Global Debt Collection Software Market

Market Size in USD Billion

CAGR :

%

USD

3.90 Billion

USD

8.83 Billion

2024

2032

USD

3.90 Billion

USD

8.83 Billion

2024

2032

| 2025 –2032 | |

| USD 3.90 Billion | |

| USD 8.83 Billion | |

|

|

|

|

Debt Collection Software Market Size

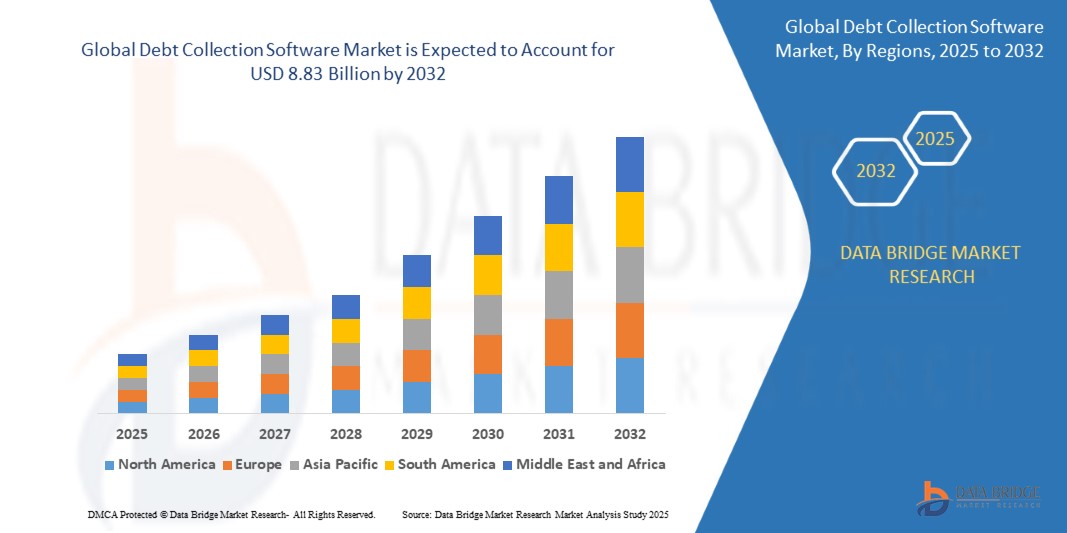

- The global debt collection software market Size was valued at USD 3.90 Billion in 2024 and is expected to reach USD 8.83 Billion by 2032, at a CAGR of 12.4 % during the forecast period

- The Global Debt Collection Software Market's growth is fueled by increasing demand for automation in debt recovery processes and rising consumer debt levels.

Debt Collection Software Market Analysis

The global debt collection software market is experiencing robust growth as organizations across sectors such as telecommunications, automotive, industrial automation, healthcare, aerospace & defense, and consumer services increasingly focus on improving cash flow management, regulatory compliance, and operational efficiency. This expansion is being fueled by the growing need to streamline debt recovery processes, reduce manual intervention, and enhance customer experience through digital platforms.

A primary driver of market growth is the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), natural language processing (NLP), robotic process automation (RPA), and cloud computing into debt collection software. These innovations enable intelligent workflow automation, predictive analytics for delinquency risk, personalized communication strategies, and real-time portfolio monitoring. As a result, debt recovery rates are improving, and operational costs are being significantly reduced across the finance, banking, and insurance sectors.

The increasing digitalization and automation of financial operations across industries are transforming the traditional collections landscape. In the telecom and utility sectors, companies are leveraging software to manage high volumes of customer data and automate billing dispute resolutions. In the automotive and retail finance segments, the rise in consumer loans and lease financing has created a demand for scalable and secure solutions to manage diverse receivables. Similarly, in healthcare, providers are adopting debt collection software to handle insurance claims, billing disputes, and patient communications in compliance with data privacy laws.

The adoption of cloud-based platforms is further accelerating growth, enabling real-time collaboration, remote accessibility, and seamless system integration with CRM, ERP, and payment gateways. Small and medium-sized enterprises (SMEs) are also embracing cloud-based debt collection tools due to their affordability, flexibility, and faster deployment capabilities.

However, the market faces several challenges. These include data privacy and compliance concerns, especially under stringent regulations such as GDPR, HIPAA, and FDCPA. Additionally, integration complexities with legacy systems, rising cyber threats, and the need for skilled personnel to manage intelligent systems may hinder adoption in certain regions. Economic downturns and inconsistent debtor behavior patterns can also impact software performance and ROI.

Despite these hurdles, the outlook remains strong. The growing emphasis on digital transformation, the rise of Buy Now, Pay Later (BNPL) platforms, and increasing regulatory scrutiny over debt collection practices are expected to drive further innovation and investment in the sector. Governments and regulatory bodies are also encouraging transparent and ethical debt collection practices, which is pushing demand for advanced compliance-focused solutions.

