Global Dental Cement Market

Market Size in USD Billion

CAGR :

%

USD

2.00 Billion

USD

3.98 Billion

2024

2032

USD

2.00 Billion

USD

3.98 Billion

2024

2032

| 2025 –2032 | |

| USD 2.00 Billion | |

| USD 3.98 Billion | |

|

|

|

|

Dental Cement Market Size

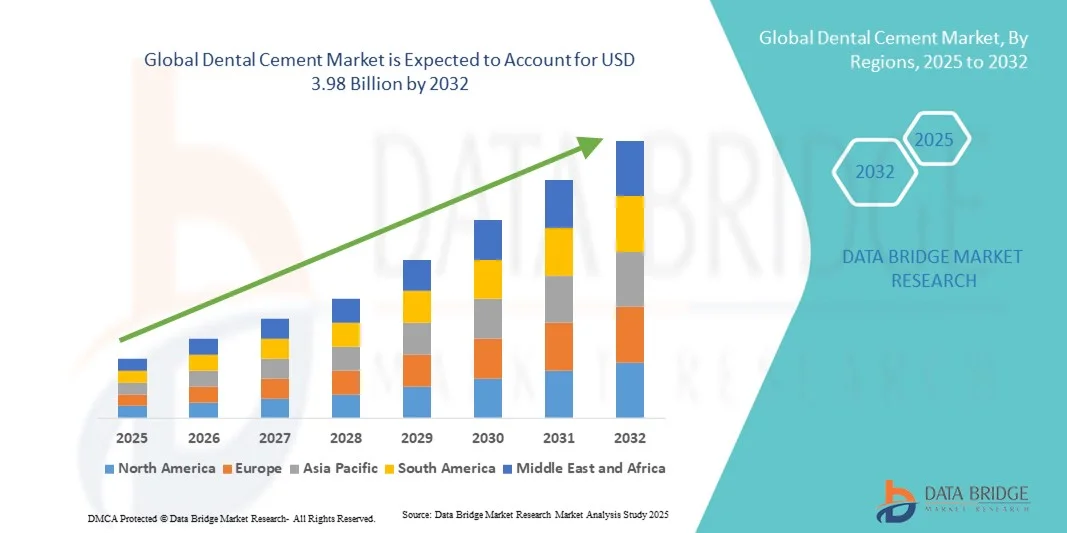

- The global Dental Cement market size was valued at USD 2.00 billion in 2024 and is expected to reach USD 3.98 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth of the global dental cement market is largely fueled by the increasing prevalence of dental procedures, growing awareness regarding oral health, and rising demand for restorative and preventive dental treatments. Technological advancements in dental cement formulations, including enhanced biocompatibility, improved adhesion properties, and longer durability, are significantly contributing to market expansion

- Furthermore, the rising adoption of cosmetic dentistry and minimally invasive dental procedures is boosting the use of advanced dental cements across both clinical and hospital settings. Increasing investments in dental clinics and hospital infrastructure, especially in emerging economies, are expanding access to high-quality dental care, thereby driving the demand for permanent and temporary dental cement solutions

Dental Cement Market Analysis

- Dental cement, used in restorative and prosthetic dentistry, is increasingly vital in both clinical and hospital settings due to its enhanced durability, adhesion properties, and compatibility with modern dental procedures

- The escalating demand for dental cement is primarily fueled by the growing awareness of oral health, rising adoption of advanced dental materials such as bioactive and resin-modified cements, and a preference for long-lasting, high-performance solutions in restorative dentistry

- North America dominated the dental cement market with the largest revenue share of 38.5% in 2024, supported by high healthcare spending, advanced dental infrastructure, and the presence of leading manufacturers. The U.S. particularly saw strong adoption of bioactive and resin-based cements in restorative procedures, driven by technological innovation and favorable reimbursement policies

- Asia-Pacific is expected to be the fastest-growing region in the dental cement market during the forecast period, with a projected CAGR fueled by increasing urbanization, rising disposable incomes, expanding dental clinics, and growing awareness of oral health in countries such as China and India

- The permanent cement segment dominated the largest market revenue share of 62.5% in 2024, driven by its extensive application in long-term dental restorations such as crowns, bridges, inlays, and onlays

