Global Desert Air Cooler Market

Market Size in USD Million

CAGR :

%

USD

410.28 Million

USD

577.69 Million

2025

2033

USD

410.28 Million

USD

577.69 Million

2025

2033

| 2026 –2033 | |

| USD 410.28 Million | |

| USD 577.69 Million | |

|

|

|

|

Desert Air Cooler Market Size

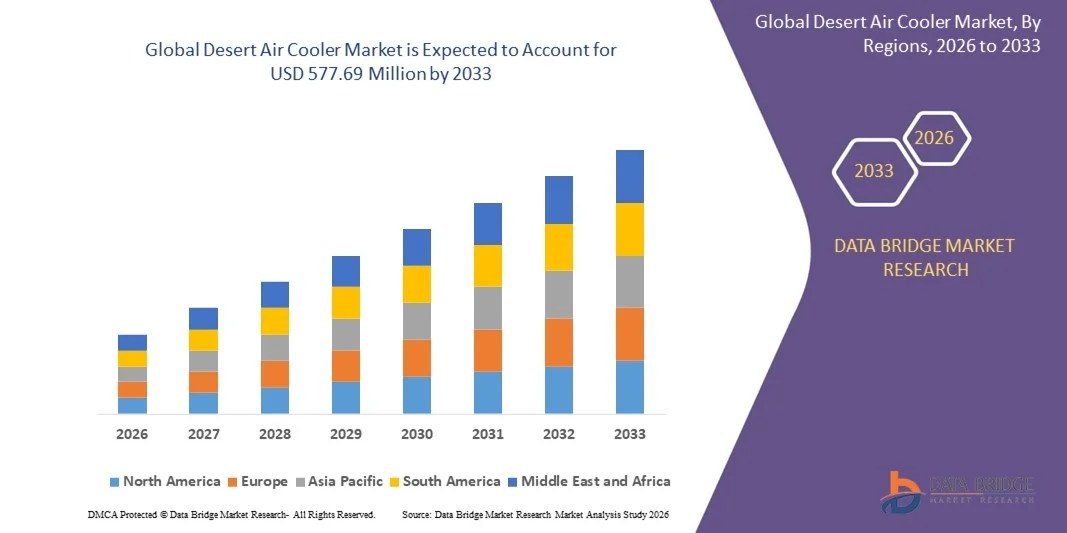

- The global desert air cooler market size was valued at USD 410.28 million in 2025 and is expected to reach USD 577.69 million by 2033, at a CAGR of 4.37% during the forecast period

- The market growth is largely fueled by the increasing demand for energy-efficient and cost-effective cooling solutions, particularly in regions with hot and arid climates, leading to a steady preference for desert air coolers over conventional air conditioning systems

- Moreover, rising consumer awareness about sustainable and eco-friendly cooling options, as seen with companies such as Symphony Limited, is driving the adoption of desert air coolers in both residential and commercial spaces. These factors are enhancing the market’s growth trajectory

Desert Air Cooler Market Analysis

- Desert air coolers, providing evaporative cooling through water evaporation, are gaining importance due to their low power consumption, minimal maintenance, and ability to cool large spaces efficiently

- The demand for compact, portable, and smart-enabled air coolers is increasing as consumers seek convenience, user-friendly operation, and integration with home automation systems. The market is further supported by technological advancements, including IoT-enabled controllers, remote monitoring, and energy-saving features, which are making modern desert air coolers more attractive to tech-savvy consumers

- Asia-Pacific dominated desert air cooler market with a share of 63.5% in 2025, due to rising temperatures, increasing residential and commercial cooling demand, and growing urbanization across the region

- North America is expected to be the fastest growing region in the desert air cooler market during the forecast period due to rising temperatures, increased focus on energy-efficient cooling appliances, and growing adoption in residential and commercial buildings

- Indoor segment dominated the market with a market share of 65.5% in 2025, due to the high adoption of air coolers in homes, offices, and commercial establishments for effective cooling in enclosed spaces. Indoor desert air coolers are preferred due to their compact design, noise reduction features, and suitability for controlling temperature in living rooms, bedrooms, and office areas. Consumers often prioritize indoor models that combine cooling efficiency with energy savings and modern aesthetics. In addition, indoor air coolers are increasingly equipped with smart controls, remote operation, and air purification functions, further enhancing their attractiveness to urban households

Report Scope and Desert Air Cooler Market Segmentation

|

Attributes |

Desert Air Cooler Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Desert Air Cooler Market Trends

