Global Dcor Paper Market

Market Size in USD Billion

CAGR :

%

USD

4.88 Billion

USD

7.43 Billion

2025

2033

USD

4.88 Billion

USD

7.43 Billion

2025

2033

| 2026 –2033 | |

| USD 4.88 Billion | |

| USD 7.43 Billion | |

|

|

|

|

Décor Paper Market Size

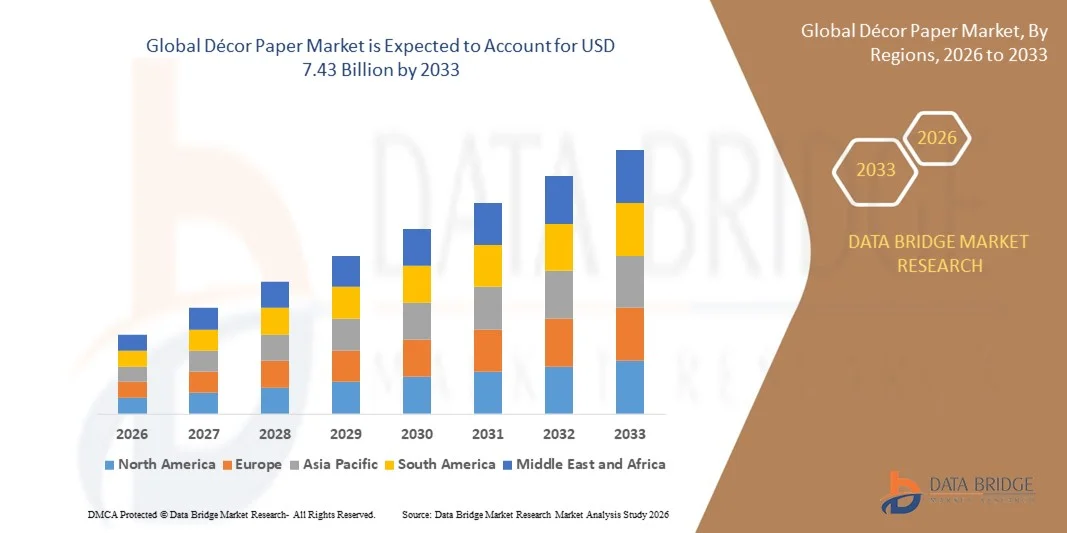

- The global décor paper market size was valued at USD 4.88 billion in 2025 and is expected to reach USD 7.43 billion by 2033, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by the rising demand for aesthetically appealing and durable surfaces in residential, commercial, and industrial interiors, leading to increased adoption of laminates, edge banding papers, and specialty décor papers

- Furthermore, technological advancements in digital printing, coating, and embossing techniques are enabling manufacturers to offer customizable designs, sustainable materials, and high-quality finishes. These converging factors are accelerating the uptake of décor papers across furniture, flooring, panelling, and store fixture applications, thereby significantly boosting the industry's growth

Décor Paper Market Analysis

- Décor papers, including high-pressure laminates, low-pressure laminates, edge banding papers, and specialty print base papers, are increasingly vital components of modern interior design and furniture manufacturing due to their decorative appeal, durability, and versatility across multiple substrates

- The escalating demand for décor papers is primarily fueled by growing consumer preference for premium, customized, and eco-friendly decorative surfaces, increasing construction and renovation activities, and rising adoption of sustainable and high-performance laminates in residential and commercial spaces

- Asia-Pacific dominated the décor paper market in 2025, due to expanding furniture and interior design industries, increasing demand for laminated surfaces, and a strong presence of paper manufacturing hubs

- North America is expected to be the fastest growing region in the décor paper market during the forecast period due to rising demand for laminated furniture, interior décor, and store fixtures

- Print base paper segment dominated the market with a market share of 45.8% in 2025, due to its extensive use in laminates and decorative surfaces where high-quality printing and surface designs are critical. This segment offers superior ink absorption, smooth finish, and design versatility, making it a preferred choice for manufacturers producing aesthetically appealing laminates. Print base papers also allow for intricate patterns, textures, and high-resolution graphics, enhancing the overall appeal of furniture, flooring, and panelling products

Report Scope and Décor Paper Market Segmentation

|

Attributes |

Décor Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Décor Paper Market Trends

Rising Demand for Versatile Décor Papers

- A significant trend in the décor paper market is the growing demand for versatile and high-quality decorative papers that can be used across laminates, edge banding, and specialty applications in furniture, flooring, and interior design. Rising consumer preference for aesthetically appealing surfaces, combined with increasing construction and renovation activities, is driving manufacturers to develop décor papers that balance durability, printability, and design versatility. This trend is shaping product development toward customizable patterns, textures, and finishes that cater to evolving interior design requirements

