Global Diagnostic And Testing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

51.09 Billion

USD

74.90 Billion

2024

2032

USD

51.09 Billion

USD

74.90 Billion

2024

2032

| 2025 –2032 | |

| USD 51.09 Billion | |

| USD 74.90 Billion | |

|

|

|

|

Diagnostic and Testing Equipment Market Size

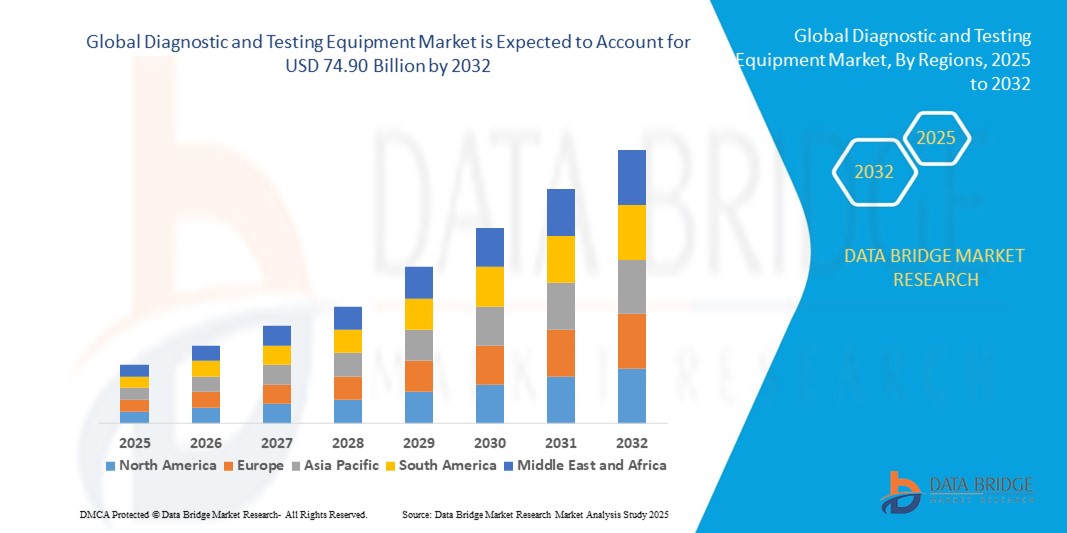

- The global diagnostic and testing equipment market size was valued at USD 51.09 billion in 2024 and is expected to reach USD 74.90 billion by 2032, at a CAGR of 4.90% during the forecast period

- The market growth is driven by the rising prevalence of chronic and infectious diseases, increasing demand for early and accurate diagnosis, and advancements in medical imaging technologies

- Growing integration of AI-enabled imaging systems, portable diagnostic solutions, and tele-radiology services is further propelling market growth across hospitals, diagnostic centers, and research facilities

Diagnostic and Testing Equipment Market Analysis

- The market is experiencing strong growth due to the increasing global healthcare burden, an aging population, and a shift towards preventive care and minimally invasive diagnostic procedures

- Technological advancements such as AI-assisted image interpretation, higher-resolution scanners, and hybrid imaging systems are enabling faster and more accurate diagnoses, boosting adoption rates

- North America dominated the diagnostic and testing equipment market with the largest revenue share of 37.6% in 2024, supported by a well-established healthcare infrastructure, high adoption of advanced medical technologies, and strong presence of leading manufacturers

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, driven by rapid healthcare infrastructure development, increasing healthcare expenditure, and rising awareness about early disease detection in countries such as China, India, and Southeast Asian nations

- The X-ray imaging segment dominated the largest market revenue share of 36.14% in 2024, driven by its wide clinical applications, cost-effectiveness, and continuous advancements in digital imaging technology. Digital X-ray systems have become the preferred choice due to faster image acquisition, lower radiation exposure, and ease of integration with hospital PACS (Picture Archiving and Communication Systems)

Report Scope and Diagnostic and Testing Equipment Market Segmentation

|

Attributes |

Diagnostic and Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Diagnostic and Testing Equipment Market Trends