Report Scope and Dental Cement Market Segmentation

|

Attributes |

Dental Cement Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Cement Market Trends

Enhanced Convenience Through Advanced Formulations and Clinical Integration

- A significant and accelerating trend in the global dental cement market is the adoption of advanced formulations and integration with modern dental workflows. These innovations are significantly enhancing procedural efficiency, clinical outcomes, and patient comfort

- For instance, resin-modified glass ionomer cements now offer superior adhesion, fluoride release, and improved handling properties, enabling dentists to perform restorations with higher precision and durability. Similarly, bioactive cements can stimulate remineralization and promote long-term tooth integrity, providing a discreet yet highly effective Dental Cement solution

- Integration of dental cements with digital dentistry tools such as CAD/CAM systems and 3D-printed restorations enables accurate customization of restorations, reducing chair time and minimizing material wastage. Additionally, improved delivery systems, such as pre-dosed capsules or syringes, allow precise and consistent application, enhancing clinical outcomes

- The seamless integration of modern dental cements with restorative workflows facilitates centralized management of multiple restorative procedures. Through optimized formulations and standardized protocols, dental professionals can manage prosthodontic, endodontic, and preventive treatments efficiently, creating a unified and effective clinical experience

- This trend towards more intelligent, clinically optimized, and multifunctional cement systems is fundamentally reshaping expectations in restorative dentistry. Consequently, companies such as 3M and GC are developing advanced Dental Cement products with enhanced mechanical properties, bioactivity, and compatibility with digital workflows

- The demand for dental cements with superior handling, aesthetic properties, and clinical efficacy is growing rapidly across hospitals, clinics, and specialized dental laboratories, as dental professionals increasingly prioritize patient safety, procedural efficiency, and long-term restoration success

Dental Cement Market Dynamics

Driver

Growing Need Due to Rising Dental Procedures and Advanced Restorative Techniques

- The increasing prevalence of dental disorders and the rising number of restorative and aesthetic procedures are significant drivers for the heightened demand for advanced Dental Cement products

- For instance, in March 2023, GC Corporation launched an innovative bioactive restorative cement designed to promote remineralization while offering high mechanical strength and ease of handling. Such strategies by key companies are expected to drive the Dental Cement industry growth in the forecast period

- As clinicians seek materials that improve procedural outcomes and patient satisfaction, modern dental cements provide enhanced adhesion, color stability, and longevity compared to traditional options, offering a compelling upgrade for restorative practices

- Furthermore, the growing adoption of minimally invasive dentistry and aesthetic-focused treatments is making advanced cements an integral component of modern dental care, offering compatibility with veneers, crowns, inlays, and onlays

- The convenience of pre-dosed formulations, improved mechanical properties, and compatibility with a range of restorative applications are key factors propelling the adoption of Dental Cement across hospitals, dental clinics, and laboratories. The trend towards integration with digital dentistry solutions and the increasing availability of user-friendly options further contribute to market growth

Restraint/Challenge

Concerns Regarding Material Costs and Technical Handling Requirements

- The relatively high cost of advanced dental cement products compared to conventional materials poses a significant challenge for broader market penetration, particularly in price-sensitive regions or smaller dental practices

- In addition, some high-performance cements require precise handling techniques and adherence to specific curing protocols, which may limit adoption among less experienced practitioners

- For instance, some bioactive cements require accurate moisture control and mixing procedures, and failure to follow these steps can compromise the material’s bonding strength or longevity, discouraging adoption among general practitioners

- Addressing these challenges through education, training programs, and the development of simplified, user-friendly cement formulations is crucial for building clinician confidence. Companies such as 3M, GC, and Ivoclar Vivadent emphasize providing instructional resources, workshops, and clinical support to ensure optimal usage

- While material prices are gradually decreasing, the perceived premium for advanced formulations can still hinder adoption, especially for practices that do not perform high volumes of restorative procedures

- Overcoming these challenges through cost-effective product innovations, clinician education, and demonstration of long-term clinical benefits will be vital for sustained growth in the Dental Cement market

Dental Cement Market Scope

The market is segmented on the basis of product, material, and end-user.

