Global Data Center Server Market

Market Size in USD Billion

CAGR :

%

USD

78.87 Billion

USD

158.32 Billion

2024

2032

USD

78.87 Billion

USD

158.32 Billion

2024

2032

| 2025 –2032 | |

| USD 78.87 Billion | |

| USD 158.32 Billion | |

|

|

|

|

Data Center Server Market Size

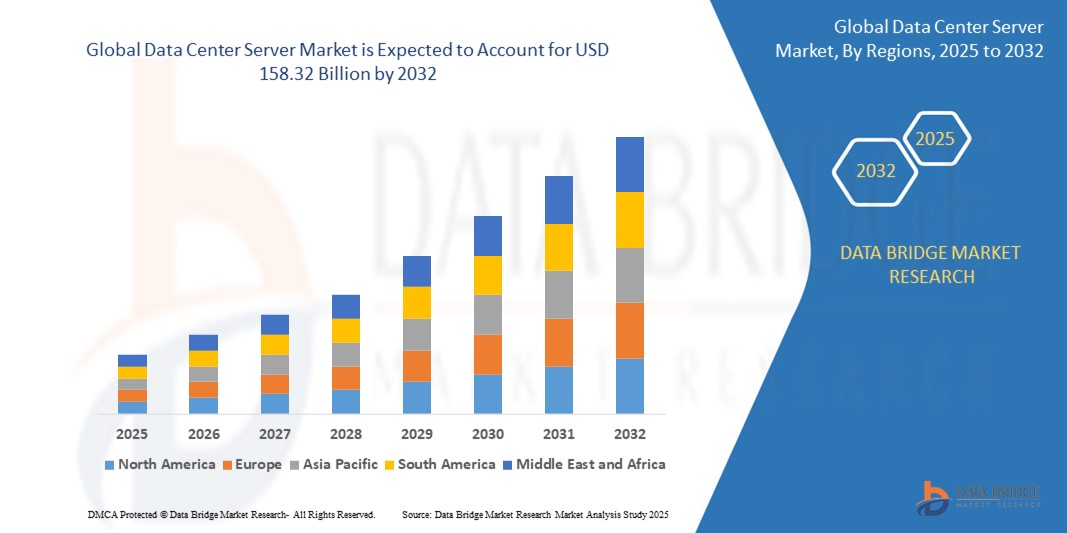

- The global data center server market size was valued at USD 78.87 billion in 2024 and is expected to reach USD 158.32 billion by 2032, at a CAGR of 9.1% during the forecast period

- The market growth is largely fuelled by the rising demand for cloud computing, increasing data traffic, and widespread digital transformation across various industries

- The expansion of hyperscale data centers and growing adoption of AI and big data analytics are further contributing to the increasing deployment of high-performance data center servers across the globe

Data Center Server Market Analysis

- The data center server market is witnessing steady growth with rising demand for efficient data processing and storage solutions across industries including healthcare, finance, and e-commerce

- Companies are investing in high-density servers and energy-efficient infrastructure to enhance performance while reducing operational costs in modern data centers

- North America leads the global data center server market with the largest revenue share of 38.5% in 2024, driven by the presence of major cloud service providers and high adoption of advanced server technologies

- The Asia-Pacific region is expected to witness the highest growth rate in the global data center server market, driven by increasing cloud adoption, rapid digital transformation, and rising investments in data center infrastructure across emerging economies such as India, China, and Southeast Asia

- Rack servers hold the largest market revenue share of 45% in 2024, driven by their high density, scalability, and ease of management in large data center environments. These servers are preferred for their efficient use of space and power, supporting intensive computing workloads

Report Scope and Data Center Server Market Segmentation

|

Attributes |

Data Center Server Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Center Server Market Trends

“Growing Shift Toward Hyperscale Data Centers”

- Enterprises are increasingly adopting hyperscale data centers to manage massive data workloads efficiently, especially for artificial intelligence and big data applications

- These facilities support cost-effective scaling and improved resource utilization, making them suitable for high-demand computing environments

- Cloud providers are investing heavily in hyperscale infrastructure to meet growing digital service needs

- For instance, Google has expanded its hyperscale data center presence across multiple regions to support increased demand for its cloud platforms

- Advanced technologies such as liquid cooling and modular server designs are being used to optimize performance and reduce operational costs

- The need for faster data processing and reliable storage is pushing industries toward hyperscale deployments

- For instance, Microsoft is building new hyperscale centers globally to power its Azure services and support real-time data operations across sectors

Data Center Server Market Dynamics

Driver

“Rising Adoption of Cloud Computing and AI Technologies”

- The growing reliance on cloud-based infrastructure across industries is significantly increasing the demand for high-performance data center servers to enhance flexibility, scalability, and operational efficiency

