Global Diagnostic Samd And Radiogenomics Market

Market Size in USD Billion

CAGR :

%

USD

1.98 Billion

USD

6.90 Billion

2024

2032

USD

1.98 Billion

USD

6.90 Billion

2024

2032

| 2025 –2032 | |

| USD 1.98 Billion | |

| USD 6.90 Billion | |

|

|

|

|

Diagnostic SaMD & Radiogenomics Market Size

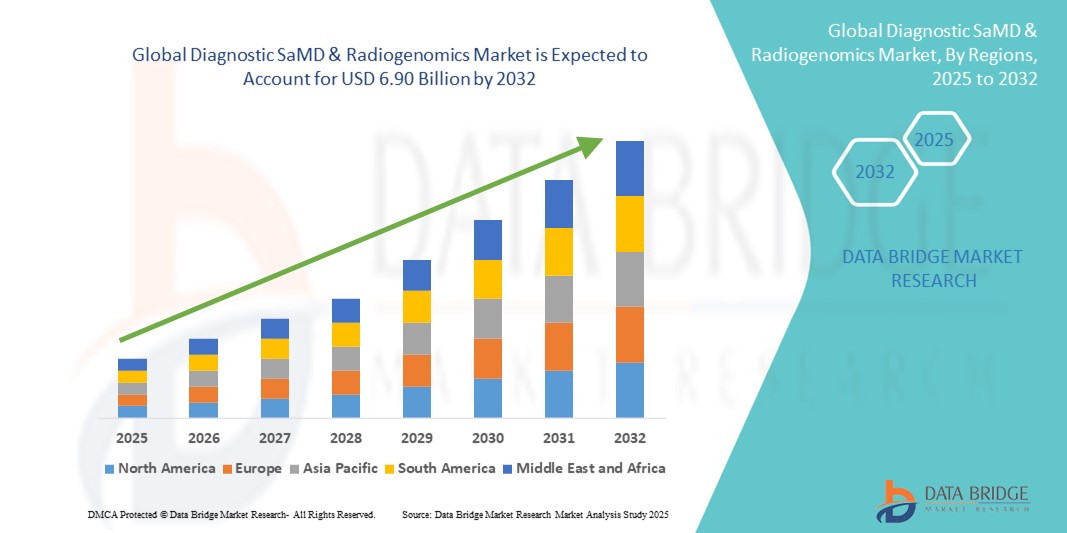

- The global diagnostic SaMD & radiogenomics market size was valued at USD 1.98 billion in 2024 and is expected to reach USD 6.90 billion by 2032, at a CAGR of 16.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced software-as-a-medical-device (SaMD) solutions and progress in radiogenomics technologies, driving precision diagnostics and personalized treatment strategies across Asia-Pacific

- Furthermore, rising demand for accurate, non-invasive, and AI-driven diagnostic tools, coupled with growing integration of genomic and imaging data, is enhancing early disease detection, risk stratification, and clinical decision-making. These converging factors are accelerating the uptake of Diagnostic SaMD & Radiogenomics solutions, thereby significantly boosting the industry’s growth in the region

Diagnostic SaMD & Radiogenomics Market Analysis

- Diagnostic SaMD and radiogenomics solutions are increasingly vital in modern healthcare, offering AI-driven software and integrated genomic-imaging analytics for early disease detection, personalized treatment planning, and improved clinical outcomes across both hospital and diagnostic center settings

- The escalating adoption of these technologies is primarily fueled by rising demand for non-invasive diagnostics, increasing prevalence of chronic and complex diseases, and growing integration of artificial intelligence and machine learning in clinical decision support systems

- North America dominated the diagnostic SaMD & radiogenomics market with the largest revenue share of 39% in 2024, supported by early adoption of advanced healthcare technologies, strong digital infrastructure, high healthcare expenditure, and a significant presence of leading diagnostic software providers and radiogenomics firms

- Asia-Pacific is expected to be the fastest-growing region in the diagnostic SaMD & radiogenomics market during the forecast period, driven by increasing urbanization, expanding healthcare infrastructure, rising investments in precision medicine, and growing government initiatives promoting digital health solutions

