Global Dental Sealants Market

Market Size in USD Billion

CAGR :

%

USD

1.12 Billion

USD

2.76 Billion

2024

2032

USD

1.12 Billion

USD

2.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.12 Billion | |

| USD 2.76 Billion | |

|

|

|

|

Dental Sealants Market Size

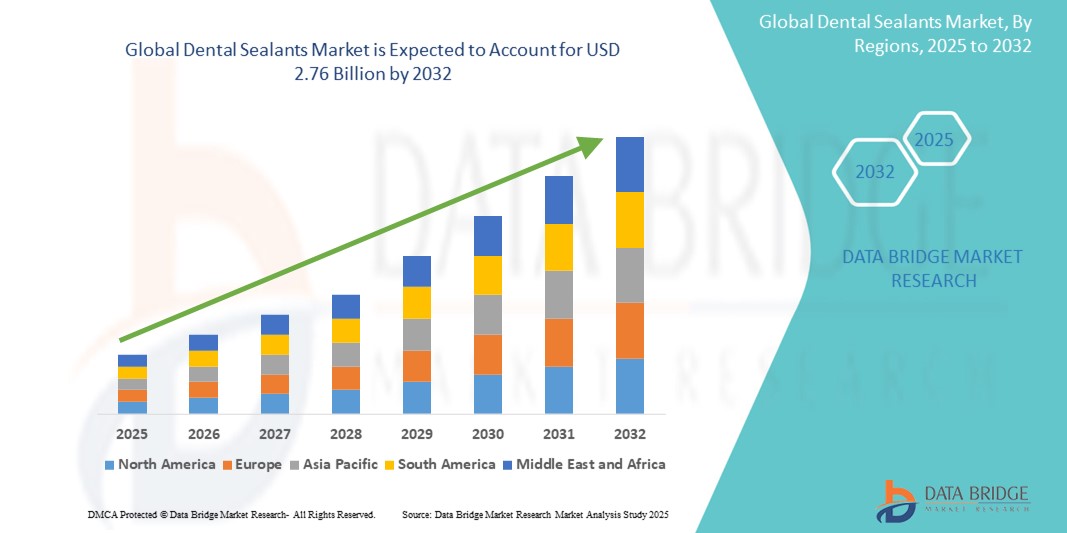

- The global dental sealants market size was valued at USD 1.12 billion in 2024 and is expected to reach USD 2.76 billion by 2032, at a CAGR of 8.00% during the forecast period

- This growth is driven by factors such as the rising awareness of oral hygiene, increasing demand for preventive dental care, and growing support from public health initiatives and school-based dental programs

Dental Sealants Market Analysis

- Dental sealants are preventive dental materials applied to the chewing surfaces of molars and premolars, providing a protective barrier against cavities by sealing deep grooves and fissures where food and bacteria often accumulate

- The demand for dental sealants is significantly driven by the growing emphasis on preventive dental care, increasing awareness of oral health, and rising dental care expenditure globally

- North America is expected to dominate the dental sealants market with a largest market share of 37.01% due to strong public oral health initiatives, high awareness levels, and widespread adoption of school-based dental programs

- Asia-Pacific is expected to be the fastest growing region in the dental sealants market during the forecast period due to expanding pediatric population, improving healthcare infrastructure, and increased government focus on oral health

- Adhesives segment is expected to dominate the market with a largest market share of 59.01% due to the popularity of tooth bonding procedure and high demand for dental restorations. The dental adhesives and sealants market is broadly categorized into adhesives and sealants. The adhesives segment is further divided into restorative and denture adhesives

Report Scope and Dental Sealants Market Segmentation

|

Attributes |

Dental Sealants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Sealants Market Trends

“Advancements in Dental Sealants Materials & Application Techniques”

- One prominent trend in the development of dental sealants is the continuous improvement in materials, such as the introduction of bioactive and fluoride-releasing sealants

- These innovations enhance the protective capabilities of sealants by promoting remineralization and reducing tooth sensitivity, providing long-term benefits for oral health