With the continuous improvement in AI-driven analytics, multi-channel communication, and cloud-native architecture, the Global Debt Collection Software Market is well-positioned for sustained growth and technological evolution in the coming years.

Report Scope and Debt Collection Software Market Segmentation

|

Attributes |

Debt Collection Software Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Debt Collection Software Market Trends

AI and ML streamlining collections by automating workflows and improving decision-making

- The Global Debt Collection Software Market is undergoing a significant transformation driven by technological innovation and evolving consumer behavior. One of the most influential trends is the integration of Artificial Intelligence (AI) and Machine Learning (ML). These technologies are automating core processes such as debtor profiling, communication, and risk assessment, allowing for faster, smarter, and more cost-effective collections. By learning from historical data, AI-powered systems can predict debtor behavior and suggest optimal engagement strategies, significantly improving recovery rates while reducing operational burdens.

- Alongside AI, there is a strong move toward omnichannel communication strategies. Debt collection platforms are now equipped to manage interactions across various channels, including email, SMS, voice calls, chatbots, and even social messaging apps like WhatsApp. This omnichannel presence ensures that debtors are engaged through their preferred mediums, leading to improved responsiveness and a more customer-friendly experience. The seamless switching between channels also helps maintain continuity and coherence in customer communication.

- Another major trend is the use of predictive analytics for advanced segmentation and prioritization. By analyzing vast sets of financial and behavioral data, modern platforms can assess the likelihood of repayment and segment debtors accordingly. This allows collectors to tailor their strategies based on the risk level or repayment potential of each case, resulting in more effective and personalized collection approaches. Predictive analytics is proving crucial in maximizing resource allocation and recovery success.

- Cloud-based and mobile-first debt collection software is gaining traction, especially among small and mid-sized businesses. These solutions offer flexibility, scalability, and cost efficiency, enabling remote access and seamless updates. Mobile compatibility further empowers collection agents and managers to track and engage with cases on the go, making operations more agile and responsive. As remote work continues to expand, cloud-based models are becoming the industry standard.

Debt Collection Software Market Dynamics

Driver

Rising volume of consumer and commercial debt worldwide

- One of the most significant drivers of the global debt collection software market is the rapid increase in consumer and commercial debt across the world. As economies expand and credit becomes more accessible, individuals and businesses are taking on more financial obligations through credit cards, loans, mortgages, utility bills, and various digital financing solutions. This rising debt load, while beneficial for economic activity, has also led to a higher volume of defaults and overdue payments, creating an urgent need for efficient and scalable debt recovery systems.

- In the consumer segment, the proliferation of Buy Now, Pay Later (BNPL) services, personal loans, and flexible credit offerings especially in e-commerce and fintech platforms—has contributed to a surge in small-ticket debts. While convenient for users, these services often result in fragmented, short-term repayment schedules that increase the risk of delinquencies. This has made it necessary for lenders to adopt automated tools that can handle high volumes of accounts, track payments, and send reminders without human intervention.

- On the commercial side, SMEs and large enterprises are also accumulating more credit—both as borrowers and creditors. Extended payment cycles, delayed invoices, and supply chain financing have added complexity to commercial debt management. Businesses increasingly require debt collection platforms that not only manage recovery but also integrate with accounting, ERP, and CRM systems for real-time visibility and financial planning.

- Additionally, macroeconomic factors such as inflation, job losses, and rising interest rates in many regions have strained repayment capacity for both consumers and businesses. As a result, defaults and late payments have become more common, placing further pressure on creditors to implement proactive and technology-driven collection strategies. Debt collection software helps institutions respond quickly, segment accounts based on risk, and deploy tailored recovery actions, improving both cash flow and customer retention.

Restraint/Challenge

Complex and evolving regulatory landscape across different countries

- The complex and evolving regulatory landscape across different countries presents a significant challenge for the global debt collection software market. Debt collection is a highly regulated activity, and laws governing how, when, and under what conditions creditors can engage with debtors vary widely from one jurisdiction to another. These regulations are designed to protect consumers from abusive, unfair, or deceptive practices—but they also place a heavy compliance burden on both software providers and end-users.

- For example, in the United States, the Fair Debt Collection Practices Act (FDCPA) mandates specific rules for communicating with debtors, including restrictions on the time of day collectors can make contact, prohibiting harassment, and requiring full disclosure of debt details. In the European Union, the General Data Protection Regulation (GDPR) imposes strict rules on how personal data is collected, stored, processed, and shared adding an additional layer of complexity when handling debtor information.

- Emerging markets in Asia, Africa, and Latin America also have their own regulatory frameworks, which are often less harmonized and subject to rapid change. This inconsistency forces software vendors to build highly flexible platforms that can be configured to meet local legal requirements, which increases development time and costs. It also requires regular updates to ensure compliance as new laws are passed or existing ones are revised.

