Global Data Centre Video On Demand Market

Market Size in USD Billion

CAGR :

%

USD

10.73 Billion

USD

22.67 Billion

2024

2032

USD

10.73 Billion

USD

22.67 Billion

2024

2032

| 2025 –2032 | |

| USD 10.73 Billion | |

| USD 22.67 Billion | |

|

|

|

|

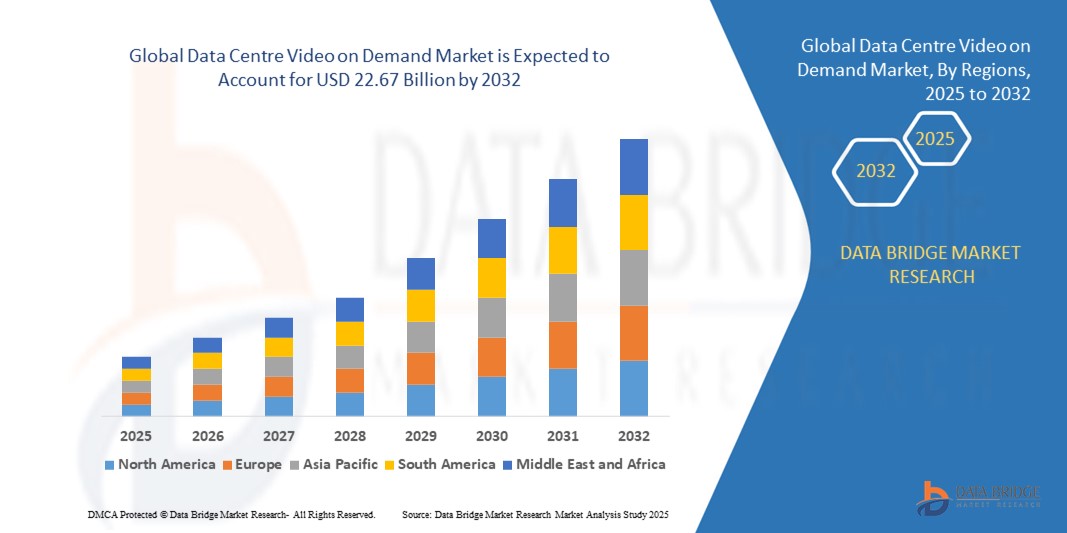

What is the Global Data Centre Video on Demand Market Size and Growth Rate?

- The global data centre video on demand market size was valued at USD 10.73 billion in 2024 and is expected to reach USD 22.67 billion by 2032, at a CAGR of 9.80% during the forecast period

- The increasing proliferation of mobile computing devices is a major factor expected to boost the growth of the data center video on demand market. The increase in the prevalence of flexibility as well as ease of use offering seamless customer experience, increasing demand of internet enabled smartphones, rising number of home fitness trends among the consumers, rise in live streaming of various events to avoid mass gatherings are some of the major as well as vital factors which will such asly to augment the growth of the data center video on demand market

What are the Major Takeaways of Data Centre Video on Demand Market?

- Rising preferences towards online steaming services over traditional, rising usage of analytics and artificial intelligence along with increasing prevalence of local players and film studios which will further contribute by generating immense opportunities that will led to the growth of the data center video on demand market in the above-mentioned forecast period

- North America dominated the data centre video on demand market with a 43.1% revenue share in 2024, supported by the widespread availability of high-speed internet, strong OTT platforms, and increasing consumer demand for flexible, on-demand video services

- The Asia-Pacific (APAC) market is projected to grow at the fastest CAGR of 8.69% during 2025–2032, fueled by rising disposable incomes, urbanization, and large-scale digitalization initiatives in countries such as China, Japan, and India

- The VOD Server segment dominated the market with the largest share of 46.5% in 2024, owing to its scalability, faster content delivery, and ability to support multiple concurrent users, which makes it essential for OTT platforms and large-scale streaming services

Report Scope and Data Centre Video on Demand Market Segmentation

|

Attributes |

Data Centre Video on Demand Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Data Centre Video on Demand Market?

