Global Decorative High Pressure Laminates Market

Market Size in USD Billion

CAGR :

%

USD

8.78 Billion

USD

11.74 Billion

2024

2032

USD

8.78 Billion

USD

11.74 Billion

2024

2032

| 2025 –2032 | |

| USD 8.78 Billion | |

| USD 11.74 Billion | |

|

|

|

|

Decorative High-Pressure Laminates Market Size

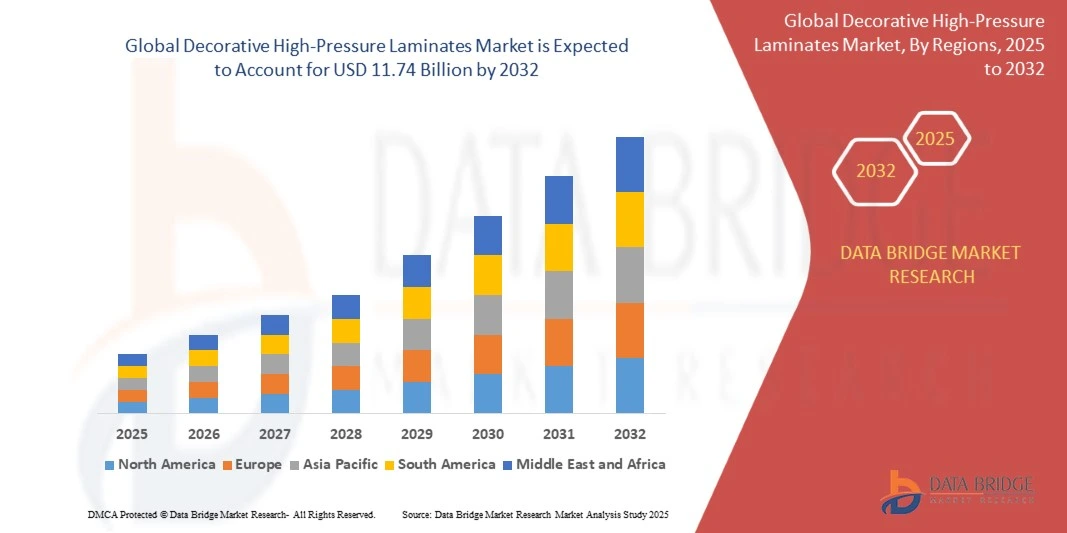

- The global decorative high-pressure laminates market size was valued at USD 8.78 billion in 2024 and is expected to reach USD 11.74 billion by 2032, at a CAGR of 3.7% during the forecast period

- The market growth is largely fueled by the increasing demand for aesthetically appealing, durable, and customizable surface solutions in residential, commercial, and institutional applications, driving widespread adoption of decorative high-pressure laminates

- Furthermore, rising consumer preference for modern interior designs, coupled with the need for cost-effective, low-maintenance, and environmentally friendly surfaces, is establishing decorative high-pressure laminates as a preferred choice in both new constructions and renovation projects. These factors are accelerating market adoption, thereby significantly boosting industry growth

Decorative High-Pressure Laminates Market Analysis

- Decorative high-pressure laminates are engineered sheets made by compressing multiple layers of kraft paper and decorative veneers under high pressure and temperature, providing durable, decorative, and functional surfaces for furniture, wall panels, countertops, and flooring

- The escalating demand for decorative high-pressure laminates is primarily fueled by the growing construction and real estate sectors, rising focus on interior aesthetics, and increasing preference for surfaces that combine durability, design versatility, and ease of maintenance in residential and commercial settings

- Asia-Pacific dominated the decorative high-pressure laminates market with a share of 46.30% in 2024, due to rapid urbanization, growing construction activities, and rising demand for aesthetically appealing and durable interior and exterior surfaces

- North America is expected to be the fastest growing region in the decorative high-pressure laminates market during the forecast period due to robust demand in residential, commercial, and hospitality projects

- Interior segment dominated the market with a market share of 62.5% in 2024, due to its widespread use in residential and commercial spaces for wall panels, furniture surfaces, kitchen countertops, and cabinetry. Interiors benefit from HPL’s aesthetic versatility, durability, and ease of maintenance, making it a preferred choice for architects and designers. The ability to provide a wide range of patterns, textures, and finishes also enhances its adoption for decorative and functional purposes. Furthermore, increasing consumer demand for modern, stylish, and sustainable interior décor solutions continues to boost market traction for interior applications

