Global Desktop Virtualization Market

Market Size in USD Billion

CAGR :

%

USD

14.43 Billion

USD

28.77 Billion

2024

2032

USD

14.43 Billion

USD

28.77 Billion

2024

2032

| 2025 –2032 | |

| USD 14.43 Billion | |

| USD 28.77 Billion | |

|

|

|

|

Desktop Virtualization Market Size

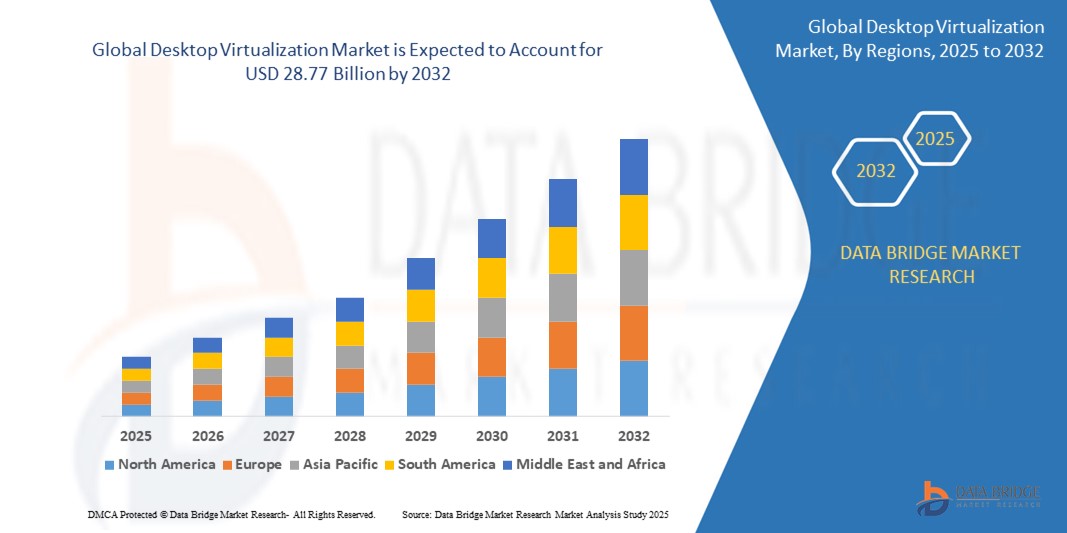

- The global desktop virtualization market size was valued at USD 14.43 billion in 2024 and is expected to reach USD 28.77 billion by 2032, at a CAGR of 9.34% during the forecast period

- The market growth is primarily driven by the increasing adoption of cloud computing, the need for flexible and remote working solutions, and advancements in virtualization technologies, fostering digital transformation across industries

- Growing demand for secure, scalable, and cost-effective desktop management solutions, coupled with the rise of hybrid work models, is positioning desktop virtualization as a critical component of modern IT infrastructure

Desktop Virtualization Market Analysis

- Desktop virtualization solutions, enabling centralized management of desktops and applications, are becoming essential for businesses seeking enhanced security, scalability, and remote access capabilities in both enterprise and SME settings

- The surge in demand for desktop virtualization is fueled by the proliferation of remote work, heightened cybersecurity concerns, and the need for simplified IT management, particularly in industries such as IT & Telecom, BFSI, and Healthcare

- North America dominated the desktop virtualization market with a revenue share of 42.5% in 2024, driven by early adoption of cloud and virtualization technologies, high technological infrastructure investment, and the presence of key market players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid digitalization, increasing IT investments, and growing adoption of cloud-based solutions in countries such as China, India, and Japan

- The Virtual Desktop Infrastructure (VDI) segment dominated the largest market revenue share of 57.3% in 2024, driven by its ability to provide centralized management, enhanced security, and customized desktop environments for enterprises

