Global Dental Software Market

Market Size in USD Billion

CAGR :

%

USD

3.04 Billion

USD

5.72 Billion

2024

2032

USD

3.04 Billion

USD

5.72 Billion

2024

2032

| 2025 –2032 | |

| USD 3.04 Billion | |

| USD 5.72 Billion | |

|

|

|

|

Dental Software Market Size

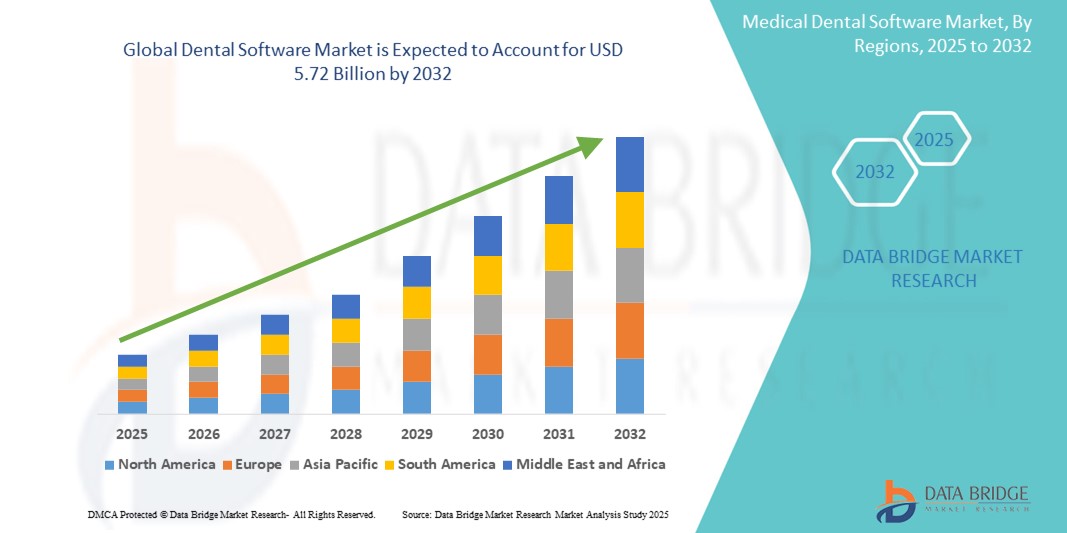

- The global dental software market size was valued at USD 3.04 billion in 2024 and is expected to reach USD 5.72 billion by 2032, at a CAGR of 8.23% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within dental practice management systems and digital health records, leading to increased digitalization across dental clinics and hospitals globally

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions to streamline administrative tasks, patient engagement, diagnostics, and treatment planning is establishing dental software as a critical component of modern dental care delivery. These converging factors are accelerating the uptake of dental software solutions, thereby significantly boosting the industry's growth

Dental Software Market Analysis

- Dental software, offering advanced solutions for imaging, patient record management, appointment scheduling, and billing, is increasingly becoming a vital component of modern dental practices across both private and institutional settings due to its enhanced operational efficiency, data accuracy, and integration with digital dental devices

- The escalating demand for dental software is primarily fueled by the widespread adoption of digital dentistry, increasing patient expectations for seamless service, and a rising preference among dental professionals for cloud-based and AI-integrated platforms that streamline workflow and improve patient outcomes

- North America dominated the dental software market with the largest revenue share of 41.8% in 2024, characterized by early adoption of dental IT solutions, high healthcare expenditure, and a strong presence of key industry players. The U.S. continues to experience substantial growth in dental software deployment, particularly in multi-chair clinics and corporate dental chains, driven by innovation in electronic health record (EHR) systems and AI-assisted diagnostic tools

- Asia-Pacific is expected to be the fastest-growing region in the dental software market, projected to expand at a CAGR of 9.1% from 2025 to 2032, due to rapid urbanization, rising disposable incomes, expanding dental infrastructure, and increasing awareness of oral healthcare technology, especially in countries such as China, India, and South Korea

- Practice management software segment dominated the dental software market with a market share of 34.5% in 2024, driven by its utility in streamlining billing, scheduling, and patient record management. This segment continues to expand as dental practices increasingly adopt integrated solutions to enhance workflow efficiency and administrative accuracy

Report Scope and Dental Software Market Segmentation

|

Attributes |

Dental Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Software Market Trends

“Increasing Shift Toward Intelligent and Automated Dental Practice Solutions”

- A significant and accelerating trend in the global dental software market is the growing integration of intelligent features and automation into practice management systems. Dental software platforms are now increasingly capable of learning from user interactions, automating repetitive tasks, and optimizing patient communication, leading to improved workflow efficiency and enhanced patient experience

