Global Diabetic Shoes Market

Market Size in USD Billion

CAGR :

%

USD

9.18 Billion

USD

15.53 Billion

2024

2032

USD

9.18 Billion

USD

15.53 Billion

2024

2032

| 2025 –2032 | |

| USD 9.18 Billion | |

| USD 15.53 Billion | |

|

|

|

|

Diabetic Shoes Market Size

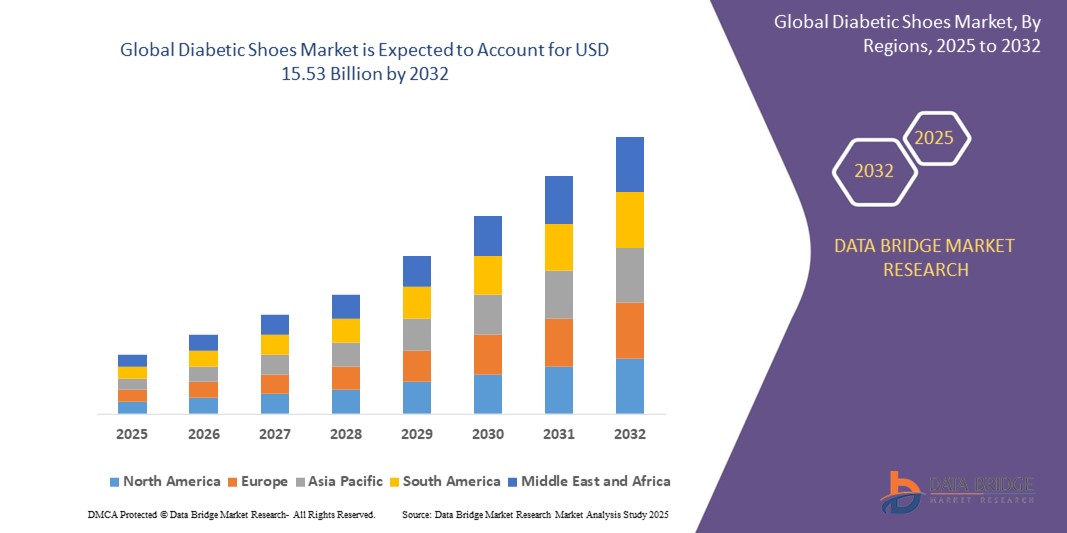

- The global diabetic shoes market size was valued at USD 9.18 billion in 2024 and is expected to reach USD 15.53 billion by 2032, at a CAGR of 6.79% during the forecast period

- The market growth is primarily driven by the rising prevalence of diabetes, increasing awareness of foot health, and growing demand for specialized footwear to prevent diabetic foot complications

- Increasing consumer awareness regarding preventive healthcare and the importance of comfortable, protective footwear is further propelling the demand for diabetic shoes across both retail and medical channels

Diabetic Shoes Market Analysis

- The diabetic shoes market is experiencing robust growth as more individuals prioritize foot health to manage diabetes-related complications, such as neuropathy and poor circulation

- Growing demand from both men and women, along with an emerging focus on pediatric diabetic footwear, is encouraging manufacturers to innovate with lightweight, breathable, and customizable shoe designs

- Europe dominates the diabetic shoes market with the largest revenue share of 35.2% in 2024, driven by a mature healthcare infrastructure, high diabetes prevalence, and strong adoption by automotive original equipment manufacturers (OEMs) for specialized footwear solutions

- North America is projected to be the fastest-growing region in the diabetic shoes market during the forecast period, fueled by increasing healthcare expenditure, rising awareness of diabetic foot care, and growing availability of advanced footwear solutions through online and offline channels

- The offline segment holds the largest market revenue share in 2024, driven by the preference for in-store purchases where consumers can try on shoes for proper fit and comfort, critical for diabetic patients with specific foot care needs

Report Scope and Diabetic Shoes Market Segmentation

|

Attributes |

Diabetic Shoes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diabetic Shoes Market Trends

“Rising Adoption of Technologically Advanced Diabetic Footwear”

