Global Dental Sleep Medicine Market

Market Size in USD Billion

CAGR :

%

USD

7.03 Billion

USD

10.56 Billion

2024

2032

USD

7.03 Billion

USD

10.56 Billion

2024

2032

| 2025 –2032 | |

| USD 7.03 Billion | |

| USD 10.56 Billion | |

|

|

|

|

Dental Sleep Medicine Market Size

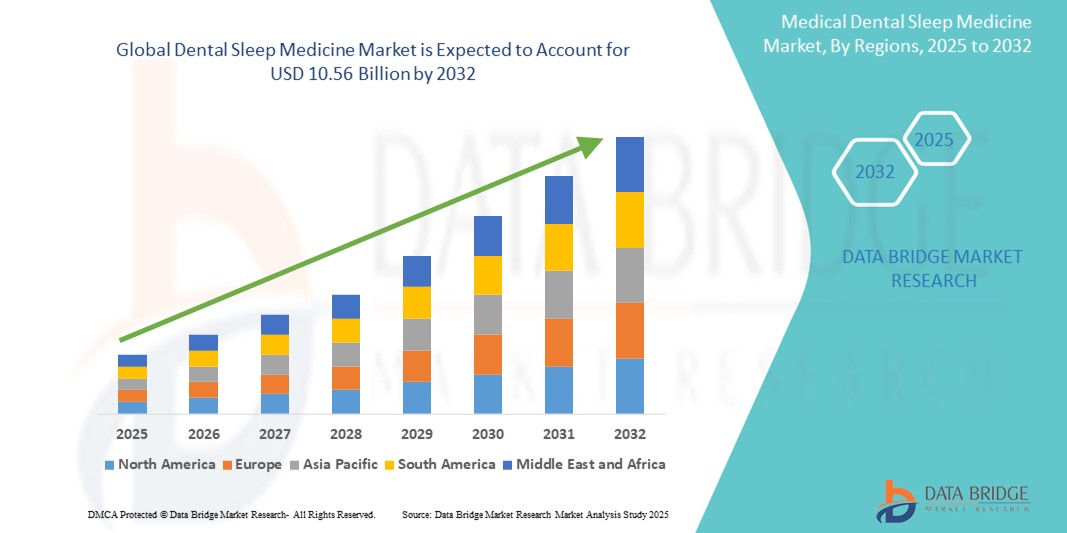

- The global dental sleep medicine market size was valued at USD 7.03 billion in 2024 and is expected to reach USD 10.56 billion by 2032, at a CAGR of 5.21% during the forecast period

- The market growth is largely fueled by the rising prevalence of sleep-related disorders such as obstructive sleep apnea (OSA), insomnia, and bruxism, combined with the increasing awareness of oral appliance therapy (OAT) as an effective, non-invasive treatment option

- Furthermore, growing consumer demand for comfortable, user-friendly, and cost-effective alternatives to CPAP therapy is establishing dental sleep medicine as a preferred modality for managing sleep-disordered breathing. These converging factors are accelerating the uptake of dental sleep medicine solutions, thereby significantly boosting the industry's growth

Dental Sleep Medicine Market Analysis

- Dental sleep medicine, offering non-invasive oral appliance therapy (OAT) for sleep-disordered breathing such as obstructive sleep apnea (OSA) and snoring, is becoming an increasingly vital component of modern sleep health and dental care services, especially in both clinical and home-based settings due to its improved patient compliance, comfort, and integration with sleep monitoring technologies

- The escalating demand for dental sleep medicine is primarily driven by the rising global prevalence of sleep-related disorders, growing awareness of the health risks associated with untreated OSA, and increased physician and dentist collaboration in sleep health management

- North America dominated the dental sleep medicine market with the largest revenue share of 42.8% in 2024, characterized by early adoption of oral appliance therapy, high diagnostic rates of OSA, and the strong presence of key industry players. The U.S. is experiencing substantial growth in dental sleep medicine, particularly within multidisciplinary sleep centers and dental sleep practices, fueled by favorable insurance coverage and increased physician referrals

- Asia-Pacific is expected to be the fastest-growing region in the dental sleep medicine market during the forecast period with a projected CAGR of 9.6%, owing to increasing urbanization, rising disposable incomes, improving healthcare infrastructure, and growing awareness of sleep disorders in countries such as China, India, and Japan

- The treatment segment dominated the dental sleep medicine market with a revenue share of 63.7% in 2024, driven by the rising demand for therapeutic interventions such as Positive Airway Pressure (PAP) therapy and oral devices, which offer effective and patient-compliant solutions for managing sleep-related breathing disorders

Report Scope and Dental Sleep Medicine Market Segmentation

|

Attributes |

Dental Sleep Medicine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Sleep Medicine Market Trends

“Enhanced Convenience Through Home-Based Sleep Solutions”

