Global Dental Radiology And Dental Imaging Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.04 Billion

USD

11.98 Billion

2025

2033

USD

7.04 Billion

USD

11.98 Billion

2025

2033

| 2026 –2033 | |

| USD 7.04 Billion | |

| USD 11.98 Billion | |

|

|

|

|

Dental Radiology and Dental Imaging Devices Market Size

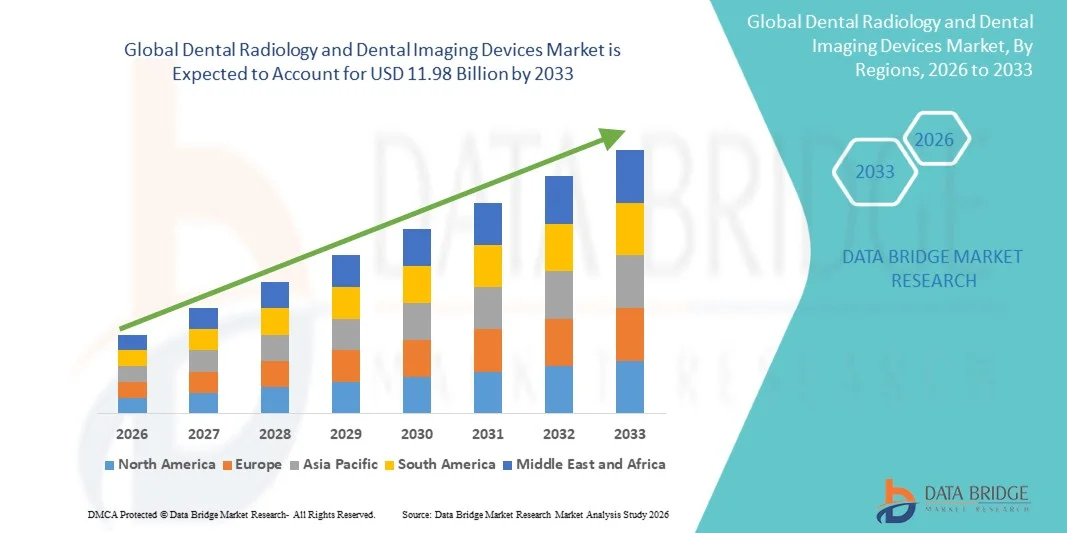

- The global dental radiology and dental imaging devices market size was valued at USD 7.04 billion in 2025 and is expected to reach USD 11.98 billion by 2033, at a CAGR of 6.88% during the forecast period

- The market growth is largely driven by the increasing adoption of advanced dental diagnostic technologies and continuous technological advancements in imaging systems, leading to improved accuracy, efficiency, and digitalization in dental clinics, hospitals, and diagnostic centers

- Furthermore, rising demand for early and precise diagnosis of dental disorders, growing awareness of preventive oral healthcare, and the increasing integration of digital imaging solutions into dental workflows are accelerating the adoption of dental radiology and dental imaging devices, thereby significantly boosting the overall market growth

Dental Radiology and Dental Imaging Devices Market Analysis

- Dental radiology and dental imaging devices, including intraoral, extraoral, and advanced 3D imaging systems, have become essential components of modern dental diagnostics across hospitals, dental clinics, and academic institutions due to their ability to deliver accurate, high-resolution images for effective diagnosis and treatment planning

- The growing demand for dental imaging devices is primarily driven by the increasing prevalence of dental disorders, rising awareness of preventive oral healthcare, technological advancements such as digital radiography and cone-beam computed tomography (CBCT), and the growing adoption of minimally invasive and precision-based dental procedures.

- North America dominated the dental radiology and dental imaging devices market with the largest revenue share of approximately 38.5% in 2025, supported by advanced healthcare infrastructure, high adoption of digital dental technologies, favorable reimbursement policies, and strong presence of leading imaging device manufacturers, with the U.S. accounting for a major share of regional demand due to widespread use in dental clinics and specialty practices

- Asia-Pacific is expected to be the fastest-growing region in the dental radiology and dental Imaging Devices market during the forecast period, driven by expanding dental care infrastructure, increasing disposable incomes, rising dental tourism, and growing awareness of advanced diagnostic solutions in countries such as China, India, Japan, and South Korea

- The 2-Dimensional imaging segment accounted for the largest market revenue share of 61.7% in 2025, owing to its widespread use as a first-line diagnostic tool in dentistry