- For instance, SURTECO GmbH has introduced advanced digital printing and coating techniques that enable high-resolution, customizable décor papers, allowing furniture manufacturers to offer premium designs while reducing material waste. Such innovations are increasing the adoption of décor papers across both residential and commercial applications

- The adoption of digitally printed and sustainable décor papers is also rising rapidly as manufacturers such as Felix Schoeller launch eco-conscious options with recycled fibers and reduced polymer use, supporting environmentally responsible interior solutions. This trend positions décor papers as key enablers for modern furniture and décor design that demands both functionality and style

- The market is witnessing strong uptake in specialty laminates and decorative panels where high-pressure laminates require décor papers with superior durability, scratch resistance, and print clarity. This is reinforcing the role of décor papers as foundational components in high-quality furniture, flooring, and interior surfaces

- Consumer interest in unique, limited-edition, or designer-inspired decorative patterns is fueling the creation of small-batch, customizable décor papers, which is supporting growth in digital printing solutions. Manufacturers are increasingly integrating advanced coatings, embossing, and surface treatments to meet this demand, further driving market innovation

- Overall, the décor paper market is evolving toward solutions that combine aesthetic flexibility, sustainability, and high performance, reflecting the broader trend of personalized and environmentally conscious interior design adoption

Décor Paper Market Dynamics

Driver

Increased Use in Furniture and Interior Design

- The growing integration of décor papers into furniture, flooring, panelling, and store fixtures is a key driver for market growth, as these papers provide high-quality surfaces, customization options, and durability for both residential and commercial interiors. Rising investments in home and office renovations, modular furniture, and interior design projects are encouraging manufacturers to adopt high-performance decorative papers

- For instance, Koehler Paper Group produces specialty décor papers used in high-pressure laminates for premium furniture and cabinetry, supporting the adoption of advanced decorative solutions. Such usage demonstrates the critical role décor papers play in modern design trends, allowing manufacturers to meet aesthetic and functional requirements simultaneously

- Increasing collaborations between décor paper producers and furniture or interior design companies are expanding product reach, providing designers with a broader range of customizable options. This integration supports a stronger focus on quality, visual appeal, and sustainability, further accelerating demand

- The rising preference for environmentally responsible and recyclable décor solutions is also contributing to market expansion, as companies develop papers with recycled content or reduced polymer coatings for laminates. This trend aligns with broader consumer expectations for eco-friendly materials without compromising on appearance or durability

- Overall, the expanding use of décor papers in diverse interior and furniture applications is reinforcing their importance as essential components of modern design, driving sustained market growth

Restraint/Challenge

High Raw Material and Production Costs

- The décor paper market faces challenges due to the increasing cost of raw materials such as specialty pulp, coatings, and polymers required for high-quality decorative surfaces. Maintaining quality, consistency, and performance in décor papers involves complex production processes, which add to overall operational costs

- For instance, Felix Schoeller’s sustainable digital-media papers require specialized recycled fibers and advanced microporous coatings, which increase production expense while ensuring high-quality print performance. Such factors create cost pressures for manufacturers, limiting pricing flexibility in a competitive market

- Producing high-resolution, digitally printed décor papers involves significant investment in inkjet workflows, embossing, and finishing technologies. These requirements extend production timelines and contribute to higher capital and operational expenditures across the supply chain

- The reliance on specialized materials and coating technologies also increases vulnerability to supply fluctuations and market volatility, which can further impact cost stability. Manufacturers must balance innovation, sustainability, and performance while optimizing production efficiency to remain competitive

- Overall, the combination of expensive raw materials and intricate manufacturing processes continues to challenge the décor paper market, influencing pricing, margins, and scalability of high-quality decorative solutions

Décor Paper Market Scope

The market is segmented on the basis of basis weight, product type, application, and end use.

- By Basis Weight

On the basis of basis weight, the décor paper market is segmented into less than 65 gsm, 65–80 gsm, 81–100 gsm, and above 100 gsm. The 65–80 gsm segment dominated the market with the largest revenue share in 2025, driven by its balanced combination of durability and flexibility, making it highly suitable for laminates and decorative applications. Manufacturers and designers often prefer this weight range as it ensures strong adhesion with substrates while allowing intricate printing patterns and textures. The segment also benefits from compatibility with various coating and finishing technologies that enhance visual appeal and surface resistance. The consistent quality and performance across different décor applications further reinforce its dominance.

The above 100 gsm segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for premium and high-performance décor papers in luxury furniture and customized interior solutions. Heavier basis weight papers offer superior thickness, strength, and tactile feel, making them ideal for high-pressure laminates and edge banding applications. Rising consumer preference for durable and long-lasting decorative surfaces in commercial and residential interiors also contributes to the growth of this segment. Manufacturers are increasingly investing in advanced production technologies to meet the rising demand for thicker décor papers with enhanced printability and finishing options.

