Global Deflaker Market

Market Size in USD Million

CAGR :

%

USD

750.03 Million

USD

1,025.69 Million

2024

2032

USD

750.03 Million

USD

1,025.69 Million

2024

2032

| 2025 –2032 | |

| USD 750.03 Million | |

| USD 1,025.69 Million | |

|

|

|

|

Deflaker Market Size

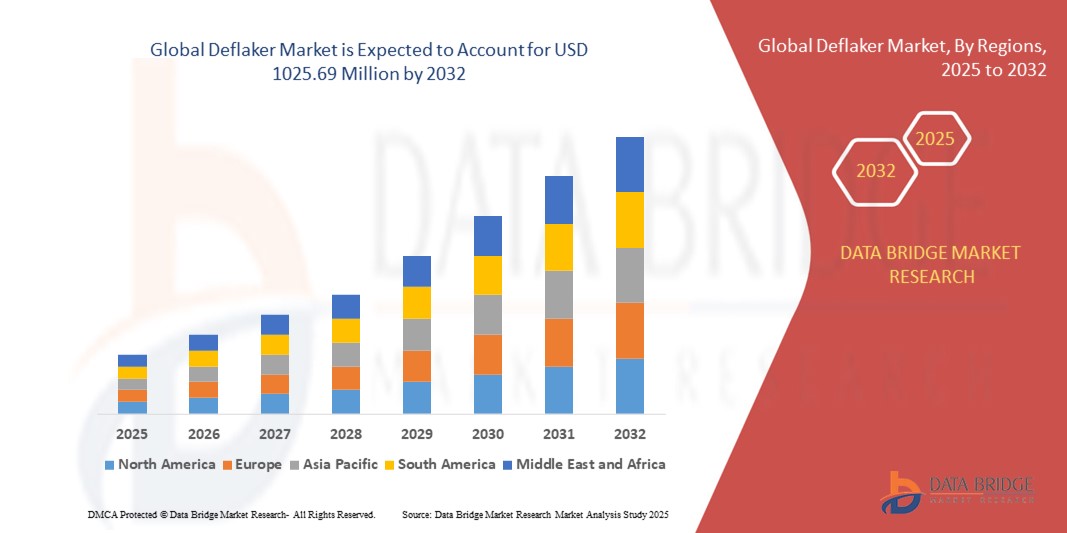

- The global deflaker market size was valued at USD 750.03 million in 2024 and is expected to reach USD 1025.69 million by 2032, at a CAGR of 3.99% during the forecast period

- The market growth is largely fueled by increasing demand for high-quality pulp and paper products, coupled with the adoption of advanced deflaker technologies that improve fiber quality, throughput, and operational efficiency in pulp processing

- Furthermore, rising pressure on manufacturers to reduce energy consumption, minimize maintenance costs, and comply with sustainability regulations is driving the adoption of automated and IoT-enabled deflaker systems. These converging factors are accelerating the uptake of modern deflaker solutions, thereby significantly boosting the industry's growth

Deflaker Market Analysis

- Deflakers are specialized industrial machines used in pulp and paper manufacturing to separate and refine fiber bundles, enhancing pulp quality and consistency. Modern deflakers integrate advanced rotor designs, automation, and IoT capabilities for real-time monitoring and predictive maintenance

- The escalating demand for deflakers is primarily fueled by the need for higher efficiency in pulp processing, improved fiber quality, reduced downtime, and the growing emphasis on sustainable and energy-efficient manufacturing practices

- North America dominated the deflaker market in 2024, due to the presence of advanced pulp and paper industries, high adoption of energy-efficient machinery, and significant investments in automation and modernization of stock preparation processes

- Asia-Pacific is expected to be the fastest growing region in the deflaker market during the forecast period due to rapid industrialization, expansion of paper and packaging industries, and growing adoption of high-capacity and energy-efficient machinery in countries such as China, India, and Japan

- 90 kW-400 kW segment dominated the market with a market share of 43% in 2024, due to its optimal balance between energy efficiency and processing capacity. This power range is widely preferred in small to medium-scale paper and pulp mills, offering reliable performance without excessive energy consumption. The segment’s popularity is also supported by its adaptability to various stock types and the ease of integration into existing production lines. Manufacturers favor this range for its cost-effectiveness, maintenance simplicity, and consistent throughput, making it a standard choice across multiple geographies

Report Scope and Deflaker Market Segmentation

|

Attributes |

Deflaker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Deflaker Market Trends

Growing Adoption of IoT-enabled and Automated Deflaker Systems

- The deflaker market is advancing with the integration of IoT and automation technologies, allowing mills to monitor and optimize deflaking processes in real time. Data-driven insights and remote control capabilities are helping improve fiber quality and reduce operational downtime

- For instance, ANDRITZ has deployed IoT-enabled deflaker systems with real-time data analytics and automated process adjustments, enabling paper manufacturers to achieve higher efficiency and product consistency

- The shift toward fully automated deflaker lines is streamlining labor requirements and supporting better energy management, crucial for cost-effective and sustainable production. Growing use of predictive maintenance platforms enables timely identification of wear and process anomalies, minimizing unplanned outages and costly repairs

