Global Dental Sleep Apnea Screening Devices Market

Market Size in USD Million

CAGR :

%

USD

84.15 Million

USD

239.54 Million

2024

2032

USD

84.15 Million

USD

239.54 Million

2024

2032

| 2025 –2032 | |

| USD 84.15 Million | |

| USD 239.54 Million | |

|

|

|

|

Dental Sleep Apnea Screening Devices Market Size

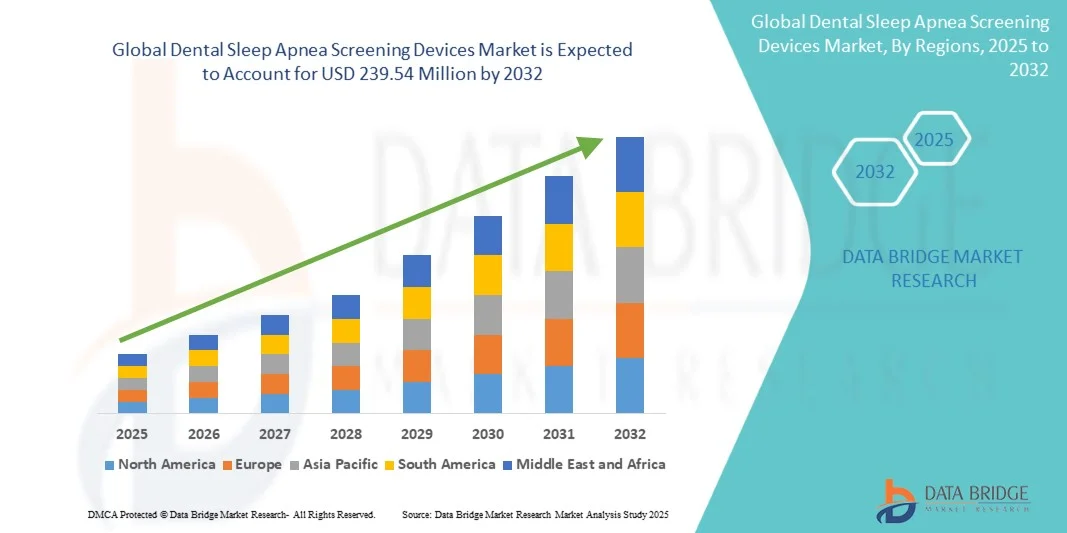

- The global dental sleep apnea screening devices market size was valued at USD 84.15 million in 2024 and is expected to reach USD 239.54 million by 2032, at a CAGR of 13.97% during the forecast period

- The market growth is largely fueled by the increasing prevalence of obstructive sleep apnea (OSA) and the rising awareness of its health risks, which have prompted greater demand for early diagnosis and effective treatment. Technological advancements in dental screening devices, including digital oral appliances and portable home-based systems, are improving diagnostic accuracy and patient comfort, driving wider adoption among dental professionals and patients

- Furthermore, the growing collaboration between dentists and sleep physicians, supported by telehealth integration and digital record sharing, is enhancing the accessibility and efficiency of sleep apnea screening. These converging factors are accelerating the adoption of dental sleep screening technologies, thereby significantly strengthening market growth

Dental Sleep Apnea Screening Devices Market Analysis

- Dental sleep apnea screening devices, designed to detect and evaluate sleep-disordered breathing through oral or digital diagnostic methods, are becoming essential tools in both dental and medical settings. Their ability to identify airway obstructions early enables timely treatment and improved patient outcomes

- The increasing global focus on preventive healthcare, combined with the expanding role of dental professionals in sleep disorder management, is driving substantial growth in this market. Rising use of home-based diagnostic devices, enhanced patient awareness, and ongoing innovations in bioengineered oral appliances are expected to further support long-term market expansion

- North America dominated the dental sleep apnea screening devices market due to rising awareness of sleep-related health issues and the growing integration of diagnostic technologies in dental practices

- Asia-Pacific is expected to be the fastest growing region in the dental sleep apnea screening devices market during the forecast period due to increasing awareness of sleep health, rapid urbanization, and expanding healthcare infrastructure in countries such as China, Japan, and India

