Global Dermal Fillers Market

Market Size in USD Billion

CAGR :

%

USD

6.35 Billion

USD

14.53 Billion

2024

2032

USD

6.35 Billion

USD

14.53 Billion

2024

2032

| 2025 –2032 | |

| USD 6.35 Billion | |

| USD 14.53 Billion | |

|

|

|

|

Dermal Fillers Market Size

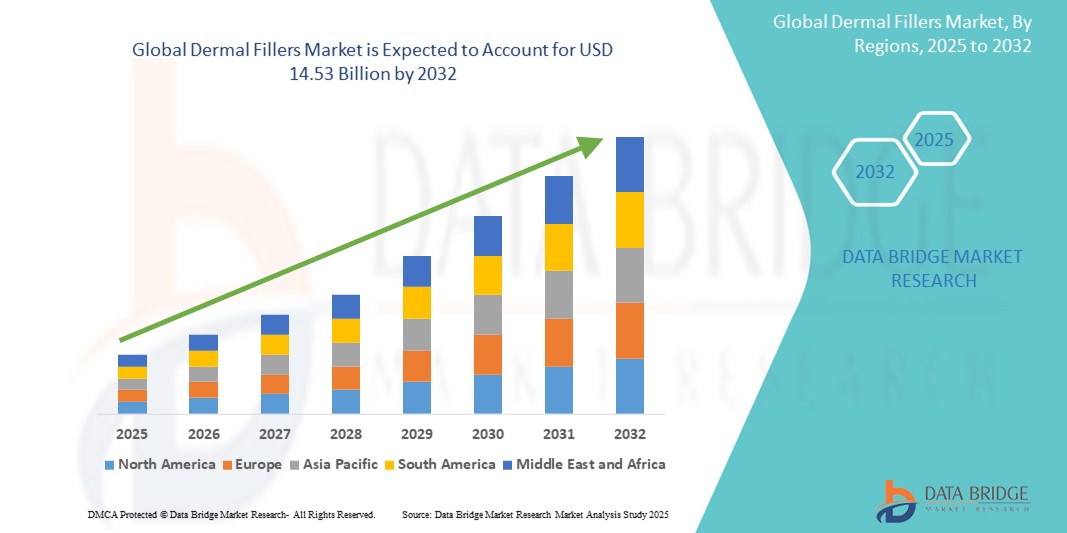

- The global dermal fillers market size was valued at USD 6.35 billion in 2024 and is expected to reach USD 14.53 billion by 2032, at a CAGR of 10.9% during the forecast period

- The dermal fillers market growth is largely fueled by the increasing global demand for minimally invasive aesthetic procedures, driven by a desire for a more youthful appearance and an enhanced focus on self-care. This leads to a growing acceptance and digitalization of cosmetic treatments in both specialty clinics and medical spas

- Furthermore, rising consumer demand for safe, effective, and natural-looking results, coupled with advancements in filler technologies, is establishing dermal fillers as a preferred choice for facial rejuvenation and augmentation. These converging factors are accelerating the uptake of dermal filler solutions, thereby significantly boosting the industry's growth

Dermal Fillers Market Analysis

- Dermal fillers, injectable substances used to restore facial volume, smooth wrinkles, and enhance facial contours, have become essential in aesthetic medicine due to their minimally invasive nature, immediate results, and customizable treatment options for diverse cosmetic needs.

- The growing demand for dermal fillers is primarily driven by increasing consumer interest in non-surgical cosmetic procedures, rising global awareness of aesthetic enhancement, and the expanding availability of advanced, long-lasting filler products made from hyaluronic acid, calcium hydroxylapatite, and other biocompatible materials

- North America dominates the dermal fillers market with the largest revenue share of 44.8% in 2024, characterized by high disposable incomes, a technologically inclined population, and a strong presence of key industry players

- Asia-Pacific is expected to be the fastest growing region in the dermal fillers market during the forecast period, with a CAGR of 9.3%, due to increasing urbanization, rising disposable incomes, growing aesthetic consciousness, and technological advancements in countries such as China, Japan, and India

- The biodegradable dermal fillers segment dominates the dermal fillers market with a market share of 86.2% in 2024, driven by their superior safety profile, natural integration into tissues, and the fact that most commonly used fillers, such as Hyaluronic Acid (HA) fillers, fall into this category, making them the most preferred and widely adopted type of dermal filler globally

Report Scope and Dermal Fillers Market Segmentation

|

Attributes |

Dermal Fillers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dermal Fillers Market Trends

“Streamlined Operations Through Digital Integration”

- A significant and accelerating trend in the global dermal fillers market is the deepening integration with advanced digital tools and streamlined consultation platforms. This fusion of technologies is significantly enhancing practitioner efficiency and patient experience in cosmetic procedures

