Global Dental Composite Materials Market

Market Size in USD Billion

CAGR :

%

USD

970.20 Billion

USD

2,156.55 Billion

2025

2033

USD

970.20 Billion

USD

2,156.55 Billion

2025

2033

| 2026 –2033 | |

| USD 970.20 Billion | |

| USD 2,156.55 Billion | |

|

|

|

|

Dental Composite Materials Market Size

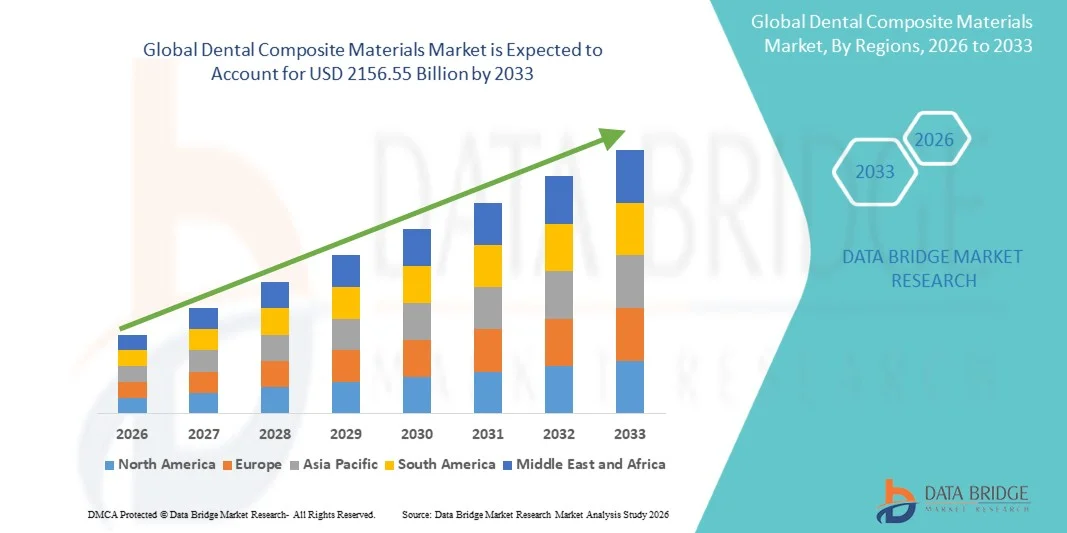

- The global dental composite materials market size was valued at USD 970.20 billion in 2025 and is expected to reach USD 2156.55 billion by 2033, at a CAGR of 10.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced restorative dentistry solutions and continuous innovations in dental materials, which are enhancing durability, aesthetics, and clinical performance in both cosmetic and therapeutic dental procedures. Growing digitalization in dental clinics—such as the use of CAD/CAM systems and digital impression technologies—is further supporting the rapid uptake of modern composite materials across global dental practices

- Furthermore, rising patient demand for natural-looking, minimally invasive, and long-lasting dental restorations is positioning dental composite materials as a preferred solution among dentists and patients alike. These converging factors are accelerating the use of Dental Composite Materials solutions in restorative dentistry, thereby significantly boosting the industry's growth

Dental Composite Materials Market Analysis

- Dental composite materials, which are used for tooth restoration, cavity fillings, and cosmetic dental procedures, are increasingly vital components of modern dentistry due to their superior aesthetics, biocompatibility, and ability to mimic natural tooth structure. Their demand continues to grow as both patients and clinicians prefer minimally invasive, tooth-colored restorative solutions

- The escalating demand for dental composite materials is primarily fueled by the rising prevalence of dental caries, growing adoption of cosmetic dentistry, increasing dental tourism, and advancements in nanohybrid and bulk-fill composite technologies that offer enhanced strength, polishability, and durability

- North America dominated the dental composite materials market with the largest revenue share of approximately 41.25% in 2025, supported by high dental care expenditure, a strong presence of leading dental material manufacturers, and a growing preference for aesthetic restorative procedures

- Asia-Pacific is expected to be the fastest-growing region in the Dental Composite Materials market during the forecast period, driven by increasing dental disease burden, rising disposable incomes, expanding dental clinics, and significant growth in dental tourism across India, China, Thailand, and South Korea

- The restorative dentistry segment dominated with 41.3% market share in 2025, fueled by rising dental caries prevalence, increasing routine dental check-ups, and adoption of minimally invasive techniques

Report Scope and Dental Composite Materials Market Segmentation

|

Attributes |

Dental Composite Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Composite Materials Market Trends

