Global Diagnostic Imaging Disposables Market

Market Size in USD Billion

CAGR :

%

USD

5.29 Billion

USD

10.40 Billion

2024

2032

USD

5.29 Billion

USD

10.40 Billion

2024

2032

| 2025 –2032 | |

| USD 5.29 Billion | |

| USD 10.40 Billion | |

|

|

|

|

Diagnostic Imaging Disposables Market Size

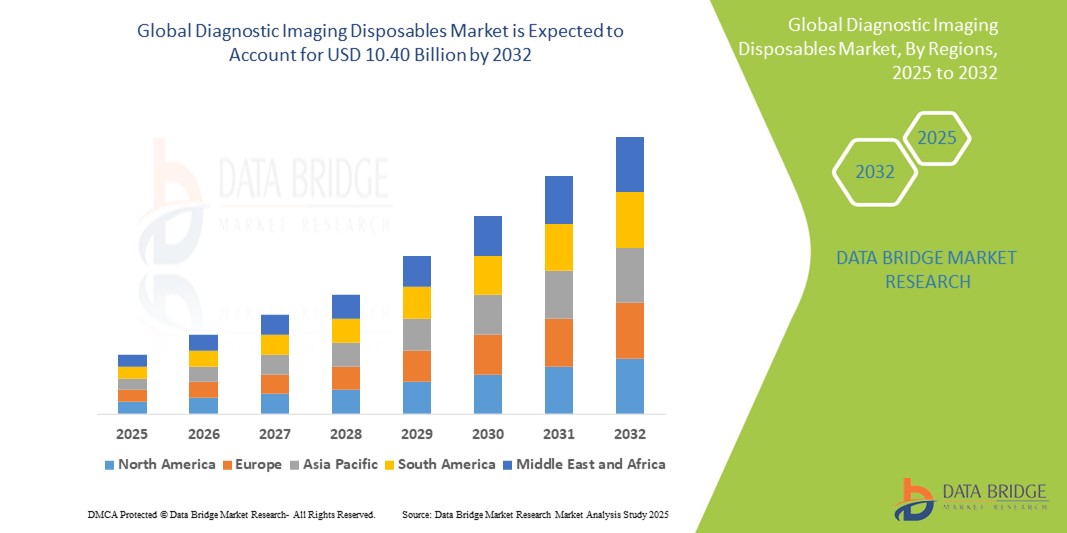

- The global diagnostic imaging disposables market size was valued at USD 5.29 billion in 2024 and is expected to reach USD 10.40 billion by 2032, at a CAGR of 4.40% during the forecast period

- The market growth is largely fuelled by the rising volume of diagnostic imaging procedures worldwide, coupled with increasing demand for sterile, single-use medical products to prevent cross-contamination and hospital-acquired infections (HAIs). This trend is especially prominent in hospitals, diagnostic imaging centres, and ambulatory surgical centres

- Furthermore, advancements in imaging technologies and the growing need for disposable accessories tailored to each imaging modality—such as CT, MRI, and ultrasound—are significantly boosting product innovation. These converging factors are accelerating the uptake of Diagnostic Imaging Disposables, thereby significantly driving the industry's growth

Diagnostic Imaging Disposables Market Analysis

- Diagnostic imaging disposables, encompassing a wide range of single-use products such as syringes, needles, drapes, and patient positioning aids, are increasingly vital components of modern diagnostic and interventional radiology procedures in both hospital and outpatient settings due to their essential role in patient safety, infection control, and efficient workflow

- The escalating demand for diagnostic imaging disposables is primarily fuelled by the increasing volume of diagnostic imaging procedures globally, the rising prevalence of chronic diseases requiring frequent imaging, a heightened focus on infection prevention in healthcare settings, and the rapid growth of interventional radiology

- North America dominates the diagnostic imaging disposables market with the largest revenue share of 37.40% in 2024. This leadership is characterized by high healthcare expenditure, advanced medical infrastructure, a strong emphasis on patient safety, and a significant number of complex diagnostic and interventional procedures performed

- Asia-Pacific is expected to be the fastest growing region in the diagnostic imaging disposables market during the forecast period, with a CAGR of 9.3%. This rapid growth is primarily due to increasing healthcare investments, a burgeoning patient population with rising disease burdens, improving access to advanced diagnostic imaging modalities, and a growing awareness about early disease detection

- Syringes & Needles segment dominates the diagnostic imaging disposables market with a market share of 25.3% in 2024. This is driven by their ubiquitous and critical role in the administration of contrast media for various imaging modalities (such as CT, MRI, and angiography) and their essential contribution to maintaining sterile procedures in a high-volume clinical environment

Report Scope and Diagnostic Imaging Disposables Market Segmentation

|

Attributes |

Diagnostic Imaging Disposables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diagnostic Imaging Disposables Market Trends