- For instance, many dermal fillers practices now utilize digital mapping systems for precise injection planning, allowing practitioners to visualize and target specific areas. Similarly, online booking and virtual consultation platforms offer a discreet and convenient solution for initial patient engagement and follow-up

- The integration of digital technologies in dermal fillers enables features such as learning patient preferences to suggest personalized aesthetic approaches and providing more intelligent alerts based on client history. For instance, some advanced systems utilize digital imaging to improve treatment consistency over time and can send intelligent reminders for follow-up appointments. Furthermore, digital patient portals offer users the ease of remote access to their treatment history and post-procedure care instructions

- The seamless integration of these tools with digital patient management systems and broader clinic platforms facilitates centralized control over various aspects of the aesthetic treatment environment. Through a single interface, users can manage patient consultations, inventory, and scheduling, creating a unified and automated practice experience

- The demand for dermal filler solutions that offer seamless digital integration is growing rapidly across dermatology clinics and medical spas, as practitioners increasingly prioritize precision, efficiency, and comprehensive patient engagement

Dermal Fillers Market Dynamics

Driver

“Growing Demand for Minimally Invasive Aesthetic Procedures”

- The increasing prevalence of age-related skin concerns, coupled with a rising global aesthetic consciousness, is a significant driver for the heightened demand for dermal fillers. Consumers are increasingly seeking effective yet non-surgical solutions to address wrinkles, volume loss, and fine lines

- For instance, the escalating popularity of non-invasive cosmetic procedures worldwide is directly fueling the market. dermal fillers offer advantages such as minimal downtime, lower risks compared to surgery, and immediate results, making them an attractive option for a broad demographic

- As individuals become more aware of available aesthetic treatments and seek subtle enhancements for their appearance, dermal fillers provide a compelling alternative to traditional surgical interventions

- Furthermore, the growing influence of social media and celebrity culture is normalizing aesthetic treatments, making dermal fillers an integral part of beauty routines and desires for a rejuvenated look

- The convenience of quick in-office procedures, minimal recovery time, and the ability to achieve natural-looking results are key factors propelling the adoption of dermal fillers. The increasing availability of trained practitioners and a wider range of product options further contribute to market growth

Restraint/Challenge

“Concerns Regarding Potential Side Effects and High Initial Costs”

- Concerns surrounding the potential side effects and complications associated with dermal filler injections pose a significant challenge to broader market penetration. While generally safe, issues such as swelling, bruising, redness, lumps, or more serious complications such as allergic reactions or vascular occlusion, can raise anxieties among potential consumers

- For instance, high-profile reports of adverse events, though rare, can make some consumers hesitant to undergo dermal filler procedures, impacting overall market growth

- Addressing these safety concerns through robust clinical studies, clear patient education on risks and benefits, and ensuring administration by highly qualified practitioners is crucial for building consumer trust. Companies emphasize product purity and comprehensive training programs to reassure potential patients. In addition, the relatively high initial cost of some advanced dermal filler treatments can be a barrier to adoption for price-sensitive consumers, particularly in developing regions or for those on tighter budgets. While a standard filler procedure can be more affordable than surgery, the temporary nature often requires repeated treatments, leading to cumulative costs

- While prices may vary, the perceived premium for high-quality fillers and skilled practitioners can still hinder widespread adoption, especially for those who are not prepared for ongoing financial commitment.

- Overcoming these challenges through enhanced product safety profiles, comprehensive practitioner training, transparent patient communication, and the development of more affordable and longer-lasting dermal filler options will be vital for sustained market growth

Dermal Fillers Market Scope

The market is segmented on the basis of type, material type, application, drug type, end user, and distribution channel.

- By Type

On the basis of type, the dermal fillers market is segmented into biodegradable dermal fillers and non-biodegradable dermal fillers. The biodegradable dermal fillers segment held the largest market share of 86.2% in 2024, driven by their biocompatibility, safety profile, and the temporary nature of their effects, which allows for adjustments and a more natural-looking outcome. Their composition, often from substances naturally found in the body such as hyaluronic acid, makes them highly favored.

The non-biodegradable dermal fillers segment is expected to witness the fastest CAGR from 2025 to 2032, due to their longer-lasting effects, appealing to patients seeking more permanent solutions, despite lower initial market share.

- By Material Type

On the basis of material type, the dermal fillers market is segmented into natural dermal fillers and synthetic dermal fillers. The natural dermal fillers segment (primarily Hyaluronic Acid) held the largest market revenue share of 76.5% in 2024, driven by hyaluronic acid's natural compatibility with the human body, its reversibility, and its versatility in addressing various aesthetic concerns from fine lines to significant volume loss.