- Smart diabetic shoes are gaining traction due to their integration of advanced technologies such as pressure sensors, temperature-regulating materials, and 3D scanning for customized fit, enhancing foot health monitoring and comfort. For instance, in September 2022, Sensoria Health and Defender launched the 'Foot Defender' smart diabetic shoe, featuring a mobile app and clinician dashboard for monitoring foot ulcer healing

- Customizable footwear options are increasingly popular, allowing consumers to select specific sizes, widths, and features tailored to individual needs, particularly for diabetic neuropathy and foot deformities

- Eco-friendly and sustainable materials are being incorporated into diabetic shoes, aligning with growing consumer demand for environmentally conscious products. Brands are adopting breathable, moisture-wicking materials such as mesh fabric and microfiber bamboo fiber to prevent infections and promote foot hygiene

- Fashion-forward designs are breaking the stereotype of bulky, unattractive therapeutic shoes, especially for women, who seek stylish yet functional footwear to complement their lifestyle

- Partnerships and collaborations between manufacturers and healthcare organizations are boosting awareness and accessibility. For example, in February 2022, the American Diabetes Association partnered with Dr. Comfort to promote diabetic foot care and footwear adoption

- Increased focus on women’s segment due to rising awareness of diabetes-related foot complications among female patients, driving demand for fashionable, therapeutic shoes that cater to both medical and aesthetic needs

Diabetic Shoes Market Dynamics

Driver

“Rising Prevalence of Diabetes and Foot-Related Complications”

- he increasing global prevalence of diabetes, projected to reach 783 million cases by 2045 according to the International Diabetes Federation, is driving demand for diabetic shoes to prevent complications such as foot ulcers, neuropathy, and amputations

- Growing awareness of foot health among diabetic patients, particularly in regions with high diabetes rates such as North America and Europe, is boosting the adoption of specialized footwear to reduce risks of sores, infections, and deep vein thrombosis (DVT)

- Aging population, especially in Europe and North America, is a significant driver, as older adults are more susceptible to diabetes and related foot issues, necessitating preventive footwear. The global population aged 60 and over is expected to reach 1.4 billion by 2030

- Energy efficiency in healthcare is a growing focus, with diabetic shoes reducing healthcare costs by preventing severe foot complications, thereby decreasing hospital visits and treatments for diabetic patients

- OEM partnerships with footwear brands, particularly in Europe, which dominates revenue growth in the automotive OEM market, are influencing the diabetic footwear market by integrating advanced manufacturing techniques for enhanced quality and scalability

Restraint/Challenge

“Regulatory and Accessibility Barriers”

- Varying global regulations on diabetic footwear standards, such as FDA guidelines in the U.S. and EU safety requirements, create challenges for manufacturers in maintaining compliance across regions, impacting production costs and market expansion

- High production costs for advanced diabetic shoes, especially those with smart technology or custom features, limit affordability for some consumers, particularly in developing regions such as parts of Asia-Pacific and LAMEA

- Limited reimbursement policies for diabetic footwear in many countries discourage adoption, as patients often bear the full cost of specialized shoes, hindering market growth

- Lack of awareness about the importance of diabetic footwear in certain regions, such as parts of Latin America and the Middle East & Africa, restricts market penetration despite rising diabetes cases

- Counterfeit and low-quality products in the market, particularly in offline retail channels, pose a challenge by undermining consumer trust and potentially causing harm due to inadequate therapeutic benefits

Diabetic Shoes Market Scope

The market is segmented on the basis of distribution channel, end-user, and patient type.

- By Distribution Channel

On the basis of distribution channel, the diabetic shoes market is segmented into offline and online distribution channels. The offline segment holds the largest market revenue share in 2024, driven by the preference for in-store purchases where consumers can try on shoes for proper fit and comfort, critical for diabetic patients with specific foot care needs. Specialty retail stores and pharmacies offer personalized assistance and expert guidance, contributing to the dominance of offline channels.

The online segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by the growing adoption of e-commerce platforms, increasing internet penetration, and the convenience of home delivery. Online retailers provide a wide range of diabetic shoe options, detailed product descriptions, and customer reviews, making them an attractive choice for tech-savvy consumers seeking accessibility and variety.

