Global Defense Cyber Warfare Market

Market Size in USD Billion

CAGR :

%

USD

153.20 Billion

USD

583.71 Billion

2024

2032

USD

153.20 Billion

USD

583.71 Billion

2024

2032

| 2025 –2032 | |

| USD 153.20 Billion | |

| USD 583.71 Billion | |

|

|

|

|

Defense Cyber Warfare Market Size

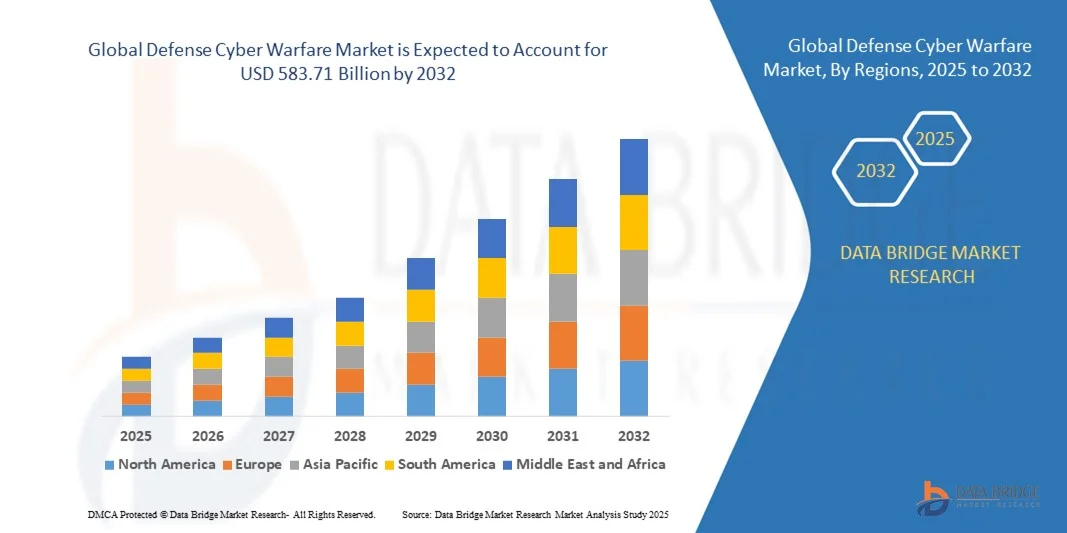

- The global defense cyber warfare market size was valued at USD 153.20 billion in 2024 and is expected to reach USD 583.71 billion by 2032, at a CAGR of 18.20% during the forecast period

- The market growth is largely fuelled by the rising frequency of cyberattacks targeting critical defense infrastructure and government networks, prompting increased investments in cybersecurity modernization programs

- The growing integration of artificial intelligence (AI), machine learning, and big data analytics in military cyber defense operations is further enhancing threat detection, incident response, and network resilience capabilities

Defense Cyber Warfare Market Analysis

- The defense cyber warfare market is witnessing rapid expansion as nations prioritize the development of advanced cyber defense and offensive capabilities to safeguard national security in an increasingly digital battlespace

- Strategic collaborations between defense agencies and private cybersecurity firms are accelerating the innovation of next-generation cyber solutions designed to protect command, control, communications, and intelligence (C3I) systems

- North America dominated the defense cyber warfare market with the largest revenue share of 41.22% in 2024, driven by the rising number of state-sponsored cyberattacks, rapid defense digitalization, and increasing government investments in cybersecurity modernization programs

- Asia-Pacific region is expected to witness the highest growth rate in the global defense cyber warfare market, driven by increasing geopolitical tensions, military modernization programs, and growing investments in cyber intelligence and defense technologies

- The Defense Solutions segment held the largest market revenue share in 2024, driven by the growing demand for advanced cybersecurity tools to protect classified military networks and digital assets. These solutions encompass intrusion detection, encryption systems, and secure communication technologies that enhance defense preparedness and threat mitigation

Report Scope and Defense Cyber Warfare Market Segmentation

|

Attributes |

Defense Cyber Warfare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Defense Cyber Warfare Market Trends

Integration Of Artificial Intelligence And Machine Learning In Cyber Defense Operations

