Global Dental Workflow Ai Platforms Market

Market Size in USD Million

CAGR :

%

USD

333.23 Million

USD

892.17 Million

2025

2033

USD

333.23 Million

USD

892.17 Million

2025

2033

| 2026 –2033 | |

| USD 333.23 Million | |

| USD 892.17 Million | |

|

|

|

|

Dental Workflow AI Platforms Market Size

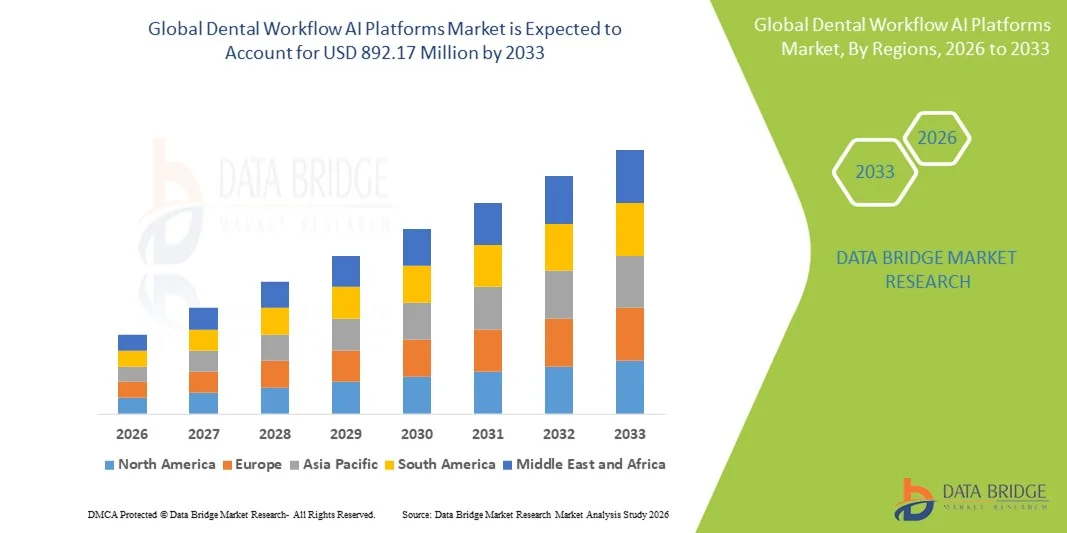

- The global dental workflow AI platforms market size was valued at USD 333.23 Million in 2025 and is expected to reach USD 892.17 Million by 2033, at a CAGR of 13.10% during the forecast period

- The market growth is largely fueled by the growing adoption of digital dentistry and AI-driven technologies, leading to enhanced efficiency, accuracy, and automation in dental workflows across both clinical and laboratory settings

- Furthermore, rising demand for personalized patient care, faster treatment planning, and improved diagnostic capabilities is driving the adoption of Dental Workflow AI Platforms solutions, thereby significantly boosting the industry's growth

Dental Workflow AI Platforms Market Analysis

- AI-driven dental workflow platforms, offering end-to-end automation for diagnostics, treatment planning, and patient management, are increasingly vital components of modern dental practices and laboratories due to their enhanced accuracy, efficiency, and integration with digital imaging and patient record systems

- The escalating demand for dental workflow AI platforms is primarily fueled by the growing adoption of digital dentistry, rising focus on personalized patient care, and the need for faster and more precise treatment planning

- North America dominated the dental workflow AI platforms market with the largest revenue share of 38.7% in 2025, driven by advanced dental infrastructure, high adoption of AI-based solutions, and the strong presence of key industry players, with the U.S. experiencing substantial growth in AI platform installations across dental clinics, hospitals, and specialty labs

- Asia-Pacific is expected to be the fastest-growing region in the dental workflow AI platforms market during the forecast period, registering a robust CAGR driven by increasing urbanization, rising dental healthcare expenditure, and the growing adoption of AI-enabled digital dentistry in countries such as China, India, and Japan

- The Diagnostics & Imaging segment dominated the market with the largest revenue share of approximately 41.5% in 2025, driven by the increasing adoption of AI-assisted imaging software in dental clinics for accurate diagnosis

Report Scope and Dental Workflow AI Platforms Market Segmentation

|

Attributes |

Dental Workflow AI Platforms Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Dentsply Sirona (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dental Workflow AI Platforms Market Trends

Increasing Adoption of Digital and Automated Dental Workflow Solutions

- A major and growing trend in the global dental workflow AI platforms market is the shift from traditional manual processes toward digital and automated dental workflows, aimed at improving operational efficiency, accuracy, and patient outcomes

