Global Dental Connected Technology Solutions Market

Market Size in USD Billion

CAGR :

%

USD

8.06 Billion

USD

13.30 Billion

2024

2032

USD

8.06 Billion

USD

13.30 Billion

2024

2032

| 2025 –2032 | |

| USD 8.06 Billion | |

| USD 13.30 Billion | |

|

|

|

|

Dental Connected Technology Solutions Market Size

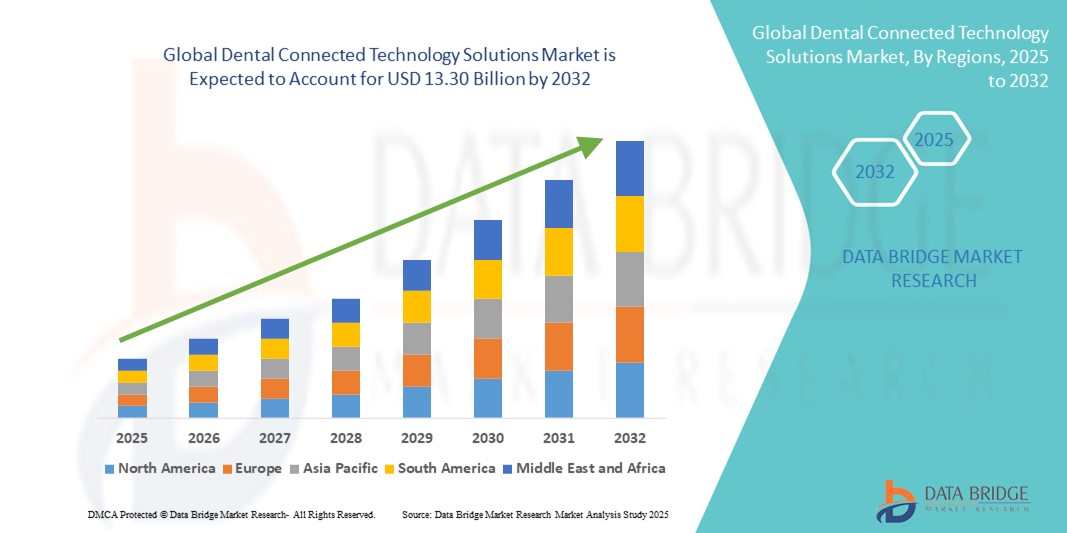

- The global dental connected technology solutions market size was valued at USD 8.06 billion in 2024 and is expected to reach USD 13.30 billion by 2032, at a CAGR of 6.45% during the forecast period

- The market growth is largely fueled by the increasing digital transformation in dental practices and the integration of advanced technologies such as AI, IoT, and cloud-based platforms, enhancing diagnostic precision and patient experience

- Furthermore, rising demand for real-time data access, remote consultations, and streamlined workflow management is positioning dental connected solutions as a critical component of modern dental care. These synergistic trends are accelerating market adoption and driving robust industry growth

Dental Connected Technology Solutions Market Analysis

- Dental connected technology solutions, encompassing digital imaging systems, cloud-based practice management platforms, and smart diagnostic tools, are becoming essential in modern dental practices due to their ability to streamline workflows, enhance diagnostic accuracy, and improve patient engagement through real-time data access and remote capabilities

- The surging demand for these solutions is primarily driven by the rising adoption of digital dentistry, growing patient expectations for advanced care delivery, and the increasing emphasis on interoperability and data integration across dental systems

- North America dominated the dental connected technology solutions market with the largest revenue share of 39.5% in 2024, supported by advanced healthcare infrastructure, high patient awareness, and early adoption of digital solutions, particularly in the U.S., where integration of AI-powered imaging, teledentistry, and EHR platforms is accelerating practice modernization

- Asia-Pacific is expected to be the fastest growing region in the dental connected technology market during the forecast period due to the expansion of private dental clinics, increasing healthcare digitization initiatives, and growing demand for quality dental care

- The dental imaging systems segment dominated the dental connected technology solutions market with a market share of 41.8% in 2024, attributed to its critical role in accurate diagnostics, treatment planning, and integration with other digital systems

Report Scope and Dental Connected Technology Solutions Market Segmentation

|

Attributes |

Dental Connected Technology Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Connected Technology Solutions Market Trends

Increased Integration of AI, IoT, and Cloud-Based Platforms

- A significant and accelerating trend in the global dental connected technology solutions market is the increasing integration of artificial intelligence (AI), Internet of Things (IoT), and cloud computing within dental workflows. This fusion is transforming dental practices by improving diagnostic accuracy, enhancing patient outcomes, and streamlining practice management

