Global Diagnostic Radiopharmaceuticals Market

Market Size in USD Billion

CAGR :

%

USD

5.51 Billion

USD

9.41 Billion

2024

2032

USD

5.51 Billion

USD

9.41 Billion

2024

2032

| 2025 –2032 | |

| USD 5.51 Billion | |

| USD 9.41 Billion | |

|

|

|

Global Diagnostic Radiopharmaceuticals Market Analysis

The global diagnostic radiopharmaceuticals market is experiencing robust growth, driven by increasing prevalence of chronic diseases, advancements in nuclear imaging technologies, and rising demand for early diagnosis and personalized medicine. Factors such as the growing adoption of PET and SPECT imaging in oncology, cardiology, and neurology, along with the expansion of healthcare infrastructure, particularly in emerging markets, are further propelling market expansion. In addition, collaborations between pharmaceutical companies and research institutions to develop novel radiopharmaceuticals and a rising focus on targeted therapy are expected to enhance market dynamics. Despite regulatory challenges and high production costs, the overall outlook for the diagnostic radiopharmaceuticals market remains positive, presenting significant opportunities for stakeholders in the healthcare sector.

Global Diagnostic Radiopharmaceuticals Market Size

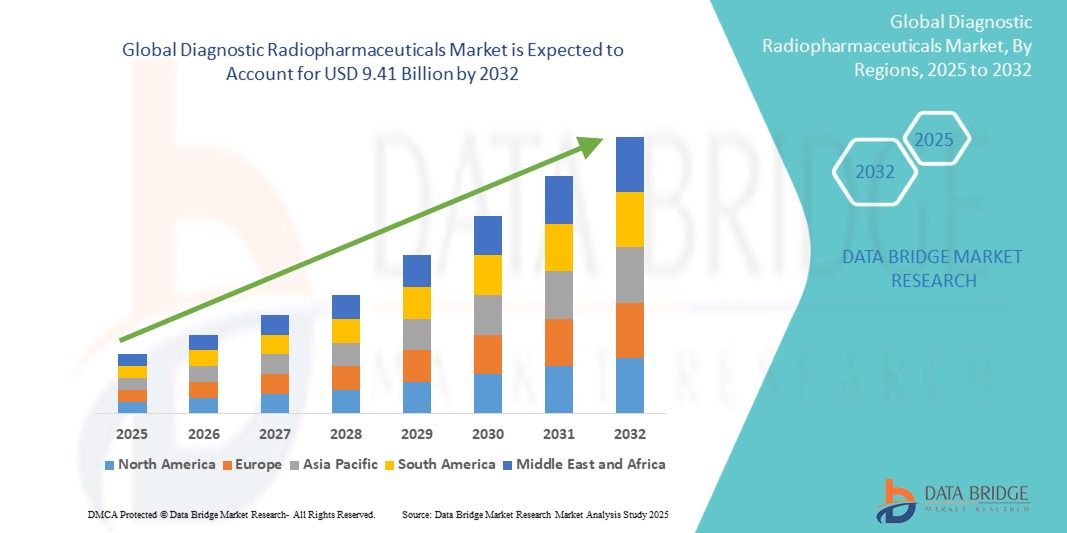

Global diagnostic radiopharmaceuticals market size was valued at USD 5.51 billion in 2024 and is projected to reach USD 9.41 billion by 2032, with a CAGR of 6.9% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Global Diagnostic Radiopharmaceuticals Market Trends

“Increasing Adoption of Personalized Medicine ”

One significant trend in the global diagnostic radiopharmaceuticals market is the increasing adoption of personalized medicine, which emphasizes tailoring medical treatment to individual patient characteristics, preferences, and genetic profiles. This trend is driving demand for advanced radiopharmaceuticals that provide more precise imaging and targeted therapies, particularly in oncology. The growing integration of genomic testing with radiopharmaceuticals allows for improved diagnostics and treatment plans, enabling healthcare providers to identify the most effective therapeutic approaches for each patient. Consequently, this shift towards personalized medicine is encouraging significant investments in research and development of novel radiopharmaceuticals and biomarker-targeted agents, fostering innovation and improving patient outcomes in diagnostic imaging.

