Global Dental Imaging System Market

Market Size in USD Billion

CAGR :

%

USD

3.53 Billion

USD

6.54 Billion

2024

2032

USD

3.53 Billion

USD

6.54 Billion

2024

2032

| 2025 –2032 | |

| USD 3.53 Billion | |

| USD 6.54 Billion | |

|

|

|

|

Dental Imaging System Market Size

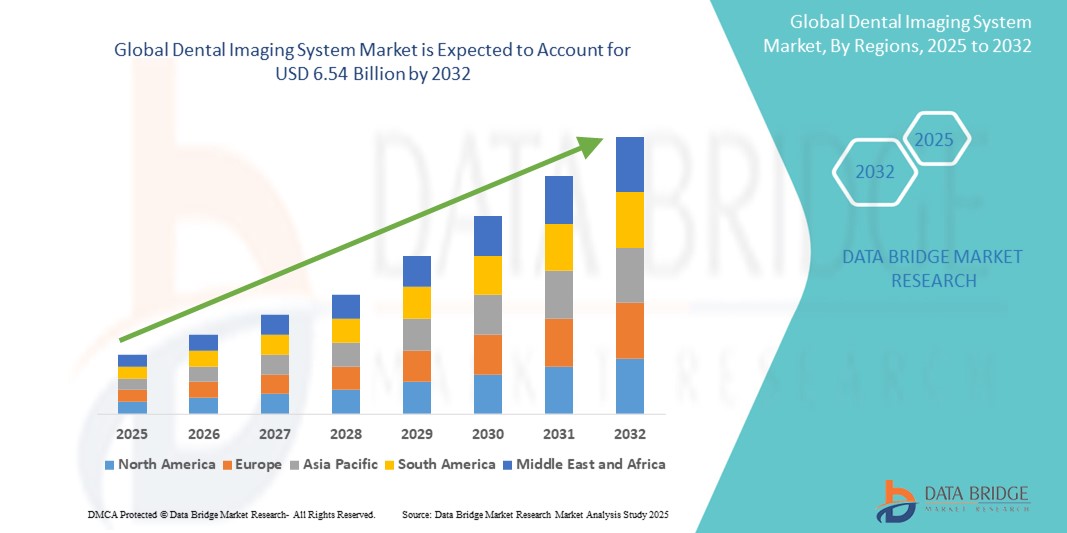

- The global dental imaging system market size was valued at USD 3.53 billion in 2024 and is expected to reach USD 6.54 billion by 2032, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of dental disorders and the rising demand for advanced diagnostic tools in dental care, driven by innovations in 3D and digital imaging technologies

- Furthermore, the growing emphasis on early diagnosis, minimally invasive procedures, and the integration of AI in imaging software is enhancing accuracy and efficiency in dental practices. These converging factors are accelerating the adoption of dental imaging systems, thereby significantly boosting the industry's growth

Dental Imaging System Market Analysis

- Dental imaging systems, enabling the visualization of teeth, bones, and surrounding tissues, are increasingly vital tools in modern dental diagnostics and treatment planning due to their ability to deliver high-resolution, accurate, and non-invasive imaging solutions for both general dentistry and specialized procedures

- The escalating demand for dental imaging systems is primarily fueled by the rising prevalence of oral health issues, growing awareness about preventive dental care, and technological advancements such as 3D imaging, cone-beam computed tomography (CBCT), and AI-assisted diagnostics

- North America dominated the dental imaging system market with the largest revenue share of 37.5% in 2024, driven by a well-established dental infrastructure, high patient awareness, and rapid adoption of advanced diagnostic technologies in the U.S. and Canada, with a notable rise in cosmetic dentistry further supporting market expansion

- Asia-Pacific is expected to be the fastest growing region in the dental imaging system market during the forecast period due to increasing dental tourism, improving healthcare infrastructure, and a rising number of dental clinics and professionals

- The intraoral imaging systems segment dominated the dental imaging system market with a market share of 42.4% in 2024, driven by its widespread use in routine dental check-ups, cost-effectiveness, and continued innovations improving diagnostic accuracy and workflow efficiency

Report Scope and Dental Imaging System Market Segmentation

|

Attributes |

Dental Imaging System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Imaging System Market Trends

“Enhanced Diagnostic Precision Through AI and Digital Integration”

