Global Data Loss Prevention Market

Market Size in USD Billion

CAGR :

%

USD

3.52 Billion

USD

17.43 Billion

2024

2032

USD

3.52 Billion

USD

17.43 Billion

2024

2032

| 2025 –2032 | |

| USD 3.52 Billion | |

| USD 17.43 Billion | |

|

|

|

|

Data Loss Prevention Market Size

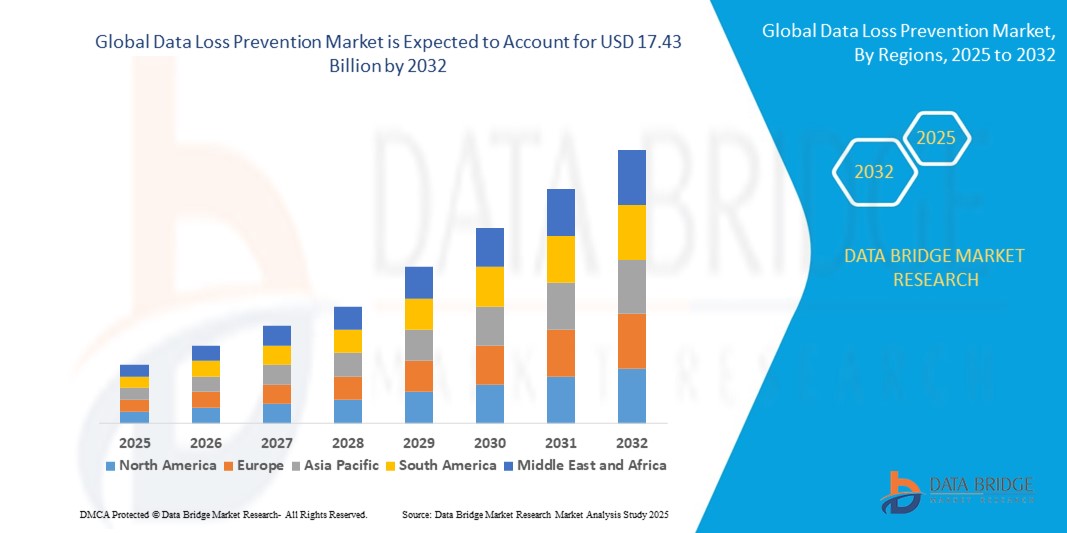

- The global data loss prevention market size was valued at USD 3.52 billion in 2024 and is expected to reach USD 17.43 billion by 2032, at a CAGR of 22.1% during the forecast period

- The market growth is largely fueled by the rising need for robust data protection across organizations as digital transformation accelerates, cloud adoption increases, and cyber threats become more frequent and sophisticated. This has led businesses to prioritize data visibility, control, and compliance across endpoints, networks, and cloud environments

- Furthermore, regulatory frameworks such as GDPR, HIPAA, and CCPA are compelling enterprises to adopt integrated, scalable, and policy-driven Data Loss Prevention (DLP) solutions. These converging factors are driving widespread deployment of DLP tools across industries, thereby significantly boosting the market’s expansion

Data Loss Prevention Market Analysis

- Data Loss Prevention (DLP) refers to security solutions designed to detect and prevent unauthorized access, transfer, or leakage of sensitive data, whether at rest, in motion, or in use. These tools support policy enforcement, encryption, data classification, and user behavior monitoring to protect confidential information across digital infrastructures

- The growing adoption of cloud services, remote work models, and mobile endpoints—combined with increasing regulatory pressure and cyberattack risks—is fueling demand for advanced DLP solutions that offer centralized control, real-time visibility, and comprehensive coverage across modern IT ecosystems

- North America dominated the data loss prevention market with a share of 33.5% in 2024, due to stringent data privacy regulations and the widespread digitization of enterprise operations

- Asia-Pacific is expected to be the fastest growing region in the data loss prevention market during the forecast period due to rapid digitization, data localization laws, and rising cybercrime rates across developing economies

- Cloud DLP segment dominated the market with a market share of 67.8% in 2024, due to the increasing use of cloud-based platforms across all industry verticals. Cloud DLP offers scalable and cost-efficient protection for data in motion, at rest, and in use across SaaS environments. Its centralized policy enforcement and real-time risk detection make it suitable for hybrid work models. Integration with collaboration tools such as Microsoft 365 and Google Workspace boosts relevance. The surge in cloud-native businesses and demand for minimal IT overhead drives this segment forward