- In addition, advances in sensor integration are improving the precision of fiber separation and flake sizing, supporting the production of high-quality recycled and specialty papers

- Adoption of modular, retrofittable deflaker designs is facilitating upgrades in existing mills, accelerating modernization across regions facing resource or regulatory constraints

- Increasing industry collaboration with automation firms is promoting rapid adoption of smart deflaker systems that deliver actionable process intelligence and flexible control

Deflaker Market Dynamics

Driver

Increasing Demand for Recycled Paper Products

- Global demand for recycled paper is a major market driver, as sustainable sourcing pressures and circular economy initiatives motivate investment in deflaker systems for fiber recovery and refinement. Efficient deflaking boosts fiber utilization rates in recycled pulp, improving the mechanical properties of the final product

- For instance, Voith has supplied advanced deflaker systems for major packaging and tissue paper producers responding to surging demand for recycled consumer and commercial paper goods

- Rising regulations and voluntary certifications emphasizing recycled content drive manufacturers to maximize recovered fiber performance, pushing adoption of specialized deflaking equipment

- In addition, increasing adoption of recycled raw materials in high-value printing, tissue, and specialty paper segments intensifies the need for aggressive but controlled deflaking to maintain product quality

- Strong growth in urban populations and waste collection infrastructure supports the scaling of recycling operations, marking deflaker systems as foundational to modern recovered fiber supply chains

Restraint/Challenge

Fluctuating Raw Material Prices

- Volatility in the cost and availability of recovered fiber and virgin pulp inputs creates challenges for mills seeking predictable returns on investments in new deflaker technology. Changing market prices can disrupt capital allocation and production planning

- For instance, paper mills in North America and Europe operating Voith and ANDRITZ deflaker lines have reported margin pressures following sudden increases in recovered fiber prices linked to global supply chain fluctuations

- In addition, geographically uneven access to wastepaper resources and shifting global trade dynamics for recyclables can affect the business case for adopting automated deflaker solutions

- Shortages or drastic swings in pulp cost increase the risk of underutilized assets or delayed modernization projects, particularly among independent and mid-sized mills

- Operational efficiency gains from advanced deflaker systems can be undermined if high or unstable raw material costs limit production or force mills to switch between fiber sources frequently

Deflaker Market Scope

The market is segmented on the basis of power and application.

- By Power

On the basis of power, the deflaker market is segmented into below 90 kW, 90 kW–400 kW, 400 kW–800 kW, and above 800 kW. The 90 kW–400 kW segment dominated the market with a share of 43% in 2024, capturing the largest revenue share, due to its optimal balance between energy efficiency and processing capacity. This power range is widely preferred in small to medium-scale paper and pulp mills, offering reliable performance without excessive energy consumption. The segment’s popularity is also supported by its adaptability to various stock types and the ease of integration into existing production lines. Manufacturers favor this range for its cost-effectiveness, maintenance simplicity, and consistent throughput, making it a standard choice across multiple geographies.

The above 800 kW segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand in large-scale industrial operations requiring high-capacity stock preparation. High-power deflakers are increasingly adopted in modern mills aiming to improve production efficiency, reduce fiber damage, and handle larger volumes of raw material. The ongoing focus on industrial automation and the shift towards high-output pulp production are accelerating the adoption of high-capacity deflakers. In addition, investments in energy-optimized, robust machinery that can sustain heavy-duty operations contribute to the projected growth of this segment.

- By Application

On the basis of application, the deflaker market is segmented into stock preparation and broke handling processes. The stock preparation segment dominated the market in 2024, accounting for the largest revenue share, as it plays a critical role in improving fiber quality, refining pulp, and ensuring uniform consistency before paper formation. Deflakers in this application help mills reduce fiber entanglement, increase drainage, and enhance overall production efficiency. The segment benefits from increasing adoption in mills seeking high-quality paper products and the need to optimize raw material usage, minimizing waste. Its compatibility with various pulp types and ability to integrate with modern stock preparation lines strengthen its market dominance.

The broke handling processes segment is anticipated to witness the fastest growth from 2025 to 2032, driven by the rising emphasis on recycling and efficient reuse of paper waste within mills. Deflakers used in broke handling improve fiber reusability, reduce energy consumption, and maintain product quality, making them crucial for sustainable operations. The growth is further fueled by the increased regulatory and economic incentives for mills to implement recycling processes, along with advancements in broke handling technologies that allow seamless integration with existing production lines.

Deflaker Market Regional Analysis

- North America dominated the deflaker market with the largest revenue share in 2024, driven by the presence of advanced pulp and paper industries, high adoption of energy-efficient machinery, and significant investments in automation and modernization of stock preparation processes

- Mills in the region prioritize high-quality fiber processing, consistent pulp production, and reliable machinery performance, making North America a key revenue-generating market

- The widespread adoption of modern deflakers is further supported by skilled labor availability, stringent regulatory standards, and strong focus on sustainability, establishing the region as a hub for technologically advanced pulp and paper operations

U.S. Deflaker Market Insight

The U.S. deflaker market captured the largest revenue share in 2024 within North America, fueled by increasing investments in modern stock preparation systems and high-capacity pulp processing equipment. Mills are prioritizing efficiency, fiber quality, and reduced energy consumption, driving demand for medium-power deflakers (90 kW–400 kW). The adoption of automated and energy-optimized machinery, combined with the need to handle both virgin and recycled pulp efficiently, further propels market growth. Moreover, U.S. manufacturers continue to invest in high-end deflakers capable of supporting large-scale production and industrial automation trends.