- By End-User

On the basis of end-user, the diabetic shoes market is segmented into women, men, and children. The men’s segment accounted for the largest market revenue share in 2024, driven by the higher prevalence of diabetes among men and their need for specialized footwear to prevent foot complications. Men’s diabetic shoes are designed to offer enhanced support, cushioning, and protection, catering to the specific needs of male diabetic patients.

The women’s segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by increasing awareness of diabetic foot care among women and the rising demand for stylish yet functional diabetic footwear. Manufacturers are focusing on aesthetically appealing designs to cater to female consumers, boosting adoption in this segment.

- By Patient Type

On the basis of patient type, the diabetic shoes market is segmented into inpatient and outpatient based on patient type. The outpatient segment held the largest market revenue share in 2024, driven by the growing number of diabetic patients managing their condition outside hospital settings. Outpatient diabetic shoes are designed for daily use, offering comfort and protection to prevent ulcers and other foot complications during regular activities.

The inpatient segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing number of diabetic patients requiring hospital care and specialized footwear during treatment. Hospitals and healthcare facilities are prioritizing diabetic shoes to support patient recovery and prevent complications during inpatient stays.

Diabetic Shoes Market Regional Analysis

- Europe dominates the diabetic shoes market with the largest revenue share of 35.2% in 2024, driven by a mature healthcare infrastructure, high diabetes prevalence, and strong adoption by automotive original equipment manufacturers (OEMs) for specialized footwear solutions

- North America is projected to be the fastest-growing region in the diabetic shoes market during the forecast period, fueled by increasing healthcare expenditure, rising awareness of diabetic foot care, and growing availability of advanced footwear solutions through online and offline channels

U.S. Diabetic Shoes Market Insight

The U.S. is expected to witness the fastest growth rate in the North America Diabetic Shoes market, fueled by a rising diabetic population, increasing awareness of foot care, and supportive healthcare policies. The U.S., in particular, holds a significant share of the market due to high consumer spending on healthcare products, advanced retail infrastructure, and the integration of smart technologies in diabetic footwear. The growing trend of customized and orthotic footwear, coupled with collaborations between healthcare providers and footwear manufacturers, further drives market expansion in the region.

Europe Diabetic Shoes Market Insight

The Europe Diabetic Shoes market is expected to dominate the market revenue share of 35.2% in 2024, driven by stringent healthcare regulations, a high prevalence of diabetes, and a strong focus on preventive care. The region benefits from advanced manufacturing capabilities, with automotive OEMs contributing to the development of high-quality, durable materials for diabetic footwear. Countries such as Germany and the U.K. are leading the market, with increasing demand for stylish yet functional diabetic shoes. The integration of sustainable materials and eco-conscious designs is also gaining traction, aligning with Europe’s emphasis on sustainability.

U.K. Diabetic Shoes Market Insigh

The U.K. holds the largest share of Europe diabetic shoes market in 2024, driven by increasing awareness of diabetes-related complications and the growing trend of preventive healthcare. The demand for stylish, functional diabetic footwear is rising among both healthcare professionals and consumers. The U.K.’s strong retail and e-commerce infrastructure, combined with government-backed healthcare initiatives, is facilitating market growth. Concerns about foot ulcers and amputations are also encouraging the adoption of specialized diabetic shoes.

Germany Diabetic Shoes Market Insight

The German diabetic shoes market is projected to expand at a significant CAGR, fueled by the country’s advanced healthcare system, high awareness of diabetes management, and focus on innovation in medical footwear. Germany’s leadership in automotive OEMs contributes to the development of high-quality materials for diabetic shoes, enhancing durability and comfort. The integration of eco-friendly and sustainable designs aligns with German consumer preferences, while the growing demand for customized orthotic solutions is driving market expansion in residential and clinical settings.