Global Diagnostic Radiopharmaceuticals Market Segmentation

|

Attributes |

Diagnostic Radiopharmaceuticals Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, Rest of South America |

|

Key Market Players |

Siemens Healthineers (Germany), GE Healthcare (U.S.), Eli Lilly and Company (U.S.), Novartis AG (Switzerland), Bracco Imaging (Italy), Cardinal Health, Inc. (U.S.), Bayer AG (Germany), Bertin Technologies (France), Telix Pharmaceuticals (Australia), Lantheus Holdings, Inc. (U.S.), Curium (U.S.), Advanced Accelerator Applications (U.S.), Ion Beam Applications (IBA) (Belgium), Nordion Inc. (Canada), Fresenius Medical Care (Germany), Alpha Tau Medical (Israel), PharmAbcine Inc. (South Korea), Radiopharm Theranostics (Australia), Jubilant DraxImage (Canada), Medtronic (Ireland), and ImaginAb, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Global Diagnostic Radiopharmaceuticals Market Definition

Diagnostic radiopharmaceuticals are specialized medical compounds that contain radioactive isotopes used to detect and evaluate diseases within the body. These agents are designed to target specific organs, tissues, or cellular receptors, allowing healthcare providers to obtain detailed imaging through techniques such as positron emission tomography (PET) or single-photon emission computed tomography (SPECT). Diagnostic radiopharmaceuticals are critical tools in nuclear medicine, providing non-invasive, accurate, and early detection of various medical conditions, which facilitates timely and effective treatment planning.

Global Diagnostic Radiopharmaceuticals Market

Drivers

- Rapidly Aging Population

One of the primary drivers of the global diagnostic radiopharmaceuticals market is the rapidly aging population. As individuals age, they become more susceptible to a variety of health issues, including chronic diseases such as cancer, cardiovascular conditions, and neurodegenerative disorders. This demographic shift significantly increases the demand for diagnostic imaging solutions, as early detection and timely intervention are crucial in managing these health concerns. Consequently, healthcare systems are increasingly adopting advanced imaging techniques that utilize radiopharmaceuticals, leading to a higher market demand for these specialized diagnostic agents. The growing emphasis on preventive healthcare and routine screening further propels the adoption of diagnostic radiopharmaceuticals among healthcare providers and patients alike.

- Technological Advancements in Imaging Modalities

Technological advancements in imaging modalities represent another critical driver of the global diagnostic radiopharmaceuticals market. Innovations such as hybrid imaging techniques—combining positron emission tomography (PET) with computed tomography (CT) or magnetic resonance imaging (MRI)—enhance diagnostic accuracy and provide comprehensive insights into patient conditions. Furthermore, developments in radiopharmaceutical formulations, including the creation of novel targeted agents that improve specificity and reduce side effects, contribute to the market's growth. These advancements not only broaden the applications of diagnostic imaging in clinical practice but also encourage research and development investments, fostering the introduction of new products and thereby elevating the overall demand for diagnostic radiopharmaceuticals in the healthcare sector.

Opportunities

- Expansion into Emerging Markets

One significant opportunity in the global diagnostic radiopharmaceuticals market lies in the expansion into emerging markets. As healthcare infrastructure improves and economies grow in regions such as Asia-Pacific, Latin America, and parts of Africa, there is an increasing demand for advanced medical technologies, including diagnostic imaging solutions. These markets are witnessing a rise in healthcare expenditure, a growing burden of chronic diseases, and an increasing awareness of the importance of early disease detection. Consequently, companies in the diagnostic radiopharmaceutical space can capitalize on these trends by establishing local partnerships, investing in regional production facilities, and tailoring their offerings to meet the unique healthcare needs of these diverse populations. This expansion not only opens up new revenue streams but also enhances global accessibility to critical diagnostic tools.