“Enhanced Convenience Through Advanced Material Innovation and Digital Dentistry Integration”

- A major and accelerating trend in the global dental composite materials market is the adoption of advanced nano-hybrid and nano-ceramic composite formulations that offer superior aesthetics, strength, and polish retention compared to conventional composites. This trend is transforming restorative procedures by providing dentists with more durable and visually appealing options for direct and indirect restorations

- For instance, in 2025, 3M launched an updated nano-hybrid composite system featuring improved wear resistance and simplified shade-matching technology, allowing dentists to replicate natural tooth translucency more effectively and complete restorations more efficiently

- The integration of digital dentistry—such as CAD/CAM workflows—with composite materials is further enhancing precision, reducing chair time, and improving patient outcomes. Advanced flowable composites optimized for digital impression systems allow seamless blending with milling and 3D printing technologies

- Minimally invasive dentistry is also driving the adoption of high-quality composites, as modern formulations support micro-preparation, better bonding, and enamel preservation

- Manufacturers such as Dentsply Sirona and Ivoclar are focusing on resin matrices and filler technologies that provide superior handling, reduced shrinkage, and long-term color stability, aligning with growing patient demand for cosmetic and durable restorations

- The increasing preference for tooth-colored restorative materials over amalgam is accelerating the shift toward composite-based solutions globally

Dental Composite Materials Market Dynamics

Driver

“Growing Demand for Aesthetic Restorations and Minimally Invasive Procedures”

- The rising preference for natural-looking, aesthetic dental restorations is one of the most significant drivers of the Dental Composite Materials market. Patients increasingly opt for tooth-colored fillings and cosmetic enhancements that blend seamlessly with the natural dentition

- For instance, in April 2025, GC Corporation introduced a new universal composite optimized for both anterior and posterior restorations, designed to provide enhanced shade adaptation and long-term polish retention, supporting the growing aesthetic demands across global dental practices

- In addition, the shift towards minimally invasive procedures encourages the use of composites due to their strong bonding ability, enamel-preserving application, and versatility in both direct and indirect restoration

- Rising awareness of oral health, expanding dental tourism markets, and increased spending on cosmetic dentistry are propelling the adoption of advanced composite systems

- Furthermore, advancements in filler technology, polymerization methods, and improved handling properties are encouraging dental professionals to transition from amalgam and other restorative materials toward high-performance composite solutions

Restraint/Challenge

“High Cost of Advanced Composites and Concerns Over Polymerization Shrinkage”

- The relatively high cost of premium dental composite materials compared to traditional restorative options remains a key barrier, especially in price-sensitive or developing markets. Nano-ceramic and bioactive composites often come at a higher price point due to advanced manufacturing processes

- For instance, clinics in emerging regions frequently limit the use of high-end universal composites due to affordability constraints, opting for lower-cost alternatives that may compromise strength or aesthetics

- Polymerization shrinkage is another ongoing technical challenge associated with resin-based composites, which can lead to marginal gaps, postoperative sensitivity, and reduced restoration longevity if not properly managed

- Dentists must invest in compatible curing lights, adhesives, and handling protocols to minimize shrinkage, increasing overall treatment costs

- In addition, the technique-sensitive nature of composite placement requires skilled practitioners; improper layering, curing, or bonding may result in restoration failure, limiting adoption in clinics with limited training resources

- Overcoming these challenges will require continued innovation in low-shrinkage resin chemistry, improved clinician training, and more cost-effective composite technologies

Dental Composite Materials Market Scope

The market is segmented on the basis of type, filler type, application, and end-user.

• By Type

On the basis of type, the Dental Composite Materials market is segmented into microhybrid composites, nanohybrid composites, nanofilled composites, microfilled composites, flowable composites, bulk-fill composites, and others. The nanohybrid composites segment dominated the largest market revenue share of 38.5% in 2025, driven by their balanced combination of strength, polishability, and aesthetic appeal, making them ideal for anterior and posterior restorations. These composites are widely preferred in clinical settings due to high wear resistance and long-lasting performance. Manufacturers focus on improving filler loading and resin matrix properties to enhance mechanical strength and reduce polymerization shrinkage. Increasing adoption in dental clinics and hospitals further strengthens demand. Training programs and dental school curricula highlight nanohybrid composites, supporting clinician preference. Regulatory approvals and endorsements by dental associations encourage broader adoption. Continuous product innovations with enhanced esthetics drive revenue growth. The segment is expected to maintain a CAGR of 9.8% from 2026 to 2033.