- The increasing integration of artificial intelligence (AI) and machine learning (ML) in defense cyber warfare systems is transforming how military organizations detect, predict, and neutralize cyber threats. AI-driven algorithms enhance situational awareness by analyzing massive datasets in real time, enabling proactive defense strategies and faster response times against evolving attacks. These systems allow defense agencies to automate the detection of irregular patterns and enhance network resilience against large-scale digital assaults

- The ability of AI-based systems to learn and adapt to new threat patterns is significantly improving defense capabilities. Machine learning models can automatically identify anomalies, detect zero-day vulnerabilities, and predict adversarial tactics, providing a decisive advantage in both offensive and defensive cyber operations. Governments are investing heavily in AI-based cyber command centers to strengthen national security frameworks, enabling cross-domain coordination and predictive risk analysis at unprecedented speed

- The collaboration between defense contractors and cybersecurity firms is leading to the development of advanced AI-integrated systems capable of autonomous threat hunting and data correlation across complex networks. These systems improve efficiency and reduce human error, establishing a new benchmark for next-generation cyber warfare infrastructure. In addition, this collaboration is fostering the creation of AI-enabled simulation environments that replicate real-world cyberattacks to enhance defense readiness and tactical planning

- For instance, in 2024, the U.S. Department of Defense initiated large-scale deployment of AI-enabled cyber defense systems designed to predict and prevent foreign intrusions targeting military communication networks. This initiative marked a major milestone in the modernization of defense cybersecurity operations. The program also focused on integrating real-time analytics and automated countermeasure protocols, minimizing human dependency and improving response accuracy in high-pressure scenarios

- While AI is revolutionizing cyber warfare, ensuring ethical implementation, minimizing false positives, and maintaining algorithmic transparency remain critical challenges. The success of AI-driven defense depends on human oversight, continuous model training, and secure data management frameworks. Defense organizations must also ensure that reliance on autonomous systems does not create vulnerabilities from adversarial AI or data manipulation attacks, necessitating robust verification mechanisms

Defense Cyber Warfare Market Dynamics

Driver

Rising Frequency Of Cyberattacks On Defense Networks And Increasing Defense Digitization

- The rising number of cyber intrusions targeting military systems and classified networks is compelling governments to enhance their cyber warfare capabilities. The growing sophistication of state-sponsored attacks and espionage activities has elevated cybersecurity to a top-tier national defense priority across major economies. This surge in attacks has prompted defense agencies to adopt advanced, layered security architectures and establish 24/7 cyber command centers for continuous monitoring

- The increasing digitalization of defense infrastructure, such as command-and-control systems, unmanned vehicles, and intelligence-sharing platforms, has expanded the potential attack surface. As a result, defense agencies are focusing on developing integrated, multilayered cyber defense systems to protect sensitive information and operational networks. These systems combine hardware security modules, encrypted communication, and behavioral analytics to counter multi-vector cyber threats effectively

- Governments are allocating substantial budgets toward cybersecurity modernization, investing in real-time monitoring systems, cyber threat intelligence platforms, and secure communication channels. The adoption of next-generation encryption and blockchain-based data protection tools is also gaining traction across military operations. Such investments are driving innovation in quantum-resistant encryption and edge computing to safeguard tactical data exchanges

- For instance, in 2023, the North Atlantic Treaty Organization (NATO) launched the Cyber Defense Pledge initiative to strengthen member nations’ digital resilience, emphasizing investments in advanced threat detection and coordinated cyber response systems. This collaboration improved information sharing among allies, allowing for faster response to cross-border cyber incidents and reducing exposure to hostile cyber actors

- As cyber warfare evolves, maintaining operational resilience through continuous innovation, training, and inter-agency collaboration remains essential to sustaining global defense readiness. Defense forces are increasingly adopting hybrid defense models that combine AI-driven analytics, human expertise, and real-time intelligence sharing to ensure multi-domain security superiority

Restraint/Challenge

Lack Of Skilled Cybersecurity Professionals And Complexity Of Cyber Defense Infrastructure