“Trends in Diagnostic Imaging Disposables Market”

- A significant and accelerating trend in the global diagnostic imaging disposables market is the deepening emphasis on ensuring enhanced patient safety and optimizing clinical workflow efficiency. This focus is significantly improving the quality of patient care and streamlining operational processes within imaging departments

- For instance, the increasing adoption of pre-filled syringes for contrast media, which are disposable, minimizes preparation time and reduces the risk of medication errors and contamination. Similarly, innovations in single-use biopsy needles and guidewires offer improved sterility and sharpness for each procedure, enhancing diagnostic accuracy and patient outcomes

- The advancements in disposable diagnostic imaging products enable features such as guaranteed sterility for every patient encounter, reducing the incidence of hospital-acquired infections (HAIs), and providing consistent product performance without the need for reprocessing. This ensures a reliable and predictable environment for critical imaging procedures

- The seamless integration of specialized disposables with advanced imaging equipment facilitates smoother workflows, reduces setup times, and minimizes the potential for human error during complex diagnostic and interventional procedures. This creates a unified and more efficient imaging experience for both clinicians and patients

- This trend towards safer, more efficient, and consistently performing disposable medical products is fundamentally reshaping expectations for diagnostic accuracy and patient care in radiology. Consequently, companies are developing highly specialized and user-friendly disposables with features such as integrated safety mechanisms and clear indicators to enhance usability and reduce procedural risks

- The demand for diagnostic imaging disposables that offer enhanced patient safety and contribute to improved workflow efficiency is growing rapidly across hospitals, diagnostic centers, and specialty clinics, as healthcare providers increasingly prioritize optimal patient outcomes and operational excellence

Diagnostic Imaging Disposables Market Dynamics

Driver

“Rising Volume of Diagnostic Procedures and Strict Infection Control Norms”

- The increasing number of diagnostic imaging procedures performed globally, coupled with the escalating emphasis on stringent infection control protocols in healthcare facilities, is a significant driver for the heightened demand for diagnostic imaging disposables

- For instance, the growing adoption of interventional radiology techniques, which are inherently minimally invasive, directly fuels the need for single-use catheters, guidewires, and specialized needles. Such advancements and procedural growth are expected to drive the diagnostic imaging disposables industry growth in the forecast period

- As healthcare providers prioritize patient safety and seek to minimize the risk of hospital-acquired infections (HAIs), disposables offer a compelling advantage over reusable instruments by ensuring sterility for each procedure and eliminating the need for complex and costly reprocessing

- Furthermore, the increasing prevalence of chronic diseases such as cancer, cardiovascular issues, and neurological disorders necessitates more frequent diagnostic imaging, directly translating to a higher consumption of related disposables. The convenience of pre-filled syringes for contrast media and single-use kits also streamlines workflow, contributing to their wider adoption

- The convenience and safety of single-use items, along with their crucial role in maintaining hygiene standards and reducing procedural turnaround times, are key factors propelling the adoption of diagnostic imaging disposables in hospitals, diagnostic centers, and specialty clinics. The trend towards efficient, high-volume patient care and the continuous innovation in user-friendly disposable options further contribute to market growth

Restraint/Challenge

“Concerns Regarding High Costs and Environmental Impact”

- Concerns surrounding the relatively high cumulative costs associated with the constant procurement of single-use diagnostic imaging disposables, coupled with the growing environmental impact of medical waste, pose a significant challenge to broader market penetration. As these disposables are designed for one-time use, their ongoing cost can be substantial for healthcare systems, raising budgetary anxieties

- For instance, the substantial volume of plastic and other non-biodegradable waste generated by single-use medical products has drawn increasing scrutiny from environmental organizations and healthcare sustainability initiatives. This has made some institutions hesitant about the unchecked use of disposables where reusable alternatives might exist

- Addressing these cost and environmental concerns through value analysis, the development of more sustainable or biodegradable disposable materials, and optimizing supply chain efficiencies is crucial for long-term market acceptance. Companies are exploring eco-friendly manufacturing processes and emphasizing the clinical benefits that justify the cost in their marketing to reassure potential buyers. In addition, the need for robust waste management infrastructure for medical disposables can be a barrier, particularly in developing regions.

- While the clinical benefits of disposables in terms of safety and efficiency are clear, the perceived premium for certain advanced disposable products, alongside the volume-driven costs, can still hinder widespread adoption, especially for price-sensitive healthcare facilities or in regions with limited reimbursement

- Overcoming these challenges through continued innovation in cost-effective and environmentally friendly disposable materials, increased consumer education on the long-term benefits of infection control, and the development of efficient medical waste disposal solutions will be vital for sustained market growth

Diagnostic Imaging Disposables Market Scope

The market is segmented on the basis of product type, imaging modality, end-use vertical, and material.