- Positive Airway Pressure (PAP) devices segment dominated the market with a market share of 49.1% due to their high clinical effectiveness in maintaining airway patency and preventing obstruction during sleep. PAP devices such as CPAP, APAP, and BPAP systems are widely prescribed for moderate to severe sleep apnea patients, ensuring consistent airflow and improving sleep quality. Their established reliability, strong physician endorsement, and integration with data monitoring software for compliance tracking further strengthen their dominance in both home and clinical settings

Report Scope and Dental Sleep Apnea Screening Devices Market Segmentation

|

Attributes |

Dental Sleep Apnea Screening Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Sleep Apnea Screening Devices Market Trends

“Adoption of AI-Driven and Digital Screening Technologies”

- The integration of artificial intelligence and digital diagnostic solutions is emerging as a key trend transforming the dental sleep apnea screening devices market. These technologies enable faster detection of sleep-related breathing disorders and improve diagnostic accuracy by analyzing complex oral and airway data to assist dental professionals in making precise assessments

- For instance, companies such as Itamar Medical Ltd. and ResMed Inc. have developed advanced digital platforms that combine AI-based algorithms with dental imaging to enhance screening capabilities in clinical practices. For instance, Itamar’s WatchPAT ONE leverages AI-driven interpretation for home-based sleep apnea testing, providing actionable results that can be seamlessly integrated with dental workflows

- AI-driven screening devices are enabling real-time analysis of sleep parameters such as airflow, snoring, and oxygen saturation levels. This allows dentists to identify patients at risk of obstructive sleep apnea during routine checkups and provide timely referrals or interventions that were previously limited to specialized sleep centers

- In addition, the growing incorporation of digital workflows and cloud connectivity is improving the patient experience by enabling data sharing between dental and medical professionals. This helps create a more connected diagnostic ecosystem that enhances clinical efficiency and patient engagement through remote monitoring capabilities

- The fusion of AI, digital screening sensors, and telehealth platforms is facilitating early diagnosis while reducing the reliance on traditional polysomnography techniques, which are often time-consuming and expensive for patients. Such innovation ensures broader accessibility to screening, particularly across emerging markets

- The accelerating shift towards AI-powered and digitally enabled devices is poised to redefine the landscape of dental diagnostics, promoting precise, data-driven, and patient-centric care models within the broader field of sleep medicine

Dental Sleep Apnea Screening Devices Market Dynamics

Driver

“Increasing Prevalence of Obstructive Sleep Apnea”

- The growing prevalence of obstructive sleep apnea (OSA) across global populations is driving the adoption of dental-based screening solutions. Rising awareness of the health risks associated with untreated OSA, such as cardiovascular disease and hypertension, has significantly pushed demand for early diagnostic tools in dental clinics

- For instance, as reported by SomnoMed Limited in 2024, the company observed an increase in the number of patients screened for sleep-disordered breathing in collaboration with dental practices in North America and Europe. Such partnerships between dental networks and sleep technology providers are encouraging broader adoption of dental screening devices aimed at early identification of OSA

- The aging global population, coupled with lifestyle factors contributing to obesity and respiratory disorders, continues to elevate the incidence of sleep apnea among adults. Dental professionals are increasingly being trained to recognize symptoms such as teeth grinding and abnormal jaw structures that may indicate OSA risks

- Furthermore, government healthcare programs and dental associations are promoting the inclusion of sleep disorder screening as part of preventive oral healthcare, thereby expanding the patient base for dental screening technologies. This ongoing emphasis on preventive diagnostics supports growth across primary care and private dental settings

- The growing need for accessible, reliable, and non-invasive diagnostic options is strengthening the role of dental screening devices as a bridge between dental care and sleep medicine. The integration of such tools into dental workflows is expected to sustain steady market expansion in coming years

Restraint/Challenge

“High Device Costs and Limited Insurance Coverage”

- One of the major challenges impeding the broader adoption of dental sleep apnea screening devices is the high initial cost of advanced diagnostic equipment. Many dental clinics, particularly smaller or independently owned facilities, face budget constraints that limit investments in AI-enabled or digital screening technologies

- For instance, Dentsply Sirona dental practitioners have reported that despite interest in integrating sleep screening tools, upfront device and software costs remain a major barrier for clinics with limited patient volumes or financing options. This financial burden restricts the widespread implementation of advanced systems across mid- to small-scale dental care providers

