Global Dental Practice Management Software Market

Market Size in USD Billion

CAGR :

%

USD

2.86 Billion

USD

6.45 Billion

2024

2032

USD

2.86 Billion

USD

6.45 Billion

2024

2032

| 2025 –2032 | |

| USD 2.86 Billion | |

| USD 6.45 Billion | |

|

|

|

|

Dental Practice Management Software Market Size

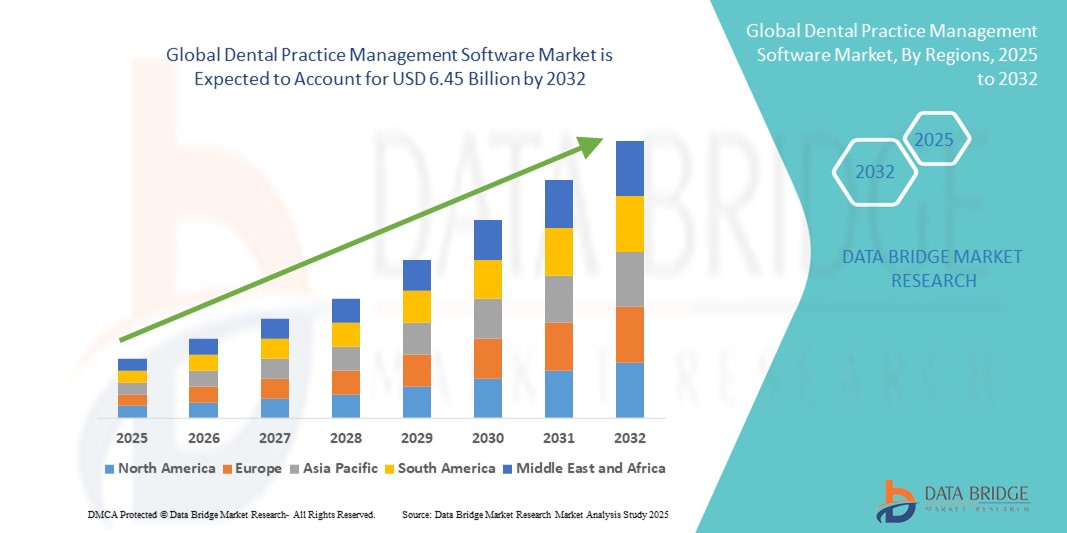

- The global dental practice management software market size was valued at USD 2.86 billion in 2024 and is expected to reach USD 6.45 billion by 2032, at a CAGR of 10.70% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital solutions in dental clinics, rising demand for efficient patient management, and the integration of cloud-based and AI-enabled software solutions

- Furthermore, growing awareness among dental professionals for streamlined scheduling, billing, and record-keeping, along with the need for enhanced patient engagement and regulatory compliance, is driving the adoption of dental practice management software, thereby significantly boosting the industry’s growth

Dental Practice Management Software Market Analysis

- Dental practice management software, providing integrated solutions for appointment scheduling, patient records, billing, and workflow optimization, is becoming an essential tool for modern dental clinics and multi-location practices due to its ability to enhance operational efficiency, improve patient engagement, and ensure regulatory compliance

- The increasing demand for dental practice management software is primarily driven by the growing adoption of digital health solutions, rising patient expectations for seamless care, and the need for streamlined administrative processes in clinics

- North America dominated the dental practice management software market with the largest revenue share of 39% in 2024, supported by high technology adoption, a large number of private dental practices, and strong presence of major software providers offering AI-enabled analytics and cloud-based solutions

- Asia-Pacific is expected to be the fastest-growing region in the dental practice management software market during the forecast period due to increasing awareness about digital dental solutions, expanding healthcare infrastructure, and rising investments in dental clinics across urban centers

- Cloud-based deliver mode segment dominated the dental practice management software market with a market share of 45.8% in 2024, driven by its flexibility, real-time data accessibility, scalability, and reduced IT infrastructure costs for dental practices

Report Scope and Dental Practice Management Software Market Segmentation

|

Attributes |

Dental Practice Management Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Practice Management Software Market Trends

