Global Dessert Mix Market

Market Size in USD Billion

CAGR :

%

USD

3.44 Billion

USD

6.23 Billion

2025

2033

USD

3.44 Billion

USD

6.23 Billion

2025

2033

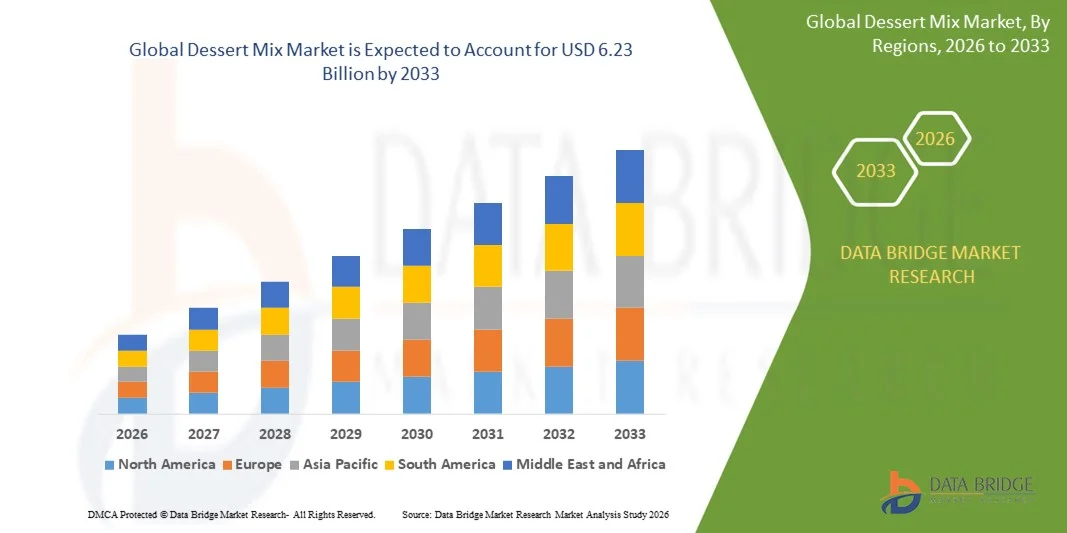

| 2026 –2033 | |

| USD 3.44 Billion | |

| USD 6.23 Billion | |

|

|

|

|

Dessert Mix Market Size

- The global dessert mix market size was valued at USD 3.44 billion in 2025 and is expected to reach USD 6.23 billion by 2033, at a CAGR of 7.70% during the forecast period

- The market growth is largely fuelled by the increasing demand for convenient and ready-to-make dessert solutions among busy consumers

- Rising popularity of innovative flavors, low-sugar, and health-oriented dessert mixes is further boosting market adoption

Dessert Mix Market Analysis

- Consumers are increasingly seeking quick and easy dessert preparation options that save time without compromising taste

- The market is witnessing growth from both home users and commercial establishments such as bakeries, cafés, and restaurants looking for consistent quality and convenience

- North America dominated the dessert mix market with the largest revenue share of 36.45% in 2025, driven by a growing preference for convenient home baking solutions, busy lifestyles, and increasing demand for health-oriented and fortified dessert mixes

- Asia-Pacific region is expected to witness the highest growth rate in the global dessert mix market, driven by rapid urbanization, expanding middle-class population, increasing exposure to global dessert trends, and rising demand for convenient and fortified dessert products

- The chocolate mix segment held the largest market revenue share in 2025, driven by widespread consumer preference for chocolate-based desserts and its versatility across bakery and home-prepared recipes. Chocolate mixes are increasingly popular among households and bakeries for their consistent taste, ease of preparation, and indulgent appeal

Report Scope and Dessert Mix Market Segmentation

|

Attributes |

Dessert Mix Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• General Mills (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dessert Mix Market Trends

Rise of Convenient and Health-Oriented Dessert Mixes

- The growing shift toward convenient and ready-to-make dessert mixes is transforming the global dessert mix market by enabling quick and easy preparation without compromising taste. These products allow consumers to enjoy bakery-style desserts at home, resulting in higher adoption across households and small commercial kitchens. The trend is further reinforced by increasing interest in DIY baking and home-based culinary experimentation, making dessert mixes a popular choice among millennials and Gen Z consumers

