Global Data Center Solutions Market

Market Size in USD Billion

CAGR :

%

USD

252.00 Billion

USD

590.00 Billion

2024

2032

USD

252.00 Billion

USD

590.00 Billion

2024

2032

| 2025 –2032 | |

| USD 252.00 Billion | |

| USD 590.00 Billion | |

|

|

|

|

Global Data Centre Solutions Market Size

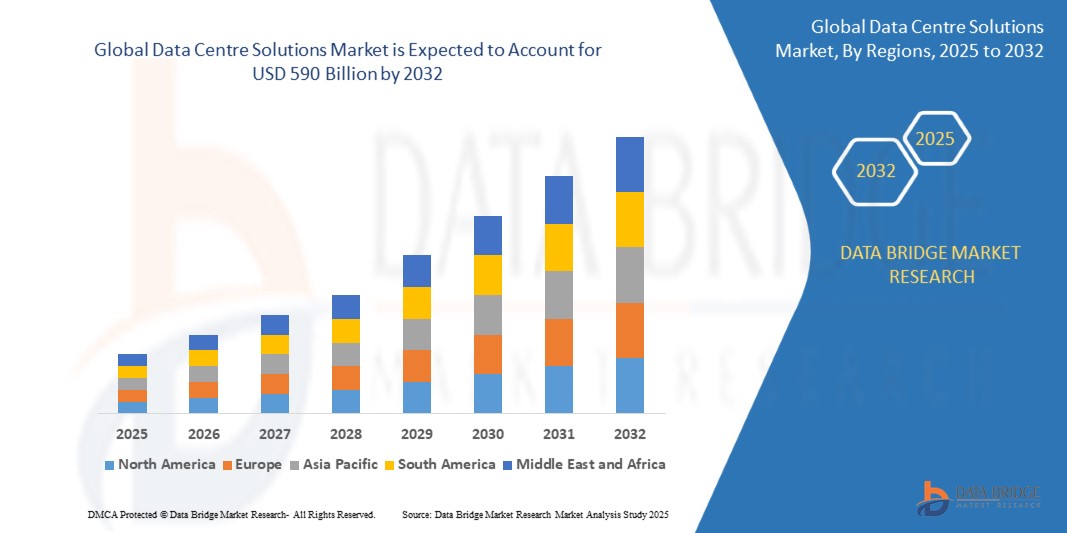

- The Global Data Centre Solutions Market Size was valued at USD 252 Billion in 2024 and is expected to reach USD 590 Billion by 2032, at a CAGR of 12.9% during the forecast period

- The growth of the Global Data Centre Solutions Market is primarily fueled by the surge in data generation, widespread cloud adoption, and increasing demand from AI, IoT, and digital transformation initiatives.

Global Data Centre Solutions Market Analysis

The Global Data Centre Solutions Market is experiencing rapid expansion, driven by the surging demand for digital transformation, cloud adoption, and data-intensive technologies such as AI, IoT, and edge computing. Industries across healthcare, finance, manufacturing, telecom, and government are investing heavily in scalable, efficient, and secure data centre infrastructures to support evolving IT workloads.

A primary driver of market growth is the increasing need for cloud-native applications, hybrid IT environments, and virtualization technologies. Enterprises are modernizing their legacy systems by integrating data centre solutions that offer improved agility, automation, and real-time performance. This trend is further fueled by the rising volumes of unstructured data and the growing need for centralized data processing, storage, and management.

The market is also being reshaped by the accelerated adoption of AI and machine learning workloads, which require high-performance computing environments and efficient cooling and power management systems. Consequently, innovations in liquid cooling, modular data centres, software-defined infrastructure (SDI), and edge data centre architectures are gaining traction, enabling faster deployment and improved energy efficiency.

In addition, increasing emphasis on sustainability and green IT is prompting organizations to adopt solutions that optimize power usage effectiveness (PUE) and reduce carbon footprints. Hyperscale data centres, powered by renewable energy sources and equipped with AI-driven resource optimization, are becoming a cornerstone of future-ready digital ecosystems.

Despite strong momentum, the market faces challenges such as high capital investment, complex integration processes, data privacy and cybersecurity risks, and limited skilled workforce availability. Regulatory compliance requirements, especially in data sovereignty and environmental standards, can also delay implementation across certain geographies.

Nevertheless, the outlook remains highly promising. Growing investments in digital infrastructure, increased funding for smart city and 5G projects, and the proliferation of remote work and e-commerce are expected to create significant opportunities. As technologies mature and economies of scale are achieved, the Data Centre Solutions Market is poised for sustained growth and technological advancement over the coming years.