- A significant and accelerating trend in the global dental imaging system market is the deeper integration of artificial intelligence (AI) and advanced digital platforms into imaging software and hardware. This convergence is transforming diagnostic workflows, enhancing accuracy, and significantly improving clinical decision-making in dental care

- For instance, AI-powered platforms such as Pearl’s Second Opinion and VideaHealth’s solutions are being integrated into intraoral and panoramic imaging systems, allowing real-time identification of dental pathologies such as caries, bone loss, and lesions with a high degree of accuracy

- AI integration in dental imaging systems enables features such as automated diagnostics, workflow optimization, and predictive treatment planning. Some CBCT and intraoral systems now include AI-based image enhancement that improves contrast and resolution, facilitating better evaluation by clinicians and minimizing diagnostic errors

- Seamless integration with cloud-based dental software platforms is also rising, allowing practitioners to access and share patient images securely across multiple devices and locations, improving collaboration and continuity of care

- This trend toward intelligent, interoperable, and AI-enabled imaging solutions is fundamentally reshaping expectations in dental diagnostics. Consequently, leading players such as Dentsply Sirona and Planmeca are developing AI-enhanced systems with cloud compatibility, automated reporting, and real-time clinical support

- The demand for dental imaging systems that offer AI-driven accuracy and digital workflow compatibility is rapidly growing across general dentistry, orthodontics, and implantology, as dental professionals prioritize efficiency, accuracy, and patient-centered care

Dental Imaging System Market Dynamics

Driver

“Increased Demand Due to Rising Dental Disorders and Cosmetic Dentistry”

- The growing global burden of dental diseases such as caries, periodontal issues, and edentulism, alongside the surge in aesthetic dental procedures, is a key driver fueling demand for advanced dental imaging systems

- For instance, the WHO reports that over 3.5 billion people suffer from oral diseases globally, reinforcing the need for early diagnosis and efficient treatment planning—both of which are enabled by modern imaging technologies such as CBCT and digital X-rays

- As patient awareness of oral health rises and governments invest in preventive care initiatives, dental practitioners are increasingly adopting imaging systems that offer detailed visualization and lower radiation exposure

- Furthermore, the rise in cosmetic and restorative procedures—such as veneers, implants, and orthodontics—requires precision planning, pushing the demand for high-resolution 3D imaging and software integration tools

- The shift toward digital dentistry, including the use of CAD/CAM systems, is also boosting the adoption of compatible dental imaging equipment that supports efficient and accurate treatment workflows

Restraint/Challenge

“High Equipment Cost and Data Privacy Concerns”

- The relatively high cost of acquiring and maintaining advanced dental imaging systems, especially CBCT and panoramic devices, presents a major barrier to adoption, particularly among small and mid-sized dental clinics in price-sensitive regions

- For instance, the initial investment for a CBCT unit can range from USD 50,000 to over USD 150,000, which may deter adoption despite long-term diagnostic benefits

- In addition, concerns about patient data privacy and compliance with regulations such as HIPAA and GDPR are mounting, as digital dental records and imaging systems increasingly rely on cloud connectivity and data sharing

- Addressing these concerns through robust data encryption, regular software updates, and adherence to international compliance standards is essential for building trust among both dental professionals and patients

- Moreover, the shortage of trained professionals capable of operating and interpreting high-tech imaging systems poses an operational challenge, especially in rural and underdeveloped region

- Overcoming these challenges through cost-effective equipment offerings, simplified user interfaces, secure data practices, and continuous training programs will be critical for expanding the global dental imaging system market

Dental Imaging System Market Scope

The market is segmented on the basis of product, application, end-user, and imaging method.

- By Product

On the basis of product, the dental imaging system market is segmented into CBCT, intraoral X-ray systems, intraoral cameras, and intraoral scanners. The CBCT segment dominated the market with the largest market revenue share in 2024, driven by its ability to provide 3D visualization with high precision, making it essential for complex dental procedures such as implantology, orthodontics, and endodontics. Dentists increasingly prefer CBCT due to its enhanced diagnostic capabilities, lower radiation dose compared to traditional CT, and its integration with digital treatment planning software.

The intraoral scanners segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing shift toward digital dentistry. Intraoral scanners enhance patient comfort, eliminate the need for physical impressions, and improve accuracy for restorations and orthodontic treatments. The rise in cosmetic dentistry, CAD/CAM integration, and chairside solutions are also driving rapid adoption among dental professionals globally.

