Global Dental 3d Printed Complete Dentures Market

Market Size in USD Million

CAGR :

%

USD

254.82 Million

USD

663.18 Million

2025

2033

USD

254.82 Million

USD

663.18 Million

2025

2033

| 2026 –2033 | |

| USD 254.82 Million | |

| USD 663.18 Million | |

|

|

|

|

Dental 3D-Printed Complete Dentures Market Size

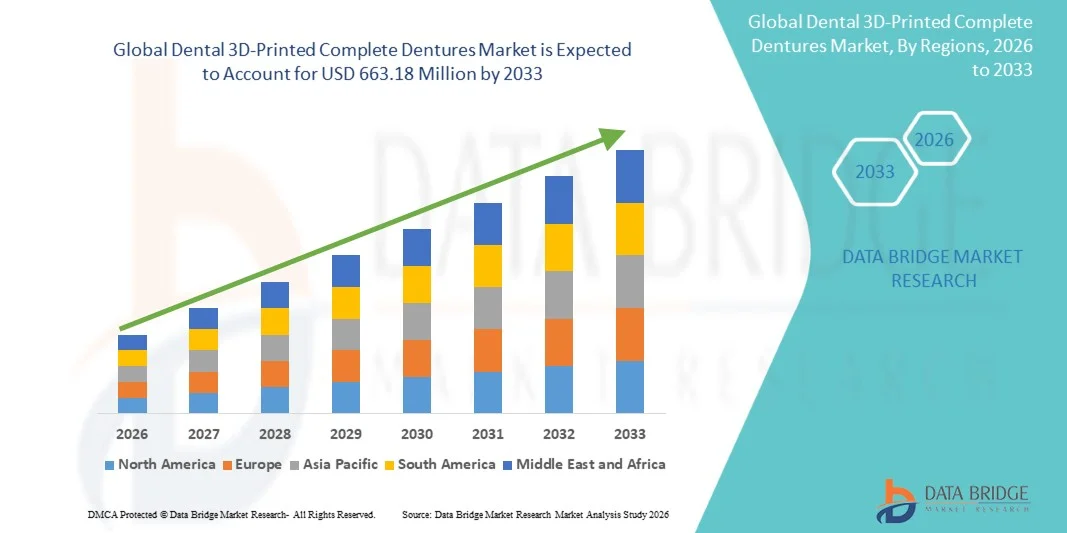

- The global Dental 3D-Printed Complete Dentures market size was valued at USD 254.82 Million in 2025 and is expected to reach USD 663.18 Million by 2033, at a CAGR of 12.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within digital dentistry and 3D printing technologies, leading to enhanced efficiency, faster production, and highly personalized denture solutions in both dental clinics and laboratories

- Furthermore, rising patient demand for comfortable, customized, and cost-effective prosthetic solutions, combined with the integration of CAD/CAM workflows and AI-assisted denture design, is establishing 3D-printed complete dentures as the preferred choice over conventional methods. These converging factors are significantly accelerating the adoption of Dental 3D-Printed Complete Dentures solutions, thereby boosting the industry's growth

Dental 3D-Printed Complete Dentures Market Analysis

- The Dental 3D‑Printed Complete Dentures market is experiencing strong growth as 3D printing technologies revolutionize prosthodontics with faster production, highly personalized prosthetics, improved fit, and reduced chair time compared with traditional denture fabrication methods

- The escalating demand for 3D‑printed complete dentures is primarily driven by the widespread adoption of digital dentistry technologies, increasing prevalence of edentulism among aging populations, and a rising preference among patients and clinicians for customized, efficient, and cost‑effective dental prosthetic solutions

- North America dominated the dental 3D‑printed complete dentures market in 2025, holding the largest revenue share of approximately 39.2% due to early adoption of digital dentistry, high healthcare spending, advanced dental infrastructure, and a strong presence of key dental technology providers, with the U.S. market showing substantial growth in clinics and labs integrating 3D printing solutions

- Asia‑Pacific is expected to be the fastest‑growing region in the dental 3D‑printed complete dentures market during the forecast period due to rising healthcare investment, expanding dental infrastructure, increasing dental care awareness, and growing disposable incomes across countries such as China, India, Japan, and South Korea

- The SLA segment dominated the largest market revenue share of 55.6% in 2025, driven by its high accuracy, smooth surface finish, and compatibility with a wide range of dental materials

