Global Deltamethrin Market

Market Size in USD Million

CAGR :

%

USD

292.40 Million

USD

459.05 Million

2024

2032

USD

292.40 Million

USD

459.05 Million

2024

2032

| 2025 –2032 | |

| USD 292.40 Million | |

| USD 459.05 Million | |

|

|

|

|

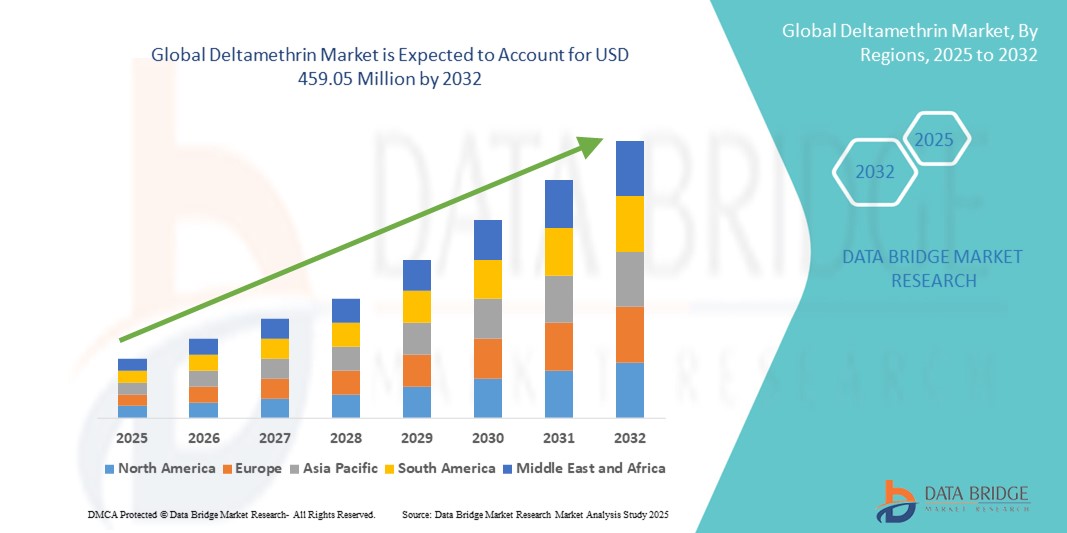

What is the Global Deltamethrin Market Size and Growth Rate?

- The global deltamethrin market size was valued at USD 292.40 million in 2024 and is expected to reach USD 459.05 million by 2032, at a CAGR of 5.80% during the forecast period

- Market expansion is driven by the increasing use of deltamethrin-based insecticides in agriculture, public health programs, and livestock protection due to their high efficacy against a broad spectrum of pests

- In addition, rising concerns over vector-borne diseases, coupled with governmental and non-governmental initiatives for pest control, are fueling product demand, particularly in developing nations

What are the Major Takeaways of Deltamethrin Market?

- Deltamethrin, a synthetic pyrethroid insecticide, is widely utilized for crop protection, household pest control, and vector management programs due to its potent action at low dosages

- Growing adoption in integrated pest management (IPM) strategies, coupled with rising agricultural productivity requirements, is significantly driving market growth

- The market is further supported by expanding use in public health campaigns aimed at controlling mosquitoes and other disease-carrying insects, especially in tropical and subtropical regions

- Asia Pacific dominated the deltamethrin market with the largest revenue share of 46.2% in 2024, driven by extensive agricultural activities, rising pest control requirements, and growing awareness about vector-borne disease prevention

- North America is projected to grow at the fastest CAGR of 8.6% from 2025 to 2032, driven by the increasing need for effective pest control solutions in agriculture, urban pest management, and public health initiatives

- The Deltamethrin EC segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its wide usage in agricultural pest control and vector management programs due to its high effectiveness and ease of application

Report Scope and Deltamethrin Market Segmentation

|

Attributes |

Deltamethrin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Deltamethrin Market?

