Global Diabetes Pen Market

Market Size in USD Billion

CAGR :

%

USD

11.03 Billion

USD

21.82 Billion

2024

2032

USD

11.03 Billion

USD

21.82 Billion

2024

2032

| 2025 –2032 | |

| USD 11.03 Billion | |

| USD 21.82 Billion | |

|

|

|

|

Diabetes Pen Market Size

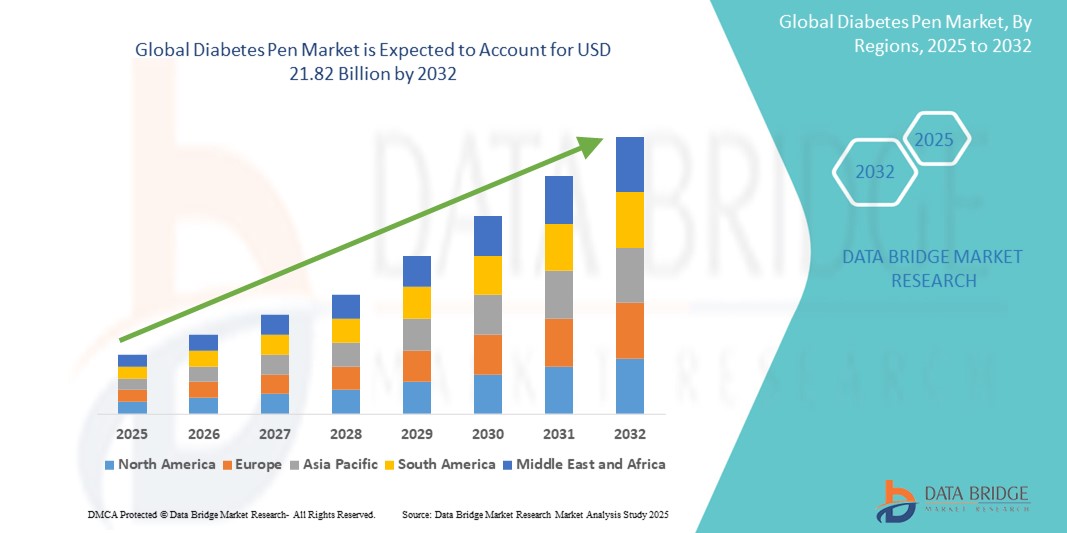

- The global diabetes pen market size was valued at USD 11.03 billion in 2024 and is expected to reach USD 21.82 billion by 2032, at a CAGR of 8.90% during the forecast period

- This growth is driven by factors such as the technological advancements in smart insulin pens,

- expanding diabetic population globally, and improved pen designs for better patient compliance

Diabetes Pen Market Analysis

- Diabetes pens are essential tools for the accurate and convenient administration of insulin and other diabetes medications, improving patient adherence and overall diabetes management. They offer precise dosing, reduced injection pain, and ease of use, making them popular among both patients and healthcare providers

- The demand for diabetes pens is significantly driven by the increasing global prevalence of diabetes, advancements in pen technologies, and a growing focus on patient-centered care. Rising awareness about the importance of early diabetes management further supports market growth

- North America is expected to dominate the diabetes pen market, accounting for 45.8% of the global market share, driven by advanced healthcare infrastructure, high adoption of insulin delivery technologies, and the strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the diabetes pen market, accounting for approximately 25.6% of the global market share, driven by rapid healthcare infrastructure expansion, rising awareness about diabetes, and increasing healthcare spending

- The type 2 diabetes segment is expected to dominate the diabetes pen market with the largest share of 65.1% due to its high prevalence and demand for effective blood sugar management

Report Scope and Diabetes Pen Market Segmentation

|

Attributes |

Diabetes Pen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diabetes Pen Market Trends

“Technological Advancements in Smart Diabetes Pens”

- One prominent trend in the evolution of diabetes pens is the increasing integration of smart technologies, including Bluetooth connectivity, real-time dose tracking, and data synchronization with mobile apps