Report Scope and Global Data Centre Solutions Market Segmentation

|

Attributes |

Global Data Centre Solutions Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Data Centre Solutions Market Trends

“Innovation and Integration: Powering Efficiency, Scalability, and Intelligence in Next-Generation Data Centres”

- A significant and accelerating trend in the Global Data Centre Solutions Market is the integration of artificial intelligence (AI), machine learning (ML), and automation tools to enable predictive maintenance, dynamic resource allocation, and real-time system optimization. These technologies are transforming how data centres operate, ensuring higher uptime, energy efficiency, and workload adaptability across enterprise environments.

- Enterprises are increasingly adopting modular and prefabricated data centre solutions to meet demands for speed, scalability, and cost-efficiency. This trend is particularly prevalent in fast-growing sectors such as e-commerce, telecom, and fintech, where rapid infrastructure deployment and edge capability are critical to staying competitive.

- The use of cloud-connected and IoT-enabled infrastructure is rising, allowing for remote monitoring, intelligent diagnostics, and AI-driven infrastructure management. These features support distributed architectures and are essential for hybrid and multi-cloud environments, as well as for real-time service delivery.

- The convergence of green energy solutions, liquid cooling technologies, and software-defined infrastructure (SDI) is gaining traction merging sustainability, automation, and high performance into a single, future-ready data centre ecosystem. This trend is driving greater investment in carbon-neutral facilities, especially among hyperscalers and large enterprises with ESG mandates.

Global Data Centre Solutions Market Dynamics

Driver

“Digital Acceleration and Infrastructure Transformation Across Industries”

- The rising demand for cloud computing, big data analytics, AI/ML workloads, and remote collaboration tools is driving large-scale investments in data centre infrastructure. Enterprises across industries are modernizing their IT environments to enhance performance, scalability, and security.

- Increasing adoption of hybrid and multi-cloud strategies is encouraging organizations to deploy flexible, software-defined, and modular data centre solutions. This enables seamless integration between on-premises systems and public cloud platforms.

- The rapid expansion of IoT, 5G networks, and edge computing is generating demand for decentralized and latency-sensitive data processing. This is pushing data centre providers to offer compact, high-efficiency solutions closer to the point of use.

- Growing focus on energy efficiency and sustainability is fueling innovation in green data centres, including the use of renewable energy sources, advanced cooling technologies, and AI-based energy optimization tools.

Restraint/Challenge

“Cost, Complexity, and Regulatory Challenges in Implementation”

- High capital expenditure (CapEx) and operational expenditure (OpEx) required for building, maintaining, and upgrading data centre infrastructure continue to be major barriers, particularly for small and mid-sized enterprises.

- The complexity of integrating legacy systems with modern, cloud-native data centre architectures presents technical and organizational challenges, often requiring skilled personnel and extended migration timelines.

- Increasing concerns over data privacy, compliance, and cybersecurity—driven by global regulations like GDPR, CCPA, and data sovereignty laws—can delay deployments and increase operational risk for service providers and enterprises alike.

- Limited availability of skilled IT professionals in areas like data engineering, cloud management, and cybersecurity is slowing down the pace of digital infrastructure adoption in many regions.

Global Data Centre Solution Market Scope

The market is segmented on the basis of Component, Data Center Type, Tier Type and End-user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Data Center Type |

|

|

By Tier Type |

|

|

By End-user |

|

- By Component

The Global Data Centre Solutions Market is segmented into hardware, software, and services. Hardware forms the core infrastructure, including servers, storage, networking, power, and cooling systems. Demand is rising for high-density servers, modular designs, and energy-efficient cooling solutions to support AI, cloud, and edge computing needs. Software enables automation and intelligence within data centres. This includes infrastructure management (DCIM), virtualization, SDN, and cloud orchestration tools. The use of AI and ML for predictive maintenance and resource optimization is gaining traction. Services include consulting, integration, managed services, and maintenance. With growing IT complexity, businesses increasingly rely on service providers and models like IaaS and DCaaS for flexible, scalable support.Together, these components are driving the modernization of data centre infrastructure globally.

- By Data Center Type

The Global Data Centre Solutions Market is segmented by data center type into enterprise data centers, colocation data centers, cloud data centers, edge data centers, and modular data centers. Enterprise data centers are owned and managed by individual organizations to support their internal IT operations. While traditionally built for in-house needs, they are now evolving toward hybrid environments to improve scalability and performance. Colocation data centers provide shared infrastructure where businesses rent space, power, and cooling without owning the facility. This model is gaining popularity due to cost efficiency, physical security, and reduced maintenance responsibilities. Cloud data centers, operated by hyperscale providers like Amazon Web Services, Microsoft Azure, and Google Cloud, dominate the market with their global reach, scalability, and flexibility, supporting a wide range of digital transformation initiatives. Edge data centers are becoming increasingly important with the rise of 5G, IoT, and real-time analytics. These smaller, decentralized facilities process data closer to the end user, reducing latency and supporting time-sensitive applications such as autonomous vehicles and smart city infrastructure. Lastly, modular data centers offer prefabricated, scalable solutions that can be quickly deployed in remote or rapidly growing areas. They are ideal for organizations seeking flexibility, fast setup, and lower initial costs. Together, these diverse data center types serve different business models and technological needs, driving overall market growth.

