Global Diabetic Footwear Market

Market Size in USD Billion

CAGR :

%

USD

9.58 Billion

USD

18.95 Billion

2025

2033

USD

9.58 Billion

USD

18.95 Billion

2025

2033

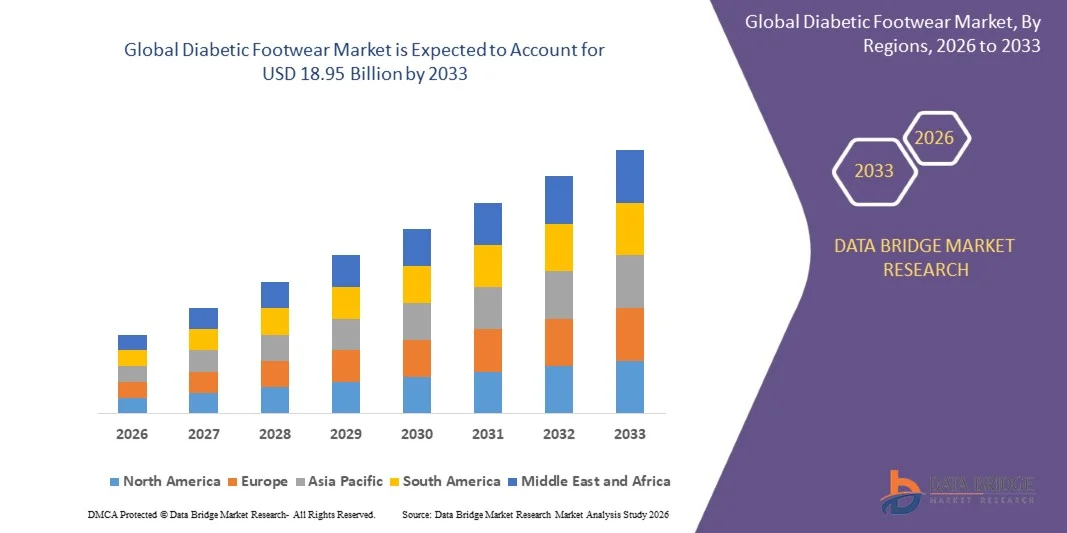

| 2026 –2033 | |

| USD 9.58 Billion | |

| USD 18.95 Billion | |

|

|

|

|

Diabetic Footwear Market Size

- The global diabetic footwear market size was valued at USD 9.58 billion in 2025 and is expected to reach USD 18.95 billion by 2033, at a CAGR of 8.90% during the forecast period

- The market growth is largely fueled by the rising global prevalence of diabetes and the increasing incidence of diabetes-related foot complications, which is driving greater demand for preventive and therapeutic footwear solutions

- Furthermore, growing awareness among patients and healthcare professionals regarding the importance of proper foot care, along with recommendations for medically approved footwear, is establishing diabetic footwear as an essential component of diabetes management. These converging factors are accelerating adoption and significantly strengthening market growth

Diabetic Footwear Market Analysis

- Diabetic footwear, designed to reduce pressure points, prevent ulcers, and enhance overall foot protection, plays a crucial role in managing diabetes-related foot conditions across both clinical and homecare settings due to its comfort-focused and medically supportive features

- The escalating demand for diabetic footwear is primarily driven by increasing healthcare awareness, an expanding elderly population, and a growing emphasis on preventive care to reduce complications such as infections, ulcers, and amputations

- North America dominated diabetic footwear market with a share of 40.18% in 2025, due to the high prevalence of diabetes, strong awareness regarding preventive foot care, and advanced healthcare infrastructure

- Asia-Pacific is expected to be the fastest growing region in the diabetic footwear market during the forecast period due to rapidly increasing diabetes prevalence, expanding middle-class population, and improving healthcare access

- Shoes segment dominated the market with a market share of 53.02% in 2025, due to their superior support, protective design, and ability to accommodate advanced features such as extra depth, cushioned insoles, and pressure-relief soles. Diabetic shoes are widely recommended by healthcare professionals as they help prevent foot ulcers and reduce the risk of complications. Their suitability for daily wear and outdoor activities further strengthens demand among patients with moderate to severe diabetic foot conditions. The availability of orthopedic customization and durable materials also reinforces the dominance of this segment

Report Scope and Diabetic Footwear Market Segmentation

|

Attributes |

Diabetic Footwear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diabetic Footwear Market Trends