- The high demand for innovative flavors, low-sugar, and fortified dessert mixes is accelerating the introduction of diverse product offerings. These products appeal to health-conscious consumers, busy professionals, and households seeking both indulgence and nutrition. In addition, brands are leveraging superfood ingredients, vegan formulations, and functional additives to differentiate products and meet the rising demand for functional foods

- The affordability and wide availability of modern dessert mixes are making them attractive across multiple consumer segments. Supermarkets, modern trade outlets, and e-commerce platforms are increasingly stocking these products to meet evolving consumer preferences and convenience demands. Retailers are also promoting bundled packs and seasonal flavors to drive impulse purchases and enhance market penetration

- For instance, in 2023, several bakery brands and packaged food manufacturers in the U.S. reported a surge in sales after launching fortified and flavored dessert mixes, catering to health-conscious consumers and convenience-seekers. The popularity of online recipe content and social media trends showcasing home-baked desserts further fueled consumer interest and repeat purchases

- While convenience and flavor innovations are driving market growth, long-term impact depends on continuous product development, quality maintenance, and meeting changing consumer expectations. Manufacturers are increasingly focusing on sustainable packaging and clean-label claims to build brand trust and encourage loyalty in a competitive market

Dessert Mix Market Dynamics

Driver

Rising Demand for Convenient and Nutritious Desserts

- Increasing health awareness and changing lifestyles are pushing consumers toward dessert mixes that save time while offering indulgent taste. Products such as cake mixes, pudding mixes, and brownie mixes are gaining traction among home bakers and working professionals. The rise of remote working and busy urban lifestyles has further amplified the preference for quick-to-prepare desserts that do not compromise on quality

- Busy lifestyles and rising interest in home baking are accelerating the adoption of ready-to-make dessert mixes. Consumers prefer easy-to-use solutions that provide consistent quality and flavor, boosting market penetration across urban and semi-urban areas. Manufacturers are responding by offering pre-portioned mixes, microwaveable options, and easy-to-follow recipes, enhancing convenience and usability

- Expansion of retail and e-commerce channels is further supporting market growth. Organized supermarkets, specialty stores, and online platforms are enhancing product accessibility and visibility for a wide variety of dessert mix offerings. Digital marketing campaigns, influencer collaborations, and subscription-based delivery models are also contributing to higher consumer engagement and adoption rates

- For instance, in 2022, several U.S. and European brands launched innovative low-sugar and fortified dessert mixes that quickly gained consumer acceptance, increasing overall category sales. The integration of nutrition-focused messaging and promotional campaigns emphasizing health benefits significantly boosted consumer confidence and repeat purchases

- While convenience and health awareness are driving the market, ensuring product quality, nutritional value, and continuous innovation remain essential to sustain adoption. Companies are investing in research and development to create novel flavors, functional ingredients, and allergen-free options to meet evolving consumer demands

Restraint/Challenge

High Cost of Premium Dessert Mixes and Competitive Alternatives

- The relatively higher price of premium, fortified, or organic dessert mixes compared to conventional mixes limits adoption among price-sensitive consumers. Cost remains a key barrier, particularly in emerging markets. Consumers often compare products with ready-to-eat bakery items or traditional desserts, making price competitiveness a critical factor for brand success

- Intense competition from ready-to-eat desserts, bakery items, and other confectionery products reduces market penetration for dessert mixes. Consumers often switch based on taste preference, price, and convenience. The proliferation of home delivery services and meal kits also provides alternative dessert options, challenging dessert mix manufacturers to differentiate through innovation and branding

- Supply chain fluctuations in raw materials such as flour, cocoa, and dairy ingredients can impact production costs and product pricing. Disruptions in logistics or ingredient quality may affect availability and consistency. Seasonal price volatility and geopolitical factors affecting commodity imports further contribute to cost pressures and potential delays in product launches

- For instance, in 2023, reports indicated that rising costs of key ingredients constrained the expansion of premium dessert mix offerings in certain regions. Smaller manufacturers faced additional challenges in scaling production while maintaining quality standards, affecting overall market growth in specific territories

- While product innovation continues, addressing price sensitivity, supply chain efficiency, and differentiation from alternative desserts remains crucial to unlocking the full potential of the global dessert mix market. Companies focusing on cost optimization, sustainable sourcing, and value-added product features are better positioned to capture market share in an increasingly competitive environment

Dessert Mix Market Scope

The dessert mix market is segmented on the basis of flavour, form, nature, speciality type, and distribution channels.

