Global Debris Extraction Tools Market

Market Size in USD Billion

CAGR :

%

USD

8.61 Billion

USD

12.43 Billion

2024

2032

USD

8.61 Billion

USD

12.43 Billion

2024

2032

| 2025 –2032 | |

| USD 8.61 Billion | |

| USD 12.43 Billion | |

|

|

|

|

Debris Extraction Tools Market Size

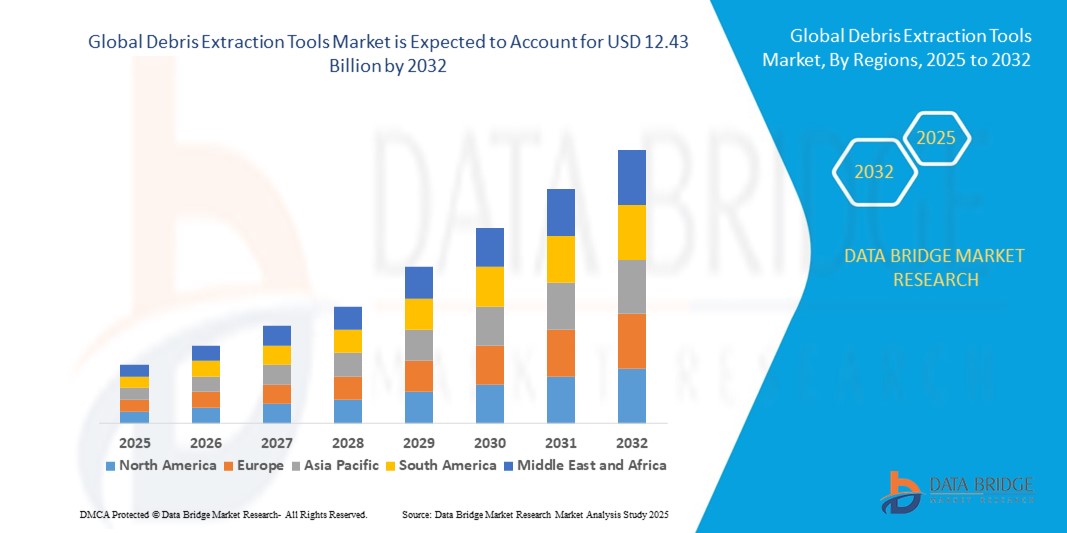

- The global debris extraction tools market size was valued at USD 8.61 billion in 2024 and is expected to reach USD 12.43 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient and safe debris removal solutions across construction, mining, and disaster management sectors, coupled with rising investments in infrastructure development and industrial automation

- In addition, the surge in natural disasters, urban redevelopment projects, and stringent government regulations for workplace safety and waste management are further propelling the demand for advanced debris extraction tools globally

Debris Extraction Tools Market Analysis

- The adoption of automated and semi-automated debris extraction tools is transforming traditional operations by improving speed, safety, and precision in debris handling across various industries

- Technological advancements such as remote-controlled, robotic, and IoT-enabled extraction tools are enhancing operational efficiency, reducing human exposure to hazardous environments, and lowering labor costs

- North America dominated the debris extraction tools market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, urban infrastructure expansion, and the adoption of mechanized construction solutions.

- Asia-Pacific region is expected to witness the highest growth rate in the global debris extraction tools market, driven by rising industrialization, increased construction projects, technological advancements in extraction tools, and growing adoption of mechanized systems in countries such as China, Japan, and India

- The dry dust extractors segment dominated the market in 2024 due to its superior efficiency in handling fine particulate matter, widespread use in large-scale industrial operations, and compatibility with various debris types. Dry dust extractors are highly preferred in construction, chemical, and mining industries for their consistent performance and ease of integration with existing workflows

Report Scope and Debris Extraction Tools Market Segmentation

|

Attributes |

Debris Extraction Tools Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Growing Adoption Of Automated Debris Extraction Systems |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Debris Extraction Tools Market Trends

Advancement of Automated and High-Efficiency Debris Extraction Systems

- The increasing shift toward automated debris extraction systems is transforming the construction and industrial cleanup landscape by enabling faster and more precise removal of debris. These systems reduce manual labor, improve operational efficiency, and minimize downtime during projects, ultimately saving costs and boosting productivity

