Global Delta Robots Market

Market Size in USD Billion

CAGR :

%

USD

4.44 Billion

USD

8.40 Billion

2024

2032

USD

4.44 Billion

USD

8.40 Billion

2024

2032

| 2025 –2032 | |

| USD 4.44 Billion | |

| USD 8.40 Billion | |

|

|

|

|

Delta Robots Market Size

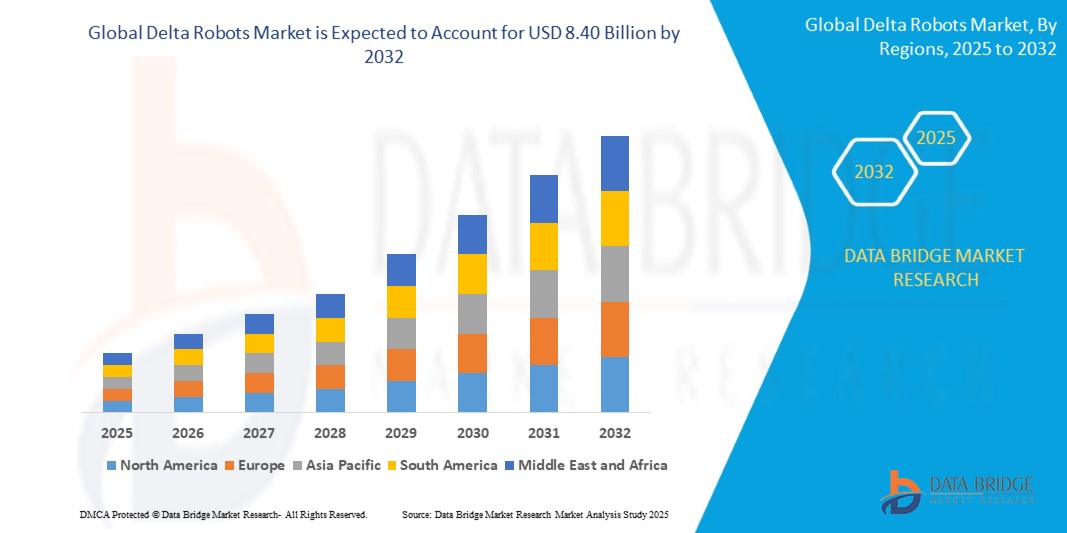

- The global delta robots market size was valued at USD 4.44 billion in 2024 and is expected to reach USD 8.40 billion by 2032, at a CAGR of 8.30% during the forecast period

- The market growth is largely fuelled by the rising demand for high-speed and precision automation across industries such as food and beverage, electronics, and pharmaceuticals

- Increasing adoption of robotics for packaging, assembly, and material handling is further accelerating market expansion

Delta Robots Market Analysis

- The delta robots market is witnessing steady growth as industries prioritize automation for cost reduction, operational efficiency, and scalability. With their ability to deliver high throughput and precise movements, delta robots are becoming an integral part of modern production lines

- Growing investments in Industry 4.0 and smart factories are supporting the adoption of robotics, particularly in applications requiring speed and accuracy

- North America dominated the delta robots market with the largest revenue share of 38.7% in 2024, driven by strong adoption in food processing, packaging, and electronics assembly. The region’s emphasis on automation, coupled with government-backed smart manufacturing initiatives, is accelerating the demand for high-speed and precise robotic systems

- Asia-Pacific region is expected to witness the highest growth rate in the global delta robots market, driven by robust manufacturing infrastructure, strong demand from consumer goods and electronics industries, and continuous investments in automation technologies by China, Japan, and India

- The parallel delta robots segment held the largest market revenue share in 2024, driven by their superior speed, precision, and efficiency in high-throughput industries such as packaging and electronics. Their ability to handle lightweight and repetitive tasks with exceptional accuracy makes them highly preferred in fast-paced manufacturing environments

Report Scope and Delta Robots Market Segmentation

|

Attributes |

Delta Robots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Delta Robots Market Trends

Integration Of Delta Robots In High-Speed Industrial Automation

- The increasing adoption of delta robots in packaging, assembly, and material handling is reshaping industrial automation by enabling rapid and precise operations. Their parallel-arm design allows for exceptional speed and accuracy, making them highly effective in food, pharmaceuticals, and electronics manufacturing where efficiency is crucial. This enhances throughput while reducing labor costs. In addition, their ability to perform repetitive tasks with consistent precision helps companies minimize waste, maintain high product quality, and streamline supply chain efficiency