• By Product Type

On the basis of product type, the diagnostic imaging disposables market is segmented into syringes & needles, contrast media injectors, patient positioning & immobilization devices, biopsy devices, catheters & guidewires, drapes, gowns, & covers, electrodes & leads, specimen collection & handling devices, wound care & dressing supplies, and other disposables. The syringes & needles segment accounted for the largest revenue share of 25.3% in 2024, owing to their widespread usage across various imaging procedures, especially for contrast agent administration. The demand is driven by increased procedural volumes in CT and MRI scans that require contrast injection.

The biopsy devices segment is projected to witness the fastest CAGR of 7.9% from 2025 to 2032, propelled by the growing reliance on image-guided biopsies for cancer diagnosis and the expansion of minimally invasive procedures in outpatient settings.

• By Imaging Modality

On the basis of imaging modality, the diagnostic imaging disposables market is segmented into X-ray/CT imaging disposables, MRI imaging disposables, ultrasound imaging disposables, nuclear medicine imaging disposables, interventional radiology disposables, and mammography disposables. The X-ray/CT imaging disposables segment captured the largest revenue share of about 33.6% in 2024, due to the high global volume of X-ray and CT procedures, and the increasing adoption of disposable components to maintain infection control standards.

The interventional radiology disposables segment is expected to grow at the fastest CAGR of 8.5% during the forecast period, driven by rising demand for minimally invasive interventions that require a wide range of sterile, single-use imaging accessories.

• By End-Use Vertical

On the basis of end-use vertical, the diagnostic imaging disposables market is segmented into hospitals, diagnostic imaging centers, ambulatory surgical centers, specialty clinics, and research & academic institutions. The hospitals segment held the largest market revenue share of 45.1% in 2024, attributed to their dominant role in diagnostic services, higher procedural volumes, and stringent infection prevention protocols mandating disposable product usage.

The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 7.4% from 2025 to 2032, due to their growing role in outpatient imaging services, cost-efficiency, and rising patient preference for same-day procedures.

• By Material

On the basis of material, the diagnostic imaging disposables market is segmented into plastic-based disposables, non-woven material disposables, metal-based disposables, glass-based disposables, and other materials. The plastic-based disposables segment dominated the market with the largest share of 51.3% in 2024, owing to their versatility, cost-effectiveness, and widespread application across most imaging procedures.

The non-woven material disposables segment is projected to grow at the fastest CAGR of 8.1% during 2025–2032, driven by the increasing demand for high-barrier, breathable, and skin-friendly materials for drapes, gowns, and covers used in diagnostic environments.

Diagnostic Imaging Disposables Market Regional Analysis

- North America dominates the diagnostic imaging disposables market with the largest revenue share of 37.40% in 2024, driven by the high volume of diagnostic imaging procedures and well-established healthcare infrastructure across the U.S. and Canada. The region benefits from strong investments in medical imaging technologies and a heightened focus on infection prevention protocols, particularly post-pandemic

- Healthcare providers in the region increasingly rely on disposable imaging components such as contrast media syringes, drapes, and electrodes to ensure patient safety and workflow efficiency. This reliance is further reinforced by regulatory standards and accreditation requirements promoting the use of single-use items

- The widespread adoption of disposable products is also propelled by rising diagnostic volumes in outpatient settings and the growing demand for advanced, patient-centric care. This positions North America as a consistent leader in driving innovation and consumption in the global diagnostic imaging disposables market

U.S. Diagnostic Imaging Disposables Market Insight

The U.S. diagnostic imaging disposables market captured the largest revenue share of 38.7% in 2024 within North America, driven by the nation's high imaging procedure volume, growing geriatric population, and stringent infection control standards. The demand for single-use items such as syringes, drapes, electrodes, and catheters remains strong in hospitals and imaging centers, where compliance with safety regulations is paramount. Furthermore, the integration of advanced imaging modalities such as PET-CT and MRI, coupled with increased outpatient imaging services, continues to fuel market growth.

Europe Diagnostic Imaging Disposables Market Insight

The Europe diagnostic imaging disposables market is projected to expand at a substantial CAGR throughout the forecast period, primarily due to the rising incidence of chronic diseases, aging demographics, and the need for cost-effective diagnostic solutions. The adoption of disposable components is further strengthened by EU regulatory emphasis on infection control and medical waste reduction. High healthcare expenditure across Germany, France, and the U.K. contributes significantly to the regional demand for safe, reliable, and hygienic imaging consumables.

U.K. Diagnostic Imaging Disposables Market Insight

The U.K. diagnostic imaging disposables market is anticipated to grow at a notable CAGR during the forecast period, driven by expanding diagnostic imaging services within the NHS and private health systems. An aging population and increasing prevalence of conditions such as cancer and cardiovascular disease are boosting imaging volumes. Emphasis on efficiency, coupled with safety concerns in post-pandemic healthcare settings, is accelerating the adoption of single-use imaging items in hospitals and ambulatory centers.

