Global Data Center Fabric Market

Market Size in USD Billion

CAGR :

%

USD

68.01 Billion

USD

337.54 Billion

2024

2032

USD

68.01 Billion

USD

337.54 Billion

2024

2032

| 2025 –2032 | |

| USD 68.01 Billion | |

| USD 337.54 Billion | |

|

|

|

|

Global Data Center Fabric Market Size

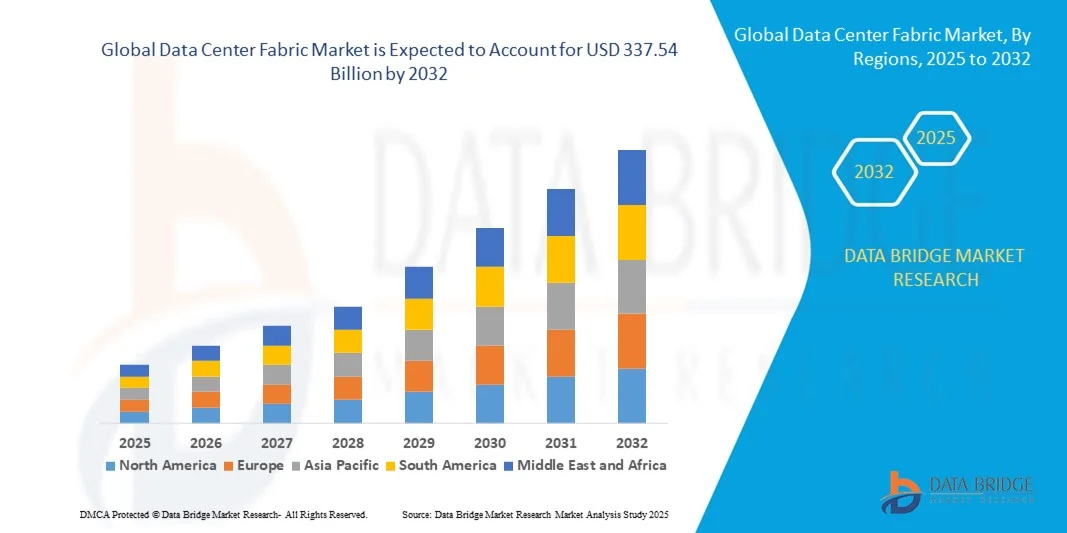

- The global data center fabric market size was valued at USD 68.01 billion in 2024 and is projected to reach USD 337.54 billion by 2032, growing at a CAGR of 22.17% during the forecast period

- Market expansion is being driven by the rapid increase in data traffic, cloud computing adoption, and the shift toward virtualization across enterprise IT infrastructures

- In addition, the need for high-speed, scalable, and efficient networking architecture to support AI workloads and big data analytics is fueling demand for advanced data center fabrics, propelling strong industry growth

Global Data Center Fabric Market Analysis

- Data center fabric, a high-performance networking architecture designed to improve communication between servers and storage systems, is becoming increasingly critical in modern data centers due to its scalability, low latency, and ability to support cloud services, virtualization, and AI-driven workloads

- The rising demand for data center fabrics is primarily driven by the exponential growth in data generation, widespread cloud computing adoption, and the need for agile, software-defined networking solutions that enhance operational efficiency

- North America dominated the data center fabric market with the largest revenue share of 39.6% in 2024, supported by robust investments in hyperscale data centers, early adoption of advanced network technologies, and the strong presence of major cloud service providers and tech giants in the U.S.

- Asia-Pacific is projected to be the fastest growing region in the data center fabric market during the forecast period, fueled by rapid digital transformation, expanding internet infrastructure, and government initiatives supporting data localization and smart city development

- The fabric switches segment dominated the market with the highest revenue share of 63.5% in 2024, due to their ability to reduce latency and improve east-west traffic flow within data centers

Report Scope and Global Data Center Fabric Market Segmentation

|

Attributes |

Data Center Fabric Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Data Center Fabric Market Trends

Enhanced Efficiency Through AI and Automation Integration

- A significant and accelerating trend in the global Data Center Fabric Market is the increasing integration of artificial intelligence (AI), machine learning (ML), and automation tools to optimize network performance, enhance scalability, and support intelligent infrastructure management in data centers. This evolution is critical as modern data centers face rising demands from cloud, AI, and IoT workloads.