- These innovations enhance diabetes management by providing precise dosing, reducing the risk of insulin errors, and offering valuable insights into patient adherence and glucose trends

- For instance, smart insulin pens such as Novo Nordisk's NovoPen 6 and Eli Lilly's Tempo Pen feature advanced dose memory and data sharing capabilities, allowing patients and healthcare providers to monitor insulin usage and adjust therapy plans accordingly

- These advancements are transforming diabetes care, improving patient outcomes, and driving the demand for next-generation diabetes pens with cutting-edge connectivity and personalized support features

Diabetes Pen Market Dynamics

Driver

“Rising Prevalence of Diabetes and Growing Need for Effective Insulin Delivery”

- The increasing global prevalence of diabetes is significantly contributing to the rising demand for diabetes pens, as effective insulin delivery is critical for managing blood sugar levels and preventing long-term complications

- As the global population ages and obesity rates climb, the incidence of both type 1 and type 2 diabetes continues to grow, driving the need for convenient, accurate, and user-friendly insulin delivery solutions

- Many patients, particularly those with type 1 diabetes or advanced type 2 diabetes, rely on regular insulin therapy, making insulin pens a critical component of their daily care

For instance,

- In 2023, according to the International Diabetes Federation (IDF), the global prevalence of diabetes is expected to reach 643 million by 2030 and 783 million by 2045, highlighting the urgent need for efficient insulin delivery systems to reduce the risk of severe complications such as nerve damage, heart disease, and kidney failure

- As a result of this growing diabetic population, the demand for diabetes pens is expected to rise significantly, supporting market expansion globally

Opportunity

“Integration of Smart Technologies for Personalized Diabetes Management”

- Smart insulin pens, which integrate features such as Bluetooth connectivity, real-time dose tracking, and data synchronization with mobile apps, are transforming diabetes management by providing precise dosing and personalized insights

- These advanced pens can reduce dosing errors, improve patient adherence, and offer valuable insights to healthcare providers for better diabetes control

For instance,

- In January 2025, according to a study published in the Journal of Diabetes Science and Technology, smart insulin pens such as Novo Nordisk’s NovoPen 6 and Eli Lilly’s Tempo Pen have shown significant improvements in glycemic control by reducing missed doses and supporting real-time dose adjustments. These innovations are expected to drive market growth as more patients seek data-driven diabetes management solutions

- The integration of smart technologies in diabetes pens can lead to better patient outcomes, reduced healthcare costs, and improved quality of life for millions of diabetes patients worldwide

Restraint/Challenge

“High Cost of Advanced Insulin Pens Limiting Market Penetration”

- Despite their advantages, the high cost of smart insulin pens remains a significant barrier, particularly in price-sensitive markets and developing regions

- Many patients, especially those without adequate insurance coverage or in low-income regions, may struggle to afford these advanced devices, leading to a reliance on traditional, less expensive syringes or vials

For instance,

- In November 2024, a market analysis by the Medical Device Manufacturers Association (MDMA) highlighted that the cost of smart insulin pens, which can be significantly higher than traditional pens, limits their widespread adoption in regions with lower healthcare budgets. This cost barrier can slow market growth and reduce patient access to advanced insulin delivery technologies

- As a result, manufacturers must focus on cost reduction strategies and expanding access to ensure broader market penetration

Diabetes Pen Market Scope

The market is segmented on the basis of product type, usage, application and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Usage |

|

|

By Application |

|

|

By Distribution Channel |

|

In 2025, the type 2 diabetes is projected to dominate the market with a largest share in application segment

The type 2 diabetes segment is expected to dominate the diabetes pen market with the largest share of 65.1% in 2025 due to its high prevalence and demand for effective blood sugar management. As the most common form of diabetes, advancements in insulin delivery systems, including diabetes pens, contribute to better disease management, driving market growth. The increasing global prevalence of Type 2 diabetes, driven by factors such as obesity, sedentary lifestyles, and an aging population, further contributes to its market dominance.