Rising Adoption of Deltamethrin in Integrated Pest Management (IPM)

- A prominent and accelerating trend in the global deltamethrin market is its increasing integration into integrated pest management programs, where chemical control is combined with biological and cultural methods to minimize environmental impact while ensuring high efficacy. This approach is driving sustainable adoption across agriculture and public health sectors

- For instance, large-scale agricultural projects in Asia and Africa have implemented Deltamethrin as part of seasonal pest rotation strategies, reducing resistance build-up and maintaining crop yields. Similarly, public health agencies are using Deltamethrin-treated nets and sprays in malaria-prone regions to enhance disease control outcomes

- The adaptability of Deltamethrin in IPM enables targeted pest elimination with minimal non-target effects, aligning with stricter regulatory requirements and environmental safety norms. In addition, it offers flexibility in formulation, ranging from sprays to granules, supporting diverse application needs

- Its compatibility with other pest control methods allows farmers and health agencies to create comprehensive pest suppression plans, improving long-term effectiveness and reducing dependency on single-mode chemicals

- This shift towards sustainable, multi-pronged pest control is reshaping procurement strategies for agrochemical buyers and government programs. As a result, leading companies are investing in next-generation Deltamethrin formulations with enhanced stability, rainfastness, and resistance management capabilities

- The growing focus on sustainability, regulatory compliance, and reduced ecological footprint is expected to further accelerate the integration of Deltamethrin into IPM strategies across global markets

What are the Key Drivers of Deltamethrin Market?

- Rising global demand for effective and broad-spectrum insecticides in agriculture, public health, and livestock management is a major driver for Deltamethrin adoption

- For instance, in March 2024, several African malaria control programs expanded Deltamethrin use in indoor residual spraying, citing its proven efficacy against insecticide-resistant mosquito populations. Such public sector initiatives are expected to fuel market growth during the forecast period

- Increasing concerns over crop losses due to pest outbreaks, along with the need for cost-effective solutions that work in low doses, are making Deltamethrin a preferred choice among farmers and governments

- Furthermore, the versatility of deltamethrin across multiple application formats sprays, powders, aerosols ensures its suitability for agriculture, vector control, and household pest management

- The shift towards safer and more targeted pest control solutions is aligning with global regulatory approvals, boosting confidence among both producers and end-users. Growing awareness of its high efficacy, stability under different climatic conditions, and long residual action continues to strengthen market adoption

Which Factor is challenging the Growth of the Deltamethrin Market?

- Concerns over insecticide resistance development in target pest populations remain a significant challenge to long-term deltamethrin efficacy. Continuous overuse without rotation increases the risk of reduced effectiveness

- For instance, resistance reports in some mosquito and agricultural pest species have prompted calls for stricter rotation and dose management guidelines from agricultural and health authorities

- Addressing resistance through integrated application strategies, combination formulations, and stewardship programs is essential for sustaining market growth. Leading producers are now collaborating with research bodies to develop resistance monitoring systems and next-gen variants

- In addition, regulatory scrutiny over chemical pesticide use, especially in the EU and parts of North America, can slow market expansion due to compliance costs and registration delays.

- Price sensitivity in developing markets, where cheaper alternatives may be preferred despite lower efficacy, also poses an adoption barrier. While generic versions are available, they may lack the quality assurance of branded products, impacting user trust

- Overcoming these challenges will require innovative formulations, strong stewardship practices, and targeted education for both farmers and public health implementers to maintain Deltamethrin’s market relevance

How is the Deltamethrin Market Segmented?

The market is segmented on the basis of product type, form, formulation type, and application.

- By Product Type

On the basis of product type, the deltamethrin market is segmented into Deltamethrin EC, Deltamethrin WP, Deltamethrin SC, Deltamethrin ULV, and Others. The Deltamethrin EC segment dominated the market with the largest revenue share of 38.5% in 2024, driven by its wide usage in agricultural pest control and vector management programs due to its high effectiveness and ease of application. The EC formulation’s compatibility with existing spraying equipment and its quick knockdown action make it a preferred choice among farmers and public health agencies.

The Deltamethrin SC segment is anticipated to witness the fastest growth rate of 7.9% from 2025 to 2032, fueled by increasing adoption in areas requiring reduced odor, safer handling, and longer residual activity, particularly in commercial pest control services and sensitive environments.

- By Form

On the basis of form, the deltamethrin market is segmented into solid and liquid. The liquid segment held the largest market revenue share of 64.2% in 2024, owing to its versatility in application, ease of mixing with other pesticides, and suitability for both large-scale agricultural operations and public health spraying campaigns.

The solid segment is expected to register the fastest CAGR of 6.4% from 2025 to 2032, driven by its stability, longer shelf life, and suitability for targeted pest control applications in grain storage and household pest management.

- By Formulation Type

On the basis of formulation type, the deltamethrin market is segmented into granules, emulsifiable concentrates (EC), suspension concentrates (SC), wettable powders (WP), and liquid formulations. The emulsifiable concentrates (EC) segment dominated the market with a 41.7% revenue share in 2024, supported by its proven performance in pest control, easy dilution, and fast pest knockdown properties.

