Global Dental Intraoral Radiology Equipment Market

Market Size in USD Billion

CAGR :

%

USD

1.33 Billion

USD

2.26 Billion

2024

2032

USD

1.33 Billion

USD

2.26 Billion

2024

2032

| 2025 –2032 | |

| USD 1.33 Billion | |

| USD 2.26 Billion | |

|

|

|

|

Dental Intraoral Radiology Equipment Market Analysis

The dental intraoral radiology equipment market has seen significant advancements in recent years, driven by technological innovations aimed at enhancing diagnostic accuracy and patient comfort. Modern intraoral radiology equipment now features digital imaging, which offers higher resolution, reduced radiation exposure, and faster image processing compared to traditional film-based systems. The introduction of 3D cone beam computed tomography (CBCT) has revolutionized dental diagnostics by providing detailed three-dimensional views of teeth, bones, and surrounding structures, improving treatment planning and outcomes. In addition, the integration of AI-powered software has further advanced the field, enabling automated detection of dental conditions such as cavities and periodontal disease, which supports faster and more accurate diagnoses. Manufacturers are focusing on developing compact, user-friendly, and energy-efficient equipment that can be easily integrated into dental clinics and hospitals. These advancements are improving patient care and workflow efficiency and meeting the growing demand for high-quality, cost-effective imaging solutions. As the market expands, particularly in emerging regions with increasing access to dental care, the focus remains on continuous innovation to meet the evolving needs of the dental community.

Dental Intraoral Radiology Equipment Market Size

The global dental intraoral radiology equipment market size was valued at USD 1.33 billion in 2024 and is projected to reach USD 2.26 billion by 2032, with a CAGR of 6.83 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Dental Intraoral Radiology Equipment Market Trends

“Increasing Adoption of Digital Imaging Technology”

One key trend in the dental intraoral radiology equipment market is the increasing adoption of digital imaging technology, driven by its benefits in enhancing diagnostic accuracy and reducing patient radiation exposure. For instance, digital sensors offer higher resolution images and faster processing times compared to traditional film-based X-rays, leading to improved efficiency in dental practices. In addition, the integration of 3D cone beam computed tomography (CBCT) has transformed dental diagnostics by providing comprehensive three-dimensional views that aid in precise treatment planning, such as in complex orthodontic and implant cases. This trend is further supported by advancements in AI-powered software, which can automate the detection of oral health issues, streamlining workflow and increasing diagnostic confidence. The shift toward digital and 3D imaging solutions is particularly prominent in North America and Europe, where the demand for advanced, efficient, and patient-friendly dental care continues to rise.

Report Scope and Dental Intraoral Radiology Equipment Market Segmentation

|

Attributes |

Dental Intraoral Radiology Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Danaher (U.S.), Dentsply Sirona (U.S.), Acteon (France), BIOLASE, Inc. (U.S.), amdlasers (U.S.), Carestream Health (U.S.), KaVo Dental (Germany), VATECH (South Korea), Midmark Corporation (U.S.), A-dec Inc. (U.S.), Ivoclar Vivadent (Liechtenstein), Nobel Biocare Services AG (Switzerland), PLANMECA OY (Finland), American Dental Association (U.S.), FUJIFILM Corporation (Japan), 3M (U.S.), Koninklijke Philips N.V. (Netherlands), IATOME ELECTRIC (I) PVT. LTD. (India), Shimadzu Corporation (Japan), and Hu-Friedy Mfg. Co., LLC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Intraoral Radiology Equipment Market Definition

Dental intraoral radiology equipment refers to specialized imaging devices used in dentistry to capture detailed X-ray images of the inside of the mouth. These systems help dental professionals diagnose and monitor conditions such as cavities, periodontal disease, and other oral health issues.