- Moreover, in multi-jurisdictional operations such as those of multinational banks, telecom providers, or fintech companies organizations must ensure that their debt collection activities comply with all applicable laws in every region where their customers reside. This makes cross-border compliance a logistical and legal challenge, requiring deep localization features in the software, including audit trails, consent tracking, language-specific templates, and customizable workflows.

- Adding to this complexity is the growing focus on ethical and responsible debt collection, with regulators increasingly emphasizing debtor rights, dispute resolution mechanisms, and data transparency. Any software used in the collection process must now go beyond functionality to also ensure that all communications and actions are documented, traceable, and legally defensible.

Debt Collection Software Market Scope

The market is segmented on the basis of Component, Deployment Mode, Organization Size and Application.

- By Component

The Global Debt Collection Software Market, segmented by component into Software and Services, reflects a comprehensive approach to automating and streamlining the debt recovery process. The software segment dominates the market, offering cloud-based and on-premise platforms equipped with features such as automated reminders, analytics, compliance tracking, and CRM integration—driven by the growing need for operational efficiency and reduced manual intervention across industries like banking, healthcare, and telecom. On the other hand, the services segment, which includes implementation, training, support, and customization, plays a vital role in ensuring effective deployment and optimal use of these platforms. As businesses increasingly prioritize digital transformation and regulatory compliance, both segments are expected to witness strong demand, with cloud-based solutions and managed services gaining particular traction.

- By Deployment Mode

The Global Debt Collection Software Market, segmented by deployment mode into Cloud-Based and On-Premises, caters to diverse organizational needs based on scalability, cost, and data control preferences. Cloud-based deployment is witnessing rapid growth due to its flexibility, lower upfront costs, ease of access, and ability to support remote operations. It is particularly attractive to small and medium-sized enterprises (SMEs) seeking scalable and cost-effective solutions without the burden of heavy infrastructure. In contrast, on-premises deployment remains favored by large enterprises and organizations in highly regulated industries that prioritize data security, control, and compliance. While on-premises solutions offer greater customization and integration with existing systems, they require significant capital investment and IT support. As digital transformation accelerates and cloud security improves, cloud-based debt collection platforms are expected to dominate the market in the coming years.

- By Organization Size

The Global Debt Collection Software Market, segmented by organization size into Large Enterprises and SMEs (Small and Medium Enterprises), addresses the varying operational and financial needs of different business scales. Large enterprises often deal with high volumes of debt accounts across multiple regions and require advanced, customizable software with robust analytics, compliance features, and integration capabilities. They typically prefer comprehensive solutions that offer automation, multi-channel communication, and real-time reporting to enhance recovery rates and operational efficiency. Meanwhile, SMEs are increasingly adopting cloud-based debt collection software due to its affordability, ease of use, and scalability. These businesses are focused on reducing manual processes and improving cash flow management without the burden of high upfront costs. As digital adoption continues to rise among smaller firms, the SME segment is expected to contribute significantly to market growth, driven by the increasing availability of flexible, user-friendly, and cost-effective solutions.

- By Application

The Global Debt Collection Software Market, segmented by application into Financial Institutions, Collection Agencies, Healthcare, Government, and Telecom & Utilities, reflects the broad use of these solutions across industries with high receivables and complex billing structures. Financial institutions represent a major segment, leveraging advanced software to manage large volumes of personal and commercial debts, improve recovery rates, and maintain compliance with financial regulations. Collection agencies rely heavily on automated tools to handle multiple clients efficiently, reduce operational costs, and ensure consistent communication with debtors. In the healthcare sector, debt collection software helps hospitals and medical providers manage patient billing, insurance claims, and overdue payments, all while maintaining compliance with privacy regulations like HIPAA. Government bodies use these platforms to recover overdue taxes, fines, and fees with transparency and accountability. Meanwhile, telecom and utility companies, facing high churn and billing complexity, utilize debt collection systems to automate dunning processes, manage customer disputes, and reduce delinquencies. Each segment is driving market growth as organizations seek to enhance financial performance through smarter, tech-enabled debt recovery strategies.

Debt Collection Software Market Regional Analysis

North America

The North America debt collection software market is highly mature and technologically advanced, underpinned by a well-established credit ecosystem and widespread adoption of digital financial services. The region is characterized by a high volume of both consumer and commercial debt, particularly in the United States, which accounts for the largest share of the market. This growing debt burden driven by sectors such as student loans, credit cards, and healthcare has compelled financial institutions to invest heavily in efficient, automated debt recovery solutions. One of the key trends in the North American market is the integration of artificial intelligence (AI), machine learning (ML), and predictive analytics into debt collection platforms. These technologies enable more personalized, data-driven approaches that enhance recovery rates while maintaining compliance with stringent consumer protection laws. Moreover, the increasing shift towards omnichannel communication—using SMS, email, voice, and chatbots qcaters to changing borrower preferences and improves engagement. Cloud-based deployment continues to gain traction in the region due to its scalability, security, and cost-effectiveness, particularly among small and mid-sized enterprises. Regulatory compliance remains a critical factor in software selection, as firms must adhere to frameworks such as the Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and various state-level guidelines.

