Global Data Center Security Market

Market Size in USD Billion

CAGR :

%

USD

15.96 Billion

USD

62.20 Billion

2024

2032

USD

15.96 Billion

USD

62.20 Billion

2024

2032

| 2025 –2032 | |

| USD 15.96 Billion | |

| USD 62.20 Billion | |

|

|

|

|

Global Data Center Security Market Size

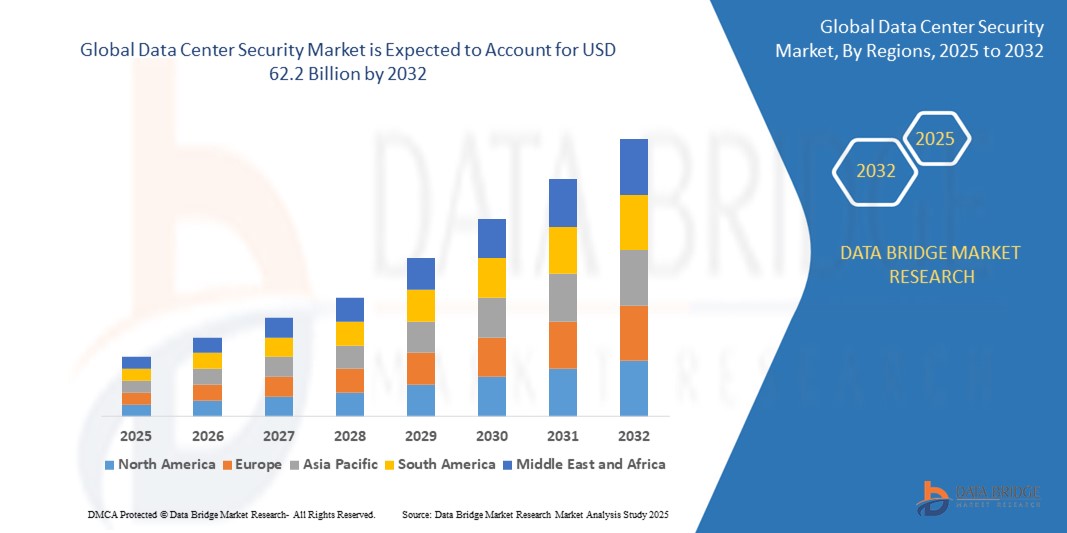

- The Global Data Center Security Market Size was valued at USD 15.96 Billion in 2024 and is expected to reach USD 62.2 Billion by 2032, at a CAGR of 35.5% during the forecast period

- The growth of the Global Data Center Security Market is fueled by rising cyber threats, increasing data center deployments, and the growing need for regulatory compliance and data protection.

Global Data Center Security Market Analysis

The Global Data Center Security Market is experiencing rapid expansion as businesses across industries prioritize protecting sensitive data, maintaining business continuity, and ensuring regulatory compliance. The rise in cyber threats, such as ransomware, DDoS attacks, and insider breaches, has made data center security a critical focus area for organizations of all sizes. Companies are increasingly adopting advanced physical and logical security solutions to safeguard infrastructure, networks, and stored data.

A primary driver of market growth is the accelerated digital transformation across sectors such as BFSI, healthcare, retail, manufacturing, and government. As enterprises shift toward cloud computing, IoT, AI, and big data analytics, the need for secure and resilient data center environments becomes more pronounced. The integration of technologies like artificial intelligence (AI), machine learning (ML), and behavior-based analytics is improving real-time threat detection, incident response, and overall security posture.

The growing adoption of cloud-based deployment models has also reshaped the landscape. Cloud-native security solutions offer scalability, flexibility, and cost-effectiveness, allowing enterprises to implement robust security without heavy infrastructure investments. Furthermore, hybrid and multi-cloud environments are prompting organizations to deploy comprehensive, centralized security frameworks that protect both on-premises and virtualized data centers.