- The demand for hygienic and contamination-free automation in sectors such as food and pharmaceuticals is accelerating the adoption of delta robots with stainless steel bodies and washdown capabilities. These robots ensure compliance with stringent safety standards while maintaining consistent performance. Beyond hygiene, their durability and resilience in harsh operating environments provide manufacturers with long-term cost savings and reduced downtime, ensuring continuous operation and higher ROI

- The versatility of delta robots, combined with their compact footprint, makes them attractive for industries looking to maximize production efficiency in limited spaces. Their adaptability to multiple end-effectors allows seamless transition across various tasks, boosting operational flexibility. This multifunctionality is increasingly important for businesses operating in dynamic markets, where frequent product changes and customization demands require adaptable automation systems

- For instance, in 2023, several electronics manufacturers in Asia integrated delta robots for micro-assembly processes, improving precision in circuit board production and significantly reducing defect rates. This led to cost savings and faster delivery cycles, strengthening competitiveness in global markets. The move also highlighted delta robots’ ability to improve labor productivity in high-demand regions, enabling manufacturers to scale production capacity without proportionally increasing labor costs

- While delta robots are driving industrial efficiency, their success depends on continuous innovations in AI integration, machine vision, and predictive maintenance. Manufacturers must focus on localized customization and training to maximize adoption and long-term performance benefits. Collaborations with AI developers and IoT platforms are also vital to ensure delta robots are aligned with smart factory ecosystems, unlocking greater real-time decision-making capabilities

Delta Robots Market Dynamics

Driver

Rising Demand For Automation And High-Speed Manufacturing Efficiency

- The growing focus on operational efficiency and precision across industries is propelling the demand for delta robots as frontline automation tools. Their ability to handle lightweight, repetitive, and high-speed tasks makes them indispensable in sectors aiming to optimize productivity. Industries such as electronics and FMCG are leading adopters as delta robots drastically shorten production cycles and improve throughput

- Companies are increasingly aware of the benefits of delta robots, including reduced human error, lower operating costs, and enhanced quality control. These factors are encouraging large-scale adoption, particularly in consumer goods and packaging industries where rapid throughput is critical. Businesses also view automation as a competitive differentiator, enabling them to meet rising consumer demands while lowering defect rates

- Governments and industry associations are also supporting automation through subsidies, Industry 4.0 initiatives, and smart manufacturing programs, further boosting the market for delta robots worldwide. Many public-private partnerships are fostering training programs for robotics engineers, addressing workforce skill gaps while encouraging SME adoption. This has created a favorable policy environment, especially in Europe and Asia

- For instance, in 2022, multiple European food processors adopted delta robots in compliance with EU food safety regulations, improving production speed while ensuring hygiene and consistency. Such regulatory-driven adoption is reinforcing the role of delta robots in ensuring both compliance and competitiveness in international trade

- While demand and institutional support are strong, further improvements in integration with AI, machine learning, and IoT platforms are necessary to unlock the full potential of delta robots in smart factories. Industry leaders are also pushing toward predictive analytics integration, ensuring that robotics maintenance becomes proactive rather than reactive, minimizing downtime

Restraint/Challenge

High Initial Investment And Integration Complexity

- The significant upfront cost of deploying delta robots, including hardware, software, and integration expenses, remains a major barrier for small and medium-sized enterprises. Many businesses find it difficult to justify the return on investment without large-scale production volumes. Even when leasing models are offered, financial constraints in SMEs often delay decision-making

- In several developing regions, there is a shortage of skilled engineers and technicians capable of operating and maintaining advanced robotic systems. This lack of technical expertise limits widespread adoption, particularly among smaller factories. Training gaps also slow down adoption timelines, as companies must invest additional resources in workforce upskilling

- Market expansion is further challenged by the complexity of integrating delta robots with existing production lines, especially when customization is required for industry-specific applications. Downtime during integration often adds to the overall cost. This makes many firms hesitant to disrupt ongoing operations for automation upgrades, especially in cost-sensitive industries

- For instance, in 2023, several SMEs in Latin America delayed their automation plans due to the high costs of robotic integration and limited access to local technical support, slowing down adoption in the region. The reliance on imported parts and expertise further raised expenses, making implementation less feasible for smaller firms

- While delta robots offer clear advantages in efficiency and productivity, overcoming financial and integration hurdles through scalable solutions, leasing models, and modular systems will be essential to drive broader adoption globally. Partnerships between robot manufacturers and system integrators will also be key to simplifying deployment and minimizing transition risks

Delta Robots Market Scope

The market is segmented on the basis of type, application, end user, payload capacity, and control system.