Increasing Integration of AI and Big Data Analytics in Diagnostic Imaging

- The global diagnostic and testing equipment market is experiencing a significant shift toward the integration of Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced image recognition, automated reporting, and real-time analysis, providing faster and more accurate diagnostic results across X-Ray Imaging, MRI, Ultrasound, CT-Scan, and Nuclear Imaging systems

- AI-powered diagnostic platforms assist healthcare professionals in early disease detection, personalized treatment planning, and improved workflow efficiency

- For instance, several companies are launching AI-driven imaging tools that detect subtle abnormalities in oncology scans, analyze cardiac function with greater precision, or automate orthopedic image interpretation to reduce diagnosis time

- This trend is increasing the diagnostic accuracy, reducing human error, and enabling predictive health assessments, making advanced imaging more valuable for hospitals, diagnostic centres, and research facilities

- AI algorithms can analyze a wide range of diagnostic data, from tumor growth patterns in oncology to cardiac motion irregularities, skeletal structure alignment, and internal organ imaging changes over time

Diagnostic and Testing Equipment Market Dynamics

Driver

Rising Demand for Early Disease Detection and Advanced Medical Imaging

- Increasing awareness about preventive healthcare and the importance of early diagnosis is driving demand for advanced diagnostic imaging systems across oncology, cardiology, orthopaedics, and other medical fields

- Technological advancements in imaging modalities such as high-resolution MRI, 3D and 4D Ultrasound, and low-dose CT-Scan are enhancing the accuracy and safety of diagnostic procedures

- Growing healthcare infrastructure, particularly in North America—the dominant region—has led to wider adoption of both stationary and portable imaging systems in hospitals and diagnostic centres

- The expansion of telemedicine and remote diagnostic capabilities, supported by faster internet connectivity, is enabling real-time consultation and image sharing between patients and specialists

- Governments and healthcare organizations are increasingly investing in modern diagnostic equipment to improve public health outcomes and reduce treatment costs through early detection

Restraint/Challenge

High Equipment Costs and Data Privacy Concerns in Medical Imaging

- The substantial upfront investment required for acquiring advanced diagnostic and testing equipment, such as MRI, CT-Scan, and Nuclear Imaging systems, can be a significant barrier for smaller healthcare providers and facilities in emerging markets

- Maintenance, calibration, and skilled workforce training add to the total cost of ownership, making widespread adoption challenging

- In addition, the use of AI-driven diagnostic systems raises concerns regarding patient data privacy, storage, and compliance with healthcare data protection regulations such as HIPAA and GDPR

- Interoperability issues between imaging devices from different manufacturers can slow down integration into existing hospital information systems

- The fragmented regulatory landscape across various regions further complicates market expansion for global equipment manufacturers, especially when adapting to diverse compliance requirements

- These factors can slow adoption rates in cost-sensitive markets and among facilities with limited technical infrastructure

Diagnostic and Testing Equipment market Scope

The market is segmented on the basis of product type, application, portability, and end-users.

- By Product Type

On the basis of product type, the global diagnostic and testing equipment market is segmented into X-ray imaging (digital and analog), MRI, ultrasound, CT scan, and nuclear imaging. The X-ray imaging segment dominated the largest market revenue share of 36.14% in 2024, driven by its wide clinical applications, cost-effectiveness, and continuous advancements in digital imaging technology. Digital X-ray systems have become the preferred choice due to faster image acquisition, lower radiation exposure, and ease of integration with hospital PACS (Picture Archiving and Communication Systems). In addition, the increasing prevalence of orthopedic disorders, dental issues, and chest-related conditions fuels the demand for X-ray diagnostics.

MRI is expected to register the fastest growth rate from 2025 to 2032, supported by the rising need for advanced imaging in neurological, musculoskeletal, and oncological assessments. The growing emphasis on early disease detection, combined with innovations such as 3T and 7T MRI systems offering higher resolution, is driving adoption among both developed and emerging healthcare markets. Furthermore, the push toward precision diagnostics and the use of AI-based image analysis are enhancing MRI’s diagnostic value and operational efficiency.

