Global Data Center Storage Market

Market Size in USD Billion

CAGR :

%

USD

61.61 Billion

USD

147.79 Billion

2024

2032

USD

61.61 Billion

USD

147.79 Billion

2024

2032

| 2025 –2032 | |

| USD 61.61 Billion | |

| USD 147.79 Billion | |

|

|

|

|

Data Center Storage Market Size

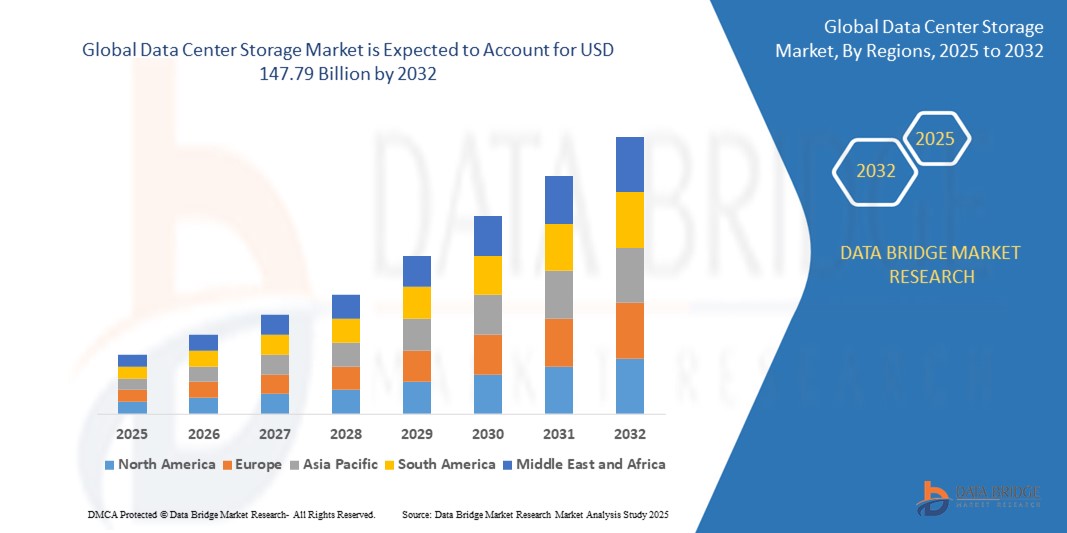

- The global data center storage market was valued at USD 61.61 billion in 2024 and is expected to reach USD 147.79 billion by 2032, at a CAGR of 11.49% during the forecast period

- This growth is fueled by factors such as the rising volume of data generated by businesses, advancements in storage technologies, and the increasing adoption of digital transformation across industries

Data Center Storage Market Analysis

- Data center storage solutions are vital for managing and storing large volumes of data in modern data centers, providing high-capacity, high-speed storage systems that support the demands of cloud computing, big data analytics, and enterprise applications

- The demand for data center storage is primarily driven by the growing volume of data generated by businesses, the rapid adoption of cloud services, and advancements in storage technologies such as solid-state drives (SSDs) and software-defined storage (SDS). Over half of the global demand for data center storage is driven by the growing need for cloud-based storage services, with the highest demand in regions undergoing digital transformation

- North America is expected to dominate the data center storage market with the largest market share of 40.1% due to high adoption of cloud services

- Asia-Pacific is expected to be the fastest growing region in the data center storage market during the forecast period due to rising awareness about eye health

- IT & Telecommunications segment is expected to dominate the market with a market share of 23.9% due to the swift growth of cloud computing, 5G networks, and AI-powered applications

Report Scope and Data Center Storage Market Segmentation

|

Attributes |

Data Center Storage Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Data Center Storage Market Trends

"Increasing Adoption of Software-Defined Storage (SDS) and Cloud Integration"

- One prominent trend in the global data center storage market is the growing adoption of software-defined storage (SDS) and cloud integration

- These advanced solutions offer greater scalability, flexibility, and cost-efficiency by decoupling storage management from hardware, enabling businesses to manage vast amounts of data with increased agility

- For instance, SDS allows organizations to easily scale their storage infrastructure to meet growing data demands, while cloud integration enables seamless access to off-site storage, facilitating data backup, disaster recovery, and global accessibility

- Cloud integration also enhances collaboration and data sharing across geographies, driving the adoption of hybrid and multi-cloud environments, which is becoming increasingly common in modern data centers