- Artificial intelligence applications such as machine learning and predictive analytics are driving the need for powerful servers with advanced computing, storage, and networking capabilities

- Cloud providers including Amazon Web Services, Microsoft Azure, and Google Cloud are continuously expanding data center capacities to meet enterprise and consumer demands

- For instance, hyperscale data centers are integrating AI-optimized chips and GPU-based servers to handle complex AI workloads and real-time data processing

- Technologies such as virtualization, containerization, and edge computing are reshaping server deployment strategies, while initiatives in smart cities, healthcare, and manufacturing are boosting investment in scalable server infrastructure

Restraint/Challenge

“High Energy Consumption and Environmental Impact”

- High energy consumption in large-scale data centers leads to increased operational costs and environmental concerns, especially in hyperscale and high-density server environments

- The need to maintain cooling systems significantly adds to electricity usage, contributing to carbon emissions and stressing utility grids

- Regulatory pressure and stakeholder focus on reducing the carbon footprint of digital infrastructure are driving the demand for sustainable solutions

- For instance, traditional cooling methods consume vast amounts of electricity, prompting data centers to explore alternatives such as liquid cooling and AI-based energy optimization

- Smaller enterprises and developing regions face challenges investing in energy-efficient infrastructure due to high initial costs and limited access to renewable energy sources

Data Center Server Market Scope

The global data center server market is segmented on the basis of type, data center size, application, and end user.

- By Type

On the basis of type, the data center server market is segmented into rack servers, blade servers, micro servers, and tower servers. Rack servers hold the largest market revenue share of 45% in 2024, driven by their high density, scalability, and ease of management in large data center environments. These servers are preferred for their efficient use of space and power, supporting intensive computing workloads.

Blade servers is expected to witness the fastest growth rate from 2025 to 2032, fueled by their modularity, compact design, and ability to deliver high processing power with reduced cooling needs, making them ideal for hyperscale and enterprise data centers.

- By Data Center Size

Based on data center size, the data center server market is segmented into small, medium, and large data centers. Large data centers dominate the market revenue share of 55% in 2024 due to their extensive infrastructure supporting cloud services and enterprise applications.

Medium-sized data centers is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand from regional cloud providers and enterprises seeking scalable solutions. Their flexibility and cost-effectiveness make them ideal for businesses aiming to expand IT capabilities without large capital expenditure.

- By Application

On the basis of application, the data center server market is segmented into industrial servers and commercial servers. Commercial servers account for the largest revenue share of 60% in 2024, driven by widespread adoption in cloud computing, e-commerce, and data analytics sectors.

Industrial servers is expected to witness the fastest growth rate from 2025 to 2032, supported by use cases in manufacturing automation and IoT-enabled operations requiring robust and reliable computing. These servers offer enhanced durability and real-time processing essential for critical industrial environments.

- By End User

On the basis of end user, the data center server market is segmented into banking, financial services, and insurance, information technology and telecom, government, and healthcare sectors. The IT and telecom segment commands the largest market revenue share of 50% in 2024 due to extensive cloud adoption and digital transformation initiatives.

Healthcare sector is expected to witness the fastest growth rate from 2025 to 2032, fuelled by increasing investments in digital health infrastructure and data-intensive medical applications. Growing adoption of telemedicine, electronic health records, and AI-driven diagnostics further drive demand for high-performance servers in this sector.

Data Center Server Market Regional Analysis

- North America leads the global data center server market with the largest revenue share of 38.5% in 2024, driven by the presence of major cloud service providers and high adoption of advanced server technologies

- The region benefits from strong IT infrastructure, significant enterprise investments, and early adoption of AI and big data analytics, fueling demand for high-performance servers

- Enterprises and cloud providers in North America prioritize scalable, energy-efficient server solutions to support growing data workloads, further strengthening market dominance

- The region's focus on digital transformation and edge computing also contributes to steady market expansion

U.S. Data Center Server Market Insight

The U.S. captured the largest revenue share of approximately 80% within North America in 2024, supported by rapid growth in cloud services, artificial intelligence, and data analytics. Investments from tech giants and hyperscale data centers are driving the demand for powerful and reliable server systems. Increasing adoption of hybrid and multi-cloud environments alongside government initiatives for digital infrastructure development also accelerate market growth.

Europe Data Center Server Market Insight

The Europe data center server market is expected to witness the fastest growth rate from 2025 to 2032, during the forecast period, supported by regulatory compliance requirements and growing digital transformation across industries. The demand for secure and energy-efficient data center servers is rising, particularly in Germany, France, and the U.K. The region is witnessing increased adoption of green data centers and innovative cooling technologies, which are boosting the market for advanced server solutions.