- By Flavour

On the basis of flavour, the dessert mix market is segmented into chocolate mix, brownie mix, cake mix, vanilla mix, red velvet mix, berries mix, butter scotch mix, and others. The chocolate mix segment held the largest market revenue share in 2025, driven by widespread consumer preference for chocolate-based desserts and its versatility across bakery and home-prepared recipes. Chocolate mixes are increasingly popular among households and bakeries for their consistent taste, ease of preparation, and indulgent appeal.

The red velvet mix segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising consumer interest in visually appealing and specialty desserts. Red velvet mixes are gaining traction for celebrations, festive occasions, and premium dessert offerings, supported by social media trends and influencer promotions that enhance visibility and desirability.

- By Form

On the basis of form, the dessert mix market is segmented into dry powder and semi-liquid mixes. The dry powder segment held the largest revenue share in 2025 due to its long shelf life, convenience, and ease of storage. Dry powder mixes are widely used in homes, bakeries, and foodservice outlets for quick preparation with consistent quality.

The semi-liquid segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for ready-to-use mixes that reduce preparation time and offer consistent texture. Semi-liquid mixes appeal to busy consumers and small food businesses looking for premium, hassle-free dessert solutions.

- By Nature

On the basis of nature, the dessert mix market is segmented into ordinary, organic, and conventional mixes. The conventional segment held the largest market revenue share in 2025, supported by the affordability, availability, and widespread acceptance among consumers. Conventional mixes cater to everyday household baking needs and are widely distributed through supermarkets and retail outlets.

The organic segment is expected to witness the fastest growth rate from 2026 to 2033, driven by growing health consciousness and demand for clean-label products. Organic dessert mixes attract health-conscious consumers and premium buyers seeking additive-free, environmentally friendly ingredients, supporting sustainable growth.

- By Speciality Type

On the basis of speciality type, the dessert mix market is segmented into sugar-free, gluten-free, fat-free, and others. The sugar-free segment held the largest revenue share in 2025 due to rising health awareness and increasing prevalence of diabetes and lifestyle-related conditions. Sugar-free mixes appeal to consumers seeking healthier alternatives without compromising taste.

The gluten-free segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the growing adoption of gluten-free diets, rising allergy awareness, and demand for specialty baked products. Gluten-free mixes are increasingly incorporated into both home baking and commercial bakery products to cater to dietary requirements.

- By Distribution Channels

On the basis of distribution channels, the dessert mix market is segmented into online stores, supermarkets, speciality stores, and retailers. The supermarket segment held the largest market revenue share in 2025, driven by high accessibility, variety, and promotional activities attracting mass consumers.

The online store segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by rising e-commerce penetration, convenience of doorstep delivery, and digital marketing strategies promoting home baking and specialty dessert mixes. Online platforms allow brands to reach wider audiences and offer subscription or bundle options to enhance consumer engagement.

Dessert Mix Market Regional Analysis

- North America dominated the dessert mix market with the largest revenue share of 36.45% in 2025, driven by a growing preference for convenient home baking solutions, busy lifestyles, and increasing demand for health-oriented and fortified dessert mixes

- Consumers in the region highly value ready-to-make dessert mixes that save preparation time while providing consistent taste and quality, making them a popular choice across households, cafés, and small bakeries

- This widespread adoption is further supported by high disposable incomes, strong retail and e-commerce infrastructure, and the growing trend of home baking and DIY desserts, establishing dessert mixes as a favored category among urban consumers

U.S. Dessert Mix Market Insight

The U.S. dessert mix market captured the largest revenue share in 2025 within North America, fueled by the rising popularity of convenient and fortified dessert products. Consumers increasingly prioritize time-saving solutions without compromising taste and nutritional value. The growing trend of at-home baking, coupled with robust demand for organic, low-sugar, and gluten-free options, further propels the market. Moreover, extensive distribution networks through supermarkets, online stores, and specialty retailers significantly contribute to the expansion of dessert mixes in the U.S.

Europe Dessert Mix Market Insight

The Europe dessert mix market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by rising health awareness, changing lifestyles, and demand for premium and specialty dessert mixes. Consumers are drawn to sugar-free, low-fat, and organic variants that cater to healthier indulgence. The market is also benefiting from the expansion of modern retail, e-commerce platforms, and the growing home-baking culture across countries such as Germany, France, and Italy.

