Global Devsecops Market

Market Size in USD Billion

CAGR :

%

USD

5.89 Billion

USD

52.67 Billion

2024

2032

USD

5.89 Billion

USD

52.67 Billion

2024

2032

| 2025 –2032 | |

| USD 5.89 Billion | |

| USD 52.67 Billion | |

|

|

|

|

DevSecOps Market Analysis

The DevSecOps market is experiencing significant growth, driven by the increasing need for integrating security into the software development lifecycle. As businesses face escalating cybersecurity threats, the demand for solutions that enable secure development practices from the outset has surged. DevSecOps, which stands for Development, Security, and Operations, fosters collaboration between development, security, and operations teams, ensuring security is built into applications from the start rather than being added as an afterthought. Key advancements in the market include the integration of AI and machine learning to enhance threat detection, as well as automation tools that simplify security processes, making them more efficient and less prone to human error. In addition, cloud-native solutions, coupled with the growing adoption of microservices architecture, have further increased the demand for robust security frameworks.

The market is poised for substantial growth, driven by factors such as the rise in cyberattacks, regulatory requirements, and the widespread adoption of cloud-based technologies. Companies such as Snyk Limited and GitLab are leading the way in providing solutions that empower developers to build and deploy secure applications at scale, contributing to the ongoing expansion of the DevSecOps market.

DevSecOps Market Size

The global DevSecOps market size was valued at USD 5.89 billion in 2024 and is projected to reach USD 52.67 billion by 2032, with a CAGR of 31.50% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

DevSecOps Market Trends

“Growing Integration of AI and Machine Learning”

A key trend in the DevSecOps market is the growing integration of AI and machine learning to enhance security automation. With the increasing complexity of cybersecurity threats, businesses are turning to AI-driven tools to automatically detect vulnerabilities and potential risks in real-time. For instance, companies such as Snyk are utilizing machine learning algorithms to scan open-source code for vulnerabilities, enabling developers to address security flaws early in the development process. This trend reduces manual intervention and enhances the speed and accuracy of threat identification, making the security process more efficient. As cloud-native technologies and microservices architecture become more prevalent, AI-powered DevSecOps solutions help ensure that security measures are seamlessly integrated across various development and deployment environments. The trend towards AI in DevSecOps underscores the increasing need for automation in securing applications and systems, driving the demand for intelligent security solutions that streamline the overall development lifecycle.

Report Scope and DevSecOps Market Segmentation

|

Attributes |

DevSecOps Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Broadcom (U.S.), IBM (U.S.), MicroFocus (U.K.), Synopsys (U.S.), Microsoft (U.S.), Google Inc., (U.S.), Check Point Software Technologies Ltd. (Israel), Palo Alto Networks (U.S.), Qualys, Inc. (U.S.), Progress Software Corporation (U.S.), Threat Modeler (U.S.), Contrast Security (U.S.), CyberArk (Israel), Entersoft (Australia), Rogue Wave Software, Inc. (U.S.), Splunk Inc., (U.S.), 4ARMED LIMITED (U.K.), Aqua Security Software Ltd. (Israel), Check Marx Ltd., (Israel), Conntinuum Security Consultants Inc. (Spain), and Synopsys, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

DevSecOps Market Definition

DevSecOps is an approach that integrates security practices into the DevOps process, where development, security, and operations teams collaborate to build, test, and deploy secure applications and infrastructure. Traditionally, security was considered a separate phase in software development, typically addressed after coding. However, DevSecOps emphasizes that security should be embedded throughout the entire development lifecycle, from the design phase through to deployment and maintenance.