- This trend is transforming the way data is stored and managed, supporting the rapid growth of cloud services, big data analytics, and digital transformation across industries

Data Center Storage Market Dynamics

Driver

"Growing Need Due to the Surge in Data Generation"

- The increasing volume of data generated by businesses, cloud services, and emerging technologies such as IoT, AI, and big data analytics is significantly driving the demand for data center storage solutions

- As industries across the globe undergo digital transformation, the need for high-capacity, scalable, and high-performance storage systems to manage this massive data influx continues to grow

- Cloud computing, in particular, is one of the largest contributors to this data explosion, as more businesses move to cloud environments to store, manage, and analyze their data

- The ongoing advancements in storage technologies, such as the development of software-defined storage (SDS) and NVMe-based solutions, further highlight the need for cutting-edge storage infrastructure to support complex workloads and ensure efficient data management

- As businesses, governments, and individuals create more data, the demand for reliable and scalable storage solutions increases, ensuring data availability, security, and faster access to critical information

For instance,

- In April 2022, according to a report by Statista, the global data volume is expected to reach 175 zettabytes by 2025, further fueling the demand for advanced data center storage technologies to manage and store these massive datasets

- In August 2021, a study by IDC projected that by 2025, the total amount of data stored in the global data centers will grow significantly, further driving the need for efficient, scalable storage solutions to accommodate this expanding data landscape

- As a result of the surge in data generation, driven by digital transformation and the increasing reliance on cloud-based services, there is a significant rise in demand for data center storage solutions

Opportunity

"Advancing Data Management with Artificial Intelligence Integration"

- AI-powered data center storage solutions are enhancing data management capabilities by automating storage allocation, optimizing data retrieval, and improving predictive maintenance. These AI-driven technologies enable data centers to handle massive amounts of data more efficiently and cost-effectively

- AI algorithms can analyze usage patterns, predict storage requirements, and provide real-time insights, helping organizations optimize storage resources and ensure that critical data is always available when needed

- Additionally, AI can assist in anomaly detection, enabling data centers to identify potential security threats or hardware failures before they disrupt operations, thereby improving system reliability and reducing downtime

- The integration of AI in data center storage solutions also leads to enhanced operational efficiency, improved data security, and lower overall infrastructure costs. By leveraging AI-driven technologies, data centers can better manage storage assets, reduce risks, and ensure continuous, high-performance data access

Restraint/Challenge

"High Equipment and Infrastructure Costs Hindering Market Penetration"

- The high cost of data center storage solutions remains a significant challenge, especially for small and mid-sized businesses (SMBs) or organizations in developing regions with limited budgets

- Advanced storage technologies, including high-performance SSDs, software-defined storage (SDS), and hybrid storage solutions, often come with substantial upfront investment costs that can deter organizations from upgrading their infrastructure or adopting newer technologies

- This financial barrier can lead to a reliance on older, less efficient storage systems, limiting access to the latest innovations in data management and hindering overall growth in the market

For instance,

- In June 2024, according to a report published by Data Center Knowledge, one of the primary concerns surrounding the high cost of data center infrastructure is its potential impact on business scalability and long-term operational efficiency. The initial investment in high-performance storage systems can often exceed the budgets of smaller businesses, preventing them from adopting cutting-edge technologies

- Consequently, such limitations may result in disparities in data management capabilities between large enterprises and SMBs, ultimately hindering broader adoption and growth in the global data center storage market

Data Center Storage Market Scope

The market is segmented on the basis of deployment, application, and storage type

|

Segmentation |

Sub-Segmentation |

|

By Deployment |

|

|

By Application |

|

|

By Storage Type |

|

In 2025, the IT and telecommunications is projected to dominate the market with a largest share in application segment

The IT and telecommunications segment is expected to dominate the data center storage market with the largest share of 23.9% in 2025. This dominance is attributed to the segment’s heavy reliance on large-scale data processing, storage, and management solutions. The rapid expansion of cloud computing, 5G infrastructure, and AI-driven applications has significantly increased the demand for high-capacity, efficient, and scalable storage systems. Additionally, the growing need for real-time data access, network optimization, and enhanced customer experiences further accelerates storage adoption within this sector.

