Global Dental Carpule Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

4.05 Billion

2025

2033

USD

2.20 Billion

USD

4.05 Billion

2025

2033

| 2026 –2033 | |

| USD 2.20 Billion | |

| USD 4.05 Billion | |

|

|

|

|

Dental Carpule Market Size

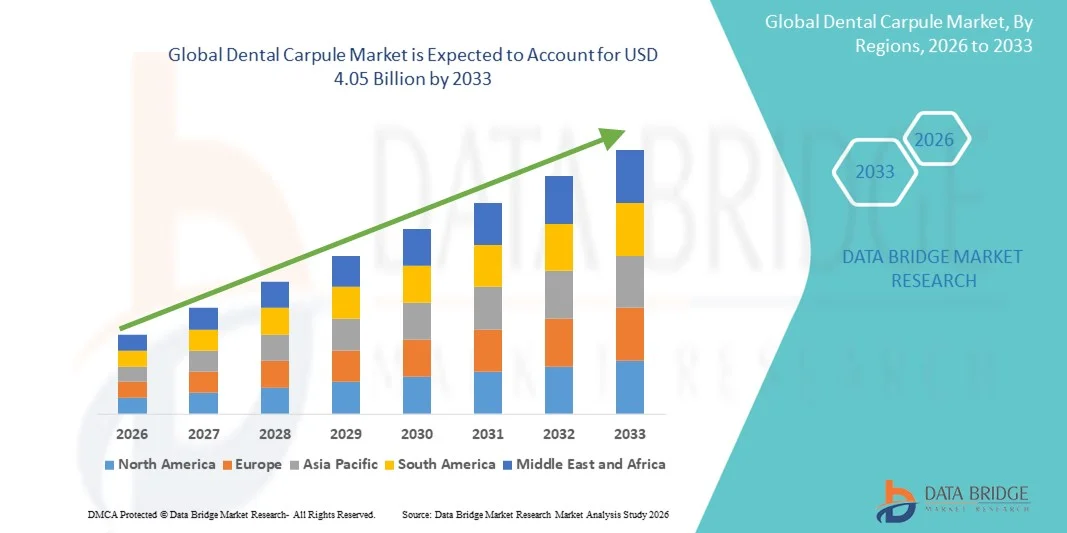

- The global dental carpule market size was valued at USD 2.20 billion in 2025 and is expected to reach USD 4.05 billion by 2033, at a CAGR of 7.92% during the forecast period

- The market growth is primarily driven by the increasing prevalence of dental procedures, rising awareness about oral health, and growing adoption of advanced anesthetic delivery systems in dental practices worldwide

- In addition, the demand for precise, safe, and efficient local anesthesia solutions in both routine and specialized dental treatments is propelling the adoption of dental carpules, thereby significantly enhancing the market’s expansion

Dental Carpule Market Analysis

- Dental carpules, providing prefilled anesthetic cartridges for precise and safe local anesthesia delivery, are becoming essential components in modern dental practices for both routine and specialized procedures due to their convenience, accuracy, and compatibility with standard dental syringes

- The increasing adoption of dental carpules is primarily driven by the rising prevalence of dental procedures, growing awareness of oral health, and demand for safe, efficient, and pain-minimized treatment methods

- North America dominated the dental carpule market with the largest revenue share of 38.7% in 2025, supported by high dental procedure volumes, well-established dental infrastructure, and the presence of leading dental product manufacturers, with the U.S. witnessing substantial adoption in both private and institutional dental clinics due to innovations in anesthetic formulations and ergonomically designed carpules

- Asia-Pacific is expected to be the fastest-growing region in the dental carpule market during the forecast period owing to expanding dental healthcare services, increasing urbanization, and rising disposable incomes

- Lidocaine-based carpules dominated the dental carpule market with a market share of 41.5% in 2025, driven by their widespread use, effectiveness, and strong clinician preference for safe and reliable local anesthesia in diverse dental treatments

Report Scope and Dental Carpule Market Segmentation

|

Attributes |

Dental Carpule Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Dental Carpule Market Trends

Shift Towards Digital and Ergonomic Delivery Systems

- A significant and accelerating trend in the global dental carpule market is the increasing adoption of digital and ergonomically designed anesthetic delivery systems, improving precision, safety, and clinician comfort during dental procedures

- For instance, the Single Dose Digital Carpule Syringe enables precise anesthetic administration with minimal wastage and improved handling, reducing clinician fatigue and enhancing patient comfort

- Integration with digital platforms allows tracking of anesthetic usage, monitoring dosage, and ensuring compliance with treatment protocols, thereby improving overall treatment efficiency