DevSecOps Market Dynamics

Drivers

- Growing Prevalence of Cybersecurity Threats

The growing prevalence of cybersecurity threats is a major driver for the adoption of DevSecOps, as organizations face an increasing number of cyberattacks, data breaches, and other security risks. According to a 2023 report by IBM, the average cost of a data breach globally reached $4.45 million, highlighting the critical need for proactive security measures. As organizations seek to protect sensitive data and intellectual property, DevSecOps enables them to detect and address security vulnerabilities early in the development process, before they can be exploited by malicious actors. By integrating security testing, vulnerability assessments, and compliance checks directly into the DevOps pipeline, companies can significantly reduce the risk of security incidents while improving the speed and efficiency of software delivery. For instance, Snyk has reported that integrating security into the development lifecycle through DevSecOps has helped organizations reduce vulnerability exposure by up to 80%, demonstrating the direct impact of DevSecOps on improving application security. As cyber threats continue to escalate, DevSecOps becomes an essential approach, driving market growth by empowering businesses to deliver secure software without delays.

- Growing Focus on Regulatory Compliances

The need for regulatory compliance is increasingly driving the adoption of DevSecOps as organizations face growing pressure to meet stringent data protection and security regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) have raised the bar for how companies must protect user data, with severe penalties for non-compliance. In response, organizations are adopting DevSecOps practices to integrate security and compliance into their development processes from the outset. For instance, GitLab has developed built-in automated compliance checks that run as part of the continuous integration pipeline, enabling organizations to monitor and maintain compliance in real-time without manual intervention. This helps in reducing the risk of costly fines and streamlines the process of staying up to date with evolving regulations. As regulations tighten, DevSecOps offers a proactive and efficient approach, becoming a key driver in the growth of the DevSecOps market, as businesses look for solutions to mitigate the risk of non-compliance.

Opportunities

- Growing Adoption of Cloud Computing and Microservices Architectures

The adoption of cloud computing and microservices architectures has significantly increased the need for scalable, integrated security solutions, positioning DevSecOps as a key market opportunity. As businesses increasingly migrate to the cloud and embrace microservices for flexibility and scalability, security must evolve to meet the challenges of managing multiple, distributed systems. DevSecOps addresses these challenges by integrating security into the continuous development and deployment pipeline, providing real-time monitoring and automated security checks. For instance, Amazon Web Services (AWS) offers built-in DevSecOps capabilities such as AWS Security Hub, which aggregates security findings across an organization’s cloud infrastructure and automates threat detection. This ensures that security is continuously maintained across various microservices, without hindering development speed. As more companies embrace cloud-native environments and microservices, the demand for secure DevSecOps solutions will grow, creating a significant market opportunity for vendors offering integrated, automated security solutions to protect these complex, dynamic environments.

- Increasing Demand for Faster Delivery of Software

The demand for faster delivery of software has become a crucial market driver, especially with the increasing reliance on Continuous Integration/Continuous Deployment (CI/CD) pipelines. As businesses strive to release software quickly to stay competitive, integrating security into these rapid development cycles is essential to avoid potential vulnerabilities and risks. DevSecOps addresses this challenge by embedding security controls into the CI/CD pipeline, enabling teams to identify and address security issues early in the development process, without slowing down delivery. For instance, Jenkins, a popular CI/CD tool, offers plugins that integrate security scans into the deployment pipeline, allowing developers to detect vulnerabilities in real-time and fix them before they make it to production. As the need for faster software deployment grows, DevSecOps becomes a valuable solution that ensures security is maintained without compromising on speed, thereby creating a significant market opportunity for companies offering automated, secure development tools that streamline the deployment of safe, high-quality software.

Restraints/Challenges

- Shortage of Skilled Workforce

The skilled workforce shortage is a significant challenge in the DevSecOps market, as it requires professionals who possess a rare combination of expertise in software development, security, and operations. For instance, a company looking to implement DevSecOps strategies must find individuals who understand the development lifecycle and have deep knowledge of security practices such as risk assessment, vulnerability management, and compliance. This need for specialized skills has led to a large gap between demand and supply, making it increasingly difficult for organizations to build effective teams. The shortage of qualified DevSecOps professionals is further compounded by the fact that the field is still relatively new, and many educational programs or certifications are just beginning to address the intersection of these three domains. As a result, organizations often struggle to find talent that can bridge the gap between development and security, delaying the adoption of DevSecOps strategies and adding to the challenge of securing software in fast-paced development environments. This shortage of skilled professionals is a key barrier to the growth and success of the DevSecOps market, limiting the ability of organizations to fully implement security throughout the software development lifecycle.