Asia-Pacific Diabetic Shoes Market Insight

The Asia-Pacific diabetic shoes market is poised for substantial growth, with a projected CAGR exceeding 20% in 2025, driven by rapid urbanization, rising disposable incomes, and increasing diabetes prevalence in countries such as China, India, and Japan. Government initiatives promoting healthcare awareness and the growing availability of affordable diabetic footwear are key factors boosting market growth. The region’s emergence as a manufacturing hub for diabetic shoes, combined with advancements in e-commerce, is making these products more accessible to a broader consumer base.

China Diabetic Shoes Market Insight

China holds the largest revenue share in the Asia-Pacific diabetic shoes market in 2025, attributed to its large diabetic population, rapid urbanization, and increasing healthcare awareness. The country’s robust manufacturing sector and growing middle class are driving the adoption of diabetic footwear in both urban and rural areas. Affordable pricing, coupled with innovations in lightweight and breathable materials, is further propelling market growth. The rise of e-commerce platforms has also enhanced the accessibility of diabetic shoes, particularly in residential and medical settings.

Japan Diabetic Shoes Market Insight

The Japan diabetic shoes market is gaining momentum due to the country’s aging population, high prevalence of diabetes, and advanced healthcare infrastructure. Japanese consumers prioritize comfort and quality, driving demand for technologically advanced diabetic footwear that integrates seamlessly with medical needs. The market is also supported by collaborations between footwear manufacturers and healthcare providers, focusing on customized solutions for diabetic foot care. In addition, Japan’s emphasis on innovation is fostering the development of smart diabetic shoes with pressure-sensing capabilities.

Diabetic Shoes Market Share

The diabetic shoes industry is primarily led by well-established companies, including:

- Healer Health, LLC (U.S.)

- Orthofeet, Inc(U.S.)

- Podartis Srl (Italy)

- Propet Footwear (U.S.)

- Etonic (U.S.)

- Apexfoot (U.S.)

- Pilgrim Shoes (U.S.)

- Advanced Diabetic Solutions (U.S.)

- DARCO International (U.S.)

- THUASNE SA (France)

- SIGVARIS (Switzerland)

- Hanger Clinic (U.S.)

- Anodyne, LLC (U.S.)

- Pedors247 (U.S.)

- Apis Footwear Company (U.S.)

Latest Developments in Global Diabetic Shoes Market

- In April 2024, Researchers at the Central Leather Research Institute (CLRI) in Chennai, India, launched patented AFO (Ankle-Foot Orthosis) footwear designed to treat diabetic foot ulcers. By redistributing plantar pressure, the footwear aids in ulcer healing, improves gait, and reduces amputation risks. This product targets the growing diabetic population in Asia, enhancing accessibility to therapeutic footwear solutions

- In April 2024, strengthening its portfolio in orthopedic medical devices. MedShape specializes in superelastic nickel-titanium alloy (NiTiNOL) and shape memory polymer technology, offering innovative surgical solutions for foot and ankle care. This acquisition enhances DJO’s diabetic footwear offerings, enabling advanced treatments for complex diabetic foot conditions. The deal aligns with DJO’s strategy to expand its market share and improve clinical outcomes in orthopedic care

- In November 2023, Aetrex Worldwide, Inc. introduced its FitStarter platform in collaboration with Heeluxe, a shoe fit testing company. This innovative tool enhances retailer capabilities by providing personalized footwear recommendations using 3D foot scanning technology. Designed to improve fitting accuracy, reduce returns, and enhance customer satisfaction, the platform targets the growing demand for customized diabetic footwear, strengthening Aetrex’s position in the global market

- In November 2023, Fyous, a custom-fit footwear brand, secured USD 1.75 million from Innovate UK to develop diabetic footwear using proprietary polymorphic moulding technology. This innovation enables rapid production of tailored shoes, reducing the risk of foot ulceration and amputations. The product launch addresses the critical need for personalized solutions, positioning Fyous to meet the rising demand for diabetic footwear in high-risk populations

- In February 2022, the American Diabetes Association (ADA) partnered with Dr. Comfort to enhance initiatives focused on preventing and managing diabetic foot complications. This collaboration promotes education and access to high-quality diabetic footwear, raising awareness among patients and healthcare providers. By leveraging Dr. Comfort’s expertise, the partnership strengthens the market’s focus on preventive foot care solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIABETIC SHOES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIABETIC SHOES MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL DIABETIC SHOES MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL DIABETIC SHOES MARKET, BY PRODUCT TYPE, (2022-2031), (USD MILLION)

