Global Dental Wax Market

Market Size in USD Billion

CAGR :

%

USD

1.14 Billion

USD

1.64 Billion

2025

2033

USD

1.14 Billion

USD

1.64 Billion

2025

2033

| 2026 –2033 | |

| USD 1.14 Billion | |

| USD 1.64 Billion | |

|

|

|

|

Dental Wax Market Size

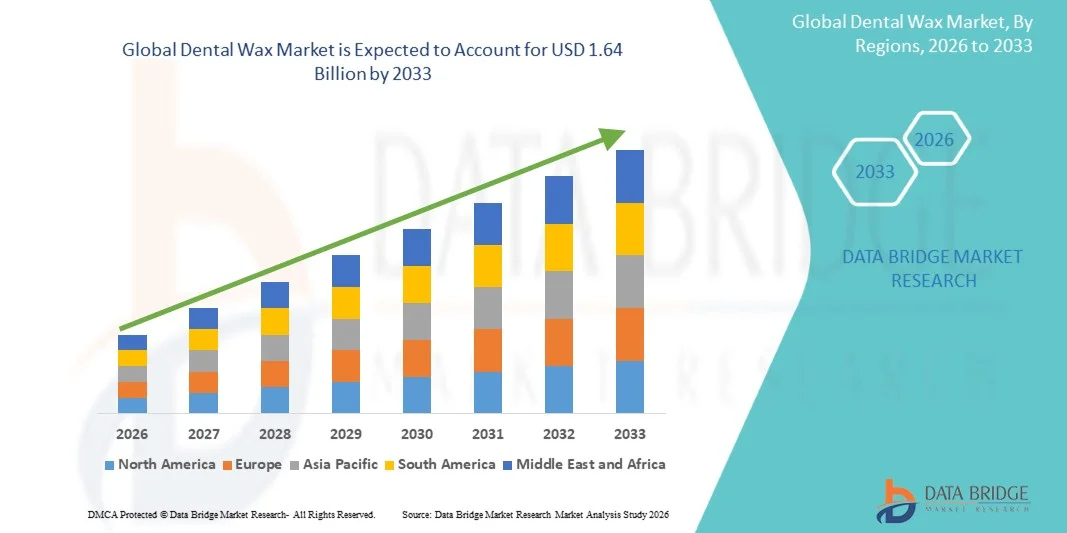

- The global Dental Wax market size was valued at USD 1.14 billion in 2025 and is expected to reach USD 1.64 billion by 2033, at a CAGR of 4.73% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced dental care solutions, rising awareness of oral hygiene, and growing demand for prosthetic and orthodontic treatments in both clinical and at-home settings

- Furthermore, the expanding geriatric population, rising prevalence of dental disorders, and growing focus on cosmetic dentistry are establishing dental wax as a key material in restorative and orthodontic procedures. These converging factors are accelerating the uptake of Dental Wax solutions, thereby significantly boosting the industry's growth

Dental Wax Market Analysis

- Dental wax, widely used in prosthodontics, orthodontics, and restorative dentistry, is increasingly vital in dental laboratories and clinical practices due to its ease of molding, biocompatibility, and precision in creating dental impressions and appliances

- The escalating demand for dental wax is primarily fueled by the growing prevalence of dental disorders, rising cosmetic dentistry adoption, and increasing investments in dental healthcare infrastructure across emerging and developed markets

- North America dominated the dental wax market with the largest revenue share of approximately 35.4% in 2025, supported by a high number of dental clinics and laboratories, advanced dental technologies, strong healthcare spending, and the presence of key industry players. The U.S. experienced substantial growth in dental wax usage due to innovations in orthodontics and prosthodontics and rising patient awareness of dental aesthetics

- Asia-Pacific is expected to be the fastest growing region in the dental wax market during the forecast period, registering a robust CAGR of around 10.2%, driven by increasing urbanization, rising disposable incomes, expanding dental infrastructure, and growing awareness of oral care in countries such as China, India, and Japan

- The Standard Gastroscopes segment dominated the market with the largest revenue share of approximately 42.8% in 2025

Report Scope and Dental Wax Market Segmentation

|

Attributes |

Dental Wax Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Wax Market Trends

“Growing Adoption of Advanced Dental Materials and Digital Dentistry”

- A significant and accelerating trend in the global dental wax market is the rising adoption of advanced wax materials and digital dentistry techniques for improved precision in prosthetics, orthodontics, and restorative procedures

