Global Defoliant Market

Market Size in USD Billion

CAGR :

%

USD

22.42 Billion

USD

34.93 Billion

2025

2033

USD

22.42 Billion

USD

34.93 Billion

2025

2033

| 2026 –2033 | |

| USD 22.42 Billion | |

| USD 34.93 Billion | |

|

|

|

|

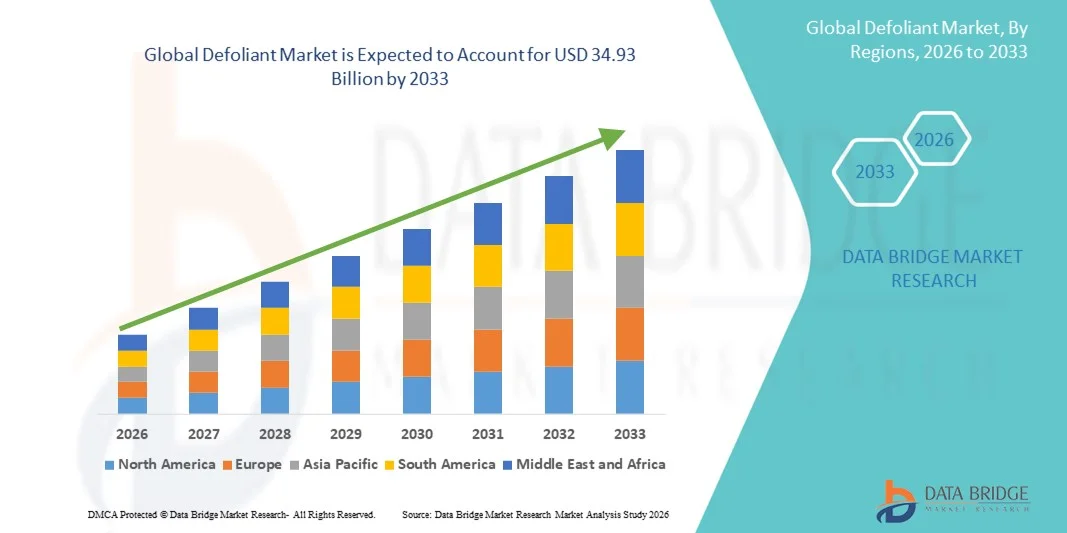

What is the Global Defoliant Market Size and Growth Rate?

- The global defoliant market size was valued at USD 22.42 billion in 2025 and is expected to reach USD 34.93 billion by 2033, at a CAGR of5.70% during the forecast period

- Rising pressure on global food supply will emerge as the major factor fostering the growth of defoliant market. Rise in venture funding for the development of agricultural products and increasing availability of fertilizers, pesticides, herbicides, and other chemicals are other factors fostering the growth of defoliant market

What are the Major Takeaways of Defoliant Market?

- Growth and expansion of fertilizers industry especially in the developing economies coupled with increasing personal disposable income, will further create lucrative and remunerative growth opportunities for the defoliant market. Rising industrialization and globalization will also carve the way for the growth of the defoliant market

- North America dominated the defoliant market with the largest revenue share of 32.26% in 2025, driven by large-scale commercial farming, high adoption of mechanized harvesting, and strong demand for defoliants in cotton and row crop cultivation across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.59% from 2026 to 2033, driven by expanding agricultural activities, rising cotton and plantation crop production, and increasing mechanization across China, India, Southeast Asia, and parts of Japan

- The Purity 50% segment dominated the market with an estimated 43% share in 2025, as it offers an optimal balance between effectiveness, crop safety, and cost-efficiency

Report Scope and Defoliant Market Segmentation

|

Attributes |

Defoliant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Defoliant Market?

Increasing Shift Toward Eco-Friendly, Crop-Specific, and Precision Defoliant Solutions

- The defoliant market is witnessing a growing shift toward environmentally safer, biodegradable, and low-toxicity formulations to meet stricter regulatory standards

- Manufacturers are developing crop-specific and selective defoliants that improve leaf drop efficiency while minimizing yield loss and crop damage

- Rising adoption of precision agriculture and mechanized harvesting, especially in cotton and plantation crops, is driving demand for advanced defoliant products

- For instance, companies such as BASF, Bayer, Corteva, FMC, and Syngenta are focusing on improved formulations with controlled action and reduced environmental impact

- Increasing need to optimize harvest timing, reduce labor dependency, and enhance crop quality is accelerating adoption of modern defoliants

- As sustainable farming practices expand globally, defoliants will remain critical for improving harvesting efficiency and crop management

What are the Key Drivers of Defoliant Market?

- Rising demand for efficient harvesting and labor cost reduction in large-scale agriculture

- For instance, in 2024–2025, companies such as BASF, ADAMA, and Corteva expanded their defoliant portfolios to support cotton and plantation crop applications

- Growing adoption of mechanized farming, particularly in cotton-producing regions across the U.S., China, India, and Brazil

- Increasing focus on crop yield optimization and quality improvement through uniform and timely defoliation

- Expansion of commercial farming, contract farming, and large-scale plantations is boosting defoliant usage

- Supported by advancements in agrochemical formulations and precision farming technologies, the Defoliant market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Defoliant Market?