Physical security systems—such as biometric access control, surveillance cameras, and perimeter intrusion detection—continue to play a vital role in safeguarding facilities. Simultaneously, logical security solutions, including firewalls, encryption, identity and access management (IAM), and SIEM systems, are essential for protecting digital assets and ensuring compliance with global regulations like GDPR, HIPAA, and ISO 27001.

Despite strong momentum, the market faces challenges. These include high implementation costs, the complexity of integrating security solutions with legacy systems, and shortages of skilled cybersecurity professionals. Moreover, data sovereignty issues and varying international regulations can complicate deployment strategies for multinational enterprises.

Nevertheless, the outlook remains highly promising. Growing investments in green data centers, edge computing, and 5G infrastructure are expected to generate new security demands. Additionally, the increasing frequency and sophistication of cyberattacks will continue to drive innovation and adoption in the data center security space.

Report Scope and Global Data Center Security Market Segmentation

|

Attributes |

Global Data Center Security Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Data Center Security Market Trends

“Innovation and Integration: Enhancing Security Through Smart Technologies”

- A significant and accelerating trend in the Global Data Center Security Market is the integration of smart technologies, such as AI, machine learning, and behavioral analytics, to enable proactive threat detection, automated incident response, and predictive risk management. These capabilities are reshaping how data centers defend against sophisticated cyberattacks.

- Enterprises are increasingly deploying cloud-based and hybrid data center security platforms to gain real-time visibility, centralized control, and scalable protection across diverse environments. This shift supports the dynamic needs of remote workforces, edge computing, and multi-cloud infrastructure.

- The adoption of Zero Trust Architecture (ZTA) is rising, emphasizing identity verification, least-privilege access, and micro-segmentation to strengthen internal network security and reduce attack surfaces.

- Convergence of physical and logical security solutions is gaining traction—combining biometric access controls, smart surveillance, and cybersecurity measures into unified platforms to provide holistic protection for data center infrastructure.

Global Data Center Security Market Dynamics

Driver

“Rising Demand for Compliance, Resilience, and Digital Security Infrastructure”

- The growing emphasis on regulatory compliance (e.g., GDPR, HIPAA, PCI DSS) and data privacy laws across sectors such as BFSI, healthcare, and government is driving demand for robust data center security solutions to safeguard sensitive information and avoid legal penalties.

- The surge in cyberattacks, ransomware threats, and data breaches has led to increased investment in intrusion detection systems, next-gen firewalls, and endpoint protection to ensure business continuity and resilience.

- Cloud adoption, remote workforces, and digital transformation initiatives are accelerating the deployment of scalable, cloud-native security platforms to monitor and protect hybrid and multi-cloud environments.

- Advancements in AI, machine learning, and threat intelligence are enabling proactive threat detection, real-time monitoring, and automated incident response, enhancing the efficiency and effectiveness of data center security operations.

- Growing deployment of edge data centers and the rise of smart cities and 5G infrastructure are creating new security demands, encouraging providers to offer tailored solutions for distributed and high-speed data environments.

Restraint/Challenge

“High Cost, Integration Complexities, and Limited Awareness in Emerging Markets”

- The deployment of comprehensive data center security solutions—including next-generation firewalls, intrusion prevention systems, biometric access control, and AI-driven threat intelligence platforms—requires significant upfront capital. This presents a major challenge for small and medium enterprises (SMEs) and startups, particularly in developing economies, limiting their ability to adopt enterprise-grade security infrastructure.

- Integrating modern security technologies with existing legacy IT systems can be highly complex. Many data centers still operate with outdated infrastructure that lacks compatibility with advanced security tools. As a result, organizations face extended implementation times, increased costs, and operational disruptions during integration, deterring security upgrades.

- A major barrier in both developed and developing regions is the lack of adequately trained cybersecurity professionals. The shortage of skilled personnel who can manage, monitor, and maintain sophisticated security systems hinders the effective use of these technologies, especially in organizations with limited IT resources.

- Global data center operators often struggle to comply with varying data privacy and cybersecurity regulations across jurisdictions (e.g., GDPR in Europe, CCPA in California, and PDPA in Asia). Inconsistent enforcement and differing legal interpretations create confusion, slow down technology rollouts, and add to compliance-related costs.