- By Product

On the basis of product, the Dental Cement market is segmented into temporary and permanent cements. The permanent cement segment dominated the largest market revenue share of 62.5% in 2024, driven by its extensive application in long-term dental restorations such as crowns, bridges, inlays, and onlays. Permanent cements provide durable adhesion, superior mechanical strength, and resistance to oral conditions, making them the preferred choice for both dental clinics and hospitals. Increasing demand for restorative dental procedures, coupled with rising patient awareness about oral aesthetics and longevity, further fuels adoption. Technological improvements in resin-based permanent cements, enhanced biocompatibility, and reduced post-operative sensitivity have strengthened market presence. Growing dental insurance coverage, rising per capita dental spending, and the expanding geriatric population also support segment dominance. The ease of integration with modern adhesive systems and compatibility with multiple substrate types reinforce its leadership.

The temporary cement segment is expected to witness the fastest CAGR of 18.3% from 2025 to 2032, driven by its growing use in short-term restorative procedures, provisional crowns, and orthodontic applications. Temporary cements allow easy removal and repositioning, which is ideal for staged dental treatments. Increasing adoption in pediatric dentistry and orthodontics, where provisional solutions are frequently required, supports rapid growth. Technological advancements in non-eugenol and resin-based temporary cements improve patient comfort and clinical outcomes. Rising dental clinic numbers, increased dental awareness, and the need for efficient interim solutions further propel this segment. Furthermore, ease of handling, cost-effectiveness, and integration with modern dental workflows enhance market traction globally.

- By Material

On the basis of material, the Dental Cement market is segmented into glass ionomers, zinc oxide eugenol, zinc phosphate, polycarboxylate, composite resins, and others. The glass ionomer segment held the largest market revenue share of 41.7% in 2024, owing to its excellent fluoride release, strong adhesion to enamel and dentin, and biocompatibility. Glass ionomer cements are widely preferred for permanent restorations, luting of crowns and bridges, and restorative fillings, particularly in pediatric and geriatric dentistry. The combination of antibacterial properties, minimal shrinkage, and ease of use has driven widespread adoption. Increasing preference among dental professionals for tooth-friendly, long-lasting materials further supports market dominance. Rising demand in both developed and emerging economies, coupled with continuous product innovations and improved handling characteristics, ensures sustained growth of the segment.

The composite resin segment is anticipated to witness the fastest CAGR of 19.6% from 2025 to 2032, fueled by increasing aesthetic dentistry trends and patient preference for tooth-colored restorative materials. Composite resins offer superior esthetics, high strength, and compatibility with modern adhesive systems. Growing demand in cosmetic dentistry, including anterior restorations, veneers, and inlays, supports expansion. Technological advancements in nanocomposites, enhanced bonding agents, and improved polishability further drive adoption. The increasing number of dental clinics offering aesthetic treatments, along with awareness campaigns on smile enhancement, also contribute to strong market growth. Rising disposable income and dental insurance coverage in urban areas enhance the segment’s rapid adoption globally.

- By End-User

On the basis of end-user, the Dental Cement market is segmented into hospitals, dental clinics, dental ambulatory surgical centers, and dental research and academic centers. The dental clinics segment dominated the largest market revenue share of 54.2% in 2024, driven by the growing number of private dental practices, rising patient footfall, and increasing demand for restorative and cosmetic dental procedures. Clinics provide quick, convenient, and accessible solutions for both temporary and permanent restorations. The segment benefits from rising awareness of oral health, expanding insurance coverage, and a preference for aesthetic and functional dental solutions. Advancements in chair-side procedures and minimally invasive dentistry further enhance adoption. Urbanization, higher per capita income, and increasing dental tourism also support the dominance of this end-user segment.

The hospitals segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, driven by rising adoption of dental cements in multi-specialty hospitals, institutional dental departments, and government healthcare programs. Hospitals increasingly utilize advanced cements for complex restorative, surgical, and prosthodontic procedures requiring high precision and longevity. Growing investment in hospital-based dental care infrastructure, increased training for dental surgeons, and incorporation of innovative cements for both temporary and permanent applications contribute to segment growth. The segment also benefits from patient preference for integrated healthcare services that offer convenience, affordability, and high-quality restorative treatments.