AI-Driven Automation and Cloud Integration

- A significant and accelerating trend in the global dental practice management software market is the integration of artificial intelligence (AI) and cloud-based platforms. These technologies are enhancing operational efficiency, automating administrative tasks, and improving patient engagement

- For instance, Dentrix Ascend and Curve Dental offer cloud-enabled platforms with AI-powered analytics for appointment optimization, patient recall, and treatment recommendations. Similarly, Open Dental provides real-time data access and remote practice management capabilities for multi-location clinics

- AI integration enables predictive scheduling, automated reminders, and intelligent insights into patient behavior, helping clinics reduce no-shows and optimize workflow. Cloud connectivity allows dentists and staff to access patient records, billing information, and reports securely from any location

- Seamless integration with other digital healthcare tools, such as imaging software and tele-dentistry platforms, facilitates centralized management of the entire dental practice ecosystem. Through a single interface, practitioners can manage appointments, patient records, billing, and treatment planning efficiently

- This trend towards smarter, interconnected, and cloud-based dental management systems is reshaping expectations for clinic efficiency and patient care. Companies such as Patterson Dental and Henry Schein are developing AI-enabled solutions to provide automated scheduling, treatment suggestions, and remote access features

- The demand for dental practice management software with AI and cloud integration is rapidly growing across private practices and multi-location clinics, as dental professionals increasingly prioritize efficiency, accuracy, and enhanced patient experience

Dental Practice Management Software Market Dynamics

Driver

Rising Demand for Efficient Workflow and Patient-Centric Care

- The growing need for streamlined administrative processes, enhanced patient engagement, and efficient clinic workflow is a significant driver of dental practice management software adoption

- For instance, in March 2024, Carestream Dental launched an AI-powered scheduling module to optimize appointment flow and reduce patient wait times, strengthening its software offerings

- As dental professionals seek to improve clinic productivity and patient satisfaction, management software provides features such as automated reminders, treatment tracking, and billing integration, offering clear advantages over manual systems

- The increasing adoption of digital health solutions and tele-dentistry platforms further reinforces the demand for integrated practice management systems

- The convenience of cloud access, remote monitoring of clinic operations, and real-time reporting are key factors propelling software adoption in small to large dental practices

Restraint/Challenge

Data Security Concerns and High Implementation Costs

- Concerns regarding patient data privacy and compliance with healthcare regulations, such as HIPAA and GDPR, pose significant challenges to widespread adoption. As software platforms handle sensitive health information, robust security measures are essential

- For instance, reports of data breaches in healthcare software have made some clinics cautious about adopting cloud-based solutions without proper encryption and access control

- Addressing these concerns through secure authentication, regular software updates, and compliance certifications is crucial for building trust. Companies such as Dentrix and Carestream emphasize strong encryption and regulatory compliance in their offerings

- In addition, high initial costs of comprehensive dental practice management solutions can be a barrier for small or budget-conscious clinics. While subscription-based cloud models are more affordable, advanced features such as AI analytics or tele-dentistry integration often come at a premium

- Overcoming these challenges through enhanced data security, cost-effective pricing models, and practitioner education on digital workflows will be vital for sustained market growth

Dental Practice Management Software Market Scope

The market is segmented on the basis of delivery mode, component, deployment, interface type, end user, and distribution channel.

- By Delivery Mode

On the basis of delivery mode, the dental practice management software market is segmented into cloud-based, hybrid, and on-premise. The cloud-based delivery mode dominated the market with the largest revenue share of 45.8% in 2024, driven by its flexibility, remote accessibility, and cost-effective deployment. Clinics can manage appointments, billing, and patient records from any location, reducing IT infrastructure requirements. Cloud solutions also support real-time analytics, automated updates, and multi-location practice management. Integration with imaging and tele-dentistry platforms further enhances workflow efficiency. The increasing adoption of SaaS models and preference for scalable solutions strengthen its dominance.