- High Cost of Implementation

The cost of implementation is a major challenge for organizations looking to adopt DevSecOps, as it often requires significant upfront investments in tools, training, and process changes. For instance, integrating security tools such as automated vulnerability scanners, compliance checks, and secure coding practices into an existing DevOps pipeline can be costly, especially for small and medium-sized enterprises (SMEs) that have limited budgets. These organizations may struggle to justify the expense, particularly when security needs must be balanced with other business priorities such as product development or customer acquisition. In addition, there can be a perceived lack of immediate return on investment (ROI) from implementing DevSecOps, as the benefits of enhanced security and risk mitigation may not be immediately visible or quantifiable. As a result, SMEs might hesitate to invest in the resources required for DevSecOps adoption, fearing that the costs will outweigh the benefits, especially if security breaches or vulnerabilities have not yet had a significant impact on the organization. This high initial investment and uncertain ROI are key barriers to the widespread adoption of DevSecOps, particularly among smaller organizations that are more cost-conscious.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

DevSecOps Market Scope

The market is segmented on the basis of deployment type, component, organization size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Deployment Type

- Cloud

- On-Premises

Component

- Solution

- Services

Organization Size

- Small and Medium-Sized Enterprises

- Large Enterprises

Vertical

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunications

- Government and Public Sector

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Healthcare and Life Sciences

- Others

DevSecOps Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, deployment type, component, organization size, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