U.K. Dessert Mix Market Insight

The U.K. dessert mix market is expected to witness significant growth from 2026 to 2033, driven by the increasing adoption of convenient and health-conscious dessert solutions. Busy lifestyles and the desire for homemade desserts without compromising on quality are encouraging consumers to purchase ready-to-make mixes. In addition, the robust e-commerce sector and specialty food stores are making a wide variety of flavored and fortified dessert mixes readily available, supporting sustained market growth.

Germany Dessert Mix Market Insight

The Germany dessert mix market is expected to witness robust growth from 2026 to 2033, fueled by increasing awareness of healthy eating and preference for high-quality, convenient dessert options. Consumers are showing a rising interest in organic, sugar-free, and gluten-free mixes. Well-developed retail infrastructure and the emphasis on innovative and sustainable food products promote adoption in both households and small-scale commercial kitchens.

Asia-Pacific Dessert Mix Market Insight

The Asia-Pacific dessert mix market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and a growing interest in at-home baking in countries such as China, India, Japan, and South Korea. The region's expanding middle class, increasing awareness of health-oriented products, and the rising trend of flavored and fortified mixes are boosting adoption. Moreover, the growth of organized retail and online grocery platforms is improving product accessibility, further propelling market expansion.

Japan Dessert Mix Market Insight

The Japan dessert mix market is expected to witness strong growth from 2026 to 2033, driven by consumers’ interest in convenient, high-quality dessert solutions and busy urban lifestyles. Consumers prefer ready-to-make mixes that are both nutritious and indulgent. The integration of fortified, low-sugar, and specialty dessert options into household routines, coupled with strong retail and e-commerce channels, is accelerating adoption across both residential and commercial segments.

China Dessert Mix Market Insight

The China dessert mix market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, increasing disposable incomes, and rising interest in home baking. Consumers are seeking convenient, flavored, and fortified dessert mixes that combine taste and nutrition. The growth of modern retail chains, online stores, and the availability of diverse product portfolios from domestic and international brands are key factors driving market expansion in China.

Dessert Mix Market Share

The Dessert Mix industry is primarily led by well-established companies, including:

• General Mills (U.S.)

• Conagra Brands, Inc. (U.S.)

• ARDENT MILLS (U.S.)

• Chelsea Milling Co. (U.S.)

• Continental Mills, Inc. (U.S.)

• AB Mauri (U.K.)

• Stonewall Kitchen (U.S.)

• Bundt (U.S.)

• Royal Desserts (U.S.)

• Tastefully Simple (U.S.)

• Pillsbury (U.S.)

• Arrowhead Mills (U.S.)

• Dr. Oetker (U.K.)

• Archer Daniels Midland (U.S.)

• Pinnacle Foods Corp. (U.S.)

• Kosto Foods (U.S.)

• Ornua Ingredients (U.K.)

• The J.M. Smucker Co. (U.S.)

• Bob’s Red Mill Natural Foods (U.S.)

Latest Developments in Global Dessert Mix Market

- In February 2022, Carr's Flour launched a new premium line of "Bake at Home Cake Mixes," featuring Decadent Chocolate Cake, Salted Caramel Cake, Luscious Lemon Cake, Heavenly Victoria Sponge, and Delicious Carrot Cake. This launch aimed to provide consumers with convenient, bakery-quality desserts at home, enhancing the brand’s portfolio and appealing to home bakers seeking indulgent and easy-to-make treats. The introduction of these gourmet cake mixes is expected to boost sales, strengthen customer loyalty, and drive growth in the premium dessert mix segment

- In April 2022, Krusteaz introduced a Chocolate Pie Bar Mix as part of its expansion into dessert bars. The product combines a smooth chocolate cream pie-style filling with a chocolate crust, targeting consumers looking for convenient, indulgent, and ready-to-bake dessert options. This launch is expected to increase the brand’s market presence, attract chocolate lovers, and contribute to the growing demand for easy-to-make dessert mixes

- In August 2022, Elia unveiled a line of Mediterranean-inspired olive oil-based cake mixes in flavors such as Dark Chocolate & Espresso, Vanilla with a Hint of Lemon, and Grecian. The launch focuses on providing healthier, artisanal baking options while catering to consumers seeking unique and high-quality flavors. This development is projected to enhance brand differentiation, expand the health-conscious dessert segment, and drive adoption among premium dessert mix consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dessert Mix Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dessert Mix Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dessert Mix Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.