Rising Adoption of Energy-Efficient and Eco-Friendly Cooling Solutions

- A significant trend in the desert air cooler market is the increasing preference for energy-efficient and environmentally friendly cooling solutions, driven by the need to reduce electricity consumption and carbon emissions in residential and commercial spaces. This trend is positioning desert air coolers as viable alternatives to conventional air conditioners, especially in regions with hot and dry climates

- For instance, companies such as Symphony Limited and Bajaj Electricals are offering innovative desert air coolers with energy-saving motors, water-efficient pads, and eco-friendly refrigerants. Such solutions enhance operational efficiency while supporting sustainability goals and reducing utility costs

- The demand for portable and compact desert air coolers is rising as consumers seek convenient cooling options that can be easily installed and moved across rooms. This trend is encouraging manufacturers to focus on lightweight designs, enhanced mobility, and user-friendly features

- Technological advancements in smart and IoT-enabled desert air coolers are also shaping market growth, allowing remote operation, automated fan speed adjustment, and water-level monitoring. This development is enhancing user experience and aligning with the broader smart home ecosystem

- The market is witnessing expansion in commercial applications, where offices, retail stores, and warehouses are adopting desert air coolers to provide effective cooling at lower operating costs. This is increasing demand for units with higher airflow capacity and energy efficiency

- The rising awareness of climate-adaptive cooling solutions among consumers and businesses is further strengthening the market. Desert air coolers are being positioned as cost-effective, sustainable, and practical alternatives to energy-intensive cooling systems

Desert Air Cooler Market Dynamics

Driver

Increasing Demand for Cost-Effective and Low-Power Cooling Devices

- The growing need for affordable and energy-efficient cooling solutions is driving the adoption of desert air coolers across residential and commercial sectors. These devices consume significantly less electricity than conventional air conditioners while providing sufficient cooling in hot and dry climates

- For instance, Symphony Limited supplies desert air coolers equipped with energy-saving fans and water-conserving cooling pads that appeal to cost-conscious consumers. Such devices reduce operational costs while maintaining effective cooling performance

- Rising electricity prices and environmental regulations in several countries are motivating consumers to adopt low-power cooling alternatives. Desert air coolers provide a practical solution that balances comfort with energy efficiency

- The expansion of urban households and commercial spaces in emerging economies is fueling demand for cost-effective cooling devices. Desert air coolers are increasingly preferred due to their low installation costs, minimal maintenance requirements, and affordability

- Consumer preference for eco-friendly and resource-efficient appliances is strengthening this driver. Desert air coolers are marketed as sustainable cooling devices that minimize electricity usage and water wastage, aligning with environmental consciousness

Restraint/Challenge

Limited Effectiveness in High-Humidity Environments

- Desert air coolers face performance challenges in regions with high humidity, where evaporative cooling becomes less efficient. This limits their applicability in tropical and coastal areas, affecting market growth potential

- For instance, companies such as Bajaj Electricals highlight humidity-based usage recommendations, advising consumers that optimal cooling occurs in dry climates. Such limitations restrict market penetration in humid regions and reduce adoption rates

- The dependency on water availability for cooling operations can pose operational challenges in water-scarce regions. Inconsistent water supply affects the device’s performance and reliability, discouraging potential buyers

- Maintaining consistent airflow and cooling efficiency in larger indoor spaces also presents technical challenges. Desert air coolers are typically more effective in medium-sized rooms, limiting their use in expansive commercial setups

- The market continues to face constraints from climatic and environmental factors that reduce overall effectiveness. Manufacturers are focusing on technological innovations, but performance limitations in high-humidity conditions remain a persistent challenge

Desert Air Cooler Market Scope

The market is segmented on the basis of water capacity, sales channel, application, and end user.

- By Water Capacity

On the basis of water capacity, the desert air cooler market is segmented into 30–40 liters, 40–50 liters, 50–60 liters, and 60–70 liters. The 40–50 liters segment dominated the market with the largest market revenue share in 2025, driven by its optimal balance of cooling efficiency and portability for medium-sized residential and commercial spaces. Consumers prefer 40–50 liter coolers due to their capacity to provide sustained cooling over extended periods without frequent water refills, making them practical for daily use. This segment also benefits from widespread availability, affordable pricing, and compatibility with energy-efficient technologies, enhancing its appeal across households and small offices. In addition, manufacturers often offer additional features such as remote control operation, ice packs, and adjustable fan speeds in this capacity range, further boosting its adoption.

The 50–60 liters segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand in larger residential homes, offices, and commercial spaces where extended cooling performance is critical. For instance, Symphony Ltd. has reported strong sales growth in this capacity range due to its ability to cover bigger areas with high airflow and minimal maintenance. Consumers increasingly seek coolers that combine higher water capacity with smart features such as energy-efficient motors and air purification functions, driving adoption in urban and semi-urban regions. The rising trend of larger living and working spaces, in addition to growing awareness of effective indoor climate control, further supports the rapid growth of this segment.