- By Product Type

On the basis of product type, the décor paper market is segmented into absorbent kraft paper, print base paper, and other décor papers. The print base paper segment dominated the market with the largest revenue share of 45.8% in 2025, driven by its extensive use in laminates and decorative surfaces where high-quality printing and surface designs are critical. This segment offers superior ink absorption, smooth finish, and design versatility, making it a preferred choice for manufacturers producing aesthetically appealing laminates. Print base papers also allow for intricate patterns, textures, and high-resolution graphics, enhancing the overall appeal of furniture, flooring, and panelling products.

The absorbent kraft paper segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its functional benefits in industrial and high-pressure laminate applications. For instance, companies such as WestRock are expanding production of kraft décor papers due to their high mechanical strength, porosity for resin impregnation, and ability to withstand pressing conditions without deformation. Growing emphasis on sustainable and eco-friendly raw materials is further accelerating the adoption of absorbent kraft papers in premium décor solutions. The segment’s versatility across laminates, edge banding, and specialty décor applications supports its rapid growth trajectory.

- By Application

On the basis of application, the décor paper market is segmented into low-pressure laminates, high-pressure laminates, and edge banding paper. The high-pressure laminates segment dominated the market with the largest revenue share in 2025, driven by their superior durability, scratch resistance, and ability to maintain vibrant decorative patterns over time. High-pressure laminates are widely preferred for furniture, flooring, and panelling applications where both aesthetics and long-term performance are crucial. Manufacturers and interior designers often choose high-pressure laminates to achieve consistent surface quality, enhanced moisture resistance, and premium finishes. The segment also benefits from ongoing innovations in resins, coatings, and printing techniques that improve surface appeal and functionality.

The edge banding paper segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for seamless finishing solutions in furniture and cabinetry. For instance, companies such as Abet Laminati are introducing specialized edge banding papers that provide high adhesion, durability, and design compatibility with laminated surfaces. The growing focus on refined interior aesthetics and customized furniture designs is driving the adoption of edge banding papers in residential and commercial projects. Advancements in embossing, coating, and color-matching technologies further support the accelerated growth of this segment.

- By End Use

On the basis of end use, the décor paper market is segmented into furniture and cabinets, flooring, panelling, and store fixtures. The furniture and cabinets segment dominated the market with the largest revenue share in 2025, driven by the rising global demand for stylish and durable home and office furniture. Manufacturers prefer décor papers for furniture due to their ability to offer customizable designs, high-quality finishes, and strong surface protection. The segment also benefits from growing residential and commercial construction activities and the trend of modular and ready-to-assemble furniture solutions. Consumers increasingly favor furniture products with decorative surfaces that combine aesthetic appeal with durability, supporting sustained market growth.

The flooring segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption of laminated and decorative flooring solutions in residential and commercial spaces. For instance, companies such as Pergo are expanding the use of décor papers in laminate flooring to provide realistic wood, stone, and textured finishes with enhanced scratch and moisture resistance. Rising preference for low-maintenance and visually appealing flooring solutions is driving the demand for high-performance décor papers. Technological innovations in surface printing, embossing, and protective coatings further enhance the appeal and functional performance of décor papers for flooring applications.

Décor Paper Market Regional Analysis

- Asia-Pacific dominated the décor paper market with the largest revenue share in 2025, driven by expanding furniture and interior design industries, increasing demand for laminated surfaces, and a strong presence of paper manufacturing hubs

- The region’s cost-effective production capabilities, growing investments in specialty paper production, and rising exports of decorative laminates are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid urbanization across developing economies are contributing to increased consumption of décor papers in residential, commercial, and industrial applications

China Décor Paper Market Insight

China held the largest share in the Asia-Pacific décor paper market in 2025, owing to its leadership in furniture manufacturing, high-volume laminate production, and established paper production infrastructure. The country’s strong industrial base, favorable regulations supporting manufacturing expansion, and export capabilities for decorative and high-performance papers are key growth drivers. Demand is also bolstered by rising domestic consumption in residential and commercial interiors and ongoing investments in advanced printing and coating technologies.

India Décor Paper Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding furniture and interior design sector, increasing adoption of high-pressure laminates, and rising investments in specialty paper manufacturing. Government initiatives supporting “Make in India” and industrial growth are strengthening the demand for décor papers. In addition, growing exports of laminated furniture components and increasing urban housing developments are contributing to robust market expansion.

Europe Décor Paper Market Insight

The Europe décor paper market is expanding steadily, supported by stringent quality and sustainability standards, high demand for premium laminates, and growing investments in specialty paper production. The region places strong emphasis on environmentally friendly materials, innovative designs, and advanced finishing technologies. Increasing adoption of décor papers in commercial, retail, and residential interiors is further enhancing market growth.