- By Tier Type

The Global Data Centre Solutions Market is also categorized by tier type, including Tier 1, Tier 2, Tier 3, and Tier 4 data centers, each defined by their level of infrastructure redundancy, uptime, and fault tolerance. Tier 1 data centers are the most basic, offering limited redundancy and around 99.671% uptime, suitable for small businesses with minimal critical data processing needs. Tier 2 data centers provide partial redundancy for power and cooling, delivering improved uptime (approximately 99.741%) and greater reliability for small to mid-sized enterprises. Tier 3 data centers offer concurrently maintainable infrastructure, allowing systems to remain operational during maintenance activities. With approximately 99.982% uptime, they are widely adopted by large enterprises and service providers requiring high availability and resilience. Tier 4 data centers represent the highest standard, offering fault-tolerant infrastructure with full redundancy across all systems, achieving 99.995% uptime. These facilities are designed for mission-critical operations such as financial services, government, and hyperscale cloud environments. The increasing demand for business continuity and data security is driving adoption toward higher-tier facilities globally.

- By End-user

The Global Data Centre Solutions Market serves a wide range of end-user industries, including BFSI, IT and Telecom, Government and Public Sector, Healthcare and Life Sciences, Retail and E-commerce, Manufacturing, and Media and Entertainment. The BFSI (Banking, Financial Services, and Insurance) sector relies heavily on data centre solutions for secure transaction processing, fraud detection, and regulatory compliance, driving demand for high-availability and disaster recovery capabilities. The IT and Telecom sector is a major adopter, requiring robust data infrastructure to support cloud services, network operations, and large-scale data transmission. Government and public sector organizations are increasingly investing in modernized data centres to support digital governance, citizen services, and national data sovereignty initiatives. In healthcare and life sciences, the demand for secure, compliant data storage and real-time analytics to support electronic health records (EHRs), telemedicine, and research is fueling growth. The retail and e-commerce sector depends on data centres for managing online transactions, customer analytics, and omnichannel delivery systems, especially during peak sales periods. Manufacturing companies leverage data centre solutions to support automation, smart factory operations, and supply chain optimization, particularly with the rise of Industry 4.0. Finally, the media and entertainment industry increasingly depends on data centres for high-speed content delivery, streaming, and digital asset management, driven by the explosion of online content consumption. Each of these end-user segments plays a critical role in shaping the evolving demand for advanced, scalable, and secure data centre infrastructure.

Global Data Centre Solutions Market Regional Analysis

- North America leads the global market, driven by high digital adoption, widespread cloud deployment, and significant investments by hyperscalers like Amazon, Google, and Microsoft. The presence of advanced IT infrastructure and a strong focus on data security and regulatory compliance further supports regional growth.

- Europe is experiencing robust growth, particularly in countries like Germany, the UK, and the Netherlands, where sustainability initiatives and data privacy regulations such as GDPR are encouraging the adoption of energy-efficient, compliant data centre solutions.

- Asia-Pacific is the fastest-growing region, propelled by rapid digital transformation in emerging economies like China, India, and Southeast Asia. Increasing demand for cloud services, the expansion of 5G networks, and growing internet penetration are key drivers in this region.

- In Latin America, countries such as Brazil and Mexico are witnessing steady growth due to increasing investments in IT infrastructure, data localization laws, and the expansion of local cloud providers.

- Meanwhile, the Middle East & Africa region is gradually evolving, with governments and private enterprises investing in digital infrastructure to support smart city projects, e-government services, and diversified economies. As regional cloud providers and colocation firms expand, the demand for scalable, secure, and energy-efficient data centre solutions continues to rise across all geographies.

North America Data Center Security Market Insight

The North America data center security market is growing steadily due to rising cyber threats, data breaches, and the need for robust physical protection. Organizations are investing in advanced security solutions, including firewalls, intrusion detection, biometric access, and surveillance systems, to protect sensitive data and ensure business continuity. Regulatory compliance and the shift to hybrid and cloud infrastructures further drive demand for integrated security frameworks. Technologies like AI and machine learning are enhancing real-time threat detection and automation. With a mature digital landscape and strong regulatory support, North America continues to lead in adopting advanced data center security solutions.