Report Scope and Decorative High-Pressure Laminates Market Segmentation

|

Attributes |

Decorative High-Pressure Laminates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Decorative High-Pressure Laminates Market Trends

Rising Preference for Modern, Customized Interior Designs

- The decorative high-pressure laminates (HPL) market is witnessing strong growth driven by increasing consumer and commercial demand for modern, customized interior finishes. HPL offers extensive design flexibility with textures and patterns that replicate natural materials, supporting personalized aesthetics in residential, retail, hospitality, and office environments

- For instance, companies such as Formica Group and Wilsonart provide vast collections of customizable designs that cater to evolving modern architecture and interior design trends. The rise in home renovation and remodeling activities, coupled with increasing disposable incomes, has led to greater adoption of decorative HPL in furniture, wall paneling, and flooring applications

- Technological advancements in HPL manufacturing enable improved surface durability, scratch resistance, and environmental compliance, enhancing appeal for high-traffic and high-use commercial spaces. Digital printing and embossing technologies allow more intricate, high-quality designs, meeting designer and consumer preferences for uniqueness and style

- The growing popularity of modular construction and-prefabricated interiors also supports HPL demand due to its lightweight, easy-to-install, and durable properties. Increasing awareness of sustainable and low-emission building materials has resulted in HPL offerings with reduced formaldehyde and VOC emissions

- Emerging markets in Asia-Pacific are leading growth due to rapid urbanization and expanding infrastructure projects, while mature regions such as North America and Europe see steady gains driven by refurbishment and green building initiatives

- This trend toward modern, customized interior designs supported by versatile decorative laminates is projected to continue, positioning HPL as a preferred surface material for visually appealing and functional interiors

Decorative High-Pressure Laminates Market Dynamics

Driver

Growing Demand for Durable, Low-Maintenance Surfaces

- Durability and low maintenance requirements are key drivers for decorative HPL market growth. HPL products offer high resistance to scratches, heat, moisture, and chemicals, making them ideal for surfaces in residential, commercial, and institutional buildings that demand long-lasting and easy-care finishes

- For instance, HPL is extensively used in healthcare facilities, educational institutions, and retail spaces where hygiene and wear resistance are critical. The construction of new commercial buildings and hotels incorporates HPL to reduce interior maintenance costs and enhance lifecycle performance of surfaces

- The material’s ability to maintain structural integrity and aesthetic appeal under heavy usage reduces renovation frequency and total cost of ownership for end-users. This economic benefit is compelling architects, designers, and facility managers to specify HPL in various applications such as countertops, cabinetry, partitions, and wall cladding

- Advancements in coating technologies improve stain repellency and cleanability, further simplifying maintenance efforts. These attributes align closely with building sustainability standards by promoting resource efficiency and reducing waste

- The demand for durable, low-maintenance surfacing solutions remains a powerful market impetus, emphasizing HPL’s critical role in contemporary interior material selections

Restraint/Challenge

Fluctuating Raw Material Prices

- The decorative HPL market faces challenges due to volatility in raw material prices, particularly for phenolic resins, kraft paper, and decorative films essential for laminate production. Price fluctuations cause uncertainties in manufacturing costs and can impact product pricing competitiveness

- For instance, global supply disruptions of phenolic resin precursors and fluctuations in pulp and paper costs due to environmental regulations and market demand have led to periodic cost surges affecting HPL producers worldwide. These factors may limit profit margins, especially for smaller manufacturers operating with thin margins

- Raw material price instability also complicates long-term procurement plans and investment decisions in capacity expansion. Cost volatility can lead to increased product prices, which may dampen demand in price-sensitive markets and restrict market penetration in developing regions

- Efforts to mitigate raw material risks include diversifying sourcing, developing bio-based resin alternatives, and improving process efficiencies. However, the challenge remains significant given the complexity of raw material supply chains and global economic fluctuations

- In conclusion, while demand for decorative HPL remains robust, raw material price fluctuations represent a notable restraint. Strategic supply management and innovation in sustainable raw materials are essential for stabilizing costs and sustaining market growth through 2030 and beyond

Decorative High-Pressure Laminates Market Scope

The market is segmented on the basis of application, surface finish, and end use.