Germany Diagnostic Imaging Disposables Market Insight

The Germany diagnostic imaging disposables market is expected to expand at a considerable CAGR during the forecast period, supported by the country's robust healthcare infrastructure and technological leadership in imaging equipment. German healthcare facilities are investing in disposable positioning accessories, leads, and biopsy tools to improve infection control and diagnostic precision. The shift toward minimally invasive procedures and outpatient diagnostic services further enhances demand for high-quality, sterile imaging disposables.

Asia-Pacific Diagnostic Imaging Disposables Market Insight

The Asia-Pacific diagnostic imaging disposables market is poised to grow at the fastest CAGR of 9.3% during the forecast period of 2025 to 2032. Growth is driven by increasing healthcare access, a growing middle class, and rising chronic disease prevalence. Countries such as China, India, and Japan are rapidly expanding their diagnostic infrastructure, with public and private investments in imaging equipment and consumables. As APAC emerges as a hub for medical manufacturing, the affordability and local availability of disposables are supporting wider adoption across hospitals and clinics.

Japan Diagnostic Imaging Disposables Market Insight

The Japan diagnostic imaging disposables market is gaining strong momentum due to the country's advanced medical technology landscape and aging population. High diagnostic imaging utilization in both hospitals and specialty clinics is pushing demand for disposable electrodes, positioning tools, and contrast delivery supplies. Emphasis on safety, automation, and patient-centric care is also driving the transition to single-use items, especially in large diagnostic centers and urban healthcare networks.

China Diagnostic Imaging Disposables Market Insight

The China diagnostic imaging disposables market accounted for the largest revenue share within Asia-Pacific in 2024, estimated at 10.7% of the global market, supported by rapid urbanization, high imaging volume, and favorable government healthcare reforms. As imaging centers expand across both urban and rural regions, there is a growing shift toward standardized, disposable accessories to reduce cross-contamination and enhance throughput. Strong domestic manufacturing and lower production costs also make China a key exporter of imaging disposables.

Diagnostic Imaging Disposables Market Share

The diagnostic imaging disposables industry is primarily led by well-established companies, including:

- BD (U.S.)

- Bayer AG (Germany)

- Guerbet (France)

- Bracco (Italy)

- GE HealthCare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Hologic Inc. (U.S.)

- Cardinal Health, Inc. (U.S.)

- Merit Medical Systems (U.S.)

- Teleflex Incorporated (U.S.)

- Terumo Corporation (Japan)

- Cook (U.S.)

- Stryker (U.S.)

- Medtronic (Ireland)

- Ambu A/S (Denmark)

- Nipro Corporation (Japan)

- Aspen Surgical Products, Inc. (U.S.)

- ICU Medical, Inc. (U.S.)

- Henry Schein, Inc. (U.S.)

Latest Developments in Global Diagnostic Imaging Disposables Market

- In April 2024, GE HealthCare introduced a new line of eco-friendly diagnostic imaging disposables compatible with its MRI and CT systems. These sustainable products aim to reduce medical waste while maintaining the high-quality standards required for imaging accuracy. This move reflects GE HealthCare's commitment to environmental sustainability and innovation in diagnostic imaging technologies, aligning with global healthcare trends toward greener solutions

- In March 2024, Siemens Healthineers launched an advanced suite of disposable imaging accessories for its Artis icono platform, designed to optimize interventional radiology procedures. The new line features improved biocompatibility and enhanced ergonomic design for clinical staff, reinforcing the company’s focus on patient safety and workflow efficiency in diagnostic imaging settings

- In February 2024, Philips Healthcare expanded its diagnostic imaging consumables portfolio with the release of single-use ultrasound transducer covers and probe sheaths. These new products aim to minimize the risk of cross-contamination during procedures and support infection control protocols in hospitals and outpatient centers. This development underscores Philips’ dedication to enhancing hygiene standards in clinical diagnostics

- In January 2024, Canon Medical Systems Corporation announced the introduction of a novel range of CT imaging disposables, including injection syringes and patient positioning aids, developed in collaboration with frontline radiologists. These products are designed to improve contrast media delivery and enhance patient comfort during scans, supporting better clinical outcomes and procedural safety

- In December 2023, Agfa-Gevaert Group unveiled a strategic partnership with a European OEM manufacturer to co-develop cost-effective diagnostic imaging disposables tailored for emerging markets. This initiative aims to make high-quality imaging accessories more accessible in regions with limited healthcare infrastructure, reinforcing Agfa’s global expansion strategy and commitment to inclusive healthcare solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.