- For instance, Cisco’s Nexus Dashboard utilizes AI and analytics to provide real-time insights, automate fabric management, and predict potential network issues before they impact operations. Similarly, Juniper’s Apstra platform enables intent-based networking and closed-loop automation, reducing manual errors and improving operational agility.

- AI integration in data center fabrics enables dynamic traffic routing, predictive maintenance, and resource optimization based on workload requirements. For instance, HPE’s AI-driven InfoSight platform helps data centers forecast capacity needs and detect anomalies early by learning from historical performance patterns. This predictive intelligence minimizes downtime and ensures smoother operations.

- The fusion of AI with automated orchestration platforms allows seamless coordination across compute, storage, and network layers. By automating repetitive tasks such as provisioning, monitoring, and troubleshooting, AI-powered fabric solutions reduce operational complexity and enhance the agility of hybrid and multi-cloud environments.

- This shift towards intelligent, self-optimizing infrastructure is fundamentally transforming data center operations. Leading players such as Arista Networks are incorporating AI into their CloudVision platform to support proactive automation and telemetry-driven decision-making across large-scale data fabrics.

- The demand for data center fabrics with integrated AI and automation capabilities is rapidly growing across enterprises, cloud service providers, and colocation centers, as organizations seek more efficient, adaptive, and future-ready network solutions.

Global Data Center Fabric Market Dynamics

Driver

Growing Need Due to Rising Data Volumes and Cloud Adoption

-

The exponential growth of data generated by cloud computing, IoT, AI, and enterprise applications is driving a critical need for high-performance, scalable, and efficient data center network architectures. This has significantly boosted demand for data center fabrics, which enable seamless communication across servers and storage systems with low latency and high throughput.

- For instance, in March 2024, Cisco unveiled advancements in its Silicon One portfolio, designed to power next-gen data center fabrics with increased bandwidth and power efficiency. These innovations align with the rising demand for scalable solutions that support AI training workloads and multi-cloud architectures.

- As organizations increasingly shift toward hybrid and multi-cloud environments, data center fabrics provide the necessary agility and reliability to manage complex workloads. Features such as automated provisioning, real-time analytics, and intent-based networking are becoming essential components of modern data infrastructure.

- Furthermore, the rise in hyperscale and edge data centers is accelerating the deployment of fabric-based networking, particularly in emerging markets where digital transformation and 5G deployment are rapidly progressing.

- The ability of data center fabrics to optimize traffic flows, reduce bottlenecks, and support rapid scaling is a key factor behind their adoption across diverse sectors such as finance, healthcare, telecommunications, and e-commerce. As enterprises look to modernize their IT operations, fabric architecture is becoming a strategic investment to ensure performance and future readiness.

Restraint/Challenge

Complex Implementation and Integration Challenges

- Despite the benefits, implementing data center fabric architectures can be complex and costly, particularly for organizations transitioning from legacy systems. Challenges related to infrastructure compatibility, system integration, and staff training can slow deployment and add to operational expenses.

- For Instance, many enterprises struggle with integrating new fabric technologies with their existing hardware and software stacks, leading to higher project costs and longer implementation timelines.

- Additionally, the high capital expenditure associated with upgrading network infrastructure—especially with components such as high-speed switches, cabling, and advanced controllers—can be a significant barrier for small to mid-sized businesses or data centers operating under tight budgets.

- Cybersecurity is another concern, as highly automated and interconnected data center environments become more attractive targets for sophisticated cyberattacks. Ensuring end-to-end security across fabric networks requires advanced encryption, access control, and real-time threat detection capabilities.