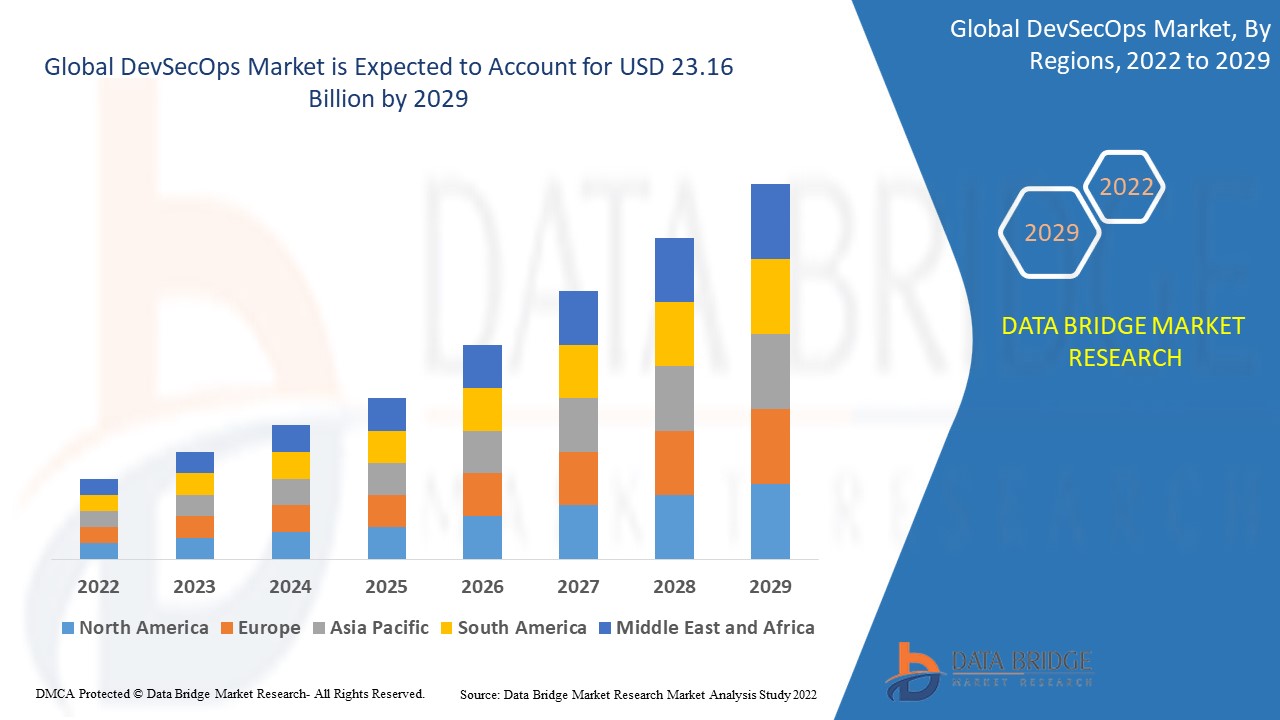

North America dominates the DevSecOps market due to the widespread adoption of these solutions by medium and large enterprises in the region, particularly between 2025 and 2032. The growing demand for secure and efficient application development, coupled with the need for continuous delivery, is driving the need for advanced security measures. Furthermore, the increasing emphasis on protecting digital assets amid expanding digital transformation initiatives is expected to accelerate market growth. As businesses prioritize security in the development lifecycle, the region’s market share is set to expand significantly.

Asia-Pacific is projected to experience highest growth rate from 2025 to 2032, driven by rapid advancements and the widespread adoption of emerging technologies such as cloud computing and the Internet of Things (IoT). The region's market expansion is further fueled by the growing adoption of DevSecOps solutions among small and medium-sized enterprises (SMEs), which are increasingly recognizing the need for robust security measures. As businesses across sectors prioritize digital transformation, the demand for secure, scalable solutions is expected to rise. This trend, coupled with regional innovation, will contribute significantly to the growth of the DevSecOps market in Asia-Pacific.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

DevSecOps Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

DevSecOps Market Leaders Operating in the Market Are:

- Broadcom (U.S.)

- IBM (U.S.)

- MicroFocus (U.K.)

- Synopsys (U.S.)

- Microsoft (U.S.)

- Google Inc., (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Palo Alto Networks (U.S.)

- Qualys, Inc. (U.S.)

- Progress Software Corporation (U.S.)

- Threat Modeler (U.S.)

- Contrast Security (U.S.)

- CyberArk (Israel)

- Entersoft (Australia)

- Rogue Wave Software, Inc. (U.S.)

- Splunk Inc., (U.S.)

- 4ARMED LIMITED (U.K.)

- Aqua Security Software Ltd. (Israel)

- Check Marx Ltd., (Israel)

- Conntinuum Security Consultants Inc. (Spain)

- Synopsys, Inc. (U.S.)

Latest Developments in DevSecOps Market

- In January 2024, Snyk Limited, a leading player in developer security, acquired Helios. This acquisition is anticipated to enhance Snyk's capabilities in Application Security Posture Management (ASPM), enabling teams to better manage and control application security programs at scale

- In March 2024, GitLab Inc., a key provider of integrated software delivery platforms, acquired Oxeye, a prominent company specializing in risk management and cloud-native application security solutions. This move strengthens GitLab's position in the growing field of cloud security

- In October 2023, for SAP ABAP developers, the ABAP SDK for Google Cloud introduced over 40 additional APIs, along with a new authentication mechanism, enhancing developer productivity and providing new tools for cloud-native application development

- In May 2022, Progress, a software infrastructure company, launched Progress Chief Cloud Security, extending its support to DevSecOps with compliance features for native cloud assets and end-to-end management of resources, irrespective of their deployment. The product aimed to help enterprises succeed with DevOps practices

- In May 2022, JFrog, a software development firm, introduced JFrog Connect, a solution designed for interaction with Linux and IoT devices. This platform helps developers automate DevSecOps activities, simplifying the process of integrating security into their DevOps workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.