Report Scope and Dental Radiology and Dental Imaging Devices Market Segmentation

|

Attributes |

Dental Radiology and Dental Imaging Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Radiology and Dental Imaging Devices Market Trends

“Growing Adoption of Advanced Digital Imaging and 3D Diagnostic Technologies”

- A major and accelerating trend in the global dental radiology and dental imaging devices market is the widespread transition from conventional analog imaging to advanced digital radiography systems. Dental practices are increasingly adopting digital X-ray systems due to their superior image quality, reduced radiation exposure, faster image processing, and improved diagnostic accuracy

- The rising use of cone-beam computed tomography (CBCT) systems is significantly shaping the market, particularly for implant planning, orthodontics, endodontics, and maxillofacial surgery. For instance, companies such as Dentsply Sirona, Carestream Dental, and Planmeca have expanded their CBCT portfolios with high-resolution 3D imaging systems that support precise implant placement and comprehensive anatomical assessment, driving strong adoption across specialty dental clinics and hospitals

- Intraoral imaging devices, including digital sensors and phosphor plate systems, are gaining strong traction due to their ease of use, compact design, and ability to integrate seamlessly with dental practice management software. These systems support efficient workflows and enhanced patient communication

- The growing emphasis on minimally invasive dentistry and early disease detection is further driving demand for high-resolution imaging technologies that allow dentists to identify caries, bone loss, and other oral conditions at an early stage

- In addition, increasing adoption of portable and compact dental imaging devices is supporting market growth in ambulatory dental clinics, mobile dental units, and outreach programs, particularly in emerging economies

Dental Radiology and Dental Imaging Devices Market Dynamics

Driver

“Rising Demand for Accurate Dental Diagnosis and Expanding Dental Care Infrastructure”

- The increasing prevalence of dental disorders such as caries, periodontal disease, edentulism, and malocclusion is a primary driver for the Dental Radiology and Dental Imaging Devices market. Accurate diagnosis and treatment planning for these conditions rely heavily on advanced dental imaging technologies

- The global expansion of dental clinics, specialty dental centers, and hospital-based dental departments is significantly boosting the demand for radiology and imaging devices

- For instance, large dental service organizations (DSOs) in North America and Europe are increasingly equipping new clinics with panoramic and CBCT imaging systems as standard diagnostic tools, accelerating equipment installations and replacement demand

- Rising awareness among patients regarding oral health and preventive dental care is leading to more frequent dental visits, thereby increasing the need for routine diagnostic imaging

- Technological advancements that reduce radiation dose while improving image clarity are encouraging faster replacement of legacy imaging systems with modern digital solutions

- Furthermore, the growth of cosmetic dentistry, dental implants, and orthodontic procedures is directly contributing to increased utilization of dental imaging devices across clinical settings

Restraint/Challenge

“High Equipment Costs and Radiation Safety Concerns”

- The high initial cost associated with advanced dental radiology and imaging systems, particularly CBCT and panoramic imaging units, remains a key challenge for market growth. Small and independent dental practices may face financial constraints when investing in these systems

- Ongoing maintenance expenses, software upgrades, and the need for trained personnel to operate sophisticated imaging equipment further add to the total cost of ownership. For instance, CBCT systems often require specialized training and periodic calibration, increasing operational costs for smaller dental clinics and limiting adoption in price-sensitive markets

- Concerns related to radiation exposure, despite technological advancements in dose reduction, continue to influence patient perception and regulatory scrutiny. Strict regulatory requirements for radiation safety and equipment compliance can delay installation and adoption

- In developing regions, limited access to skilled dental radiology professionals and inadequate infrastructure pose additional barriers to market expansion

- Addressing these challenges through cost-effective imaging solutions, enhanced practitioner training, and continued innovation in low-dose imaging technologies will be critical for sustained growth of the dental radiology and dental imaging devices market

Dental Radiology and Dental Imaging Devices Market Scope

The market is segmented on the basis of device, imaging type, method, application, and end use.

• By Device

On the basis of device, the Dental Radiology and Dental Imaging Devices market is segmented into Dental Imaging and Dental Radiology. The Dental Imaging segment dominated the largest market revenue share of 56.4% in 2025, driven by its indispensable role in routine dental diagnostics, treatment planning, and follow-up care. Dental imaging systems are extensively used for detecting dental caries, periodontal disease, impacted teeth, bone defects, and oral pathologies. Their integration into everyday clinical workflows makes them essential tools in dental practices worldwide. The shift from analog to digital imaging has significantly improved image quality, diagnostic accuracy, and workflow efficiency. Increasing demand for cosmetic dentistry, orthodontics, and implantology further supports widespread adoption. Dental imaging devices also reduce examination time, improving patient throughput. Growing investments by clinics in digital infrastructure reinforce demand. Continuous technological improvements, including AI-enabled diagnostics and cloud-based image storage, further strengthen dominance. High replacement rates of older systems contribute to sustained revenue generation. Increasing awareness of early oral disease detection globally supports long-term leadership of this segment.