Enhanced User Experience Through AI and Personalization

- A major trend reshaping the global data centre VoD market is the integration of artificial intelligence (AI) and machine learning (ML) for content personalization, recommendation engines, and improved streaming quality. AI enables platforms to analyze user behavior, viewing history, and preferences to deliver highly customized recommendations

- For instance, Netflix employs advanced AI algorithms to personalize thumbnails and recommend content, driving higher user engagement. Similarly, Amazon Prime Video uses predictive analytics to optimize content delivery and improve user satisfaction

- AI also supports voice-controlled navigation through platforms such as Amazon Alexa and Google Assistant, enabling users to search, play, or pause content via simple voice commands. This integration boosts accessibility and convenience

- The fusion of VoD platforms with AI-driven analytics and voice ecosystems ensures seamless navigation, enhanced engagement, and real-time adaptability, redefining customer expectations for entertainment

- Companies such as Hulu and Disney+ are leveraging AI-based ad insertion to deliver targeted advertisements, maximizing ad revenues while maintaining a personalized user experience

- As consumer demand for intelligent, intuitive, and personalized platforms grows, the adoption of AI-integrated Data Centre VoD systems is accelerating across entertainment, education, and enterprise applications

What are the Key Drivers of Data Centre Video on Demand Market?

- The rising global consumption of digital video content, supported by widespread internet penetration and increasing smartphone adoption, is a primary driver of Data Centre VoD market growth

- For instance, in March 2024, Disney+ Hotstar announced a record surge in subscriber growth in India during the ICC Cricket World Cup, showcasing how live-streaming events fuel demand for VoD platforms

- Consumers increasingly prefer on-demand, flexible viewing over traditional TV, driving a shift toward subscription-based and ad-supported VoD services

- The rapid expansion of OTT platforms, bundled packages, and partnerships with telecom operators are further strengthening the market

- Moreover, the demand for enterprise VoD solutions is rising, with corporates and educational institutions using video streaming for training, e-learning, and remote collaboration

- The convenience of multi-device access, high-definition streaming, and downloadable content continues to attract new users. As infrastructure improves and broadband penetration rises, VoD adoption is expected to scale rapidly in both developed and emerging regions

Which Factor is Challenging the Growth of the Data Centre Video on Demand Market?

- A key challenge in the Data Centre VoD market is content piracy and cybersecurity risks. Illegal streaming platforms and peer-to-peer sharing significantly affect revenue generation for legitimate VoD providers

- For instance, in 2024, reports highlighted that nearly 20% of global VoD content consumption occurred through unauthorized streaming websites, impacting major players such as Netflix, Disney+, and Amazon Prime

- In addition, data privacy concerns related to user tracking and recommendation algorithms are creating hesitation among consumers. As platforms collect extensive viewing data, compliance with evolving data protection laws (such as GDPR and CCPA) becomes essential

- Another barrier is the high infrastructure and licensing cost for VoD providers. Ensuring smooth HD/4K/8K streaming requires substantial investment in data centers, CDNs, and network bandwidth. Smaller providers face difficulty competing with established giants

- Furthermore, subscription fatigue is emerging as consumers juggle multiple platforms, leading to churn. While AVOD (ad-supported VoD) models provide alternatives, excessive advertising can also deter users

- Overcoming these challenges will require stronger anti-piracy measures, improved cybersecurity, flexible pricing models, and diversified content libraries, ensuring sustainable market expansion

How is the Data Centre Video on Demand Market Segmented?

The market is segmented on the basis of type, monetization model, solution, application and industry vertical.

- By Type

On the basis of type, the Data Centre Video on Demand (VoD) market is segmented into VOD Server, Video Server, and Storage Area Network (SAN). The VOD Server segment dominated the market with the largest share of 46.5% in 2024, owing to its scalability, faster content delivery, and ability to support multiple concurrent users, which makes it essential for OTT platforms and large-scale streaming services. VOD servers are particularly critical for entertainment platforms where uninterrupted streaming is a key consumer demand.

The Storage Area Network (SAN) segment is anticipated to grow at the fastest CAGR of 18.9% from 2025 to 2032, driven by the rising need for secure, high-capacity storage solutions that enable rapid access to massive video libraries. As content demand grows exponentially, storage optimization and faster retrieval mechanisms will remain key growth drivers for SAN adoption.

- By Monetization Model

Based on monetization model, the market is segmented into Subscription-Based and Advertising-Based. The Subscription-Based model accounted for the largest revenue share of 57.8% in 2024, primarily due to the global popularity of subscription platforms such as Netflix, Amazon Prime Video, and Disney+, which rely on recurring revenue from loyal subscribers. Consumers value ad-free viewing experiences, exclusive content, and flexible subscription tiers, fueling this segment’s dominance.