10.1 OVERVIEW

10.2 DRESS SHOES

10.3 RUNNING SHOES

10.4 STROLLING SHOES

10.5 OTHERS

11 GLOBAL DIABETIC SHOES MARKET, BY PATIENT TYPE, (2022-2031), (USD MILLION)

11.1 OVERVIEW

11.2 OUTPATIENT

11.3 INPATIENT

12 GLOBAL DIABETIC SHOES MARKET, BY SHOE OUTER MATERIAL, (2022-2031), (USD MILLION)

12.1 OVERVIEW

12.2 CANVAS

12.3 COTTON

12.4 FAUX FUR

12.5 FAUX LEATHER

12.6 MESH

12.7 NYLON

12.8 POLYESTER

12.9 WOOL

12.1 OTHERS

13 GLOBAL DIABETIC SHOES MARKET, BY PATTERN (2022-2031), (USD MILLION)

13.1 OVERVIEW

13.2 ANIMAL PRINT

13.3 CAMOUFLAGE

13.4 CHECKERED

13.5 FLORAL

13.6 LETTER PRINT

13.7 SOLID

13.8 STRIPED

13.9 OTHERS

14 GLOBAL DIABETIC SHOES MARKET, BY WIDTH, (2022-2031), (USD MILLION)

14.1 OVERVIEW

14.2 NARROW

14.3 MEDIUM

14.4 WIDE

14.5 OTHERS

15 GLOBAL DIABETIC SHOES MARKET, BY END USER, (2022-2031), (USD MILLION)

15.1 OVERVIEW

15.2 MEN

15.3 WOMEN

16 GLOBAL DIABETIC SHOES MARKET, BY DISTRIBUTION CHANNEL, (2022-2031), (USD MILLION)

16.1 OVERVIEW

16.2 ONLINE

16.2.1 E-COMMERCE WEBSITE

16.2.2 COMPANY OWNED WEBSITE

16.3 OFFLINE

16.3.1 SUPERMARKET/HYPERMARKET

16.3.2 BRAND STORES

16.3.3 SPORTS STORES

16.3.4 SPECALTY STORES

16.3.5 OTHERS

17 GLOBAL DIABETIC SHOES MARKET, BY REGION, (2022-2031) (USD MILLION) (KILO TONS)

GLOBAL DIABETIC SHOES MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

17.2 EUROPE

17.2.1 GERMANY

17.2.2 U.K.

17.2.3 ITALY

17.2.4 FRANCE

17.2.5 SPAIN

17.2.6 RUSSIA

17.2.7 SWITZERLAND

17.2.8 TURKEY

17.2.9 BELGIUM

17.2.10 NETHERLANDS

17.2.11 LUXEMBURG

17.2.12 REST OF EUROPE

17.3 ASIA-PACIFIC

17.3.1 JAPAN

17.3.2 CHINA

17.3.3 SOUTH KOREA

17.3.4 INDIA

17.3.5 SINGAPORE

17.3.6 THAILAND

17.3.7 INDONESIA

17.3.8 MALAYSIA

17.3.9 PHILIPPINES

17.3.10 AUSTRALIA & NEW ZEALAND

17.3.11 REST OF ASIA-PACIFIC

17.4 SOUTH AMERICA

17.4.1 BRAZIL

17.4.2 ARGENTINA

17.4.3 REST OF SOUTH AMERICA

17.5 MIDDLE EAST AND AFRICA

17.5.1 SOUTH AFRICA

17.5.2 EGYPT

17.5.3 SAUDI ARABIA

17.5.4 UNITED ARAB EMIRATES

17.5.5 ISRAEL

17.5.6 REST OF MIDDLE EAST AND AFRICA

18 GLOBAL DIABETIC SHOES MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: GLOBAL

18.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

18.3 COMPANY SHARE ANALYSIS: EUROPE

18.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

18.5 MERGERS AND ACQUISITIONS

18.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

18.7 EXPANSIONS

18.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

19 SWOT ANALYSIS

20 GLOBAL DIABETIC SHOES MARKET– COMPANY PROFILE

20.1 APIS FOOTWEAR COMPANY

20.1.1 COMPANY SNAPSHOT

20.1.2 PRODUCT PORTFOLIO

20.1.3 PRODUCTION CAPACITY OVERVIEW

20.1.4 REVENUE ANALYSIS