- Addressing these issues through vendor-neutral solutions, better interoperability standards, and the development of more accessible deployment models such as software-defined fabrics or as-a-service offerings will be crucial to overcoming resistance and unlocking the full potential of data center fabric technologies.

Global Data Center Fabric Market Scope

The market is segmented on the basis of by component, enterprise size, type, application, and end user.

- By Component

On the basis of component, the global data center fabric market is segmented into solutions and services. The solutions segment dominated the market with the largest revenue share of 63.5% in 2024, owing to the rising adoption of fabric-based infrastructure that supports scalable, low-latency networking. These solutions encompass fabric switches, controllers, and software that facilitate agile, software-defined networking (SDN) environments. Enterprises and hyperscale data centers increasingly rely on fabric solutions to handle high data throughput, AI workloads, and cloud-native applications.

The services segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for consulting, integration, and managed services. As organizations transition from legacy systems to modern data center fabrics, they require expert guidance for deployment, optimization, and maintenance. The rise in outsourced data center management and growing complexity of IT infrastructure is accelerating demand for professional services to ensure seamless performance and scalability.

- By Enterprise Size

On the basis of enterprise size, the market is segmented into Small & Medium Enterprises (SMEs) and large enterprises. Large enterprises held the largest market share of 71.3% in 2024, owing to their high-volume data traffic and advanced infrastructure needs. These organizations often operate multi-cloud environments and need scalable data center fabric architectures to support automation, security, and performance at scale. Enterprises in sectors like banking, telecom, and healthcare rely on high-performance networking for mission-critical applications.

The SMEs segment is anticipated to grow at the fastest CAGR from 2025 to 2032, driven by increased digitalization, cloud migration, and the adoption of as-a-service models. Cost-effective fabric solutions and simplified network management platforms are enabling SMEs to modernize their IT infrastructure without significant capital investment. Additionally, growing awareness of the advantages of fabric networking in terms of efficiency, security, and flexibility is encouraging adoption among smaller businesses.

- By Type

On the basis of type, the global data center fabric market is segmented into traditional 3-tier fabric and fabric switches. The fabric switches segment dominated the market with the highest revenue share of 63.5% in 2024, due to their ability to reduce latency and improve east-west traffic flow within data centers. Fabric switches are essential for building scalable, high-bandwidth infrastructures suited for cloud services, AI workloads, and real-time analytics. Major vendors like Cisco and Arista are continuously innovating to improve switch performance and programmability.

The traditional 3-tier fabric segment is expected to register a slower growth rate as enterprises increasingly move toward flatter, leaf-spine architectures for greater efficiency. However, some legacy data centers still rely on the 3-tier model due to existing investments and compatibility concerns. Nonetheless, fabric switches remain the clear preference for future-ready and high-performance data center environments.

- By Application

On the basis of application, the market is segmented into IT & communication, banking & financial services, healthcare, retail, media & entertainment, and others. The IT & communication segment held the dominant market share of 36.9% in 2024, driven by the massive growth of data generated from cloud services, AI applications, and 5G networks. Enterprises in this sector require high-speed, low-latency infrastructure to ensure seamless data transmission, automation, and network orchestration.

The banking & financial services segment is projected to witness the fastest CAGR from 2025 to 2032, due to rising demand for secure, reliable, and scalable infrastructure to support digital banking, real-time transactions, and fraud detection. Fabric networks enable banks to improve data security, support high-frequency trading systems, and ensure uptime in mission-critical operations. Additionally, regulatory compliance and growing cyber threats further necessitate the adoption of robust networking solutions in the BFSI sector.

- By End User

On the basis of end user, the global data center fabric market is segmented into cloud service providers and telecom service providers. The cloud service providers segment held the largest revenue share of 58.8% in 2024, owing to their extensive need for highly scalable, automated, and performance-oriented data center infrastructure. Leading cloud players such as AWS, Microsoft Azure, and Google Cloud rely on fabric architectures to handle vast data volumes and dynamic workload allocation efficiently.