- The shortage of trained cybersecurity experts in the defense sector is a major restraint hindering the full-scale implementation of cyber warfare capabilities. Advanced systems require personnel skilled in threat intelligence, digital forensics, and ethical hacking, yet the global demand far exceeds supply, particularly in developing regions. This talent gap weakens the ability of defense institutions to deploy and manage cutting-edge cybersecurity infrastructure effectively

- Managing the complexity of defense cyber ecosystems that integrate multiple layers of hardware, software, and encrypted communication platforms poses operational challenges. Coordinating real-time information across military branches and allied networks demands robust interoperability standards and continuous system updates. The absence of unified cybersecurity frameworks often leads to operational silos and increased vulnerabilities across national defense systems

- High setup and maintenance costs of cybersecurity infrastructure further limit adoption, especially for smaller defense forces and developing nations. Upgrading legacy systems and aligning them with modern cyber defense architectures require significant investment and technical expertise. Limited funding also delays modernization programs and restricts procurement of advanced AI-enabled tools and secure network solutions

- For instance, in 2024, several defense organizations in Europe and Asia-Pacific reported delays in cybersecurity modernization projects due to talent shortages and technical integration issues, highlighting the urgent need for workforce development programs. Governments are responding by establishing specialized cyber academies and defense-focused training initiatives to bridge the skills gap and prepare future cyber warriors

- Overcoming these challenges requires strategic investment in cybersecurity education, global defense collaborations, and AI-assisted automation to mitigate the skill gap and ensure the resilience of defense networks against evolving digital threats. A multi-pronged approach combining human capital development, public-private partnerships, and innovation in cyber automation will be key to building robust defense ecosystems

Defense Cyber Warfare Market Scope

The defense cyber warfare market is segmented on the basis of solution, application, deployment type, and organization size.

- By Solution

On the basis of solution, the defense cyber warfare market is segmented into Defense Solutions, Threat Assessment, Network Fortification, and Training Services. The Defense Solutions segment held the largest market revenue share in 2024, driven by the growing demand for advanced cybersecurity tools to protect classified military networks and digital assets. These solutions encompass intrusion detection, encryption systems, and secure communication technologies that enhance defense preparedness and threat mitigation.

The Threat Assessment segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to the increasing need for real-time risk evaluation and predictive analytics in defense operations. Threat assessment platforms leverage artificial intelligence and machine learning to identify, analyze, and neutralize potential cyberattacks before they compromise critical defense infrastructure.

- By Application

On the basis of application, the defense cyber warfare market is segmented into Banking, Financial Services and Insurance (BFSI), Media & Communication Services, Corporate and Private, Aerospace and Defence, Transportation and Logistics, Government and Utilities, and Others. The Aerospace and Defence segment accounted for the largest market share in 2024, primarily due to rising investments in cybersecurity modernization and secure communication systems for military operations. Governments are increasingly integrating cyber defense capabilities into aerial, naval, and space-based defense systems to prevent espionage and sabotage.

The Government and Utilities segment is projected to grow at the fastest rate from 2025 to 2032, driven by rising cyberattacks on national infrastructure such as energy grids, transportation networks, and public administration systems. The need to safeguard sensitive citizen data and ensure operational continuity is pushing governments to adopt advanced cyber defense solutions.

- By Deployment Type

On the basis of deployment type, the defense cyber warfare market is segmented into On-Premises and Cloud. The On-Premises segment dominated the market in 2024, owing to the preference for localized data control and stringent security standards within defense and intelligence agencies. On-premises deployment ensures maximum protection of classified information, providing enhanced monitoring and reduced exposure to external threats.

The Cloud segment is anticipated to register the highest CAGR from 2025 to 2032, fuelled by its scalability, cost-effectiveness, and ease of integration across multi-domain operations. Cloud-based cyber warfare solutions are increasingly being adopted by defense forces for data analytics, real-time threat detection, and mission coordination, enabling more agile and responsive cyber defense infrastructures.

- By Organization Size

On the basis of organization size, the defense cyber warfare market is segmented into SMEs and Large Enterprises. The Large Enterprises segment held the dominant market share in 2024, as established defense contractors and government organizations invest heavily in next-generation cybersecurity infrastructure and AI-driven threat management systems. These enterprises possess the financial and technical resources required to deploy complex defense-grade cyber frameworks.