Dental Cement Market Regional Analysis

- North America dominated the dental cement market with the largest revenue share of 38.5% in 2024

- Supported by high healthcare spending, advanced dental infrastructure, and the presence of leading manufacturers

- The market particularly saw strong adoption of bioactive and resin-based cements in restorative procedures, driven by technological innovation, increasing clinical adoption, and favorable reimbursement policies

U.S. Dental Cement Market Insight

The U.S. dental cement market captured the largest revenue share within North America in 2024, fueled by the rising prevalence of dental disorders, growing demand for cosmetic and restorative dentistry, and the availability of advanced resin-based and bioactive cement formulations. High-quality clinical infrastructure and emphasis on patient-centric treatments are further driving market expansion.

Europe Dental Cement Market Insight

The Europe dental cement market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing investments in dental healthcare, awareness of advanced restorative materials, and growing adoption in hospitals, dental clinics, and research centers. Regulatory support for quality dental materials and rising demand for minimally invasive procedures are further propelling growth.

U.K. Dental Cement Market Insight

The U.K. dental cement market is expected to grow at a noteworthy CAGR during the forecast period, driven by rising dental awareness, increasing cosmetic dentistry procedures, and strong clinical infrastructure. Government initiatives promoting oral health and the increasing adoption of resin-based and bioactive cements are contributing to market expansion.

Germany Dental Cement Market Insight

The Germany dental cement market is anticipated to expand at a considerable CAGR during the forecast period, fueled by increased dental research, awareness of advanced restorative techniques, and demand for eco-conscious, technologically improved cement materials. Hospitals, clinics, and research centers are adopting high-performance cements to meet evolving clinical standards.

Asia-Pacific Dental Cement Market Insight

The Asia-Pacific dental cement market is expected to be the fastest-growing region during the forecast period, driven by increasing urbanization, rising disposable incomes, expanding dental clinics, and growing awareness of oral health in countries such as China and India. The adoption of both temporary and permanent dental cements is expanding across hospitals, clinics, and academic centers, supported by advancements in material technology and manufacturing capabilities.

Japan Dental Cement Market Insight

The Japan dental cement market is gaining momentum due to the country’s high-tech dental environment, increasing focus on aesthetic restorations, and growing investment in dental research and education. Adoption of bioactive and resin-based cements in hospitals and clinics is accelerating market growth.

China Dental Cement Market Insight

The China dental cement market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the expanding middle-class population, rising prevalence of dental disorders, and increasing investment in advanced dental material manufacturing. Growing hospital and clinic infrastructure and increasing awareness of oral health are driving adoption of diverse dental cement materials, including glass ionomers, composite resins, and zinc-based formulations.

Dental Cement Market Share

The Dental Cement industry is primarily led by well-established companies, including:

- 3M ESPE (U.S.)

- Dentsply Sirona (U.S.)

- GC Corporation (Japan)

- Kuraray Noritake Dental Inc. (Japan)

- SDI Limited (Australia)

- VOCO GmbH (Germany)

- Septodont (France)

- Tokuyama Dental Corporation (Japan)

- Kerr Corporation (U.S.)

- Coltene Holding AG (Switzerland)

- Sun Medical Co., Ltd. (Japan)

- Heraeus Kulzer GmbH (Germany)

- Dental Technologies Inc. (U.S.)

- Shofu Inc. (Japan)

Latest Developments in Global Dental Cement Market

- In September 2022, Kerr Dental relaunched its Nexus RMGI resin‑modified glass ionomer luting cement, introducing the innovative Smart Response Ion technology designed to actively combat secondary caries. This advanced formulation enhances the cement’s ability to release fluoride ions in response to acidic conditions, strengthening the surrounding enamel and dentin. The material also offers improved adhesion to both enamel and dentin, providing durable, long-lasting cementation for crowns, bridges, inlays, and onlays. Its optimized handling properties allow dental professionals to achieve precise placement with minimal waste, while maintaining consistent working and setting times.

- In July 2024, SDI Limited launched its “Riva Cem Automix” resin‑modified glass‑ionomer cement with ionglass technology, designed for permanent cementation of zirconia and porcelain restorations while offering improved bond strength and better esthetics

- In April 2025, a materials science study on glass‑ionomer cements illustrated enhanced fluoride release and improved biological properties in newer formulations, reinforcing the push toward bioactive dental cements that aid in enamel remineralisation and microbial balance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.