The Storage Area Network (SAN) System is expected to account for the largest share during the forecast period in deployment segment

In 2025, the Storage Area Network (SAN) System segment is expected to dominate the data center storage market with the largest market share of 17.8%. This dominance is driven by SAN systems' ability to deliver high-speed, reliable, and scalable data storage solutions, which are critical for supporting enterprise workloads and mission-critical applications. The increasing adoption of virtualization, cloud services, and big data analytics across industries is fueling the demand for SAN systems, as they offer enhanced data management, centralized storage, and improved network performance. Additionally, advancements in storage technologies and the need for efficient disaster recovery solutions further bolster the growth of the SAN system segment.

Data Center Storage Market Regional Analysis

“North America is the Dominant Region in the Data Center Storage Market”

- North America dominates the global data center storage market with the largest market share of 40.1%, driven by advanced IT infrastructure, high adoption of cloud services, and a strong presence of leading market players

- The U.S. holds a significant share of 30.5% due to the growing demand for high-performance storage solutions, the expansion of data centers, and continuous advancements in storage technologies such as NVMe and software-defined storage (SDS)

- The availability of robust data security regulations, established cloud service providers, and substantial investments in technology by major companies further strengthen the market

- Additionally, the increasing adoption of big data analytics, artificial intelligence, and IoT is fueling the demand for scalable and efficient storage systems across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the data center storage market, driven by rapid expansion in digital infrastructure, increasing data generation, and rising cloud adoption

- Countries such as China, India, and Japan are emerging as key markets due to rapid urbanization, increasing internet penetration, and significant investments in data center infrastructure

- Japan, with its advanced technology infrastructure and high demand for reliable storage solutions, remains a crucial market for data center storage providers. The country continues to lead in the adoption of high-capacity and high-performance storage systems to support its digital transformation

- China and India, with their large and growing populations, are seeing increased government investments and private sector growth in data storage and cloud services. The expanding presence of global IT giants and the need for data localization are further contributing to market growth across the region

Data Center Storage Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dell Technologies (U.S.)

- Hewlett Packard Enterprise (U.S.)

- IBM Corporation (U.S.)

- NetApp (U.S.)

- Hitachi Vantara (Japan)

- Huawei Technologies (China)

- Western Digital Corporation (U.S.)

- Seagate Technology (U.S.)

- Pure Storage (U.S.)

- Cisco Systems (U.S.)

Latest Developments in Global Data Center Storage Market

- In May 2023, Pure Storage Inc. broadened its flash-based storage portfolio with the introduction of FlashBlade//E, designed to address the approximately 80% of data stored on disk-based systems that is classified as non-primary or "cold." This innovative solution aims to improve both efficiency and cost-effectiveness within data center storage environments

- In April 2023, Microsoft furthered its global expansion by launching its first trusted cloud space in Poland, marking a pivotal milestone as the inaugural facility in Central and Eastern Europe. This strategic initiative is designed to enhance cloud accessibility and improve data services within the region

- In June 2022, Pure Storage Inc. established a research and development center in Bengaluru, with a strategic focus on advancing storage and data management solutions, including FlashArray, FlashBlade, FlashStack, and Pure as-a-Service

- In September 2020, INVITE Systems, an innovation-focused technology platform, partnered with Huawei to develop a highly reliable data center designed to meet the diverse requirements of enterprises. This collaboration underscores a unified effort to deliver robust and dependable infrastructure solutions for businesses within the technology sector

- In December 2022, Samsung Electronics announced the development of its 16-gigabit (Gb) DDR5 DRAM built with the industry's first 12-nanometer (nm)-class process technology and the completion of product compatibility testing with AMD

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DATA CENTER STORAGE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DATA CENTER STORAGE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMAPANY MARKET SHARE ANALYSIS

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 STANDARDS OF MEASUREMENT

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DATA CENTER STORAGE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE SYSTEM TYPE