- Advanced carpule designs with color-coded or prefilled cartridges enhance safety and reduce procedural errors, making the delivery of local anesthesia more standardized and reliable across practices

- This trend towards digital, ergonomic, and safer delivery systems is reshaping clinician expectations and patient experience, encouraging manufacturers to innovate in carpule design and compatibility

- Development of eco-friendly and biodegradable carpules is emerging as a trend to reduce medical waste and support sustainability initiatives in dental practices

- The demand for carpules compatible with digital and ergonomic delivery systems is rising rapidly across both general and specialized dental practices, as practitioners increasingly prioritize precision, safety, and ease of use

Dental Carpule Market Dynamics

Driver

Increasing Demand Due to Rising Dental Procedures and Oral Health Awareness

- The rising prevalence of dental treatments, coupled with increasing public awareness of oral health, is a significant driver for the heightened demand for dental carpules

- For instance, in March 2025, Septodont introduced advanced lidocaine carpules targeting high-volume dental practices to improve anesthesia efficiency and patient comfort

- As patients seek painless and safe treatment experiences, prefilled carpules offer standardized doses and reduced risk of cross-contamination, providing a compelling reason for adoption

- Growing dental infrastructure, increasing number of dental clinics, and expansion of cosmetic and pediatric dentistry are further boosting the adoption of dental carpules globally

- The convenience of prefilled cartridges, compatibility with various syringes, and improved safety over traditional vial-based anesthesia are key factors propelling the market across diverse regions

- Technological advancements such as computer-controlled anesthesia delivery systems are encouraging dental professionals to adopt modern carpule solutions

- The rising preference for minimally invasive and pain-minimized treatments in both routine and specialized dental procedures continues to drive the adoption of dental carpules in clinics worldwide

Restraint/Challenge

Allergic Reactions and Regulatory Compliance Hurdles

- Concerns regarding allergic reactions or adverse effects from anesthetic agents in dental carpules pose a challenge to wider market adoption, particularly in sensitive patient groups

- For instance, reports of lidocaine-induced allergic responses have made some clinicians cautious in selecting carpules for pediatric or high-risk patients

- Ensuring strict adherence to regulatory standards, proper labeling, and quality control measures is crucial for building trust among dental professionals and patients

- The relatively higher cost of prefilled carpules compared to traditional vials can limit adoption in cost-sensitive clinics or developing regions, despite their advantages in safety and convenience

- While prices are gradually decreasing, the perception of premium costs and potential side effects can hinder widespread uptake, especially in smaller practices or regions with budget constraints

- Addressing these challenges through enhanced safety measures, allergen-free formulations, and regulatory compliance will be vital for sustained growth in the global dental carpule market

- Limited availability of certain anesthetic agents in specific regions may restrict the adoption of dental carpules in those markets

- Lack of adequate training among dental professionals on modern carpule systems can slow adoption rates, particularly in smaller or rural dental practices

Dental Carpule Market Scope

The market is segmented on the basis of material, component, and end-user.

- By Material

On the basis of material, the dental carpule market is segmented into glass carpule, plastic carpule, and metal carpule. The glass carpule segment dominated the market with the largest revenue share in 2025, owing to its long-standing use in dental practices and chemical inertness, which preserves the efficacy of anesthetic solutions. Glass carpules are preferred for their transparency, allowing clinicians to visually inspect the anesthetic and check for air bubbles before administration. Their compatibility with most standard dental syringes and ease of sterilization further enhance their adoption. Hospitals and high-volume dental clinics favor glass carpules for their reliability and consistency during multiple procedures. Moreover, glass carpules maintain the stability of anesthetic agents over extended storage periods. Their widespread acceptance and clinician familiarity continue to reinforce their market dominance.

The plastic carpule segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the demand for lightweight, shatterproof, and safer alternatives in pediatric dentistry and mobile dental clinics. Plastic carpules are easier to handle and reduce the risk of accidental breakage, making them suitable for high-traffic dental settings. Their cost-effectiveness and compatibility with eco-friendly initiatives are further propelling adoption. Recent innovations in plastic formulations allow for enhanced chemical stability, making them viable substitutes for traditional glass carpules. The growing focus on sustainability in dental practices is also increasing the preference for plastic options. In addition, plastic carpules are easier to transport and dispose of safely, supporting emerging markets.