- By Sales Channel

On the basis of sales channel, the desert air cooler market is segmented into wholesalers or distributors, hypermarkets or supermarkets, specialty stores, multi-brand stores, and others. The specialty stores segment dominated the market with the largest market revenue share in 2025, driven by its ability to provide expert guidance, after-sales service, and personalized product selection. Consumers often prefer specialty stores for purchasing desert air coolers because of the availability of a wide range of models, detailed product demonstrations, and professional advice on choosing the right capacity and features. This segment also benefits from strong brand partnerships and promotional campaigns that enhance consumer trust and awareness. In addition, specialty stores often provide value-added services such as installation and warranty support, increasing customer confidence in their purchase decisions.

The multi-brand stores segment is expected to witness the fastest growth from 2026 to 2033, driven by the convenience of one-stop shopping and competitive pricing. For instance, Reliance Digital has expanded its multi-brand air cooler offerings, attracting customers seeking various brands and models under a single roof. Consumers increasingly prefer the flexibility to compare specifications, features, and prices across brands, driving rapid adoption of this sales channel. The segment also benefits from growing urban retail infrastructure and rising consumer inclination toward physical stores that combine variety with immediate product availability.

- By Application

On the basis of application, the desert air cooler market is segmented into indoor and outdoor. The indoor segment dominated the market with the largest market revenue share of 65.5% in 2025, driven by the high adoption of air coolers in homes, offices, and commercial establishments for effective cooling in enclosed spaces. Indoor desert air coolers are preferred due to their compact design, noise reduction features, and suitability for controlling temperature in living rooms, bedrooms, and office areas. Consumers often prioritize indoor models that combine cooling efficiency with energy savings and modern aesthetics. In addition, indoor air coolers are increasingly equipped with smart controls, remote operation, and air purification functions, further enhancing their attractiveness to urban households.

The outdoor segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in outdoor commercial spaces, gardens, and open-event venues. For instance, Bajaj Electricals has introduced high-capacity outdoor desert coolers specifically designed for large areas and open-air ventilation. Consumers are drawn to models that provide extended coverage, portability, and durability against weather conditions, supporting rapid segment growth. The expansion of outdoor recreational spaces and increasing summer temperatures further boost the adoption of outdoor desert air coolers in both residential and commercial settings.

- By End User

On the basis of end user, the desert air cooler market is segmented into residential and commercial. The residential segment dominated the market with the largest market revenue share in 2025, driven by the widespread adoption of desert air coolers in homes across urban and semi-urban regions. Residential consumers prefer these coolers due to their affordability, ease of use, and ability to provide efficient cooling in living spaces during peak summer months. In addition, compact designs, aesthetic appeal, and energy-efficient features contribute to the popularity of residential desert air coolers. Consumers also increasingly seek models that offer quiet operation, low maintenance, and multi-functional performance, enhancing the segment’s market dominance.

The commercial segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing deployment in offices, retail stores, restaurants, and industrial settings where consistent and high-capacity cooling is required. For instance, Crompton Greaves has seen strong demand for commercial-grade desert air coolers capable of cooling large areas with high airflow. Businesses increasingly prioritize durable, high-performance coolers that combine energy efficiency with minimal maintenance to optimize operational costs. The growth of commercial spaces, in addition to rising workplace comfort standards, further supports the expansion of this end-user segment.

Desert Air Cooler Market Regional Analysis

- Asia-Pacific dominated the desert air cooler market with the largest revenue share of 63.5% in 2025, driven by rising temperatures, increasing residential and commercial cooling demand, and growing urbanization across the region

- The region’s cost-effective manufacturing, expanding consumer base, and rising investments in energy-efficient cooling solutions are accelerating market growth

- The availability of skilled labor, favorable government policies, and rapid industrialization in developing economies are contributing to increased adoption of desert air coolers for both residential and commercial applications

China Desert Air Cooler Market Insight

China held the largest share in the Asia-Pacific desert air cooler market in 2025, owing to its status as a global manufacturing hub and high demand for home and commercial cooling solutions. The country’s strong industrial base, supportive government policies promoting energy-efficient appliances, and extensive domestic distribution network are key growth drivers. Demand is also strengthened by rapid urbanization, rising disposable incomes, and increasing awareness of sustainable cooling technologies.

India Desert Air Cooler Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing temperatures, growing urban population, and rising demand for affordable cooling solutions. For instance, Symphony Ltd. has expanded its product offerings in India to meet rising residential and commercial demand. Government initiatives promoting energy-efficient appliances and increased investments in manufacturing infrastructure are further boosting adoption. The surge in awareness about sustainable cooling, in addition to rapid expansion of commercial and retail spaces, is contributing to robust market growth.