The Dental Radiology segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, driven by growing adoption of advanced radiographic systems in specialized dental care. Rising prevalence of complex oral disorders requiring precise radiological evaluation is accelerating demand. Dental radiology plays a critical role in implant planning, orthodontic assessments, and maxillofacial surgeries. Increasing awareness regarding radiation-optimized and low-dose imaging technologies enhances acceptance. Expansion of dental hospitals and specialty centers in emerging economies further fuels growth. Technological advancements improving resolution while minimizing radiation exposure increase clinician confidence. Integration of radiology systems with digital dentistry platforms supports workflow efficiency. Rising investments in healthcare infrastructure also contribute to adoption. Increased training of dental professionals in radiographic interpretation further boosts demand. Regulatory support for early diagnosis strengthens market expansion. These factors collectively drive rapid growth during the forecast period.

• By Imaging Type

On the basis of imaging type, the Dental Radiology and Dental Imaging Devices market is segmented into 2-Dimensional and 3-Dimensional. The 2-Dimensional imaging segment accounted for the largest market revenue share of 61.7% in 2025, owing to its widespread use as a first-line diagnostic tool in dentistry. 2D imaging systems such as panoramic and intraoral X-rays are cost-effective and easy to operate. They are routinely used for basic examinations, cavity detection, and periodontal assessments. Lower equipment costs make them accessible to small and mid-sized dental clinics. Reduced radiation exposure compared to advanced imaging further supports adoption. High patient volumes in general dentistry contribute to consistent usage. Established clinical protocols favor 2D imaging in routine cases. Rapid image acquisition improves workflow efficiency. Availability of compact and portable systems enhances accessibility. High replacement demand for aging equipment supports revenue stability. Reimbursement support in several healthcare systems further reinforces dominance.

The 3-Dimensional imaging segment is projected to register the fastest CAGR of 10.1% from 2026 to 2033, driven by increasing adoption of cone beam computed tomography (CBCT). 3D imaging provides superior visualization of anatomical structures, enabling precise diagnosis and treatment planning. Growth in dental implant procedures and orthodontic treatments strongly supports demand. Increasing complexity of dental surgeries necessitates advanced imaging solutions. Technological advancements have reduced scan time and radiation dosage. Growing affordability of CBCT systems encourages adoption among mid-sized clinics. Rising demand for personalized and precision dentistry accelerates growth. Improved clinical outcomes enhance patient satisfaction. Expansion of training programs for 3D imaging further supports usage. These factors collectively contribute to robust growth prospects.

• By Method

On the basis of method, the Dental Radiology and Dental Imaging Devices market is segmented into Extra-Oral, Intra-Oral, Imaging, and Others. The Extra-Oral segment dominated the market with a revenue share of 48.9% in 2025, driven by its ability to capture comprehensive anatomical views. Extra-oral imaging systems are widely used for panoramic imaging and CBCT scans. These systems enable evaluation of jaw structure, sinuses, and impacted teeth. High demand from implantology and orthodontics supports dominance. Hospitals and large dental clinics rely heavily on extra-oral systems for advanced diagnostics. Improved image clarity and diagnostic confidence enhance adoption. The ability to assess large areas in a single scan improves efficiency. Increasing prevalence of complex dental cases supports usage. Continuous upgrades in imaging software further enhance value. Strong capital investments by large practices contribute to revenue leadership.

The Intra-Oral segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by rising adoption of digital intra-oral sensors and cameras. These systems offer high-resolution images with minimal radiation exposure. Increasing emphasis on chairside diagnostics supports growth. Integration with digital patient records enhances workflow efficiency. Rising preference for minimally invasive and preventive dentistry accelerates adoption. Portable and wireless designs improve clinician convenience. Growing demand for patient engagement tools supports usage. Cost reductions in digital sensors improve affordability. Expanding dental care access in emerging regions further fuels growth. These factors drive rapid expansion during the forecast period.