The flowable composites segment is anticipated to witness the fastest CAGR of 12.4% from 2026 to 2033, fueled by rising demand for minimally invasive procedures and ease of handling in small cavities. Flowable composites offer superior adaptation to cavity walls, reduced voids, and versatility in preventive and restorative dentistry. Increasing patient preference for aesthetic and conservative restorations contributes to growth. Expansion of private dental clinics and increasing insurance coverage support market penetration. Pharmaceutical R&D investments in low-viscosity composites enhance clinical performance. Promotional campaigns and training workshops for dentists drive adoption. Enhanced curing depth and radiopacity properties boost popularity. Rising awareness about bulk-fill flowable composites for posterior restorations also fuels CAGR growth.

• By Filler Type

On the basis of filler type, the market is segmented into macrofilled, microfilled, nanofilled, hybrid filled, and others. The nanofilled segment dominated with 36.9% market share in 2025, due to superior polishability, esthetics, and mechanical performance. Nanofilled composites allow precise control over particle size distribution, enhancing translucency and natural tooth appearance. They are widely adopted in cosmetic dentistry for anterior restorations. Clinician preference is high owing to reduced polymerization shrinkage and excellent surface finish. Continuous innovation in nanoparticle technology supports consistent product quality. Regulatory approvals, high clinician trust, and growing dental school training programs contribute to dominance. Rising patient demand for esthetic restorations drives adoption. Nanofilled composites provide versatility across cavity classes and bonding systems, supporting market leadership. Enhanced durability and color stability make them suitable for long-term restorations.

The macrofilled segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, primarily driven by restorative dentistry in posterior teeth where strength is prioritized over esthetics. Macrofilled composites are preferred in high-stress load areas, and expanding dental insurance coverage supports adoption. New formulations with improved handling and reduced shrinkage enhance clinician interest. Cost-effectiveness encourages use in emerging markets. In addition, growing awareness among dentists about long-term durability benefits is boosting adoption. Research into hybrid macrofilled composites with improved polishability is further driving market growth.

• By Application

On the basis of application, the Dental Composite Materials market is segmented into restorative dentistry, cosmetic dentistry, dental bonding, dental bridges, and others. The restorative dentistry segment dominated with 41.3% market share in 2025, fueled by rising dental caries prevalence, increasing routine dental check-ups, and adoption of minimally invasive techniques. Dental composites are preferred for filling cavities due to adhesive properties, esthetic match, and durability. Awareness campaigns by dental associations and insurance coverage encourage restorative procedures. Clinical studies demonstrating improved longevity drive practitioner confidence. R&D investments by leading manufacturers focus on bulk-fill and low-shrinkage composites for restorations. Expansion of dental hospitals and clinics further supports market leadership. High patient preference for tooth-colored restorations sustains dominance.

The cosmetic dentistry segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, driven by growing demand for smile enhancement, tooth whitening, and veneer applications. Increasing disposable income, aesthetic awareness, and social media influence fuel cosmetic treatments. Manufacturers are innovating high-translucency and stain-resistant composites. Training programs for cosmetic dentistry enhance adoption rates. Collaborations between dental clinics and cosmetic product manufacturers support wider market penetration. Furthermore, advancements in minimally invasive techniques are boosting patient preference for cosmetic procedures, thereby increasing composite material usage.

• By End-User

On the basis of end-user, the market is segmented into dental hospitals & clinics, dental laboratories, academic & research institutes, and others. The dental hospitals & clinics segment dominated with 52.4% market share in 2025, due to higher patient footfall, complex restorative procedures, and preference for advanced composite solutions. Clinics adopt a wide range of composite types to address multiple dental indications. Government healthcare initiatives and insurance support increase patient access. High clinician expertise and preference for premium composite products drive revenue. Expansion of dental chains and increasing dental tourism in emerging regions strengthen this segment.

The dental laboratories segment is expected to witness the fastest CAGR of 12.5% from 2026 to 2033, fueled by growth in custom dental prosthetics, veneers, and CAD/CAM-based restorative solutions. Laboratory adoption of high-performance composites and growing collaboration with clinics enhance demand. Increasing investments in digital dentistry and 3D printing technologies are further driving the segment’s growth. Rising demand for personalized dental solutions from patients supports laboratory expansion. Regulatory approvals for advanced composite materials encourage adoption in lab settings. In addition, partnerships with dental education institutes for research and training contribute to market development.

