Global Decorticator Machine Market

Market Size in USD Billion

CAGR :

%

USD

565.22 Billion

USD

838.91 Billion

2024

2032

USD

565.22 Billion

USD

838.91 Billion

2024

2032

| 2025 –2032 | |

| USD 565.22 Billion | |

| USD 838.91 Billion | |

|

|

|

|

Decorticator Machine Market Size

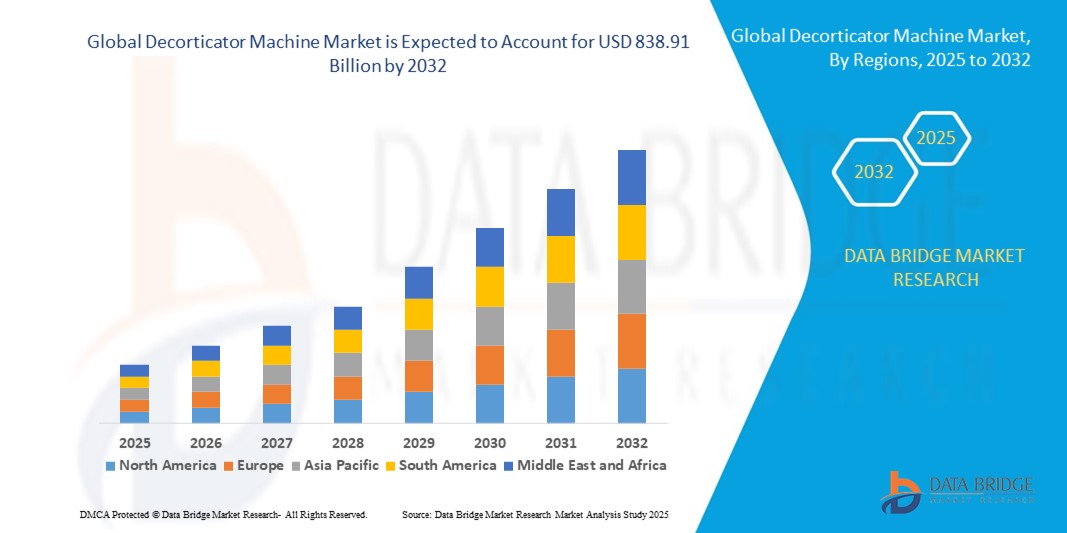

- The global decorticator machine market size was valued at USD 565.22 billion in 2024 and is expected to reach USD 838.91 billion by 2032, at a CAGR of 5.06% during the forecast period

- The market growth is largely fueled by the rising adoption of mechanized solutions in agriculture and textile industries, increasing demand for natural fibers such as jute, hemp, and banana fiber, and the growing emphasis on sustainable raw material processing

- Technological advancements in decortication machinery, coupled with government initiatives promoting agro-based industries, are further driving the market expansion

Decorticator Machine Market Analysis

- Growing demand for natural fibers and government support for sustainable agriculture are driving the adoption of decorticator machines worldwide

- Technological advancements, including automation and portable designs, are improving efficiency and expanding applications across industries

- Asia-Pacific dominated the decorticator machine market with the largest revenue share of 41.5% in 2024, driven by the region’s extensive cultivation of fiber crops such as jute, hemp, and banana, alongside government initiatives promoting agro-mechanization and rural development

- North America region is expected to witness the highest growth rate in the global decorticator machine market, driven by rising demand for eco-friendly raw materials, strong investment in agro-processing infrastructure, and the presence of key machinery manufacturers

- The Machine-Operated segment held the largest market revenue share in 2024, driven by rising demand for automation and the need to process high volumes of fiber crops efficiently. These machines significantly reduce labor costs and processing time, making them ideal for commercial-scale operations

Report Scope and Decorticator Machine Market Segmentation

|

Attributes |

Decorticator Machine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

Expanding Use Of Natural Fibers In Biodegradable Products Growing Adoption Of Decorticator Machines In Emerging Economies |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Decorticator Machine Market Trends

Adoption Of Automated And Portable Decorticator Machines

- The shift toward automated and portable decorticator machines is revolutionizing fiber extraction by offering higher efficiency and reduced manual labor. These machines enable farmers and processors to achieve consistent fiber quality and improved processing speed, especially for crops such as jute, hemp, and banana. This transition is helping lower production costs and enhance productivity in agro-based industries

- The demand for compact and mobile decortication units is rising in rural and semi-urban regions where smallholder farmers lack access to large-scale processing facilities. Portable machines allow decentralized fiber processing, improving local employment opportunities and reducing logistical expenses

- Cost-effective, user-friendly designs are encouraging broader adoption, even among small and medium-scale farmers. Manufacturers focusing on low-maintenance and energy-efficient models are witnessing increased market penetration

- For example, in 2023, several farmer cooperatives in Southeast Asia adopted solar-powered portable decorticators for jute processing, reducing energy expenses while improving output quality and fiber yield