The Advertising-Based model is expected to witness the fastest CAGR of 20.2% during 2025–2032, as emerging players and regional platforms adopt free or low-cost ad-supported services to attract price-sensitive consumers. With advertisers increasingly shifting budgets toward digital platforms to capture younger audiences, ad-based VoD is set to expand rapidly, particularly in emerging markets where disposable income remains limited.

- By Solution

The Data Centre VoD market is categorized into Pay TV, OTT Services, and IPTV. In 2024, OTT Services dominated the market with a share of 62.4%, driven by their global accessibility, diverse content libraries, and convenience of on-demand viewing. The widespread adoption of high-speed internet, smart TVs, and mobile devices further supports OTT growth, with platforms such as Netflix, Hulu, and Disney+ leading the way.

Meanwhile, the IPTV segment is expected to grow at the fastest CAGR of 19.7% from 2025 to 2032, fueled by telecom operators and ISPs bundling IPTV services with broadband packages. The increasing demand for personalized and interactive viewing experiences, combined with the growth of hybrid models integrating live TV with VoD, is further propelling IPTV adoption across regions.

- By Application

On the basis of application, the market is segmented into Entertainment, Education and Training, Network Video Kiosks, Online Commerce, Digital Libraries, and Others. The Entertainment segment held the largest market share of 65.1% in 2024, reflecting the dominance of films, TV shows, sports, and music streaming as the primary content drivers for VoD services worldwide. Increasing investments in original programming and exclusive licensing deals continue to strengthen this segment.

The Education and Training segment is projected to witness the fastest CAGR of 21.4% during 2025–2032, fueled by the rise of e-learning platforms, corporate training solutions, and demand for digital content in academic institutions. Remote learning trends and increasing use of video lectures for skill development are expected to sustain this rapid growth.

- By Industry Vertical

By industry vertical, the market is segmented into Healthcare, Manufacturing, Academia and Government, Consumer Goods and Retail, Hospitality and Tourism, Telecommunications and IT, Media and Entertainment, Transport and Logistics, Banking, Financial Services and Insurance (BFSI), and Others. The Media and Entertainment vertical dominated the market with the largest share of 48.3% in 2024, owing to the strong adoption of VoD platforms for film, television, and music streaming, as well as the rising trend of live streaming events. This sector benefits from the digital-first consumption habits of global audiences.

The Healthcare vertical is expected to register the fastest CAGR of 22.1% between 2025 and 2032, driven by the use of VoD for telemedicine consultations, training medical staff, patient education, and sharing clinical resources. With healthcare digitization accelerating globally, video-based content delivery is becoming increasingly integral to improving outcomes.

Which Region Holds the Largest Share of the Data Centre Video on Demand Market?

- North America dominated the data centre video on demand market with a 43.1% revenue share in 2024, supported by the widespread availability of high-speed internet, strong OTT platforms, and increasing consumer demand for flexible, on-demand video services

- Consumers in this region place a high value on personalized content, subscription-based services, and multi-device accessibility, driving adoption across both households and enterprises

- The region’s leadership is reinforced by the presence of major players such as Netflix, Amazon Prime Video, Disney+, and Hulu, coupled with high disposable incomes and advanced infrastructure

U.S. Data Centre Video on Demand Market Insight

The U.S. captured 81% of North America’s market share in 2024, making it the dominant country in the region. Growth is fueled by the rapid uptake of OTT platforms, strong broadband penetration, and rising cord-cutting trends. The demand for subscription-based services is reinforced by investments in exclusive content and integration with smart devices. Moreover, the surge in streaming sports, online education, and mobile-first video platforms continues to strengthen the U.S. market outlook.

Europe Data Centre Video on Demand Market Insight

The Europe market is projected to grow steadily at a strong CAGR through 2032, driven by stringent content regulations, rising demand for multilingual content, and increasing adoption of VoD across households and enterprises. European consumers seek flexibility, bundled digital services, and enhanced accessibility, fostering adoption across residential and commercial sectors. Growth is also supported by high broadband penetration and strong investments in original local content.

U.K. Data Centre Video on Demand Market Insight

The U.K. is expected to witness significant growth during 2025–2032, propelled by cord-cutting, the adoption of streaming-first models, and the growing appetite for both subscription-based and ad-supported services. Rising consumer interest in localized content, coupled with a robust digital infrastructure, is encouraging higher VoD penetration. The shift toward mobile-based video consumption and strong partnerships with telecom providers further strengthen the U.K.’s position.