• By Application

On the basis of application, the Dental Radiology and Dental Imaging Devices market is segmented into Therapeutic, Diagnosis, Forensic, Cosmetic, and Others. The Diagnosis segment held the largest market revenue share of 53.8% in 2025, driven by the essential role of imaging in identifying dental conditions. Diagnostic imaging is critical for detecting caries, periodontal disease, infections, and oral abnormalities. High global prevalence of dental disorders sustains strong demand. Imaging enables accurate treatment planning and monitoring. Dental professionals rely heavily on diagnostic imaging for clinical decision-making. Growing emphasis on early detection supports widespread usage. Integration with AI-based diagnostic tools enhances accuracy. Increasing routine dental check-ups contribute to volume growth. Standardized clinical guidelines favor imaging-based diagnosis. High repeat usage across patient visits reinforces dominance.

The Cosmetic segment is anticipated to grow at the fastest CAGR of 9.8% from 2026 to 2033, driven by increasing demand for aesthetic dental procedures. Imaging is crucial for smile design, veneers, orthodontics, and implants. Rising patient awareness regarding dental aesthetics supports growth. Growth in disposable income boosts elective dental spending. Advanced imaging enables precise cosmetic treatment planning. Digital visualization improves patient communication and acceptance. Expanding cosmetic dentistry clinics contribute to adoption. Technological advancements improve treatment predictability. Social media influence further fuels demand. These factors collectively drive strong growth momentum.

• By End Use

On the basis of end use, the Dental Radiology and Dental Imaging Devices market is segmented into Forensic Laboratories, Hospitals & Dental Clinics, and Academic & Research Institutes. The Hospitals & Dental Clinics segment dominated the market with a revenue share of 62.1% in 2025, driven by high patient volumes and routine diagnostic requirements. Dental clinics are the primary users of imaging devices globally. Hospitals handle complex and referral cases requiring advanced imaging. Continuous equipment upgrades support revenue generation. Increasing number of dental clinics worldwide sustains demand. Integration of imaging systems into daily workflows enhances efficiency. Rising prevalence of dental disorders supports frequent imaging usage. Expansion of private dental practices strengthens adoption. Government investments in oral healthcare also contribute. These factors reinforce segment dominance.

The Forensic Laboratories segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by increasing use of dental imaging in forensic identification. Dental radiology is essential for age estimation and human identification. Rising crime investigation requirements support adoption. Disaster victim identification programs boost demand. Advancements in imaging accuracy enhance forensic reliability. Growing collaboration between healthcare and forensic institutions supports growth. Increasing legal acceptance of dental imaging evidence further drives usage. Expansion of forensic infrastructure globally contributes to demand. These factors collectively support rapid segment growth.

Dental Radiology and Dental Imaging Devices Market Regional Analysis

- North America dominated the dental radiology and dental imaging devices market with the largest revenue share of approximately 38.5% in 2025, supported by advanced healthcare infrastructure, high adoption of digital dental technologies, and favorable reimbursement policies for diagnostic imaging

- The region benefits from widespread use of intraoral imaging, panoramic systems, and cone-beam computed tomography (CBCT) across dental clinics and specialty practices

- A strong presence of leading dental imaging device manufacturers, continuous technological innovation, and early adoption of AI-enabled imaging solutions further reinforce North America’s market leadership

U.S. Dental Radiology and Dental Imaging Devices Market Insight

The U.S. dental radiology and dental imaging devices market accounted for the majority of regional revenue share in 2025, driven by widespread adoption of digital radiography and CBCT systems in general dentistry, orthodontics, and oral surgery. High patient volumes, strong emphasis on early diagnosis, and increasing demand for minimally invasive and image-guided dental procedures are accelerating market growth. Favorable insurance coverage, rapid replacement of analog systems with digital platforms, and strong investments in dental technology by private clinics and group practices continue to propel the U.S. market.

Europe Dental Radiology and Dental Imaging Devices Market Insight

The Europe dental radiology and dental imaging devices market is projected to expand at a steady CAGR during the forecast period, driven by increasing demand for advanced diagnostic tools and a growing focus on preventive dental care. Rising prevalence of dental disorders, aging populations, and increasing adoption of digital imaging technologies are supporting market growth. Countries such as Germany, France, and Italy are witnessing strong uptake of CBCT and panoramic imaging systems across hospitals and dental clinics. Regulatory support for radiation safety and diagnostic accuracy further strengthens market expansion.