• By Application

On the basis of application, the decorative HPL market is segmented into interior and exterior. The interior segment dominated the largest market revenue share of 62.5% in 2024, driven by its widespread use in residential and commercial spaces for wall panels, furniture surfaces, kitchen countertops, and cabinetry. Interiors benefit from HPL’s aesthetic versatility, durability, and ease of maintenance, making it a preferred choice for architects and designers. The ability to provide a wide range of patterns, textures, and finishes also enhances its adoption for decorative and functional purposes. Furthermore, increasing consumer demand for modern, stylish, and sustainable interior décor solutions continues to boost market traction for interior applications.

The exterior segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the rising use of HPL in façades, cladding, and outdoor furniture. HPL’s resistance to weathering, UV radiation, and moisture makes it ideal for exterior environments. Growing urbanization and the construction of high-rise buildings in developing regions are further accelerating the adoption of exterior HPL applications. In addition, architects increasingly prefer exterior HPL for its ability to combine functionality with contemporary design aesthetics.

• By Surface Finish

On the basis of surface finish, the decorative HPL market is segmented into wood, metal, abstract, and others. The wood finish segment dominated the largest market revenue share in 2024, owing to the rising demand for natural wood aesthetics at affordable costs. Wood-finished HPL offers the visual appeal of natural wood without the maintenance challenges, warping, or cost associated with solid wood. Its versatility in application across furniture, flooring, and wall panels further strengthens its dominance. Consumers and designers also favor wood finishes for their ability to complement a wide range of interior styles, from traditional to contemporary.

The abstract finish segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing preference for unique, artistic, and customized designs in residential and commercial interiors. Abstract finishes allow designers to create visually striking surfaces that stand out while maintaining the durability and ease of maintenance of HPL. Rising trends in personalized interiors, boutique hospitality projects, and commercial spaces that emphasize creative expression are propelling the demand for abstract surface finishes.

• By End Use

On the basis of end use, the decorative HPL market is segmented into residential, commercial, and others. The residential segment dominated the largest market revenue share in 2024, supported by the increasing adoption of HPL in kitchens, wardrobes, furniture, and wall paneling. Homeowners prefer HPL for its cost-effectiveness, durability, and wide variety of finishes that enhance interior aesthetics. Growing urban housing projects and a rising middle-class population seeking modern, stylish, and low-maintenance surfaces are further driving residential adoption.

The commercial segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the expanding use of HPL in offices, hotels, retail spaces, and institutional buildings. Commercial spaces require durable, easy-to-maintain surfaces that can withstand high traffic and wear, making HPL a suitable choice. Increasing investment in smart and modern commercial infrastructure, coupled with demand for visually appealing and branded interiors, is accelerating the adoption of HPL in commercial end-use applications.

Decorative High-Pressure Laminates Market Regional Analysis

- Asia-Pacific dominated the decorative high-pressure laminates market with the largest revenue share of 46.30% in 2024, driven by rapid urbanization, growing construction activities, and rising demand for aesthetically appealing and durable interior and exterior surfaces

- The region’s cost-effective manufacturing, abundant raw material availability, and expanding residential and commercial infrastructure are accelerating market expansion

- Increasing investments in modern architecture, favorable government policies supporting construction, and rising adoption of premium interior décor solutions are contributing to higher consumption of Decorative High-Pressure Laminates in both residential and commercial sectors

China Decorative High-Pressure Laminates Market Insight

China held the largest share in the Asia-Pacific Decorative High-Pressure Laminates market in 2024, supported by its robust construction industry, growing urban housing projects, and strong presence of Decorative High-Pressure Laminates manufacturers. The country’s focus on modern interior design, rising demand for furniture and wall paneling, and government initiatives promoting residential and commercial infrastructure are major growth drivers. Demand is further strengthened by investments in high-quality Decorative High-Pressure Laminates production for both domestic use and exports.

India Decorative High-Pressure Laminates Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing construction activities, expanding hospitality and commercial sectors, and rising urban middle-class consumer spending. Government initiatives promoting urban development and policies supporting local manufacturing are enhancing the availability and adoption of Decorative High-Pressure Laminates. Growing demand for durable, cost-effective, and aesthetically versatile surfaces in residential and commercial projects is further accelerating market expansion.

