Global Delivery Robots Market

Market Size in USD Million

CAGR :

%

USD

36.14 Million

USD

128.65 Million

2025

2033

USD

36.14 Million

USD

128.65 Million

2025

2033

| 2026 –2033 | |

| USD 36.14 Million | |

| USD 128.65 Million | |

|

|

|

|

Delivery Robots Market Size

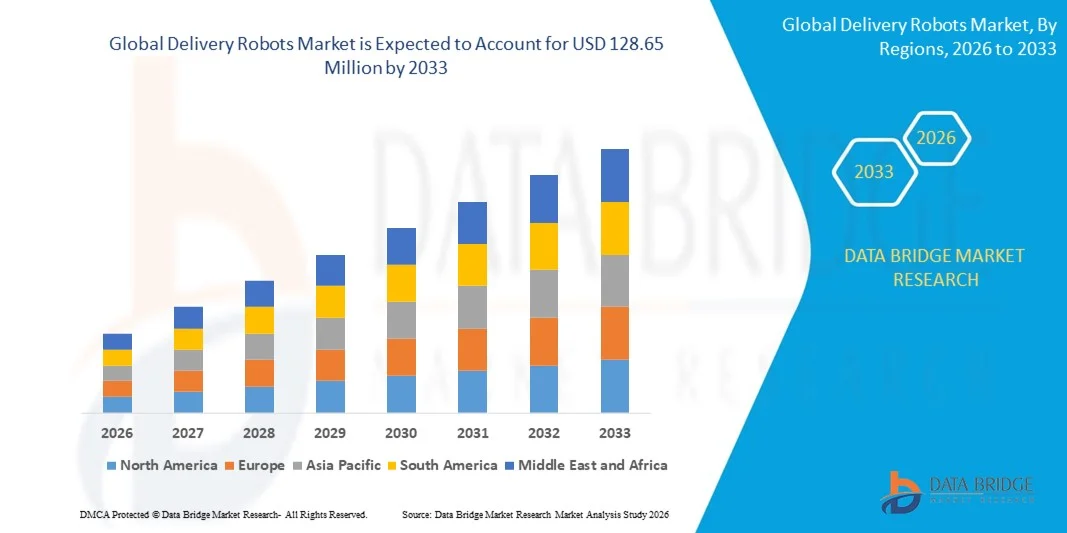

- The global delivery robots market size was valued at USD 36.14 million in 2025 and is expected to reach USD 128.65 million by 2033, at a CAGR of 17.20% during the forecast period

- The market growth is largely fuelled by the increasing demand for contactless and last-mile delivery solutions across e-commerce, food, and healthcare sectors

- Rising adoption of AI, robotics, and autonomous navigation technologies is enhancing delivery efficiency and reducing operational costs for logistics and retail companies

Delivery Robots Market Analysis

- The market is witnessing rapid technological advancements, including AI-based obstacle detection, GPS navigation, and smart routing, which are increasing the efficiency and reliability of delivery robots

- Increasing investments by major logistics and robotics companies, along with government support for autonomous vehicle testing and smart city initiatives, are strengthening market growth

- North America dominated the delivery robots market with the largest revenue share in 2025, driven by the increasing adoption of autonomous and AI-enabled solutions for last-mile logistics. Retailers, restaurants, and e-commerce providers are leveraging delivery robots to enhance efficiency, reduce human contact, and improve customer satisfaction

- Asia-Pacific region is expected to witness the highest growth rate in the global delivery robots market, driven by rapid urbanization, rising adoption of automation and robotics in logistics, expanding e-commerce infrastructure, and increasing investments in AI and smart delivery technologies

- The up to 10 Kg segment held the largest market revenue share in 2025, driven by its suitability for lightweight deliveries in urban areas, campuses, and indoor facilities. Robots in this segment are widely adopted by food delivery, retail, and postal services due to their ease of maneuverability and low operational costs

Report Scope and Delivery Robots Market Segmentation

|

Attributes |

Delivery Robots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Starship Technologies (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Delivery Robots Market Trends

Rise of Autonomous and AI-Enabled Delivery Solutions

- The growing adoption of autonomous and AI-enabled delivery robots is transforming last-mile logistics by enabling real-time, contactless delivery of goods. These robots reduce dependency on human labor, improve delivery speed, and ensure safe handling of packages, enhancing overall operational efficiency. Integration with AI-powered navigation and real-time tracking systems is further improving route optimization and service reliability

- Increasing demand for automated deliveries in urban and high-density areas is accelerating the deployment of sidewalk, indoor, and campus delivery robots. These systems are particularly effective in congested environments where traditional delivery methods face delays, supporting faster and more reliable service. In addition, they contribute to reducing carbon emissions and traffic congestion in busy cities