- The Hospitals & Clinics segment dominated the diagnostic SaMD & radiogenomics market with a revenue share of 44.2% in 2024, driven by the increasing deployment of diagnostic software and radiogenomics solutions for patient monitoring, imaging analysis, and treatment planning. Hospitals benefit from AI-enabled tools that reduce diagnostic errors and enhance workflow efficiency

Report Scope and Diagnostic SaMD & Radiogenomics Market Segmentation

|

Attributes |

Diagnostic SaMD & Radiogenomics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diagnostic SaMD & Radiogenomics Market Trends

Intelligent Diagnostics with AI and Voice Assistance

- A significant and accelerating trend in the global diagnostic SaMD & radiogenomics market is the growing integration with artificial intelligence (AI) and popular voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple HomeKit. This convergence is enhancing user convenience, allowing healthcare professionals and patients to interact more efficiently with diagnostic tools and data

- For instance, certain AI-powered radiogenomics platforms are beginning to integrate with major voice assistants, enabling clinicians to query patient results, receive notifications, or review diagnostic insights through simple voice commands. Similarly, patient-facing diagnostic applications can use voice interfaces to guide users through sample collection procedures or explain genomic reports, improving accessibility and engagement

- AI integration in Diagnostic SaMD facilitates advanced features such as pattern recognition in medical imaging, predictive analysis of genomic data, and personalized diagnostic recommendations. For example, some radiogenomics platforms leverage AI to identify subtle imaging biomarkers and correlate them with genomic profiles, while generating intelligent alerts for abnormal findings. Voice interfaces further streamline these workflows by enabling hands-free operation and on-demand information retrieval

- The integration of Diagnostic SaMD & Radiogenomics solutions with digital assistants and broader healthcare IT ecosystems allows centralized control over multiple diagnostic workflows. Users can review imaging results, monitor patient progress, and manage genomic data alongside other clinical tools via a unified interface, supporting a more automated and efficient healthcare environment

- This trend toward more intelligent, intuitive, and interconnected diagnostic platforms is reshaping expectations in precision medicine. Companies in the sector are increasingly developing AI-enabled solutions that provide predictive insights, automated reporting, and voice-activated access to clinical information, enhancing both practitioner efficiency and patient experience

- The demand for Diagnostic SaMD & Radiogenomics solutions that combine AI analytics with voice control integration is rapidly increasing across hospitals, research institutions, and personalized medicine applications, as healthcare providers prioritize convenience, accuracy, and seamless digital workflows

Diagnostic SaMD & Radiogenomics Market Dynamics

Driver

Growing Demand Driven by Rising Healthcare Needs and Digital Health Adoption

- The increasing prevalence of complex diseases, rising demand for personalized medicine, and accelerating adoption of digital health ecosystems are significant drivers of heightened demand for Diagnostic SaMD & Radiogenomics solutions

- For instance, in April 2024, Onity, Inc. announced advancements in IoT-enabled remote diagnostic monitoring systems, highlighting integration with advanced sensors for real-time patient data collection. Such initiatives by leading companies are expected to drive growth in the Diagnostic SaMD & Radiogenomics market over the forecast period

- As healthcare providers and patients seek more accurate, timely, and non-invasive diagnostic solutions, Diagnostic SaMD & Radiogenomics platforms offer advanced capabilities such as AI-driven predictive analytics, genomic profiling, and remote monitoring, providing a compelling alternative to traditional diagnostic methods

- Furthermore, the growing integration of digital health devices, telemedicine platforms, and electronic health records is making Diagnostic SaMD & Radiogenomics solutions an essential component of modern healthcare ecosystems, enabling seamless data sharing and real-time clinical insights.