- For instance, solutions such as DEXIS™ IS Cloud and Planmeca Romexis® allow for secure, cloud-based image storage and seamless data sharing between practitioners, enabling collaborative diagnosis and treatment planning. Similarly, Henry Schein One’s AI-powered practice management platforms offer predictive analytics for patient scheduling and financial forecasting

- AI algorithms are increasingly being used in dental imaging to automatically detect caries, bone loss, and other oral conditions. Solutions such as Pearl’s Second Opinion® use AI to analyze radiographs with clinical precision, assisting dentists in making faster and more informed decisions

- Cloud-based systems also enable real-time synchronization between devices such as intraoral scanners, imaging software, and electronic health records (EHRs), allowing dental professionals to access patient data remotely and securely. This interoperability not only improves workflow efficiency but also facilitates teledentistry and virtual consultations

- The growing demand for patient-centric care is also pushing developers to incorporate mobile and wearable tech integration, allowing patients to view treatment plans, receive post-operative care instructions, or even monitor oral hygiene digitally

- This trend toward more intelligent, connected, and remote-capable dental technology solutions is redefining clinical workflows and patient engagement, leading to an increased demand for comprehensive digital ecosystems within the dental industry

- As a result, companies such as Carestream Dental, Dentsply Sirona, and Align Technology are intensifying efforts to provide all-in-one platforms that combine AI-driven diagnostics, cloud access, and connected device interoperability

Dental Connected Technology Solutions Market Dynamics

Driver

Digital Dentistry Boom and Demand for Real-Time, Data-Driven Care

- The global shift toward digital healthcare, particularly in dentistry, is a key driver fueling the demand for dental connected technology solutions. Practices are increasingly seeking ways to digitize operations, improve patient outcomes, and remain competitive through the adoption of smart systems

- For instance, in January 2024, Align Technology announced enhancements to its iTero intraoral scanner and Invisalign systems, integrating AI-powered chairside visualization tools and cloud connectivity for improved treatment planning. These types of innovations are setting new standards for digital dental workflows

- Patients today expect faster, more accurate, and more transparent care delivery. Dental connected technologies, such as AI-based diagnostic software, 3D imaging systems, and cloud-enabled patient portals, meet this need by offering real-time insights, improved communication, and tailored treatment recommendations

- In addition, government initiatives and increasing investments in healthcare digitization across both developed and emerging markets are expanding infrastructure capabilities for dental clinics to adopt connected technology solutions

- The ability to integrate with EHRs, automate appointment scheduling, and conduct virtual consultations is making these platforms indispensable in modern dental practices, especially in urban and high-volume clinics

Restraint/Challenge

Cybersecurity Risks and Cost-Intensive Integration

- One of the major challenges facing the widespread adoption of dental connected technology solutions is concern over data security and privacy. Since these solutions involve cloud storage and network-connected devices, they are vulnerable to cyber threats, including unauthorized access to sensitive patient health information

- High-profile data breaches in healthcare IT systems have raised awareness and concern among both providers and patients

- For instance, in 2023, a ransomware attack on a U.S.-based dental service organization affected over 120 affiliated practices, leading to weeks-long service disruptions and exposure of patient data. This incident highlighted the sector's vulnerability and the pressing need for more robust cybersecurity protocols

- Compliance with stringent regulations such as HIPAA in the U.S. and GDPR in Europe adds further complexity for dental practices and solution providers

- Addressing these issues requires the implementation of robust cybersecurity protocols, including end-to-end encryption, multi-factor authentication, and regular software updates—measures that can be resource-intensive for smaller clinics

- In addition, the upfront costs for integrating advanced systems such as AI-based imaging, cloud platforms, and EHR interoperability can be prohibitively high, especially for independent dental offices in emerging economies. The lack of skilled IT personnel in dental settings further complicates system maintenance and optimization

- Although the long-term return on investment is promising, the initial complexity and financial burden of adopting dental connected technology solutions remain significant barriers to mass adoption. Overcoming these obstacles will require industry-wide collaboration, vendor support, and targeted financial incentives for practitioners

Dental Connected Technology Solutions Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the dental connected technology solutions market is segmented into dental imaging systems, dental practice management software, dental CAD/CAM systems, dental lasers, dental sensors, and other connected dental devices. The dental imaging systems segment dominated the market with the largest market revenue share of 41.8% in 2024, attributed to its critical role in diagnostics and treatment planning. These systems, which include digital X-rays, CBCT, and intraoral cameras, enable precise visualization of oral structures and are increasingly integrated with AI to enhance diagnostic accuracy. Their widespread use in dental clinics and diagnostic centers, coupled with advancements in image resolution and cloud-based storage, supports their leading position.