The SMEs segment is expected to experience the fastest growth during the forecast period, supported by rising participation of small and mid-sized defense technology firms in developing specialized cybersecurity tools. Governments are encouraging SMEs to collaborate on defense innovation programs, fostering a more diverse and technologically advanced cyber defense ecosystem.

Defense Cyber Warfare Market Regional Analysis

- North America dominated the defense cyber warfare market with the largest revenue share of 41.22% in 2024, driven by the rising number of state-sponsored cyberattacks, rapid defense digitalization, and increasing government investments in cybersecurity modernization programs

- The region’s defense agencies are heavily investing in advanced threat detection systems, AI-powered defense analytics, and real-time cyber intelligence platforms to enhance operational resilience against evolving digital threats

- Strong collaboration between military organizations, private defense contractors, and cybersecurity firms continues to bolster North America’s dominance, supported by substantial funding from the U.S. Department of Defense and NATO cyber defense initiatives

U.S. Defense Cyber Warfare Market Insight

The U.S. defense cyber warfare market captured the largest revenue share in 2024 within North America, driven by large-scale investments in cyber defense infrastructure and national security frameworks. The growing sophistication of foreign cyber threats has prompted the U.S. Department of Defense to deploy AI-based threat detection systems and establish cyber command centers. Furthermore, continuous advancements in digital warfare capabilities and cross-agency cooperation are strengthening the nation’s preparedness for large-scale cyber conflicts.

Europe Defense Cyber Warfare Market Insight

The Europe defense cyber warfare market is expected to witness robust growth from 2025 to 2032, fuelled by the enforcement of stringent cybersecurity policies, growing defense digitization, and the increasing number of cyber intrusions targeting European defense networks. The European Union’s emphasis on strategic cyber autonomy, combined with heavy investments in AI-integrated defense systems, is reshaping the regional landscape. The region is also focusing on inter-country defense collaborations to enhance real-time threat intelligence and collective security.

U.K. Defense Cyber Warfare Market Insight

The U.K. defense cyber warfare market is expected to witness significant growth from 2025 to 2032, driven by rising cyber espionage activities and growing adoption of advanced security architectures in the military sector. The U.K. Ministry of Defence’s ongoing investment in cyber defense programs and partnerships with global cybersecurity firms are accelerating market growth. The increasing focus on securing defense communication networks and national critical infrastructure is further boosting adoption across the country.

Germany Defense Cyber Warfare Market Insight

The Germany defense cyber warfare market is expected to witness steady growth from 2025 to 2032, propelled by the government’s commitment to enhancing national cyber resilience and defense innovation. Germany’s strategic focus on developing AI-driven defense platforms and secure digital ecosystems is fostering the adoption of advanced cyber defense systems. The collaboration between the Bundeswehr and private cybersecurity organizations is also driving the integration of next-generation technologies into military operations.

Asia-Pacific Defense Cyber Warfare Market Insight

The Asia-Pacific defense cyber warfare market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising geopolitical tensions, increasing state-sponsored cyberattacks, and rapid modernization of defense networks in countries such as China, Japan, India, and South Korea. Governments across the region are investing in cyber command units, indigenous cybersecurity technologies, and advanced digital defense infrastructure. The growing focus on cyber sovereignty and national security is further propelling the market.

China Defense Cyber Warfare Market Insight

The China defense cyber warfare market accounted for the largest revenue share in Asia-Pacific in 2024, fuelled by strong government initiatives, extensive military modernization, and heavy investments in cybersecurity R&D. China’s focus on developing indigenous AI-based defense technologies and strengthening its cyber command capabilities underpins its leadership in the regional market. Furthermore, the integration of 5G networks and quantum computing into defense cyber systems is driving technological advancements and boosting overall market growth.

Japan Defense Cyber Warfare Market Insight

The Japan defense cyber warfare market is expected to witness notable growth from 2025 to 2032, driven by the country’s increasing focus on strengthening national cybersecurity and protecting critical defense infrastructure. Japan’s Ministry of Defense is actively investing in AI-based threat detection, cyber defense training programs, and autonomous monitoring systems to counter sophisticated cyberattacks from foreign adversaries. The nation’s strategic defense policy emphasizes digital resilience, data protection, and cyber deterrence capabilities, aligning with its broader military modernization goals.