Report Scope and Data Loss Prevention Market Segmentation

|

Attributes |

Data Loss Prevention Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Data Loss Prevention Market Trends

Growing Adoption of Bring Your Own Device in Enterprises

- The increasing use of Bring Your Own Device (BYOD) policies in enterprises is driving demand for robust DLP solutions that can secure sensitive data across diverse personal devices and endpoints, balancing security with user flexibility and productivity

- For instance, organizations are integrating advanced DLP software with mobile device management (MDM) and endpoint detection and response (EDR) platforms from vendors such as Symantec (Broadcom), Microsoft, and McAfee to monitor and control data flows on laptops, smartphones, and tablets without hampering employee workflows

- BYOD adoption increases complexity in maintaining data governance as corporate data moves beyond traditional IT perimeters into cloud services and unsecured networks, necessitating DLP solutions that operate consistently across environments

- The remote working trend, accelerated by global events, has intensified BYOD use, creating more entry points for data leakage and making real-time data discovery, classification, and leakage prevention critical

- Enterprises are adopting integrated DLP systems capable of contextual analysis to detect unauthorized data sharing or transmission in BYOD scenarios, using AI-driven behavioral analytics to reduce false positives and improve threat detection

- Enhanced user education and policy enforcement coupled with DLP monitoring help organizations maintain compliance with data privacy regulations such as GDPR, HIPAA, and CCPA when personal and corporate devices intermingle

Data Loss Prevention Market Dynamics

Driver

High Prevalence of Cyberattacks

- The growing frequency, sophistication, and cost of cyberattacks globally are major factors driving investments in DLP technologies to prevent data breaches, insider threats, ransomware attacks, and accidental data exposures

- For instance, according to a 2024 industry report, the average global cost of a data breach has reached USD 4.88 million, prompting enterprises and governments to prioritize preventative tools such as DLP solutions from Microsoft, IBM, Forcepoint, Symantec, and McAfee

- Increasing digitalization, cloud adoption, and expansion of mobile workforces amplify exposure to cyber risks, while threat actors continually develop new attack vectors targeting sensitive information, intellectual property, and customer data

- Advances in AI and machine learning incorporated into modern DLP platforms enable proactive identification and automated mitigation of suspicious data handling, reducing risk and operational response times

- Growing reliance on third-party vendors and supply chains also increases the attack surface, making centralized and integrated DLP solutions essential for holistic organizational risk management

Restraint/Challenge

Lack of Awareness

- Despite the critical importance of data protection, many enterprises—especially small and medium-sized businesses (SMBs)—face challenges due to insufficient awareness of DLP technologies, data governance best practices, and evolving cyber risks

- For instance, surveys reveal that a significant portion of organizations underestimate the likelihood or impact of insider threats and accidental data leaks, leading to underinvestment in DLP and cybersecurity training programs

- Employee negligence and insufficient training on data handling policies often result in circumventing security controls, reducing overall DLP effectiveness and increasing vulnerability to phishing and social engineering attacks

- Smaller firms may struggle with budget constraints, lack of skilled security personnel, and rapidly evolving regulatory compliance landscapes, causing slower DLP implementation despite rising cyber threats

- Industry awareness campaigns, government incentives, and vendor-led education programs are gradually improving knowledge levels but require continued focus to close gaps in adoption and maximize ROI from DLP investments

Data Loss Prevention Market Scope

The market is segmented on the basis of type, deployment type, services, organization size, application, and verticals.

- By Type

On the basis of type, the Data Loss Prevention market is segmented into Network DLP, Endpoint DLP, and Storage/Data Center DLP. The Network DLP segment held the largest market share in 2024 due to the rising demand for data visibility and control across enterprise networks. With growing concerns around data breaches and regulatory compliance, businesses are prioritizing network-based DLP to monitor and prevent sensitive data transfers. Its ability to detect unauthorized data movement through communication channels such as emails and web uploads drives adoption. The integration with other security tools enhances protection in hybrid and remote working setups.

