Global Developmental Dyspraxia Drug Market

Market Size in USD Billion

CAGR :

%

USD

9.23 Billion

USD

13.33 Billion

2024

2032

USD

9.23 Billion

USD

13.33 Billion

2024

2032

| 2025 –2032 | |

| USD 9.23 Billion | |

| USD 13.33 Billion | |

|

|

|

|

Developmental Dyspraxia Drug Market Size

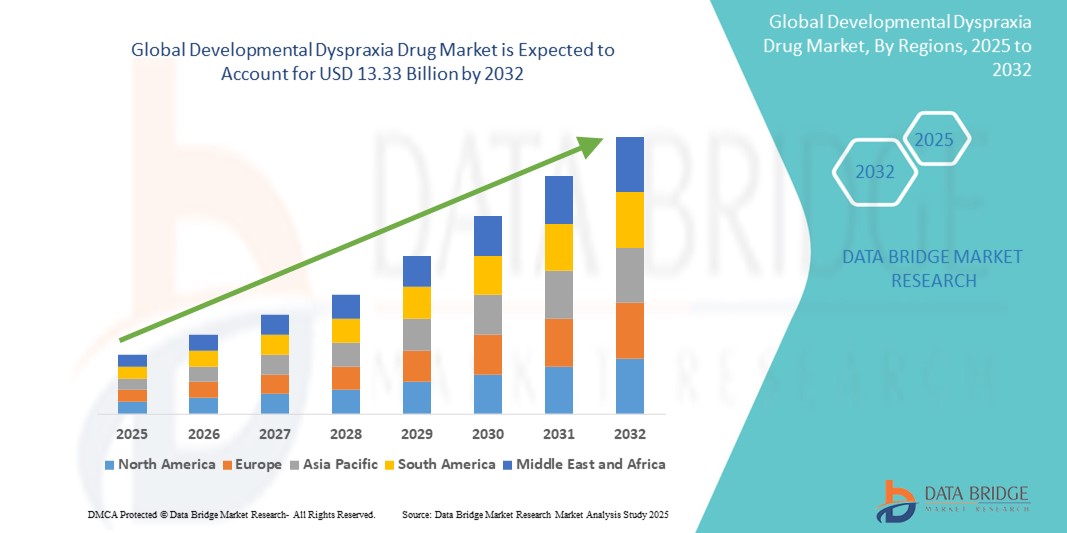

- The global developmental dyspraxia drug market size was valued at USD 9.23 billion in 2024 and is expected to reach USD 13.33 billion by 2032, at a CAGR of 4.7% during the forecast period

- This growth is driven by increasing awareness of childhood neurological disorders, advancements in pediatric neuropharmacology, and growing demand for early intervention therapies.

Developmental Dyspraxia Drug Market Analysis

- Developmental dyspraxia, or developmental coordination disorder (DCD), is a neurological condition affecting motor coordination and cognitive processing in children. Pharmacologic treatment is typically used alongside occupational and speech therapy

- The market is growing due to increasing diagnosis rates, improvements in school-based screening, and availability of combination drug therapy

- North America dominates the developmental dyspraxia drug market with an estimated share of 43.6%, driven by well-established pediatric neurology networks, widespread implementation of early diagnosis programs, and robust pharmaceutical research and development (R&D) capabilities

- The Asia-Pacific region is projected to witness the highest compound annual growth rate (CAGR) of 6.2% in the developmental dyspraxia drug market, fueled by rising investments in pediatric health services and increased awareness about neurodevelopmental disorders

- The stimulants segment is projected to dominate the market with the largest share of 39.7%, owing to their established role in improving attention span and executive function in children

Report Scope and Developmental Dyspraxia Drug Market Segmentation

|

Attributes |

Developmental Dyspraxia Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Developmental Dyspraxia Drug Market Trends

"Growing Preference for Multimodal Treatment Approaches"

- The market is witnessing a shift toward combination therapies involving medication and therapeutic interventions like occupational and speech therapy.

- Pharmaceutical companies are investing in pediatric-specific drug formulations that support neuroplasticity during early childhood development.

- Care models are evolving to include cognitive training, behavioral therapy, and pharmacotherapy for more comprehensive patient management.

- For instance, in 2024, new extended-release formulations of nootropics and attention-enhancing drugs showed promising results in improving task execution time and fine motor function in children with dyspraxia.