Germany Data Centre Video on Demand Market Insight

The Germany market is set for considerable growth, supported by demand for high-quality content, strong adoption of IPTV and OTT, and the rise of eco-conscious, sustainable technology adoption. German consumers emphasize privacy, quality, and affordability, which is driving innovation in hybrid VoD solutions. Integration with smart TVs and bundled telecom offerings is further boosting adoption in both residential and enterprise applications.

Which Region is the Fastest Growing in the Data Centre Video on Demand Market?

The Asia-Pacific (APAC) market is projected to grow at the fastest CAGR of 8.69% during 2025–2032, fueled by rising disposable incomes, urbanization, and large-scale digitalization initiatives in countries such as China, Japan, and India. APAC’s position as a manufacturing hub for video streaming infrastructure and connected devices enhances affordability and accessibility. Government-backed smart city projects and high mobile penetration are further accelerating adoption, making APAC the global growth leader.

Japan Data Centre Video on Demand Market Insight

The Japan market is expanding steadily, driven by the country’s tech-savvy population, rapid urbanization, and strong demand for premium, high-definition video content. Integration of VoD services with IoT ecosystems, gaming platforms, and smart devices is shaping consumer preferences. In addition, Japan’s aging population is pushing demand for user-friendly, accessible content delivery solutions, both for entertainment and educational purposes.

China Data Centre Video on Demand Market Insight

The China market held the largest share in APAC in 2024, supported by a rapidly expanding middle class, high smartphone adoption, and widespread availability of affordable streaming services. Domestic players such as iQIYI, Tencent Video, and Youku dominate the market, while international platforms are expanding cautiously due to regulatory constraints. The government’s push for smart cities and digital transformation further accelerates VoD adoption across residential, commercial, and educational sectors.

Which are the Top Companies in Data Centre Video on Demand Market?

The data centre video on demand industry is primarily led by well-established companies, including:

- Amazon Web Services, Inc. (U.S.)

- Google (U.S.)

- Apple Inc. (U.S.)

- Cisco System, Inc. (U.S.)

- Home Box Office, Inc. (U.S.)

- Hulu, LLC (U.S.)

- Fandango (U.S.)

- Indieflix Group Inc. (U.S.)

- COMCAST (U.S.)

- Akamai Technologies (U.S.)

- Huawei (China)

- Fujitsu Network Communications Inc. (Japan)

- CenturyLink (U.S.)

- Roku, Inc. (U.S.)

- Muvi LLC (U.S.)

- Vubiquity, Inc. (U.S.)

- FACEBOOK (U.S.)

- Microsoft (U.S.)

- Rakuten, Inc. (Japan)

- Sony Pictures Digital Productions Inc. (Japan)

- Bitmovin Inc. (Austria)

- CBS Interactive (U.S.)

- Essel Corporate (India)

- AT&T Intellectual Property (U.S.)

What are the Recent Developments in Global Data Centre Video on Demand Market?

- In January 2024, Evision expanded its strategic partnership with Disney Star, aiming to deliver South Asian entertainment content to audiences across the Middle East & Africa (MENA). This collaboration is expected to enhance Evision’s content portfolio and strengthen its presence in the region

- In August 2023, DistroTV entered into a partnership with Network18, enabling its users in India to stream Network18’s diverse range of channels live and free of cost. This move is anticipated to boost DistroTV’s user base and increase content accessibility in the Indian market

- In July 2022, Netflix partnered with Microsoft to launch new ad-supported subscription plans, with Microsoft serving as its global ad technology and delivery partner. This initiative marked a key step for Netflix in diversifying its revenue streams and broadening audience reach

- In April 2022, Hulu secured U.S. streaming rights to the popular series Schitt’s Creek, becoming the exclusive subscription VoD platform for the show in the U.S. This acquisition strengthened Hulu’s content library and reinforced its appeal to existing and new subscribers

- In September 2021, Amazon.com Inc. introduced Prime Video Channels across India, offering access to several premium on-demand video platforms such as Lionsgate Play, discovery+, Eros Now, Docubay, Hoichoi, MUB, Manorama Max, and Shorts TV for its Prime members. This launch significantly enhanced Amazon’s value proposition in the competitive Indian streaming market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.