The hybrid delivery mode is anticipated to witness the fastest growth from 2025 to 2032, as it combines on-premise security with cloud convenience. Medium and large clinics prefer hybrid solutions for sensitive data storage while utilizing cloud-based collaboration and analytics. Regulatory compliance and data privacy are easier to maintain in hybrid systems. Real-time monitoring and centralized dashboards improve operational efficiency. Clinics benefit from a tailored, cost-effective deployment model. The rising need for flexible software deployment in emerging markets fuels adoption.

- By Component

On the basis of component, the dental practice management software market is segmented into patient management, records management, finance & accounting, analytics & dashboards, and others. The patient management segment dominated the market in 2024 due to high demand for automated scheduling, reminders, and improved patient engagement. It reduces no-shows and streamlines front-desk operations while enhancing the overall patient experience. Cloud connectivity allows remote monitoring and access to patient interactions. AI-powered modules provide personalized care and treatment recommendations. Integration with billing and imaging systems improves workflow efficiency. Multi-location practices increasingly rely on patient management tools to optimize performance.

The analytics & dashboards segment is expected to witness the fastest growth during forecast period, offering actionable insights into revenue trends, patient behavior, and operational efficiency. AI-powered dashboards enable predictive decision-making and resource optimization. Real-time data helps clinics track performance metrics and identify growth opportunities. Analytics tools support regulatory compliance and reporting. Increasing adoption of performance-based practice management strategies drives growth. Demand is rising for tools that provide a holistic view of clinic operations.

- By Deployment

On the basis of deployment, the dental practice management software market is segmented into Windows, macOS, iOS, Android, and others. The Windows deployment segment dominated the market in 2024 due to its widespread compatibility with dental hardware and legacy systems. Integration with imaging, billing, and management tools is seamless. Windows-based systems support multi-user and multi-location operations efficiently. Extensive vendor support ensures reliability and regular updates. Large clinics and hospitals prefer Windows deployment for robustness and stability. Familiarity among staff maintains market dominance.

The iOS deployment segment is anticipated to witness the fastest growth during forecast period, driven by the rising use of mobile tablets and smartphones for practice management. Tele-dentistry and cloud integration enable remote access to patient records and real-time updates. Intuitive UI improves staff productivity and patient interactions. iOS apps support secure mobile workflows and appointment management. Adoption is increasing in small and medium clinics due to convenience. Growing smartphone penetration accelerates market growth.

- By Interface Type

On the basis of interface type, the dental practice management software market is segmented into biometric device, QR code scanner, barcode scanner, and RFID interfaces. The biometric device interface segment dominated in 2024, driven by high demand for secure authentication and access control. Fingerprint or facial recognition reduces errors in patient record management. Biometric systems prevent unauthorized access to sensitive information. Integration with software modules enhances operational efficiency. Hospitals and large clinics favor biometrics for staff and patient verification. Regulatory compliance and data security support market dominance.

The QR code scanner interface segment is expected to witness the fastest growth during forecast period, enabling contactless check-ins and digital patient forms. QR codes reduce front-desk workload and streamline workflows. Mobile app integration allows patients to self-check-in efficiently. Cost-effective deployment encourages adoption in smaller clinics. Real-time data sync with cloud systems improves efficiency and reduces errors. Contactless solutions are increasingly preferred post-pandemic. Post-pandemic, contactless solutions are increasingly preferred, boosting market demand.

- By End User

On the basis of end user, the dental practice management software market is segmented into hospitals, dental clinics, and others. The dental clinics segment dominated in 2024 due to high adoption in private practices and multi-specialty centers. Software improves scheduling, billing, and patient engagement. Small and medium clinics prefer affordable and functional solutions. Cloud and mobile access enhance convenience for both staff and patients. Integration with imaging and tele-dentistry platforms boosts operational efficiency. Patient expectations for seamless digital experiences drive adoption.

The hospitals segment is anticipated to witness the fastest growth during forecast period, as large hospitals adopt centralized software for dental departments and multi-department management. Centralized records streamline operations and enhance collaboration. Cloud modules enable remote monitoring of patient and workflow data. Multi-user access ensures smooth coordination among staff. Large-scale analytics improve operational and financial outcomes. Increasing hospital investments in dental services drive growth.