20.1.5 RECENT UPDATES

20.2 REED MEDICAL LTD.

20.2.1 COMPANY SNAPSHOT

20.2.2 PRODUCT PORTFOLIO

20.2.3 PRODUCTION CAPACITY OVERVIEW

20.2.4 REVENUE ANALYSIS

20.2.5 RECENT UPDATES

20.3 ANODYNE, LLC

20.3.1 COMPANY SNAPSHOT

20.3.2 PRODUCT PORTFOLIO

20.3.3 PRODUCTION CAPACITY OVERVIEW

20.3.4 REVENUE ANALYSIS

20.3.5 RECENT UPDATES

20.4 OHI COMPANY

20.4.1 COMPANY SNAPSHOT

20.4.2 PRODUCT PORTFOLIO

20.4.3 PRODUCTION CAPACITY OVERVIEW

20.4.4 REVENUE ANALYSIS

20.4.5 RECENT UPDATES

20.5 HANGER CLINIC.

20.5.1 COMPANY SNAPSHOT

20.5.2 PRODUCT PORTFOLIO

20.5.3 PRODUCTION CAPACITY OVERVIEW

20.5.4 REVENUE ANALYSIS

20.5.5 RECENT UPDATES

20.6 EXTRO STYLE SRL

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 PRODUCTION CAPACITY OVERVIEW

20.6.4 REVENUE ANALYSIS

20.6.5 RECENT UPDATES

20.7 MENDIVIL - BIOMEDICAL SHOES, S.L.

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 PRODUCTION CAPACITY OVERVIEW

20.7.4 REVENUE ANALYSIS

20.7.5 RECENT UPDATES

20.8 NOVAMED

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 PRODUCTION CAPACITY OVERVIEW

20.8.4 REVENUE ANALYSIS

20.8.5 RECENT UPDATES

20.9 DARCO INTERNATIONAL, INC.

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 PRODUCTION CAPACITY OVERVIEW

20.9.4 REVENUE ANALYSIS

20.9.5 RECENT UPDATES

20.1 CLEMENT SALUS.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 PRODUCTION CAPACITY OVERVIEW

20.10.4 REVENUE ANALYSIS

20.10.5 RECENT UPDATES

20.11 AETREX INC.

20.11.1 COMPANY SNAPSHOT

20.11.2 PRODUCT PORTFOLIO

20.11.3 PRODUCTION CAPACITY OVERVIEW

20.11.4 REVENUE ANALYSIS

20.11.5 RECENT UPDATES

20.12 DREWSHOE, INCORPORATED

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 PRODUCTION CAPACITY OVERVIEW

20.12.4 REVENUE ANALYSIS

20.12.5 RECENT UPDATES

20.13 PILGRIM SHOES

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 PRODUCTION CAPACITY OVERVIEW

20.13.4 REVENUE ANALYSIS

20.13.5 RECENT UPDATES

20.14 HEALER HEALTH, LLC

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 PRODUCTION CAPACITY OVERVIEW

20.14.4 REVENUE ANALYSIS

20.14.5 RECENT UPDATES

20.15 ENOVIS CORPORATION

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 PRODUCTION CAPACITY OVERVIEW

20.15.4 REVENUE ANALYSIS

20.15.5 RECENT UPDATES

20.16 ORTHOFEET

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 PRODUCTION CAPACITY OVERVIEW

20.16.4 REVENUE ANALYSIS

20.16.5 RECENT UPDATES

20.17 DR. ZEN PRODUCTS INC

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 PRODUCTION CAPACITY OVERVIEW

20.17.4 REVENUE ANALYSIS

20.17.5 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

21 QUESTIONNAIRE

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.