- The rising demand for portable and modular debris extraction tools is accelerating adoption in remote, urban, and under-resourced construction sites. These solutions are particularly effective where access is limited or rapid cleanup is required, supporting timely project completion and reducing safety risks

- The versatility and user-friendliness of modern debris extraction tools are encouraging their deployment across multiple applications, including industrial cleanup, disaster management, and civil engineering. This enables frequent and efficient debris management without significant operational disruption

- For instance, in 2023, several construction firms in Southeast Asia reported enhanced project timelines and reduced labor costs after implementing automated debris extraction units on high-rise building sites. The tools improved site safety and reduced equipment wear-and-tear while lowering operational expenses

- While advancements in debris extraction tools are improving efficiency and operational safety, market growth depends on continuous innovation, workforce training, and cost-effectiveness. Manufacturers must focus on customizable, scalable solutions to fully capitalize on increasing demand

Debris Extraction Tools Market Dynamics

Driver

Increasing Construction and Infrastructure Development Activities

• The rapid expansion of construction and infrastructure projects worldwide is driving demand for advanced debris extraction tools. Growing urbanization, industrialization, and rebuilding efforts require efficient debris management solutions to maintain workflow and safety. Additionally, the rise in large-scale public and private construction projects is creating sustained demand for mechanized debris extraction systems that can handle high-volume waste efficiently. The need to meet tight project timelines and reduce environmental impact is further boosting adoption

• Contractors and project managers are adopting automated and mechanized tools to optimize site operations, minimize labor dependency, and comply with environmental regulations regarding waste disposal. These tools also help in reducing worker fatigue and operational delays caused by manual handling of debris. Furthermore, companies are leveraging these systems to enhance workplace safety and ensure regulatory compliance, which improves project reliability and reputation

• Increasing awareness of safety standards and operational efficiency is encouraging the replacement of manual debris removal methods with high-performance extraction systems. Companies are also realizing that automated tools reduce the likelihood of accidents and worksite injuries, protecting labor and minimizing insurance costs. The integration of real-time monitoring and smart sensors in modern extraction systems is enhancing productivity and providing better operational insights

• For instance, in 2022, several European construction companies implemented robotic debris extraction solutions, leading to faster cleanup cycles and reduced on-site accidents. The adoption of these tools also helped firms meet sustainability goals by minimizing waste and improving recycling efficiency. These early adopters reported enhanced project timelines, reduced operational costs, and improved overall site management

• While infrastructure growth is boosting market demand, tool manufacturers must focus on affordability, scalability, and maintenance support to maximize adoption across diverse project sizes and regions. The demand for versatile equipment that can be deployed in multiple environments, including urban, industrial, and disaster-struck sites, is increasing. Additionally, providing training programs and after-sales support can strengthen user confidence and encourage widespread adoption globally

Restraint/Challenge

High Cost of Advanced Debris Extraction Tools and Limited Access in Developing Regions

• The high cost of automated and specialized debris extraction systems limits adoption, especially for small-scale contractors and construction firms in emerging markets. Price barriers restrict market penetration and slow widespread deployment. Moreover, the initial investment required for procurement, installation, and operator training can deter smaller firms from investing in advanced equipment. The high capital expenditure can also delay return on investment, affecting overall market growth

• In developing regions, there is often a lack of trained operators capable of handling advanced extraction tools, coupled with insufficient maintenance infrastructure. This limits the operational effectiveness and reliability of the tools in critical projects. In addition, the absence of local service centers and technical expertise creates dependency on external support, increasing downtime and operational risks. Workforce training programs and skill development initiatives are necessary to overcome these barriers

• Supply chain and logistics challenges in remote or underdeveloped areas further reduce timely access to equipment, consumables, and spare parts, affecting continuity in debris removal operations. Seasonal disruptions, import restrictions, and high shipping costs exacerbate these delays. Companies often face difficulties maintaining optimal inventory levels, which can compromise project schedules and increase operational expenses

• For instance, in 2023, construction firms in Sub-Saharan Africa reported delays in project timelines due to unavailability of mechanized debris extraction units and high import costs. These delays impacted not only productivity but also overall project profitability and client satisfaction. Limited local manufacturing and distribution networks hinder the timely deployment of advanced extraction solutions in high-demand regions

• While technological advancements continue, addressing affordability, training, and accessibility challenges is essential for market growth. Manufacturers and stakeholders must invest in decentralized solutions, rental services, and localized support networks to unlock the full market potential. Additionally, developing cost-effective, modular, and easily transportable debris extraction systems can expand market adoption, particularly in emerging and remote regions

Debris Extraction Tools Market Scope

The market is segmented on the basis of type, components, industry, application, end use, and material.