• By Type

On the basis of type, the delta robots market is segmented into Cartesian delta robots and parallel delta robots. The parallel delta robots segment held the largest market revenue share in 2024, driven by their superior speed, precision, and efficiency in high-throughput industries such as packaging and electronics. Their ability to handle lightweight and repetitive tasks with exceptional accuracy makes them highly preferred in fast-paced manufacturing environments.

The Cartesian delta robots segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by their flexibility and ease of integration into diverse assembly and handling operations. Their structural simplicity, cost-effectiveness, and adaptability for customized tasks are making them attractive for small and medium-sized enterprises across multiple industries.

• By Application

On the basis of application, the delta robots market is segmented into food and beverage, pharmaceutical, electronics, and industrial automation. The food and beverage segment held the largest revenue share in 2024 due to the rising demand for hygienic and contamination-free automation systems. Delta robots with stainless steel and washdown capabilities are widely used for packaging and sorting in compliance with strict food safety standards.

The electronics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing use of delta robots in micro-assembly, circuit board handling, and precision manufacturing. Their ability to perform high-speed, accurate, and repetitive tasks makes them indispensable for improving efficiency and reducing defect rates in electronics production lines.

• By End User

On the basis of end user, the delta robots market is segmented into automotive, consumer goods, and medical devices. The automotive sector dominated the market share in 2024 as manufacturers increasingly deploy delta robots for component assembly, material handling, and quality inspection. Their integration helps improve productivity and reduce human error in high-volume production facilities.

The medical devices segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rising demand for precision, reliability, and hygienic handling in the production of surgical instruments, diagnostic devices, and other medical products. This is further supported by the need for automation in sterile environments and stringent regulatory compliance.

• By Payload Capacity

On the basis of payload capacity, the delta robots market is segmented into low payload, medium payload, and high payload. The low payload segment held the largest revenue share in 2024, owing to the wide use of delta robots in lightweight packaging, sorting, and assembly applications across food, electronics, and consumer goods industries.

The high payload segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption in heavy-duty industrial automation and automotive manufacturing. The ability of high payload robots to handle larger and heavier components while maintaining speed and accuracy is expected to boost demand significantly.

• By Control System

On the basis of control system, the delta robots market is segmented into manual control and automated control. The automated control segment held the largest share in 2024, supported by advancements in AI, IoT, and machine vision technologies that enable predictive maintenance and smart factory integration. Automated systems provide higher efficiency, reduced downtime, and real-time monitoring.

The manual control segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in small-scale operations and emerging markets where cost sensitivity and limited technical expertise drive the preference for simpler robotic systems. Their affordability and ease of use make them a practical choice for low-volume production environments.

Delta Robots Market Regional Analysis

- North America dominated the delta robots market with the largest revenue share of 38.7% in 2024, driven by strong adoption in food processing, packaging, and electronics assembly. The region’s emphasis on automation, coupled with government-backed smart manufacturing initiatives, is accelerating the demand for high-speed and precise robotic systems

- Industries in North America are investing heavily in robotics to improve productivity, safety, and cost-efficiency, with delta robots increasingly integrated into automated lines for pick-and-place operations and lightweight material handling

- This growth is further supported by a skilled workforce, rising labor costs, and the widespread presence of leading robotics manufacturers, positioning delta robots as a cornerstone of industrial automation across the region

U.S. Delta Robots Market Insight

The U.S. delta robots market captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of robotics in food, packaging, and consumer electronics industries. Companies are prioritizing speed, hygiene, and precision, making delta robots an attractive choice for automated operations. In addition, the rising shift toward smart factories, combined with robust demand for AI-integrated robotics and predictive maintenance, is further propelling the market. Strategic collaborations between manufacturers and technology providers are also enhancing innovation and accessibility.

Europe Delta Robots Market Insight

The Europe delta robots market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent regulatory standards in food safety and pharmaceuticals that favor robotic automation. The increasing push for Industry 4.0 adoption, along with strong investment in robotics research, is creating new opportunities. European industries are integrating delta robots to boost efficiency, ensure consistency, and reduce operational costs across sectors such as packaging, healthcare, and automotive. Expansion in multi-factory automation and sustainability-focused production is also driving demand.

U.K. Delta Robots Market Insight

The U.K. delta robots market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for automation in food processing, electronics, and logistics. The country’s strong focus on digital manufacturing and robotics innovation is pushing industries to adopt delta robots for faster and more reliable operations. In addition, concerns around labor shortages and the need for hygienic production are further increasing reliance on high-speed robotic systems. The U.K.’s emphasis on advanced automation and flexible robotics solutions is expected to accelerate growth.