Dental Intraoral Radiology Equipment Market Dynamics

Drivers

- Rising Number of Dental Surgeries

The rising number of dental surgeries is a significant driver for the dental intraoral radiology equipment market, as the demand for advanced diagnostic tools continues to grow. For instance, the global market for dental procedures has been steadily increasing, with an estimated 3.6 million dental surgeries performed annually in the U.S. alone. This surge is driven by factors such as an aging population, increased awareness of oral health, and advancements in cosmetic dentistry. Dental professionals are relying more on sophisticated imaging systems to ensure precise diagnoses, plan complex procedures, and monitor post-operative results. The integration of digital imaging technology and 3D cone beam CT in dental practices allows for better visualization and improved accuracy, supporting better surgical outcomes. As the frequency of dental treatments rises, so does the need for high-quality, efficient imaging solutions, which drives growth in the dental intraoral radiology equipment market.

- Rising Aging Population

The rising aging population is a significant driver for the dental intraoral radiology equipment market, as older adults often face increased dental health challenges, including tooth loss, periodontal disease, and oral cancers. According to the United Nations, the global population aged 60 and over is expected to double from 1 billion in 2020 to 2.1 billion by 2050. This demographic shift has led to an increased demand for dental care services that can cater to the specific needs of senior patients. Advanced imaging systems, such as digital radiology and 3D cone beam CT, play a crucial role in diagnosing and treating age-related dental conditions accurately and efficiently. Enhanced imaging technology improves patient outcomes and supports preventive care, helping to identify potential issues early. As the number of elderly individuals continues to rise, the demand for innovative, high-quality dental imaging solutions will drive growth in the dental intraoral radiology equipment market.

Opportunities

- Increasing Advancements in Radiographic Techniques

Increasing advancements in radiographic techniques present a significant market opportunity in the dental intraoral radiology equipment market, as they contribute to enhanced diagnostic capabilities and improved patient care. Innovations such as 3D cone beam computed tomography (CBCT) have transformed dental diagnostics by providing detailed, high-resolution images that allow for more accurate assessment of complex dental and maxillofacial conditions. In addition, digital imaging sensors have become more sophisticated, offering quicker image capture, higher clarity, and reduced radiation exposure compared to traditional film-based X-rays. For instance, advanced software that integrates artificial intelligence (AI) can now automatically identify early signs of cavities, gum disease, and other abnormalities, speeding up the diagnostic process and aiding dentists in making precise treatment plans. These technological enhancements increase the effectiveness and efficiency of dental procedures and attract new investments and adoption within clinics and hospitals, creating significant opportunities for market growth.

- Increasing Research and Development Spending in Healthcare

Increasing research and development spending in healthcare is driving significant opportunities in the dental intraoral radiology equipment market, as it fosters continuous innovation and the development of more advanced diagnostic technologies. For instance, companies are investing in research to enhance the capabilities of digital sensors and 3D cone beam computed tomography (CBCT), which offer high-resolution imaging and comprehensive views that improve diagnostic accuracy and treatment planning. In 2022, the global healthcare R&D spending surpassed $200 billion, with a notable portion allocated to dental and medical imaging advancements. This investment supports the creation of user-friendly and cost-effective systems that integrate AI for automated image analysis, reducing the time needed for diagnoses and enabling early detection of dental diseases. With the rising focus on improving patient outcomes and streamlining dental care processes, R&D initiatives continue to drive technological breakthroughs, opening up new opportunities for growth in the dental intraoral radiology market.

Restraints/Challenges

- High Cost of Equipment

The high cost of equipment is a significant challenge in the dental intraoral radiology equipment market, limiting access and adoption, especially among smaller or independent dental practices. Advanced imaging systems, such as digital X-ray machines and cone-beam computed tomography (CBCT) units, often come with steep price tags that can be difficult for smaller clinics to manage. For instance, a high-quality CBCT system can be a major financial burden, making it an expensive investment for practices that may already be working with tight budgets. The substantial initial cost can deter dental professionals from upgrading their equipment or investing in newer technologies, even when these systems offer superior diagnostic capabilities and patient care benefits. In addition, the ongoing maintenance, software updates, and potential need for system calibration add to the long-term costs, further straining financial resources. This high cost of equipment, therefore, presents a significant barrier to growth and limits the market's expansion, as it prevents widespread adoption of advanced radiology technologies.