Report Scope and Desktop Virtualization Market Segmentation

|

Attributes |

Desktop Virtualization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Desktop Virtualization Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global desktop virtualization market is experiencing a notable trend toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing, offering deeper insights into system performance, user behavior, and predictive maintenance requirements for virtual desktop infrastructure (VDI)

- AI-powered virtualization solutions facilitate proactive issue resolution, identifying potential system bottlenecks or security vulnerabilities before they impact operations

- For instances, companies are developing AI-driven platforms that analyze user activity patterns to optimize resource allocation, enhance security protocols, or streamline virtual desktop delivery based on real-time demand and network conditions

- This trend enhances the efficiency and appeal of desktop virtualization systems, making them more attractive to both large enterprises and small & medium enterprises (SMEs)

- AI algorithms can analyze a wide range of user behaviors, such as application usage, login patterns, and resource consumption, to improve system performance and user experience

Desktop Virtualization Market Dynamics

Driver

“Rising Demand for Remote Work Solutions and Enhanced Security”

- The growing demand for remote and hybrid work environments is a major driver for the global desktop virtualization market, as organizations seek secure and flexible solutions for distributed workforces

- Desktop virtualization systems enhance security by centralizing data storage and management, offering features such as secure remote access, endpoint security integration, and centralized patch management

- Government regulations, particularly in regions such as Europe with stringent data protection laws , are driving the adoption of virtualization to ensure compliance and data security

- The proliferation of cloud computing and advancements in 5G technology are enabling faster data transmission and lower latency, supporting more robust virtualization applications and services

- Enterprises are increasingly adopting virtual desktop infrastructure (VDI), Desktop-as-a-Service (DaaS), and Remote Desktop Services (RDS) as standard or optional solutions to meet user expectations and enhance operational efficiency

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The significant initial investment required for hardware, software, and integration of desktop virtualization systems can be a barrier to adoption, particularly for SMEs and in emerging markets

- Retrofitting existing IT infrastructure with virtualization solutions can be complex and costly, requiring specialized expertise and planning

- Data security and privacy concerns remain a major challenge, as virtualization systems collect and transmit sensitive user and organizational data, raising risks of breaches or misuse

- The fragmented global regulatory landscape for data privacy and compliance, varying across regions such as North America, Europe, and Asia-Pacific, complicates operations for international providers

- These factors may deter adoption in cost-sensitive regions or where awareness of data privacy issues is high, potentially limiting market growth

Desktop Virtualization market Scope

The market is segmented on the basis of type, enterprise type, and industry.

- By Type

On the basis of type, the global desktop virtualization market is segmented into Virtual Desktop Infrastructure (VDI), Remote Desktop Services (RDS), and Desktop-as-a-Service (DaaS). The Virtual Desktop Infrastructure (VDI) segment dominated the largest market revenue share of 57.3% in 2024, driven by its ability to provide centralized management, enhanced security, and customized desktop environments for enterprises. VDI's seamless integration with existing IT infrastructure and its scalability make it a preferred choice for organizations seeking robust virtualization solutions.

The Desktop-as-a-Service (DaaS) segment is expected to witness the fastest growth rate of 17.2% from 2025 to 2032, fueled by the rising adoption of cloud-based solutions, which offer flexibility, cost-efficiency, and simplified management. The increasing popularity of DaaS among small and medium enterprises (SMEs) due to its minimal hardware requirements and scalability further accelerates its growth.

- By Enterprise Type

On the basis of enterprise type, the global desktop virtualization market is segmented into Large Enterprises and Small & Medium Enterprises (SMEs). The Large Enterprises segment dominated the market with a revenue share of 62.4% in 2024, attributed to their extensive IT infrastructure, higher budgets, and need to manage thousands of desktops across global locations. Large enterprises leverage desktop virtualization for enhanced security, centralized control, and operational efficiency.