6.1 OVERVIEW

6.2 DIRECT ATTACHED STORAGE (DAS)

6.3 NETWORK ATTACHED STORAGE (NAS)

6.3.1 BY PROTOCOLS

6.3.1.1. NETWORK FILE SYSTEM (NFS)

6.3.1.2. COMMON INTERNET FILE SYSTEM (CIFS)

6.3.1.3. FILE TRANSFER PROTOCOL (FTP)

6.3.1.4. HYPER TEXT TRANSFER PROTOCOL (HTTP)

6.3.1.5. OTHERS

6.4 STORAGE AREA NETWORK (SAN)

6.4.1 BY TYPE

6.4.1.1. FC-SAN

6.4.1.2. IP-SAN

7 GLOBAL DATA CENTER STORAGE MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 HARDWARE

7.2.1 ROUTERS

7.2.2 SWITCHES

7.2.3 FIREWALLS

7.2.4 OTHERS

7.3 SOFTWARE

7.3.1 STORAGE MANAGEMENT SOFTWARE

7.3.2 BACKUP MANAGEMENT SOFTWARE

7.3.3 OTHERS

7.4 SERVICES

7.4.1 PROFESSIONAL SERVICES

7.4.1.1. CONSULTING

7.4.1.2. INTEGRATION

7.4.1.3. SUPPORT & MAINTENANCE

7.4.2 MANAGED SERVICES

8 GLOBAL DATA CENTER STORAGE MARKET, BY SYSTEM ARCHITECTURE

8.1 OVERVIEW

8.2 BLOCK STORAGE DEVICES

8.3 FILE STORAGE DEVICES

9 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE TECHNOLOGY

9.1 OVERVIEW

9.2 HARD DISK DRIVE (HDD)

9.3 SOLID STATE DRIVE (SSD)

9.4 HYBRID STORAGE

10 GLOBAL DATA CENTER STORAGE MARKET, BY DEPLOYMENT MODE

10.1 OVERVIEW

10.2 ON-PREMISES

10.3 CLOUD

11 GLOBAL DATA CENTER STORAGE MARKET, BY TYPE OF DATA CENTER

11.1 OVERVIEW

11.2 ENTERPRISE DATA CENTERS

11.3 MANAGED SERVICES DATA CENTERS

11.4 COLOCATION DATA CENTERS

11.5 CLOUD DATA CENTERS

11.6 EDGE DATA CENTERS

11.7 OTHERS

12 GLOBAL DATA CENTER STORAGE MARKET, BY TIER TYPE

12.1 OVERVIEW

12.2 TIER I

12.3 TIER II

12.4 TIER III

12.5 TIER IV

13 GLOBAL DATA CENTER STORAGE MARKET, BY DATA CENTER SIZE

13.1 OVERVIEW

13.2 MICRO DATA CENTER

13.3 SMALL DATA CENTERS

13.4 MID-SIZED DATA CENTERS

13.5 LARGE DATA CENTERS

14 GLOBAL DATA CENTER STORAGE MARKET, BY STORAGE TYPE

14.1 OVERVIEW

14.2 TRADITIONAL STORAGE

14.3 ALL-FLASH STORAGE

14.4 HYBRID STORAGE

15 GLOBAL DATA CENTER STORAGE MARKET, BY END USER

15.1 OVERVIEW

15.2 ENTERPRISE

15.2.1 BY SIZE,

15.2.1.1. SMALL & MEDIUM SIZE ENTERPRISE

15.2.1.2. LARGE SIZE ENTERPRISE

15.3 COLOCATION PROVIDERS

15.4 CLOUD PROVIDERS

16 GLOBAL DATA CENTER STORAGE MARKET, BY INDUSTRY

16.1 OVERVIEW

16.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

16.2.1 BY STORAGE SYSTEM TYPE

16.2.1.1. DIRECT ATTACHED STORAGE (DAS)

16.2.1.2. NETWORK ATTACHED STORAGE (NAS)

16.2.1.2.1. BY PROTOCOLS

16.2.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.2.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.2.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.2.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.2.1.2.1.5 OTHERS

16.2.1.3. STORAGE AREA NETWORK (SAN)

16.2.1.3.1. BY TYPE

16.2.1.3.1.1 FC-SAN

16.2.1.3.1.2 IP-SAN

16.3 GOVERNMENT & DEFENSE

16.3.1 BY STORAGE SYSTEM TYPE

16.3.1.1. DIRECT ATTACHED STORAGE (DAS)

16.3.1.2. NETWORK ATTACHED STORAGE (NAS)

16.3.1.2.1. BY PROTOCOLS

16.3.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.3.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.3.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.3.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.3.1.2.1.5 OTHERS

16.3.1.3. STORAGE AREA NETWORK (SAN)

16.3.1.3.1. BY TYPE

16.3.1.3.1.1 FC-SAN

16.3.1.3.1.2 IP-SAN

16.4 HEALTHCARE

16.4.1 BY STORAGE SYSTEM TYPE

16.4.1.1. DIRECT ATTACHED STORAGE (DAS)

16.4.1.2. NETWORK ATTACHED STORAGE (NAS)

16.4.1.2.1. BY PROTOCOLS

16.4.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.4.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.4.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.4.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.4.1.2.1.5 OTHERS