Endpoint DLP is expected to register the fastest growth rate from 2025 to 2032, fueled by the proliferation of remote work and mobile workforce trends. Organizations are increasingly deploying DLP at endpoints such as laptops and mobile devices to reduce risks associated with data portability and insider threats. These solutions offer advanced policy enforcement, device control, and contextual data awareness. Improvements in agent efficiency and seamless policy synchronization across devices further boost demand. The need to secure sensitive files accessed outside corporate networks contributes to its rapid expansion.

- By Deployment Type

On the basis of deployment type, the market is segmented into On-Premise and Cloud DLP. The Cloud DLP segment dominated the market revenue share of 67.8% in 2024 supported by the increasing use of cloud-based platforms across all industry verticals. Cloud DLP offers scalable and cost-efficient protection for data in motion, at rest, and in use across SaaS environments. Its centralized policy enforcement and real-time risk detection make it suitable for hybrid work models. Integration with collaboration tools such as Microsoft 365 and Google Workspace boosts relevance. The surge in cloud-native businesses and demand for minimal IT overhead drives this segment forward.

The On-Premise segment is projected to grow at the highest CAGR between 2025 and 2032, as large enterprises prefer complete control over data flow and security infrastructure. It allows tighter integration with existing legacy systems and ensures that critical data remains within internal environments, crucial for compliance-heavy sectors. Industries such as government and BFSI lean towards on-premise due to their security priorities. The ability to tailor the deployment to specific operational needs and maintain low-latency data processing supports its dominance.

supported by the increasing use of cloud-based platforms across all industry verticals. Cloud DLP offers scalable and cost-efficient protection for data in motion, at rest, and in use across SaaS environments. Its centralized policy enforcement and real-time risk detection make it suitable for hybrid work models. Integration with collaboration tools such as Microsoft 365 and Google Workspace boosts relevance. The surge in cloud-native businesses and demand for minimal IT overhead drives this segment forward.

- By Services

On the basis of services, the market is segmented into Consulting, System Integration and Installation, Managed Security Services (MSS), Education and Training, and Risk and Threat Assessment. The System Integration and Installation segment accounted for the largest share in 2024 due to the complexity of DLP deployments in large organizations. Enterprises require professional services to ensure DLP systems are compatible with existing cybersecurity frameworks. Seamless integration across data centers, endpoints, and cloud platforms is critical for maintaining security continuity. Customization to organization-specific policies and compliance standards adds to the demand. The rise in enterprise-scale transformation projects sustains this segment's leadership.

The Managed Security Services (MSS) segment is expected to witness the fastest growth during the forecast period, driven by the growing need for continuous monitoring and rapid threat response. MSS allows organizations to outsource DLP operations, reducing in-house security workload and operational costs. It is particularly attractive for SMBs that lack dedicated IT security teams. Real-time threat intelligence, advanced analytics, and incident handling capabilities make MSS a preferred choice. As threat landscapes evolve, MSS offers agility and resilience through expert-managed platforms.

- By Organization Size

On the basis of organization size, the market is categorized into Small and Medium Businesses (SMBs) and Enterprises. The Enterprise segment led the market in 2024 due to its large-scale operations, high-value data assets, and broader regulatory obligations. Enterprises deploy multi-layered DLP strategies spanning on-premise and cloud to safeguard against external and insider threats. Their ability to invest in comprehensive solutions, including AI-driven analytics and adaptive access control, enhances protection. Sectors such as BFSI and healthcare are particularly active in enterprise-scale deployments due to compliance pressures.

The SMB segment is expected to experience the highest growth rate from 2025 to 2032 as DLP becomes more affordable and easier to deploy through cloud-based and managed services. SMBs are increasingly targeted by cyberattacks, prompting them to invest in scalable and lightweight DLP solutions. These organizations benefit from pre-configured policies, minimal setup times, and reduced infrastructure costs. As awareness grows, many SMBs are integrating DLP with their digital expansion strategies. The accessibility of low-maintenance and subscription-based models fuels adoption.

- By Application

On the basis of application, the market is segmented into Encryption, Centralized Management, Policy, Standards and Procedures, Web and Email Protection, Cloud Storage, and Incident Response and Workflow Management. Web and Email Protection held the largest share in 2024 due to the high exposure of sensitive data through emails and web-based communications. DLP tools detect and block unauthorized file transfers or data exfiltration attempts in real time. Businesses rely on this layer to mitigate phishing risks, prevent data leaks, and ensure compliance. Integration with email gateways and browsers enhances proactive threat management.

