometric and identity-centric access control systems to strengthen physical security across mission-critical data center facilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Data Center Access Control Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Center Access Control Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Center Access Control Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.