- For instance, bioactive sealants are designed to release fluoride and calcium ions, helping to repair early-stage enamel damage and prevent future decay

- These advancements are transforming preventive dental care, improving patient outcomes, and driving the demand for more durable and effective dental sealant products

Dental Sealants Market Dynamics

Driver

“Increasing Prevalence of Dental Caries and Growing Focus on Preventive Care”

- The rising prevalence of dental caries, particularly among children and the aging population, is significantly driving the demand for dental sealants as a preventive solution to tooth decay

- As the global population ages, the need for oral care intensifies, with older adults being more prone to tooth decay and requiring preventive treatments like dental sealants to maintain oral health

- With the growing awareness of the importance of preventive dental care and the cost-effectiveness of dental sealants in reducing cavity formation, the demand for these products continues to rise

For instance,

- According to the World Health Organization, dental caries remains one of the most common chronic diseases globally, affecting nearly 60–90% of school-aged children and the vast majority of adults

- As a result of the increasing prevalence of dental caries and the growing emphasis on preventive oral care, dental sealants are gaining popularity, driving market growth

Opportunity

“Integration of Digital Dentistry and Smart Technologies”

- The integration of digital technologies, such as 3D imaging, intraoral scanners, and CAD/CAM systems, with dental sealants is creating new opportunities for enhanced precision and customized treatments in preventive dental care

- These technologies allow for accurate mapping of tooth anatomy, enabling dental professionals to apply sealants more effectively and efficiently, ensuring better coverage and longer-lasting results

- Additionally, the rise of smart dental devices, such as AI-powered diagnostic tools and smart toothbrushes, is fostering a greater focus on proactive oral health management, creating opportunities for the wider adoption of dental sealants as part of routine care

For instance,

- In 2023, according to a report by the American Dental Association, the use of digital impressions and real-time patient monitoring is becoming more common, leading to more personalized and preventive treatment plans in dental care

- The integration of digital technologies and smart devices in dental practices presents a significant opportunity for expanding the use of dental sealants, improving treatment outcomes, and driving market growth

Restraint/Challenge

“High Cost of Dental Sealants and Application Procedures”

- The relatively high cost of dental sealants, particularly advanced resin-based or bioactive sealants, poses a challenge for widespread adoption, especially in price-sensitive regions or among lower-income populations

- While dental sealants are an effective preventive measure, the cost of materials, along with the fees for professional application, can deter patients from opting for this treatment, particularly in developing countries or for individuals without dental insurance coverage

- This financial barrier may also prevent dental professionals from offering sealants as part of routine care, especially in smaller clinics or underserved areas

For instance,

- In 2023, a study published by the World Health Organization highlighted that the affordability of preventive dental care, including dental sealants, remains a significant challenge in low-income regions, where many individuals lack access to comprehensive oral healthcare services

- As a result, the high cost of dental sealants and their application can limit access to this effective preventive treatment, slowing market growth and widening health disparities in dental care

Dental Sealants Market Scope

The market is segmented on the basis of etching type, curing, technology, and product type

|

Segmentation |

Sub-Segmentation |

|

By Etching Type |

|

|

By Curing |

|

|

By Technology |

|

|

By Product Type |

|

In 2025, the adhesives segment is projected to dominate the market with a largest share in product type segment

The adhesives segment is expected to dominate the dental sealants market with the largest share of 59.01% in 2025 due to the popularity of tooth bonding procedure and high demand for dental restorations. The dental adhesives and sealants market is broadly categorized into adhesives and sealants. The adhesives segment is further divided into restorative and denture adhesives.

The sealants is expected to account for the largest share during the forecast period in product type segment

In 2025, the sealants segment is expected to dominate the market with the largest market share of 56.6% due to their ease of use and versatility, making them a preferred choice for a variety of dental procedures, particularly in the prevention of cavities in children’s molars.