Defense Cyber Warfare Market Share

The Defense Cyber Warfare industry is primarily led by well-established companies, including:

• IBM Corporation (U.S.)

• Check Point Software Technologies Ltd. (Israel)

• Cisco Systems, Inc. (U.S.)

• CyberArk Software Ltd. (Israel)

• F5, Inc. (U.S.)

• FireEye, Inc. (U.S.)

• Forcepoint LLC (U.S.)

• Fortinet, Inc. (U.S.)

• Amazon Web Services, Inc. or its affiliates (U.S.)

• Oracle Corporation (U.S.)

• Palo Alto Networks, Inc. (U.S.)

• Imperva, Inc. (U.S.)

• Qualys, Inc. (U.S.)

• Accenture plc (Ireland)

• HCL Technologies Ltd. (India)

• Capgemini SE (France)

• Cognizant Technology Solutions (U.S.)

• NortonLifeLock Inc. (U.S.)

• Tata Consultancy Services Limited (India)

• Wipro Limited (India)

Latest Developments in Global Defense Cyber Warfare Market

- In September 2025, the U.S. Department of Defense launched a Cyber Talent Management System to recruit and retain top cyber warfare specialists, aiming to bridge the cybersecurity talent gap, enhance workforce modernization, and strengthen national defense readiness against evolving digital threats, marking a major step toward sustainable cyber resilience

- In May 2025, Darktrace secured a contract with the UK Ministry of Defence to deploy its AI-driven cyber defense technology across critical military infrastructure, enabling autonomous threat detection and faster incident response while enhancing the UK’s defense cyber capabilities and supporting its national security objectives

- In April 2025, Northrop Grumman won a USD 400 million contract from the U.S. Department of Defense to develop and deploy advanced cyber warfare systems, aiming to modernize the U.S. military’s cyber operations, strengthen defense network security, and improve strategic readiness in cyberspace

- In February 2025, Israel Aerospace Industries and Lockheed Martin established a joint venture to develop integrated cyber defense solutions for global defense clients, combining both firms’ technological expertise to deliver next-generation AI-based cyber protection systems and expanding their global footprint in defense cybersecurity

- In January 2025, Raytheon introduced an AI-powered cyber threat detection platform specifically designed for military and government agencies, providing real-time threat identification and response capabilities to enhance defense agility and reduce the risk of cyber breaches across mission-critical networks

- In August 2024, Microsoft launched a secure cloud platform tailored for defense agencies, featuring advanced encryption and compliance capabilities to safeguard classified data, enabling secure cloud migration for military operations and enhancing cyber resilience across digital command infrastructures

- In July 2024, Thales completed the acquisition of Tesserent, an Australian cybersecurity firm, to expand its global cyber defense portfolio, strengthening its presence in the Asia-Pacific defense sector and enhancing its ability to deliver end-to-end managed cybersecurity services

- In June 2024, Lockheed Martin opened a cyber innovation center in Maryland focused on developing cutting-edge cyber warfare and defense technologies, aiming to foster collaboration with defense agencies and accelerate innovation in AI-driven cyber operations for military use

- In April 2024, Palantir Technologies was awarded a USD 178 million contract by the U.S. Air Force to deliver advanced analytics and software solutions for cyber operations, enhancing the Air Force’s digital defense capabilities and strengthening Palantir’s role in national security data systems

- In April 2024, BAE Systems secured a USD 318 million contract from the U.S. Army to deliver advanced cyber defense solutions including real-time threat detection and rapid response technologies, boosting the Army’s cybersecurity posture and reinforcing BAE Systems’ leadership in defense cyber innovation

- In April 2024, Cado Security raised USD 50 million in funding to expand its cloud-based cyber forensics platform targeted at defense and intelligence agencies, accelerating the company’s product development and enhancing its presence in the defense cybersecurity market

- In March 2024, CrowdStrike announced a strategic partnership with NATO to provide endpoint protection and threat intelligence services, strengthening the alliance’s cyber defense infrastructure and supporting enhanced coordination among member nations to counter evolving digital threats

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.