“Increasing Adoption of Preventive and Comfort-Focused Diabetic Footwear”

- A key trend in the diabetic footwear market is the growing adoption of footwear designed to prevent foot complications while enhancing daily comfort for diabetic patients. This trend is driven by rising awareness of diabetes-related foot risks and the need to reduce pressure points, friction, and injuries during regular movement

- For instance, brands such as Dr. Comfort and Orthofeet offer specialized diabetic shoes with cushioned insoles and extra-depth designs that help minimize ulcer formation. These products support long-term foot protection and improve mobility for patients managing chronic conditions

- The demand for preventive diabetic footwear is increasing as healthcare providers emphasize early intervention to avoid severe complications such as infections and amputations. This is positioning therapeutic footwear as a routine component of diabetes care rather than a corrective solution

- Advancements in material technology are enabling lighter, breathable, and shock-absorbing footwear that improves comfort during extended wear. These improvements are encouraging higher compliance among patients who require continuous foot support

- Lifestyle integration is also shaping this trend, with manufacturers focusing on designs that combine medical functionality with everyday aesthetics. This is broadening acceptance among younger and active diabetic populations

- Overall, the rising focus on prevention, comfort, and daily usability is strengthening the role of diabetic footwear as an essential solution for long-term diabetes management

Diabetic Footwear Market Dynamics

Driver

“Rising Global Diabetes Prevalence and Related Foot Complications”

- The increasing global prevalence of diabetes is a major driver of the diabetic footwear market, as a growing patient population faces heightened risk of foot ulcers, nerve damage, and circulation issues. These conditions necessitate specialized footwear to prevent injuries and support foot health

- For instance, companies such as Apex Foot Health Industries develop medically approved shoes that address pressure redistribution and stability needs for diabetic patients. Such products help reduce complication rates and encourage consistent usage

- The rise in diabetes-related complications is prompting healthcare systems to emphasize preventive foot care strategies. This is increasing physician recommendations for therapeutic footwear as part of standard diabetes treatment plans

- An expanding elderly population further amplifies this driver, as older individuals are more susceptible to chronic conditions and mobility challenges. Diabetic footwear helps maintain independence and reduces hospitalization risks

- Growing patient education and screening programs are also contributing to higher demand, as early diagnosis increases awareness of preventive solutions. This sustained rise in diabetes cases continues to reinforce market growth

Restraint/Challenge

“High Cost of Specialized Diabetic Footwear Limiting Affordability”

- The diabetic footwear market faces challenges due to the relatively high cost of specialized shoes compared to regular footwear. Advanced materials, orthopedic design, and medical compliance requirements increase production and retail prices

- For instance, custom-molded or prescription-based diabetic shoes often involve higher manufacturing and fitting costs, making them less accessible for price-sensitive consumers. This limits adoption in low- and middle-income populations

- Limited insurance coverage in certain regions further adds to the affordability barrier, forcing patients to prioritize basic footwear over medically recommended options. This affects consistent usage despite clinical need

- Distribution through specialty stores and clinics can also increase overall costs due to professional fitting services and limited economies of scale. These factors collectively restrict wider penetration

- As a result, balancing product quality with cost efficiency remains a key challenge for manufacturers. Addressing affordability while maintaining medical effectiveness is essential for expanding access and sustaining long-term market growth

Diabetic Footwear Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

• By Product Type

On the basis of product type, the diabetic footwear market is segmented into shoes, sandals, and slippers. The shoes segment dominated the market with the largest revenue share of 53.02% in 2025, driven by their superior support, protective design, and ability to accommodate advanced features such as extra depth, cushioned insoles, and pressure-relief soles. Diabetic shoes are widely recommended by healthcare professionals as they help prevent foot ulcers and reduce the risk of complications. Their suitability for daily wear and outdoor activities further strengthens demand among patients with moderate to severe diabetic foot conditions. The availability of orthopedic customization and durable materials also reinforces the dominance of this segment.

The sandals segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising preference for breathable and lightweight footwear, particularly in warm and tropical regions. Diabetic sandals offer adjustable straps and open designs that reduce moisture buildup and friction, improving comfort for prolonged use. Increasing consumer focus on combining medical functionality with casual aesthetics is accelerating adoption. Growing product innovation and expanding availability through both retail and online platforms are further supporting rapid growth.