- For instance, in 2023, GC Corporation launched a new line of high-performance dental waxes designed for CAD/CAM-assisted prosthetic modeling, enhancing workflow efficiency and accuracy in dental laboratories

- Dental waxes are increasingly formulated to offer superior thermal stability, fine detail reproduction, and ease of carving for complex dental restorations

- There is a growing preference for pre-formed and color-coded wax sheets to reduce errors and improve aesthetic outcomes

- The use of wax in combination with 3D printing and digital modeling is expanding, allowing for faster production of crowns, bridges, and dentures. Customizable wax formulations tailored to different dental procedures are gaining traction among practitioners

- Increasing demand for cosmetic and restorative dental procedures is driving innovation in wax composition and properties

- Dental educational institutions are adopting digital and wax-based simulation models for hands-on training

- High-precision waxes are also being used in implantology and complex prosthetic planning. The development of low-shrinkage and high-fidelity waxes supports better clinical outcomes

- Manufacturers are focusing on environmentally friendly and biocompatible wax options. Overall, the trend reflects a shift towards more efficient, accurate, and technologically integrated dental practices

Dental Wax Market Dynamics

Driver

“Rising Demand for Cosmetic and Restorative Dental Procedures”

- The increasing prevalence of dental disorders, along with the growing awareness and demand for cosmetic and restorative dentistry, is a major driver for the global dental wax market

- For instance, in 2022, Kerr Dental expanded its line of dental wax products targeting crown and bridge applications, to meet rising demand in both private and institutional dental practices

- Population aging and the associated need for dentures and partial prosthetics are fueling market growth

- Growing disposable income and increased spending on oral care products support higher adoption of dental waxes

- Dental tourism and elective cosmetic dentistry procedures in emerging economies are contributing to market expansion. Professional dental training programs continue to adopt wax-based practice models, boosting demand

- Increasing prevalence of malocclusion and orthodontic treatments drives the need for modeling waxes. Technological advancements such as CAD/CAM and 3D printing in dentistry are expanding wax applications

- Rising awareness about oral health among consumers promotes the use of high-quality wax materials. Hospital and clinic adoption of wax-based models for treatment planning adds to market growth

- The trend toward minimally invasive dentistry emphasizes precision wax products for better outcomes. Overall, these factors collectively support sustained growth and expansion in the Dental Wax market

Restraint/Challenge

“Price Volatility and Material Handling Complexity”

- Challenges related to fluctuating raw material prices and the technical handling of dental waxes are key restraints affecting market growth

- For instance, in 2021, reports highlighted that the rising cost of paraffin and beeswax derivatives led to increased production costs for dental wax manufacturers, impacting small-scale laboratories

- Some waxes require precise temperature control during modeling, making handling complex and skill-dependent.

- Substandard wax quality or improper storage can compromise dental restoration accuracy. Limited awareness of advanced wax products in emerging markets can slow adoption

- Competition from alternative materials such as resins and polymers may restrain market share. Inconsistent supply chains for high-quality raw waxes pose challenges to manufacturers

- Clinicians may require additional training to efficiently use advanced wax formulations. Environmental and biocompatibility compliance adds cost and complexity to production

- High-end wax products often carry premium pricing, limiting access in cost-sensitive regions. Overcoming these challenges through consistent raw material supply, product standardization, and user training will be crucial for sustained growth

- Addressing price and handling concerns while expanding awareness of wax benefits will support long-term adoption in both dental laboratories and clinical practices

Dental Wax Market Scope

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the Dental Wax market is segmented into Standard Gastroscopes, Trans Nasal Gastroscopes, Therapeutic Gastroscopes, Dual Channel Gastroscopes, and Others. The Standard Gastroscopes segment dominated the market with the largest revenue share of approximately 42.8% in 2025. This dominance is driven by their widespread use in routine dental procedures, diagnostics, and educational purposes. Dental practitioners prefer standard gastroscopes due to their reliability, compatibility with conventional dental wax formulations, and ease of handling. Their established presence in both developed and emerging markets makes them a first-choice tool for most dental procedures. Furthermore, standard gastroscopes offer consistent performance across a variety of patient types, which reinforces their high adoption in hospitals, clinics, and academic institutions. Availability of standardized protocols, training familiarity, and the growing number of dental care centers globally also support this segment’s leading position. The segment’s dominance is further strengthened by the cost-effectiveness and multi-purpose utility of standard gastroscopes, making them integral to dental diagnostic workflows.