- By Application

On the basis of application, the dental imaging system market is segmented into oral and maxillofacial surgery, implantology, orthodontics, endodontics, and others. The implantology segment dominated the market in 2024 with the largest revenue share, due to the increasing number of dental implant procedures and the critical need for accurate imaging to assess bone density, nerve positioning, and implant placement.

The oral and maxillofacial surgery segment is expected to witness the fastest growth rate during the forecast period, driven by the growing prevalence of jaw disorders, trauma cases, and impacted tooth extractions. Advanced imaging such as CBCT and panoramic X-rays play a vital role in preoperative planning and post-surgical evaluations, enhancing precision and patient outcomes.

- By End User

On the basis of end-user, the dental imaging system market is segmented into dental hospitals & clinics, dental diagnostic centers, and academic & research institutes. The dental hospitals & clinics segment dominated the market with the largest revenue share in 2024, supported by high patient volume, increasing adoption of advanced imaging technologies, and the growing number of multi-specialty dental clinics offering comprehensive diagnostic and treatment services.

The dental diagnostic centers segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for outsourced imaging services, cost-effectiveness, and the ability to offer high-end technologies such as CBCT without the need for dental clinics to invest in expensive equipment. The expansion of standalone diagnostic chains in urban and semi-urban areas is further boosting segment growth.

- By Imaging Method

On the basis of imaging method, the dental imaging system market is segmented into extraoral imaging and intraoral imaging. The intraoral imaging segment dominated the market with the largest revenue share of 42.4% in 2024, owing to its routine application in general dentistry, cost-effectiveness, and high resolution for detecting early-stage caries, periodontal disease, and periapical lesions.

The extraoral imaging segment is anticipated to witness the fastest growth rate during the forecast period, supported by rising adoption of panoramic, cephalometric, and CBCT systems in complex cases involving orthodontics, oral surgery, and temporomandibular joint disorders. The demand for comprehensive 2D and 3D visualizations for surgical planning and treatment monitoring is driving this growth.

Dental Imaging System Market Regional Analysis

- North America dominated the dental imaging system market with the largest revenue share of 37.5% in 2024, driven by a well-established dental infrastructure, high patient awareness, and rapid adoption of advanced diagnostic technologies in the U.S. and Canada, with a notable rise in cosmetic dentistry further supporting market expansion

- Consumers and dental practitioners in North America place strong emphasis on early diagnosis, minimally invasive treatments, and technological integration, which has accelerated the uptake of digital imaging systems such as CBCT and intraoral scanners

- This high adoption rate is further supported by favorable reimbursement policies, a robust network of dental service organizations (DSOs), and increasing demand for cosmetic and restorative dental procedures, making North America a leading market for dental imaging innovations in both clinical and academic settings

U.S. Dental Imaging System Market Insight

The U.S. dental imaging system market captured the largest revenue share of 79% in 2024 within North America, fueled by the widespread adoption of advanced dental technologies and the growing prevalence of dental disorders. Dental professionals are increasingly investing in high-precision imaging solutions such as CBCT and digital X-rays to enhance diagnostic accuracy and treatment planning. The rise of group dental practices, favorable reimbursement policies, and strong integration of AI-based diagnostic tools are further accelerating market growth. In addition, a focus on cosmetic dentistry and preventive care supports ongoing demand for innovative imaging solutions.

Europe Dental Imaging System Market Insight

The Europe dental imaging system market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising number of dental clinics, increasing awareness of oral health, and early adoption of digital technologies. Government-backed oral health initiatives, a growing elderly population, and the region’s commitment to innovation are promoting the use of advanced imaging systems. European countries are also seeing strong growth in aesthetic and restorative dental procedures, leading to rising demand for accurate and efficient imaging tools across both public and private dental settings.

U.K. Dental Imaging System Market Insight

The U.K. dental imaging system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increased demand for early diagnostic tools and minimally invasive treatments. The adoption of CBCT and intraoral scanning technologies is gaining traction among dental practitioners due to their clinical accuracy and improved patient experience. In addition, public awareness campaigns and NHS-backed dental programs are supporting market expansion by making advanced imaging more accessible across the country.

Germany Dental Imaging System Market Insight

The Germany dental imaging system market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s advanced healthcare infrastructure and strong presence of key dental equipment manufacturers. Germany’s focus on precision medicine, high healthcare spending, and growing popularity of cosmetic dentistry are contributing to increased investments in CBCT, panoramic, and digital intraoral imaging technologies. Moreover, compliance with stringent radiation safety regulations is encouraging the shift toward modern low-dose imaging systems.