- The convenience of remote patient monitoring, automated data analysis, and personalized diagnostic recommendations are key factors propelling the adoption of Diagnostic SaMD & Radiogenomics across hospitals, research institutions, and home-based care settings. The trend towards digital-first healthcare and the increasing availability of user-friendly platforms further contributes to market growth

Restraint/Challenge

Concerns Regarding Data Security and High Initial Costs

- Concerns surrounding the cybersecurity of connected diagnostic systems pose a significant challenge to broader market adoption. As Diagnostic SaMD & Radiogenomics solutions rely on network connectivity and cloud-based platforms, they are susceptible to hacking attempts and data breaches, raising concerns among healthcare providers and patients about the security of sensitive medical data

- High-profile reports of vulnerabilities in connected medical devices have made some institutions hesitant to adopt digital diagnostic platforms, slowing adoption in certain regions

- Addressing these concerns through robust encryption, secure authentication protocols, and regular software updates is critical for building trust. Leading companies emphasize advanced security measures, compliance with healthcare regulations, and data protection features in their solutions to reassure potential users

- In addition, the relatively high initial cost of advanced Diagnostic SaMD & Radiogenomics systems compared to conventional diagnostic methods can be a barrier, particularly for smaller clinics, developing regions, or budget-conscious healthcare providers. While prices are gradually decreasing, premium features such as AI-driven predictive analytics, genomic integration, and advanced imaging analytics often come with higher costs

- Overcoming these challenges through enhanced cybersecurity, education on digital health best practices, and the development of more affordable and scalable Diagnostic SaMD & Radiogenomics solutions will be vital for sustained market growth

Diagnostic SaMD & Radiogenomics Market Scope

The market is segmented on the basis of type, data integration method, user authentication mechanism, and application.

- By Type

On the basis of type, the global diagnostic SaMD & radiogenomics market is segmented into Software as a Medical Device (SaMD), radiogenomics platforms, data analytics solutions, image interpretation tools, predictive modeling tools, and others. The Software as a Medical Device (SaMD) segment dominated the largest market revenue share of 41.8% in 2024, driven by its widespread adoption for automated clinical decision support, remote patient monitoring, and integration with electronic health records (EHRs). SaMD platforms are highly favored for their regulatory compliance, ease of deployment, and ability to deliver accurate diagnostics across multiple clinical workflows.

The Radiogenomics Platforms segment is anticipated to witness the fastest CAGR of 22.4% from 2025 to 2032, fueled by the growing demand for personalized medicine and precision oncology. These platforms enable the correlation of imaging biomarkers with genomic data, offering predictive insights that aid in treatment planning and patient stratification. Increased investment in research and rising adoption of AI-based analytics further contribute to the rapid growth of this segment.

- By Data Integration Method

On the basis of data integration method, the global diagnostic SaMD & radiogenomics market is segmented into cloud-based connectivity (cloud), health level seven / fast healthcare interoperability resources (HL7/FHIR), digital imaging and communications in medicine (DICOM), application programming interface (API), proprietary protocols (custom), and others. The cloud-based connectivity segment held the largest market revenue share of 38.7% in 2024, owing to the increasing adoption of cloud infrastructure for scalable data storage, remote accessibility, and real-time clinical decision support. Cloud-enabled solutions allow healthcare providers to centralize patient data and facilitate seamless collaboration between institutions.

The HL7/FHIR segment is expected to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by the need for standardized interoperability between EHRs, diagnostic platforms, and laboratory information systems (LIS). These standards support secure and structured data exchange, which is critical for effective genomic and imaging analysis.

- By Unlocking Mechanism

On the basis of unlocking mechanism, the global diagnostic SaMD & radiogenomics market is segmented into user authentication systems, role-based access controls, multi-factor authentication, biometric verification, token-based access, and others. The user authentication systems segment held the largest market revenue share of 42.5% in 2024, owing to its essential role in ensuring secure access to sensitive patient data and diagnostic results. Strong authentication mechanisms are increasingly mandated by healthcare regulators to protect patient privacy and comply with data protection laws.

The biometric verification segment is expected to witness the fastest CAGR of 24.3% from 2025 to 2032, supported by the rising adoption of fingerprint, facial, and iris recognition for secure access to clinical platforms and genomic databases. Biometric authentication improves security while maintaining ease of access for authorized users.