- Training and Skill Requirements

Training and skill requirements pose a significant challenge in the dental intraoral radiology equipment market, as advanced imaging systems demand specialized knowledge and expertise to operate effectively. While traditional X-ray machines may be more straightforward to use, modern systems, including digital sensors and 3D cone-beam computed tomography (CBCT) devices, come with complex features that require proper training. For instance, interpreting 3D images and understanding detailed cross-sectional views can be difficult for dental professionals who are accustomed to 2D radiographs. This need for additional training can be a barrier for smaller dental practices that may not have the resources to invest in ongoing education for their staff. Without adequate training, there is a risk of improper use or misinterpretation of images, which can compromise diagnostic accuracy and patient care. Moreover, the learning curve associated with transitioning from traditional to digital or 3D imaging systems can be time-consuming, affecting productivity and patient flow in dental clinics. These training and skill requirements, therefore, represent a substantial market challenge, as they can impede the adoption and optimal utilization of advanced dental radiology technologies.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Dental Intraoral Radiology Equipment Market Scope

The market is segmented on the basis of treatment type and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Treatment Type

- Orthodontic

- Endodontic

- Periodontic

- Prosthodontic

End User

- Hospitals

- Diagnostic Centers

- Ambulatory Surgical Centers

- Dental Clinics

Dental Intraoral Radiology Equipment Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, treatment type, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