- The limited reimbursement or insurance coverage for dental sleep apnea screening further complicates market growth. Many insurance policies classify such diagnostics under elective or non-medical services, discouraging both patients and dental professionals from adopting these technologies due to out-of-pocket expenses

- Moreover, ongoing maintenance requirements, software updates, and calibration costs contribute to long-term ownership expenses for clinics. The absence of clear regulatory and billing frameworks for dental sleep diagnostics further adds to the uncertainty faced by practitioners considering such investments

- Addressing these challenges through lower-cost device models, improved insurance collaboration, and increased awareness of the medical significance of dental sleep screening will be critical for achieving equitable market expansion and ensuring broader accessibility of these life-improving diagnostic tools

Dental Sleep Apnea Screening Devices Market Scope

The market is segmented on the basis of device, end user, gender, and age group.

- By Device

On the basis of device, the Dental Sleep Apnea Screening Devices market is segmented into Oral Appliances, Positive Airway Pressure (PAP) Devices, and Other Therapeutic Devices. The Positive Airway Pressure (PAP) devices segment dominated the market with the largest revenue share of 49.1% in 2024, driven by their high clinical effectiveness in maintaining airway patency and preventing obstruction during sleep. PAP devices such as CPAP, APAP, and BPAP systems are widely prescribed for moderate to severe sleep apnea patients, ensuring consistent airflow and improving sleep quality. Their established reliability, strong physician endorsement, and integration with data monitoring software for compliance tracking further strengthen their dominance in both home and clinical settings.

The Oral Appliances segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising patient preference for compact, comfortable, and travel-friendly treatment options. These devices, including mandibular advancement devices (MADs) and tongue stabilizing devices (TSDs), are increasingly favored by individuals with mild to moderate sleep apnea or CPAP intolerance. The growing role of dental professionals in sleep disorder management, along with advancements in custom-fit and 3D-printed oral appliances, is projected to accelerate adoption across home and clinical use.

- By End User

On the basis of end user, the market is segmented into Home Care Settings, Hospitals and Sleep Laboratories, and Clinics and Office Facilities. The Hospitals and Sleep Laboratories segment dominated the market in 2024 owing to the availability of advanced diagnostic tools, expert supervision, and comprehensive sleep evaluation facilities. These centers play a crucial role in performing polysomnography and providing customized treatment plans, driving significant equipment utilization. The strong referral network from physicians and insurance coverage for diagnostic testing have further strengthened their leadership position.

The Home Care Settings segment is anticipated to grow at the fastest rate from 2025 to 2032, driven by the increasing preference for home-based sleep testing and therapeutic convenience. Portable diagnostic devices and user-friendly PAP systems enable patients to monitor and manage their condition remotely, promoting adherence and reducing clinical visit frequency. The expansion of telehealth platforms and growing awareness about self-care solutions are further fueling market growth in residential environments.

- By Gender

On the basis of gender, the Dental Sleep Apnea Screening Devices market is segmented into Male and Female. The Male segment dominated the market in 2024 due to the higher prevalence of sleep apnea among men, attributed to anatomical and physiological factors such as larger neck circumference and upper airway resistance. Men are more frequently diagnosed with moderate to severe sleep apnea, resulting in greater adoption of PAP devices and oral appliances for long-term management. Awareness programs targeting male populations and early screening initiatives by healthcare providers further reinforce their market share.

The Female segment is projected to record the fastest growth from 2025 to 2032 as awareness increases regarding underdiagnosis among women. Hormonal fluctuations, pregnancy-related sleep issues, and post-menopausal airway changes contribute to rising cases in this demographic. Growing research on gender-specific symptoms and the availability of smaller, customized device designs are enhancing adoption among female patients, strengthening this segment’s potential expansion.

- By Age Group

On the basis of age group, the market is segmented into Less than 40, 41 to 50, 51 to 60, and 61 and Above. The 51 to 60 age group held the largest market share in 2024, driven by the higher incidence of obstructive sleep apnea among middle-aged adults due to weight gain, reduced muscle tone, and lifestyle-related factors. This demographic is more likely to seek diagnosis and treatment to manage comorbidities such as hypertension, diabetes, and cardiovascular disorders. The growing awareness of sleep health and regular medical screening further boost device adoption within this segment.