Cloud Storage is anticipated to grow at the fastest pace over the forecast period, driven by the increasing reliance on cloud-based collaboration and storage platforms. Organizations are adopting cloud DLP to maintain visibility and control over data shared across applications such as OneDrive, Dropbox, and Google Drive. These solutions ensure data classification, access control, and automated policy enforcement. The rapid shift to remote work and SaaS usage makes cloud-native DLP a strategic priority. It enables secure content management without disrupting user productivity.

- By Verticals

On the basis of verticals, the market is segmented into Aerospace, Defense and Intelligence, Government and Public Utilities, Banking, Financial Services and Insurance (BFSI), Telecom and IT, Healthcare, Retail and Logistics, Manufacturing, and Others. The BFSI segment led the market share in 2024 due to its need for strict data governance and protection of financial information. Data breaches in this sector can lead to significant financial losses and reputational damage, prompting proactive DLP adoption. Financial institutions integrate DLP with transaction systems and compliance tools. Enforcement of regional regulations such as GDPR and PCI DSS further strengthens demand.

The Healthcare sector is projected to be the fastest-growing vertical from 2025 to 2032, due to the increasing digitization of patient data and rising cybersecurity threats. With the expansion of electronic health records (EHRs) and telehealth platforms, protecting personal health information (PHI) is paramount. DLP solutions ensure that data remains secure during storage, transfer, and access by authorized personnel. Compliance with standards such as HIPAA and HITECH necessitates strong data protection frameworks. The surge in ransomware incidents targeting hospitals also accelerates deployment.

Data Loss Prevention Market Regional Analysis

- North America dominated the data loss prevention market with the largest revenue share of 33.5% in 2024, driven by stringent data privacy regulations and the widespread digitization of enterprise operations

- Organizations across sectors are prioritizing data security frameworks to comply with regulations such as HIPAA, CCPA, and GLBA, spurring DLP adoption

- The region’s high cybersecurity awareness, robust IT infrastructure, and significant investments in cloud computing and remote workforce management further accelerate demand for advanced DLP solutions

U.S. Data Loss Prevention Market Insight

The U.S. DLP market captured the largest revenue share in 2024 within North America, primarily driven by growing concerns over data breaches, insider threats, and compliance requirements. Enterprises are adopting integrated DLP tools to secure sensitive data across endpoints, networks, and cloud systems. The rise of remote work, combined with the push for digital transformation, is driving demand for scalable, cloud-based DLP solutions. The presence of leading cybersecurity vendors and widespread use of enterprise SaaS applications also supports market growth.

Europe Data Loss Prevention Market Insight

The Europe DLP market is projected to expand at a substantial CAGR during the forecast period, propelled by the strict implementation of GDPR and rising enterprise-level cybersecurity investments. Businesses are actively deploying DLP to monitor data access and transmission across digital channels. Growth is supported by the expanding cloud infrastructure and increasing incidents of targeted cyberattacks. Public sector digitalization and growing SME adoption are expected to broaden the scope of DLP implementation across the region.

U.K. Data Loss Prevention Market Insight

The U.K. DLP market is anticipated to grow at a noteworthy CAGR during the forecast period, influenced by rising data protection requirements and the need for secure information governance. Regulatory frameworks such as the UK GDPR are pushing businesses to invest in preventive technologies. A tech-savvy business environment and strong emphasis on secure digital infrastructure enhance the appeal of DLP solutions. Organizations in BFSI, healthcare, and government sectors are particularly active in integrating DLP into their cybersecurity strategies.

Germany Data Loss Prevention Market Insight

The Germany DLP market is expected to expand at a considerable CAGR during the forecast period, driven by an increased focus on digital security and strict regulatory compliance in sectors such as manufacturing and finance. German enterprises are emphasizing zero-trust security frameworks, leading to the integration of DLP with broader security architectures. Data localization trends and the need for secure cloud adoption further boost DLP deployment. The country’s strong privacy norms and technology-forward industrial base create favorable conditions for market growth.