16.4.1.3. STORAGE AREA NETWORK (SAN)

16.4.1.3.1. BY TYPE

16.4.1.3.1.1 FC-SAN

16.4.1.3.1.2 IP-SAN

16.5 MANUFACTURING

16.5.1 BY STORAGE SYSTEM TYPE

16.5.1.1. DIRECT ATTACHED STORAGE (DAS)

16.5.1.2. NETWORK ATTACHED STORAGE (NAS)

16.5.1.2.1. BY PROTOCOLS

16.5.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.5.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.5.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.5.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.5.1.2.1.5 OTHERS

16.5.1.3. STORAGE AREA NETWORK (SAN)

16.5.1.3.1. BY TYPE

16.5.1.3.1.1 FC-SAN

16.5.1.3.1.2 IP-SAN

16.6 RETAIL

16.6.1 BY STORAGE SYSTEM TYPE

16.6.1.1. DIRECT ATTACHED STORAGE (DAS)

16.6.1.2. NETWORK ATTACHED STORAGE (NAS)

16.6.1.2.1. BY PROTOCOLS

16.6.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.6.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.6.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.6.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.6.1.2.1.5 OTHERS

16.6.1.3. STORAGE AREA NETWORK (SAN)

16.6.1.3.1. BY TYPE

16.6.1.3.1.1 FC-SAN

16.6.1.3.1.2 IP-SAN

16.7 IT & TELECOM

16.7.1 BY STORAGE SYSTEM TYPE

16.7.1.1. DIRECT ATTACHED STORAGE (DAS)

16.7.1.2. NETWORK ATTACHED STORAGE (NAS)

16.7.1.2.1. BY PROTOCOLS

16.7.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.7.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.7.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.7.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.7.1.2.1.5 OTHERS

16.7.1.3. STORAGE AREA NETWORK (SAN)

16.7.1.3.1. BY TYPE

16.7.1.3.1.1 FC-SAN

16.7.1.3.1.2 IP-SAN

16.8 MEDIA & ENTERTAINMENT

16.8.1 BY STORAGE SYSTEM TYPE

16.8.1.1. DIRECT ATTACHED STORAGE (DAS)

16.8.1.2. NETWORK ATTACHED STORAGE (NAS)

16.8.1.2.1. BY PROTOCOLS

16.8.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.8.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.8.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.8.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.8.1.2.1.5 OTHERS

16.8.1.3. STORAGE AREA NETWORK (SAN)

16.8.1.3.1. BY TYPE

16.8.1.3.1.1 FC-SAN

16.8.1.3.1.2 IP-SAN

16.9 TRANSPORTATION & LOGISTICS

16.9.1 BY STORAGE SYSTEM TYPE

16.9.1.1. DIRECT ATTACHED STORAGE (DAS)

16.9.1.2. NETWORK ATTACHED STORAGE (NAS)

16.9.1.2.1. BY PROTOCOLS

16.9.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.9.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.9.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.9.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.9.1.2.1.5 OTHERS

16.9.1.3. STORAGE AREA NETWORK (SAN)

16.9.1.3.1. BY TYPE

16.9.1.3.1.1 FC-SAN

16.9.1.3.1.2 IP-SAN

16.1 EDUCATION

16.10.1 BY STORAGE SYSTEM TYPE

16.10.1.1. DIRECT ATTACHED STORAGE (DAS)

16.10.1.2. NETWORK ATTACHED STORAGE (NAS)

16.10.1.2.1. BY PROTOCOLS

16.10.1.2.1.1 NETWORK FILE SYSTEM (NFS)

16.10.1.2.1.2 COMMON INTERNET FILE SYSTEM (CIFS)

16.10.1.2.1.3 FILE TRANSFER PROTOCOL (FTP)

16.10.1.2.1.4 HYPER TEXT TRANSFER PROTOCOL (HTTP)

16.10.1.2.1.5 OTHERS

16.10.1.3. STORAGE AREA NETWORK (SAN)

16.10.1.3.1. BY TYPE

16.10.1.3.1.1 FC-SAN

16.10.1.3.1.2 IP-SAN

16.11 OTHERS

17 GLOBAL DATA CENTER STORAGE MARKET, BY GEOGRAPHY

GLOBAL DATA CENTER STORAGE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 FRANCE