- By Component

On the basis of component, the dental carpule market is segmented into lidocaine, bupivacaine, articaine, mepivacaine, prilocaine, etidocaine, ropivacaine, and others. The lidocaine segment dominated the market in 2025 with a market share of 41.5% due to its widespread acceptance as a standard local anesthetic, proven safety profile, and rapid onset of action. Lidocaine is commonly used in general, pediatric, and cosmetic dentistry, making it a versatile choice across clinics. Prefilled lidocaine carpules enhance precision, reduce procedural errors, and minimize cross-contamination risks. Clinician familiarity and established usage protocols further strengthen its position. In addition, manufacturers continue to innovate lidocaine carpules with color-coded or ergonomic designs to improve usability. Lidocaine’s consistent effectiveness and low side-effect profile make it the preferred choice for high-volume dental practices.

The articaine segment is expected to witness the fastest growth from 2026 to 2033, fueled by its superior penetration in bone tissue and effectiveness in complex dental procedures. Articaine is increasingly preferred in cosmetic and surgical dentistry due to its rapid onset and extended duration. Prefilled articaine carpules improve procedural efficiency and patient comfort. Its adoption in pediatric and geriatric dentistry is rising because of its high efficacy and safety profile. Growing awareness among dental professionals about its advantages over traditional anesthetics is also driving demand. The expansion of specialized dental clinics and cosmetic dentistry further accelerates articaine adoption globally.

- By End-User

On the basis of end-user, the dental carpule market is segmented into hospitals & dental clinics, home care, and others. The hospitals & dental clinics segment dominated the market in 2025, accounting for the largest share due to the high volume of dental procedures performed in professional settings. Hospitals and clinics require standardized, prefilled anesthetic solutions to ensure patient safety, reduce procedural errors, and maintain hygiene standards. The segment benefits from advanced infrastructure, trained dental professionals, and regulatory compliance, which support adoption of high-quality carpules. Bulk procurement by hospitals and clinics ensures consistent demand for reliable products. Prefilled carpules also reduce preparation time and improve workflow efficiency in busy clinical environments. In addition, hospitals and dental chains prefer premium anesthetic brands for quality assurance and patient trust.

The home care segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of portable dental care kits and increased awareness of emergency dental management at home. Home-use carpules are designed for safety, ease of handling, and compatibility with tele-dentistry guidance. Growing e-commerce channels are facilitating direct-to-consumer sales of these carpules. Single-use, prefilled carpules ensure hygiene and reduce dosing errors for home applications. Rising interest in at-home oral care solutions and pain management is also propelling growth. Furthermore, innovations in compact and ergonomic home-use carpules are enhancing accessibility for patients outside clinical settings.

Dental Carpule Market Regional Analysis

- North America dominated the dental carpule market with the largest revenue share of 38.7% in 2025, supported by high dental procedure volumes, well-established dental infrastructure, and the presence of leading dental product manufacturers

- Dental professionals in the region highly value the safety, dosing accuracy, and hygiene benefits offered by prefilled dental carpules, which support efficient and pain-minimized treatment outcomes

- This widespread adoption is further supported by high healthcare expenditure, strong presence of leading dental product manufacturers, and growing patient demand for comfortable and high-quality dental care, positioning dental carpules as a preferred anesthesia delivery solution across hospitals and dental clinics

U.S. Dental Carpule Market Insight

The U.S. dental carpule market captured the largest revenue share within North America in 2025, driven by high volumes of dental procedures and widespread adoption of advanced anesthetic delivery solutions. Dental professionals increasingly prioritize patient comfort, safety, and dosing accuracy through the use of prefilled carpules. The growing prevalence of cosmetic, pediatric, and geriatric dentistry further supports market growth. In addition, strong reimbursement structures and continuous innovation in anesthetic formulations are accelerating adoption. The presence of leading dental manufacturers and well-established clinical protocols continues to reinforce market expansion.

Europe Dental Carpule Market Insight

The Europe dental carpule market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and a strong emphasis on patient safety. Increasing awareness of oral health and rising demand for standardized anesthesia delivery are fostering market growth. European dental practices favor carpules for their hygiene benefits and reduced risk of cross-contamination. Growth is evident across hospitals, private clinics, and academic dental institutions. The integration of modern dental technologies in both new and renovated facilities further supports adoption across the region.

U.K. Dental Carpule Market Insight

The U.K. dental carpule market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing dental visits and rising demand for pain-free treatment experiences. Growing awareness of oral hygiene and preventive dental care is encouraging the use of standardized anesthetic solutions. Dental clinics are increasingly adopting prefilled carpules to improve workflow efficiency and patient safety. The country’s strong regulatory framework supports the use of high-quality, compliant dental consumables. In addition, the expansion of private dental clinics is contributing to sustained market growth.