The synthetic dermal fillers segment is expected to witness the fastest CAGR from 2025 to 2032, particularly for longer-lasting results in specific applications. These fillers, often composed of substances such as polymethylmethacrylate (PMMA) and poly-L-lactic acid (PLLA), are not easily broken down by the body, which leads to extended aesthetic effects lasting up to several years. This durability makes them especially appealing for patients seeking more permanent solutions in areas such as deep wrinkles, nasolabial folds, and volume loss in the cheeks or jawline.

- By Application

On the basis of application, the dermal fillers market is segmented into face lift, rhinoplasty, reconstructive surgery, facial line correction, lip enhancement, sagging skin, cheek depression, skin smoothing, dentistry, aesthetic restoration, lip plum, scar treatment, chin augmentation, lipoatrophy treatment, earlobe rejuvenation, and others. The facial line correction segment held the largest market share of 46% in 2024. This dominance is driven by the widespread demand for reducing visible signs of aging, such as nasolabial folds and marionette lines.

The lip enhancement segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing trends in lip augmentation and definition among diverse age groups.

- By Drug Type

On the basis of drug type, the dermal fillers market is segmented into branded and generic. The branded segment held the largest market revenue share in 2024. This dominance is attributed to strong brand recognition, established clinical efficacy, extensive marketing by major manufacturers, and the perceived reliability and safety of well-known products among both practitioners and patients.

The generic segment is expected to witness the fastest CAGR from 2025 to 2032, as more off-patent formulations become available, potentially offering more cost-effective options. This growth is primarily driven by the increasing expiration of patents for several blockbuster biologic and branded drugs used in the treatment of blood cancers. As these patents expire, pharmaceutical companies can introduce generic versions, which are significantly more affordable while maintaining therapeutic efficacy.

- By End User

On the basis of end user, the dermal fillers market is segmented into dermatology clinics, ambulatory surgical centers, hospitals, academic research institutes, and others. The dermatology clinics segment held the largest market share of 32.86% in 2024. This dominance is due to these clinics being specialized facilities for aesthetic procedures, offering expert care, and having dedicated infrastructure for dermal filler treatments.

The Hospitals segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising demand for complex reconstructive procedures. Hospitals are increasingly preferred for advanced dermal filler applications involving facial deformities, trauma recovery, post-surgical restoration, and congenital anomalies—cases that require high precision, patient monitoring, and integrated care. Many reconstructive treatments are performed alongside other medical interventions, positioning hospitals as comprehensive care providers.

- By Distribution Channel

On the basis of distribution channel, the dermal fillers market is segmented into direct tender, drug stores, retail pharmacy, online pharmacy, and others. The drug stores segment held the largest market share in 2024. This is attributed to the easy accessibility and widespread presence of drug stores which serve as primary points of sale for a range of medical and aesthetic products, including dermal fillers.

The Direct Tender segment is expected to witness the fastest growth from 2025 to 2032, particularly among larger institutions or for bulk purchases, due to its cost-efficiency and streamlined procurement process. Hospitals, government agencies, and large healthcare organizations often prefer direct tendering as it allows them to negotiate better pricing, secure consistent supply chains, and customize product specifications to meet institutional standards.

Dermal Fillers Market Regional Analysis

- North America dominates the dermal fillers market with the largest revenue share of 44.8% in 2024. This is driven by a strong consumer preference for minimally invasive aesthetic procedures and increased awareness of available cosmetic treatments

- Consumers in the region highly value the convenience, effective results, and natural-looking outcomes offered by dermal fillers for facial rejuvenation

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the growing preference for non-surgical enhancements, establishing dermal fillers as a favored solution for aesthetic improvements

U.S. Dermal Fillers Market Insight

The U.S. dermal fillers market captured the largest revenue share of 77.1% in 2024 within North America, fueled by the swift uptake of minimally invasive cosmetic procedures and the expanding trend of aesthetic self-care. Consumers are increasingly prioritizing the enhancement of facial features through advanced, non-surgical methods. The growing preference for personalized aesthetic plans, combined with robust demand for natural-looking results and innovative product formulations, further propels the dermal fillers industry. Moreover, the increasing adoption of advanced aesthetic technologies in clinics and medical spas is significantly contributing to the market's expansion.

Europe Dermal Fillers Market Insight

The Europe dermal fillers market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising aesthetic consciousness and the escalating demand for anti-aging solutions. The increase in the aging population, coupled with growing disposable incomes, is fostering the adoption of dermal fillers. European consumers are also drawn to the safety and natural results these products offer. The region is experiencing significant growth across various application areas, with dermal fillers being incorporated into both facial rejuvenation and reconstructive procedures.