U.K. Data Center Server Market Insight

The U.K. data center server market is expected to witness the fastest growth rate from 2025 to 2032, driven by investments in cloud infrastructure and a shift toward data sovereignty. Growing adoption of AI and edge computing, along with a strong presence of financial and technology firms, creates robust demand for flexible and scalable server systems.

Germany Data Center Server Market Insight

The Germany data center server is expected to witness the fastest growth rate from 2025 to 2032, due to its well-established industrial base and emphasis on Industry 4.0 initiatives. Increasing demand for industrial automation and digital manufacturing fuels server requirements. Germany’s commitment to sustainability also promotes the adoption of energy-efficient and eco-friendly server technologies.

Asia-Pacific Data Center Server Market Insight

The Asia-Pacific data center server is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing cloud adoption, and expanding IT infrastructure in countries such as China, India, and Japan. The region is witnessing a surge in hyperscale data center developments and government-led digital initiatives, significantly boosting server market demand.

Japan Data Center Server Market Insight

The Japan’s data center server market is expected to witness the fastest growth rate from 2025 to 2032, due to advancements in technology and strong demand for reliable and secure IT infrastructure. The country’s focus on smart manufacturing, digital healthcare, and IoT deployments drives the need for high-performance servers. Aging infrastructure replacement and investments in green data centers also support market growth.

China Data Center Server Market Insight

The China dominates the Asia-Pacific region with the largest revenue share in 2024, propelled by its vast cloud services sector and expanding hyperscale data centers. The government’s smart city projects and increased focus on AI and big data analytics drive server demand. Local manufacturers are rapidly innovating, making China a key market for affordable and scalable data center server solutions.

Data Center Server Market Share

The Data Center Server industry is primarily led by well-established companies, including:

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc. (U.S.)

- IBM (U.S.)

- FUJITSU (Japan)

- Cisco Systems, Inc. (U.S.)

- Lenovo (Hongkong)

- Oracle (U.S.)

- Huawei Technologies Co., Ltd. (China)

- NEC Corporation (U.S.)

- Vertiv Group Corp (U.S.)

- Schneider Electric (France)

- Atos SE (France)

Latest Developments in Global Data Center Server Market

- In July 2023, Lenovo introduced its latest innovation in data management by launching the ThinkSystem DG Enterprise Storage Arrays and ThinkSystem DM3010H Enterprise Storage Arrays. These new solutions aim to simplify the deployment of artificial intelligence workloads for organizations, enhancing their ability to extract valuable insights from data. By improving data storage efficiency and performance, Lenovo is enabling businesses to accelerate AI adoption and optimize operations. This development strengthens Lenovo’s position in the enterprise storage market and supports the growing demand for AI-ready infrastructure.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DATA CENTER SERVER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DATA CENTER SERVER MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DATA CENTER SERVER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL DATA CENTER SERVER MARKET, BY TYPE