- For instances, some advanced dental platforms offer voice-activated charting, appointment setting, and clinical note entry, enabling dental professionals to operate hands-free during procedures. These features are particularly beneficial in busy clinics, where multitasking without compromising hygiene is essential

- Intelligent scheduling tools within modern dental software can analyze patient history and practitioner availability to automatically suggest optimal appointment times. Predictive analytics are also being used to forecast patient no-shows and treatment outcomes, allowing clinics to better plan resources and manage revenues

- Integration with smart devices and cloud platforms facilitates real-time data sharing across multiple operatories or even different clinic locations. Dentists can monitor practice performance, patient flow, and treatment statuses through centralized dashboards—whether in-office or remotely

- Furthermore, intuitive interfaces and guided workflows are helping reduce training time and human errors, making even sophisticated tools accessible to non-technical staff. Dental software developers are increasingly focusing on interoperability with digital imaging systems, CAD/CAM tools, and third-party apps to ensure seamless data flow across the dental ecosystem

- The demand for intelligent, intuitive, and interoperable dental solutions is rising across private clinics, DSOs (Dental Service Organizations), and academic institutions, as the industry moves toward a fully digital and patient-centric care model

Dental Software Market Dynamics

Driver

“Growing Need Due to Rising Digitalization and Patient Engagement Requirements”

- The increasing demand for streamlined practice management and digital dental workflows, coupled with the expanding adoption of electronic health record (EHR) systems, is a significant driver for the heightened demand for dental software

- For instance, in April 2024, Planet DDS introduced new AI-powered scheduling and billing tools integrated into its Denticon platform, aimed at improving operational efficiency for group practices. Such advancements are expected to drive the Dental Software industry growth over the forecast period

- As dental practices increasingly seek efficient and centralized tools to manage appointments, billing, imaging, diagnostics, and compliance, dental software offers integrated solutions that enhance clinical and operational performance

- Furthermore, the growing emphasis on patient experience and communication is leading to a surge in demand for software with features such as online booking, telehealth, digital treatment planning, and patient portals

- The convenience of cloud-based platforms, secure data storage, and remote access capabilities are key factors propelling the adoption of dental software in both small practices and large dental service organizations (DSOs). The trend toward digitized dental ecosystems and the increasing availability of user-friendly, scalable dental software options further contributes to market expansion

Restraint/Challenge

“Concerns Regarding Data Security and High Implementation Costs”

- Concerns surrounding cybersecurity vulnerabilities in cloud-based and network-connected software systems pose a significant challenge to broader market penetration. As dental software relies on storing sensitive patient data, it is susceptible to hacking attempts and data breaches, raising compliance and privacy concerns

- For instance, recent reports of healthcare data leaks globally have made some practices cautious in transitioning fully to digital systems without robust safeguards

- Addressing these cybersecurity concerns through strong encryption, HIPAA-compliant protocols, and regular software updates is crucial for building trust among users. Vendors such as Curve Dental and Carestream Dental emphasize their secure cloud architecture in marketing strategies to reassure clients

- In addition, the relatively high initial cost of software implementation, integration, staff training, and data migration can act as a barrier, especially for small- to mid-sized practices with limited IT infrastructure or capital. Although cloud solutions help reduce hardware costs, the ongoing subscription and customization fees may remain a concern for budget-conscious dental facilities

Dental Software Market Scope

The dental software market is segmented into four notable segments based on type, application, deployment model, and end user.

• By Type

On the basis of type, the dental software market is segmented into practice management software, patient communication software, treatment planning software, patient education software, and dental imaging software. The practice management software segment dominated the market with the largest revenue share of 34.5% in 2024, driven by its utility in streamlining billing, scheduling, and patient record management.

The dental imaging software segment is expected to witness the fastest growth with a CAGR of 15.2% from 2025 to 2032, due to rising demand for advanced diagnostic tools and integration with treatment software.

• By Application

On the basis of application, the dental software market is segmented into clinical application and administrative. The clinical application segment accounted for the largest revenue share of 58.7% in 2024, fueled by increasing use of imaging, diagnostics, and treatment planning technologies.

The administrative segment is projected to register the fastest CAGR of 12.8% from 2025 to 2032, driven by the demand for automated workflows and electronic health records management.

• By Deployment Model

On the basis of deployment model, the dental software market is segmented into on-premise model and web-based/cloud-based model. The web-based/cloud-based model held the largest revenue share of 61.3% in 2024, due to its cost-effectiveness, scalability, and remote accessibility. It is also expected to be the fastest growing segment with a CAGR of 13.4% during 2025–2032, as cloud adoption increases across dental practices.

• By End User

On the basis of end users, the dental software market is segmented into hospitals, clinics, academics and research institutes, and others. The clinics segment dominated the market with a revenue share of 49.6% in 2024, owing to the growing number of independent dental clinics adopting software for daily operations.