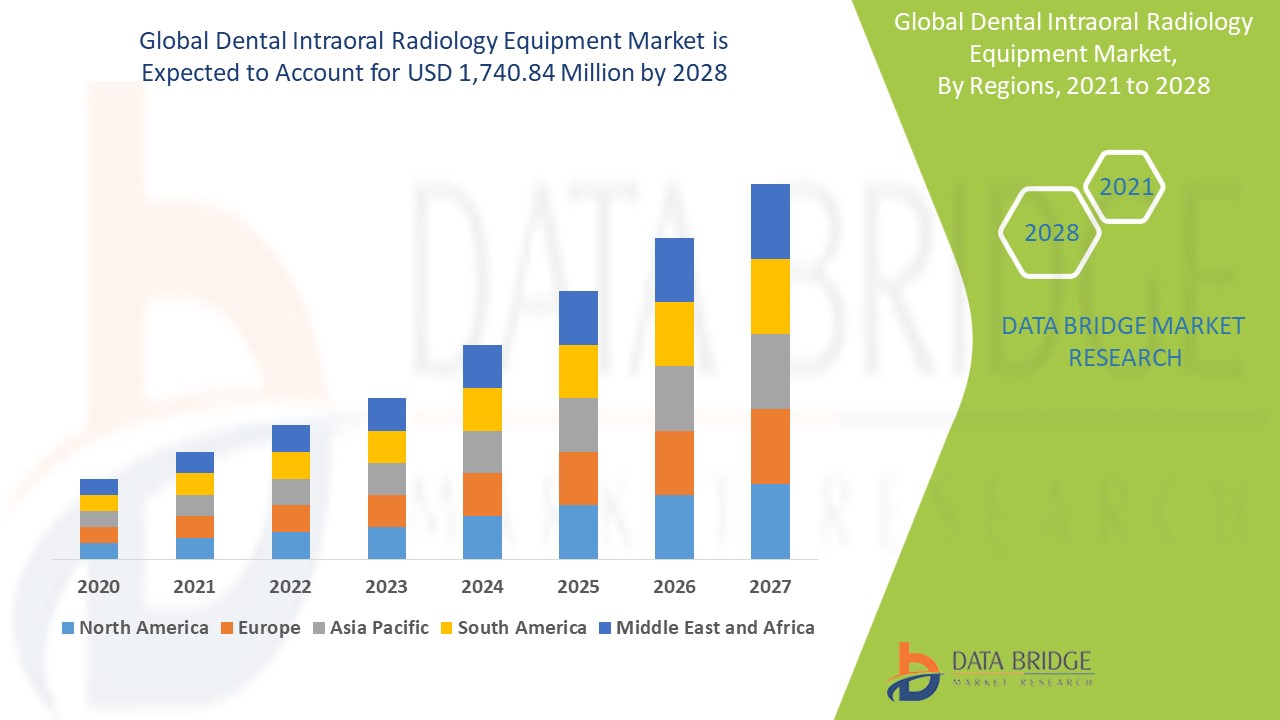

North America is dominating the Dental Intraoral Radiology Equipment Market, driven by a significant rise in the population that can afford high-cost dental treatments. This region benefits from advanced healthcare infrastructure, strong adoption of innovative dental technologies, and widespread access to quality dental care. With rising awareness about oral health and preventive measures, the demand for advanced imaging equipment has surged. In addition, higher disposable incomes and comprehensive dental insurance plans in North America contribute to increased investments in state-of-the-art radiology equipment, supporting market growth and technological advancements.

Asia-Pacific region is projected to experience significant growth in the Dental Intraoral Radiology Equipment Market from 2025 to 2032, driven by an expanding population and a growing emphasis on dental and oral hygiene. Increased awareness of oral health and the importance of early diagnosis has fueled the demand for advanced dental imaging technologies. In addition, rapid urbanization and economic development in countries such as China and India are contributing to better access to modern dental care and equipment. With improved healthcare infrastructure and rising disposable incomes, more individuals in the region are seeking high-quality dental treatments, driving the adoption of innovative radiology solutions.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Dental Intraoral Radiology Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Dental Intraoral Radiology Equipment Market Leaders Operating in the Market Are:

- Danaher (U.S.)

- Dentsply Sirona (U.S.)

- Acteon (France)

- BIOLASE, Inc. (U.S.)

- amdlasers (U.S.)

- Carestream Health (U.S.)

- KaVo Dental (Germany)

- VATECH (South Korea)

- Midmark Corporation (U.S.)

- A-dec Inc. (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- Nobel Biocare Services AG (Switzerland)

- PLANMECA OY (Finland)

- American Dental Association (U.S.)

- FUJIFILM Corporation (Japan)

- 3M (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- IATOME ELECTRIC (I) PVT. LTD. (India)

- Shimadzu Corporation (Japan)

- Hu-Friedy Mfg. Co., LLC (U.S.)

Latest Developments in Dental Intraoral Radiology Equipment Market

- In January 2024, Align Technology, Inc. launched the iTero Lumina intraoral scanner, featuring a 3X wider field of capture in a wand that is 45% lighter and 50% smaller, providing enhanced visualization, increased accuracy, and a faster scanning process

- In October 2023, Denti.AI announced that it had secured FDA 510(k) clearance for its innovative AI-powered imaging solution, Denti.AI Detect, which improves disease detection in intra- and extraoral radiography and offers automated charting capabilities

- In June 2023, LunaLite Dental introduced its latest innovation, the LunaLite automated laser-guided dental x-ray positioner, aiming to transform the x-ray process by enhancing efficiency and comfort for both dental professionals and patients

- In March 2022, Align Technology, Inc. launched a new integration feature for its ClinCheck digital treatment planning software, which incorporated cone beam computed tomography (CBCT), allowing dentists to visualize a patient’s roots as part of the treatment planning process by combining data from roots, bone, and crowns

- In February 2022, Overjet was awarded a U.S. patent for its AI technology that measures anatomical structures and quantifies disease on dental X-rays, underscoring the recognition and protection of Overjet’s innovative approach to AI-driven dental imaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.