- Development of Personalized Medicine

Another significant opportunity in the diagnostic radiopharmaceuticals market is the growing trend towards personalized medicine. Advances in genomics and biotechnology are paving the way for more targeted therapies, and radiopharmaceuticals can play a crucial role in this paradigm shift. By developing radiopharmaceuticals that are tailored to specific biomarkers or genetic characteristics of diseases, pharmaceutical companies can provide more effective and personalized diagnostic solutions. This approach not only enhances the efficacy of treatment interventions but also optimizes patient outcomes. As healthcare systems increasingly prioritize personalized medicine, there is a growing opportunity for the creation and commercialization of innovative radiopharmaceuticals that cater to these individualized treatment strategies, thereby driving market growth and improving patient care.

Restraints/Challenges

- Regulatory Hurdles

One of the significant challenges facing the global diagnostic radiopharmaceuticals market is navigating the complex regulatory landscape. Given that radiopharmaceuticals are subject to stringent regulations due to their radioactive nature and potential health risks, obtaining regulatory approval can be a lengthy and costly process. Companies must comply with various safety, efficacy, and quality standards that differ across regions, complicating the development and commercialization of these products. In addition, frequent changes in regulations and the need for extensive clinical trials to demonstrate safety and efficacy can hinder market entry and slow down the pace of innovation. As a result, these regulatory hurdles may limit the ability of companies to bring new diagnostic radiopharmaceuticals to market in a timely manner, affecting their competitiveness and growth potential.

- Limited Supply of Raw Materials

Another significant challenge in the diagnostic radiopharmaceuticals market is the limited supply of raw materials, particularly radioisotopes used in the production of these agents. The production of certain critical isotopes, like Technetium-99m, is concentrated in a few facilities around the world, making the supply chain vulnerable to disruptions caused by geopolitical issues, facility outages, or changes in production regulations. These supply constraints can lead to shortages, increased costs, and potential delays in the availability of important diagnostic tools. Such uncertainties can not only impact healthcare providers' ability to deliver timely diagnostic services but can also strain the relationships between manufacturers and customers, as well as hamper the market's overall growth potential. Addressing these supply chain vulnerabilities will require strategic partnerships, investment in alternative production methods, and potentially the development of new isotopes to ensure a reliable supply of radiopharmaceuticals.

Global Diagnostic Radiopharmaceuticals Market Scope

The market is segmented on the basis of By type, By Application, By End-User , By Distribution Channel, By Region. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Single Photon Emission Computed Tomography (SPECT) Radiopharmaceuticals

- Positron Emission Tomography (PET) Radiopharmaceuticals

- Alpha-Emitters and Beta-Emitters

Application

- Oncology

- Cardiology

- Neurology

- Infectious Diseases

- Others

Distribution Channel

- Direct Sales

- Distributors

End-User

- Hospitals

- Diagnostic Imaging Centers

- Research Institutions

Global Diagnostic Radiopharmaceuticals Market Regional Analysis

The market is analysed and market size insights and trends are provided of by type, by application, by distribution channel, by end-user, by region as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the global diagnostic radiopharmaceuticals market due to a combination of advanced healthcare infrastructure, high healthcare spending, and a robust emphasis on research and development. The region hosts some of the world's leading pharmaceutical companies and research institutions, which are at the forefront of innovation in diagnostic imaging technologies. In addition, the prevalence of chronic diseases and an aging population in North America contribute to an increasing demand for effective diagnostic tools. The presence of favorable reimbursement policies and regulatory frameworks also facilitates quicker market entry for new products. Moreover, with a greater awareness of the importance of early diagnosis and improved patient outcomes, healthcare providers in North America are increasingly adopting advanced radiopharmaceuticals, driving market growth in this region.