The Small & Medium Enterprises (SMEs) segment is anticipated to experience the fastest growth rate of 18.5% from 2025 to 2032. SMEs are increasingly adopting desktop virtualization, particularly DaaS, to reduce capital expenditure on hardware, streamline IT management, and support flexible work environments, making it an attractive solution for businesses with limited resources.

- By Industry

On the basis of industry, the global desktop virtualization market is segmented into IT & Telecom, BFSI, Retail & E-commerce, Government, Education, Manufacturing, Healthcare, and Others. The IT & Telecom segment held the largest market revenue share of 20.1% in 2024, driven by the sector’s need for flexible, scalable, and secure IT infrastructure to support a mobile workforce and ensure employee productivity. The rapid adoption of virtualization solutions post-COVID-19 has further bolstered this segment's dominance.

The BFSI segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing cybercrimes and the need for secure data management. Desktop virtualization, particularly VDI, supports compliance with stringent regulations such as GDPR and enhances customer service through secure, centralized platforms, driving rapid adoption in this sector.

Desktop Virtualization Market Regional Analysis

- North America dominated the desktop virtualization market with a revenue share of 42.5% in 2024, driven by early adoption of cloud and virtualization technologies, high technological infrastructure investment, and the presence of key market players

- Enterprises prioritize desktop virtualization for enhanced data security, centralized management, and scalability, particularly in industries with stringent compliance requirements

- Growth is supported by advancements in cloud-based virtualization technologies, such as Desktop-as-a-Service (DaaS), and rising adoption across both large enterprises and small & medium enterprises (SMEs)

U.S. Desktop Virtualization Market Insight

The U.S. desktop virtualization market captured the largest revenue share of 82.8% in 2024 within North America, fueled by strong demand for flexible work solutions and growing awareness of cost-efficiency and security benefits. The trend toward digital transformation and increasing adoption of cloud-based technologies further boost market expansion. Enterprises’ growing integration of Virtual Desktop Infrastructure (VDI) and Remote Desktop Services (RDS) complements DaaS adoption, creating a robust virtualization ecosystem.

Europe Desktop Virtualization Market Insight

The Europe desktop virtualization market is expected to witness significant growth, supported by regulatory emphasis on data security and compliance with GDPR. Enterprises seek virtualization solutions that enhance operational efficiency while ensuring secure access to applications. Growth is prominent in IT & Telecom and BFSI sectors, with countries such as Germany and France showing significant uptake due to increasing digitalization and hybrid work environments.

U.K. Desktop Virtualization Market Insight

The U.K. market for desktop virtualization is expected to witness rapid growth, driven by demand for secure remote access and operational flexibility in urban business hubs. Increased interest in cost-effective virtualization solutions and rising awareness of data protection benefits encourage adoption. Evolving regulations around data privacy and cybersecurity influence enterprise choices, balancing scalability with compliance.

Germany Desktop Virtualization Market Insight

Germany is expected to witness rapid growth in the desktop virtualization market, attributed to its advanced IT & Telecom sector and high enterprise focus on digital transformation and efficiency. German enterprises prefer advanced virtualization solutions such as DaaS and VDI to reduce IT management costs and enhance security. Integration of these solutions in large enterprises and growing SME adoption supports sustained market growth.

Asia-Pacific Desktop Virtualization Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding IT infrastructure and rising digitalization in countries such as China, India, and Japan. Increasing awareness of virtualization benefits, such as cost savings and remote work enablement, is boosting demand. Government initiatives promoting digital transformation and cybersecurity further encourage the adoption of advanced virtualization solutions.

Japan Desktop Virtualization Market Insight

Japan’s desktop virtualization market is expected to witness rapid growth due to strong enterprise preference for high-quality, secure virtualization solutions that enhance operational efficiency and remote access. The presence of major IT & Telecom players and integration of virtualization in large enterprises accelerate market penetration. Rising interest in DaaS for SMEs also contributes to growth.