U.K. Dental Radiology and Dental Imaging Devices Market Insight

The U.K. dental radiology and dental imaging devices market is anticipated to grow at a notable CAGR, supported by increasing investments in modern dental equipment and expanding private dental care services. Rising awareness of early diagnosis of oral diseases and growing adoption of digital radiography in NHS and private practices are key growth drivers. The expansion of cosmetic and orthodontic procedures is further increasing demand for high-resolution imaging systems. In addition, technological upgrades and replacement of legacy imaging systems continue to support market development.

Germany Dental Radiology and Dental Imaging Devices Market Insight

The Germany dental radiology and dental imaging devices market is expected to expand at a considerable CAGR, driven by strong dental care standards and high adoption of advanced diagnostic technologies. Germany’s well-established healthcare system, coupled with a strong presence of dental equipment manufacturers, supports continuous innovation in imaging solutions. Increasing use of CBCT for implant planning and maxillofacial diagnostics is a key growth factor. The market also benefits from strict regulatory frameworks that emphasize diagnostic accuracy and patient safety.

Asia-Pacific Dental Radiology and Dental Imaging Devices Market Insight

The Asia-Pacific dental radiology and dental imaging devices market is expected to be the fastest-growing region during the forecast period, driven by expanding dental care infrastructure and rising disposable incomes. Rapid growth in dental clinics, increasing awareness of advanced diagnostic solutions, and growing dental tourism are accelerating market adoption. Government initiatives aimed at improving oral healthcare access and modernization of diagnostic facilities further support growth. The region is also witnessing increasing penetration of cost-effective digital imaging systems.

Japan Dental Radiology and Dental Imaging Devices Market Insight

The Japan dental radiology and dental imaging devices market is gaining steady momentum due to a high standard of dental care and strong emphasis on precision diagnostics. An aging population and high prevalence of dental disorders are driving demand for advanced imaging systems. Japanese dental practices are early adopters of digital radiography and CBCT technologies, supported by technological innovation and skilled professionals. Integration of imaging systems with digital workflows is further enhancing clinical efficiency and diagnostic accuracy.

China Dental Radiology and Dental Imaging Devices Market Insight

The China dental radiology and dental imaging devices market accounted for a significant share of the Asia-Pacific market in 2025, driven by rapid expansion of dental clinics and increasing awareness of oral health. Rising disposable incomes, growing demand for cosmetic dentistry, and expanding urban healthcare infrastructure are key contributors to market growth. Domestic manufacturing of imaging devices and increasing availability of affordable digital systems are improving market accessibility. In addition, government support for healthcare modernization is strengthening China’s position in the regional market.

Dental Radiology and Dental Imaging Devices Market Share

The Dental Radiology and Dental Imaging Devices industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Carestream Dental (U.S.)

- Planmeca Group (Finland)

- Vatech Co., Ltd. (South Korea)

- Danaher Corporation (U.S.)

- Envista Holdings Corporation (U.S.)

- Acteon Group (France)

- Midmark Corporation (U.S.)

- Owandy Radiology (France)

- Asahi Roentgen Ind. Co., Ltd. (Japan)

- FONA Dental (Slovakia)

- Morita Corporation (Japan)

- Carestream Health (U.S.)

- LED Dental Inc. (Canada)

- Villa Sistemi Medicali (Italy)

Latest Developments in Global Dental Radiology and Dental Imaging Devices Market

- In April 2025, Planmeca Oy revealed several new imaging products including the Planmeca Viso G1 CBCT, Planmeca Viso 2D Pro, Viso 2D Classic, and the handheld intra-oral Planmeca ProX GO. These systems offer improved imaging precision and workflow flexibility for dental practices, underscoring Planmeca’s commitment to expanding its diagnostic hardware portfolio

- In March 2025, Align Technology, Inc. launched Align X-ray Insights, an AI-based computer-aided detection (CADe) software for 2D radiographs in the EU and UK, designed to automatically analyze dental X-rays and assist clinicians in early disease detection and treatment planning

- In February 2025, DEXIS launched DEXIS Connect Pro, a proactive service platform for its CBCT and intraoral sensor devices focused on increasing device uptime and remote diagnostic support, demonstrating the industry’s shift toward connected service solutions for imaging hardware

- In April 2024, DEXIS introduced the all-new DEXIS Ti2 Sensor, the successor to its Titanium Sensor, as part of its expanding digital ecosystem. This intraoral sensor enhances image quality and integrates AI-powered workflows to streamline dental imaging processes

- In August 2024, DEXIS launched DEXIS Connect Pro for increased device uptime, marking continued platform expansion to support CBCT and intraoral imaging systems with proactive diagnostics and maintenance tools

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.