- By Distribution Channel

On the basis of distribution channel, the dental practice management software market is segmented into direct tender and third-party distributors. The direct tender segment dominated in 2024 as providers sell directly to large clinics and hospital networks. Direct sales allow customized deployment, training, and dedicated support. Pricing control and quality assurance are additional benefits. Personalized onboarding improves adoption rates. Dedicated support ensures smooth software integration. High-value contracts favor direct engagement, strengthening market share.

The third-party distributor segment is expected to witness the fastest growth during forecast period, expanding software reach to small and mid-sized clinics, especially in emerging markets. Localized support and bundled hardware-software solutions enhance adoption. Distributors help penetrate remote regions with cost-effective packages. Clinics benefit from ready-to-use, pre-configured solutions. Vendor reach is extended without direct investment in sales. Increasing dental software awareness accelerates adoption.

Dental Practice Management Software Market Regional Analysis

- North America dominated the dental practice management software market with the largest revenue share of 39% in 2024, supported by high technology adoption, a large number of private dental practices, and strong presence of major software providers offering AI-enabled analytics and cloud-based solutions

- Dental clinics and hospitals in the region increasingly rely on software to efficiently manage appointments, patient records, billing, and workflow

- This widespread adoption is further supported by strong healthcare infrastructure, high technology penetration, and growing demand for cloud-based and AI-enabled solutions. Practitioners value features such as automated reminders, tele-dentistry integration, and real-time analytics to improve operational efficiency

U.S. Dental Practice Management Software Market Insight

The U.S. dental practice management software market captured the largest revenue share of 82% in 2024 within North America, fueled by widespread adoption of digital healthcare solutions and cloud-based practice management systems. Clinics and hospitals are increasingly prioritizing workflow automation, patient engagement, and secure electronic health records. The growing preference for tele-dentistry, mobile app integration, and AI-driven analytics further propels the market. Moreover, multi-location practices and dental chains are leveraging centralized software platforms for efficient management. High technology penetration and strong IT infrastructure support market expansion. The increasing regulatory emphasis on patient data security and compliance also drives adoption.

Europe Dental Practice Management Software Market Insight

The Europe dental practice management software market is projected to expand at a substantial CAGR during the forecast period, driven by increasing digitalization in dental clinics and hospitals. Strict healthcare regulations and the need for secure patient record management are key growth factors. Rising urbanization and technological adoption among dentists are fostering software deployment. The market sees growing interest in cloud-based solutions and integrated imaging and tele-dentistry tools. Both private clinics and multi-specialty hospitals are adopting software to improve workflow efficiency. European consumers and practitioners value convenience, accuracy, and regulatory compliance, supporting steady market growth.

U.K. Dental Practice Management Software Market Insight

The U.K. dental practice management software market is expected to grow at a noteworthy CAGR, fueled by increasing demand for automation and enhanced patient care. Rising concerns regarding appointment management, billing accuracy, and data security are encouraging clinics to adopt comprehensive solutions. The trend of cloud-based software and mobile access is expanding rapidly. Private dental clinics and hospitals are prioritizing solutions that integrate patient records, analytics, and tele-dentistry. The U.K.’s advanced healthcare infrastructure and digital literacy further support market expansion. Continuous improvements in software usability and customer support are also boosting adoption.

Germany Dental Practice Management Software Market Insight

The Germany dental practice management software market is expected to expand at a considerable CAGR, driven by strong healthcare infrastructure, emphasis on technological innovation, and regulatory compliance. Dental clinics and hospitals are adopting software for secure patient record management, scheduling, and billing. Cloud-based and AI-powered systems are becoming increasingly prevalent in multi-location practices. Germany’s focus on data privacy and digital security aligns with local consumer expectations. Integration with imaging and tele-dentistry platforms is enhancing operational efficiency. Growing awareness of performance tracking and analytics in dental practices further fuels market growth.