The telecom service providers segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by the rollout of 5G, increasing edge data center deployments, and rising demand for real-time connectivity. Telecoms are modernizing their infrastructure to handle ultra-low latency and high-bandwidth applications such as video streaming, IoT, and immersive technologies. Data center fabrics enable telcos to streamline network operations and support network function virtualization (NFV) and software-defined networking (SDN).

Global Data Center Fabric Market Regional Analysis

- North America dominated the global data center fabric market with the largest revenue share of 39.6% in 2024, driven by the rapid expansion of cloud services, increased demand for high-performance computing, and widespread adoption of digital transformation initiatives across industries.

- Enterprises and service providers in the region prioritize scalability, low-latency performance, and robust network architecture, making data center fabrics an essential component for modern data centers, especially in supporting AI, IoT, and big data workloads.

- The region’s leadership is further fueled by strong investments in hyperscale data centers, a mature IT infrastructure, and the presence of major technology companies, reinforcing North America’s position as a key market for data center fabric solutions across both private and public sectors.

U.S. Data Center Fabric Market Insight

The U.S. data center fabric market captured the largest revenue share of 79.5% in 2024 within North America, driven by the accelerated adoption of cloud computing, edge computing, and AI-powered applications. The presence of major hyperscale data center operators and cloud service providers, such as Amazon Web Services, Microsoft Azure, and Google Cloud, significantly boosts demand. Enterprises increasingly prioritize low-latency, scalable, and programmable network infrastructure, reinforcing the need for modern data center fabrics. Additionally, the ongoing shift toward software-defined networking (SDN) and network function virtualization (NFV) further supports market expansion in the U.S.

Europe Data Center Fabric Market Insight

The Europe data center fabric market is projected to witness substantial CAGR growth over the forecast period, primarily fueled by data sovereignty regulations, GDPR compliance, and rising cloud service adoption. European enterprises are modernizing their IT infrastructure to enhance network efficiency, automation, and performance. The market benefits from strong demand in countries such as Germany, the UK, and the Netherlands, where digital transformation initiatives and smart city projects are accelerating. Additionally, sustainability mandates are prompting the adoption of energy-efficient data center technologies, further stimulating demand for advanced fabric architectures.

U.K. Data Center Fabric Market Insight

The U.K. data center fabric market is anticipated to grow at a significant CAGR during the forecast period, driven by the increasing digitization of public and private sector services. The country's strong financial services sector, rising demand for cloud-native applications, and expanding 5G infrastructure are key growth drivers. Furthermore, enterprises are embracing hybrid and multi-cloud environments, necessitating agile and resilient data center networks. The U.K.’s data center fabric adoption is also supported by investments in AI, machine learning, and edge computing technologies.

Germany Data Center Fabric Market Insight

Germany’s data center fabric market is expected to expand at a considerable CAGR, supported by the country’s industrial digitalization efforts and strong manufacturing base. The push toward Industry 4.0 and IoT integration is increasing the demand for high-performance, scalable network fabrics. German enterprises value secure, privacy-compliant infrastructure, prompting investment in next-generation data center networks. Moreover, the presence of major colocation and cloud data centers, particularly in Frankfurt, positions Germany as a strategic hub for advanced data center technologies.

Asia-Pacific Data Center Fabric Market Insight

The Asia-Pacific data center fabric market is projected to grow at the fastest CAGR of 25.2% from 2025 to 2032, fueled by the explosive growth of internet users, mobile applications, and digital services in countries such as China, India, and Southeast Asian nations. The region is witnessing massive investments in hyperscale data centers and cloud infrastructure to support digital economies. Additionally, favorable government initiatives, 5G rollouts, and expanding e-commerce sectors are driving the need for high-speed, automated, and agile data center networks across APAC.