- By Type

On the basis of type, the debris extraction tools market is segmented into wet dust extractors and dry dust extractors. The dry dust extractors segment dominated the market in 2024 due to its superior efficiency in handling fine particulate matter, widespread use in large-scale industrial operations, and compatibility with various debris types. Dry dust extractors are highly preferred in construction, chemical, and mining industries for their consistent performance and ease of integration with existing workflows.

The wet dust extractors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in sectors such as pharmaceutical, chemical, and food processing industries, where moisture-laden dust and hazardous particles require safe handling to minimize contamination and ensure worker safety.

- By Components

On the basis of components, the market is segmented into blower, dust filter, and filter cleaning. The dust filter segment dominated the market in 2024 because of its critical role in capturing fine debris, ensuring cleaner exhaust, and maintaining high operational efficiency. Effective dust filtration is essential for complying with workplace safety and environmental standards, making it a key driver of market demand.

The blower segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by technological advancements in high-powered and energy-efficient blowers that improve extraction speed, reduce downtime, and support continuous operations in large-scale construction, industrial, and disaster recovery projects.

- By Industry

On the basis of industry, the market is segmented into chemical, powder, wooden, construction, pharmaceutical, and others. The construction segment dominated the market in 2024 due to the large volume of debris generated during urbanization, infrastructure projects, and building renovations. High demand for efficient debris management and compliance with safety regulations has made mechanized extraction tools a necessity in this sector.

The chemical and pharmaceutical industries is expected to witness the fastest growth rate from 2025 to 2032 as these sectors require strict hygiene and safety standards, including specialized extraction tools to handle hazardous dust and prevent contamination of sensitive materials.

- By Application

On the basis of application, the market is segmented into construction, mining, marine, and disaster recovery. The construction segment dominated the market in 2024 owing to widespread infrastructure development, urbanization, and industrial expansion, which generate significant amounts of debris requiring mechanized removal.

The disaster recovery segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing frequency of natural disasters, industrial accidents, and urban emergency scenarios that require rapid debris removal solutions for recovery and reconstruction efforts.

- By End Use

On the basis of end use, the market is segmented into industrial, commercial, and residential. The industrial segment dominated the market in 2024 due to high demand for large-scale mechanized extraction tools in factories, construction sites, and mining operations. Industrial setups require continuous debris removal to maintain workflow, safety, and compliance with environmental standards.

The commercial segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption in office complexes, warehouses, shopping centers, and public facilities, where debris management is increasingly automated to enhance operational efficiency and safety.

- By Material

On the basis of material, the market is segmented into metal, plastic, concrete, and organic waste. The metal and concrete segments dominated the market in 2024 due to their prevalence in construction, demolition, and industrial processes, which produce large volumes of heavy debris requiring robust extraction tools.

The organic waste segment is expected to witness the fastest growth rate from 2025 to 2032, as sustainable waste management practices gain prominence in agriculture, residential, and commercial sectors, encouraging the use of specialized extraction tools to handle biodegradable and compostable debris efficiently.

Debris Extraction Tools Market Regional Analysis

• North America dominated the debris extraction tools market with the largest revenue share of 38.5% in 2024, driven by rapid industrialization, urban infrastructure expansion, and the adoption of mechanized construction solutions.

• Companies and contractors in the region highly value advanced debris extraction tools for improving operational efficiency, maintaining safety standards, and ensuring regulatory compliance in construction and industrial projects.

• This widespread adoption is further supported by strong technological infrastructure, availability of skilled labor, and the growing preference for automated solutions, establishing debris extraction tools as a preferred choice across industrial and commercial sectors.