- For instance, cloud-based dental workflow platforms now allow dental clinics to streamline patient scheduling, treatment planning, and prosthetic design, reducing manual errors and turnaround time for dental restorations

- Integration with 3D imaging, intraoral scanners, and CAD/CAM systems has become increasingly common, enabling seamless communication between the clinic and dental laboratories

- In addition, platforms that provide real-time analytics and performance tracking help dental practices optimize resource allocation, reduce waste, and enhance overall patient care quality

- This trend toward digitization is transforming the dental industry by enabling faster procedures, improved treatment precision, and enhanced patient satisfaction, driving the adoption of dental workflow platforms across clinics, hospitals, and academic institutions globally

Dental Workflow AI Platforms Market Dynamics

Driver

Rising Demand for Efficient and Patient-Centric Dental Care

- The growing need for efficient dental care solutions is a key factor driving market growth. Dental practices are increasingly looking to improve treatment precision, reduce procedural time, and enhance patient comfort

- For instance, in Europe and North America, clinics are adopting integrated digital workflow platforms to reduce the time required for designing dental prosthetics and orthodontic appliances, ensuring faster treatment cycles

- Increasing awareness of oral health and preventive dental care, along with rising disposable income in emerging economies, is boosting demand for modern dental technologies

- The growing number of dental clinics, coupled with expansion of dental insurance coverage, supports investment in workflow optimization platforms

- Moreover, dental education institutions are implementing digital platforms to train professionals in modern techniques, further driving adoption and standardization across the industry

Restraint/Challenge

High Implementation Costs and Integration Complexity

- A major challenge in the Dental Workflow AI Platforms market is the high initial cost of deployment, including software licensing, hardware acquisition (scanners, 3D printers), and staff training, which may limit adoption in small clinics or budget-conscious regions

- For instance, practices in developing countries often face financial constraints in procuring fully integrated digital solutions, resulting in slower market penetration

- Integration with existing legacy systems and laboratory processes can also be complex, requiring technical expertise and potentially causing operational disruptions during implementation

- In addition, concerns about data security and patient information privacy when using cloud-based platforms may restrain some dental practices from full adoption

- Overcoming these challenges will require the development of cost-effective solutions, modular platforms, and comprehensive training programs to ensure smoother integration and wider market acceptance globally

Dental Workflow AI Platforms Market Scope

The market is segmented on the basis of application and end user.

- By Application

On the basis of application, the Dental Workflow AI Platforms market is segmented into Treatment Planning, Diagnostics & Imaging, Patient Management, and Workflow Optimization. The Diagnostics & Imaging segment dominated the market with the largest revenue share of approximately 41.5% in 2025, driven by the increasing adoption of AI-assisted imaging software in dental clinics for accurate diagnosis. AI algorithms enhance precision in detecting cavities, bone density analysis, and orthodontic assessments. The surge in digital dentistry adoption, particularly in radiography and intraoral imaging, supports this growth. Rising awareness among dental professionals about reducing human error, along with regulatory approvals for AI-based diagnostic tools, boosts adoption. Integration with CAD/CAM systems further strengthens market demand. Hospitals and specialized dental clinics invest heavily in AI-enabled imaging solutions for improved patient outcomes. Continuous software upgrades and cloud-based data analytics add value. Partnerships between AI software providers and dental imaging hardware manufacturers increase adoption. Increased training and awareness programs for dental professionals also accelerate usage. Overall, this segment maintains dominance due to its critical role in clinical decision-making.

The Treatment Planning segment is expected to witness the fastest CAGR of around 18.2% from 2026 to 2033, driven by rising demand for AI-assisted treatment simulation and personalized care planning. AI platforms optimize treatment sequences, simulate outcomes, and reduce procedural errors. The growing use of 3D imaging, patient-specific surgical guides, and AI-powered predictive models in implantology and orthodontics fuels adoption. Workflow integration with patient management systems further accelerates implementation. Increasing investments in digital dental infrastructure across developed and emerging markets support growth. AI-assisted planning reduces chairside time, enhances patient satisfaction, and improves clinical efficiency. Rising elective procedures, including cosmetic dentistry and orthodontics, drive adoption. Cloud-enabled collaboration between clinics and laboratories strengthens usage. AI platforms also help in insurance and cost management planning, making them increasingly valuable.