- Stringent environmental and regulatory restrictions on chemical usage limit product approvals and adoption

- For instance, during 2024–2025, tighter regulations on agrochemicals in Europe and parts of Asia-Pacific increased compliance costs for manufacturers

- Rising concerns over soil health, residue impact, and ecological safety restrict excessive defoliant usage

- Limited awareness among smallholder farmers regarding proper application timing and dosage reduces effectiveness

- Competition from manual defoliation, integrated pest and crop management practices, and alternative agronomic methods impacts demand

- To overcome these challenges, companies are investing in bio-based defoliants, farmer education programs, and precision-application solutions to improve global adoption of defoliants

How is the Defoliant Market Segmented?

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the defoliant market is segmented into Purity 20%, Purity 50%, Purity 80%, and Others. The Purity 50% segment dominated the market with an estimated 43% share in 2025, as it offers an optimal balance between effectiveness, crop safety, and cost-efficiency. These defoliants are widely used in cotton and plantation crops, providing uniform leaf drop while minimizing adverse effects on yield and fiber quality. Their ease of application and compatibility with mechanized harvesting systems further support strong adoption across large-scale farms.

The Purity 80% segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by rising demand for high-efficacy solutions in commercial farming and regions with labor shortages. High-purity defoliants deliver faster action, improved consistency, and better performance under challenging climatic conditions, making them increasingly preferred in intensive and export-oriented agriculture.

- By Application

Based on application, the defoliant market is segmented into Farm Land, Fruit Tree, Experiment, and Other. The Farm Land segment accounted for the largest share of around 48% in 2025, supported by extensive use of defoliants in cotton, soybean, and other field crops to enable timely harvesting and reduce labor dependency. Large acreage cultivation, increasing mechanization, and focus on yield optimization continue to drive strong demand in this segment.

The Fruit Tree segment is projected to witness the fastest growth during the forecast period, fueled by increasing adoption of defoliants for orchard management, harvest uniformity, and improved fruit quality. Growing commercial fruit production, especially in Asia-Pacific and Latin America, along with advancements in crop-specific formulations, is accelerating defoliant usage in fruit tree applications.

Which Region Holds the Largest Share of the Defoliant Market?

- North America dominated the defoliant market with the largest revenue share of 32.26% in 2025, driven by large-scale commercial farming, high adoption of mechanized harvesting, and strong demand for defoliants in cotton and row crop cultivation across the U.S. and Canada. Widespread use of advanced agrochemicals to improve harvest efficiency, reduce labor dependency, and ensure uniform crop maturity continues to support market leadership

- Leading agrochemical companies in North America are introducing crop-specific, fast-acting, and environmentally compliant defoliant formulations, strengthening the region’s competitive position. Strong regulatory frameworks, advanced farming practices, and high awareness among growers further boost adoption

- High agricultural productivity, strong distribution networks, and sustained investment in precision agriculture reinforce North America’s dominance in the global Defoliant market

U.S. Defoliant Market Insight

The U.S. is the largest contributor in North America, supported by extensive cotton cultivation, widespread mechanized harvesting, and strong adoption of defoliants to optimize yield and fiber quality. Presence of major agrochemical manufacturers and high farmer awareness further drive market growth.

Canada Defoliant Market Insight

Canada contributes steadily, driven by growing use of defoliants in large-scale farms and increasing focus on efficient crop management practices supported by modern agricultural technologies.

Asia-Pacific Defoliant Market

Asia-Pacific is projected to register the fastest CAGR of 8.59% from 2026 to 2033, driven by expanding agricultural activities, rising cotton and plantation crop production, and increasing mechanization across China, India, Southeast Asia, and parts of Japan. Rapid growth in commercial farming, labor shortages, and rising awareness of yield optimization are accelerating defoliant adoption.

China Defoliant Market Insight

China leads the region due to large agricultural acreage, strong cotton production, and growing use of chemical solutions to support timely harvesting and productivity improvements.

India Defoliant Market Insight

India is emerging as a high-growth market, supported by increasing cotton cultivation, government support for modern farming practices, and rising demand to reduce manual labor dependency.

Japan Defoliant Market Insight

Japan shows moderate growth driven by adoption of precision agriculture and controlled chemical usage to enhance crop quality and harvest efficiency.

Which are the Top Companies in Defoliant Market?

The defoliant industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta (Switzerland)

- DuPont (U.S.)

- Corteva (U.S.)

- Novozymes (Denmark)

- Valent BioSciences LLC (U.S.)

- Dow Inc. (U.S.)

- China National Chemical Corporation (China)

- FMC Corporation (U.S.)

- Drexel Chemical Company (U.S.)

- Nissan Chemical Corporation (Japan)

- EuroChem Group (Switzerland)

- Nufarm Canada (Canada)

- ROTAM (Israel)

- Dormiente (Germany)

- AMVAC Chemical Corporation (U.S.)

- ADAMA (Israel)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.