Europe Desert Air Cooler Market Insight

The Europe desert air cooler market is expanding steadily, supported by increasing adoption of energy-efficient appliances, rising consumer focus on indoor air quality, and government incentives for sustainable cooling solutions. The region emphasizes environmental compliance, advanced product designs, and low-energy consumption features. Growing demand in residential and commercial sectors, coupled with innovation in smart cooling solutions, is further enhancing market growth.

Germany Desert Air Cooler Market Insight

Germany’s desert air cooler market is driven by its focus on energy-efficient and technologically advanced cooling appliances. The country benefits from a mature manufacturing base, strong R&D infrastructure, and high consumer awareness about sustainable products. Demand is particularly strong in urban residential and commercial spaces, where efficiency and low maintenance requirements are key considerations.

U.K. Desert Air Cooler Market Insight

The U.K. market is supported by rising interest in eco-friendly and energy-efficient cooling solutions, increased investments in smart home technologies, and strong adoption in both residential and commercial sectors. The focus on sustainability, regulatory support, and modern appliance designs continues to drive the market. Growing demand for portable and easy-to-install air coolers in offices and homes further strengthens market expansion.

North America Desert Air Cooler Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising temperatures, increased focus on energy-efficient cooling appliances, and growing adoption in residential and commercial buildings. A strong emphasis on innovative designs, smart connectivity, and energy conservation is boosting demand. In addition, growing awareness of sustainable cooling alternatives and rising investments in home comfort solutions are supporting market growth.

U.S. Desert Air Cooler Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by high consumer demand for energy-efficient and smart cooling solutions, strong manufacturing infrastructure, and widespread distribution networks. The country’s focus on sustainability, innovative cooling technologies, and consumer preference for portable and versatile air coolers further strengthens its market position. Presence of key players and growing urban and commercial adoption solidify the U.S.’s leadership in the region.

Desert Air Cooler Market Share

The desert air cooler industry is primarily led by well-established companies, including:

- Olimpia Splendid S.p.A. (Italy)

- AB Electrolux (Sweden)

- LG Electronics (South Korea)

- Havells India Ltd. (India)

- Symphony (India)

- Philips (Netherlands)

- Daikin Industries, Ltd. (Japan)

- Delta Cooling Tower, Inc. (U.S.)

- Climate Technologies (Australia)

- Orient Electric (India)

- Samsung Group (South Korea)

- Honeywell International Inc. (U.S.)

- SHARP CORPORATION (Japan)

- Fujian Jinghui Environmental Technology Co., Ltd. (China)

- Kenstar (India)

- Usha International Ltd. (India)

- Voltas Limited (India)

- Haier Group (China)

- Intex (India)

Latest Developments in Global Desert Air Cooler Market

- In December 2024, Cellecor entered the desert air cooler market with a new line of high-performance coolers, offering both personal and desert models ranging from 45L to 110L capacity, and secured advance orders for 42,000 units in just the first week. This development significantly strengthened Cellecor’s market presence and demonstrated robust consumer demand, positioning the company as a competitive player in both residential and commercial segments

- In April 2024, Orient Electric launched its latest desert air cooler models—Smartchill 125L, Avante 105L, and Titan 100L—designed with enhanced cooling performance and large tank capacities to meet high-demand environments. The launch reinforced Orient Electric’s market leadership and enabled the company to cater to consumers seeking high-capacity, efficient cooling solutions for homes and offices, thereby expanding its market share

- In May 2023, Elista unveiled two new desert air cooler models, the Desert Snow Monk and Aurora Cool, each featuring a 90L capacity and stylish toughened glass top frames. By combining performance with modern aesthetics, Elista attracted design-conscious consumers and strengthened its brand positioning in the mid-to-high-end desert air cooler segment, contributing to increased adoption in premium households

- In April 2023, Voltas expanded its air cooler portfolio with the FreshAir series, which includes desert, tower, personal, window, and room coolers integrated with advanced 4-side cooling technology. This expansion allowed Voltas to address diverse consumer needs, enhance cooling efficiency across various applications, and solidify its competitive advantage in both residential and commercial markets

- In February 2023, Symphony Ltd. introduced its latest high-capacity desert air coolers with energy-efficient motors and smart IoT-enabled features, targeting large residential spaces and commercial establishments. This development strengthened Symphony’s innovation-driven market strategy, increased adoption of connected and sustainable cooling solutions, and reinforced its leadership in the high-performance desert air cooler segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.