- A significant and accelerating trend in the global dental sleep medicine market is the rising preference for at-home diagnostic and treatment solutions. This shift is driven by increased patient awareness, improved accessibility of portable diagnostic tools, and the growing need for convenient and cost-effective care—especially for sleep disorders such as obstructive sleep apnea (OSA)

- For instance, portable polysomnography devices and home-based oximetry tools are gaining popularity as they allow patients to undergo sleep assessments without visiting specialized labs. Companies are increasingly developing user-friendly, accurate devices that deliver reliable results while improving patient compliance

- In terms of therapy, there’s a growing demand for custom-fitted oral appliances that can be used outside of clinical environments. These devices are designed to reposition the jaw and tongue to maintain open airways during sleep, providing an effective alternative to CPAP for mild to moderate OSA

- In addition, advancements in telehealth integration have allowed sleep physicians and dental professionals to monitor treatment remotely, adjusting devices and care plans as needed based on patient-reported outcomes and remote diagnostic data

- This transition towards non-invasive, patient-centric care is reshaping the market landscape, encouraging innovation in device miniaturization, cloud-based diagnostics, and cross-disciplinary collaboration between dental practitioners and sleep specialists

- As a result, manufacturers are investing heavily in home-based treatment solutions, emphasizing comfort, portability, and ease of use to meet the growing demand for personalized sleep therapies across various patient demographics

Dental Sleep Medicine Market Dynamics

Driver

“Growing Need Due to Rising Sleep Disorder Prevalence and Home-Based Care Adoption”

- The increasing prevalence of sleep-related disorders such as obstructive sleep apnea (OSA), insomnia, and snoring, particularly among adults and the geriatric population, is a significant driver fueling the demand for dental sleep medicine globally

- For instance, in April 2024, ResMed Inc. announced the development of advanced home-based diagnostic solutions combined with oral appliance therapy to expand accessibility for patients with undiagnosed OSA. Such strategies by key players are expected to boost the growth of the dental sleep medicine market during the forecast period

- As awareness regarding the serious health risks of untreated sleep apnea grows—including cardiovascular complications and impaired cognitive function—patients and providers are increasingly turning to oral and non-invasive therapeutic solutions as effective alternatives to CPAP

- In addition, the trend toward home-based diagnosis and teleconsultation is transforming traditional care models. Patients can now access initial screening, follow-up consultations, and oral appliance adjustments from the comfort of their homes, which has improved compliance and satisfaction

- The rising demand for non-invasive, comfortable, and easy-to-use treatment options, including mandibular advancement devices and positional therapy solutions, is also fueling market growth. This trend is further supported by the proliferation of sleep-focused dental practices and multidisciplinary collaboration between dentists and sleep specialists

Restraint/Challenge

“Low Diagnosis Rate and High Initial Treatment Cost”

- One of the major restraints in the dental sleep medicine market is the low rate of diagnosis for sleep apnea and related conditions. Many individuals remain undiagnosed due to limited awareness, lack of access to sleep specialists, or misattribution of symptoms to other health issues

- For instance, research indicates that over 80% of moderate to severe OSA cases go undiagnosed, limiting the addressable market for dental-based interventions. This diagnostic gap creates a barrier to market growth despite the availability of effective therapies

- In addition, high upfront costs associated with customized oral appliances, diagnostic procedures like polysomnography, and long-term therapy compliance can deter patients, particularly in low-income or uninsured populations

- Insurance coverage for dental sleep medicine remains inconsistent across regions and payers, which affects patient willingness to pursue treatment. Although some countries have begun including oral appliance therapy in reimbursement plans, many markets still lack robust coverage frameworks

- To overcome these barriers, companies and healthcare providers must focus on education, early screening programs, and more affordable, scalable solutions. Partnerships between dental clinics and primary care networks are also key to driving earlier intervention and wider adoption

Dental Sleep Medicine Market Scope

The market is segmented on the basis of type, treatment & diagnostics, age group, and end user.

• By Type

On the basis of type, the dental sleep medicine market is segmented into diagnostic and treatment. The treatment segment dominated the market with a revenue share of 63.7% in 2024, driven by the rising demand for therapeutic interventions like PAP therapy and oral devices.

The diagnostic segment is expected to witness the fastest CAGR of 8.4% from 2025 to 2032, due to the increasing adoption of sleep testing and screening technologies.

• By Treatment & Diagnostics

On the basis of treatment & diagnostics, the dental sleep medicine market is segmented into positive airway pressure (PAP) therapy, oral and nasal devices, airway systems, other devices, drugs, surgery, polysomnography and polygraphy, and oximetry and actigraphy. The positive airway pressure (PAP) therapy segment held the largest market share of 41.2% in 2024, owing to its effectiveness in managing obstructive sleep apnea.

The oral and nasal devices segment is projected to grow at the fastest CAGR of 9.6% from 2025 to 2032, fueled by increasing patient preference for non-invasive and comfortable alternatives.