Dental Sealants Market Regional Analysis

“North America Holds the Largest Share in the Dental Sealants Market”

- North America dominates the global dental sealants market, with a largest market share of 37.01% driven by a well-established healthcare infrastructure, high consumer awareness, and significant demand for preventive dental care

- The U.S. holds a substantial largest market share of 30.4% due to increasing awareness of oral health, high adoption of dental sealants in pediatric and adult dentistry, and the growing emphasis on preventive care

- The presence of key dental product manufacturers, continuous advancements in dental technologies, and a high rate of dental insurance coverage further bolster market growth

- Additionally, the rising number of dental visits, increasing incidence of dental caries, and strong regulatory support for preventive oral health measures contribute to the region’s market dominance

“Asia-Pacific is Projected to Register the Highest CAGR in the Dental Sealants Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the global dental sealants market, driven by rapid advancements in healthcare infrastructure, increasing oral health awareness, and a growing population seeking preventive dental care

- Countries such as China, India, and Japan are emerging as key markets due to the increasing prevalence of dental caries, especially among children, and the rising demand for affordable dental treatments

- Japan, with its advanced healthcare system and emphasis on high-quality dental care, remains a significant market for dental sealants, particularly in pediatric dentistry

- China and India, with their large populations and increasing urbanization, are witnessing heightened awareness of oral health, resulting in more dental visits and increased adoption of sealants as a preventive measure. Additionally, the expanding presence of global dental manufacturers and improving accessibility to advanced dental products further support market growth in the region

Dental Sealants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- Dentsply Sirona (U.S.)

- GC Corporation (Japan)

- Ivoclar Vivadent (Liechtenstein)

- Ultradent Products Inc. (U.S.)

- Kuraray Noritake Dental Inc. (Japan)

- SDI Limited (Australia)

- Pulpdent Corporation (U.S.)

- BISCO, Inc. (U.S.)

- Sunstar Group (Switzerland)

- Tokuyama Dental Corporation (Japan)

- KaVo Kerr Group (U.S.)

- Heraeus Kulzer (Germany)

- Sino-dentex Co., Ltd. (China)

- Chemence (U.S.)

- Premier Dental Products Company (U.S.)

- Coltene Holding AG (Switzerland)

- DMG Dental Materials (Germany)

- Ivoclar Vivadent AG (Liechtenstein)

- Voco GmbH (Germany)

Latest Developments in Global Dental Sealants Market

- In 2021, Danaher Corporation acquired Nobel Biocare, a prominent provider of dental implants and a diverse portfolio of dental products. This strategic acquisition has significantly strengthened Danaher’s position in the global dental adhesives and sealants market, as Nobel Biocare’s extensive range of innovative dental solutions, including adhesives and sealants, enhances Danaher's offerings. This move is particularly relevant to the global dental sealants market, as it allows Danaher to capitalize on Nobel Biocare’s established market presence and contribute to the growing demand for preventive dental care solutions worldwide

- In 2019, 3M completed the acquisition of Acelity, Inc., a move aimed at expanding 3M’s portfolio in the wound care sector. The acquisition provides 3M with access to Acelity’s renowned brands, including KerraMax, Hydrocolloids, and Mepilex, further strengthening its position in the global wound care market. Additionally, this acquisition enhances 3M’s capabilities in the growing field of negative pressure wound therapy. This acquisition expand 3M’s expertise in healthcare products and technologies, positioning the company to leverage its advanced manufacturing and innovation capabilities in the dental adhesives and sealants segment

- In March 2024, Dentsply Sirona launched Prime&Bond Universal, an advanced and versatile dental adhesive technology engineered for both direct and indirect restorations. This innovative product enhances the company's portfolio by offering a reliable bonding solution across a wide range of dental procedures. This launch enhance bonding strength and versatility, which are essential for ensuring the durability and effectiveness of dental sealants in preventive care and restorative treatments

- In January 2024, 3M introduced an advanced dental adhesive designed to enhance bonding strength and durability, ultimately improving clinical outcomes. This innovative adhesive technology offers superior performance for a wide range of dental procedures, ensuring long-lasting results., as it contributes to the growing demand for high-quality adhesive solutions that provide reliable, durable bonds for dental sealants

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.