- By Application

On the basis of application, the global diagnostic and testing equipment market is categorized into oncology, cardiology, orthopaedics, and others. The oncology segment accounted for the highest revenue share in 2024, driven by the escalating global cancer burden and the critical need for early detection and accurate staging. Imaging modalities such as PET-CT, MRI, and digital mammography are integral in cancer screening programs, treatment planning, and monitoring therapeutic response. Rising government initiatives for cancer awareness and increased screening participation further bolster the segment’s dominance.

The cardiology segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by the increasing prevalence of cardiovascular diseases, the adoption of advanced echocardiography and cardiac MRI systems, and the expansion of preventive cardiac screening programs. The integration of AI-based interpretation tools for faster and more accurate cardiac assessments is also accelerating demand in this application area.

- By Portability

On the basis of portability, the global diagnostic and testing equipment market is divided into stationary X-ray imaging systems and portable X-ray imaging systems. The stationary segment held the largest market share in 2024, supported by its extensive use in hospitals and diagnostic centers for high-volume imaging requirements, superior image quality, and capability to handle complex diagnostic procedures. These systems are particularly favored in tertiary care settings where advanced imaging infrastructure is essential.

The portable X-ray imaging systems segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for point-of-care diagnostics, home healthcare services, and rapid imaging in emergency and rural healthcare settings. The development of lightweight, battery-operated, and wireless-enabled portable systems is enhancing accessibility and operational efficiency, particularly in resource-limited regions.

- By End-Users

On the basis of end-users, the global diagnostic and testing equipment market is segmented into hospitals, diagnostic centres, and research centres. The hospital segment dominated the market in 2024, driven by their comprehensive imaging capabilities, high patient throughput, and access to multi-modality diagnostic equipment. Hospitals also benefit from integration with electronic health records (EHRs) and in-house specialist expertise, enabling faster diagnosis and treatment.

The diagnostic centres segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by the trend toward decentralized healthcare, rising demand for affordable and accessible imaging services, and growing partnerships between diagnostic chains and technology providers. These centres increasingly leverage cloud-based image sharing and tele-radiology to expand service reach and improve turnaround times.

Diagnostic and Testing Equipment Market Regional Analysis

- North America dominated the diagnostic and testing equipment market with the largest revenue share of 37.6% in 2024, supported by a well-established healthcare infrastructure, high adoption of advanced medical technologies, and strong presence of leading manufacturers

- Healthcare providers prioritize diagnostic equipment for enhancing diagnostic accuracy, enabling early disease detection, and improving patient outcomes, especially in regions with high prevalence of chronic conditions

- Growth is supported by advancements in imaging technology, including AI integration and high-resolution systems, alongside rising adoption in both hospital and outpatient segments

U.S. Diagnostic and Testing Equipment Market Insight

The U.S. diagnostic and testing equipment market captured the largest revenue share of 78.8% in 2024 within North America, fueled by strong demand from imaging centers and growing awareness of early diagnosis and preventive healthcare benefits. The trend towards technological innovations and increasing regulations promoting safer and more efficient imaging standards further boost market expansion. Healthcare providers’ growing incorporation of advanced diagnostic systems complements sales in diagnostic centres, creating a diverse product ecosystem.

Europe Diagnostic and Testing Equipment Market Insight

The Europe diagnostic and testing equipment market is expected to witness significant growth, supported by regulatory emphasis on healthcare quality and patient safety. Healthcare providers seek equipment that improves imaging precision while offering cost-effective solutions. The growth is prominent in both new installations and upgrades, with countries such as Germany and France showing significant uptake due to rising health concerns and advanced medical infrastructure.

U.K. Diagnostic and Testing Equipment Market Insight

The U.K. market for diagnostic and testing equipment is expected to witness significant growth, driven by demand for improved diagnostic capabilities and efficiency in urban and rural settings. Increased interest in advanced imaging modalities and rising awareness of preventive screening benefits encourage adoption. In addition, evolving healthcare regulations influence provider choices, balancing technology advancements with compliance.

Germany Diagnostic and Testing Equipment Market Insight

Germany is expected to witness significant growth in diagnostic and testing equipment, attributed to its advanced healthcare manufacturing sector and high focus on diagnostic accuracy and efficiency. German healthcare providers prefer technologically advanced systems that enhance image quality and contribute to better resource utilization. The integration of these systems in premium facilities and diagnostic options supports sustained market growth.