The dental practice management software segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, driven by the growing need for automation and efficiency in administrative workflows. These platforms streamline appointment scheduling, billing, patient communication, and EHR integration, supporting both solo practices and large dental chains. The shift towards cloud-based and AI-powered solutions is accelerating adoption across diverse practice sizes.

- By Application

On the basis of application, the dental connected technology solutions market is segmented into diagnostics, restorative dentistry, periodontics, endodontics, and oral surgery. The diagnostics segment accounted for the largest share in 2024, driven by the growing reliance on digital imaging, intraoral scanners, and AI-based interpretation tools. Digital diagnostics are increasingly essential for early disease detection, treatment planning, and patient education, especially in high-throughput dental practices.

The restorative dentistry segment is projected to grow at the fastest pace over the forecast period, supported by the rising demand for same-day restorations and CAD/CAM integration. Technologies that allow chairside production of crowns, bridges, and veneers are transforming restorative workflows and enhancing patient satisfaction.

- By End User

On the basis of end user, the dental connected technology solutions market is segmented into dental hospitals and clinics, dental laboratories, dental academic and research institutes, dental practices and dental chains, and others. The dental hospitals and clinics segment held the largest market share in 2024 due to the high patient volume, faster adoption of advanced technologies, and availability of funds for equipment upgrades. These settings often serve as early adopters of connected systems for diagnostics and treatment coordination.

The dental practices and dental chains segment is expected to register the highest growth rate through 2032, propelled by the expanding presence of multi-location practices, growing demand for scalable cloud-based solutions, and increased investments in digital transformation. Chain practices are leveraging AI and analytics to optimize patient experience, standardize care protocols, and drive operational efficiency.

Dental Connected Technology Solutions Market Regional Analysis

- North America dominated the dental connected technology solutions market with the largest revenue share of 39.5% in 2024, supported by advanced healthcare infrastructure, high patient awareness, and early adoption of digital solutions, particularly in the U.S., where integration of AI-powered imaging, teledentistry, and EHR platforms is accelerating practice modernization

- Dental professionals in the region are increasingly adopting connected solutions such as AI-powered imaging systems, cloud-based practice management platforms, and digital diagnostic tools to enhance clinical efficiency and improve treatment outcomes

- This adoption is further fueled by supportive regulatory frameworks, high levels of healthcare spending, and strong vendor presence offering integrated digital dental ecosystems. The demand for remote access, real-time diagnostics, and interoperability is also accelerating the shift toward fully connected dental practices across the U.S. and Canada, making the region a leader in dental technology innovation and implementation

U.S. Dental Connected Technology Solutions Market Insight

The U.S. dental connected technology solutions market captured the largest revenue share of 82% in 2024 within North America, fueled by the rapid digitization of dental practices and a strong emphasis on advanced, patient-centric care. The widespread use of AI-powered imaging systems, cloud-based EHRs, and remote diagnostic tools is driving adoption. A tech-savvy population and favorable healthcare IT policies further support market expansion. In addition, the demand for integrated platforms that connect diagnostics, treatment planning, and patient communication is accelerating the growth of connected solutions in both private clinics and large dental chains.

Europe Dental Connected Technology Solutions Market Insight

The Europe dental connected technology solutions market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased investments in dental digitalization and a focus on enhancing diagnostic precision and operational efficiency. The adoption of CAD/CAM systems, cloud-based practice management software, and AI-assisted imaging is gaining traction across the region. Strict data protection regulations, such as GDPR, are prompting demand for secure, interoperable platforms. Countries such as France, Spain, and the Nordics are increasingly modernizing dental clinics, supporting regional market growth.

U.K. Dental Connected Technology Solutions Market Insight

The U.K. dental connected technology solutions market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by growing adoption of digital health records, teledentistry, and AI-supported diagnostics. Increasing patient awareness, combined with National Health Service (NHS) digitization initiatives, is fostering market growth. In addition, dental practitioners are seeking integrated platforms to manage both clinical and administrative tasks, leading to rising demand for cloud-based and interoperable dental software systems.