Europe Data Center Security Market Insight

The Europe data center security market is growing steadily, driven by rising cyber threats and strict regulations like GDPR and DORA. Organizations are adopting AI-powered threat detection, zero-trust security models, and integrated physical measures such as biometrics and surveillance systems. Countries like Germany, the UK, and France are leading in secure data infrastructure development. With increasing focus on data sovereignty and critical infrastructure protection, Europe continues to invest in resilient and compliant data center security solutions.

Asia Pacific Data Center Security Market Insight

The Asia‑Pacific data center security market is expanding rapidly due to rising cyber threats, increased data centre activity, and stringent data localization and privacy regulations across the region. Countries like China, India, Japan, Singapore, and Australia are leading adoption as digital transformation accelerates. A key trend is the integration of AI and machine learning into both physical security (e.g., video analytics, anomaly detection) and logical security (e.g., encryption, threat detection). Another major shift is the deployment of biometric access controls, replacing traditional password- or card-based systems for stronger, user-friendly security. Environmental resilience is also a focus, with data centers incorporating seismic design, flood protection, and robust monitoring to mitigate risks from natural disasters. The shift toward remote monitoring and managed security services is increasing as operators opt to outsource 24/7 surveillance and incident response through cloud-connected platforms. However, challenges persist, including complexity in hybrid/multi-cloud environments and a shortage of skilled cybersecurity professionals. To address these, many organizations are relying on AI-driven automation and upskilling programs.

Latin America Data Center Security Market Insight

The Latin America data center security market is witnessing steady growth fueled by expanding digital infrastructure, increasing cloud adoption, and evolving data protection regulations such as Brazil’s LGPD. Countries like Brazil, Mexico, Chile, and Colombia are leading the demand for advanced security systems, including biometric access control, surveillance cameras, and AI-powered monitoring tools. The rise of cloud and hybrid environments is prompting organizations to adopt integrated security solutions that combine physical and cybersecurity measures. While the market faces challenges such as a shortage of skilled professionals and high implementation costs for smaller enterprises, the push for regulatory compliance and secure digital operations is creating strong opportunities for growth in both private and public sectors.

Middle East and Africa Data Center Security Market Insight

The Middle East and Africa data centre security market is advancing steadily, driven by increasing digital infrastructure investment, government-backed smart city initiatives, and growing regulatory emphasis on data protection. Key countries like the UAE, Saudi Arabia, South Africa, and Egypt are implementing enhanced physical security layers—such as biometric access controls, video surveillance, perimeter barriers, and environmental sensors—to secure critical infrastructure. There's also growing demand for cloud-native and hybrid environment protections, including AI-powered monitoring, multi-factor authentication, and threat intelligence platforms. Despite challenges like cybersecurity skills shortages and budget constraints for smaller organizations, the region’s focus on resilient, scalable, and compliant data centre solutions—especially in public sector and energy industries—provides a strong growth outlook.

Global Data Centre Solutions Market Share

The Global Automotive Wheels industry is primarily led by well-established companies, including:

- Cisco Systems, Inc.

- Hewlett Packard Enterprise (HPE)

- Dell Technologies Inc.

- IBM Corporation

- Schneider Electric SE

- Huawei Technologies Co., Ltd.

- Lenovo Group Limited

- Equinix, Inc.

- Microsoft Corporation

- Amazon Web Services (AWS)

- Alphabet Inc. (Google Cloud)

- Oracle Corporation

- Fujitsu Limited

- Vertiv Holdings Co.

- NTT Communications Corporation

Latest Developments in Global Data Centre Solutions Market

- In May 2025, Google Cloud completed its $32 billion acquisition of Wiz, a leading cloud security startup, to enhance its data center and multicloud security offerings, marking one of the largest cybersecurity acquisitions in history.

- In March 2025, F5, Inc. acquired LeakSignal, a data leakage prevention startup, to strengthen its portfolio of zero-trust and real-time data protection solutions within hyperscale data centers.

- In January 2025, Cisco Systems launched its new Hypershield architecture, designed to secure AI-scale data centers with distributed firewall capabilities and microsegmentation tools for hybrid cloud environments.

- In November 2024, Fortinet introduced FortiGate 6000F, a high-performance firewall with advanced threat protection and integrated AI for hyperscale and colocation data centers, expanding its presence in the large enterprise segment.

- In August 2024, Trend Micro released an AI-powered threat detection suite tailored for hybrid cloud and on-premises data centers, with integrated support for major platforms like AWS, Azure, and GCP.

- In June 2024, Honeywell acquired Carrier Global's Access Solutions unit, strengthening its physical security and access control offerings across critical infrastructure and data centers globally.

- In March 2024, Check Point Software Technologies expanded its cloud-native security solutions with deeper integration into hybrid cloud environments, ensuring full-stack protection across enterprise data centers.

- In December 2023, IBM and Equinix announced a strategic collaboration to launch compliance automation and risk management solutions for colocation data centers, addressing rising regulatory demands.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.