The Trans Nasal Gastroscopes segment is expected to witness the fastest CAGR of 9.8% from 2026 to 2033. The rapid growth is primarily fueled by increasing patient preference for minimally invasive procedures that reduce discomfort and procedural time. Trans nasal gastroscopes are widely adopted in outpatient and specialty dental clinics due to their ergonomic design, better visualization, and enhanced patient compliance. Technological advancements, including improved optics and flexible tips, are further propelling adoption. Rising awareness among dentists and patients regarding minimally invasive techniques and improved procedural outcomes is boosting their utilization. In addition, the increasing prevalence of chronic oral and gastric conditions requiring precise diagnostics supports segment growth. Favorable reimbursement policies, rising healthcare expenditure in emerging markets, and expansion of dental specialty centers are expected to accelerate the adoption of trans nasal gastroscopes, positioning it as the fastest-growing type segment globally.

- By Application

On the basis of application, the Dental Wax market is segmented into Contraindications, Gastric Ulcer, Chronic Gastritis, Normal Mucosa, and Others. The Gastric Ulcer application segment accounted for the largest revenue share of 38.5% in 2025, driven by the rising clinical use of dental wax for protective and diagnostic purposes in patients with oral and gastric ulcer conditions. Hospitals and clinics prioritize this application due to its clinical efficacy in reducing patient discomfort and enhancing procedural precision. The segment benefits from strong evidence supporting wax’s protective qualities during endoscopic or dental interventions. High patient awareness, increasing procedural volumes in dental care centers, and the demand for standardized protective materials contribute to its leadership. Furthermore, ongoing training programs in dental schools emphasizing the importance of wax in ulcer-related procedures reinforce adoption. The segment also benefits from technological improvements in wax formulations, offering better adhesion, flexibility, and patient comfort, solidifying its position as the dominant application globally.

The Chronic Gastritis application segment is projected to witness the fastest CAGR of 8.7% from 2026 to 2033, attributed to the growing incidence of chronic gastritis and related oral manifestations that require specialized diagnostic and therapeutic procedures. The demand is further accelerated by increasing awareness among dental professionals and patients regarding minimally invasive treatments and preventive care. Rising geriatric populations, particularly in Asia-Pacific and Europe, are driving higher procedural volumes. The segment is also supported by innovations in wax materials that enhance procedural accuracy, ease of handling, and patient comfort. Expanding hospital infrastructure, outpatient dental facilities, and research initiatives focusing on chronic gastritis are likely to further accelerate market penetration. In addition, the increasing adoption of multi-purpose wax for both diagnostic and treatment procedures is expected to contribute significantly to the rapid growth of this application segment.

- By End User

On the basis of end user, the Dental Wax market is segmented into Hospitals and Clinics, Diagnostic Labs, Ambulatory Surgical Centres (ASCs), and Others. Hospitals and Clinics dominated the market with a revenue share of 41.2% in 2025, supported by high procedural volumes, integrated dental departments, and regular use of dental wax in diagnostic and restorative procedures. Hospitals prefer high-quality wax for patient safety, procedural precision, and reliable outcomes. The segment’s dominance is reinforced by the widespread availability of trained dental professionals, strong purchasing capacity, and consistent demand for advanced wax formulations. In addition, hospitals benefit from long-term supplier contracts and bulk procurement, ensuring continuity and cost-effectiveness in material usage. Government and private hospital investments in dental care infrastructure, coupled with growing awareness of oral health, further strengthen this segment. Hospitals also act as key training centers for dental students, further consolidating their leading position.

The Diagnostic Labs end-user segment is expected to witness the fastest CAGR of 9.2% from 2026 to 2033, fueled by the rising outsourcing of specialized dental diagnostics, increased adoption of wax for precision modeling, and the expansion of private laboratory networks in emerging markets. These labs utilize dental wax in innovative applications, including molecular modeling, prosthetic research, and experimental procedures. Increasing demand for faster, more accurate testing results and expanding outpatient diagnostic facilities are driving growth. Rising investment in dental research, the need for high-quality diagnostic outputs, and the adoption of technologically advanced wax products are key factors accelerating this segment’s growth.