The 61 and Above segment is projected to exhibit the fastest growth from 2025 to 2032 owing to increasing elderly populations and age-related airway collapsibility. Older adults often experience chronic conditions linked to sleep apnea, leading to greater utilization of PAP systems and oral appliances under medical supervision. Technological improvements enabling quieter, more comfortable, and user-adaptive devices are also enhancing treatment adherence in the senior age group.

Dental Sleep Apnea Screening Devices Market Regional Analysis

- North America dominated the dental sleep apnea screening devices market with the largest revenue share in 2024, driven by rising awareness of sleep-related health issues and the growing integration of diagnostic technologies in dental practices

- The strong presence of specialized sleep centers and advanced healthcare infrastructure supports early diagnosis and treatment adoption

- Increasing insurance coverage for sleep disorder testing and collaboration between dental professionals and sleep physicians are key factors fueling regional growth. The adoption of digital oral appliances and portable home-based screening systems is further driving the market expansion across both the U.S. and Canada

U.S. Dental Sleep Apnea Screening Devices Market Insight

The U.S. captured the largest revenue share in 2024 within North America, fueled by a high prevalence of obstructive sleep apnea (OSA) and growing public health initiatives promoting early detection. The country’s advanced healthcare ecosystem and increasing preference for non-invasive diagnostic solutions have strengthened market penetration. The adoption of oral appliance therapy (OAT) and PAP devices is accelerating, supported by FDA-approved technologies and reimbursement-friendly policies. Moreover, the widespread use of tele-dentistry and at-home sleep testing solutions is transforming patient diagnosis and monitoring efficiency.

Europe Dental Sleep Apnea Screening Devices Market Insight

The Europe dental sleep apnea screening devices market is projected to grow at a notable CAGR during the forecast period, driven by rising healthcare investments and growing recognition of OSA as a chronic condition affecting quality of life. Stringent EU health standards and a focus on preventive care are encouraging the use of clinically validated diagnostic devices. Increasing awareness among dental practitioners regarding sleep-disordered breathing and the incorporation of digital screening tools in dental clinics are further propelling market growth. The demand for personalized oral appliances and portable diagnostic systems is also rising across major European economies.

U.K. Dental Sleep Apnea Screening Devices Market Insight

The U.K. market is anticipated to expand steadily during the forecast period due to growing public awareness of sleep-related disorders and the role of dental professionals in early detection. The National Health Service (NHS) initiatives promoting home-based sleep studies and access to oral appliance therapy are driving adoption. In addition, the integration of AI-enabled diagnostic software and increased collaboration between dental and respiratory health specialists are enhancing diagnostic accuracy and patient outcomes across the country.

Germany Dental Sleep Apnea Screening Devices Market Insight

Germany’s market is expected to grow considerably during the forecast period, supported by its robust medical device industry and growing emphasis on precision healthcare. High adoption of digital diagnostic equipment and rising demand for customized mandibular advancement devices are key growth drivers. The country’s strong regulatory framework and investment in healthcare innovation are fostering the deployment of advanced screening technologies across hospitals and dental clinics. Furthermore, the increasing prevalence of sleep disorders among the aging population is significantly contributing to market expansion.

Asia-Pacific Dental Sleep Apnea Screening Devices Market Insight

The Asia-Pacific region is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing awareness of sleep health, rapid urbanization, and expanding healthcare infrastructure in countries such as China, Japan, and India. The rising prevalence of obesity and lifestyle-related sleep disorders is fueling demand for accessible, cost-effective screening devices. Government initiatives promoting sleep health awareness and the availability of locally manufactured diagnostic products are enhancing regional accessibility and affordability.

China Dental Sleep Apnea Screening Devices Market Insight

China accounted for the largest market share in the Asia-Pacific region in 2024, driven by a growing middle-class population and increased healthcare spending. Expanding adoption of home-based sleep testing and digital oral appliance systems is driving strong domestic demand. The presence of local device manufacturers offering affordable solutions and ongoing efforts to integrate smart diagnostic systems into telemedicine platforms are strengthening China’s position as a key regional market.

