Global Diabetes Biologics Market

Market Size in USD Billion

CAGR :

%

USD

20.30 Billion

USD

48.94 Billion

2024

2032

USD

20.30 Billion

USD

48.94 Billion

2024

2032

| 2025 –2032 | |

| USD 20.30 Billion | |

| USD 48.94 Billion | |

|

|

|

|

Diabetes Biologics Market Analysis

The diabetes biologics market has seen significant growth driven by technological advancements in drug development and patient care. The latest methods include the use of monoclonal antibodies (mAbs), insulin glargine biosimilars, and continuous glucose monitoring (CGM) technologies. These biologics are designed to offer better control over blood glucose levels and reduce the frequency of injections.

Technologies such as AI-driven predictive analytics are being incorporated into drug development processes, enabling the creation of biologics that can better target insulin resistance or manage complications related to diabetes. The use of gene therapy and CRISPR technology is also being explored for permanent treatment options for type 1 diabetes by targeting and modifying specific genes related to insulin production.

In addition, insulin delivery systems have advanced with the development of automated insulin pumps and smart pens, which enhance the precision of insulin dosing. The growth of telemedicine and personalized care has expanded access to diabetes biologics, fostering market expansion. As these technologies continue to improve patient outcomes, the diabetes biologics market is expected to grow rapidly, with increased demand for innovative, long-term treatments.

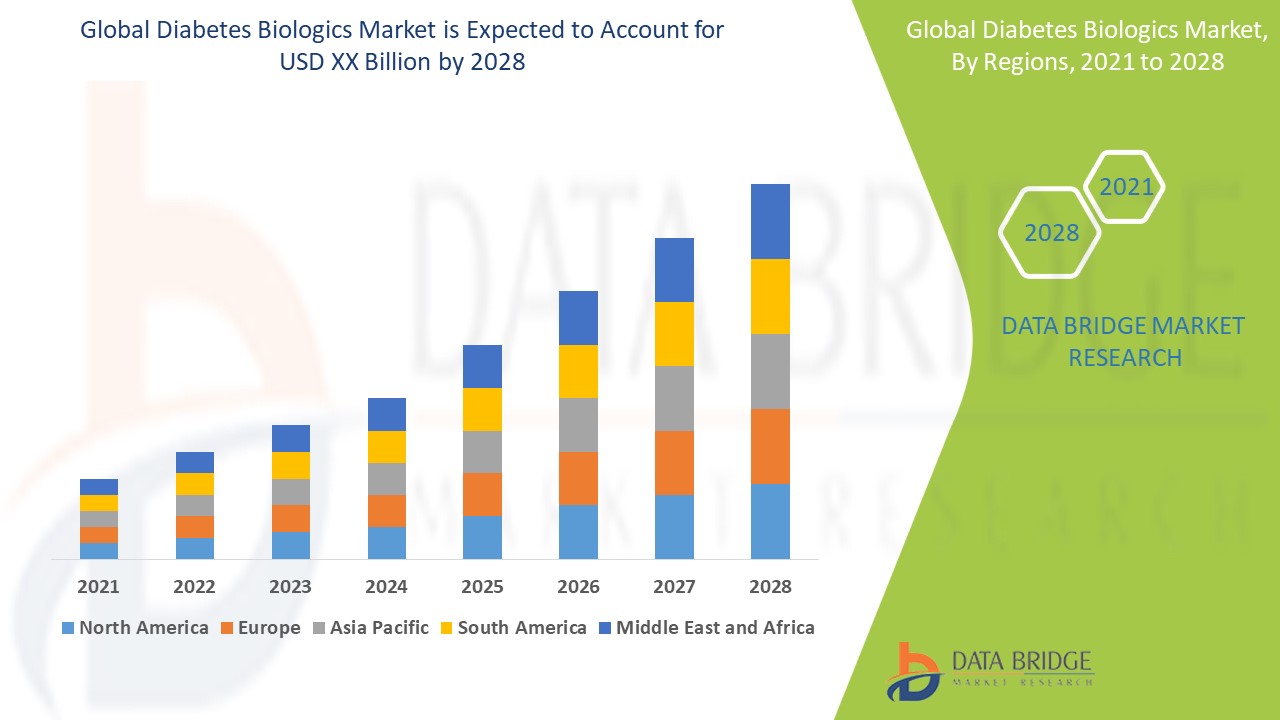

Diabetes Biologics Market Size

The global diabetes biologics market size was valued at USD 20.30 billion in 2024 and is projected to reach USD 48.94 billion by 2032, with a CAGR of 11.6% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Diabetes Biologics Market Trends

“Increasing Demand for Monoclonal Antibodies in Diabetes Biologics”

One specific trend driving growth in the diabetes biologics market is the increasing demand for monoclonal antibodies (mAbs) for diabetes treatment. mAbs, such as Taltz (ixekizumab) and Tanzeum (albiglutide), offer targeted therapies that effectively regulate blood sugar levels. These biologics are gaining traction due to their ability to specifically target and modulate immune system responses, reducing side effects compared to traditional insulin therapy. For instance, Taltz has been successful in treating diabetes-related complications by regulating immune responses, improving long-term outcomes. As mAbs provide personalized treatment options, the adoption of these biologics is expected to expand, significantly driving market growth and innovation in diabetes management.