Report Scope and Dental 3D-Printed Complete Dentures Market Segmentation

|

Attributes |

Dental 3D-Printed Complete Dentures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental 3D-Printed Complete Dentures Market Trends

“Advancements in Digital Dentistry and 3D Printing Technologies”

- A significant and accelerating trend in the global Dental 3D-Printed Complete Dentures market is the rapid adoption of digital dentistry solutions, particularly 3D printing technologies, which are transforming denture fabrication processes

- These innovations allow for precise, customizable, and efficient production of complete dentures, reducing manual labor and turnaround times while improving fit, aesthetics, and patient comfort

- For instance, dental laboratories and clinics worldwide are increasingly implementing advanced 3D printers and CAD/CAM software to design and manufacture complete dentures, enabling better reproducibility and customization tailored to individual patient anatomy

- Innovations in biocompatible denture materials and printing techniques are further enhancing the durability, comfort, and functional performance of 3D-printed dentures

- This trend is encouraging dental practitioners to adopt more automated and technologically advanced workflows, reducing errors associated with traditional denture fabrication

- Furthermore, the integration of digital impressions and intraoral scanning technologies streamlines the denture design process, enhancing collaboration between dental technicians and clinicians and enabling faster delivery of prosthetic solutions

- These technological advancements are fundamentally reshaping patient expectations and clinical practices in prosthodontics, making precision, efficiency, and customization central to modern denture solutions

Dental 3D-Printed Complete Dentures Market Dynamics

Driver

“Increasing Demand for Personalized and Efficient Dental Solutions”

- The growing global demand for personalized dental care, coupled with increasing awareness of oral health, is a key driver for the Dental 3D-Printed Complete Dentures market

- Patients are seeking highly customized dentures that ensure proper fit, improved aesthetics, and enhanced comfort

- For instance, in 2024, several leading dental device manufacturers expanded their 3D printing portfolios to include complete denture solutions with tailored occlusion and anatomy-specific designs, reflecting the rising demand for patient-specific prosthetics

- The efficiency and speed of 3D printing workflows allow dental laboratories and clinics to reduce production time and costs while increasing throughput, making this technology attractive for large-scale adoption in both developed and emerging markets

- Furthermore, the growing adoption of digital dentistry in regions such as North America, Europe, and Asia-Pacific is fueled by increased investments in advanced dental equipment and software, rising dental tourism, and the need for minimally invasive and patient-friendly prosthetic solutions

Restraint/Challenge

“High Initial Costs and Material Limitations”

- Despite strong growth prospects, the market faces challenges related to high equipment and material costs, as well as limitations in available biocompatible printing materials

- Initial investment in advanced 3D printers, CAD/CAM systems, and compatible materials can be prohibitive for small dental clinics and laboratories, especially in developing regions

- For instance, dental practices in regions with limited healthcare infrastructure may hesitate to adopt 3D printing due to the high upfront expenditure and ongoing maintenance costs

- Furthermore, certain 3D-printed denture materials may have limitations in long-term durability, color stability, or mechanical strength compared to traditional acrylic dentures, which can affect patient satisfaction and adoption

- Addressing these challenges through technological advancements in cost-effective printing materials, leasing or shared 3D printing services, and improved training for dental professionals will be essential for broader market penetration and sustained growth

Dental 3D-Printed Complete Dentures Market Scope

The market is segmented on the basis of material type, end user, and technology.

• By Material Type

On the basis of material type, the Dental 3D-Printed Complete Dentures market is segmented into Resin, PMMA (Polymethyl Methacrylate), Hybrid Materials, and Others. The PMMA segment dominated the largest market revenue share of 48.5% in 2025, driven by its proven biocompatibility, mechanical strength, and ease of customization. PMMA allows precise fit, reduces patient discomfort, and is widely adopted across dental clinics and laboratories. Its compatibility with stereolithography (SLA) and digital light processing (DLP) technologies enhances production efficiency. High aesthetic appeal ensures patient satisfaction. Regulatory approvals in multiple regions strengthen adoption. Integration with CAD/CAM systems supports workflow automation. High durability and long-term performance increase clinician preference. Cost-effectiveness further reinforces market dominance. Growing dental patient pool fuels demand. Strong supply chains ensure consistent availability.