Germany Dental Connected Technology Solutions Market Insight

The Germany dental connected technology solutions market is expected to expand at a considerable CAGR during the forecast period, propelled by the country’s leadership in healthcare innovation and commitment to high standards of care. German dental practices are actively adopting digital imaging systems, chairside CAD/CAM units, and integrated diagnostic tools. The emphasis on data privacy, combined with increasing use of AI and IoT in dental workflows, supports the growing demand for secure, efficient, and connected solutions in the country’s dental sector.

Asia-Pacific Dental Connected Technology Solutions Market Insight

The Asia-Pacific dental connected technology solutions market is poised to grow at the fastest CAGR of 23.1% from 2025 to 2032, driven by expanding dental infrastructure, rising awareness of oral healthcare, and increased digital investment in countries such as China, India, and Japan. Government-backed digitization programs and growing private sector involvement are fostering rapid adoption. Cloud-based systems and AI-powered tools are becoming more accessible, enabling clinics to upgrade diagnostic and patient management capabilities affordably.

Japan Dental Connected Technology Solutions Market Insight

The Japan dental connected technology solutions market is gaining momentum due to its advanced healthcare ecosystem, aging population, and strong focus on technological innovation. High demand for minimally invasive, digitally guided procedures is driving the use of intraoral scanners, AI diagnostics, and automated treatment planning systems. Integration with mobile platforms and EHRs is further accelerating the transition to fully connected dental practices.

India Dental Connected Technology Solutions Market Insight

The India dental connected technology solutions market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by the rapid expansion of private dental clinics, rising income levels, and increasing digital adoption in healthcare. Growing demand for affordable, AI-powered imaging and cloud-based practice management tools is driving the shift toward connected dentistry. Government initiatives promoting digital health, coupled with the presence of emerging local tech providers, are positioning India as a key growth hub for dental technology solutions.

Dental Connected Technology Solutions Market Share

The dental connected technology Solutions industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Planmeca Oy (Finland)

- Carestream Dental (U.S.)

- 3M (U.S.)

- Ivoclar Vivadent (Switzerland)

- Henry Schein (U.S.)

- Open Dental (U.S.)

- Eaglesoft (U.S.)

- Oral-B (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- SmileDirectClub (U.S.)

- Align Technology (U.S.)

- Straumann Group (Switzerland)

- Midmark Corporation (U.S.)

- KaVo Kerr (U.S.)

- Vatech Co., Ltd. (South Korea)

- Pearl Inc. (U.S.)

- Apteryx Imaging Inc. (Canada)

- DentalMonitoring SAS (France)

- Dexis (U.S.)

What are the Recent Developments in Global Dental Connected Technology Solutions Market?

- In April 2023, Align Technology, Inc. expanded its iTero digital ecosystem by integrating AI-powered features for real-time intraoral scanning and enhanced chairside visualization. The updates include improved cloud connectivity and predictive treatment simulations, aimed at improving diagnostic precision and patient engagement. This move highlights Align's commitment to driving innovation in digital dentistry and enhancing practitioner capabilities through connected solutions

- In March 2023, Dentsply Sirona introduced the latest version of its DS Core cloud platform, enabling seamless integration of imaging, diagnostics, and CAD/CAM workflows across devices and practices. The new iteration supports real-time collaboration and secure data exchange between dental professionals, boosting clinical efficiency and case accuracy. The launch reflects the company’s ongoing strategy to lead the transformation toward fully digital, connected dental ecosystems

- In March 2023, Henry Schein One announced a strategic partnership with Planmeca to integrate its Dentrix practice management software with Planmeca’s imaging and CAD/CAM systems. This collaboration aims to streamline data flow between software platforms, enabling unified case management and simplifying complex workflows for dental clinics. The initiative underscores the growing emphasis on interoperability in dental connected technologies

- In February 2023, Vatech Co., Ltd. launched its EzRay Air i series, an IoT-enabled intraoral X-ray system designed to offer high-quality imaging with wireless connectivity and cloud integration. The system enables faster diagnostics and enhanced mobility in clinics. This development demonstrates Vatech’s focus on delivering smart, efficient, and portable dental imaging solutions tailored for modern practices

- In January 2023, Pearl, an AI dental software company, received FDA clearance for its Second Opinion® AI platform, which aids in the detection of dental conditions in radiographs. This milestone represents a major step toward the mainstream adoption of AI in diagnostic dentistry and reinforces the importance of intelligent software integration in enhancing diagnostic accuracy and treatment planning in connected dental environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.