- In emerging markets, underdeveloped digital infrastructure, unreliable power supply, and harsh environmental conditions (like high humidity or temperature fluctuations) can affect the stability and effectiveness of physical security systems and surveillance technologies. These challenges often require costly custom solutions or specialized equipment to maintain optimal security performance.

Global Data Center Security Market Scope

The market is segmented on the basis of Component, Data Center Type, Deployment Mode and Application

- By Component

The Global Data Center Security Market, based on component, is segmented into solutions and services. The solutions segment includes physical security and logical security. Physical security involves safeguarding the data center infrastructure from physical threats such as unauthorized access, environmental hazards, and theft. This is achieved through systems like surveillance cameras, biometric access controls, alarm systems, and perimeter security measures. Logical security, meanwhile, addresses cybersecurity threats and focuses on protecting digital assets and network infrastructure. It includes technologies such as firewalls, intrusion detection and prevention systems (IDPS), encryption tools, identity and access management (IAM), and antivirus software. The services segment encompasses consulting, integration and deployment, and managed services. Consulting services help organizations assess potential security risks and design effective, compliant security strategies. Integration and deployment services ensure seamless installation and configuration of security solutions into existing IT environments. Managed services offer continuous monitoring, threat intelligence, and rapid incident response, often handled by third-party providers. These services are essential for organizations aiming to maintain high levels of security without the need for extensive internal resources, making them a vital component of the overall data center security ecosystem.

- By Data Center Type

The Global Data Center Security Market, when segmented by data center type, includes Small Data Centers, Medium Data Centers, and Large Data Centers, each with distinct security needs and infrastructure complexities. Small Data Centers are typically used by startups, SMEs, and branch offices. These facilities usually have limited IT resources and staff, making them more reliant on cost-effective, easy-to-deploy security solutions. Despite their size, the growing risk of cyber threats and the increasing regulatory focus on data protection are prompting small data centers to adopt advanced logical security tools like firewalls, endpoint protection, and two-factor authentication systems. Medium Data Centers serve mid-sized enterprises and are often characterized by moderate data volumes and a hybrid IT infrastructure. These data centers require a balanced approach to security, with a mix of physical measures (such as biometric access control and CCTV surveillance) and robust cyber defense systems, including intrusion prevention, encryption, and compliance management tools. Their security strategies tend to be more sophisticated than small data centers due to higher data sensitivity and operational complexity. Large Data Centers—typically operated by global enterprises, cloud service providers, or colocation facilities—are highly complex, with expansive physical footprints and multi-layered network architectures. These centers handle vast amounts of sensitive and mission-critical data, making them prime targets for both physical breaches and cyberattacks. As a result, they deploy advanced and integrated security frameworks that combine AI-driven threat detection, real-time monitoring, access management, and disaster recovery protocols. Large data centers often invest heavily in both physical infrastructure protection and advanced cybersecurity to ensure uninterrupted, compliant, and secure operations across all levels.

- By Deployment Mode

The Global Data Center Security Market, by deployment mode, is segmented into On-Premises and Cloud-Based solutions. On-Premises deployment offers organizations full control over their data and security infrastructure, making it ideal for highly regulated industries like healthcare, BFSI, and government. While it ensures data sovereignty and compliance, it requires higher upfront investment and maintenance. Cloud-Based deployment is rapidly growing due to its scalability, cost-effectiveness, and ease of integration. It enables real-time monitoring, remote access, and advanced threat detection, making it suitable for businesses seeking flexibility and lower capital expenditure. Many organizations now adopt hybrid models to leverage the benefits of both approaches.