- The affordability, scalability, and modular design of modern delivery robots are making them attractive for retailers, e-commerce players, and food delivery services, enabling frequent and cost-effective last-mile deliveries. Businesses benefit from consistent service quality without incurring high operational expenses. The flexibility of modular designs allows companies to customize payload capacity and navigation features for different use cases

- For instance, in 2023, several food delivery companies in North America reported improved delivery times and reduced contact-based interactions after integrating autonomous delivery robots into urban routes. The deployment enhanced customer satisfaction, minimized operational costs, and improved workforce allocation. The successful trials have encouraged expansion into new neighborhoods and high-demand districts

- While delivery robots are accelerating adoption of automated logistics solutions, their effectiveness depends on continued AI advancements, regulatory approvals, and maintenance infrastructure. Companies must focus on software updates, fleet management, and route optimization to fully capitalize on market growth. Enhanced AI algorithms are also enabling predictive maintenance, reducing downtime, and extending robot lifespan

Delivery Robots Market Dynamics

Driver

Rising Demand for Contactless and Efficient Last-Mile Delivery Solutions

- The increasing need for contactless delivery services is driving retailers, restaurants, and e-commerce players to adopt delivery robots as a safer and more efficient alternative. Robots help reduce human contact, improve service reliability, and enhance customer satisfaction. The trend has been further reinforced by ongoing health and safety concerns following global events such as the COVID-19 pandemic

- Businesses are becoming aware of operational cost savings, reduced delivery errors, and improved delivery speed offered by automated solutions. This awareness is encouraging broader deployment of delivery robots across urban, campus, and indoor environments. Adoption is also being supported by integration with digital payment systems, mobile apps, and real-time tracking platforms

- Government initiatives and smart city programs supporting autonomous vehicles and robotics technology are strengthening market growth. Funding for AI development, robotics trials, and pilot programs is enabling wider adoption of delivery robots. Policy frameworks are increasingly focusing on safe navigation, traffic integration, and incentives for green mobility solutions

- For instance, in 2022, several European cities implemented pilot programs for autonomous last-mile delivery, boosting demand for AI-enabled delivery robots among logistics providers and retailers. Positive outcomes from these pilots, including reduced delivery times and improved urban mobility, are encouraging more municipalities to participate in such initiatives

- While automation and AI integration are driving the market, challenges remain in infrastructure readiness, regulatory compliance, and public acceptance to ensure sustained utilization. Continuous innovation in navigation algorithms, cybersecurity, and operational efficiency is essential for successful long-term adoption

Restraint/Challenge

High Initial Cost and Infrastructure Constraints Limiting Adoption

- The high cost of autonomous delivery robots, including sensors, AI navigation systems, and fleet management software, limits adoption among small-scale logistics providers and local businesses. Capital-intensive investments remain a barrier for widespread deployment. Maintenance, software updates, and integration with existing logistics infrastructure add additional operational costs

- Many regions lack the required infrastructure such as dedicated sidewalks, charging stations, and network connectivity for seamless robot operation. Limited technical expertise further reduces operational efficiency and deployment scalability. In some areas, regulatory delays in permitting autonomous operations further hinder market growth

- Market penetration is also restricted by regulatory hurdles, safety concerns, and public acceptance issues, which slow the integration of robots into everyday logistics operations. Compliance with traffic rules and local safety standards adds complexity and cost. Incidents or accidents involving robots can also affect public trust and adoption rates

- For instance, in 2023, several logistics firms in Southeast Asia reported that over 60% of planned delivery robot deployments were delayed due to infrastructure gaps and regulatory challenges. Companies are therefore investing in partnerships with local authorities and pilot programs to ensure safe and efficient deployment

- While robotics technology continues to advance, addressing cost, infrastructure, and policy challenges remains critical to unlocking the full potential of the global delivery robots market. Strategic collaboration with tech providers, city planners, and end-users is essential to enhance scalability, reliability, and customer acceptance

Delivery Robots Market Scope

The delivery robots market is segmented on the basis of load carrying capacity, component, number of wheels, speed limit, end-user industry, and type

- By Load Carrying Capacity

On the basis of load carrying capacity, the market is segmented into up to 10 Kg, 10.01–50.00 Kg, and more than 50.00 Kg. The up to 10 Kg segment held the largest market revenue share in 2025, driven by its suitability for lightweight deliveries in urban areas, campuses, and indoor facilities. Robots in this segment are widely adopted by food delivery, retail, and postal services due to their ease of maneuverability and low operational costs.

The 10.01–50.00 Kg segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing need to transport medium-weight packages efficiently. Robots in this category are popular among e-commerce and healthcare providers for parcel and medical supply deliveries, offering a balance between payload capacity and speed.