Japan Dental Sleep Apnea Screening Devices Market Insight

Japan’s market is witnessing robust growth due to a strong cultural emphasis on preventive healthcare and rapid adoption of advanced diagnostic technologies. The country’s aging population and rising cases of sleep-related breathing disorders are increasing the demand for accurate and compact diagnostic systems. Japanese dental clinics are increasingly integrating digital screening tools with AI-based data interpretation, improving diagnosis efficiency and patient engagement across both urban and suburban healthcare facilities.

Dental Sleep Apnea Screening Devices Market Share

The dental sleep apnea screening devices industry is primarily led by well-established companies, including:

- ProSomnus, Inc. (U.S.)

- Vivos Therapeutics, Inc. (U.S.)

- ResMed Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare Corporation Limited (New Zealand)

- SomnoMed Limited (Australia)

- Whole You, Inc. (U.S.)

- Apnimed, Inc. (U.S.)

- BMC Medical Co., Ltd. (China)

- 3B Medical, Inc. (U.S.)

- Itamar Medical Ltd. (Israel)

- Cadwell Industries, Inc. (U.S.)

- Curative Medical, Inc. (China)

- DeVilbiss Healthcare LLC (U.S.)

- Braebon Medical Corporation (Canada)

Latest Developments in Global Dental Sleep Apnea Screening Devices Market

- In September 2025, Nylon flexTAP received FDA clearance as the first digitally printed single-point midline oral appliance for treating mild to moderate obstructive sleep apnea. This development represents a breakthrough in dental device manufacturing by combining precision 3D printing technology with advanced polymer materials, resulting in faster production and improved patient comfort. The innovation is expected to enhance accessibility for patients seeking cost-effective alternatives to traditional PAP systems. It also enables dental professionals to deliver highly customizable treatment solutions, thereby driving wider adoption of oral appliances and fueling growth across the dental sleep apnea screening devices market

- In September 2025, the American Academy of Dental Sleep Medicine (AADSM) issued updated guidelines endorsing the use of teledentistry in the management of sleep apnea through oral appliance therapy. This update promotes remote consultations, digital impressions, and virtual follow-ups, reducing the need for frequent in-person visits and increasing patient convenience. The move is expected to expand care accessibility, particularly in underserved regions, and enhance diagnostic efficiency. By integrating digital connectivity and remote monitoring into dental sleep medicine, these guidelines are set to strengthen the market for screening devices and accelerate digital transformation in the dental care ecosystem

- In June 2025, ProSomnus expanded its EVO line with the launch of EVO Guided, the first bioengineered oral appliance intentionally designed to dilate both the velopharynx and oropharynx to treat obstructive sleep apnea. This next-generation design optimizes airway patency and breathing efficiency by addressing two critical sites of airway collapse. The innovation highlights the growing role of bioengineering in dental sleep solutions, offering superior comfort and therapeutic outcomes. The introduction of such scientifically advanced products is expected to boost clinical adoption among dental professionals and expand the overall market for premium oral devices

- In June 2025, Apnimed, Inc. unveiled comprehensive findings from its Phase 3 SynAIRgy trial for AD109, an oral therapy candidate targeting obstructive sleep apnea. Although pharmacological in nature, the company’s progress underscores the increasing attention toward non-invasive and personalized treatment modalities. The success of AD109 is expected to raise global awareness of sleep-disordered breathing, encouraging earlier screening and diagnosis. This, in turn, supports market expansion for dental sleep apnea screening devices, as growing patient awareness and multidisciplinary treatment approaches drive demand for effective diagnostic tools

- In August 2021, Vivos Therapeutics, Inc. announced a strategic collaboration with Empower Sleep, a California-based telemedicine provider specializing in accessible sleep care solutions. This partnership aimed to integrate digital diagnostics and remote consultation into dental sleep apnea management, helping patients across North America access personalized sleep disorder evaluation. By bridging medical and dental expertise through telehealth, the alliance significantly improved patient reach and reduced barriers to diagnosis. This initiative played a pivotal role in promoting the adoption of dental sleep screening technologies and laid the groundwork for the digital transformation of the sleep care landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.