• By Age Group

On the basis of age group, the dental sleep medicine market is segmented into pediatric, adult, and geriatric. The adult segment accounted for the largest market revenue share of 58.9% in 2024, as sleep apnea is highly prevalent in middle-aged adults.

The geriatric segment is expected to witness the fastest CAGR of 7.8% from 2025 to 2032, driven by a growing elderly population and increased awareness of sleep-related disorders among seniors.

• By End User

On the basis of end user, the dental sleep medicine market is segmented into hospitals, sleep laboratories, home, and others. The hospital segment held the highest revenue share of 39.6% in 2024, supported by integrated care models and clinical treatment infrastructure.

The home segment is projected to grow at the fastest CAGR of 10.2% from 2025 to 2032, due to the expansion of telehealth, home sleep testing, and self-managed treatment solutions.

Dental Sleep Medicine Market Regional Analysis

- North America dominated the dental sleep medicine market with the largest revenue share of 42.8% in 2024, driven by a growing demand for advanced sleep therapies, widespread awareness of sleep disorders, and high healthcare expenditure

- Consumers in the region highly value the convenience and clinical effectiveness of oral appliance therapy and CPAP devices, along with broader integration into digital health ecosystems

- This widespread adoption is further supported by high disposable incomes, favorable reimbursement policies, and the presence of leading sleep medicine providers and manufacturers

U.S. Dental Sleep Medicine Market Insight

The U.S. dental sleep medicine market captured the largest revenue share of 81.05% within North America in 2024, fueled by early technology adoption, high diagnosis rates of obstructive sleep apnea (OSA), and a rising preference for home-based treatments. The integration of wearable sleep trackers, strong insurance coverage, and a high concentration of specialized clinics also supports market dominance.

Europe Dental Sleep Medicine Market Insight

The Europe dental sleep medicine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increased awareness of OSA, aging demographics, and wider access to PAP therapy. Government-supported healthcare systems and innovation in sleep diagnostics continue to push adoption across major countries.

U.K. Dental Sleep Medicine Market Insight

The U.K. dental sleep medicine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of home sleep testing and a push for early OSA intervention through oral appliances. Public and private initiatives supporting non-invasive therapies are accelerating growth.

Germany Dental Sleep Medicine Market Insight

Germany dental sleep medicine market is expected to expand at a considerable CAGR during the forecast period, driven by digital health integration, a strong network of sleep labs, and increased focus on minimally invasive therapy for moderate sleep apnea cases. Patient preference for outpatient treatment solutions continues to rise.

Asia-Pacific Dental Sleep Medicine Market Insight

The Asia-Pacific dental sleep medicine market is poised to grow at the fastest CAGR of 9.6% from 2025 to 2032, propelled by rapid urbanization, increasing awareness, and expanding diagnostic capacity in China, Japan, India, and South Korea. Affordability and regional manufacturing capabilities enhance market penetration.

Japan Dental Sleep Medicine Market Insight

The Japan dental sleep medicine market captured 29.3% of the Asia-Pacific share in 2024, projected to grow at a CAGR of 8.3%, supported by a tech-savvy population, government health initiatives, and widespread availability of advanced diagnostic tools.

China Dental Sleep Medicine Market Insight

The China dental sleep medicine market led Asia-Pacific with a revenue share of 34.7% in 2024, driven by a rising middle class, robust smart device adoption, and strong public hospital infrastructure. Growth is further supported by local manufacturers offering affordable oral appliances and home sleep testing kits.

Dental Sleep Medicine Market Share

The dental sleep medicine industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- ResMed (Australia)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Medical Depot, Inc. (U.S.)

- Curative, Inc. (U.S.)

- Apex Dental Sleep Lab (U.S.)

- BMC (China)

- BD (U.S.)

- Cadwell Industries Inc. (U.S.)

- Invacare Holding Corporation (U.S.)

- Compumedics Limited (Australia)

- Braebon Medical Corporation (Canada)

- General Electric Company (U.S.)

- SomnoMed (Australia)

- Henry Schein, Inc. (U.S.)

Latest Developments in Global Dental Sleep Medicine Market

- In June 2025, ProSomnus introduced EVO Guided, the first bioengineered oral appliance designed to expand both the velopharynx and oropharynx, now FDA‑cleared as an extension of its EVO platform

- In April 2025, the American Academy of Dental Sleep Medicine (AADSM) released updated teledentistry guidelines, providing clear standards for using remote oral appliance therapy in managing obstructive sleep apnea and snoring

- In May 2025, Panthera Dental presented interim findings from a 5‑year, multicenter real-world study demonstrating the long-term effectiveness of its CAD/CAM 3D‑printed oral appliance in treating OSA, at both AADSM and SLEEP conferences

- In February 2025, Panthera Dental launched BioMatch, a new single-step ordering and manufacturing system designed to streamline the delivery of patient-matched oral appliances and simplify workflows for dental and sleep professionals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.