U.K. Dermal Fillers Market Insight

The U.K. dermal fillers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of non-surgical aesthetic enhancements and a desire for heightened facial aesthetics and convenience. In addition, concerns regarding visible signs of aging are encouraging individuals to choose dermal filler solutions. The UK’s embrace of cosmetic procedures, alongside its robust clinic and practitioner infrastructure, is expected to continue to stimulate market growth.

Germany Dermal Fillers Market Insight

The Germany dermal fillers market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of aesthetic medicine and the demand for technologically advanced, natural-looking solutions. Germany’s well-developed healthcare infrastructure, combined with its emphasis on quality and patient safety, promotes the adoption of dermal fillers, particularly in dermatology clinics and aesthetic centers. The integration of dermal fillers into comprehensive anti-aging regimens is also becoming increasingly prevalent, with a strong preference for secure, patient-focused solutions aligning with local consumer expectations.

Asia-Pacific Dermal Fillers Market Insight

The Asia-Pacific dermal fillers market is poised to grow at the fastest CAGR of 9.3% during the forecast period of 2025 to 2032 driven by increasing urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards aesthetic procedures, supported by government initiatives promoting healthcare advancements, is driving the adoption of dermal fillers. Furthermore, as APAC emerges as a hub for dermal filler manufacturing and innovation, the affordability and accessibility of these products are expanding to a wider consumer base.

China Dermal Fillers Market Insight

The China dermal fillers market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's expanding middle class, rapid urbanization, and high rates of aesthetic procedure adoption. China stands as one of the largest markets for cosmetic treatments, and dermal fillers are becoming increasingly popular in clinics and medical spas. The push towards enhanced personal appearance and the availability of diverse dermal fillers options, alongside strong domestic manufacturers, are key factors propelling the market in China.

India Dermal Fillers Market Insight

The India dermal fillers market is experiencing significant growth and is projected to grow at a CAGR of 15.1% during the forecast period, driven by increasing awareness of aesthetic procedures among the Indian population, rising disposable incomes, and the growing influence of social media. Urbanization in India has led to a lifestyle shift where both men and women are increasingly engaging with cosmetic enhancements. Furthermore, the aging population in the country is propelling the need for non-surgical anti-aging solutions, making dermal fillers more appealing. Opportunities are expanding as more trained professionals enter the market, and technological innovation in filler formulations is improving satisfaction rates

Dermal Fillers Market Share

The dermal fillers industry is primarily led by well-established companies, including:

- Tiger Aesthetics Medical, LLC (U.S.)

- Sinclair, Inc. (U.S.)

- REVANCE (U.S.)

- BioPlus Co., Ltd. (South Korea)

- Zhejiang Jingjia Medical Technology Co.,Ltd. (China)

- GALDERMA (U.S.)

- Merz Pharma (U.S.)

- Prollenium Medical Technologies (Canada)

- Contura International Ltd. (Denmark)

- LABORATOIRES FILLMED (France)

- Anika Therapeutics, Inc (U,S.)

- Ipsen Pharma (France)

- BIOXIS Pharmaceuticals (U.S.)

- Zimmer MedizinSysteme GmbH (Germany)

- Teoxane (Switzerland)

- Amalian (U.S.)

- Givaudan (Switzerland)

- dsm-firmenich (Netherlands)

- IBSA Nordic ApS (Denmark)

Latest Developments in Global Dermal Fillers Market

-

In March 2024, Allergan Aesthetics, an AbbVie company, announced the U.S. FDA approval of JUVÉDERM VOLUMA XC for the improvement of moderate to severe temple hollowing in adults over the age of 21. This marks it as the first and only hyaluronic acid (HA) dermal filler to receive FDA approval for this specific indication

- In February 2025 (news released about May 2025 launch), Evolus announced U.S. FDA approval for Evolysse Form and Evolysse Smooth injectable hyaluronic acid gels. These are the first two products in the Evolysse collection, marking Evolus' entry into the U.S. HA dermal filler market

- In April 2023, Croma-Pharma introduced PhilArt, a complete series of injectable skin boosters comprising long-chain polynucleotides (PN). These products are designed to improve skin quality, enhance radiance, restore elasticity, and promote hydration

- In March 2024, IBSA launched its new range of Aliaxin Dermal Fillers and Profhilo Body during the IBSA NEOASIA Gala Award. This showcases IBSA's continuous expansion of its medical aesthetics portfolio with innovative solutions for skin laxity and remodeling

- In June 2023, Galderma received U.S. FDA approval for Restylane Eyelight (Hyaluronic Acid Filler) for the treatment of undereye hollows in adults over the age of 21. This approval offers a new, effective solution for patients seeking to reduce the appearance of tired-looking eyes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.