17.2.3 U.K.

17.2.4 ITALY

17.2.5 SPAIN

17.2.6 RUSSIA

17.2.7 TURKEY

17.2.8 BELGIUM

17.2.9 NETHERLANDS

17.2.10 NORWAY

17.2.11 FINLAND

17.2.12 SWITZERLAND

17.2.13 DENMARK

17.2.14 SWEDEN

17.2.15 POLAND

17.2.16 REST OF EUROPE

17.3 ASIA PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 AUSTRALIA

17.3.6 NEW ZEALAND

17.3.7 SINGAPORE

17.3.8 THAILAND

17.3.9 MALAYSIA

17.3.10 INDONESIA

17.3.11 PHILIPPINES

17.3.12 TAIWAN

17.3.13 VIETNAM

17.3.14 REST OF ASIA PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 EGYPT

17.5.3 SAUDI ARABIA

17.5.4 U.A.E

17.5.5 OMAN

17.5.6 BAHRAIN

17.5.7 ISRAEL

17.5.8 KUWAIT

17.5.9 QATAR

17.5.10 REST OF MIDDLE EAST AND AFRICA

17.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

18 GLOBAL DATA CENTER STORAGE MARKET,COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

18.5 MERGERS & ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 REGULATORY CHANGES

18.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 GLOBAL DATA CENTER STORAGE MARKET, SWOT & DBMR ANALYSIS

20 GLOBAL DATA CENTER STORAGE MARKET, COMPANY PROFILE

20.1 T-SYSTEMS INTERNATIONAL GMBH(A PART OF DEUTSCHE TELEKOM)

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 PRODUCT PORTFOLIO

20.1.4 RECENT DEVELOPMENT

20.2 CISCO SYSTEMS, INC.

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 PRODUCT PORTFOLIO

20.2.4 RECENT DEVELOPMENT

20.3 HYPERTEC GROUP INC

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 WESTERN DIGITAL CORPORATION

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 MICRON TECHNOLOGY, INC

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 PRODUCT PORTFOLIO

20.5.4 RECENT DEVELOPMENT

20.6 DELL INC.

20.6.1 COMPANY SNAPSHOT

20.6.2 REVENUE ANALYSIS

20.6.3 PRODUCT PORTFOLIO

20.6.4 RECENT DEVELOPMENT

20.7 HEWLETT PACKARD ENTERPRISE DEVELOPMENT LP

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.7.4 RECENT DEVELOPMENT

20.8 NETAPP

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 HITACHI VANTARA LLC

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENT

20.1 PURE STORAGE, INC

20.10.1 COMPANY SNAPSHOT

20.10.2 REVENUE ANALYSIS

20.10.3 PRODUCT PORTFOLIO

20.10.4 RECENT DEVELOPMENT

20.11 LENOVO

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 FUJITSU

20.12.1 COMPANY SNAPSHOT

20.12.2 REVENUE ANALYSIS

20.12.3 PRODUCT PORTFOLIO

20.12.4 RECENT DEVELOPMENT

20.13 SEAGATE TECHNOLOGY LLC

20.13.1 COMPANY SNAPSHOT

20.13.2 REVENUE ANALYSIS

20.13.3 PRODUCT PORTFOLIO

20.13.4 RECENT DEVELOPMENT

20.14 AMAZON WEB SERVICES, INC.

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENT

20.15 CLOUDIAN INC

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANALYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 EQUINIX, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 HUAWEI TECHNOLOGIES CO., LTD

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 ORACLE

20.18.1 COMPANY SNAPSHOT

20.18.2 REVENUE ANALYSIS

20.18.3 PRODUCT PORTFOLIO

20.18.4 RECENT DEVELOPMENT

20.19 NUTANIX

20.19.1 COMPANY SNAPSHOT

20.19.2 REVENUE ANALYSIS

20.19.3 PRODUCT PORTFOLIO

20.19.4 RECENT DEVELOPMENT

20.2 DATADIRECT NETWORKS

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 NFINA TECHNOLOGIES, INC

20.21.1 COMPANY SNAPSHOT

20.21.2 REVENUE ANALYSIS

20.21.3 PRODUCT PORTFOLIO

20.21.4 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 CONCLUSION

22 QUESTIONNAIRE

23 RELATED REPORTS

24 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.