Asia-Pacific is experiencing rapid growth in the global diagnostic radiopharmaceuticals market due to a combination of factors including rising healthcare infrastructure investments, increasing prevalence of chronic diseases, and a growing emphasis on advanced diagnostic imaging techniques. As countries in this region, particularly China, India, and Japan, experience economic growth, there is a corresponding rise in healthcare expenditure, enabling better access to innovative medical technologies. In addition, a burgeoning population coupled with an aging demographic is leading to higher demand for effective diagnostic solutions. Enhanced awareness of the importance of early disease detection, supported by government initiatives and partnerships with global pharmaceutical companies, is further propelling the adoption of diagnostic radiopharmaceuticals. This growing focus on personalized medicine and improved healthcare outcomes is expected to drive the market forward in the Asia-Pacific region significantly.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Diagnostic Radiopharmaceuticals Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Diagnostic Radiopharmaceuticals Market Leaders Operating in the Market Are:

- Siemens Healthineers (Germany)

- GE Healthcare (U.S.)

- Eli Lilly and Company (U.S.)

- Novartis AG (Switzerland)

- Bracco Imaging (Italy)

- Cardinal Health, Inc. (U.S.)

- Bayer AG (Germany)

- Bertin Technologies (France)

- Telix Pharmaceuticals (Australia)

- Lantheus Holdings, Inc. (U.S.)

- Curium (U.S.)

- Advanced Accelerator Applications (U.S.)

- Ion Beam Applications (IBA) (Belgium)

- Nordion Inc. (Canada)

- Fresenius Medical Care (Germany)

- Alpha Tau Medical (Israel)

- PharmAbcine Inc. (South Korea)

- Radiopharm Theranostics (Australia)

- Jubilant DraxImage (Canada)

- Medtronic (Ireland)

- ImaginAb, Inc. (U.S.)

Latest Developments in Global Diagnostic Radiopharmaceuticals Market

- In April 2024, The Bracco Group announced the establishment of Bracco Japan, aimed at strengthening its presence in the Japanese market. Bracco Japan will offer a wide range of products and services in the field of diagnostic imaging

- In April 2024, Curium, a global leader in nuclear medicine, revealed its agreement to acquire Eczacibasi Monrol Nuclear Product Co. (Monrol) from Eczacibasi Holding and Bozlu Group. This acquisition combines complementary geographical footprints, enhances lutetium-177 (Lu-177) capabilities, and strengthens PET and SPECT nuclear medicine infrastructure. It also supports the advancement of radionuclides and radiopharmaceutical pipelines for diagnostic and therapeutic applications

- In April 2024, Telix announced the completion of its acquisition of ARTMS Inc., a radioisotope production technology company. This includes ARTMS’ advanced cyclotron-based production platform, manufacturing facility, and rare metals stockpile. The acquisition enhances Telix's supply chain integration and regulatory control over key isotope production

- In April 2024, Clarity Pharmaceuticals signed a clinical supply agreement with NorthStar Medical Radioisotopes, LLC to produce the 67Cu-SAR-bisPSMA drug product for Phase I/II and Phase III clinical trials

- In February 2024, Lantheus Holdings, Inc. entered a collaboration agreement with the Consortium for Clarity in ADRD Research Through Imaging (CLARiTI), sponsored by the National Institute on Aging (NIA). The agreement facilitates the use of MK-6240, Lantheus’ clinical-stage F18-labeled PET imaging agent, in Alzheimer’s disease and dementia research

- In January 2024, Novartis presented Phase III trial results demonstrating that Lutathera (lutetium Lu 177 dotatate), combined with long-acting release (LAR) octreotide, reduced the risk of disease progression or death by 72% compared to high-dose octreotide LAR alone as a first-line therapy for patients with somatostatin receptor-positive (SSTR+) grade 2/3 advanced gastroenteropancreatic neuroendocrine tumors (GEP-NETs)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.