China Desktop Virtualization Market Insight

China holds the largest share of the Asia-Pacific desktop virtualization market, propelled by rapid digitalization, increasing enterprise adoption, and growing demand for secure remote work solutions. The country’s expanding IT & Telecom and BFSI sectors, coupled with a focus on smart infrastructure, support the adoption of advanced virtualization technologies. Strong domestic IT capabilities and competitive pricing enhance market accessibility.

Desktop Virtualization Market Share

The desktop virtualization industry is primarily led by well-established companies, including:

- Citrix Systems (U.S.)

- VMware (U.S.)

- Microsoft Corporation (U.S.)

- Amazon Web Services (AWS) (U.S.)

- Nutanix (U.S.)

- Dell Technologies (U.S.)

- IBM Corporation (U.S.)

- Cisco Systems (U.S.)

- Oracle Corporation (U.S.)

- Red Hat (U.S.)

- Parallels International (Germany)

- Huawei Technologies (China)

- HPE (Hewlett Packard Enterprise) (U.S.)

- Ericom Software (U.S.)

- NComputing (South Korea)

What are the Recent Developments in Global Desktop Virtualization Market?

- In November 2023, Microsoft announced the general availability of its redesigned Azure Virtual Desktop Web Client User Interface, delivering a more modern and customizable experience. The update introduced features such as the ability to reset web client settings to default, toggle between light and dark themes, and switch between grid or list views for resource display. These enhancements aim to improve usability, personalization, and accessibility for users across devices. The refreshed UI reflects Microsoft’s commitment to streamlining remote desktop interactions and empowering users with greater control over their virtual workspace

- In October 2023, AWS introduced the Amazon WorkSpaces Thin Client, a compact enterprise device repurposed from the Fire TV Cube to deliver cost-effective and secure virtual desktop access. Designed for remote and hybrid workforces, this hardware enables quick setup—users can connect peripherals and access cloud-based desktops in under five minutes. With centralized IT management, no local data storage, and integration with services such as Amazon WorkSpaces, AppStream, and WorkSpaces Web, the device simplifies deployment and enhances security. This launch reflects AWS’s strategy to adapt consumer tech for enterprise needs, making virtual desktops more accessible and scalable

- In July 2023, Citrix announced a strategic partnership with Twilio, a global leader in customer engagement software, to enhance virtualized contact center experiences. The collaboration integrates Twilio Flex with Citrix’s Desktop-as-a-Service (DaaS) and Unified Communication Optimization SDK, enabling high-quality, low-latency audio for remote and hybrid agents. By offloading real-time audio to endpoint devices, the solution improves call clarity, reduces network load, and boosts scalability. This partnership reflects Citrix’s commitment to delivering secure, high-performance communication tools that seamlessly support Twilio’s cloud-native platform within virtual desktop environments

- In June 2023, Cloud Software Group formed a strategic partnership with Midis Group to strengthen its presence across Eastern Europe, the Middle East, and Africa. Through its subsidiary MiCloudSW Ltd., the collaboration provides Cloud Software Group with vital local expertise and infrastructure to support transformative technology initiatives. Midis Group’s expansive network of over 170 companies in 70 countries ensures regional partners and customers gain streamlined access to Citrix and TIBCO solutions. This alliance reflects Cloud Software Group’s commitment to scalable, channel-centric growth and tailored support for emerging markets

- In April 2023, Virtual Cable partnered with Huawei Cloud to drive public cloud adoption in digital work environments. The alliance integrates Virtual Cable’s UDS Enterprise software—specialized in desktop and application virtualization and remote device access—with Huawei Cloud’s robust infrastructure. This collaboration enables organizations to deploy secure, pay-per-use virtual workspaces accessible 24/7 from any device. Enhanced automation, native multifactor authentication, Zero Trust architecture, and end-to-end encryption ensure improved security, productivity, and efficiency. The solution is optimized for Huawei’s platform and available via its KooGallery marketplace, marking a significant step in digital workplace transformation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.