- By End User

On the basis of end user, the market is segmented into Dental Clinics, Hospitals, and Academic & Research Institutes. The Dental Clinics segment dominated the market with nearly 52.3% revenue share in 2025, driven by high patient footfall and widespread adoption of AI platforms for daily operational efficiency. Clinics leverage AI for diagnostics, treatment planning, and patient management, enabling faster and more accurate outcomes. Small and medium-sized dental practices increasingly adopt AI due to cost-effectiveness and workflow optimization. Integration with imaging devices and cloud-based analytics enhances utility. Clinics prioritize platforms that offer real-time recommendations and predictive insights. Growing awareness of AI in improving patient outcomes and reducing treatment time strengthens demand. Partnerships with AI software vendors facilitate smooth onboarding and staff training. Increasing tele-dentistry initiatives also contribute to adoption. Regulatory approvals and supportive reimbursement policies in major markets drive utilization. Software updates and multi-device compatibility further support market dominance.

The Hospitals segment is projected to witness the fastest CAGR of around 16.9% from 2026 to 2033, owing to rising investments in large-scale AI deployment for comprehensive dental care. Hospitals are integrating AI across multiple departments, including diagnostics, surgical planning, and workflow optimization. AI-assisted imaging and predictive analytics improve patient safety and operational efficiency. Expansion of dental departments in multi-specialty hospitals drives demand. Growing emphasis on advanced dental procedures, such as implantology and orthodontics, fuels adoption. Hospitals increasingly use AI platforms for staff training, procedure standardization, and reducing human error. Collaboration with academic institutions for research-focused AI deployment also supports growth. The adoption of cloud-based AI software for centralized data management further accelerates the market. Rising healthcare budgets and digital transformation initiatives across hospitals in North America, Europe, and Asia-Pacific strengthen growth prospects.

Dental Workflow AI Platforms Market Regional Analysis

- The North America dental workflow AI platforms market dominated the global market with the largest revenue share of 38.7% in 2025

- Driven by advanced dental infrastructure, high adoption of AI-based solutions, and the strong presence of key industry players

- The market experienced substantial growth in AI platform installations across dental clinics, hospitals, and specialty labs, fueled by increasing demand for AI-assisted diagnostics, treatment planning, and workflow automation

U.S. Dental Workflow AI Platforms Market Insight

The U.S. dental workflow AI platforms market captured the largest revenue share in 2025 within North America, propelled by the rapid adoption of AI-based dental solutions. Clinics and hospitals are increasingly leveraging AI for imaging analysis, predictive diagnostics, and automated treatment planning, enhancing efficiency and patient outcomes. Growing investments in digital dentistry and supportive healthcare policies further accelerate market expansion. The presence of leading dental AI solution providers and the integration of AI with CAD/CAM, intraoral scanning, and practice management software are key growth drivers.

Europe Dental Workflow AI Platforms Market Insight

The Europe dental workflow AI platforms market is projected to expand at a significant CAGR during the forecast period, driven by increasing adoption of digital dentistry and AI-enabled workflow optimization across clinics and hospitals. Demand for faster diagnostics, accurate treatment planning, and cost-efficient solutions in countries such as the U.K., Germany, and France is fostering market growth. Additionally, Europe’s focus on healthcare innovation and investments in AI infrastructure support widespread adoption.

U.K. Dental Workflow AI Platforms Market Insight

The U.K. dental workflow AI platforms market is expected to grow steadily, fueled by the rising use of AI in dental imaging, diagnostics, and treatment workflows. Adoption is being supported by government initiatives for digital health, an increase in private dental care expenditure, and a preference for automated solutions that enhance patient outcomes and reduce operational inefficiencies.

Germany Dental Workflow AI Platforms Market Insight

The Germany dental workflow AI platforms market is anticipated to expand at a notable CAGR during the forecast period, driven by widespread adoption of AI in dental hospitals and clinics, increasing demand for precision treatment planning, and strong healthcare R&D infrastructure. The country’s emphasis on innovation and the integration of AI with digital dental technologies continue to support market expansion.

Asia-Pacific Dental Workflow AI Platforms Market Insight

The Asia-Pacific dental workflow AI platforms market is expected to be the fastest-growing region, registering a robust CAGR of 9.1% during the forecast period. Growth is driven by rising dental healthcare expenditure, increasing adoption of AI-enabled digital dentistry solutions, and rapid urbanization in key markets such as China, India, and Japan. The growing middle class, rising awareness of preventive dental care, and government initiatives supporting digital health technologies are key factors propelling market adoption.

Japan Dental Workflow AI Platforms Market Insight

The Japan dental workflow AI platforms market is witnessing growth due to high technological adoption, increasing investments in dental AI research, and the demand for advanced imaging and diagnostic solutions. Integration of AI with digital dentistry workflows, including imaging, orthodontics, and prosthodontics, is driving demand across clinics and hospitals.