Dental Composite Materials Market Regional Analysis

- North America dominated the dental composite materials market with the largest revenue share of approximately 41.25% in 2025, supported by high dental care expenditure, a strong presence of leading dental material manufacturers, and a growing preference for aesthetic restorative procedures

- Consumers in the region increasingly prioritize durable, tooth-colored restorative materials and minimally invasive dental solutions

- This widespread adoption is further reinforced by the availability of advanced dental technologies, growing awareness of cosmetic dentistry, and a robust network of dental clinics and hospitals

U.S. Dental Composite Materials Market Insight

The U.S. dental composite materials market captured the largest revenue share in North America, fueled by high demand for aesthetic restorative procedures and technological advancements in composite materials. Growing awareness of dental health, coupled with the increasing prevalence of dental caries and cosmetic procedures, is driving the market. Moreover, the rising adoption of bulk-fill and nanohybrid composites for efficiency and superior aesthetics contributes to market expansion.

Europe Dental Composite Materials Market Insight

The Europe dental composite materials market is projected to expand at a substantial CAGR throughout the forecast period, driven by high awareness of cosmetic dentistry, advanced dental care infrastructure, and stringent regulatory standards for dental materials. Increased investments in dental clinics and rising adoption of minimally invasive procedures further fuel market growth across countries such as Germany, France, and Italy.

U.K. Dental Composite Materials Market Insight

The U.K. dental composite materials market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising preference for cosmetic dental procedures and improved access to advanced restorative materials. Increasing dental tourism, enhanced dental care coverage, and the growing number of private dental clinics are expected to continue stimulating market growth.

Germany Dental Composite Materials Market Insight

The Germany dental composite materials market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced dental infrastructure, increased awareness of aesthetic and restorative procedures, and rising adoption of innovative composite technologies. Germany’s focus on quality dental care and sustainability supports the market’s expansion.

Asia-Pacific Dental Composite Materials Market Insight

The Asia-Pacific dental composite materials market is poised to grow at the fastest CAGR during the forecast period, driven by increasing dental disease burden, rising disposable incomes, and growth in dental tourism across India, China, Thailand, and South Korea. Expansion of dental clinics, urbanization, and rising awareness of cosmetic and restorative dentistry are key factors propelling market growth in the region.

Japan Dental Composite Materials Market Insight

The Japan dental composite materials market is growing due to a technologically advanced healthcare system, high adoption of cosmetic dental procedures, and increasing demand for minimally invasive restorative materials. The aging population also drives demand for long-lasting, high-quality dental composites in both restorative and preventive care.

China Dental Composite Materials Market Insight

The China dental composite materials market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing middle class, rising dental care awareness, and expansion of dental clinics. The increasing prevalence of dental caries and growing preference for cosmetic dentistry, combined with government initiatives to improve oral health, are key factors driving market growth.

Dental Composite Materials Market Share

The Dental Composite Materials industry is primarily led by well-established companies, including:

- Ivoclar Vivadent (Liechtenstein)

- Dentsply Sirona (U.S.)

- GC Corporation (Japan)

- Kuraray Noritake Dental (Japan)

- VOCO GmbH (Germany)

- Heraeus Kulzer (Germany)

- Tokuyama Dental Corporation (Japan)

- Septodont (France)

- COLTENE Holding AG (Switzerland)

- Shofu Dental Corporation (Japan)

- Ultradent Products, Inc. (U.S.)

- Voco Dental (Germany)

- DMG Dental-Material Gesellschaft (Germany)

- Kerr Corporation (U.S.)

- Dental Creations Pvt. Ltd. (India)

- Medicept Dental (U.S.)

- Cendres+Métaux SA (Switzerland)

Latest Developments in Global Dental Composite Materials Market

- In October 2023, DMG America unveiled its new Ecosite Elements nanohybrid universal composite shade system at a major dental meeting, making the product available digitally and commercially starting November 2023 — targeting aesthetic restorations and streamlined shade matching for dental professionals

- In December 2023, Kerr Dental launched SimpliShade Bulk Fill and SimpliShade Bulk Fill Flow, two innovative composite materials designed to simplify restorative procedures. These composites offer a one‑shade system that matches all 16 classical VITA shades, reducing the need for multiple shades and simplifying inventory and procedure workflows

- In August 2024, Mitsui Chemicals (in partnership with Shofu Dental and SUN MEDICAL CO., LTD.) launched the i‑TFC Luminous II dental material range — a new post‑and‑core composite system that uses a low‑polymerization‑shrinkage monomer, reducing shrinkage by about 28% compared with previous products and improving adhesion for restorations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.