Report Scope and Diabetes Biologics Market Segmentation

|

Attributes |

Diabetes Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Sanofi (France), Novartis AG (Switzerland), Bayer AG (Germany), Novo Nordisk A/S (Denmark), Eli Lilly and Company (U.S.), Merck & Company, Inc. (U.S.), Boehringer Ingelheim International GmbH (Germany), AstraZeneca (U.K.), Johnson & Johnson Services, Inc. (U.S.), Takeda Pharmaceutical Company Ltd. (Japan), Sun Pharmaceutical Industries Ltd (India), and Biocon (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Diabetes Biologics Market Definition

Diabetes biologics are a class of biologically derived therapies used to manage and treat diabetes, particularly Type 1 and Type 2 diabetes. These treatments often involve the use of proteins, antibodies, or other biologically sourced substances designed to modulate the immune system or improve insulin regulation. Instances include monoclonal antibodies targeting specific immune cells or agents that enhance insulin production or sensitivity. Different from traditional insulin therapies, biologics aim to provide more personalized treatment options by addressing the underlying mechanisms of diabetes. They offer potential for more effective management and better patient outcomes in individuals with challenging or resistant forms of diabetes.

Diabetes Biologics Market Dynamics

Drivers

- Increasing Diabetes Prevalence

The rising global prevalence of diabetes, particularly Type 2 diabetes, significantly drives the diabetes biologics market. With over 400 million people worldwide living with diabetes, as reported by the WHO, the demand for advanced treatments, such as biologics, is growing rapidly. The increasing number of people diagnosed with diabetes, fueled by lifestyle changes and aging populations, is expected to continue driving this demand. For instance, the market for GLP-1 receptor agonists, such as Novo Nordisk’s Ozempic, has surged due to their proven effectiveness in managing both diabetes and weight, making them highly sought-after biologic therapies. This trend underscores the importance of biologics in addressing the global diabetes crisis.

- Shifting Focus from Oral to Injectable Treatments

As the diabetes biologics market evolves, there is a significant shift from oral medications to injectable biologics. Injectable treatments, such as insulin analogs and GLP-1 receptor agonists, have shown superior efficacy in managing blood sugar levels. For instance, drugs such as Ozempic (semaglutide) and Trulicity (dulaglutide) have gained popularity due to their effectiveness in reducing HbA1c levels and promoting weight loss. This trend is driven by growing awareness among healthcare professionals and patients about the long-term benefits of injectable biologics, especially in patients who are unable to achieve optimal control with oral medications. This shift is accelerating the demand for advanced biologic treatments, further fueling market growth.

Opportunities

- Advancements in Biologic Therapies

Continuous innovation in biologic therapies, including insulin analogs, GLP-1 receptor agonists, and SGLT-2 inhibitors, has significantly improved the efficacy of diabetes management. Insulin analogs such as Lantus and Humalog provide more consistent blood sugar control, reducing the risk of hypoglycemia. GLP-1 receptor agonists such as Ozempic and Trulicity not only help regulate blood sugar but also aid in weight loss, a critical factor for Type 2 diabetes patients. In addition, SGLT-2 inhibitors such as Jardiance are effective in reducing cardiovascular risks. These advancements offer better treatment outcomes, making biologics more attractive and creating substantial growth opportunities for the diabetes biologics market as patients increasingly seek these effective therapies.

- Rising Prevalence of Obesity

The increasing prevalence of obesity globally is significantly driving the demand for diabetes biologics. Obesity is a major risk factor for Type 2 diabetes, with excess body weight contributing to insulin resistance. As obesity rates rise, particularly in regions such as North America and parts of Europe, the need for effective diabetes treatments, including biologic therapies, grows. For instance, the U.S. Centers for Disease Control and Prevention (CDC) reports that over 40% of U.S. adults are obese, creating a substantial market for biologics such as GLP-1 receptor agonists (e.g., Ozempic) that target both weight loss and diabetes management. This trend presents opportunities for pharmaceutical companies to develop and market biologic solutions targeting both obesity and diabetes.

