Global Dental Robotics And Digital Solutions Market

Market Size in USD Billion

CAGR :

%

USD

4.41 Billion

USD

8.72 Billion

2024

2032

USD

4.41 Billion

USD

8.72 Billion

2024

2032

| 2025 –2032 | |

| USD 4.41 Billion | |

| USD 8.72 Billion | |

|

|

|

|

Dental Robotics and Digital Solutions Market Size

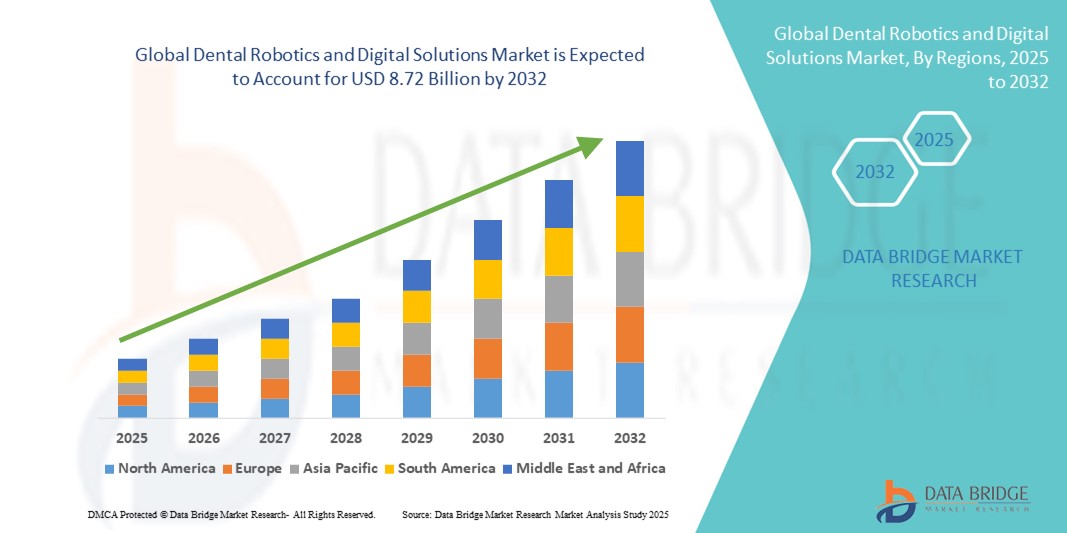

- The global dental robotics and digital solutions market size was valued at USD 4.41 billion in 2024 and is expected to reach USD 8.72 billion by 2032, at a CAGR of 8.90% during the forecast period

- The market growth is largely driven by the increasing integration of robotics and digital technologies into dental practices, improving precision, reducing treatment times, and enhancing patient outcomes. The adoption of robotic-assisted surgeries, AI-powered diagnostics, and 3D imaging systems is transforming clinical workflows and setting new standards for accuracy in procedures such as dental implants, root canal treatments, and orthodontics

- Furthermore, rising demand for minimally invasive treatments, coupled with the growing preference for digital chairside solutions, is driving significant advancements in practice efficiency and patient engagement. These evolving dynamics are accelerating the deployment of dental robotics and digital platforms across both private clinics and large dental hospital networks, thereby fueling robust growth in the global Dental Robotics and Digital Solutions Market

Dental Robotics and Digital Solutions Market Analysis

- Dental Robotics and Digital Solutions—including CAD/CAM systems, 3D imaging, intraoral scanners, and robotic-assisted surgical equipment—are increasingly essential in modern dentistry due to their ability to enhance diagnostic precision, procedural accuracy, and overall patient outcomes

- The growing adoption of these technologies is fueled by rising cases of dental disorders, patient demand for minimally invasive treatments, and a broader shift toward digital workflows in dental practices worldwide

- North America dominated the global dental robotics and digital solutions market with a revenue share of 38.7% in 2024, driven by substantial investments in R&D, early technology adoption, and a well-established ecosystem of key players such as Dentsply Sirona, Align Technology, and Straumann