Europe

The Europe debt collection software market is driven by a strong focus on regulatory compliance, data privacy, and operational efficiency within a mature financial services landscape. With strict regulations such as the General Data Protection Regulation (GDPR) and country-specific debt collection laws, organizations across the region particularly in Germany, the UK, and France are adopting advanced software solutions that ensure secure, transparent, and compliant debt recovery processes. The growing need to reduce non-performing loans, coupled with increased pressure on financial institutions to streamline operations and enhance customer experience, is accelerating the shift toward AI-powered, cloud-based, and omnichannel collection platforms.

Asia Pacific

The Asia Pacific debt collection software market is witnessing rapid growth, fueled by rising consumer credit usage, digital lending expansion, and increasing financial inclusion across emerging economies such as India, China, and Southeast Asian countries. As digital banking and fintech platforms proliferate, there is a growing need for scalable, automated debt management solutions to handle rising volumes of delinquencies efficiently. While adoption is higher in technologically advanced nations like Japan, South Korea, and Australia, emerging markets are catching up due to improving digital infrastructure and supportive government policies. However, the region's diverse regulatory landscape and varying levels of technological maturity present both challenges and opportunities for market players.

Latin America

Latin America’s debt collection software market is experiencing steady growth, driven by rising consumer debt levels, increasing non-performing loans, and the digital transformation of financial services across the region. Countries like Brazil, Mexico, and Argentina are seeing heightened demand for automated and cloud-based debt recovery tools as financial institutions, telecom operators, and fintech firms seek to streamline operations and improve recovery rates. The growth of the fintech ecosystem and mobile-based lending platforms is also contributing to software adoption, particularly among smaller lenders and collection agencies. However, challenges such as fragmented regulatory frameworks, economic instability, and limited integration capabilities with legacy systems continue to pose barriers to widespread implementation. Despite these hurdles, the region presents promising opportunities as digital infrastructure improves and more businesses embrace data-driven, customer-centric collection strategies.

Middle East and Africa

The Middle East and Africa (MEA) debt collection software market is emerging steadily, led by demand in the Gulf Cooperation Council (GCC) countries and South Africa, where financial institutions are embracing digital transformation to manage expanding credit portfolios. Governments and banks in the region are increasingly deploying cloud-based debt management tools to enhance operational efficiency, automate communication, and ensure regulatory compliance. Although awareness and technical expertise are still Limited in several countries across Africa, ongoing initiatives to promote financial inclusion and the development of digital banking infrastructure are creating fertile conditions for adoption. Challenges remain, including varying regulatory regimes, cultural differences in debt repayment practices, and limited IT capabilities in less developed states. Despite these hurdles, the MEA region holds significant growth potential as more institutions migrate from manual workflows to intelligent, scalable collection solutions.

Debt Collection Software Market Share

The global debt collection software industry is primarily led by well-established companies, including:

- FICO

- Experian

- Pegasystems Inc.

- CGI Inc.

- Temenos AG

- TransUnion

- Chetu Inc.

- Quantrax Corporation Inc.

- TietoEVRY

- EXUS

- Katabat

- Collect

- Codix

- Advantage Software

- Simplicity Collection Software

Latest Developments in Global Debt Collection Software Market

- In June 2025, Credgenics, a leading fintech debt collection platform in India, announced a near tripling of its profit to ₹25 crore (approx. USD 3 million) in FY 2024–25. The company also reported a 40% increase in revenue, highlighting strong adoption of its digital debt recovery solutions amid a surge in loan defaults and rising demand for automated collection tools.

- In April 2025, Public Sector Banks in India began implementing Spocto X, an AI-driven debt collection platform by Yubi Group. This platform reduced SMA (Special Mention Account) ratios from 8% to 3% within a year and increased recovery rates by 60%, while lowering operational costs by 57%, significantly improving overall collection performance.

- In April 2025, Helport AI launched a next-generation debt collection solution in the Philippines, featuring AI-guided conversations, compliance tracking, and analytics. The software aims to modernize the collections process for Southeast Asian financial institutions, providing enhanced consumer engagement and operational scalability.

- In January 2025, Riverty, the fintech division of Bertelsmann, partnered with Parloa to deploy AI-based voice assistants across its debt collection operations. The virtual agent successfully handled over 30% of inbound calls autonomously, resolving 15% without human involvement and reducing wait times by 50%.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.