- By Component

On the basis of component, the market is segmented into hardware, software, and services. The hardware segment dominated in 2025, due to the high demand for robust sensors, AI navigation modules, and durable chassis required for autonomous operations. These hardware components are crucial for reliability, obstacle avoidance, and long-term durability in diverse delivery environments. Manufacturers are increasingly investing in advanced robotics materials and modular designs to enhance efficiency and reduce maintenance costs.

The software segment is expected to witness the fastest growth rate from 2026 to 2033, driven by AI-driven route optimization, fleet management, and predictive maintenance solutions. Software advancements are enabling better efficiency, safety, and scalability in last-mile delivery operations. Cloud-based platforms and AI analytics are also helping companies monitor performance in real time, optimize energy usage, and coordinate multiple robots simultaneously.

- By Number of Wheels

Based on the number of wheels, the market is segmented into 3 wheels, 4 wheels, and 6 wheels. The 4-wheeled delivery robots held the largest share in 2025, favored for their stability, payload capacity, and adaptability to various terrains. They are widely used in urban streets, campuses, and indoor facilities where balance and weight distribution are critical.

The 3-wheeled segment is expected to witness the fastest growth rate from 2026 to 2033, especially in indoor and campus environments where compact design and maneuverability are critical. Their lightweight structure allows for agile navigation in tight spaces, making them ideal for universities, offices, and hotel complexes.

- By Speed Limit

On the basis of speed limit, the market is categorized into up to 3 kph, 3 kph to 6 kph, and higher than 6 kph. The 3 kph to 6 kph segment held the largest share in 2025, due to its optimal balance between safety and delivery efficiency in urban and indoor environments. This speed range allows for timely deliveries while minimizing the risk of accidents or collisions.

The higher than 6 kph segment is expected to witness the fastest growth rate from 2026 to 2033, driven by demand for rapid last-mile delivery in congested metropolitan areas and high-traffic zones. These robots are designed with advanced navigation and braking systems to maintain safety while increasing delivery throughput.

- By End-User Industry

On the basis of end-user industry, the market is segmented into food and beverages, retail, healthcare, postal, and others. The food and beverages segment dominated in 2025, fueled by the rising adoption of contactless delivery solutions in restaurants, cafes, and cloud kitchens. Robots in this segment help maintain hygiene, reduce delivery errors, and increase customer satisfaction.

The healthcare segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the need for secure, timely, and sterile transportation of medical supplies, pharmaceuticals, and laboratory samples. Delivery robots reduce human handling, ensuring controlled conditions and compliance with safety protocols.

- By Type

On the basis of type, the market is segmented into fully autonomous and semi-autonomous delivery robots. The fully autonomous segment held the largest market share in 2025, due to its ability to perform complete delivery operations with minimal human intervention. These robots leverage advanced AI and sensors to navigate complex routes safely.

The semi-autonomous segment is expected to witness the fastest growth rate from 2026 to 2033, as businesses adopt flexible solutions that combine manual oversight with autonomous navigation for safer and efficient operations. Semi-autonomous robots are particularly useful in mixed-use areas, where human guidance can complement AI decision-making to handle unexpected obstacles.

Delivery Robots Market Regional Analysis

- North America dominated the delivery robots market with the largest revenue share in 2025, driven by the increasing adoption of autonomous and AI-enabled solutions for last-mile logistics. Retailers, restaurants, and e-commerce providers are leveraging delivery robots to enhance efficiency, reduce human contact, and improve customer satisfaction

- The region’s strong infrastructure, technological readiness, and supportive smart city initiatives are further accelerating deployment across urban areas, campuses, and commercial facilities

U.S. Delivery Robots Market Insight

The U.S. delivery robots market captured the largest revenue share in North America in 2025, fueled by rapid urbanization, high e-commerce penetration, and rising demand for contactless delivery solutions. Businesses are increasingly adopting fully autonomous and semi-autonomous robots to optimize last-mile operations, reduce delivery times, and minimize operational costs. Government support through pilot programs and regulatory frameworks is also boosting market growth, encouraging innovation in AI navigation and fleet management technologies.

Europe Delivery Robots Market Insight

The Europe delivery robots market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in smart city programs and the demand for efficient urban logistics solutions. European cities are implementing pilot projects for autonomous delivery to reduce congestion and emissions. The adoption of AI-enabled robots for retail, food, and healthcare deliveries is expanding, supported by technological innovation and government incentives aimed at modernizing urban transport infrastructure.

U.K. Delivery Robots Market Insight

The U.K. delivery robots market is projected to witness strong growth from 2026 to 2033, propelled by the rising trend of contactless deliveries and urban automation. Companies are deploying robots in restaurants, offices, and residential areas to enhance speed, accuracy, and hygiene during last-mile logistics. The U.K.’s robust e-commerce sector, coupled with supportive policies for autonomous systems, is stimulating adoption across multiple industries, including food and healthcare.