Europe Deflaker Market Insight

The Europe deflaker market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by mature pulp and paper industries, strict environmental and efficiency regulations, and the demand for high-quality fiber processing. European mills are focusing on upgrading existing machinery with energy-efficient, automated deflakers to maintain product quality while reducing operational costs. Adoption is rising across both new installations and retrofit projects, with a strong emphasis on sustainability and waste minimization.

U.K. Deflaker Market Insight

The U.K. deflaker market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the need for enhanced operational efficiency, sustainable pulp handling, and improved fiber recovery in both stock preparation and broke handling processes. The region’s focus on digitalized and automated mill operations, alongside increasing demand for recycled paper, is encouraging investments in advanced deflaker solutions.

Germany Deflaker Market Insight

The Germany deflaker market is expected to expand at a considerable CAGR during the forecast period, fueled by strong technological adoption, awareness of energy-efficient machinery, and emphasis on sustainable production practices. German mills are integrating automated deflakers to enhance pulp quality, improve stock preparation efficiency, and reduce fiber damage, particularly in large-scale industrial operations.

Asia-Pacific Deflaker Market Insight

The Asia-Pacific deflaker market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rapid industrialization, expansion of paper and packaging industries, and growing adoption of high-capacity and energy-efficient machinery in countries such as China, India, and Japan. The region’s increasing focus on recycling, modernization of mills, and government initiatives promoting sustainable production are supporting market growth.

Japan Deflaker Market Insight

The Japan deflaker market is gaining momentum due to the country’s emphasis on high-quality pulp production, automation, and energy-efficient machinery. Demand is driven by the need for consistent fiber quality, integration with advanced stock preparation lines, and the handling of both virgin and recycled pulp efficiently.

China Deflaker Market Insight

The China deflaker market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the rapid expansion of the pulp and paper industry, rising domestic and international demand for paper products, and significant investment in modern, automated deflaker systems. China’s focus on high-capacity mills, energy-efficient operations, and sustainable production practices continues to propel market growth.

Deflaker Market Share

The deflaker industry is primarily led by well-established companies, including:

- Voith (Germany)

- Overmade (Italy)

- Andritz AG (Austria)

- Parason (India)

- PAPCEL (Czech Republic)

- AFT (Canada)

- Shandong Xuridong Machinery (China)

- Hergen (Brazil)

Latest Developments in Global Deflaker Market

- In March 2024, Andritz AG supplied a pressurized refining system to Switzerland-based enterprises, designed to enhance sustainable insulation production. This system allows companies to increase production efficiency while reducing energy consumption and waste, aligning with stricter European environmental regulations. By enabling local businesses to produce higher-quality insulation materials with improved sustainability, Andritz strengthens its reputation as a provider of technologically advanced solutions. This deployment is expected to drive demand for their refining systems across the European pulp and paper sector, supporting clients’ operational efficiency, product diversification, and compliance with rising sustainability standards

- In 2024, Parason introduced a deflaker model featuring an advanced rotor design engineered to boost throughput and enhance fiber quality in pulp processing. The improved design increases production efficiency and also minimizes wear and tear, reducing maintenance costs and downtime. This positions Parason as a leading innovator in the deflaker market, offering pulp mills practical, high-performance solutions. By addressing both operational efficiency and product quality, Parason’s new model is poised to accelerate adoption in modern, competitive pulp production facilities seeking to maximize output while maintaining fiber integrity

- In 2023, Valmet developed a deflaker system integrated with IoT capabilities, enabling real-time performance monitoring and predictive maintenance. This smart system provides pulp and paper manufacturers with actionable insights to optimize production processes, prevent unplanned downtime, and improve overall equipment efficiency. The integration of digital tools allows for data-driven decision-making and supports the ongoing digital transformation within the industry. Valmet’s innovation strengthens its market presence by offering technologically sophisticated solutions that enhance operational reliability and align with the evolving needs of a modern, connected manufacturing environment

- In July 2022, Voith acquired IGW Rail, a high-tech gear and coupling solutions provider, significantly enhancing its presence in the augmented market vertical. This strategic acquisition allows Voith to expand its portfolio of rail vehicle components and integrated industrial solutions, leveraging IGW Rail’s technological expertise. By combining complementary capabilities, Voith is able to provide more comprehensive, end-to-end solutions to its clients in the rail and associated industrial segments. This move reinforces Voith’s position as a key player with a strengthened technological footprint, enabling it to capture new opportunities and expand its influence in the evolving rail equipment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Deflaker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Deflaker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Deflaker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.