6.1 OVERVIEW

6.2 RACK-MOUNT SERVERS

6.3 BLADE SERVERS

6.4 TOWER SERVERS

6.5 OTHERS

7 GLOBAL DATA CENTER SERVER MARKET, BY STORAGE SYSTEM TYPE

7.1 OVERVIEW

7.2 NETWORK-ATTACHED STORAGE (NAS)

7.3 STORAGE AREA NETWORK (SAN)

8 GLOBAL DATA CENTER SERVER MARKET, BY FORM FACTOR

8.1 OVERVIEW

8.2 1U

8.3 2U

8.4 4U

8.5 5U

8.6 11U

8.7 OTHERS

9 GLOBAL DATA CENTER SERVER MARKET, BY PROCESSOR

9.1 OVERVIEW

9.2 INTEL

9.3 AMD

10 GLOBAL DATA CENTER SERVER MARKET, BY NUMBER OF PROCESSOR

10.1 OVERVIEW

10.2 LESS THAN 2

10.3 2 TO 4

10.4 MORE THAN 4

11 GLOBAL DATA CENTER SERVER MARKET, BY TIER TYPE

11.1 OVERVIEW

11.2 TIER I

11.3 TIER II

11.4 TIER III

11.5 TIER IV

12 GLOBAL DATA CENTER SERVER MARKET, BY TYPE OF DATA CENTER

12.1 OVERVIEW

12.2 ENTERPRISE DATA CENTERS

12.3 MANAGED SERVICES DATA CENTERS

12.4 COLOCATION DATA CENTERS

12.5 CLOUD DATA CENTERS

12.6 EDGE DATA CENTERS

12.7 OTHERS

13 GLOBAL DATA CENTER SERVER MARKET, BY DATA CENTER SIZE

13.1 OVERVIEW

13.2 MICRO DATA CENTER

13.3 SMALL DATA CENTERS

13.4 MID-SIZED DATA CENTERS

13.5 LARGE DATA CENTERS

14 GLOBAL DATA CENTER SERVER MARKET, BY END USER

14.1 OVERVIEW

14.2 BFSI

14.2.1 BY TYPE

14.2.1.1. RACK-MOUNT SERVERS

14.2.1.2. BLADE SERVERS

14.2.1.3. TOWER SERVERS

14.2.1.4. OTHERS

14.3 HEALTHCARE

14.3.1 BY TYPE

14.3.1.1. RACK-MOUNT SERVERS

14.3.1.2. BLADE SERVERS

14.3.1.3. TOWER SERVERS

14.3.1.4. OTHERS

14.4 GOVERNMENT & DEFENSE

14.4.1 BY TYPE

14.4.1.1. RACK-MOUNT SERVERS

14.4.1.2. BLADE SERVERS

14.4.1.3. TOWER SERVERS

14.4.1.4. OTHERS

14.5 IT & TELECOMMUNICATION

14.5.1 BY TYPE

14.5.1.1. RACK-MOUNT SERVERS

14.5.1.2. BLADE SERVERS

14.5.1.3. TOWER SERVERS

14.5.1.4. OTHERS

14.6 RETAIL

14.6.1 BY TYPE

14.6.1.1. RACK-MOUNT SERVERS

14.6.1.2. BLADE SERVERS

14.6.1.3. TOWER SERVERS

14.6.1.4. OTHERS

14.7 MEDIA & ENTERTAINMENT

14.7.1 BY TYPE

14.7.1.1. RACK-MOUNT SERVERS

14.7.1.2. BLADE SERVERS

14.7.1.3. TOWER SERVERS

14.7.1.4. OTHERS

14.8 OTHERS

15 GLOBAL DATA CENTER SERVER MARKET, BY GEOGRAPHY

15.1 GLOBAL DATA CENTER SERVER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1.1 NORTH AMERICA

15.1.1.1. U.S.

15.1.1.2. CANADA

15.1.1.3. MEXICO

15.1.2 EUROPE

15.1.2.1. GERMANY

15.1.2.2. FRANCE

15.1.2.3. U.K.

15.1.2.4. ITALY

15.1.2.5. SPAIN

15.1.2.6. RUSSIA

15.1.2.7. TURKEY

15.1.2.8. BELGIUM

15.1.2.9. NETHERLANDS

15.1.2.10. NORWAY

15.1.2.11. FINLAND

15.1.2.12. SWITZERLAND

15.1.2.13. DENMARK

15.1.2.14. SWEDEN

15.1.2.15. POLAND

15.1.2.16. REST OF EUROPE

15.1.3 ASIA PACIFIC

15.1.3.1. JAPAN

15.1.3.2. CHINA

15.1.3.3. SOUTH KOREA

15.1.3.4. INDIA

15.1.3.5. AUSTRALIA

15.1.3.6. NEW ZEALAND

15.1.3.7. SINGAPORE

15.1.3.8. THAILAND

15.1.3.9. MALAYSIA

15.1.3.10. INDONESIA

15.1.3.11. PHILIPPINES

15.1.3.12. TAIWAN

15.1.3.13. VIETNAM

15.1.3.14. REST OF ASIA PACIFIC

15.1.4 SOUTH AMERICA

15.1.4.1. BRAZIL

15.1.4.2. ARGENTINA

15.1.4.3. REST OF SOUTH AMERICA

15.1.5 MIDDLE EAST AND AFRICA

15.1.5.1. SOUTH AFRICA

15.1.5.2. EGYPT

15.1.5.3. SAUDI ARABIA

15.1.5.4. U.A.E

15.1.5.5. OMAN

15.1.5.6. BAHRAIN

15.1.5.7. ISRAEL

15.1.5.8. KUWAIT

15.1.5.9. QATAR

15.1.5.10. REST OF MIDDLE EAST AND AFRICA

15.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL DATA CENTER SERVER MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL DATA CENTER SERVER MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL DATA CENTER SERVER MARKET, COMPANY PROFILE

18.1 CISCO SYSTEMS, INC.

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 IBM

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 AMAZON WEB SERVICES, INC

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.4 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.5 DELL, INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 LENOVO

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT DEVELOPMENT

18.7 FUJITSU

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENT

18.8 KINGSTON TECHNOLOGY

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT DEVELOPMENT

18.9 SCHNEIDER ELECTRIC

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENT

18.1 SUPER MICRO COMPUTER, INC

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENT

18.11 NEC CORPORATION

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT DEVELOPMENT

18.12 MICROSOFT

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 IRON MOUNTAIN, INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENT

18.14 SAP

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENT

18.15 META

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENT

18.16 ORACLE

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENT

18.17 DIGITAL REALTY TRUST

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT DEVELOPMENT

18.18 NTT DATA, INC.

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 CONCLUSION

20 QUESTIONNAIRE

21 RELATED REPORTS

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.