Germany Delivery Robots Market Insight

The Germany delivery robots market is expected to witness significant growth from 2026 to 2033, driven by increasing urban density, demand for automated logistics, and government-backed smart city initiatives. German businesses are integrating delivery robots for food, retail, and healthcare applications to improve operational efficiency and customer experience. Emphasis on safety, AI-driven route optimization, and sustainable solutions is further promoting adoption across industrial and commercial sectors.

Asia-Pacific Delivery Robots Market Insight

The Asia-Pacific delivery robots market is expected to witness the highest growth rate from 2026 to 2033, fueled by rapid urbanization, technological advancements, and increasing e-commerce penetration in countries such as China, Japan, and India. Growing investments in autonomous solutions, along with government support for smart city programs, are accelerating deployment across urban and campus environments. The affordability and scalability of modern robots are expanding adoption among food delivery services, retail, healthcare, and postal services.

Japan Delivery Robots Market Insight

The Japan delivery robots market is expected to witness strong growth from 2026 to 2033, driven by the country’s high-tech culture, urbanization, and rising demand for convenient, contactless deliveries. Japanese businesses are adopting fully autonomous robots integrated with AI navigation systems for food, retail, and healthcare deliveries. The focus on efficiency, hygiene, and workforce optimization is propelling the market, while government-backed robotics initiatives further encourage technological advancement.

China Delivery Robots Market Insight

The China delivery robots market accounted for the largest revenue share in Asia-Pacific in 2025, owing to rapid urbanization, expanding e-commerce, and high technological adoption. Companies are increasingly deploying autonomous delivery robots for food, retail, healthcare, and postal services to improve last-mile efficiency. Government support for smart cities, combined with the presence of domestic manufacturers and cost-effective solutions, is driving widespread adoption and innovation across the country’s logistics ecosystem.

Delivery Robots Market Share

The Delivery Robots industry is primarily led by well-established companies, including:

• Starship Technologies (U.K.)

• JD Robots (China)

• Panasonic Corporation (Japan)

• Savioke (U.S.)

• Nuro, Inc. (U.S.)

• Amazon Robotics (U.S.)

• Robby (U.S.)

• Boston Dynamics (U.S.)

• Robomart, Inc. (U.S.)

• Eliport (U.K.)

• Piaggio Fast Forward (U.S.)

• Caterpillar Inc. (U.S.)

• TeleRetail (U.S.)

• KINE Robot Solutions Oy (Finland)

• Kiwibot (U.S.)

• ABB (Switzerland)

• Aethon (U.S.)

• Autonomous Solutions Inc. (U.S.)

• DJI (China)

• Ultralife Corporation (U.S.)

Latest Developments in Global Delivery Robots Market

- In August 2023, Peachtree Corners (U.S.) launched an underground autonomous delivery system named “Clevon,” designed to collect orders from retailers, warehouses, and dark stores and deliver them efficiently across the city. The deployment enhances last-mile delivery speed, improves customer satisfaction, and showcases scalable urban delivery solutions

- In March 2023, Neubility (U.S.) announced plans to deploy 400 Lidar-free autonomous delivery robots and develop a new range of security-focused robotic models. This expansion is expected to improve delivery efficiency, reduce operational costs, and strengthen the company’s footprint in urban robotics markets

- In December 2022, Hyundai Motor Group (South Korea) initiated a pilot program using LiDAR- and camera-equipped autonomous delivery robots in the hospitality sector, capable of carrying up to 10 kg. The initiative aims to ensure safer, more reliable delivery services within hotels while demonstrating the practical utility of robotics in service industries

- In August 2022, Ottonomy.io (U.S.) introduced the Ottobot 2.0 autonomous robot, deployed across restaurants, retail outlets, and e-commerce operations in the U.S., Canada, Europe, and Asia. This launch enhances delivery efficiency, reduces labor dependency, and supports global adoption of robotic solutions

- In May 2022, Pudu Robotics (China) partnered with Qualcomm to integrate 5G and AI technologies into its autonomous robots, accelerating innovation in product capabilities. The collaboration aims to improve connectivity, operational intelligence, and market competitiveness in last-mile robotics

- In March 2022, JD Logistics (China), a subsidiary of JD.com, developed autonomous robots with over 100 kg carrying capacity and a range of 80–90 km per charge. These robots enable efficient long-distance and heavy-weight product transportation, expanding the capabilities of industrial and logistics delivery solutions

- In January 2022, Nuro Inc. (U.S.) launched the “Nuro” autonomous delivery robot, designed for bulk material transport across restaurants and logistics sectors. The new device enhances operational efficiency, supports contactless deliveries, and strengthens the adoption of autonomous solutions in high-demand sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Delivery Robots Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Delivery Robots Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Delivery Robots Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.