Global Dental Fluoropolymers Market

Market Size in USD Million

CAGR :

%

USD

91.20 Million

USD

234.00 Million

2024

2032

USD

91.20 Million

USD

234.00 Million

2024

2032

| 2025 –2032 | |

| USD 91.20 Million | |

| USD 234.00 Million | |

|

|

|

|

Dental Fluoropolymers Market Size

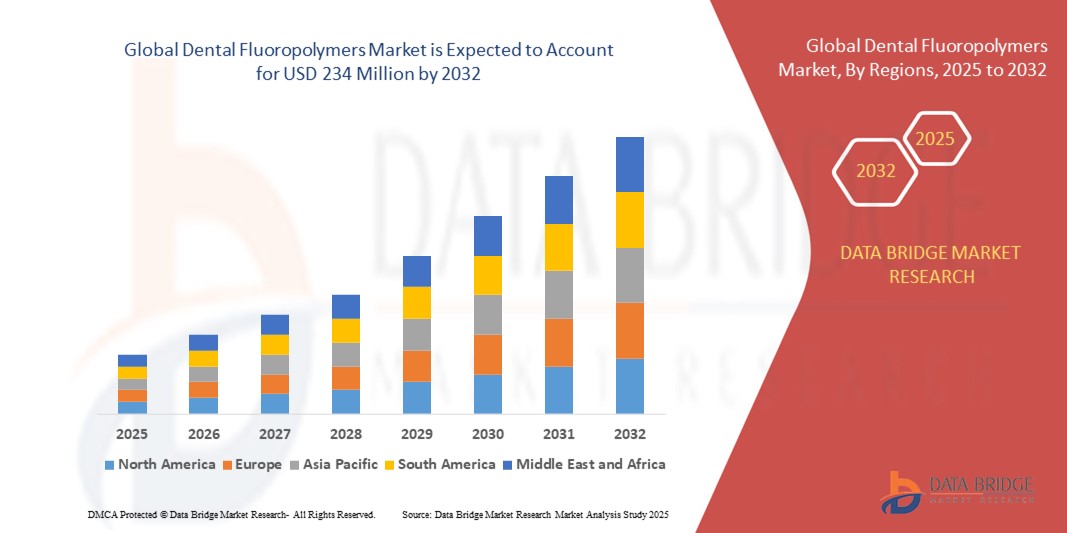

- The global dental fluoropolymers market size was valued at USD 91.2 million in 2024 and is expected to reach USD 234 million by 2032, at a CAGR of 12.5% during the forecast period

- The market growth is largely fueled by the increasing demand for advanced dental materials with enhanced durability, chemical resistance, and biocompatibility. Rising adoption of dental coatings and sealants, along with growing awareness of oral health and preventive dentistry, is further driving the market

- In addition, the expansion of dental clinics, rising geriatric population, and technological advancements in dental materials are contributing to market growth

Dental Fluoropolymers Market Analysis

- The global dental fluoropolymers market is experiencing strong growth due to increasing demand for durable, chemically resistant, and biocompatible dental materials

- Rising awareness of oral health and preventive dentistry is driving higher adoption of dental fluoropolymers in coatings and sealants

- North America dominated the dental fluoropolymers market with the largest revenue share of 38% in 2024, driven by the growing demand for advanced dental materials, increasing dental procedures, and high adoption of preventive and restorative dentistry

- Asia-Pacific region is expected to witness the highest growth rate in the global dental fluoropolymers market, driven by rising oral health awareness, government initiatives promoting dental care, increasing adoption of advanced materials, and growing investments in dental infrastructure across countries such as China, Japan, and India

- The PTFE segment held the largest market revenue share in 2024, driven by its excellent chemical resistance, low friction properties, and widespread use in dental coatings, sealants, and restorative applications. PTFE-based materials offer superior durability and biocompatibility, making them highly preferred by dental professionals for both preventive and restorative procedures

Report Scope and Dental Fluoropolymers Market Segmentation

|

Attributes |

Dental Fluoropolymers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Fluoropolymers Market Trends

Increasing Adoption of Advanced Dental Coatings and Sealants

- The growing use of advanced dental coatings and sealants is transforming restorative and preventive dentistry by enhancing material durability and chemical resistance. These fluoropolymer-based solutions allow for longer-lasting restorations and improved patient comfort, reducing repair frequency and treatment costs

- Rising demand for high-performance dental materials in both private clinics and hospital settings is accelerating the adoption of fluoropolymer coatings, especially where aesthetic and biocompatible solutions are critical. These materials are increasingly preferred for preventive care, orthodontics, and restorative procedures