• By End User

On the basis of end user, the diabetic footwear market is segmented into men and women. The men segment accounted for the largest market revenue share in 2025, primarily due to the higher prevalence of diabetes and diabetic foot complications among men globally. Men often require footwear designed for extended wear and outdoor activities, increasing demand for durable and supportive diabetic shoes. Greater awareness of preventive foot care among male patients and rising physician recommendations also contribute to segment dominance. In addition, the wider availability of product options tailored to men supports sustained demand.

The women segment is expected to register the fastest growth during the forecast period, driven by increasing diagnosis rates and growing awareness of foot health among women. Rising demand for diabetic footwear that balances therapeutic benefits with aesthetic appeal is influencing purchasing decisions. Manufacturers are increasingly introducing designs that cater to style preferences without compromising medical functionality. Expanding marketing efforts and broader product assortments are accelerating adoption in this segment.

• By Distribution Channel

On the basis of distribution channel, the diabetic footwear market is segmented into offline retail stores and online retail stores. The offline retail stores segment dominated the market in 2025, driven by the need for proper fitting, in-person consultation, and professional guidance. Consumers often prefer specialty stores, pharmacies, and orthopedic clinics where footwear can be tried on and evaluated for comfort and support. The trust associated with physical stores and the availability of expert recommendations strengthen this channel’s dominance. Immediate product availability and after-sales support further enhance customer preference.

The online retail stores segment is projected to grow at the fastest rate from 2026 to 2033, supported by increasing digital adoption and convenience-driven purchasing behavior. Online platforms offer a wider range of brands, sizes, and customization options, enabling consumers to compare products easily. Competitive pricing, home delivery, and access to detailed product information are boosting online sales. The growing confidence in e-commerce for healthcare-related products is further accelerating this trend.

Diabetic Footwear Market Regional Analysis

- North America dominated the diabetic footwear market with the largest revenue share of 40.18% in 2025, driven by the high prevalence of diabetes, strong awareness regarding preventive foot care, and advanced healthcare infrastructure

- Consumers in the region highly value clinically recommended footwear that offers pressure redistribution, enhanced comfort, and protection against foot ulcers and injuries

- This widespread adoption is further supported by high healthcare spending, favorable reimbursement policies, and the presence of established orthopedic and medical footwear brands, positioning diabetic footwear as a critical component of long-term diabetes management

U.S. Diabetic Footwear Market Insight

The U.S. diabetic footwear market captured the largest revenue share within North America in 2025, fueled by a large diabetic population and growing emphasis on preventive healthcare. Patients and healthcare providers increasingly prioritize medically approved footwear to reduce complications such as ulcers and amputations. The strong presence of podiatry clinics, insurance coverage for therapeutic footwear, and rising consumer inclination toward customized orthopedic solutions continue to propel market growth. In addition, increasing availability through both offline specialty stores and online platforms supports sustained demand.

Europe Diabetic Footwear Market Insight

The Europe diabetic footwear market is projected to expand at a steady CAGR during the forecast period, primarily driven by rising diabetes incidence and strong focus on preventive healthcare. Increasing awareness regarding diabetic foot complications and early intervention is encouraging adoption across both clinical and homecare settings. European consumers also value comfort, durability, and compliance with medical standards. Growth is supported by expanding elderly populations and rising demand across hospitals, orthopedic centers, and specialty retail outlets.

U.K. Diabetic Footwear Market Insight

The U.K. diabetic footwear market is anticipated to grow at a notable CAGR, supported by increasing diabetes prevalence and structured healthcare support systems. Public health initiatives promoting early diagnosis and foot care management are positively influencing demand. Consumers are increasingly adopting prescribed and over-the-counter diabetic footwear for daily use. The country’s well-developed retail and e-commerce infrastructure further facilitates access to a wide range of diabetic footwear products.

Germany Diabetic Footwear Market Insight

The Germany diabetic footwear market is expected to expand at a considerable CAGR, driven by high healthcare awareness and a strong focus on orthopedic and preventive care solutions. Germany’s aging population and rising cases of chronic diseases are increasing demand for specialized footwear. Consumers demonstrate a preference for high-quality, durable products that combine medical functionality with comfort. The presence of advanced manufacturing capabilities and strong distribution networks further supports market expansion.