Asia-Pacific Dental Imaging System Market Insight

The Asia-Pacific dental imaging system market is poised to grow at the fastest CAGR of 10.2% during the forecast period of 2025 to 2032, driven by improving dental healthcare infrastructure, increased dental tourism, and growing awareness about oral health. Countries such as China, Japan, and India are investing in digital dentistry, with an increasing number of clinics adopting advanced imaging technologies. Government-led health reforms, a surge in dental school enrollments, and expanding middle-class populations are significantly boosting demand for efficient diagnostic imaging systems across the region.

Japan Dental Imaging System Market Insight

The Japan dental imaging system market is gaining momentum due to its advanced technological ecosystem, aging population, and high standards of dental care. Japanese dental practices are widely adopting digital imaging systems to enhance diagnostic capabilities and streamline workflows. Integration with AI diagnostic platforms and the preference for minimally invasive treatments are driving the adoption of intraoral scanners and CBCT. The country's innovation-led approach and aging society’s demand for precision dental care contribute to steady market expansion.

India Dental Imaging System Market Insight

The India dental imaging system market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the nation’s growing dental tourism, rapid urbanization, and increasing investments in private dental infrastructure. Rising awareness of oral hygiene, an expanding middle-class population, and the adoption of digital technologies in Tier 1 and Tier 2 cities are driving the demand for intraoral imaging and panoramic systems. In addition, local manufacturing of cost-effective dental imaging equipment and supportive government initiatives under programs such as Ayushman Bharat are catalyzing industry growth.

Dental Imaging System Market Share

The dental imaging system industry is primarily led by well-established companies, including:

- Dentsply Sirona Inc. (U.S.)

- Carestream Dental LLC (U.S.)

- Planmeca Oy (Finland)

- Vatech Co., Ltd. (South Korea)

- Acteon Group (France)

- Midmark Corporation (U.S.)

- Danaher Corporation (U.S.)

- Owandy Radiology (France)

- Air Techniques, Inc. (U.S.)

- Asahi Roentgen Co., Ltd. (Japan)

- FONA Dental s.r.o. (Slovakia)

- J. MORITA CORP. (Japan)

- Genoray Co., Ltd. (South Korea)

- PreXion Corporation (U.S.)

- Ray Co., Ltd. (South Korea)

- Cefla S.C. (Italy)

- Trident S.r.l. (Italy)

- Duray Imaging LLC (U.S.)

- 3Shape A/S (Denmark)

- ImageWorks Corporation (U.S.)

What are the Recent Developments in Global Dental Imaging System Market?

- In May 2024, Planmeca Oy, a leading dental technology manufacturer based in Finland, launched the Planmeca ProX HD intraoral X-ray unit, designed to deliver sharper image quality with lower radiation doses. The new system supports advanced imaging software and integrates seamlessly with Planmeca’s Romexis platform, enhancing diagnostics and workflow efficiency. This launch reflects Planmeca’s ongoing commitment to advancing digital dentistry through precision, safety, and user-friendly innovation

- In March 2024, Dentsply Sirona partnered with Smile Train, the world’s largest cleft-focused organization, to expand access to advanced dental imaging in underserved regions. This initiative includes the deployment of portable digital imaging systems in remote clinics, enabling early diagnosis and treatment planning for children with cleft conditions. The collaboration underscores Dentsply Sirona’s commitment to social impact through technology and global oral health improvement

- In February 2024, Carestream Dental introduced its CS 8200 3D Neo Edition, an upgraded CBCT imaging system featuring enhanced diagnostic capabilities and improved AI integration. The system offers multiple fields of view and is tailored for implantology, orthodontics, and endodontics. This development highlights Carestream Dental’s focus on innovation, precision imaging, and expanding its portfolio of AI-assisted tools for modern dental practices

- In January 2024, Acteon Group announced the launch of its X-Mind Prime 3D, a compact and versatile CBCT system offering both panoramic and 3D capabilities in a space-saving design. Engineered for high-resolution diagnostics in general dentistry and implant planning, the system enhances Acteon’s competitive positioning in compact imaging technologies. This launch supports Acteon’s strategy of democratizing access to advanced imaging through user-friendly and cost-effective solutions