- By Application

The Global Data Center Security Market, by application, is driven by the rising demand for data protection and compliance across a wide range of industries, including BFSI, IT and Telecom, Healthcare, Government and Defense, Energy and Utilities, Retail, Media and Entertainment, and Manufacturing. In the Banking, Financial Services, and Insurance (BFSI) sector, data center security is critical to safeguarding customer information, ensuring transaction integrity, and complying with strict regulations like PCI DSS and SOX. Financial institutions heavily invest in intrusion prevention, encryption, and access control systems. The IT and Telecom sector depends on secure and highly available data centers to support cloud services, mobile connectivity, and digital communications. As data traffic grows, companies focus on advanced threat detection, firewall systems, and DDoS protection. In Healthcare, the protection of electronic health records (EHRs) and compliance with data privacy laws such as HIPAA and GDPR fuel the need for highly secure and reliable data center environments. Government and Defense agencies require robust, often air-gapped infrastructure to store sensitive citizen data, military intelligence, and critical national systems, making security a top priority. Energy and Utilities use smart grids and SCADA systems, which are increasingly digitized and interconnected—raising the risk of cyberattacks and requiring strong perimeter and network security in their data centers. The Retail industry, driven by e-commerce and omnichannel platforms, handles high volumes of customer data and payment information. Data center security helps protect this information and maintain customer trust. In Media and Entertainment, the rapid growth of streaming services, digital content creation, and IP protection has led to increased reliance on secure, scalable data centers to handle large media files and protect creative assets. Manufacturing organizations adopt data center security to support smart factory operations, IoT-driven production systems, and protect trade secrets and product designs from cyber threats.

Global Data Center Security Market Regional Analysis

- North America remains the dominant regional market, led by the U.S., which hosts over 38,000 secured data centers as of 2023, including more than 70% of hyperscale facilities with upgraded physical and AI-driven cyber monitoring systems. Regulatory frameworks like HIPAA and CMMC, along with heightened concerns over ransomware and cloud breaches, continue to fuel security investments. Canada’s healthcare and finance sectors also significantly contribute to North America’s growth.

- Europe holds the second-largest share, with over 35,000 secured centers, driven by GDPR enforcement, sovereign cloud initiatives, and investments in privacy technologies. Countries such as Germany, the UK, France, and the Netherlands lead regional adoption of zero-trust and secure cloud compliance.

- Asia-Pacific demonstrates the fastest regional growth trajectory, securing over 51,000 data centers in 2023. China (22,000), India, Japan, and South Korea are major contributors, with rapid cloud expansion, telecom infrastructure, and hyperscaler deployments. Government regulations in China and India’s “Digital India” initiative further support accelerated adoption.

- Middle East & Africa (MEA) has around 13,000 secure data centers, with UAE and Saudi Arabia leading through government-driven smart city and infrastructure initiatives, while South Africa contributes significantly via telco and colocation centers.

- Latin America shows steady growth supported by expanding digital services in Brazil, Mexico, and Argentina. Investments to improve data governance and cybersecurity frameworks are lifting the regional profile, albeit from a comparatively smaller base.

North America Data Center Security Market Insight

North America exhibits strong growth in the data center security market, driven by the region’s expanding digital infrastructure, high adoption of cloud computing, and stringent regulatory compliance requirements. The U.S. leads the region with a large number of hyperscale and enterprise data centers, which demand robust physical and logical security solutions. Increasing concerns over cyber threats, data breaches, and ransomware attacks have accelerated investments in advanced security technologies such as AI-based threat detection, encryption, and biometric access controls. Additionally, the presence of leading tech companies and managed service providers contributes to the rapid deployment of innovative data center security solutions, further strengthening the region's market position.

Europe Data Center Security Market Insight

Europe demonstrates robust growth in the data center security market, driven by stringent regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Digital Operational Resilience Act (DORA), which compel organizations to adopt comprehensive security strategies. These regulations are pushing enterprises and data center operators to invest heavily in both physical and logical security measures to ensure compliance and resilience against cyber threats. Western Europe particularly countries like Germany, the UK, France, and the Netherlands leads the region due to their advanced digital infrastructure and early adoption of cloud computing. The rise in hyperscale data centers and the expansion of edge computing are further intensifying the need for scalable and integrated security solutions.