- By Application

On the basis of application, the global diagnostic SaMD & radiogenomics market is segmented into hospitals & clinics, diagnostic laboratories, pharmaceutical & biotech companies, research institutions, academic & government research centers, and others. The hospitals & clinics segment accounted for the largest market revenue share of 44.2% in 2024, driven by the increasing deployment of diagnostic software and radiogenomics solutions for patient monitoring, imaging analysis, and treatment planning. Hospitals benefit from AI-enabled tools that reduce diagnostic errors and enhance workflow efficiency.

The research institutions segment is expected to witness the fastest CAGR of 21.9% from 2025 to 2032, fueled by the growing focus on precision medicine research, clinical trials, and large-scale genomic studies. These institutions are increasingly leveraging predictive modeling tools and data analytics platforms to accelerate discovery and optimize experimental outcomes.

Diagnostic SaMD & Radiogenomics Market Regional Analysis

- North America dominated the diagnostic SaMD & radiogenomics market with the largest revenue share of 39% in 2024

- Supported by the early adoption of advanced healthcare technologies, strong digital infrastructure, high healthcare expenditure, and a significant presence of leading diagnostic software providers and radiogenomics firms

- The region benefits from a technologically inclined population, robust healthcare systems, and strong investments in AI-driven diagnostics, all of which are fueling market expansion

U.S. Diagnostic SaMD & Radiogenomics Market Insight

The U.S. diagnostic SaMD & radiogenomics market captured the largest revenue share within North America, driven by rapid adoption of digital health solutions and precision diagnostics. Increasing integration of AI and machine learning into clinical workflows, coupled with high healthcare spending and the presence of key diagnostic software and radiogenomics companies, is accelerating market growth. Furthermore, the U.S. healthcare system’s focus on personalized medicine and predictive diagnostics is driving demand for advanced software tools that improve diagnostic accuracy, reduce time-to-diagnosis, and enhance patient outcomes.

Europe Diagnostic SaMD & Radiogenomics Market Insight

The Europe diagnostic SaMD & radiogenomics market is projected to grow at a substantial CAGR during the forecast period, driven by the region’s advanced healthcare infrastructure, rigorous regulatory frameworks, and a steadily increasing adoption of precision medicine. Rising awareness of personalized healthcare solutions is encouraging hospitals and clinics to integrate sophisticated diagnostic software into routine workflows. Key markets such as the U.K. and Germany are witnessing significant growth, fueled by increasing healthcare expenditure, strong digital infrastructure, and widespread integration of AI and machine learning technologies into clinical diagnostics. This trend is enhancing the accuracy, efficiency, and predictive capabilities of radiogenomics applications across the region.

U.K. Diagnostic SaMD & Radiogenomics Market Insight

The U.K. diagnostic SaMD & radiogenomics market is expected to grow at a noteworthy CAGR during the forecast period, driven by the rapid adoption of digital healthcare solutions and a growing focus on precision medicine. The country’s well-established healthcare system, coupled with proactive e-health initiatives, is creating an environment that strongly supports the use of advanced diagnostic software and radiogenomics technologies. Increasing interest in genomics-driven diagnostics, alongside rising investment in AI-enabled tools, is enabling healthcare providers to deliver faster, more accurate diagnoses and personalized treatment strategies.

Germany Diagnostic SaMD & Radiogenomics Market Insight

The Germany diagnostic SaMD & radiogenomics market is projected to expand steadily, supported by the nation’s emphasis on healthcare innovation, digitalization, and integration of AI-driven diagnostic tools. Hospitals, research institutions, and private clinics are increasingly adopting technologically advanced solutions that are efficient, secure, and privacy-compliant. Rising awareness of the benefits of precision medicine and predictive diagnostics is further encouraging the use of radiogenomics and advanced diagnostic software across clinical and research applications, positioning Germany as a leading hub for digital healthcare innovation in Europe.

Asia-Pacific Diagnostic SaMD & Radiogenomics Market Insight

The Asia-Pacific diagnostic SaMD & radiogenomics market is expected to be the fastest-growing region during the forecast period, driven by rapid urbanization, expansion of healthcare infrastructure, rising investments in precision medicine, and strong government initiatives promoting digital health solutions. Countries including China, Japan, and India are at the forefront of adopting advanced diagnostic software due to an increasing demand for personalized healthcare, higher diagnostic accuracy, and the integration of AI and machine learning into clinical workflows. The region’s growth is further supported by a large patient population, rising healthcare expenditure, and the emergence of APAC as a hub for innovation in digital healthcare technologies.