- The integration of pharmaceutical innovation with therapeutic disciplines is reshaping the treatment landscape, offering synergistic benefits and improving functional outcomes

Developmental Dyspraxia Drug Market Dynamics

Driver:

"Rising Global Awareness and Early Diagnosis Initiatives"

- Governments and healthcare bodies are implementing screening initiatives in schools and pediatric centers to detect developmental disorders early.

- This is significantly increasing treatment rates and reducing the burden of untreated dyspraxia.

- Partnerships between healthcare providers and educational institutions are promoting multidisciplinary early intervention strategies.

- For instance, in 2023, the U.K. National Health Service launched a national pediatric motor function screening program, improving early referrals by 22%.

- These efforts are accelerating the identification of developmental dyspraxia in its early stages, thereby expanding the candidate pool for pharmaceutical and therapeutic interventions.

Opportunity:

"Emergence of Targeted Cognitive Enhancers and Personalized Drug Therapy"

- The ongoing research on targeted cognitive enhancers and precision medicine in pediatric populations is opening new avenues.

- Development of drugs aimed at synaptic plasticity and neurotransmitter balance may improve symptom management for patients with dual diagnoses like ADHD-DCD.

- Advances in pharmacogenomics are enabling the tailoring of treatments based on individual genetic profiles, reducing adverse reactions and enhancing efficacy.

- For instance, in 2024, clinical trials on pediatric-specific modafinil analogs showed improved dual-task performance with fewer behavioral side effects.

- Personalized and targeted approaches are set to transform drug therapy for dyspraxia, maximizing benefit-risk ratios and paving the way for more effective management strategies.

Restraint/Challenge:

"Limited Clinical Data and Off-Label Prescribing Risks"

- Most drugs used in dyspraxia treatment are off-label, originally approved for ADHD or anxiety. The lack of condition-specific trials and pediatric safety data restricts broader approval and insurance reimbursement.

- For instance, A 2023 meta-analysis found that over 65% of prescribed medications for DCD lacked formal pediatric indication approval, raising concerns on long-term safety.

- Regulatory hesitance and ethical complexities in pediatric trials are delaying the development of dedicated medications for developmental coordination disorders.

- The absence of robust clinical data and regulatory frameworks hampers the widespread adoption of pharmacologic treatments, underscoring the need for focused research and policy reform.

Developmental Dyspraxia Drug Market Scope

The market is segmented on the basis of drug class, route of administration, indication, distribution channel, and end user

|

Segmentation |

Sub-Segmentation |

|

By Drug Class |

• Stimulants • Nootropics • Antidepressants • Others |

|

By Route of Administration |

• Injectable • Others |

|

By Indication |

• Attention Deficit • Speech Disorders • Others |

|

By End User |

• Attention Deficit • Speech Disorders • Others |

|

By Distribution Channel

|

|

In 2025, the Stimulants is projected to dominate the market with a largest share in drug class segment

In 2025, the Stimulants segment is projected to dominate the market with the largest share of 39.7%, owing to their established role in improving attention span and executive function in children. These drugs are known to enhance dopamine and norepinephrine activity in the brain, leading to improved executive functioning, attention regulation, and behavioral control.Their efficacy, rapid onset, and established dosing regimens make stimulants a first-line pharmacological option in multimodal treatment strategies. Market growth is further fueled by increasing approvals of extended-release formulations and pediatric-specific delivery systems that offer better adherence and reduced side effects. With growing clinical preference and high prescribing rates, the stimulants segment is expected to maintain its market leadership, supported by continued innovations in drug delivery and expanded indications in neurodevelopmental care.

The Attention Deficit segment is expected to account for the largest share during the forecast period in indication segment

In 2025, the attention deficit segment is projected to account for the largest share of 41.2% in the indication category, owing to the high comorbidity of ADHD with dyspraxia and the established pharmacologic protocols targeting attentional control. A significant proportion of children diagnosed with developmental dyspraxia also exhibit symptoms of ADHD, particularly inattention and impulsivity, creating a dual-diagnosis scenario.This overlap necessitates pharmacologic management tailored to improve attention span, cognitive processing, and behavioral inhibition, often using stimulant or non-stimulant agents.Clinical guidelines and practice patterns strongly support early pharmacologic intervention in such cases to facilitate better engagement in therapeutic programs such as occupational or speech therapy. Diagnostic advancements and integrated screening practices have also increased the identification rates of attention-related impairments in dyspraxic children.Given the diagnostic overlap and well-validated treatment pathways, the attention deficit segment is expected to remain the dominant indication, driving significant market demand and shaping therapeutic development.