- The affordability, ease of application, and versatility of modern dental fluoropolymers are making them attractive for routine dental treatments, leading to improved patient outcomes and material longevity. Dental professionals benefit from enhanced workflow efficiency and reduced procedural complications

- For instance, in 2023, several dental clinics in North America and Europe reported improved restoration lifespan and patient satisfaction after integrating PTFE-based coatings and sealants into routine dental procedures. These applications minimized surface wear, reduced plaque adhesion, and enhanced overall oral health outcomes

- While dental fluoropolymers are enhancing dental treatment efficacy, their impact depends on continuous innovation, practitioner training, and material availability. Manufacturers must focus on user-friendly formulations and cost-effective solutions to maximize market penetration

Dental Fluoropolymers Market Dynamics

Driver

Rising Awareness of Oral Health and Demand for Durable Dental Materials

- Growing awareness of oral health and preventive care is encouraging dental professionals and patients to adopt fluoropolymer-based coatings and sealants. These materials offer chemical resistance, low friction, and biocompatibility, making them ideal for restorative dentistry

- Patients and dental practitioners increasingly recognize the cost benefits of durable restorations, including reduced rework, fewer complications, and improved aesthetics. This awareness is driving higher demand for advanced dental materials even among mid-sized dental clinics

- Institutional support, including dental associations and academic programs, is promoting the use of modern dental materials and strengthening practitioner knowledge of fluoropolymers. Training initiatives, clinical guidelines, and research collaborations are boosting adoption rates

- For instance, in 2022, several European dental schools integrated fluoropolymer-based materials into clinical training programs, resulting in wider practitioner familiarity and uptake across associated clinics

- While awareness and professional support are boosting adoption, challenges such as cost, material accessibility, and practitioner training still need to be addressed to ensure widespread and consistent use

Restraint/Challenge

High Cost of Advanced Dental Fluoropolymers and Limited Accessibility

- The high price of advanced dental fluoropolymers, such as PTFE and PFA coatings, restricts their use in smaller dental practices and underfunded clinics. These premium materials are often limited to high-end or research-focused institutions

- In many regions, dental professionals require specialized training to apply and maintain fluoropolymer-based coatings effectively. Lack of technical expertise and supporting infrastructure reduces adoption in emerging markets

- Supply chain limitations, particularly for high-performance fluoropolymers, create inconsistencies in availability, impacting smaller clinics and rural dental centers. This can lead to reliance on conventional, less durable materials

- For instance, in 2023, surveys in Southeast Asia indicated that over 65% of mid-sized clinics had limited access to fluoropolymer dental materials due to cost and supply chain constraints

- While product innovation continues, overcoming cost, accessibility, and training challenges remains critical. Stakeholders must focus on affordable, scalable solutions and practitioner education to unlock long-term market growth

Dental Fluoropolymers Market Scope

The market is segmented on the basis of product and form.

- By Product

On the basis of product, the dental fluoropolymers market is segmented into Polytetrafluoroethylene (PTFE), Polyvinylidene Fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), Polyvinylfluoride (PVF), and Others. The PTFE segment held the largest market revenue share in 2024, driven by its excellent chemical resistance, low friction properties, and widespread use in dental coatings, sealants, and restorative applications. PTFE-based materials offer superior durability and biocompatibility, making them highly preferred by dental professionals for both preventive and restorative procedures.

The PVDF segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its excellent mechanical strength, flexibility, and thermal stability. PVDF is increasingly used in advanced dental applications where high-performance coatings and precision restorations are required. Its growing adoption is also supported by rising demand for innovative, long-lasting dental materials in clinics and hospitals worldwide.

- By Form

On the basis of form, the market is segmented into Films & Sheets, Rods & Tubes, Powders & Granules, Coatings, and Others. The coatings segment dominated the market in 2024, owing to its ease of application, versatility in dental procedures, and ability to improve restoration longevity.

Films & Sheets and Rods & Tubes are expected to witness the fastest growth rate from 2025 to 2032, driven by their increasing use in specialized dental applications. These forms provide consistent quality, precise dimensions, and superior mechanical performance, making them ideal for advanced restorative and orthodontic procedures. Their versatility and reliability are encouraging wider adoption among dental professionals globally.