Germany Dental Carpule Market Insight

The Germany dental carpule market is expected to expand at a considerable CAGR during the forecast period, fueled by strong healthcare infrastructure and high standards of clinical practice. German dental professionals emphasize precision, safety, and quality, driving demand for reliable anesthetic carpules. The growing adoption of advanced dental equipment and digital dentistry solutions further supports market growth. Sustainability and product quality are key considerations influencing purchasing decisions. The rising number of complex and cosmetic dental procedures is also contributing to increased carpule usage.

Asia-Pacific Dental Carpule Market Insight

The Asia-Pacific dental carpule market is poised to grow at the fastest CAGR during the forecast period, driven by rapid urbanization, rising disposable incomes, and expanding access to dental care. Increasing awareness of oral health and the growing number of dental clinics are accelerating demand for safe anesthetic delivery solutions. Countries such as China, Japan, and India are witnessing strong growth in both public and private dental services. Government initiatives to improve healthcare access are further supporting market expansion. In addition, local manufacturing is improving affordability and availability of dental carpules across the region.

Japan Dental Carpule Market Insight

The Japan dental carpule market is gaining momentum due to the country’s advanced healthcare system and strong focus on patient safety. The growing elderly population is increasing demand for dental procedures that require precise and gentle anesthesia. Japanese dental practices emphasize efficiency and hygiene, supporting the adoption of prefilled carpules. Integration of modern dental technologies and minimally invasive procedures is further driving market growth. In addition, high standards of clinical compliance encourage consistent use of quality anesthetic products.

India Dental Carpule Market Insight

The India dental carpule market accounted for a significant revenue share in Asia Pacific in 2025, supported by rapid urbanization and growing awareness of oral healthcare. The expansion of dental clinics and increasing affordability of dental treatments are driving adoption. Rising demand for cosmetic and restorative dentistry is further boosting the use of anesthetic carpules. Government initiatives to strengthen healthcare infrastructure are positively influencing market growth. Moreover, the presence of domestic manufacturers offering cost-effective carpules is improving accessibility across urban and semi-urban regions.

Dental Carpule Market Share

The Dental Carpule industry is primarily led by well-established companies, including:

- Septodont (France)

- Dentsply Sirona (U.S.)

- Pierrel Pharma (Italy)

- Inibsa (Spain)

- Nipro Corporation (Japan)

- Aspen Pharmacare Holdings Limited (South Africa)

- Hikma Pharmaceuticals PLC (U.K.)

- B. Braun SE (Germany)

- Milestone Scientific Inc. (U.S.)

- Ultradent Products, Inc. (U.S.)

- Patterson Dental Supply, Inc. (U.S.)

- Henry Schein, Inc. (U.S.)

- Kulzer GmbH (Germany)

- Cook-Waite Laboratories, Inc. (U.S.)

- ProDentUSA (U.S.)

- Vista Dental Products, LLC (U.S.)

- Primex Pharmaceuticals, Inc. (U.S.)

- Medispark Healthcare LLP (India)

- Pascal International, Inc. (U.S.)

- Centrix, Inc. (U.S.)

What are the Recent Developments in Global Dental Carpule Market?

- In January 2025, Septodont Inc. and Premier Dental announced the launch of BufferPro™, an 8.4% sodium bicarbonate buffering solution designed to be used with dental anesthetic cartridges to raise the pH of anesthetic solutions in a simple one-step process. The product innovation enables dentists to buffer local anesthetic carpules quickly and predictably with a sterile, single-use capsule that dispenses 0.1 mL of sodium bicarbonate directly into the anesthetic cartridge, improving patient comfort by reducing injection discomfort and speeding onset of anesthesia

- In December 2024, Septodont announced a strategic investment in U.S.-based Balanced Pharma to support the development of next-generation dental anesthetic formulations. The investment focused on improving patient comfort, reducing adverse reactions, and optimizing anesthetic efficacy when delivered through standard dental carpules

- In October 2024, Septodont finalized the acquisition of a 51% majority stake in Inibsa, strengthening its leadership position in the global dental anesthetics and carpule market. The acquisition enabled Septodont to broaden its injectable anesthetic portfolio and deepen its presence in key international markets

- In September 2024, Septodont and Acteon announced a joint agreement to become shareholders of Inibsa, a global pharmaceutical group specializing in dental anesthetics and injectable solutions. This collaboration aimed to accelerate innovation, manufacturing scalability, and international distribution of dental carpules and injectable anesthetic products

- In August 2023, 3M completed the sale of its dental local anesthetic portfolio assets to Pierrel S.p.A., including well-known injectable anesthetic brands such as Ubistesin™, Xylestesin™, and Mepivastesin™. This strategic divestment marked 3M’s exit from the dental anesthesia segment and allowed the company to sharpen its focus on core healthcare technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.