- Asia‑Pacific is projected to be the fastest‑growing region in the global dental robotics and digital solutions market, with a forecast CAGR of around 13.6% from 2025 to 2032, supported by expanding healthcare infrastructure, growing dental tourism, and rising disposable incomes across markets like China, India, and Japan

- The imaging equipment segment dominated the global dental robotics and digital solutions market with revenue share of 37.6% in 2024, owing to the increasing adoption of advanced diagnostic tools such as CBCT (Cone-Beam Computed Tomography) and intraoral scanners in dental practices. These technologies enhance diagnostic accuracy, enable 3D treatment planning, and streamline workflows, making them essential for modern dental care

Report Scope and Dental Robotics and Digital Solutions Market Segmentation

|

Attributes |

Dental Robotics and Digital Solutions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Robotics and Digital Solutions Market Trends

Digital Transformation Accelerating Adoption of Dental Robotics and Advanced Solutions

- A significant and growing trend in the global dental robotics and digital solutions market is the increasing integration of digital technologies into dental workflows—ranging from diagnostics and imaging to treatment planning and surgical procedures—which is revolutionizing modern dentistry

- For instance, leading dental robotics systems now offer real-time imaging, automated implant positioning, and AI-guided treatment planning, streamlining procedures and enhancing clinical precision. Systems such as Yomi by Neocis are widely used for robot-assisted implant placement, helping clinicians improve consistency and patient outcomes

- The demand for digital solutions such as CAD/CAM systems, 3D cone beam computed tomography (CBCT), intraoral scanners, and digital impression technologies is rising across both general dentistry and specialty clinics. These tools allow for faster, more accurate diagnoses, and improved patient comfort

- Intraoral scanners, in particular, are witnessing rapid adoption due to their ability to eliminate physical molds, accelerate lab workflows, and enhance patient engagement by allowing visual communication of oral conditions

- In addition, robotic-assisted surgeries are becoming more common in implantology and orthodontics, driven by the desire for precision and minimally invasive outcomes. Dental service providers are increasingly investing in robotic units to improve productivity and meet rising expectations for high-quality, tech-enabled care

- This shift toward automation and digitization is reshaping dental practice management, promoting the development of centralized digital platforms where diagnostics, treatment planning, and outcomes can be managed seamlessly. As a result, dental clinics and DSOs (Dental Service Organizations) are re-evaluating their technology investments to remain competitive

- The momentum behind digital and robotic technologies is expected to accelerate further as regulatory bodies approve more robotic systems and manufacturers focus on innovation to reduce cost and improve accessibility across emerging markets

Dental Robotics and Digital Solutions Market Dynamics

Driver

Growing Need Due to Increasing Dental Disorders and Demand for Precision Treatment

- The rising prevalence of dental diseases such as periodontitis, tooth loss, and malocclusion, combined with the growing geriatric population and demand for personalized, minimally invasive treatments, is significantly driving the adoption of dental robotics and digital solutions worldwide

- For instance, in April 2024, Neocis Inc., a leading innovator in robot-assisted dental surgery, expanded the reach of its Yomi robotic system across several European and Middle Eastern markets. The technology is designed to improve surgical accuracy in dental implantology, reflecting a strong push toward precision-based oral care

- Dental professionals and patients alike are increasingly seeking solutions that improve treatment efficiency, clinical outcomes, and patient comfort. Digital tools such as intraoral scanners, 3D printing systems, CBCT imaging, and computer-aided design/computer-aided manufacturing (CAD/CAM) systems are becoming integral to modern dental practices

- Furthermore, the shift toward digital dentistry is being accelerated by the demand for reduced chair time, better diagnostics, and real-time treatment planning. Robotics-assisted procedures allow for accurate implant placement, better predictability, and fewer complications, which are especially important in complex or repeat cases

- The convenience of streamlined workflows, enhanced diagnostics, and improved patient engagement through visual simulations are driving the growth of digital dental systems in both small clinics and large dental service organizations (DSOs). Adoption is further bolstered by the rise of dental tourism and cosmetic dentistry trends in regions such as Asia-Pacific and the Middle East