Asia-Pacific Dental Practice Management Software Market Insight

The Asia-Pacific dental practice management software market is poised to grow at the fastest CAGR of 23% from 2025 to 2032, driven by rising dental service demand, urbanization, and increasing adoption of digital solutions in countries such as China, Japan, and India. Cloud-based and mobile-enabled software is gaining traction in both private clinics and large hospital chains. Government initiatives promoting digital healthcare infrastructure support market expansion. Rising awareness about patient engagement, workflow efficiency, and secure record management is fueling adoption. Multi-location practices are increasingly leveraging centralized platforms. Affordable software options and local vendor support make adoption accessible across emerging APAC markets.

Japan Dental Practice Management Software Market Insight

The Japan dental practice management software market is gaining momentum due to high technological adoption, an aging population, and rising demand for efficient clinic management. Software adoption is driven by multi-specialty dental centers and smart clinics seeking automated appointment scheduling, billing, and patient engagement. Integration with tele-dentistry and imaging platforms enhances operational efficiency. The Japanese preference for data security and convenience boosts adoption. Mobile and cloud-based access enables real-time management across locations. Growing awareness of AI-driven analytics for treatment planning further strengthens market growth.

India Dental Practice Management Software Market Insight

The India dental practice management software market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, growing middle-class population, and high digital literacy among dental professionals. Both small clinics and large dental hospitals are adopting cloud-based software for patient management, billing, and tele-dentistry. Government initiatives supporting digital healthcare and smart clinic setups further drive growth. Affordable software options and strong domestic vendor presence enhance accessibility. Multi-location clinics benefit from centralized management and real-time analytics. Rising awareness about workflow optimization and patient engagement continues to propel market expansion.

Dental Practice Management Software Market Share

The dental practice management software industry is primarily led by well-established companies, including:

- Henry Schein, Inc. (U.S.)

- Carestream Dental, LLC (U.S.)

- Patterson Companies, Inc. (U.S.)

- NextGen Healthcare, Inc. (U.S.)

- Planet DDS (U.S.)

- Curve Dental (U.S.)

- CareStack (U.S.)

- DentiMax (U.S.)

- ACE Dental Software (U.S.)

- Datacon Dental Systems, Inc. (U.S.)

- NXGN Management, LLC (U.S.)

- Practice-Web, Inc. (U.S.)

- Dentiflow (U.S.)

- Open Dental Software (U.S.)

- Dental Intelligence (U.S.)

- Tab32 (U.S.)

- Dentrix (U.S.)

- Eaglesoft (U.S.)

- Dentrix Ascend (U.S.)

- Oryx Dental Software (U.S.)

What are the Recent Developments in Global Dental Practice Management Software Market?

- In July 2025, Henry Schein One launched Forms, a new digital patient intake solution. Integrated directly into its Dentrix and Dentrix Ascend platforms, Forms is designed to streamline the patient check-in process. The solution reduces manual data entry, allows patients to auto-populate forms by scanning their driver's license, and provides a customizable, multilingual experience

- In February 2025, CareStack showcased its latest AI-led enhancements to its cloud-based dental practice management system at the Chicago Dental Society Midwinter Meeting. These upgrades aimed to streamline scheduling, clinical charting, billing, patient engagement, and revenue cycle management. The integration of AI features was designed to improve operational efficiency and patient care

- In November 2023, Patterson Dental and Pearl announced a partnership to integrate Pearl's Second Opinion AI software into Patterson's Eaglesoft practice management system. This integration allows Eaglesoft users to access AI-powered clinical detections directly on X-rays without needing to switch platforms

- In September 2022, Carestream Dental launched Sensei Cloud for Oral Surgery, a cloud-based practice management software tailored specifically for the oral and maxillofacial surgery specialty. The software integrates administrative, financial, and clinical workflows into a single platform, with features such as anesthesia records, HIPAA-compliant imaging access, and performance reporting

- In June 2021, 3Shape released its Dental System 2021 software, featuring faster, simpler, and open AI-powered integrated workflows for crown & bridge, implants, dentures, and more. The update aimed to improve efficiency and precision in dental procedures through advanced digital tools

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.