- While automation and portability are improving fiber processing efficiency, long-term market growth depends on continuous technological upgrades, farmer training programs, and affordable financing options for machine acquisition

Decorticator Machine Market Dynamics

Driver

Rising Demand For Natural Fibers And Government Support For Agro-Mechanization

- The growing global preference for natural and biodegradable fibers in textiles, packaging, and automotive sectors is driving the need for efficient decorticator machines. With rising environmental concerns, industries are shifting from synthetic materials to sustainable alternatives, increasing demand for high-capacity fiber processing technologies

- Governments worldwide are offering subsidies and technical support to modernize rural agro-infrastructure. These initiatives include financial incentives, training programs, and rural mechanization schemes designed to encourage farmers to adopt modern decortication techniques and improve overall productivity

- Public-private partnerships and innovation grants are accelerating R&D in machine designs, leading to cost-effective, energy-efficient, and high-output decortication solutions. Such collaborations are also fostering the development of localized machinery adapted to specific crop requirements and climatic conditions

- For instance, in 2022, India’s Ministry of Agriculture launched a subsidy program for hemp decorticator machines, leading to a significant rise in installations across northern states cultivating fiber crops. This move improved fiber quality, reduced labor dependency, and boosted rural employment opportunities

- While government policies and sustainability trends are creating a favorable environment, consistent farmer awareness campaigns, on-ground demonstrations, and financing schemes are essential to ensure technology reaches small and marginal farmers across developing economies

Restraint/Challenge

High Initial Costs And Limited Awareness Among Small-Scale Farmers

- Advanced decorticator machines with automation and multi-crop capabilities often carry a high upfront cost, discouraging adoption among small and marginal farmers with limited financial resources. The absence of flexible leasing programs or low-interest financing options further restricts investment in modern mechanization tools

- In many developing regions, awareness about modern fiber processing techniques remains low. Farmers continue relying on traditional manual methods due to familiarity, lack of technical training, and absence of local distribution channels for machinery and spare parts

- Limited access to affordable credit and rural infrastructure hampers large-scale mechanization efforts. The absence of cooperative buying models or shared equipment centers reduces opportunities for smallholder farmers to upgrade from outdated manual processing practices

- For example, in 2023, studies in African jute-growing regions revealed that over 65% of smallholder farmers continued using manual processing techniques, citing cost barriers, inadequate financing mechanisms, and limited technical knowledge as key obstacles to modernization

- Although technological innovations and government incentives aim to address these challenges, building rural financing schemes, training workshops, and localized service networks will be critical to improving market penetration and long-term adoption

Decorticator Machine Market Scope

The market is segmented on the basis of operation type, output capacity, application, and end-user industry.

- By Operation Type

On the basis of operation type, the decorticator machine market is segmented into Hand-Operated and Machine-Operated. The Machine-Operated segment held the largest market revenue share in 2024, driven by rising demand for automation and the need to process high volumes of fiber crops efficiently. These machines significantly reduce labor costs and processing time, making them ideal for commercial-scale operations.

The Hand-Operated segment is expected to witness fastest growth rate during the forecast period from 2025 to 2032, supported by adoption among smallholder farmers and rural cooperatives where affordability and simplicity remain key decision factors.

- By Output Capacity

On the basis of output capacity, the market is segmented into Below 100 Kg/Hr, 100 Kg/Hr–500 Kg/Hr, 500 Kg/Hr–1000 Kg/Hr, and Above 1000 Kg/Hr. The 100 Kg/Hr–500 Kg/Hr segment dominated the market in 2024 due to its suitability for medium-scale fiber processing units balancing cost and productivity.

The Above 1000 Kg/Hr segment is expected to witness fastest growth rate during the forecast period from 2025 to 2032, driven by increasing demand from large industrial farms and processing centers aiming for high-volume, continuous operations with minimal downtime.

- By Application

Based on application, the decorticator machine market is categorized into Fiber Extraction, Hurd Processing, and Others. The Fiber Extraction segment accounted for the largest share in 2024 as demand for natural fibers such as jute, hemp, and banana continues to rise in the textile and packaging industries.

Hurd Processing applications is expected to witness fastest growth rate during the forecast period from 2025 to 2032, driven by rising utilization of hurds in bio-composites, animal bedding, and construction materials across global markets.

- By End-User Industry

On the basis of end-user industry, the market is segmented into Agriculture, Textile, Biofuel Production, and Others. The Textile industry segment held the largest revenue share in 2024 due to the growing adoption of natural fibers in apparel, home textiles, and industrial fabrics.

The Biofuel Production segment is expected to witness fastest growth rate during the forecast period from 2025 to 2032, supported by increasing interest in biomass-based energy sources and government incentives promoting sustainable energy alternatives.