Asia-Pacific Data Loss Prevention Market Insight

The Asia-Pacific DLP market is poised to grow at the fastest CAGR from 2025 to 2032, fueled by rapid digitization, data localization laws, and rising cybercrime rates across developing economies. Countries such as China, Japan, and India are witnessing strong demand from BFSI, IT, and e-commerce sectors for DLP integration. Government policies supporting digital infrastructure and cybersecurity frameworks are further pushing adoption. The region’s growing tech startup ecosystem and cloud migration trends also play a key role in driving the market.

Japan Data Loss Prevention Market Insight

The Japan DLP market is gaining momentum, supported by the country’s advanced IT environment and strong emphasis on compliance with privacy regulations such as APPI. The rise of smart workplaces and data-intensive services is increasing demand for DLP across both public and private sectors. Integration with security orchestration platforms and AI-based analytics is enhancing solution efficiency. Japan’s mature technology ecosystem and cultural emphasis on risk management are key drivers for sustained DLP adoption.

China Data Loss Prevention Market Insight

The China DLP market accounted for the largest market revenue share in Asia-Pacific in 2024, owing to strong regulatory support, such as the Personal Information Protection Law (PIPL), and the rapid expansion of the digital economy. Enterprises are investing in DLP to secure consumer data, intellectual property, and critical business assets. With a booming cloud services market and a vast base of internet users, demand for DLP solutions is rising across retail, finance, and government sectors. Domestic cybersecurity firms are also expanding DLP offerings, reinforcing local market growth.

Data Loss Prevention Market Share

The data loss prevention industry is primarily led by well-established companies, including:

- Digi-key Electronics (U.S.)

- Brewer Science, Inc. (U.S.)

- DuPont (U.S.)

- Murata Manufacturing Co., Ltd (Japan)

- MTS Systems Corporation (U.S.)

- Interlink Electronics, Inc. (U.S.)

- Emerson Electric Co (U.S.)

- Thin Film Electronics ASA (Norway)

- ISORG (France)

- Peratech Holdco Ltd (U.K.)

- Honeywell International Inc. (U.S.)

- TE connectivity (Switzerland)

- SpotSee (U.S.)

- KWJ Engineering Inc., (U.S.)

- Fujifilm Holding Corporation (Japan)

- Interlink Electronics, Inc. (U.S.)

- Tekscan, Inc. (U.S.)

Latest Developments in Global Data Loss Prevention Market

- In August 2025, MIND introduced the first autonomous Data Loss Prevention (DLP) platform, marking a significant advancement in the DLP industry. By enabling security teams to protect data across all IT environments with minimal manual intervention, the platform redefines traditional DLP functionality. It enhances protection against GenAI-related data risks, ensures compliance, and proactively stops sensitive data leaks. This launch is expected to reshape the DLP landscape by automating threat prevention and making data protection more scalable, especially for large enterprises managing complex infrastructures

- In October 2024, Fortinet expanded its data loss prevention capabilities by launching its new AI-powered FortiDLP product line, strengthening its presence in the enterprise security market. Backed by the acquisition of Next DLP in August, this platform offers real-time data tracking, endpoint protection, and visibility into cloud application usage. The integration of FortiDLP with Fortinet’s broader security ecosystem—including FortiGate NGFW, FortiSASE, FortiProxy, and FortiMail—positions Fortinet as a full-spectrum DLP provider. This move accelerates the adoption of unified and AI-driven DLP solutions for hybrid environments

- In May 2022, Broadcom Inc. announced the sampling of its end-to-end Wi-Fi 7 chipset solutions, providing a major technological upgrade in wireless communications. These chipsets, featuring low latency, extended range, and over double the speed of Wi-Fi 6/6E, are poised to support next-generation data-intensive applications. Their integration into routers, gateways, access points, and devices has direct implications for network-based DLP solutions, enabling faster and more secure data transmission environments. This development enhances the foundation for data security tools to operate more efficiently across wireless networks

- In May 2022, McAfee Corporation released its first Global Connected Family Study, offering insights into how families use and secure their digital environments. The findings highlighted critical gaps in awareness and protective actions taken by parents and children across ten countries. For the DLP market, this study underscores the growing importance of user education and home data protection. It also emphasizes the need for user-friendly, family-focused DLP tools that safeguard vulnerable populations—such as children—from data threats, especially in an increasingly connected world

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Data Loss Prevention Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Data Loss Prevention Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Data Loss Prevention Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.