Asia-Pacific Diabetic Footwear Market Insight

The Asia-Pacific diabetic footwear market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapidly increasing diabetes prevalence, expanding middle-class population, and improving healthcare access. Rising awareness of diabetic foot complications and growing investments in healthcare infrastructure are accelerating adoption. Countries such as China, India, and Japan are witnessing increased demand as urbanization and lifestyle changes contribute to higher diabetes incidence. The growing availability of affordable diabetic footwear is further widening consumer reach.

Japan Diabetic Footwear Market Insight

The Japan diabetic footwear market is gaining traction due to the country’s aging population and high incidence of age-related chronic conditions. Strong emphasis on preventive healthcare and quality of life is driving demand for specialized footwear that enhances mobility and reduces injury risk. Japanese consumers value precision, comfort, and product quality, supporting adoption of technologically advanced and ergonomically designed diabetic footwear. The integration of such products into routine elderly care is further fueling growth.

China Diabetic Footwear Market Insight

The China diabetic footwear market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s large diabetic population and rapid expansion of healthcare awareness. Increasing urbanization, rising disposable incomes, and government initiatives aimed at chronic disease management are supporting market growth. Consumers are increasingly adopting diabetic footwear for both preventive and therapeutic purposes. The presence of strong domestic manufacturers and expanding retail channels is significantly enhancing market accessibility and penetration.

Diabetic Footwear Market Share

The diabetic footwear industry is primarily led by well-established companies, including:

- Gravity Defyer Corp. (U.S.)

- Podartis srl (Italy)

- Apex Foot Health Industries LLC (U.S.)

- Pilgrim Shoes (India)

- Medline Industries LP (U.S.)

- Orthofeet Inc. (U.S.)

- Finn Comfort (Germany)

- Hochste Healthcare Private Limited (India)

- DARCO International Inc. (U.S.)

- Anodyne Inc. (U.S.)

- Aetrex Worldwide Inc. (U.S.)

- StepWise Health (U.S.)

- Propet USA Inc. (U.S.)

- Atlantic Footcare Inc. (U.S.)

- Drew Shoe Corporation (U.S.)

- Biomotion Healthcare (U.S.)

- Advance Diabetic Solutions (U.S.)

- Hanger Inc. (U.S.)

- Dr. Zen Products Inc. (U.S.)

- DJO Global Inc. – Dr. Comfort (U.S.)

Latest Developments in Global Diabetic Footwear Market

- In August 2025, DiabeticShoe.in partnered with Carbon Meditek to introduce a premium portfolio of diabetic shoes and socks, significantly strengthening the diabetic footwear market through innovation focused on orthopedic comfort and preventive care. By integrating advanced materials and foot-health technologies, the collaboration addresses pressure distribution, circulation support, and long-term wear comfort. This development supports rising consumer demand for high-quality therapeutic footwear and reinforces the shift toward lifestyle-oriented yet medically compliant diabetic footwear solutions

- In July 2025, Shoemart launched a new range of diabetic shoes in collaboration with the Al Jalila Foundation, contributing to market expansion in the UAE and the broader Middle East. The initiative emphasizes accessibility, comfort, and clinical relevance through features such as wide toe boxes and slip-resistant soles. By linking product innovation with diabetes awareness programs, this development strengthens trust in diabetic footwear and promotes higher adoption across both preventive and therapeutic use cases

- In November 2023, Fyous secured USD 1.75 million from Innovate UK to scale its custom-fit diabetic footwear offerings, accelerating technological advancement in the market. The company’s polymorphic moulding technology enables rapid, patient-specific shoe production, addressing unmet needs in ulcer prevention and injury reduction. This funding supports a growing trend toward personalized medical footwear, which is expected to lower healthcare costs and improve clinical outcomes, thereby positively influencing long-term market growth

- In November 2023, Aetrex launched the Fit Starter personalized footwear recommendation platform in partnership with Heeluxe, enhancing efficiency and accuracy in diabetic footwear retail. By improving fit precision, the platform helps reduce return rates and increases consumer confidence in purchasing specialized footwear. This advancement strengthens retailer capabilities, supports data-driven fitting solutions, and improves overall customer satisfaction, contributing to sustained market development

- In February 2022, the American Diabetes Association collaborated with Dr. Comfort to advance education and access related to diabetic foot care, reinforcing demand for specialized footwear. The partnership highlighted the clinical importance of preventive footwear in reducing complications such as ulcers and amputations. By encouraging early adoption and informed purchasing decisions, this initiative supported steady market expansion through stronger clinical endorsement and patient awareness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.