China Dental Workflow AI Platforms Market Insight

The China dental workflow AI platforms market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing dental healthcare expenditure, and high adoption of AI-powered dental solutions. The country’s expanding middle-class population, growing private dental sector, and strong local AI solution providers are fueling market growth. AI-based platforms for diagnostics, treatment planning, and workflow automation are becoming increasingly popular across urban dental clinics and hospitals.

Dental Workflow AI Platforms Market Share

The Dental Workflow AI Platforms industry is primarily led by well-established companies, including:

• Dentsply Sirona (U.S.)

• Align Technology (U.S.)

• 3Shape (Denmark)

• Carestream Dental (U.S.)

• Planmeca (Finland)

• Nobel Biocare (Switzerland)

• Vatech (South Korea)

• Henry Schein (U.S.)

• Straumann (Switzerland)

• DEXIS (U.S.)

• Midmark (U.S.)

• Ormco (U.S.)

• Sirona Dental Systems (Germany)

• Apteryx Imaging (U.S.)

• iTero (U.S.)

• KaVo Kerr (Germany)

• Acteon Group (France)

• Planmeca Romexis (Finland)

• ProDente (Germany)

• Vatech Global (South Korea)

Latest Developments in Global Dental Workflow AI Platforms Market

- In August 2022, NovoDynamics, Inc. and Vyne Dental announced a strategic partnership to integrate the NovoHealth Dental AI platform into Vyne Dental’s payer‑services portfolio, enabling over 800 dental insurance plans to utilise real‑time AI assessment of claims and attachments. This collaboration improved claims accuracy, reduced administrative burden, and strengthened communication between dental providers and payers

- In February 2024, 3Shape launched new AI‑driven workflows within its 3Shape LMS lab software suite, enabling dental laboratories to automate model generation and design proposals, thus reducing time‑consuming manual tasks and accelerating throughput in lab workflows. This marked a significant expansion of AI beyond clinical workflows into dental lab production and design

- In March 2024, dental AI leader Overjet announced completion of a USD 53.2 million Series C funding round, the largest investment in dental AI to date, aimed at expanding its AI platform for diagnostics, patient education, and claims automation across dental providers and payers. The funding reflects strong investor confidence in AI‑enabled dental workflow solutions

- In July 2024, CareStack and Overjet partnered to integrate Overjet’s FDA‑cleared AI dental imaging analysis into CareStack’s practice management system, enhancing automatic radiograph interpretation and clinical documentation within the dental workflow. This integration boosts diagnostic precision and supports dentists with clearer treatment insights

- In November 2024, Overjet introduced IRIS, billed as the first smart imaging platform for dentistry combining cloud‑based imaging with advanced AI to enhance low‑quality X‑rays into high‑clarity images with AI annotations highlighting conditions such as caries, periapical radiolucencies, and calculus, facilitating faster and more accurate decision‑making. IRIS is also FDA‑cleared for clinical precision use with offline capability and unlimited storage

- In December 2024, Viva AI announced a partnership with UptimeHealth to integrate its dental front‑office automation platform with dental equipment management, enhancing practice operations through tools like automated reminders, analytics and communication features for dental clinics. This partnership underscores the trend of extending AI’s value from clinical diagnostics to practice administration

- In April 2025, Pearl launched Pearl Pro, a new AI‑driven radiography platform designed to assist dentists with caries detection, periodontal analysis, and bone‑level assessment, expanding AI diagnostics capabilities across dental practices. This launch reflects rising competition and innovation in AI‑powered diagnostic tools

- In March 2025, Curve Dental integrated Bola AI into its cloud practice management platform, enabling voice recognition for clinical notes, periodontal charting, and restorative documentation, significantly reducing manual documentation time and enhancing workflow efficiency. This integration demonstrates the trend of embedding AI in everyday dental practice operations

- In June 2025, Denti.AI announced a partnership with Synergy Dental Partners to deploy its Voice Perio and Scribe AI‑powered solutions across Synergy’s practices, emphasising clinical documentation automation and comprehensive periodontal care support within dental workflows. This highlights how AI is reshaping clinical documentation and periodontal management specifically

- In June 2025, Dentsply Sirona secured a major contract win with a large U.S. dental group to deploy its AI‑enabled imaging workflow across 350 dental practices, integrating with Romexis and intraoral scanners to enhance diagnostic consistency and treatment planning accuracy. This reflects rapid adoption of AI workflows at scale within larger dental networks

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.