Dental Wax Market Regional Analysis

- North America dominated the dental wax market with the largest revenue share of approximately 35.4% in 2025

- Supported by a high number of dental clinics and laboratories, advanced dental technologies, strong healthcare spending, and the presence of key industry players

- The market experienced substantial growth in dental wax usage due to innovations in orthodontics and prosthodontics and rising patient awareness of dental aesthetics

U.S. Dental Wax Market Insight

The U.S. dental wax market captured the majority of North America’s revenue in 2025, driven by widespread adoption in dental clinics and laboratories, continuous technological advancements, and increasing demand for precision dental prosthetics. Rising patient preference for cosmetic and restorative dental procedures further propels market growth.

Europe Dental Wax Market Insight

The Europe dental wax market is projected to grow steadily during the forecast period, driven by established dental care infrastructure, increasing adoption of modern dental technologies, and rising demand for dental prosthetics. Countries like Germany, France, and the U.K. are witnessing steady expansion in orthodontic and prosthodontic applications.

U.K. Dental Wax Market Insight

The U.K. dental wax market is expected to grow at a notable CAGR, fueled by increasing investments in dental care facilities, adoption of advanced dental materials, and rising patient awareness of oral aesthetics.

Germany Dental Wax Market Insight

Germany dental wax market remains a key market in Europe, with growth supported by strong dental healthcare systems, increasing demand for high-quality dental prosthetics, and technological innovation in dental laboratories.

Asia-Pacific Dental Wax Market Insight

The Asia-Pacific dental wax market is anticipated to register the fastest CAGR of around 10.2% during the forecast period, driven by increasing urbanization, rising disposable incomes, expansion of dental infrastructure, and growing awareness of oral care. Countries such as China, India, and Japan are emerging as key contributors to market growth.

Japan Dental Wax Market Insight

The Japan dental wax market is witnessing steady growth, supported by a high standard of dental care, technological adoption in dental laboratories, and increasing patient focus on cosmetic dentistry. In addition, the country’s aging population and rising demand for restorative and prosthodontic treatments are further contributing to the sustained adoption of dental wax products across clinics and laboratories.

China Dental Wax Market Insight

China dental wax market accounted for a significant revenue share in the Asia-Pacific region in 2025, attributed to the growing number of dental clinics, rising disposable incomes, increasing awareness of dental health, and adoption of modern dental technologies and materials.

Dental Wax Market Share

The Dental Wax industry is primarily led by well-established companies, including:

- Dentsply Sirona (U.S.)

- Ivoclar Vivadent (Liechtenstein)

- GC Corporation (Japan)

- Renfert GmbH (Germany)

- Kerr Dental (U.S.)

- BEGO GmbH & Co. KG (Germany)

- Heraeus Kulzer (Germany)

- Whip Mix Corporation (U.S.)

- Yeti Dentalprodukte GmbH (Germany)

- Zhermack SpA (Italy)

- Coltène Group (Switzerland)

- 3M Oral Care (U.S.)

- Shofu Dental Corporation (Japan)

- Nissin Dental Products (Japan)

- Anaxdent GmbH (Germany)

- Prevest DenPro (India)

- Pyrax Polymars (India)

- Metrodent Limited (U.K.)

- MDM Corporation (Italy)

- Unident AB (Sweden)

Latest Developments in Global Dental Wax Market

- In August 2023, Kerr Corporation launched a new CAD/CAM-compatible dental wax block designed specifically for high-precision milling applications using 5-axis machines, improving workflow efficiency and accuracy for dental laboratories. This launch allowed dental labs to integrate traditional wax modeling with digital milling systems, reducing material waste and supporting the shift toward digital dentistry workflows

- In November 2023, DWS Systems partnered with a major 3D printer OEM to introduce a fully compatible printable dental wax blend for bridges and veneers, facilitating additive manufacturing (3D printing) of wax patterns. The collaboration expanded the utility of dental wax into digital fabrication, producing millions of dental prosthetic units and helping labs adopt 3D technologies

- In February 2024, Pyrax Polymars unveiled a color-coded educational dental wax kit for academic institutions, enabling dental students to easily distinguish wax types and model dental anatomy more effectively, leading to broad adoption in over 300 institutions soon after release. This development helped bridge educational needs with practical lab skills training

- In April 2024, Solstice T&I introduced a weather-resistant healing dental wax with enhanced shelf life up to 18 months, reducing product spoilage especially in tropical and high-humidity regions. This addressed distribution and storage challenges in emerging markets and improved product reliability for clinicians

- In March 2024, Bracon Dental filed a patent for a novel wax formulation integrated with natural antimicrobial agents, significantly reducing bacterial growth on stored wax sheets, which supports improved hygiene and safety in lab environments. The patent highlights industry focus on microbiological control in dental materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.