Europe Decorative High-Pressure Laminates Market Insight

The Europe Decorative High-Pressure Laminates market is expanding steadily, driven by high-quality construction standards, emphasis on sustainable and premium building materials, and growing demand for innovative interior design solutions. The region places strong focus on durability, eco-friendliness, and compliance with environmental regulations. Increasing adoption in commercial projects, offices, and hospitality sectors is further contributing to market growth.

Germany Decorative High-Pressure Laminates Market Insight

Germany’s Decorative High-Pressure Laminates market is driven by its leadership in premium interior design, high-quality manufacturing standards, and strong industrial and commercial infrastructure. The country’s focus on sustainable building materials, innovative surface finishes, and collaborations between design and manufacturing sectors fosters continuous market development. Demand is particularly strong for residential and commercial furniture, wall panels, and high-end interior décor applications.

U.K. Decorative High-Pressure Laminates Market Insight

The U.K. market is supported by a mature construction and interior design industry, rising demand for modern and customized décor solutions, and increasing adoption of sustainable Decorative High-Pressure Laminates products. The emphasis on energy-efficient and aesthetically appealing materials in residential and commercial projects, along with collaborations between designers and manufacturers, continues to drive market growth.

North America Decorative High-Pressure Laminates Market Insight

North America is projected to grow at the fastest compound annual growth rate from 2025 to 2032, fueled by robust demand in residential, commercial, and hospitality projects. Rising investments in real estate, modern architectural trends, and growing adoption of durable and decorative surfaces are boosting market expansion. In addition, increasing awareness of sustainable building materials and innovations in Decorative High-Pressure Laminates surface finishes are supporting regional growth.

U.S. Decorative High-Pressure Laminates Market Insight

U.S. accounted for the largest share in the North America Decorative High-Pressure Laminates market in 2024, underpinned by a strong construction industry, growing residential and commercial infrastructure, and high demand for premium interior décor solutions. Rising investments in modern furniture, wall panels, and sustainable building materials, along with a mature manufacturing and distribution network, further solidify the U.S. leading position in the region.

Decorative High-Pressure Laminates Market Share

The decorative high-pressure laminates industry is primarily led by well-established companies, including:

- Greenlam Industries Ltd (India)

- Merino Laminates (India)

- Stylam Industries Limited (India)

- Pfleiderer GmbH (Germany)

- Wilsonart LLC (U.S.)

- OMNOVA Solutions Inc (U.S.)

- Abet Laminati S.p.A. (Italy)

- Panolam Industries (U.S.)

- Fundermax GmbH (Austria)

Latest Developments in Decorative High-Pressure Laminates Market

- In June 2025, Formica Corporation expanded its product line by introducing eight new woodgrain patterns and six additional designs to the Formica Laminate portfolio. This expansion provides architects, designers, and homeowners with a broader range of contemporary and classic decorative options for applications such as furniture, cabinetry, wall panels, and casework. By offering more diverse aesthetics, the company is catering to evolving design preferences and increasing demand for visually striking, customizable, and high-quality surfaces, further strengthening its leadership in the decorative high-pressure laminates market

- In February 2022, Formica Corporation launched the Living Impressions Collection, featuring nine sophisticated laminate surfaces inspired by natural textures such as granite, stone, and wood. These realistic, high-quality designs enable the company to meet the growing consumer and commercial demand for premium and nature-inspired decorative surfaces. The collection’s versatility across residential and commercial applications reinforces Formica’s reputation for innovation and quality, addressing the market’s need for durable, visually appealing, and trend-responsive laminate products

- In September 2021, Formica Corporation introduced the Formica Laminate Antimicrobial line, offering 20 popular laminate styles in the United States and Mexico. Using BioCote technology, these laminates protect against bacteria that cause odor and staining. This development strengthened the company’s position in the decorative high-pressure laminates market by addressing the rising demand for hygienic surfaces, particularly in healthcare, hospitality, and food service applications, while enhancing consumer confidence in durable, low-maintenance, and safe surfaces

- In January 2021, Formica Corporation commissioned a new panel press at its Indianapolis distribution facility to shorten lead times and provide highly customized services. Serving regions including Illinois, Indiana, Kentucky, Michigan, Missouri, Ohio, and West Virginia, this operational enhancement improved production efficiency and the company’s ability to meet tailored customer requirements. This initiative strengthened Formica’s competitiveness in the decorative high-pressure laminates market by combining faster delivery with flexible, customized product offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Decorative High Pressure Laminates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Decorative High Pressure Laminates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Decorative High Pressure Laminates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.