Decorticator Machine Market Regional Analysis

- Asia-Pacific dominated the decorticator machine market with the largest revenue share of 41.5% in 2024, driven by the region’s extensive cultivation of fiber crops such as jute, hemp, and banana, alongside government initiatives promoting agro-mechanization and rural development

- Farmers and agro-industries in the region highly value the productivity gains, labor savings, and improved fiber quality offered by modern decorticator machines, especially as demand for natural fibers surges in global textile, packaging, and biofuel sectors

- Rapid industrialization, combined with the emergence of small-scale processing units and technology-driven rural entrepreneurship programs, further supports the adoption of advanced decorticator machinery across developing economies in the region

China Decorticator Machine Market Insight

The China decorticator machine market accounted for a significant market revenue share in Asia-Pacific in 2024, attributed to the country’s large-scale hemp production, rapid agricultural modernization, and supportive policies encouraging farm mechanization. The increasing adoption of decorticators in commercial-scale fiber processing units, along with technological advancements by local equipment manufacturers, is strengthening the country’s market position.

Japan Decorticator Machine Market Insight

The Japan decorticator machine market is expected to witness fastest growth rate during the forecast period from 2025 to 2032 due to the country’s increasing focus on sustainable materials, technological innovation, and efficient agricultural practices. The growing demand for natural fibers in textiles, packaging, and eco-friendly construction materials is driving the adoption of modern decortication equipment. Moreover, Japan’s strong R&D capabilities and emphasis on precision farming are encouraging the use of automated, high-capacity decorticators, particularly in hemp and flax processing industries.

Europe Decorticator Machine Market Insight

The Europe decorticator machine market is expected to witness fastest growth rate during the forecast period from 2025 to 2032, primarily driven by rising demand for sustainable raw materials in textiles, packaging, and automotive sectors. Strict environmental regulations promoting biodegradable materials, coupled with government incentives for modern agricultural equipment, are fostering adoption. The region is also witnessing growth in decentralized, community-level fiber processing initiatives across rural areas.

U.K. Decorticator Machine Market Insight

The U.K. decorticator machine market is expected to witness fastest growth rate during the forecast period from 2025 to 2032, supported by the country’s emphasis on sustainable agriculture, bio-based materials, and rural technology adoption programs. Increasing demand for hemp-based textiles and construction materials is further boosting investments in advanced decortication equipment.

Germany Decorticator Machine Market Insight

The Germany decorticator machine market is expected to witness fastest growth rate during the forecast period from 2025 to 2032, fueled by the nation’s strong industrial base, focus on eco-friendly materials, and technological innovation in agricultural machinery. The growing integration of decorticators with automated processing lines in both agriculture and biofuel production sectors is driving market growth in the country.

North America Decorticator Machine Market Insight

The North America decorticator machine market is expected to witness fastest growth rate during the forecast period from 2025 to 2032, driven by the rising popularity of hemp and flax cultivation for industrial applications such as textiles, bioplastics, and biofuels. The U.S. is leading the regional market due to the legalization of industrial hemp cultivation, increasing investment in agro-processing infrastructure, and growing awareness about sustainable raw materials in various end-use industries.

U.S. Decorticator Machine Market Insight

The U.S. decorticator machine market is expected to witness fastest growth rate during the forecast period from 2025 to 2032, supported by rapid adoption of advanced agricultural machinery, strong government support for industrial hemp production, and the presence of key equipment manufacturers introducing high-capacity decorticators for commercial-scale operations.

Decorticator Machine Market Share

The Decorticator Machine industry is primarily led by well-established companies, including:

- HempFlax Group (Netherlands)

- Temafa GmbH (Germany)

- Global Hemp Group Inc. (Canada)

- AG Hemp Processing (Switzerland)

- Bish Enterprises (U.S.)

- Laboy Glass (U.S.)

- Qingdao Hj Hmphn Co. Ltd. (China)

- Bast Fibers LLC (U.S.)

- Formation Ag (U.S.)

- Fives Group (France)

- Sandvik AB (Sweden)

- Canopy Growth Corporation (Canada)

- KIRK-OTHMER Encyclopedia of Chemical Technology (U.S.)

- Saskatchewan Hemp Association (Canada)

- ENTEXS GmbH (Germany)

- New Holland Agriculture (U.S.)

- Dion Engineering (U.S.)

- CROWN Iron Works (U.S.)

- Zhengzhou Taizy Machinery Co., Ltd. (China)

- Hemp Processing Solutions (U.S.)

Latest Developments in Global Decorticator Machine Market

- In September 2022, the Bangladesh Agricultural Research Institute (BARI) introduced a new jute decorticator machine, developed to efficiently extract fibers while maintaining the quality of jute sticks. The innovation, launched in collaboration with multiple research institutions and agricultural equipment manufacturers, aims to boost processing speed, reduce labor costs, and improve raw material utilization for rural farmers. This development is expected to enhance productivity in the jute industry, support sustainable fiber production, and drive the adoption of modern decortication technology across emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Decorticator Machine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Decorticator Machine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Decorticator Machine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.