Restraint/Challenge

High Capital Costs and Technical Complexity

- One of the primary challenges hindering widespread adoption of dental robotics and digital solutions is the high initial investment required for procurement and integration. Advanced robotics systems and 3D imaging devices entail significant upfront and maintenance costs, limiting access for smaller dental clinics, especially in developing countries

- For instance, a full-scale robotic dental surgery unit can cost upward of USD 150,000, while associated imaging and CAD/CAM tools add to the operational burden

- In addition, the complexity of system setup, the need for specialized training, and the integration of software with legacy systems present technical barriers. Many practitioners are hesitant to adopt robotics due to concerns over workflow disruptions, learning curves, and reliance on technical staff

- Furthermore, regulatory hurdles and limited reimbursement policies in certain markets act as additional roadblocks, slowing down commercial deployment despite strong clinical demand

- To address these challenges, companies are increasingly focusing on modular designs, cloud-based software solutions, leasing models, and strategic training partnerships to make advanced technologies more accessible and user-friendly for dental professionals across various practice settings

Dental Robotics and Digital Solutions Market Scope

The market is segmented on the basis of product type and end user.

- By Product Type

On the basis of product type, the global dental robotics and digital solutions market is segmented into robotics, digital solutions, imaging equipment, and manufacturing equipment. The imaging equipment segment held the largest revenue share of 37.6% in 2024, owing to the increasing adoption of advanced diagnostic tools such as CBCT (Cone-Beam Computed Tomography) and intraoral scanners in dental practices. These technologies enhance diagnostic accuracy, enable 3D treatment planning, and streamline workflows, making them essential for modern dental care.

The robotics segment is projected to witness the fastest CAGR of 19.8% from 2025 to 2032, driven by the rising demand for precision-guided implant surgeries, minimally invasive procedures, and AI-enabled robotic systems. Dental robotics are increasingly integrated into surgical assistance, orthodontics, and automated cleaning systems, which reduce human error and increase procedural efficiency.

- By End User

On the basis of end user, the dental robotics and digital solutions market is segmented into hospitals, dental clinics, and others. The dental clinics segment accounted for the largest market share of 58.4% in 2024, supported by the widespread presence of private dental practices and their growing investment in digital dentistry tools. Clinics are rapidly adopting intraoral scanners, chairside CAD/CAM systems, and robotic arms to improve patient experience and reduce procedure time.

The hospitals segment is expected to register the fastest growth rate of 17.5% during the forecast period, fueled by increasing adoption of robotic surgery systems and digital solutions for complex dental and maxillofacial procedures. Hospitals benefit from comprehensive diagnostic systems and integrated treatment planning solutions to enhance surgical outcomes.

Dental Robotics and Digital Solutions Market Regional Analysis

- North America dominated the dental robotics and digital solutions market with the largest revenue share of 38.7% in 2024, driven by the growing demand for precision dental procedures, integration of AI-driven imaging, and adoption of robotic-assisted surgeries across dental clinics and hospitals

- Consumers in the region highly value advanced technological solutions, including digital scanning, CAD/CAM-based restorations, and robotic surgeries that offer improved clinical outcomes and faster recovery. The presence of major market players and widespread use of intraoral scanners and chairside milling units also propel market growth

- This widespread adoption is further supported by high disposable incomes, robust dental insurance coverage, and continuous investment in digital dentistry training. These factors have firmly established North America as the frontrunner in the global Dental Robotics and Digital Solutions market

U.S. Dental Robotics and Digital Solutions Market Insight

The U.S. dental robotics and digital solutions market captured the largest revenue share of 71% in 2024 within North America, owing to strong technological adoption, a large number of dental practices, and rising demand for robotic-assisted implant surgeries and digital smile design tools. The expansion of digital workflows in private dental offices and increased usage of AI-based diagnostic systems continue to fuel market expansion. Moreover, partnerships between dental schools and robotics developers are contributing to widespread adoption in clinical settings.

Europe Dental Robotics and Digital Solutions Market Insight

The Europe dental robotics and digital solutions market is projected to grow at a substantial CAGR throughout the forecast period, driven by rising dental tourism, improved access to digital tools, and investments in robotic innovation. Adoption is particularly strong in countries like Germany, France, and the U.K., where government support for digital healthcare transformation and rising awareness among dental professionals are encouraging integration of robotics and AI into routine practice.