Germany Décor Paper Market Insight

Germany’s décor paper market is driven by its leadership in high-end furniture and cabinetry manufacturing, strong printing and paper production capabilities, and export-oriented market model. The country benefits from well-established R&D networks and collaborations between academic institutions and manufacturers, fostering continuous innovation in high-quality décor papers. Demand is particularly strong for premium laminates, edge banding papers, and specialty decorative finishes.

U.K. Décor Paper Market Insight

The U.K. market is supported by a mature furniture and interior design industry, growing efforts to incorporate sustainable and decorative surfaces, and increasing demand for high-quality laminates. Rising focus on design innovation, custom-made furniture, and specialty paper applications is driving growth. In addition, investments in advanced printing, coating, and finishing technologies further strengthen the market position in decorative paper solutions.

North America Décor Paper Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for laminated furniture, interior décor, and store fixtures. A strong focus on premium and sustainable decorative surfaces, increasing residential and commercial construction, and growing adoption of high-pressure laminates are boosting market demand. In addition, technological advancements in printing, coating, and embossing for décor papers are supporting market expansion.

U.S. Décor Paper Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive furniture manufacturing base, strong interior design sector, and investment in specialty décor papers. The country’s emphasis on innovation, sustainability, and premium-quality laminated surfaces is encouraging adoption across residential and commercial applications. Presence of key manufacturers and a mature distribution network further solidify the U.S.'s leading position in the region.

Décor Paper Market Share

The décor paper industry is primarily led by well-established companies, including:

- Koehler Paper Group (Germany)

- KAMMERER Paper GmbH (Germany)

- SURTECO GmbH (Germany)

- Onyx Specialty Papers (U.S.)

- BMK GmbH (Germany)

- Ahlstrom-Munksjö Oyj (Finland)

- Schattdecor AG (Germany)

- Neenah, Inc. (U.S.)

- PUDUMJEE PAPER PRODUCTS LTD. (India)

- Lamigraf, S.A. (Spain)

- Schoeller Allibert (Germany)

- Coveright Surfaces Spain S.A. (Spain)

- Malta-Décor (Malta)

- Impress Surfaces GmbH (Germany)

- KJ Specialty Paper Co. Ltd (China)

- Pura Group (U.K.)

- Cartiere Di Guarcino S.P.A (Italy)

- Sappi Limited (South Africa)

- NIPPON PAPER INDUSTRIES CO., LTD. (Japan)

Latest Developments in Global Décor Paper Market

- In October 2024, UPM Specialty Papers and Eastman launched a polyester-based, compostable extrusion-coated paper concept that offers grease and oxygen barrier properties at very low coat weights. This innovation is expected to impact the décor and specialty paper market by driving demand for sustainable and recyclable barrier papers in food packaging and industrial applications. The technology’s compatibility with existing extrusion lines allows manufacturers to adopt eco-friendly solutions without significant operational changes, positioning the market toward more circular and environmentally responsible production practices

- In March 2024, Felix Schoeller introduced sustainable digital-media solutions, including TRANSFER DT, a transfer paper using approximately two-thirds less plastic, and S-RACE TERRA, a sublimation-grade paper with around 65% recycled fibers. These launches are expected to transform the digital printing and décor paper market by offering eco-conscious alternatives while maintaining high-quality color performance. The advanced coating chemistries and microporous ink-receiving layers reduce polymer usage, encouraging wider adoption of sustainable materials in commercial printing, custom laminates, and decorative surface applications

- In February 2024, SURTECO unveiled a full-width digital printing method that enhances short-run personalization and expands substrate possibilities through cutting-edge inkjet workflows and tighter color control. This upgrade is expected to significantly impact the decorative laminates and décor paper market by reducing setup time and material waste while retaining industrial throughput. Faster changeovers enable manufacturers to meet growing demand for customized, small-batch decorative products, supporting efficiency and innovation in laminate and specialty paper production

- In March 2024, Christina-Lauren Pollack's Inspirations & Celebrations and Sullivans Home Decor announced a collaboration to launch new home décor designs, including baskets, vases, artisan candles, wall décor, faux florals, holiday décor, made-in-the-USA artwork, and outdoor living products. This partnership is expected to influence the home décor market by expanding product diversity and inspiring consumer adoption of curated, design-forward décor solutions, enhancing brand reach and driving sales in both online and retail channels

- In February 2024, Best Rifle Paper Co. collaborated with Target Furniture and Decor to launch 14 new home décor pieces at Target. This collaboration is expected to impact the mass-market décor segment by bringing unique, designer-inspired products to mainstream retail, increasing consumer access to premium aesthetics, and encouraging the adoption of limited-edition, branded décor collections

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dcor Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dcor Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dcor Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.