Japan Data Center Fabric Market Insight

Japan's data center fabric market is gaining momentum due to its advanced technology infrastructure and growing demand for secure, high-performance data transmission. The expansion of smart city initiatives, 5G deployment, and increasing reliance on AI applications are spurring the need for low-latency data center networking. Enterprises are investing in scalable and resilient data center fabrics to support digital services and automation. Furthermore, Japan's strategic focus on energy efficiency and reliability reinforces the adoption of modern fabric technologies.

China Data Center Fabric Market Insight

China captured the largest revenue share in the Asia-Pacific data center fabric market in 2024, driven by robust digital infrastructure development and strong government support for data localization and cloud computing. Major Chinese tech firms are investing heavily in hyperscale data centers and AI capabilities, necessitating high-throughput, low-latency network fabrics. The country’s leadership in smart city projects and industrial IoT also contributes to surging demand. Domestic innovations, cost-effective hardware manufacturing, and a rapidly expanding user base position China as a central hub for data center fabric growth in the region.

Global Data Center Fabric Market Share

The Data Center Fabric industry is primarily led by well-established companies, including:

- Arista Networks, Inc. (U.S.)

- Brocade Communications Systems (Broadcom) (U.S.)

- Cisco Systems, Inc. (U.S.)

- Dell Technologies (U.S.)

- IBM Corporation (U.S.)

- Extreme Networks (U.S.)

- Hewlett Packard (U.S.)

- Huawei Technologies (China)

- Juniper Networks (U.S.)

- NEC (Japan)

- Nokia (Finland)

- VMware (U.S.)

What are the Recent Developments in Global Data Center Fabric Market?

- In May 2023, Cisco Systems, Inc. launched its next-generation Nexus 9800 series switches, designed to deliver high-performance, scalable data center fabric solutions optimized for AI/ML workloads and hybrid cloud environments. This launch reinforces Cisco’s leadership in the global data center fabric market by addressing the growing demand for low-latency, programmable, and energy-efficient network architectures. The new series supports advanced telemetry, automation, and real-time analytics, enabling enterprises to future-proof their data center operations.

- In April 2023, Juniper Networks announced a strategic collaboration with ServiceNow to integrate Juniper's Apstra intent-based networking solution with ServiceNow’s IT operations management platform. This partnership aims to simplify and automate data center fabric management, enhancing visibility, service assurance, and network provisioning. The integration underscores Juniper's commitment to advancing AI-driven operations (AIOps) within data center networks, aligning with industry shifts toward autonomous infrastructure and operational efficiency.

- In March 2023, Arista Networks unveiled its Universal Cloud Network (UCN) 2023 framework, which extends cloud-grade data center fabric capabilities to edge and enterprise environments. Built on its flagship EOS software and 400G switching platforms, UCN 2023 is tailored for high-density, high-throughput workloads across AI, cloud, and enterprise data centers. This development highlights Arista’s focus on scalable, software-defined fabric architectures that meet the evolving performance and agility demands of modern digital infrastructure.

- In February 2023, Huawei Technologies launched its CloudFabric 3.0 Hyper-Converged Data Center Network Solution, targeting enterprises and service providers seeking ultra-fast, intelligent, and lossless network performance. Leveraging AI-based management and autonomous driving technologies, CloudFabric 3.0 supports diverse workloads including cloud computing, big data, and high-performance computing (HPC). Huawei’s innovation reflects its strategic intent to capture a larger share of the global data center fabric market, especially in Asia-Pacific and emerging economies.

- In January 2023, Dell Technologies expanded its SmartFabric Services portfolio with new integrations into its PowerSwitch networking hardware and VMware NSX environments. The enhanced offerings enable customers to deploy automated, scalable data center fabrics with simplified operations and lifecycle management. This move underscores Dell’s vision of delivering open, modern networking solutions that empower hybrid cloud and edge data center strategies, catering to the growing demand for flexibility and efficiency in IT infrastructure.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Data Center Fabric Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Center Fabric Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Center Fabric Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.