U.K. Dental Robotics and Digital Solutions Market Insight

The U.K. dental robotics and digital solutions market is expected to grow at a noteworthy CAGR, supported by an increase in cosmetic dental procedures, technological integration in private practices, and a strong focus on innovation in dental diagnostics and implantology. The market is further aided by the proliferation of digital dental startups, enhanced patient experience, and the shift toward minimally invasive procedures supported by robotics and AI-guided imaging.

Germany Dental Robotics and Digital Solutions Market Insight

The Germany dental robotics and digital solutions market is expected to expand at a considerable CAGR during the forecast period, attributed to a mature dental care ecosystem, local manufacturing capabilities, and high adoption of CAD/CAM and 3D imaging in both clinical and laboratory settings. German dental professionals increasingly rely on automated surgical robots and AI diagnostics, offering efficient workflows and improved clinical precision, especially in implant planning and prosthodontics.

Asia-Pacific Dental Robotics and Digital Solutions Market Insight

The Asia-Pacific dental robotics and digital solutions market is poised to grow at the fastest CAGR of 13.6% during 2025 to 2032, driven by rising dental awareness, technological innovation, and government initiatives promoting digital healthcare in China, Japan, and India. The region is becoming a manufacturing and R&D hub for digital dental solutions, leading to reduced costs and expanded accessibility for advanced treatments, including robotic-assisted surgeries and intraoral imaging systems.

Japan Dental Robotics and Digital Solutions Market Insight

The Japan dental robotics and digital solutions market is gaining significant traction due to a tech-savvy population, government funding for advanced dental care, and the use of robotics for minimally invasive oral surgeries and orthodontics. Integration with IoT-enabled devices and the rising need for elder-friendly dental solutions are also contributing to the growth of robotics and AI applications in dental clinics.

China Dental Robotics and Digital Solutions Market Insight

The China dental robotics and digital solutions market accounted for the largest revenue share in Asia Pacific in 2024, propelled by a fast-growing middle class, strong local manufacturers, and rapid digital transformation in healthcare. The country is witnessing increased investment in smart dental clinics, integration of AI in diagnostics, and expanding use of robotic and 3D printing tools for prosthodontics and orthodontics.

Dental Robotics and Digital Solutions Market Share

The dental robotics and digital solutions industry is primarily led by well-established companies, including:

- 3M (U.S.)

- 3Shape A/S (Denmark)

- Dentsply Sirona, Inc. (U.S.)

- Cefla s.c. (Italy)

- Midmark Corporation (U.S.)

- VATECH Co. Ltd. (South Korea)

- Envista Holdings Corporation (U.S.)

- Align Technology Inc. (Switzerland)

- Beijing Baihui Weikang Technology Co., Ltd (China)

Latest Developments in Global Dental Robotics and Digital Solutions Market

- In March 2023, PLANMECA OY introduced new AI-based tools for Planmeca Romexis, which is recognized as a powerful software platform in dentistry. This platform encompasses a wide array of tools for dental imaging, diagnosis, and treatment planning across various indications and dental specialties

- In March 2023, PLANMECA OY introduced Planmeca Viso G3, which provides dental practices with a comprehensive range of imaging tools, harnessing the advantages of proven next-generation imaging technology

- In March 2023, Straumann Group introduced its digital dentistry solutions at the International Dental Show (IDS) in Cologne. These releases included Straumann's digital solutions for implantology and also featured new elements from the Group's orthodontic brand, Clear Correct

- In March 2024, Dr. Jay Neugarten, a renowned oral surgeon, published a prospective clinical study demonstrating the unparalleled accuracy and precision of the Yomi robotic platform for dental implant surgery

- In September 2024, analyses published by Dental Economics—including data from Missouri and ten U.S. dental practices—showed that practices using Yomi robotic implant systems experienced an average 137% increase in implant volume, significantly boosting efficiency and profitability

- In January 2025, Dental Tribune featured the ongoing robotic revolution in dental implantology, highlighting Yomi’s growing influence in improving surgical precision and operational efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.