Dental Fluoropolymers Market Regional Analysis

- North America dominated the dental fluoropolymers market with the largest revenue share of 38% in 2024, driven by the growing demand for advanced dental materials, increasing dental procedures, and high adoption of preventive and restorative dentistry

- Dental professionals in the region highly value the durability, chemical resistance, and biocompatibility offered by fluoropolymer-based coatings and sealants, supporting widespread adoption

- This growth is further strengthened by well-established dental infrastructure, high disposable incomes, and a technologically advanced population, making dental fluoropolymers a preferred choice for both clinics and hospitals

U.S. Dental Fluoropolymers Market Insight

The U.S. dental fluoropolymers market captured the largest revenue share in North America in 2024, fueled by the increasing use of PTFE, PVDF, and other high-performance materials in restorative and preventive dental procedures. Rising awareness of oral health, adoption of minimally invasive dentistry, and growing patient preference for long-lasting dental materials are driving market expansion. The availability of technologically advanced dental clinics and ongoing R&D in material innovation further propels the industry.

Europe Dental Fluoropolymers Market Insight

The Europe dental fluoropolymers market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent dental material standards, rising dental healthcare spending, and growing adoption of high-performance coatings and sealants. European dental professionals are increasingly integrating fluoropolymer materials to improve restoration longevity, reduce procedural complications, and enhance patient satisfaction. The region is witnessing growth across private clinics, hospitals, and research institutes.

U.K. Dental Fluoropolymers Market Insight

The U.K. dental fluoropolymers market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing focus on preventive dentistry and rising patient demand for biocompatible, long-lasting dental materials. The adoption of PTFE- and PVDF-based coatings and sealants is being encouraged by dental associations and research initiatives. In addition, growing investments in dental clinics and modernization of dental procedures continue to support market expansion.

Germany Dental Fluoropolymers Market Insight

The Germany dental fluoropolymers market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing awareness of advanced dental materials, technological adoption in restorative dentistry, and high-quality dental infrastructure. Germany’s emphasis on innovation and sustainable materials promotes the use of fluoropolymers in coatings, sealants, and other dental applications. Dental professionals are also integrating these materials with modern dental procedures to enhance treatment outcomes.

Asia-Pacific Dental Fluoropolymers Market Insight

The Asia-Pacific dental fluoropolymers market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising awareness of oral health, growing dental service infrastructure, and increasing adoption of high-performance dental materials in countries such as China, Japan, and India. Government initiatives promoting dental health, coupled with rising disposable incomes and urbanization, are supporting market growth. The availability of affordable fluoropolymer materials and increasing number of dental clinics are further boosting adoption.

Japan Dental Fluoropolymers Market Insight

The Japan dental fluoropolymers market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced dental care infrastructure, high awareness of oral health, and adoption of preventive dentistry. Fluoropolymer-based coatings and sealants are increasingly used in restorative and orthodontic procedures to improve longevity and patient comfort. Rising demand for biocompatible, easy-to-use dental materials is expected to drive growth across clinics and hospitals.

China Dental Fluoropolymers Market Insight

The China dental fluoropolymers market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, increasing dental healthcare spending, and a growing number of dental clinics. The adoption of PTFE, PVDF, and FEP materials in restorative dentistry is rising due to their durability, chemical resistance, and low maintenance. Government support for oral health initiatives and increasing awareness of high-performance dental materials are further propelling market growth.

Dental Fluoropolymers Market Share

The Dental Fluoropolymers industry is primarily led by well-established companies, including:

- Daikin Industries (Japan)

- 3M Company (U.S.)

- Solvay S.A. (Belgium)

- Arkema Group (France)

- Chemours Company (U.S.)

- AGC Inc. (Japan)

- Dyneon (U.S.)

- Fluoropolymers Ltd. (U.K.)

- Kureha Corporation (Japan)

- Daesang Corporation (South Korea)

Latest Developments in Global Dental Fluoropolymers Market

- In 2023, Chemours launched a new generation of highly pure PTFE resins designed for use in implantable medical devices. The development enabled over 28 original equipment manufacturers (OEMs) across Europe and the U.S. to access advanced materials for safer and more reliable medical applications, strengthening Chemours’ presence in the medical-grade fluoropolymers market

- In August 2023, Kureha Group announced an expansion of PVDF production at its Iwaki Plant in Fukushima, Japan. This initiative addresses rising global demand for PVDF, which is used as an adhesive in lithium-ion batteries and as a versatile processing polymer across industries. The expansion is expected to enhance Kureha’s supply capabilities and support growth in both industrial and energy-related markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dental Fluoropolymers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dental Fluoropolymers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dental Fluoropolymers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.