The hospitals segment is anticipated to exhibit the fastest CAGR of 12.1% from 2025 to 2032, supported by the integration of dental departments into hospital health IT systems.

Dental Software Market Regional Analysis

- North America dominated the dental software market with the largest revenue share of 41.8% in 2024, driven by early adoption of digital dental technologies, robust healthcare infrastructure, and a strong presence of leading dental software providers

- The region benefits from high awareness of dental care, increasing demand for integrated EHR and imaging systems, and continued investment in cloud-based platforms to improve clinical workflow and patient experience

- The widespread use of electronic health records (EHRs), government incentives to digitalize healthcare, and the growing shift toward automation in dental practices are major contributors to market growth across the region

U.S. Dental Software Market Insight

The U.S. dental software market captured the largest revenue share of 75% within North America in 2024, fueled by the rapid digitization of dental clinics and DSOs (Dental Service Organizations). The demand for practice management software, cloud integration, and digital imaging is surging as clinics seek to streamline operations, enhance patient care, and ensure regulatory compliance. Continuous advancements in AI-driven diagnostic tools and tele-dentistry solutions are further accelerating adoption.

Europe Dental Software Market Insight

The Europe dental software market is projected to expand at a substantial CAGR throughout the forecast period, driven by the increasing prevalence of oral diseases, demand for workflow automation, and stringent regulatory compliance for medical software. The region is witnessing high uptake in countries such as Germany, the U.K., and France, where digitized healthcare systems and government-supported eHealth initiatives are prominent. Integration of 3D imaging and CAD/CAM modules is a growing trend in European dental clinics.

U.K. Dental Software Market Insight

The U.K. dental software market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increased funding in dental technology, the NHS’s digital health agenda, and rising awareness of preventive dental care. Clinics are focusing on patient engagement and digital record management through user-friendly platforms that comply with GDPR and NHS data security frameworks.

Germany Dental Software Market Insight

The Germany dental software market is expected to expand at a considerable CAGR during the forecast period, due to a well-established healthcare system, widespread adoption of imaging and charting software, and strong emphasis on eco-friendly, paperless solutions. The integration of dental software with hospital IT systems and insurance platforms is a significant trend driving growth in both public and private practices.

Asia-Pacific Dental Software Market Insight

The Asia-Pacific dental software market is poised to grow at the fastest CAGR of 9.1% from 2025 to 2032, driven by increasing urbanization, government support for healthcare digitization, and rapid adoption of cloud-based platforms. Countries such as China, India, and Japan are leading the regional growth due to rising dental tourism, expanding private healthcare sectors, and the adoption of mobile-friendly patient engagement tools.

Japan Dental Software Market Insight

The Japan dental software market is steadily gaining momentum, bolstered by the country’s tech-savvy population, aging demographic, and demand for remote dental consultations. Cloud-based imaging and real-time communication tools are becoming increasingly popular as dental providers prioritize efficiency and remote service delivery.

China Dental Software Market Insight

The China dental software market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by a growing middle class, massive investments in healthcare IT, and increasing consumer spending on oral health. The country’s push toward smart clinics and integration of AI diagnostics in urban hospitals is boosting demand for scalable, localized dental software solutions across the public and private sectors.

Dental Software Market Share

The dental software industry is primarily led by well-established companies, including:

- ABELDent Inc (Canada)

- DentiMax (U.S.)

- Carestream Health (U.S.)

- Henry Schein, Inc. (U.S.)

- YAPI Inc. (U.S.)

- ACE Dental Software (U.S.)

- Datacon Dental Systems (U.S.)

- KaVo Dental (Germany)

- Open Dental Software (U.S.)

- PLANMECA OY (Finland)

- Dentsply Sirona (U.S.)

- Consult-PRO (Canada)

- CD Newco, LLC (U.S.)

- Practice-Web Inc. (U.S.)

- NXGN (U.S.)

- Veradigm LLC (U.S.)

Latest Developments in Global Dental Software Market

- In June 2025, ZimVie launched RealGUIDE Dental Implant Software Suite, a digital planning solution designed to enhance efficiency, accuracy, and esthetic outcomes in implant dentistry

- In March 2025, Planmeca introduced advanced software during IDS 2025, featuring seamless integration with its intraoral and extraoral imaging systems—reinforcing its position in delivering unified digital workflows for diagnostics and CAD/CAM treatment planning

- In February 2025, ZimVie also announced new AI-powered digital dentistry features at major conferences, expanding its imaging and treatment planning tools with enhanced automation and clinical insights

- In January 2025, VideaHealth, a prominent dental AI company, successfully secured USD 40 million in an oversubscribed Series B funding round. Since its inception in 2022, VideaHealth has solidified its position as a frontrunner in providing cutting-edge AI-powered software solutions for dental service organizations (DSOs)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.