Germany Delta Robots Market Insight

The Germany delta robots market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s leadership in engineering and manufacturing excellence. German industries are increasingly implementing delta robots in electronics, automotive, and industrial automation for their precision and adaptability. With a strong focus on sustainable and smart production, delta robots are being integrated into fully automated manufacturing ecosystems. Government initiatives supporting robotics R&D and the presence of global automation leaders further solidify Germany’s position as a key market.

Asia-Pacific Delta Robots Market Insight

The Asia-Pacific delta robots market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, increasing labor costs, and strong demand for automation in food, pharmaceuticals, and electronics manufacturing. Countries such as China, Japan, and India are leading adoption, supported by government-led digitalization and smart factory programs. With APAC emerging as a global hub for electronics and packaging industries, the affordability and availability of delta robots are expanding to SMEs as well as large enterprises.

Japan Delta Robots Market Insight

The Japan delta robots market is expected to witness the fastest growth rate from 2025 to 2032, supported by the nation’s advanced robotics ecosystem, high-tech manufacturing culture, and emphasis on precision engineering. Delta robots are increasingly deployed in electronics and automotive assembly, where accuracy and speed are critical. Integration with AI and IoT-enabled production systems is driving further adoption. Moreover, Japan’s aging workforce is pushing industries to rely more heavily on automation, with delta robots playing a key role in ensuring productivity and efficiency.

China Delta Robots Market Insight

The China delta robots market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, large-scale electronics production, and the growing food and packaging industry. China’s position as a global manufacturing hub, combined with supportive government initiatives such as “Made in China 2025,” is fueling adoption. Domestic robotics manufacturers are playing a major role in making cost-effective delta robots more accessible, expanding their use in both large enterprises and smaller factories. This strong momentum continues to make China a leader in the regional delta robots market.

Delta Robots Market Share

The Delta Robots industry is primarily led by well-established companies, including:

- FANUC Corporation (Japan)

- Yaskawa Electric Corporation (Japan)

- ABB Ltd. (Switzerland)

- KUKA AG (Germany)

- Omron Corporation (Japan)

- Epson Robotics (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Staubli International AG (Switzerland)

- Denso Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Comau S.p.A. (Italy)

- Seiko Instruments Inc. (Japan)

- Nachi-Fujikoshi Corp. (Japan)

- Techman Robot Inc. (Taiwan)

- Adept Technology, Inc. (U.S.)

- Toshiba Machine Co., Ltd. (Japan)

- Precise Automation, Inc. (U.S.)

- Stäubli Robotics (France)

- Delta Electronics, Inc. (Taiwan)

- Yamaha Robotics (Japan)

Latest Developments in Global Delta Robots Market

- In June 2024, Flexiv has announced its partnership with O-DEAR to unveil the Moonlight adaptive delta robots at the 37th Taipei International Robotics and Automation Show (TAiROS) 2024, marking a significant milestone for both companies in Taiwan's dynamic automation market. The Moonlight robot, featuring three degrees of freedom and a load capacity of seven kilograms, is designed for high-precision tasks that require force control, making it ideal for applications such as automotive production. During the event, live demonstrations showcased the robot’s capabilities in ball balancing, FPC connection, and massage applications, emphasizing its force perception and precise control. This collaboration not only highlights Flexiv's commitment to advancing robotic technology but also aims to strengthen its presence in Taiwan's high-tech manufacturing sector, fostering innovation and growth through strategic partnerships. The participation at TAiROS is seen as a crucial opportunity for both Flexiv and O-DEAR to connect with local industry leaders and expand their market reach

- In March 2023, ValTara SRL has unveiled the innovative PKR-Dual Delta robots Cell, which promises to revolutionize case packing in the packaging industry. Featuring a compact and modular design, this advanced automatic case packing machine allows for flexible operation of both cells either together or separately, enabling customers to adapt to fluctuating production demands while optimizing productivity and resource allocation. At its core, the system integrates dual Codian robots with Omron vision-guided technology, facilitating precise pick-and-place operations that handle delicate bakery products with exceptional care. Manufactured in Schio, Italy, the PKR-Dual Delta robots Cell exemplifies high standards of quality and craftsmanship, ensuring seamless integration into diverse production processes. It not only excels at handling rigid packages but also demonstrates remarkable versatility with various flexible package types, positioning it as a cutting-edge solution for manufacturers seeking efficiency and adaptability in their packaging lines

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Delta Robots Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Delta Robots Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Delta Robots Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.