- In December 2023, Vatech Co., Ltd., a South Korean imaging specialist, unveiled its EzRay Air P intraoral sensor, built with advanced CMOS technology to deliver high-quality images with minimal radiation. Targeted at general dental practices, the device also includes wireless data transfer capabilities and real-time image display. This innovation reinforces Vatech’s leadership in efficient, low-dose digital imaging tailored to diverse clinical needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DENTAL IMAGING SYSTEM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DENTAL IMAGING SYSTEM MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VOLUME DATA

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DENTAL IMAGING SYSTEM MARKET : RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8 COST ANALYSIS BREAKDOWN

9 TECHNONLOGY ROADMAP

10 INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 MERGERS AND ACQUISITIONS

10.8 FUTURE OUTLOOK

11 REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR GLOBAL DENTAL IMAGING SYSTEM MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

12 REIMBURSEMENT FRAMEWORK

13 OPPUTUNITY MAP ANALYSIS

14 VALUE CHAIN ANALYSIS

15 HEALTHCARE ECONOMY

15.1 HEALTHCARE EXPENDITURE

15.2 CAPITAL EXPENDITURE

15.3 CAPEX TRENDS

15.4 CAPEX ALLOCATION

15.5 FUNDING SOURCES

15.6 INDUSTRY BENCHMARKS

15.7 GDP RATION IN OVERALL GDP

15.8 HEALTHCARE SYSTEM STRUCTURE

15.9 GOVERNMENT POLICIES

15.1 ECONOMIC DEVELOPMENT

16 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY PRODUCT TYPE

16.1 OVERVIEW

16.2 X-RAY SYSTEMS

16.2.1 DIGITAL X-RAY SYSTEM

16.2.1.1. INTRAORAL X-RAYS

16.2.1.1.1. BITE-WING X-RAYS

16.2.1.1.2. PERIAPICAL X-RAYS

16.2.1.1.3. OCCLUSAL X-RAYS

16.2.1.2. EXTRAORAL X-RAYS

16.2.1.2.1. PANORAMIC X-RAYS

16.2.1.2.2. TOMOGRAMS

16.2.1.2.3. CEPHALOMETRIC PROJECTIONS

16.2.1.2.4. SIALOGRAPHY

16.2.1.2.5. COMPUTED TOMOGRAPHY

16.2.2 HYBRID X-RAY SYSTEMS

16.2.3 ANALOG X-RAY SYSTEM

16.2.4 CONE BEAM COMPUTED TOMOGRAPHY (CBCT) SYSTEMS

16.2.5 BY TYPE

16.2.5.1. STANDARD CBCT SYSTEMS

16.2.5.2. PORTABLE/COMPACT CBCT SYSTEMS

16.2.6 BY FIELD OF VIEW

16.2.6.1. LARGE

16.2.6.2. MEDIUM

16.2.6.3. SMALL

16.2.7 BY PATIENT POSITION

16.2.7.1. STANDING

16.2.7.2. SEATED

16.2.7.3. SUPINE

16.3 INTRAORAL CAMERAS

16.3.1 WIRED CAMERAS

16.3.2 WIRELESS CAMERAS

16.4 INTRAORAL SCANNERS

16.4.1 2D INTRAORAL SCANNERS

16.4.2 3D INTRAORAL SCANNERS

16.5 OTHERS

17 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY TECHNOLOGY

17.1 OVERVIEW

17.2 DIGITAL IMAGING

17.3 ANALOG IMAGING

18 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY MODE

18.1 2D IMAGING

18.2 3D IMAGING

18.3 OTHERS

19 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY MODALITY

19.1 OVERVIEW