The insulin pens is expected to account for the largest share during the forecast period in product type market

In 2025, the insulin pens segment is expected to dominate the market with the largest market share of 59.60% due to their convenience, ease of use, and precision in insulin administration. As the most commonly used device for insulin delivery, advancements in insulin pen technology, such as smart insulin pens, enhance patient compliance and therapy effectiveness. The growing prevalence of diabetes and the demand for more portable, user-friendly devices further contribute to the market dominance of insulin pens.

Diabetes Pen Market Regional Analysis

“North America Holds the Largest Share in the Diabetes Pen Market”

- North America dominates the diabetes pen market, accounting for approximately 45.8% of the global market share, driven by advanced healthcare infrastructure, high adoption of insulin delivery technologies, and the strong presence of key market players

- U.S. alone accounts for around 40.9% of the global market share, primarily due to the high prevalence of diabetes, increasing adoption of insulin pens, and the availability of comprehensive insurance coverage that supports the widespread use of diabetes management devices

- In addition, the U.S. leads in technological advancements, including the development of smart insulin pens and connected devices, which further strengthen the market

- Robust R&D investments, the focus on improving patient compliance, and the growing demand for more convenient and user-friendly diabetes management solutions are also key factors driving market growth in this region

“Asia-Pacific is Projected to Register the Highest CAGR in the Diabetes Pen Market”

- Asia-Pacific is expected to witness the highest growth rate in the diabetes pen market, accounting for approximately 25.6% of the global market share, driven by rapid healthcare infrastructure expansion, rising awareness about diabetes, and increasing healthcare spending

- Countries such as China, India, and Japan are emerging as key markets due to their large diabetic populations and the growing demand for advanced diabetes management solutions

- Japan, with its advanced healthcare system and high adoption rates for insulin pens, remains a crucial market for diabetes management devices, particularly for patients with Type 2 diabetes. The country continues to lead in adopting innovative insulin delivery solutions

- India is projected to register the highest CAGR in the region, driven by expanding healthcare infrastructure, increasing patient awareness, and the rising prevalence of diabetes, especially among the aging population

Diabetes Pen Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AstraZeneca (U.K.)

- BD (U.S.)

- Lilly (U.S.)

- Biocon (India)

- Sanofi (France)

- Jiangsu Delfu Medical Device Co., Ltd. (China)

- Owen Mumford Limited (U.K.)

- Wockhardt Limited (India)

- Smiths Group plc (U.K.)

- Nipro Europe Group Companies (Netherlands)

- Novo Nordisk A/S (Denmark)

- MannKind Corporation (U.S.)

- Bristol-Myers Squibb Company (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Nemera (France)

- Ypsomed AG (Switzerland)

- Medical Technology and Devices S.p.A. (Italy)

- Merck & Co., Inc. (U.S.)

- Bayer AG (Germany)

Latest Developments in Global Diabetes Pen Market

- In January 2025, Novo Nordisk announced the launch of its next-generation smart insulin pen, the NovoPen 7, in the European Union. The NovoPen 7 features advanced connectivity for seamless integration with diabetes management apps, allowing users to track their insulin doses, monitor blood glucose levels, and optimize their insulin therapy. It also includes a memory function and Bluetooth capability for real-time data sharing, enhancing patient compliance and outcomes

- In October 2024, Eli Lilly and Company presented its latest innovation, the Tempo Pen®, at the European Association for the Study of Diabetes (EASD) 2024 meeting. The Tempo Pen® is designed to improve patient experience with intuitive handling, accurate dosing, and smart connectivity, helping diabetes patients achieve better glycemic control

- In September 2024, Biocon Biologics, a subsidiary of Biocon, showcased its advanced insulin pen portfolio, including the Basalog One, at the World Diabetes Congress in Barcelona. These pens are designed for ease of use, precise dosing, and enhanced patient comfort, reflecting the company's commitment to affordable and innovative diabetes care solutions

- In September 2024, Owen Mumford launched the Aidaptus auto-injector, a next-generation pen system for diabetes and chronic disease management. The device offers customizable dose delivery, ergonomic design, and compatibility with a wide range of drug formulations, making it an ideal solution for diabetes patients requiring regular insulin therapy

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.