The Hybrid Materials segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, driven by growing demand for materials that combine the flexibility of resins with the strength of PMMA. Hybrid materials improve wear resistance, provide superior aesthetics, and are increasingly preferred in high-end dental applications. Adoption is fueled by dental laboratories and clinics seeking efficient, durable solutions. Increasing investment in 3D printing technology supports expansion. Rising awareness among dental professionals accelerates uptake. The ability to reduce production time and post-processing enhances workflow. Growing popularity of personalized dentures drives demand. Compatibility with multiple 3D printing technologies strengthens market penetration. Collaborative initiatives with dental schools boost adoption.

• By End User

On the basis of end user, the Dental 3D-Printed Complete Dentures market is segmented into Dental Clinics, Hospitals, and Dental Laboratories. The Dental Laboratories segment held the largest market revenue share of 50.2% in 2025, driven by the high volume of prosthetic production and strong investment in 3D printing infrastructure. Laboratories offer centralized services for multiple clinics, providing cost-effective, high-quality denture fabrication. Skilled technicians enhance precision and patient outcomes. Integration with CAD/CAM systems allows seamless workflow. Expansion of dental insurance coverage supports demand. Regulatory compliance ensures product safety. Global demand for complete dentures fuels laboratory-based production. Adoption of advanced post-processing techniques improves efficiency. Strategic partnerships with clinics and dental schools increase market penetration.

The Dental Clinics segment is projected to witness the fastest CAGR of 23.1% from 2026 to 2033, fueled by growing adoption of in-house 3D printing capabilities. Clinics benefit from faster turnaround times, reduced dependency on third-party laboratories, and improved patient satisfaction. Increasing patient demand for same-day dentures drives growth. Adoption of chairside technologies enhances workflow efficiency. Growing awareness among dentists about 3D printing advantages accelerates uptake. Training programs and workshops boost adoption. The ability to customize dentures per patient improves clinical outcomes. Rising investments in dental technology infrastructure support expansion.

• By Technology

On the basis of technology, the Dental 3D-Printed Complete Dentures market is segmented into Stereolithography (SLA), Digital Light Processing (DLP), and Fused Deposition Modeling (FDM). The SLA segment dominated the largest market revenue share of 55.6% in 2025, driven by its high accuracy, smooth surface finish, and compatibility with a wide range of dental materials. SLA allows rapid production of complete dentures with minimal post-processing. Its precision improves fit and reduces patient discomfort. Integration with CAD/CAM software enhances design flexibility. High adoption among dental laboratories strengthens market dominance. Regulatory approvals for SLA materials in multiple regions boost credibility. Compatibility with PMMA and hybrid materials increases versatility. Reduced production time and high reproducibility reinforce preference. Growth in dental clinics and hospitals further fuels SLA adoption.

The DLP segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, driven by its rapid printing speed and cost-effectiveness. DLP technology allows mass production of dentures while maintaining precision and aesthetics. Rising adoption in dental laboratories and clinics supports growth. Compatibility with emerging resin and hybrid materials enhances application scope. Training programs and workshops increase dentist and technician adoption. Expansion of dental 3D printing service providers accelerates uptake. Ability to produce complex geometries efficiently strengthens penetration. Rising awareness among patients for faster prosthetic solutions boosts demand. Investment in advanced DLP printers by clinics improves service offerings.

Dental 3D-Printed Complete Dentures Market Regional Analysis

- North America dominated the dental 3D‑printed complete dentures market in 2025

- Holding the largest revenue share of approximately 39.2%

- This growth is supported by early adoption of digital dentistry, high healthcare spending, advanced dental infrastructure, and a strong presence of key dental technology providers

U.S. Dental 3D-Printed Complete Dentures Market Insight

The U.S. dental 3D‑printed complete dentures market captured the majority of North America’s revenue share, driven by substantial growth in dental clinics and laboratories integrating 3D printing solutions. The market expansion is fueled by the adoption of CAD/CAM technology, demand for precision and customized dentures, rising patient awareness, and the presence of leading dental technology providers offering innovative solutions.

Europe Dental 3D-Printed Complete Dentures Market Insight

The Europe dental 3D‑printed complete dentures market is projected to expand at a notable CAGR during the forecast period, driven by rising investments in dental technology, increasing adoption of digital dentistry, and the growing emphasis on patient-centric care. Countries such as Germany, France, and Italy are witnessing accelerated integration of 3D printing in dental labs and clinics, supported by advancements in dental materials and regulatory support for innovative dental solutions.