19.2 STATIONARY SYSTEMS

19.2.1 WALL-MOUNTED UNITS

19.2.2 STANDALONE SYSTEMS

19.3 PORTABLE

19.3.1 MOBILE

19.3.2 HANDHELD

20 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY USAGE

20.1 OVERVIEW

20.2 DIAGNOSTICS

20.3 THERAPEUTICS/SURGICAL

20.4 COSMETIC

20.5 OTHERS

21 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY APPLICATION

21.1 OVERVIEW

21.2 DENTAL IMPLANTS

21.3 ENDODONTICS

21.4 GENERAL DENTISTRY

21.5 ORAL AND MAXILLOFACIAL SURGERY

21.6 ORTHODONTICS

21.7 TEMPOROMANDIBULAR JOINT (TMJ) DISORDERS

21.8 PERIODONTICS

21.9 FORENSIC DENTISTRY

21.1 OTHERS

22 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY END USER

22.1 OVERVIEW

22.2 HOSPITALS

22.2.1 PUBLIC

22.2.2 PRIVATE

22.3 DENTAL CLINICS

22.3.1 INDEPENDENT CLINICS

22.3.2 CHAIN BASED CLINICS

22.4 DENTAL LABORATORIES

22.5 RESEARCH & ACADEMIC INSTITUTES

22.6 OTHERS

23 GLOBAL DENTAL IMAGING SYSTEM MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT TENDERS

23.3 RETAIL SALES

23.3.1 OFFLINE

23.3.2 ONLINE

23.4 OTHERS

24 GLOBAL DENTAL IMAGING SYSTEM MARKET , BY COUNTRY

25 GLOBAL DENTAL IMAGING SYSTEM MARKET , COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: GLOBAL

25.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

25.3 COMPANY SHARE ANALYSIS: EUROPE

25.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

25.5 MERGERS & ACQUISITIONS

25.6 NEW PRODUCT DEVELOPMENT & APPROVALS

25.7 EXPANSIONS

25.8 REGULATORY CHANGES

25.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26 GLOBAL DENTAL IMAGING SYSTEM MARKET , SWOT AND DBMR ANALYSIS

27 GLOBAL DENTAL IMAGING SYSTEM MARKET , COMPANY PROFILE

27.1 DENSTPLY SIRONA

27.1.1 COMPANY OVERVIEW

27.1.2 REVENUE ANALYSIS

27.1.3 GEOGRAPHIC PRESENCE

27.1.4 PRODUCT PORTFOLIO

27.1.5 RECENT DEVELOPMENTS

27.2 KAVO DENTAL (A SUBSIDIARY OF DANAHER)

27.2.1 COMPANY OVERVIEW

27.2.2 REVENUE ANALYSIS

27.2.3 GEOGRAPHIC PRESENCE

27.2.4 PRODUCT PORTFOLIO

27.2.5 RECENT DEVELOPMENTS

27.3 CARESTREAM HEALTH

27.3.1 COMPANY OVERVIEW

27.3.2 REVENUE ANALYSIS

27.3.3 GEOGRAPHIC PRESENCE

27.3.4 PRODUCT PORTFOLIO

27.3.5 RECENT DEVELOPMENTS

27.4 PLANMECA OY

27.4.1 COMPANY OVERVIEW

27.4.2 REVENUE ANALYSIS

27.4.3 GEOGRAPHIC PRESENCE

27.4.4 PRODUCT PORTFOLIO

27.4.5 RECENT DEVELOPMENTS

27.5 VATECH

27.5.1 COMPANY OVERVIEW

27.5.2 REVENUE ANALYSIS

27.5.3 GEOGRAPHIC PRESENCE

27.5.4 PRODUCT PORTFOLIO

27.5.5 RECENT DEVELOPMENTS

27.6 MIDMARK CORPORATION

27.6.1 COMPANY OVERVIEW

27.6.2 REVENUE ANALYSIS

27.6.3 GEOGRAPHIC PRESENCE

27.6.4 PRODUCT PORTFOLIO

27.6.5 RECENT DEVELOPMENTS

27.7 3SHAPE A/S

27.7.1 COMPANY OVERVIEW

27.7.2 REVENUE ANALYSIS

27.7.3 GEOGRAPHIC PRESENCE

27.7.4 PRODUCT PORTFOLIO

27.7.5 RECENT DEVELOPMENTS

27.8 ALIGN TECHNOLOGY, INC.

27.8.1 COMPANY OVERVIEW