Developmental Dyspraxia Drug Market Regional Analysis

“North America Holds the Largest Share in the Developmental Dyspraxia Drug Market”

• North America dominates the developmental dyspraxia drug market with an estimated share of 43.6%, driven by well-established pediatric neurology networks, widespread implementation of early diagnosis programs, and robust pharmaceutical research and development (R&D) capabilities.

• The U.S. holds a substantial market share of 81.4% within North America, leading in FDA-approved pediatric neurological drugs and being a hub for active clinical trials focused on developmental coordination disorders (DCD) and comorbid conditions like ADHD.

• A strong healthcare ecosystem that supports early intervention and a high level of insurance coverage for pediatric therapies further bolsters the region’s market dominance.

• The presence of global pharmaceutical leaders such as Pfizer, Johnson & Johnson, and Eli Lilly, along with a mature regulatory framework, enables quicker market access for novel therapies, reinforcing North America’s position as the frontrunner in dyspraxia drug innovation.

• The growing emphasis on integrated care models, combining pharmacologic and therapeutic approaches, is also driving treatment uptake, solidifying North America’s leadership in the developmental dyspraxia drug market.

“Asia-Pacific is Projected to Register the Highest CAGR in the Developmental Dyspraxia Drug Market”

• The Asia-Pacific region is projected to witness the highest compound annual growth rate (CAGR) of 6.2% in the developmental dyspraxia drug market, fueled by rising investments in pediatric health services and increased awareness about neurodevelopmental disorders.

• Countries such as India, China, and Japan are driving this growth through government-led child wellness initiatives, adoption of neurodevelopmental screening guidelines, and an increase in public-private partnerships aimed at expanding access to early treatment in underserved communities.

• India holds a growing market share of 9.6% in the APAC region, supported by a surge in mental health outreach programs, expanding diagnostic infrastructure, and growing availability of pediatric neurologists in urban and semi-urban areas.

• Technological advancements in diagnostics and increased foreign investment in pediatric R&D are accelerating the region’s progress in treating conditions like dyspraxia and comorbid ADHD.

• The integration of pharmacogenomics and targeted drug development across emerging economies is also contributing to the regional market’s rapid expansion. As awareness and healthcare access rise, the Asia-Pacific market is set to become a major growth engine for developmental dyspraxia drug innovation..

Developmental Dyspraxia Drug Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Pfizer Inc. (U.S.)

- Johnson & Johnson (U.S.)

- Eli Lilly and Company (U.S.)

- Novartis AG (Switzerland)

- Shire (part of Takeda Pharmaceutical Company) (Japan)

- GlaxoSmithKline plc (U.K.)

- Sunovion Pharmaceuticals Inc. (U.S.)

- Neurocrine Biosciences Inc. (U.S.)

Latest Developments in Global Developmental Dyspraxia Drug Market

• In February 2025, Eli Lilly launched a Phase II pediatric trial for a novel norepinephrine-dopamine modulator for developmental motor delays. Eli Lilly initiated a mid-stage clinical study to assess a new agent that targets norepinephrine and dopamine pathways, aiming to improve motor planning and execution in children with developmental dyspraxia. This reflects the growing emphasis on neurochemical modulation in pediatric motor disorders.

• In December 2024, Neurocrine Biosciences announced a breakthrough patent for a cognitive enhancer targeting verbal dyspraxia. Neurocrine Biosciences secured a patent for a novel cognitive enhancer formulated to support speech coordination and verbal processing in children with verbal dyspraxia, marking a significant advancement in pharmacologic options for language-specific motor impairments.

• In September 2024, Pfizer submitted regulatory filings for an extended-release formulation of a nootropic compound for use in DCD. Pfizer submitted applications to regulatory authorities for approval of an extended-release nootropic designed to support executive functioning, attention, and motor learning in children with developmental coordination disorder, offering improved adherence through simplified dosing.

• In July 2024, Takeda partnered with a U.S. academic center to develop dual-action drugs for co-occurring dyspraxia and anxiety in children. Takeda formed a strategic research partnership to co-develop pharmacologic solutions that address both motor coordination issues and anxiety symptoms in pediatric patients, aiming to provide more comprehensive care through combination therapy approaches.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.