Asia Pacific Data Center Security Market Insight

Asia Pacific is witnessing robust growth in the data center security market, driven by rapid digital transformation, growing cloud adoption, and rising cyber threats across major economies. Countries like China, India, Japan, and Australia are investing heavily in secure digital infrastructure, propelled by government-led initiatives and increasing enterprise demand for secure data environments. The expansion of 5G, IoT, and edge computing is further accelerating the need for integrated security solutions. Additionally, stricter regulatory frameworks around data privacy and sovereignty are compelling organizations to upgrade their physical and logical data center security systems. The region’s dynamic digital ecosystem, along with a surge in hyperscale data centers and colocation facilities, positions Asia Pacific as one of the fastest-growing markets in the global data center security landscape.

Middle East and Africa Data Center Security Market Insight

he Middle East and Africa region is witnessing steady growth in the data center security market, driven by increased investments in digital infrastructure, rising cyber threats, and government-led smart city initiatives. Countries like the UAE, Saudi Arabia, and South Africa are leading the charge with large-scale data center developments and heightened focus on data protection regulations. The growing presence of cloud service providers and expanding telecom and BFSI sectors are also driving the demand for advanced physical and logical security solutions. However, challenges such as limited cybersecurity awareness, skills shortages, and fragmented regulatory frameworks continue to restrain widespread adoption.

Latin America Data Center Security Market Insight

Latin America is experiencing steady growth in the data center security market, driven by the increasing digitalization of services across sectors such as banking, retail, and telecommunications. Countries like Brazil and Mexico are leading the region in terms of data center investments and cybersecurity initiatives. The expansion of cloud computing, growing concerns over data breaches, and the implementation of stricter regulatory frameworks are prompting enterprises to adopt advanced physical and logical security solutions. Moreover, the rise in hybrid work models and the increasing use of online services are pushing both public and private sectors to strengthen data center infrastructure and protection mechanisms. Despite challenges such as budget constraints and varying technological maturity across countries, the market is poised for expansion due to increasing awareness and government-backed digital transformation programs.

Global Data Center Security Market Share

The Global Automotive Wheels industry is primarily led by well-established companies, including:

- Cisco Systems, Inc.

- IBM Corporation

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- Honeywell International Inc.

- Hewlett Packard Enterprise (HPE)

- Schneider Electric SE

- McAfee Corp.

- Dell Technologies Inc.

- Symantec Corporation (Broadcom Inc.)

- Juniper Networks, Inc.

- Palo Alto Networks, Inc.

- Trend Micro Incorporated

- Siemens AG

- Avigilon (a Motorola Solutions company)

Latest Developments in Global Data Center Security Market

- In May 2025, Google Cloud completed its $32 billion acquisition of Wiz, a leading cloud security startup, to enhance its data center and multicloud security offerings, marking one of the largest cybersecurity acquisitions in history.

- In March 2025, F5, Inc. acquired LeakSignal, a data leakage prevention startup, to strengthen its portfolio of zero-trust and real-time data protection solutions within hyperscale data centers.

- In January 2025, Cisco Systems launched its new Hypershield architecture, designed to secure AI-scale data centers with distributed firewall capabilities and microsegmentation tools for hybrid cloud environments.

- In November 2024, Fortinet introduced FortiGate 6000F, a high-performance firewall with advanced threat protection and integrated AI for hyperscale and colocation data centers, expanding its presence in the large enterprise segment.

- In August 2024, Trend Micro released an AI-powered threat detection suite tailored for hybrid cloud and on-premises data centers, with integrated support for major platforms like AWS, Azure, and GCP.

- In June 2024, Honeywell acquired Carrier Global's Access Solutions unit, strengthening its physical security and access control offerings across critical infrastructure and data centers globally.

- In March 2024, Check Point Software Technologies expanded its cloud-native security solutions with deeper integration into hybrid cloud environments, ensuring full-stack protection across enterprise data centers.

- In December 2023, IBM and Equinix announced a strategic collaboration to launch compliance automation and risk management solutions for colocation data centers, addressing rising regulatory demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.