27.8.2 REVENUE ANALYSIS

27.8.3 GEOGRAPHIC PRESENCE

27.8.4 PRODUCT PORTFOLIO

27.8.5 RECENT DEVELOPMENTS

27.9 ACTEON

27.9.1 COMPANY OVERVIEW

27.9.2 REVENUE ANALYSIS

27.9.3 GEOGRAPHIC PRESENCE

27.9.4 PRODUCT PORTFOLIO

27.9.5 RECENT DEVELOPMENTS

27.1 APTERYX IMAGING INC. ( PLANET DDS, INC.)

27.10.1 COMPANY OVERVIEW

27.10.2 REVENUE ANALYSIS

27.10.3 GEOGRAPHIC PRESENCE

27.10.4 PRODUCT PORTFOLIO

27.10.5 RECENT DEVELOPMENTS

27.11 AIR TECHNIQUES, INC.

27.11.1 COMPANY OVERVIEW

27.11.2 REVENUE ANALYSIS

27.11.3 GEOGRAPHIC PRESENCE

27.11.4 PRODUCT PORTFOLIO

27.11.5 RECENT DEVELOPMENTS

27.12 CEFLA S.C.

27.12.1 COMPANY OVERVIEW

27.12.2 REVENUE ANALYSIS

27.12.3 GEOGRAPHIC PRESENCE

27.12.4 PRODUCT PORTFOLIO

27.12.5 RECENT DEVELOPMENTS

27.13 APIXIA CORP.

27.13.1 COMPANY OVERVIEW

27.13.2 GEOGRAPHIC PRESENCE

27.13.3 PRODUCT PORTFOLIO

27.13.4 RECENT DEVELOPEMENTS

27.14 HDXWILL NORTH AMERICA

27.14.1 COMPANY OVERVIEW

27.14.2 GEOGRAPHIC PRESENCE

27.14.3 PRODUCT PORTFOLIO

27.14.4 RECENT DEVELOPEMENTS

27.15 VILLA SISTEMI MEDICALI SPA. (DEL GLOBAL TECHNOLOGIES)

27.15.1 COMPANY OVERVIEW

27.15.2 GEOGRAPHIC PRESENCE

27.15.3 PRODUCT PORTFOLIO

27.15.4 RECENT DEVELOPEMENTS

27.16 CURVEBEAMAI.COM

27.16.1 COMPANY OVERVIEW

27.16.2 GEOGRAPHIC PRESENCE

27.16.3 PRODUCT PORTFOLIO

27.16.4 RECENT DEVELOPEMENTS

27.17 SORDEX

27.17.1 COMPANY OVERVIEW

27.17.2 GEOGRAPHIC PRESENCE

27.17.3 PRODUCT PORTFOLIO

27.17.4 RECENT DEVELOPEMENTS

27.18 GENORAY

27.18.1 COMPANY OVERVIEW

27.18.2 GEOGRAPHIC PRESENCE

27.18.3 PRODUCT PORTFOLIO

27.18.4 RECENT DEVELOPMENTS

27.19 MEGA’GEN IMPLANT CO.,LTD.

27.19.1 COMPANY OVERVIEW

27.19.2 GEOGRAPHIC PRESENCE

27.19.3 PRODUCT PORTFOLIO

27.19.4 RECENT DEVELOPMENTS

27.2 J. MORITA CORP

27.20.1 COMPANY OVERVIEW

27.20.2 REVENUE ANALYSIS

27.20.3 GEOGRAPHIC PRESENCE

27.20.4 PRODUCT PORTFOLIO

27.20.5 RECENT DEVELOPMENTS

27.21 CYBER MEDICAL IMAGING, INC.

27.21.1 COMPANY OVERVIEW

27.21.2 REVENUE ANALYSIS

27.21.3 GEOGRAPHIC PRESENCE

27.21.4 PRODUCT PORTFOLIO

27.21.5 RECENT DEVELOPMENTS

27.22 PREXION INC. A

27.22.1 COMPANY OVERVIEW

27.22.2 REVENUE ANALYSIS

27.22.3 GEOGRAPHIC PRESENCE

27.22.4 PRODUCT PORTFOLIO

27.22.5 RECENT DEVELOPMENTS

27.23 RAY CO.

27.23.1 COMPANY OVERVIEW

27.23.2 REVENUE ANALYSIS

27.23.3 GEOGRAPHIC PRESENCE

27.23.4 PRODUCT PORTFOLIO

27.23.5 RECENT DEVELOPMENTS

27.24 REALCLOUD IMAGING I

27.24.1 COMPANY OVERVIEW

27.24.2 REVENUE ANALYSIS

27.24.3 GEOGRAPHIC PRESENCE

27.24.4 PRODUCT PORTFOLIO

27.24.5 RECENT DEVELOPMENTS

27.25 DENTERPRISE INTERNATIONAL

27.25.1 COMPANY OVERVIEW

27.25.2 REVENUE ANALYSIS

27.25.3 GEOGRAPHIC PRESENCE

27.25.4 PRODUCT PORTFOLIO

27.25.5 RECENT DEVELOPMENTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.