Japan Diagnostic SaMD & Radiogenomics market Insight

The Japan diagnostic SaMD & radiogenomics market is gaining significant momentum, fueled by the country’s high technological adoption in healthcare, a rapidly aging population, and the increasing need for convenient and precise diagnostic solutions. Hospitals and clinics are progressively integrating AI-based diagnostic tools, which is accelerating the adoption of advanced diagnostic software and radiogenomics solutions. The focus on patient-centric care and demand for efficient, accurate, and secure diagnostics is driving continued market expansion in both residential healthcare facilities and large hospital networks.

China Market Insight

The China diagnostic SaMD & radiogenomics market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by rapid urbanization, a growing middle class, expanding healthcare infrastructure, and strong government support for digital health initiatives. The widespread adoption of domestic diagnostic software and radiogenomics solutions in hospitals, research institutes, and private healthcare centers is accelerating market growth. China’s focus on smart hospitals, precision medicine, and AI-enabled healthcare technologies, coupled with increasing investments in digital health startups, is creating a robust ecosystem for the continued expansion of the Diagnostic SaMD & Radiogenomics market.

Diagnostic SaMD & Radiogenomics Market Share

The Diagnostic SaMD & Radiogenomics industry is primarily led by well-established companies, including:

- Tempus AI, Inc. (U.S.)

- FLATIRON HEALTH (U.S.)

- Guardant Health (U.S.)

- Freenome Holdings, Inc. (U.S.)

- SOPHiA GENETICS (Switzerland)

- Qlucore (Sweden)

- PathAI, Inc. (U.S.)

- OncoDNA (Belgium)

- Personalis, Inc. (U.S.)

- Labcorp (U.S.)

- Caris Life Sciences (U.S.)

- Strata Oncology, Inc. (U.S.)

- GRAIL, Inc. (U.S.)

- Bluebee (Netherlands)

- CureMetrix, Inc. (U.S.)

- AstraZeneca (U.K.)

- PierianDx (U.S.)

Latest Developments in Global Diagnostic SaMD & Radiogenomics Market

- In January 2021, the FDA published the "Artificial Intelligence and Machine Learning Software as a Medical Device Action Plan," outlining a framework to support the development of AI/ML-based SaMD. This plan aimed to ensure the safety and effectiveness of these devices while fostering innovation in the medical device sector

- In October 2021, the FDA released "Good Machine Learning Practice for Medical Device Development: Guiding Principles," providing recommendations to manufacturers on best practices for developing and maintaining AI/ML-based medical devices. This guidance emphasized transparency, accountability, and continuous learning in the development process

- In April 2023, the FDA issued "Draft Guidance: Marketing Submission Recommendations for a Predetermined Change Control Plan for Artificial Intelligence/Machine Learning (AI/ML)-Enabled Device Software Functions," offering recommendations for manufacturers on how to manage changes to AI/ML-enabled devices post-market. This guidance aimed to ensure that modifications do not adversely affect the device's safety or effectiveness

- In October 2023, the FDA published "Predetermined Change Control Plans for Machine Learning-Enabled Medical Devices: Guiding Principles," providing further clarification on how manufacturers should approach changes to AI/ML-enabled devices, including the need for a predetermined change control plan

- In June 2024, the FDA released "Transparency for Machine Learning-Enabled Medical Devices: Guiding Principles," emphasizing the importance of transparency in the development and deployment of AI/ML-enabled medical devices. This guidance encouraged manufacturers to provide clear information about the device's capabilities, limitations, and the data used to train the AI models

- In December 2024, the FDA issued "Final Guidance: Marketing Submission Recommendations for a Predetermined Change Control Plan for Artificial Intelligence-Enabled Device Software Functions," providing finalized recommendations for managing changes to AI-enabled devices post-market. This guidance aimed to help manufacturers maintain the safety and effectiveness of their devices as they evolve over time.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.