Restraints/Challenges

- High Treatment Costs

High treatment costs remain a significant restraint for the diabetes biologics market. Biologic drugs, such as insulin and GLP-1 receptor agonists, are costly due to their intricate manufacturing processes, which involve advanced biotechnology and specialized facilities. This results in high production costs that are passed on to consumers. As a consequence, many diabetic patients, particularly in low-income regions, struggle to afford these treatments, limiting their accessibility. The financial burden restricts widespread adoption, especially in developing countries where the prevalence of diabetes is rising rapidly. This affordability issue presents a significant challenge to the market, hindering growth and limiting treatment options for a large portion of the population.

- Side Effects and Safety Concerns

Side effects and safety concerns significantly hinder the growth of the diabetes biologics market. For instance, GLP-1 receptor agonists are commonly associated with gastrointestinal issues such as nausea, vomiting, and diarrhea, which can lead to patient discomfort and decreased adherence to treatment regimens. In addition, immune reactions, including hypersensitivity and injection site reactions, are concerns with some biologics, potentially resulting in patients discontinuing therapy. These adverse effects not only affect patient compliance but also increase the risk of therapy failure. As a result, the occurrence of these side effects contributes to reduced market acceptance, limited usage of these biologics, and overall slow market growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Diabetes Biologics Market Scope

The market is segmented on the basis of drugs and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Drugs

- Insulin

- Oral Anti-Diabetic Drugs

- Non-Insulin Injectable Drugs

- Combination Drugs

- Others

End User

- Hospitals

- Clinics

- Others

Diabetes Biologics Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, drugs and end user as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

North America is expected to dominate the diabetes biologics market due to the high prevalence of diabetes, an increasing patient population, and ongoing awareness programs about the disease. The region benefits from advanced healthcare infrastructure, robust research, and strong adoption of innovative biologic treatments, further driving market growth and demand.

Europe is expected to show significant growth in the diabetes biologics market due to the rising prevalence of genetic disorders and the increasing number of diabetes cases. The region also benefits from advanced healthcare infrastructure, refined medical facilities, and a robust focus on innovative biologics, contributing to its strong market share and growth prospects.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Diabetes Biologics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Diabetes Biologics Market Leaders Operating in the Market Are:

- Sanofi (France)

- Novartis AG (Switzerland)

- Bayer AG (Germany)

- Novo Nordisk A/S (Denmark)

- Eli Lilly and Company (U.S.)

- Merck & Company, Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- AstraZeneca (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Takeda Pharmaceutical Company Ltd. (Japan)

- Sun Pharmaceutical Industries Ltd (India)

- Biocon (India)

Latest Developments in Diabetes Biologics Market

- In January 2024, The U.S. FDA granted marketing approval for Lupin’s Dapagliflozin and Saxagliptin tablets, a generic version of AstraZeneca’s Qtern tablets. This approval marks a significant step in providing affordable treatment options for Type 2 Diabetes, combining two medications that work together to regulate blood sugar levels in diabetic patients

- In January 2024, Glenmark Pharmaceuticals Ltd. launched Lirafit, a biosimilar of Liraglutide, in India. Lirafit is designed for Type 2 diabetes management and offers a cost-effective alternative to the brand-name drug. At a price of USD 1.21 per day for a 1.2 mg dose, it aims to improve accessibility to diabetes care in India

- In December 2023, The Union Minister launched the Rural Diabetes Prevention & Control Campaign in Varanasi, India. The initiative aims to raise awareness about Type 2 Diabetes Mellitus in rural areas. By educating the population on prevention, early detection, and management of diabetes, this campaign seeks to combat the rising prevalence of the disease

- In May 2023, Eli Lilly and Company launched a consumer campaign to introduce Mounjaro, a new Type 2 diabetes drug. Mounjaro utilizes a unique mechanism of action and offers a novel approach to blood sugar control. The campaign focuses on informing the public about the drug’s benefits in improving diabetes management

- In December 2022, Glenmark Pharmaceuticals Ltd. launched Zita-PioMet, a triple fixed-dose combination (FDC) drug for Type 2 diabetes treatment in India. The combination of Teneligliptin, Pioglitazone, and Metformin offers patients a convenient and effective solution for managing blood glucose levels. This drug enhances the accessibility of comprehensive diabetes care in India

- In September 2022, Novo Nordisk A/S introduced an unbranded biologic version of Tresiba (insulin degludec) injection, a long-acting basal insulin, for diabetes management. Indicated for patients aged one year and older, Tresiba helps regulate blood sugar levels. Its unbranded version makes diabetes treatment more affordable and accessible for patients worldwide

- In August 2022, Cadila Pharmaceuticals launched generic versions of Sitagliptin in India under the brand names Jankey and Sitenali. These generic medications target Type 2 diabetes and provide a more affordable alternative to the original Sitagliptin. The introduction of these drugs aims to address the increasing demand for diabetes treatments in the Indian market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.