U.S. Debris Extraction Tools Market Insight

The U.S. debris extraction tools market captured the largest revenue share in 2024 within North America, fueled by the increasing pace of construction projects, infrastructural redevelopment, and mining activities. Demand for automated and mechanized debris removal systems is rising as contractors focus on efficiency, safety, and reduced labor dependency. Moreover, ongoing government initiatives for workplace safety and environmental compliance are encouraging the adoption of advanced extraction solutions, further driving market growth.

Europe Debris Extraction Tools Market Insight

The Europe debris extraction tools market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by strict workplace safety regulations and the growing emphasis on efficient waste management in industrial and construction projects. Countries such as Germany, France, and the U.K. are witnessing increased adoption of high-performance extraction systems to comply with environmental and operational standards. The region is experiencing significant growth across construction, mining, and disaster recovery applications.

U.K. Debris Extraction Tools Market Insight

The U.K. debris extraction tools market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising construction and renovation activities and the growing demand for automated and mechanized waste removal solutions. Contractors are increasingly replacing manual debris handling methods with advanced extraction tools to improve efficiency, minimize safety hazards, and reduce labor costs. The country’s strong industrial framework and regulatory focus on environmental protection are further supporting market expansion.

Germany Debris Extraction Tools Market Insight

The Germany debris extraction tools market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of operational efficiency, workplace safety, and eco-friendly waste management solutions. Germany’s advanced industrial and construction sectors, coupled with an emphasis on technological innovation, are promoting the adoption of automated and high-performance debris extraction tools. Integration with industrial workflow management systems is becoming increasingly prevalent, enhancing project efficiency and compliance.

Asia-Pacific Debris Extraction Tools Market Insight

The Asia-Pacific debris extraction tools market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, industrialization, and infrastructure development in countries such as China, India, and Japan. Rising construction activities, government initiatives promoting smart and safe construction practices, and increasing manufacturing capabilities are boosting the adoption of mechanized and automated debris extraction tools. Additionally, cost-effective manufacturing and wide availability of components in the region are expanding accessibility to advanced solutions.

Japan Debris Extraction Tools Market Insight

The Japan debris extraction tools market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s focus on high-tech construction practices, infrastructure modernization, and demand for safety-oriented solutions. Japanese contractors increasingly rely on automated debris extraction systems to optimize cleanup efficiency and reduce human intervention in hazardous environments. The adoption of integrated systems with IoT-enabled monitoring and maintenance solutions is further supporting growth across commercial, industrial, and disaster recovery applications.

China Debris Extraction Tools Market Insight

The China debris extraction tools market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urban development, large-scale infrastructure projects, and growing industrial activities. China is emerging as a manufacturing hub for advanced extraction tools and components, which, combined with government support for construction efficiency and safety, is driving widespread adoption. Affordable solutions and strong domestic production capabilities are key factors accelerating market growth in both residential and commercial projects.

Debris Extraction Tools Market Share

The debris extraction tools industry is primarily led by well-established companies, including:

- Robert Bosch Tool Corporation (Germany)

- Makita (Japan)

- 3M (U.S.)

- Dover Corporation (U.S.)

- Robovent (U.S.)

- Envirosystems Manufacturing LLC (Canada)

- National Environmental Service Company (U.S.)

- Delta NEU (France)

- Dustcontrol Canada Inc. (Canada)

- BOFA International Ltd. (U.K.)

Latest Developments in Global Debris Extraction Tools Market

- In November 2023, ClearSpace, a pioneer in in-orbit servicing and debris removal, unveiled its "Mission Hera" spacecraft. This spacecraft is specifically designed for the first European active debris removal (ADR) mission, collaborating with the European Space Agency (ESA). The launch of Mission Hera represents a crucial milestone for both ClearSpace and Europe in their commitment to addressing the growing issue of space debris. The successful demonstration of this mission will pave the way for future large-scale debris removal initiatives, contributing to a more sustainable space environment

- In October 2023, Astroscale, a leading company in debris removal solutions, announced the launch of its next-generation debris removal satellite, the "ELSA-d." This launch signifies a significant step forward in Astroscale's ongoing efforts to develop and deploy effective solutions for tackling the growing problem of space debris. The improved capabilities of ELSA-d are expected to contribute to a cleaner and more sustainable space environment for future generations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Debris Extraction Tools Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Debris Extraction Tools Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Debris Extraction Tools Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.