The suspension concentrates (SC) segment is projected to record the fastest CAGR of 7.5% from 2025 to 2032, attributed to increasing preference for low-odor, user-safe formulations with prolonged residual action.

- By Application

On the basis of application, the deltamethrin market is segmented into agriculture, industrial & commercial, residential, livestock, and others. The agriculture segment accounted for the largest market revenue share of 52.8% in 2024, driven by the increasing need for effective pest management to protect crop yields, rising pest infestations due to climate change, and the cost-effectiveness of Deltamethrin-based solutions in integrated pest management (IPM) programs.

The industrial & commercial segment is expected to witness the fastest CAGR of 8.1% from 2025 to 2032, fueled by the growing demand for pest control in food processing, storage facilities, hospitality sectors, and public infrastructure projects.

Which Region Holds the Largest Share of the Deltamethrin Market?

- Asia Pacific dominated the deltamethrin market with the largest revenue share of 46.2% in 2024, driven by extensive agricultural activities, rising pest control requirements, and growing awareness about vector-borne disease prevention

- The region’s strong reliance on crop protection chemicals, combined with rapid advancements in formulation technologies, supports the widespread adoption of Deltamethrin in both agricultural and public health sectors

- Government-supported pest management programs and favorable regulatory frameworks in countries such as China, India, and Australia further strengthen demand, making Asia Pacific the global leader in this market

China Deltamethrin Market Insight

The China deltamethrin market accounted for the largest share within Asia Pacific in 2024, fueled by large-scale agricultural production, increasing incidences of pest outbreaks, and strong domestic manufacturing capacity. Deltamethrin is extensively used in crop protection, grain storage, and mosquito control programs. China’s commitment to food security and urban sanitation is further boosting market penetration, while competitive pricing and the availability of multiple formulation types make it accessible to a broad customer base.

India Deltamethrin Market Insight

The India deltamethrin market is experiencing steady growth due to its critical role in pest control for crops such as cotton, rice, and vegetables. Rising farmer awareness about the benefits of synthetic pyrethroids, along with government initiatives for integrated pest management (IPM), are fueling adoption. In addition, India’s expanding public health programs for mosquito control are contributing to the increased use of deltamethrin in urban and rural areas asuch as.

Australia Deltamethrin Market Insight

The Australia deltamethrin market is witnessing growing adoption in both agricultural and residential applications. Its effectiveness against a broad spectrum of pests makes it popular for protecting stored grains, livestock, and public spaces. Strict biosecurity standards and export-driven agriculture encourage the use of high-quality, compliant deltamethrin formulations, while the country's strong pest management industry supports ongoing demand.

Which Region is the Fastest Growing Region in the Deltamethrin Market?

North America is projected to grow at the fastest CAGR of 8.6% from 2025 to 2032, driven by the increasing need for effective pest control solutions in agriculture, urban pest management, and public health initiatives. High awareness about vector-borne diseases, coupled with stringent food safety and sanitation standards, is driving market growth. The region also benefits from advanced formulation technologies, strong R&D investments, and an established distribution network.

U.S. Deltamethrin Market Insight

The U.S. deltamethrin market captured the largest share within North America in 2024, supported by its widespread use in crop protection, termite control, and mosquito abatement programs. Increasing pest resistance to older insecticides is prompting a shift towards advanced pyrethroid formulations such as deltamethrin. Regulatory approvals for expanded uses and the presence of key agrochemical companies further bolster market growth.

Canada Deltamethrin Market Insight

The Canada deltamethrin market is gaining momentum, particularly in the agricultural sector for grain storage pest control and livestock protection. The country’s integrated pest management approach, combined with strict pest control standards in food processing and public spaces, drives the adoption of deltamethrin-based products. Demand is further supported by seasonal pest surges and the need for effective, long-lasting solutions in remote and rural regions.

Which are the Top Companies in Deltamethrin Market?

The deltamethrin industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- Rotam (Taiwan)

- Nufarm Limited (Australia)

- FMC Corporation (U.S.)

- Heranba Industries Ltd. (India)

- Pharma AS, Virbac (France)

- Tagros Chemicals India Ltd. (India)

- Jiangsu Yangnong Chemical (China)

- Gharda Chemicals (India)

- Sumitomo Chemical (Japan)

- Nanjing Red Sun (China)

- Bharat Group (India)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.