Asia-Pacific Diagnostic and Testing Equipment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding healthcare production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of early detection, disease management, and medical aesthetics is boosting demand. Government initiatives promoting healthcare efficiency and patient safety further encourage the use of advanced diagnostic equipment.

Japan Diagnostic and Testing Equipment Market Insight

Japan’s diagnostic and testing equipment market is expected to witness the fastest growth rate due to strong provider preference for high-quality, technologically advanced systems that enhance diagnostic comfort and accuracy. The presence of major healthcare manufacturers and integration of equipment in clinical settings accelerate market penetration. Rising interest in customized solutions also contributes to growth.

China Diagnostic and Testing Equipment Market Insight

China holds the largest share of the Asia-Pacific diagnostic and testing equipment market, propelled by rapid urbanization, rising healthcare access, and increasing demand for imaging and testing solutions. The country’s growing middle class and focus on smart healthcare support the adoption of advanced systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Diagnostic and Testing Equipment Market Share

The diagnostic and testing equipment industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- Hitachi Ltd. (Japan)

- Hologic, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Samsung Medison Co., Ltd. (South Korea)

- Shimadzu Corporation (Japan)

- CANON MEDICAL SYSTEM CORPORATION (Japan)

- Esaote SPA (Italy)

- Allengers (U.S.)

- CURA Healthcare (India)

- Neusoft Corporation (China)

- NP JSC Amico (Russia)

- Shanghai Lianying Medical Technology Co., Ltd. (China)

- FUJIFILM Corporation (Japan)

- Siemens Healthineers AG (Germany)

What are the Recent Developments in Global Diagnostic and Testing Equipment Market?

- In April 2025, Bosch launched a new range of electrical testing equipment designed specifically for professional electricians and technicians. The lineup includes five robust tools: a non-contact voltage tester, voltage tester, digital multimeter, clamp meter, and fork meter. Engineered for demanding environments such as construction sites, these devices feature shock-resistant rubber housing, IP54 to IP67 protection ratings, and dual power sources. Enhanced usability features such as inverted displays, magnetic hangers, and integrated flashlights make them ideal for precise, efficient diagnostics. This launch reinforces Bosch’s commitment to delivering comprehensive, high-performance solutions for the electrical trade

- In March 2025, Keysight Technologies introduced two advanced sampling oscilloscopes—a single optical channel DCA-M and a dual optical channel DCA-M—specifically designed for testing 1.6T optical transceivers. These instruments deliver high-speed, precise signal analysis with integrated clock recovery up to 120 GBaud, supporting the rigorous demands of next-generation data centers and AI-driven telecommunications. With exceptional optical measurement sensitivity, low jitter, and wide bandwidth, they enable engineers to validate transceiver performance under challenging conditions, while streamlining automated testing for scalable production

- In March 2024, Roche Diagnostics launched new high-throughput PCR platforms aimed at accelerating the screening of chronic illnesses and infectious agents. These advanced systems are part of Roche’s broader PCR ecosystem, which includes solutions such as the cobas® 6800/8800 systems. Designed for centralized, automated molecular testing, the platforms offer enhanced efficiency, flexibility, and diagnostic accessibility. With features such as Temperature-Activated Generation of Signal (TAGS) technology and support for multiplex testing, Roche’s innovations help laboratories deliver faster, more accurate results while optimizing resources and reducing operational costs

- In February 2024, Keysight Technologies introduced the E7515W UXM Wireless Connectivity Test Platform, a cutting-edge solution tailored for testing Wi-Fi 7 technology in line with the latest IEEE 802.11be standards. Built on the proven UXM 5G architecture, this platform enables signaling RF and throughput testing for both client devices and access points, supporting features such as 4x4 MIMO and 320 MHz bandwidth. It simplifies complex test setups with automated synchronization, enhanced repeatability, and deep PHY/MAC-level analysis, helping device makers accelerate development and ensure performance in real-world conditions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Diagnostic And Testing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Diagnostic And Testing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Diagnostic And Testing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.