U.K. Dental 3D-Printed Complete Dentures Market Insight

The U.K. Dental 3D‑Printed Complete Dentures market is expected to grow steadily, fueled by rising patient awareness regarding dental aesthetics, increasing dental insurance coverage, and adoption of advanced dental treatment options. The presence of specialized dental clinics and growing integration of CAD/CAM and 3D printing technologies are further supporting market growth.

Germany Dental 3D-Printed Complete Dentures Market Insight

The Germany dental 3D‑printed complete dentures market is anticipated to expand at a considerable CAGR, driven by technological innovation, well-established dental infrastructure, and strong support for research and development in dental materials and 3D printing solutions. The adoption of digital dentistry in both clinics and laboratories is facilitating precise, efficient, and cost-effective denture production.

Asia-Pacific Dental 3D-Printed Complete Dentures Market Insight

The Asia‑Pacific dental 3D‑printed complete dentures market is expected to grow at the fastest CAGR during the forecast period. This rapid growth is fueled by rising healthcare investment, expanding dental infrastructure, increasing awareness about dental care, and growing disposable incomes across countries such as China, India, Japan, and South Korea. The adoption of digital dentistry and 3D printing technologies in dental clinics and laboratories is accelerating market expansion.

Japan Dental 3D-Printed Complete Dentures Market Insight

The Japan Dental 3D‑Printed Complete Dentures market is gaining traction due to the country’s advanced healthcare system, high adoption of digital dental solutions, and a strong focus on patient-specific treatment. Increasing elderly population and demand for customized dentures are key factors driving growth in both clinical and laboratory settings.

China Dental 3D-Printed Complete Dentures Market Insight

The China dental 3D‑printed complete dentures market accounted for the largest market revenue share in Asia-Pacific in 2025. Growth is supported by expanding dental infrastructure, high rates of urbanization, rising disposable incomes, and increasing adoption of digital dentistry. Domestic manufacturers and dental labs are increasingly implementing 3D printing solutions for cost-effective and precise denture production, further boosting market demand.

Dental 3D-Printed Complete Dentures Market Share

The Dental 3D-Printed Complete Dentures industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- DENTCA (U.S.)

- Glidewell (U.S.)

- Aspen Dental (U.S.)

- Kulzer GmbH (Germany)

- SHOFU (Japan)

- Modern Dental Group (China)

- Shenzhen Royal Dental Laboratory (China)

- Yunan Jiahong Dental (China)

- Guangzhou JGQ (Nice Dental) Industry (China)

- Zhengzhou Sanhe Denture (China)

- 3D Systems (U.S.)

- Stratasys Ltd. (U.S./Israel)

- Formlabs Inc. (U.S.)

- Carbon, Inc. (U.S.)

- Asiga (Australia)

- Prodways Group (France)

- SprintRay Inc. (U.S.)

- Roland DG Corporation (Japan)

Latest Developments in Global Dental 3D-Printed Complete Dentures Market

- In February 2024, 3D Systems introduced the industry’s first multi‑material, monolithic jetted denture solution that can print one‑piece, full‑arch dentures using bespoke materials for both teeth and gum structures, combining strength, aesthetics, and high precision into a single printing process. This innovation enables dental labs and clinics to streamline workflows, reduce manual assembly, and deliver digitally fabricated dentures more rapidly, while achieving consistent quality and reproducibility across large production runs

- In April 2024, Desktop Health announced the validation of its Flexcera family of resins for use with Asiga 3D printers, expanding the availability of high‑quality 3D printable dental materials globally and enhancing the production of durable, comfortable digital dentures for dental labs and clinics. This collaboration broadens material options for clinicians and technicians seeking resilient and biocompatible solutions in complete denture fabrication

- In August 2025, 3D Systems began commercial availability of its NextDent 300 MultiJet 3D printer and corresponding NextDent Jet Denture materials in the U.S. market, offering FDA‑cleared, high‑speed, multi‑material printed dentures that reduce turnaround and improve fit and aesthetics. Early adopters reported up to 300% improvements in production efficiency, indicating strong industry interest in advanced digital workflows

- In September 2025, Stratasys expanded its digital denture solution into the European market after receiving CE Mark Class I approval for its TrueDent‑D resin system, enabling European dental labs to produce monolithic, multi‑shade complete dentures with streamlined workflows and reduced cost and time to delivery. The expansion reflects increasing global adoption of digital denture systems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.